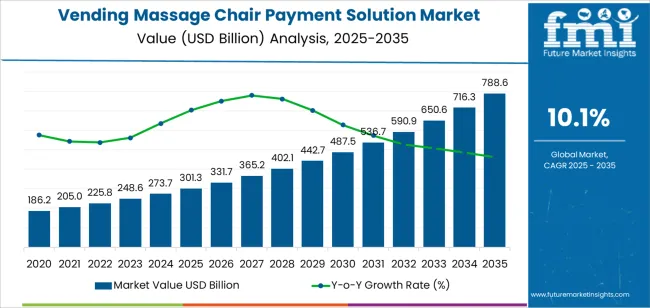

The global vending massage chair payment solution market is projected to reach USD 788.5 billion by 2035, recording an absolute increase of USD 487.4 billion over the forecast period. The market is valued at USD 301.3 billion in 2025 and is set to rise at a CAGR of 10.1% during the assessment period. The overall market size is expected to grow by nearly 2.6 times during the same period, supported by increasing demand for automated payment systems in commercial massage chair operations worldwide, driving demand for efficient cashless transaction infrastructure and increasing investments in smart vending technologies and contactless payment integration projects globally. Integration complexity with legacy massage chair systems and cybersecurity concerns regarding payment data protection may pose challenges to market expansion.

The market expansion between 2025 and 2035 reflects fundamental shifts in consumer payment preferences and commercial massage chair deployment strategies across high-traffic locations including shopping malls, airports, entertainment venues, and wellness centers. Payment solution providers are developing integrated systems that combine mobile payment acceptance, subscription management capabilities, and real-time revenue monitoring platforms that enable massage chair operators to optimize utilization rates and pricing strategies. The transition from cash-based operations to digital payment infrastructure addresses operator challenges related to cash handling costs, revenue tracking accuracy, and customer convenience expectations in markets where contactless transactions have become standard consumer behavior.

Technology advancement in near-field communication payment acceptance, QR code transaction processing, and biometric authentication systems creates opportunities for enhanced user experiences and operational efficiency improvements. Payment solution providers are incorporating artificial intelligence-driven analytics for demand forecasting, dynamic pricing optimization, and maintenance prediction based on usage patterns collected through integrated payment terminals. The market benefits from regulatory support for cashless economy initiatives in major markets including China, India, and Southeast Asian countries where government policies incentivize digital payment adoption across commercial vending applications. Distribution channels through massage chair manufacturers, commercial operators, and payment technology integrators expand deployment across diverse location types and customer segments.

Between 2025 and 2030, the vending massage chair payment solution market is projected to expand from USD 301.3 billion to USD 487.4 billion, resulting in a value increase of USD 186.1 billion, which represents 38.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for contactless payment infrastructure and digital transaction solutions, product innovation in mobile payment integration and subscription-based pricing models, as well as expanding deployment across commercial massage chair networks in shopping centers, transportation hubs, and hospitality venues. Companies are establishing competitive positions through investment in advanced payment processing technologies, multi-currency support capabilities, and strategic partnerships with massage chair manufacturers across diverse geographic markets.

From 2030 to 2035, the market is forecast to grow from USD 487.4 billion to USD 788.5 billion, adding another USD 301.1 billion, which constitutes 61.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized payment ecosystems, including integrated loyalty programs and personalized pricing algorithms tailored for high-frequency usage patterns, strategic collaborations between payment solution providers and massage chair commercial operators, and an enhanced focus on data security compliance and biometric authentication capabilities. The growing emphasis on customer experience optimization and revenue maximization through dynamic pricing will drive demand for advanced, intelligent payment solutions across commercial massage chair deployment networks.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 301.3 billion |

| Market Forecast Value (2035) | USD 788.5 billion |

| Forecast CAGR (2025-2035) | 10.1% |

The vending massage chair payment solution market grows by enabling commercial operators to maximize revenue collection efficiency and customer convenience while reducing operational costs associated with cash handling infrastructure. Massage chair operators face mounting pressure to deliver seamless payment experiences comparable to other automated retail services, with digital payment solutions typically providing 25-35% improvement in transaction completion rates compared to cash-only systems, making modern payment infrastructure essential for commercial viability. The shift toward cashless society trends create demand for integrated solutions that accept mobile wallets, credit cards, and app-based payments while providing real-time revenue visibility and remote management capabilities across distributed massage chair networks.

Consumer preference for contactless transactions and the proliferation of smartphone-based payment methods drive adoption in shopping malls, airports, and entertainment venues where massage chair operators compete for customer attention. The expansion of massage chair deployment in commercial locations accelerates payment solution demand as operators seek systems that reduce theft risk, eliminate cash collection logistics, and enable flexible pricing strategies including time-based rates and subscription models. High upfront costs for payment terminal integration and ongoing transaction processing fees may limit adoption among small-scale operators and locations with established cash-handling infrastructure where conversion economics remain challenging.

The market is segmented by payment mode, application, and region. By payment mode, the market is divided into pay with cash and pay without cash. Based on application, the market is categorized into massage chair manufacturers and massage chair commercial operators. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

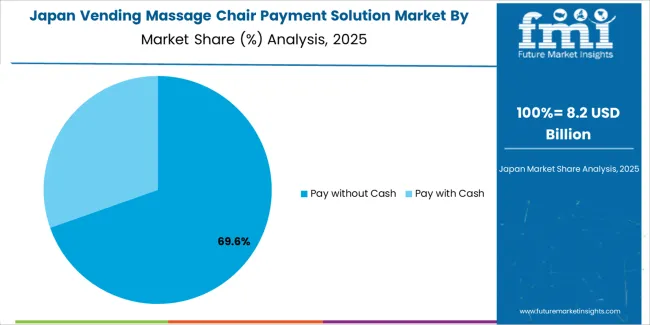

The pay without cash segment represents the dominant force in the vending massage chair payment solution market, capturing approximately 67% of total market share in 2025. This advanced category encompasses formulations featuring mobile payment integration, credit card processing systems, QR code payment acceptance, and contactless near-field communication terminals, delivering comprehensive transaction capabilities with enhanced user convenience properties. The pay without cash segment's market leadership stems from its exceptional alignment with consumer payment preferences, operational efficiency advantages, and compatibility with modern commercial massage chair deployment strategies that prioritize customer experience optimization.

The pay with cash segment maintains a 33.0% market share, serving operators in markets with limited digital payment infrastructure penetration and customer demographics that maintain cash payment preferences. This segment benefits from lower initial investment requirements and independence from electronic payment network dependencies in locations with unreliable internet connectivity.

Key advantages driving the pay without cash segment include rapid transaction processing reducing customer wait times and improving throughput efficiency, elimination of cash handling costs and theft risks associated with physical currency collection, comprehensive data collection enabling usage analytics and dynamic pricing optimization, seamless integration with loyalty programs and subscription-based business models enabling recurring revenue streams.

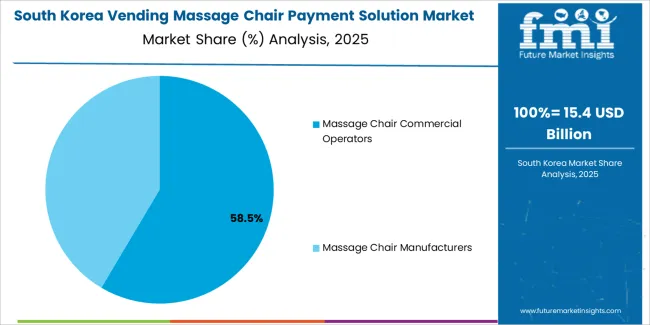

Massage chair commercial operators dominate the vending massage chair payment solution market with approximately 58% market share in 2025, reflecting the practical requirements of managing distributed massage chair networks across multiple locations with centralized revenue monitoring and operational management capabilities. The commercial operators segment's market leadership is reinforced by deployment across shopping centers, airports, hotels, and entertainment venues where professional management infrastructure and sophisticated payment systems provide competitive advantages in utilization optimization and customer service delivery.

The massage chair manufacturers segment represents 42.0% market share through direct sales models and demonstration facilities where payment solutions serve dual purposes of revenue generation and product showcase capabilities. This segment benefits from integrated hardware-software bundles and manufacturer support relationships that simplify deployment logistics for end customers.

Key market dynamics supporting application preferences include commercial operators requiring multi-location management platforms with consolidated reporting and remote configuration capabilities, manufacturers leveraging payment integration as product differentiation and value-added service offerings, growing third-party operator networks expanding massage chair deployment beyond traditional retail environments, scalability requirements for payment infrastructure supporting fleet expansion and geographic market diversification.

The market is driven by three concrete demand factors tied to operational efficiency and consumer behavior shifts. First, cashless society trends accelerate digital payment adoption, with contactless transaction volumes growing 30-40% annually in major urban markets worldwide, requiring massage chair operators to accept mobile wallets and card payments for competitive viability. Second, operational cost reduction drives commercial operators toward automated payment systems, with digital solutions eliminating 15-25% of cash handling expenses while improving revenue tracking accuracy and reducing theft losses that impact profitability. Third, customer experience expectations require seamless payment processes, as consumers increasingly demand convenience comparable to other automated retail services where transaction friction determines usage rates and repeat customer development.

Market restraints include integration complexity with diverse massage chair hardware platforms affecting deployment timelines and technical support requirements, particularly for legacy massage chair models lacking standardized communication protocols for payment system connectivity. Transaction processing fees of 2-4% reduce operator margins on low-value transactions, posing adoption barriers for locations with thin profit margins where payment costs consume significant revenue portions. Cybersecurity concerns regarding customer payment data protection create additional challenges, as operators require compliance with payment card industry standards and data security regulations that necessitate ongoing investments in security infrastructure and vulnerability management programs.

Key trends indicate accelerated deployment in Asia-Pacific markets, particularly China and India, where smartphone payment penetration exceeds traditional banking infrastructure and government initiatives promote cashless transaction adoption. Technology advancement trends toward biometric authentication integration, subscription management platforms with recurring billing capabilities, and artificial intelligence-powered pricing optimization that adjusts rates based on location demand patterns and time-of-day usage trends are enabling next-generation commercial models. The market thesis could face disruption if regulatory restrictions on payment data collection or standardization requirements for payment hardware interfaces create barriers to innovation and increase compliance costs across fragmented international markets.

| Country | CAGR (2025-2035) |

|---|---|

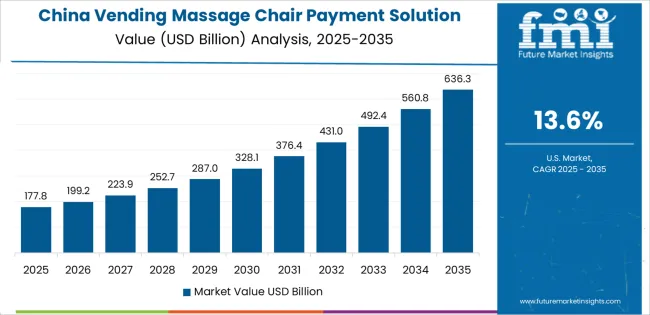

| China | 13.6% |

| India | 12.6% |

| Germany | 11.6% |

| Brazil | 10.6% |

| U.S. | 9.6% |

| U.K. | 8.6% |

| Japan | 7.6% |

The vending massage chair payment solution market is gaining momentum worldwide, with China taking the lead thanks to aggressive mobile payment infrastructure development and extensive commercial massage chair deployment programs. Close behind, India benefits from digital payment promotion initiatives and expanding urban wellness retail infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where payment technology innovation and consumer cashless adoption strengthen its role in European market development. The U.S. demonstrates robust growth through contactless payment infrastructure expansion and commercial massage chair network development, signaling continued investment in automated wellness service delivery. Meanwhile, the U.K. stands out for its mature digital payment ecosystem and airport massage chair deployment focus, while Brazil and Japan continue to record consistent progress driven by urbanization trends and commercial operator network expansion. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

China demonstrates the strongest growth potential in the vending massage chair payment solution market with a CAGR of 13.6% through 2035. The country's leadership position stems from comprehensive mobile payment infrastructure including Alipay and WeChat Pay integration, intensive commercial massage chair deployment across shopping centers and transportation hubs, and aggressive cashless society initiatives driving adoption of digital transaction systems. Growth is concentrated in major urban centers, including Beijing, Shanghai, Guangzhou, and Shenzhen, where massage chair operators are implementing integrated payment platforms for customer convenience and operational efficiency optimization. Distribution channels through massage chair manufacturers, commercial operator networks, and payment technology providers expand coverage across retail locations and high-traffic public venues. The country's Digital China strategy provides policy support for cashless payment adoption, including regulatory frameworks for payment data security and consumer protection standards.

Key market factors include urban population concentration in commercial districts with comprehensive massage chair deployment networks, government support through cashless payment promotion initiatives and digital infrastructure investment programs, comprehensive technology ecosystem including established mobile payment platforms and QR code transaction processing, integration of artificial intelligence analytics for usage optimization and dynamic pricing implementation across commercial networks.

In major metropolitan areas, shopping districts, and airport terminals, the adoption of digital payment systems for massage chair operations is accelerating across commercial wellness facilities, retail centers, and transportation infrastructure, driven by smartphone penetration growth and government financial inclusion initiatives. The market demonstrates strong growth momentum with a CAGR of 12.6% through 2035, linked to comprehensive digital payment ecosystem expansion and increasing focus on automated retail service delivery. Indian operators are implementing contactless payment terminals and mobile app integration to accommodate consumer preferences while reducing cash handling requirements in high-volume locations. The country's Digital India program creates continued demand for cashless payment infrastructure, while increasing emphasis on customer experience optimization drives adoption of modern transaction processing systems.

Leading commercial development regions, including Mumbai, Delhi NCR, Bengaluru, and Hyderabad, driving payment solution adoption across massage chair networks. Government incentive programs enabling financial inclusion through digital payment promotion and unified payment interface infrastructure. Technology partnership agreements accelerating deployment with international payment solution providers and domestic fintech companies. Policy support through Reserve Bank of India digital payment guidelines and consumer protection frameworks linked to electronic transactions.

Advanced commercial infrastructure in Germany demonstrates sophisticated implementation of payment solution systems, with documented case studies showing 35-45% transaction completion rate improvement through contactless payment integration in airport and shopping center massage chair installations. The country's retail technology infrastructure in major commercial regions, including Berlin, Munich, Frankfurt, and Hamburg, showcases integration of payment technologies with existing massage chair networks, leveraging expertise in payment security standards and consumer data protection compliance. German operators emphasize reliability standards and regulatory compliance, creating demand for certified payment systems that support consumer protection requirements and electronic transaction regulations. The market maintains strong growth through focus on operational efficiency and customer experience enhancement, with a CAGR of 11.6% through 2035.

Key development areas include payment security compliance with General Data Protection Regulation and Payment Services Directive requirements ensuring consumer trust, technical infrastructure supporting near-field communication and mobile wallet integration with documented 30-40% adoption rates, strategic partnerships between payment technology providers and massage chair operator networks expanding market coverage, integration of subscription management platforms and comprehensive analytics systems for revenue optimization programs.

The Brazilian market leads in payment solution adaptation based on integration with local payment methods and mobile banking infrastructure popular across Latin American consumer segments. The country shows solid potential with a CAGR of 10.6% through 2035, driven by smartphone payment adoption growth and increasing massage chair deployment across urban commercial centers, including São Paulo, Rio de Janeiro, Brasília, and major regional shopping districts. Brazilian operators are adopting payment terminals that accept domestic payment methods including PIX instant payment system and local credit card networks for maximum customer accessibility. Technology deployment channels through commercial operator partnerships, massage chair distributors, and payment processing companies expand coverage across retail environments.

Leading market segments include shopping center installations implementing comprehensive payment acceptance capabilities for diverse customer preferences, technology partnerships with local payment processors achieving 85-90% transaction success rates in urban deployments, strategic collaborations between massage chair operators and retail property managers enabling integrated service delivery models, focus on mobile payment integration and real-time revenue monitoring platforms supporting operational efficiency goals.

The USA market leads in payment technology sophistication based on integration with established credit card processing networks and emerging mobile wallet platforms across commercial massage chair installations. The country shows solid potential with a CAGR of 9.6% through 2035, driven by contactless payment infrastructure expansion and increasing massage chair deployment across airports, shopping malls, and hospitality venues in major metropolitan regions, including New York, Los Angeles, Chicago, and Dallas-Fort Worth areas. American operators are implementing payment systems that support credit card chip readers, near-field communication terminals, and mobile app-based transactions for comprehensive payment method coverage. Technology deployment channels through commercial property managers, massage chair leasing companies, and payment solution integrators expand deployment across high-traffic location types.

Key market characteristics include airport terminal installations requiring reliable payment processing and multi-currency support capabilities for international travelers, technology partnerships with established payment processors enabling secure transaction processing and chargeback management services, strategic collaborations between massage chair manufacturers and payment technology companies creating integrated product offerings, emphasis on data analytics platforms and customer relationship management integration supporting marketing optimization programs.

In London, Manchester, Birmingham, and Edinburgh, commercial operators are implementing payment solutions that leverage the country's mature contactless payment adoption and established financial services infrastructure, with documented integration achieving 90-95% contactless transaction rates in urban massage chair installations. The market shows solid growth potential with a CAGR of 8.6% through 2035, linked to comprehensive payment card penetration, transportation hub massage chair deployment, and consumer preference for rapid transaction processing. British operators are adopting payment terminals that prioritize contactless card readers and mobile wallet acceptance to align with established consumer payment behaviors in retail environments.

Market development factors include transportation infrastructure installations at airports and railway stations prioritizing rapid payment processing for time-sensitive travelers, payment security compliance with Financial Conduct Authority regulations and Strong Customer Authentication requirements, strategic partnerships between massage chair operators and retail property management companies expanding coverage across shopping centers, emphasis on subscription models and loyalty program integration enabling recurring revenue development through app-based platforms.

Japan's payment solution market demonstrates sophisticated implementation focused on integration with domestic electronic money systems and mobile carrier payment platforms popular across Japanese consumer segments. The country maintains steady growth momentum with a CAGR of 7.6% through 2035, driven by established cashless payment infrastructure and massage chair deployment across retail environments, transportation facilities, and entertainment venues in major urban centers including Tokyo, Osaka, Nagoya, and Fukuoka metropolitan areas. Major commercial regions showcase deployment of payment terminals that accept transportation IC cards, mobile carrier payments, and credit card processing that align with Japanese consumer payment method preferences.

Key market characteristics include integration with transportation card systems including Suica and PASMO enabling convenient payment for commuter demographics, technology partnerships between payment providers and mobile carriers achieving 80-85% digital payment acceptance in urban installations, collaboration between massage chair manufacturers and commercial property operators ensuring consistent service delivery standards, emphasis on user interface design and payment process simplification supporting high transaction completion rates among diverse age groups.

The vending massage chair payment solution market in Europe is projected to grow from USD 69.8 billion in 2025 to USD 186.2 billion by 2035, registering a CAGR of 10.3% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced payment technology infrastructure and major commercial centers, including Berlin, Munich, and Frankfurt retail districts.

France follows with a 19.2% share in 2025, projected to reach 19.5% by 2035, driven by comprehensive contactless payment adoption and massage chair deployment expansion in shopping centers. The United Kingdom holds a 17.8% share in 2025, expected to reach 18.1% by 2035 through airport massage chair network development and established financial services infrastructure. Italy commands a 13.6% share in both 2025 and 2035, backed by urban retail center installations. Spain accounts for 10.4% in 2025, rising to 10.6% by 2035 on commercial property development growth. The Netherlands maintains 4.2% in 2025, reaching 4.3% by 2035 on payment technology innovation leadership. The Rest of Europe region is anticipated to hold 6.3% in 2025, expanding to 6.4% by 2035, attributed to increasing payment solution adoption in Nordic countries and emerging Central and Eastern European commercial massage chair deployments.

The Japanese vending massage chair payment solution market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of electronic money systems and mobile carrier payment platforms with existing massage chair infrastructure across retail locations, transportation terminals, and entertainment facilities. Japan's emphasis on transaction speed and user experience drives demand for payment terminals that support multiple domestic electronic money brands while maintaining compatibility with international credit card networks. The market benefits from established partnerships between payment technology providers and massage chair manufacturers including domestic operators, creating service ecosystems that prioritize reliability and customer convenience across commercial installations. Commercial centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced payment implementations where massage chair systems achieve 85-90% digital transaction rates through integration with transportation IC cards and mobile payment platforms.

The South Korean vending massage chair payment solution market is characterized by growing mobile payment provider presence, with companies maintaining significant positions through comprehensive smartphone payment integration and technology services capabilities for commercial massage chair applications. The market demonstrates increasing emphasis on app-based transactions and mobile wallet adoption, as Korean operators increasingly demand payment systems that integrate with domestic mobile banking infrastructure and popular mobile payment platforms deployed across commercial retail environments. Regional payment solution providers are gaining market share through strategic partnerships with international technology companies, offering specialized services including Korean payment network integration and mobile-first transaction processing optimized for smartphone-dependent consumer segments. The competitive landscape shows increasing collaboration between global payment technology companies and Korean telecommunications operators, creating hybrid service models that combine international payment processing expertise with local mobile payment ecosystem integration and consumer behavior understanding.

The vending massage chair payment solution market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 35-42% of global market share through established payment processing networks and comprehensive technology platforms. Competition centers on payment method coverage, transaction processing reliability, and integration capabilities with diverse massage chair hardware rather than price competition alone. Nayax leads with approximately 16.0% market share through its comprehensive unattended retail payment solutions portfolio.

Market leaders include Nayax, Cantaloupe, and Sm Vend, which maintain competitive advantages through global payment network connectivity, multi-currency processing capabilities, and deep expertise in cashless transaction systems across automated retail applications, creating reliability advantages with massage chair operators managing distributed commercial networks. These companies leverage research and development capabilities in mobile payment integration and ongoing technical support relationships to defend market positions while expanding into subscription management and customer analytics platforms.

Challengers encompass DennyVend and AVA, which compete through specialized payment hardware integration and regional market presence in key massage chair deployment territories. Product specialists focus on specific payment method types or commercial operator segments, offering differentiated capabilities in mobile wallet acceptance, biometric authentication systems, and customized pricing optimization platforms.

Regional players and emerging payment technology providers create competitive pressure through localized payment method support and rapid deployment capabilities, particularly in high-growth markets including China and India, where domestic mobile payment ecosystems and regulatory requirements provide advantages in market access and customer preference alignment. Market dynamics favor companies that combine comprehensive payment method acceptance with advanced analytics platforms that enable operators to optimize pricing strategies and customer engagement programs throughout the massage chair utilization cycle.

| Item | Value |

|---|---|

| Quantitative Units | USD 301.3 billion |

| Payment Mode | Pay with Cash, Pay without Cash |

| Application | Massage Chair Manufacturers, Massage Chair Commercial Operators |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Nayax, Cantaloupe, Sm Vend, DennyVend, AVA |

| Additional Attributes | Dollar sales by payment mode and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with payment technology providers and integration networks, payment terminal hardware specifications and communication protocols, integration with massage chair control systems and operator management platforms, innovations in contactless payment acceptance and mobile wallet connectivity, and development of subscription-based pricing models with enhanced customer engagement and revenue optimization capabilities. |

The global vending massage chair payment solution market is estimated to be valued at USD 301.3 billion in 2025.

The market size for the vending massage chair payment solution market is projected to reach USD 788.6 billion by 2035.

The vending massage chair payment solution market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in vending massage chair payment solution market are pay without cash and pay with cash.

In terms of application, massage chair commercial operators segment to command 58.0% share in the vending massage chair payment solution market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vending Cups Market Size and Share Forecast Outlook 2025 to 2035

Fuel Vending Machines Market

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Vending Machine Suppliers

Medical Vending Machines Market

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Industry Share Analysis for Massage Therapy Service Providers

Massage Equipment Market

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Electric Massagers Market Analysis - Size, Share, and Forecast 2025 to 2035

Women Personal Massager Market Size and Share Forecast Outlook 2025 to 2035

USA Percussion Massage Gun Market Growth - Trends & Forecast, 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA