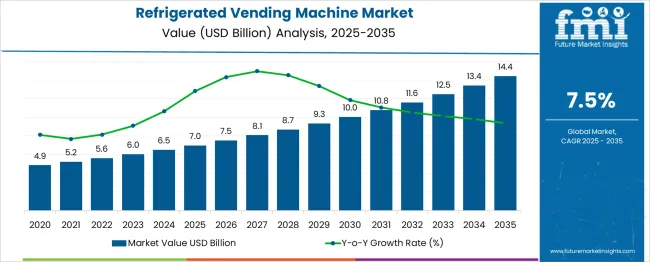

The Refrigerated Vending Machine Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. This growth reflects a 7.5% CAGR over the forecast period. The first half of the decade (2025–2030) contributes approximately USD 3.0 billion, with the market reaching around USD 10.0 billion by 2030. The latter half (2030–2035) shows even stronger growth, adding USD 4.4 billion, fueled by a faster adoption rate and maturing deployment strategies across regions. This sustained momentum is driven by rising demand for self-service cold food and beverage solutions in urban areas, expanding retail automation, and growing investments in smart vending infrastructure. The transition toward energy-efficient and climate-controlled vending technologies supports adoption in transit hubs, educational institutions, and workplaces.

The market’s expanding footprint in emerging economies further boosts its revenue potential. Increasing deployment in semi-public environments and smart city initiatives continues to enhance accessibility and consumer interaction. With consistent year-over-year gains and accelerating volume deployment post-2028, the Refrigerated Vending Machine Market offers a compelling opportunity for manufacturers, retailers, and technology providers aiming to tap into a high-growth, tech-integrated retail channel.

| Metric | Value |

|---|---|

| Refrigerated Vending Machine Market Estimated Value in (2025 E) | USD 7.0 billion |

| Refrigerated Vending Machine Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The refrigerated vending machine market is experiencing robust growth, driven by expanding applications in foodservice automation, retail innovation, and smart infrastructure. Increasing demand for contactless solutions, extended product shelf life, and cold chain integrity is pushing adoption across high-footfall locations such as offices, transport hubs, hospitals, and campuses.

Governments and private institutions are supporting digital vending rollouts to enhance accessibility to fresh and perishable goods. Technology advancements such as remote inventory monitoring, predictive restocking, and adaptive cooling systems are reshaping operational efficiency.

Rising consumer expectations for 24/7 access to refrigerated items—especially healthy snacks, beverages, and ready-to-eat meals—are further catalyzing market demand. Sustainability trends like energy-efficient cooling, solar integration, and modular construction are also influencing vendor investments.

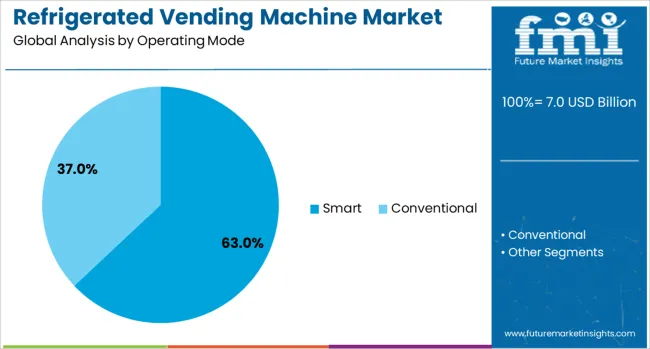

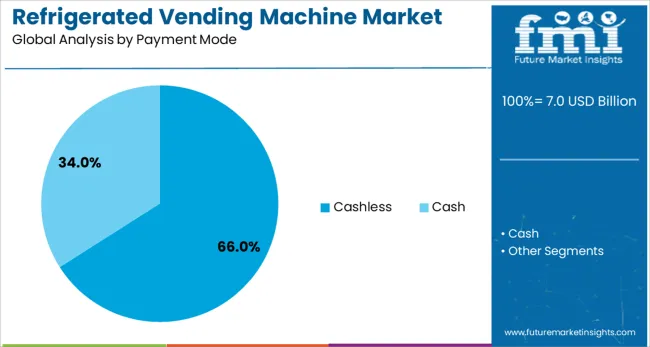

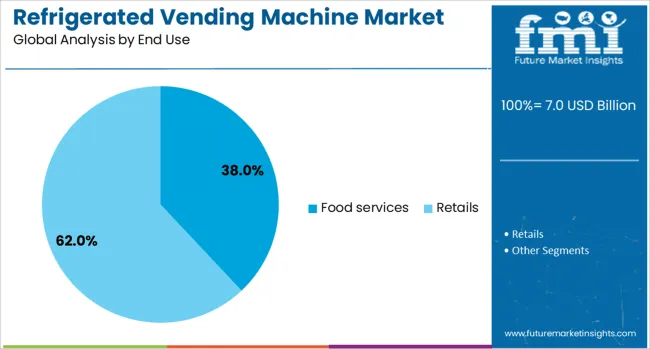

The refrigerated vending machine market is segmented by operating mode, payment mode, end use, distribution channel, and geographic regions. The operating mode of the refrigerated vending machine market is divided into Smart and Conventional. In terms of payment modes, the refrigerated vending machine market is classified into Cashless and Cash. The end use of the refrigerated vending machine market is segmented into Food services and retail. The distribution channel of the refrigerated vending machine market is segmented into Offline, Online, E-commerce, and Company Website. Regionally, the refrigerated vending machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Smart vending machines are projected to account for 63.0% of total revenue in the refrigerated vending machine market by 2025, making this the dominant operating mode. Their leadership stems from their ability to offer real-time diagnostics, remote inventory tracking, and user interaction features that elevate customer experience.

Smart units can optimize temperature settings based on product type, reduce energy consumption, and enable dynamic pricing or promotions through cloud connectivity.

Integration with digital payment systems, loyalty programs, and mobile apps is allowing operators to target younger, tech-savvy demographics and improve vending ROI.

Cashless payment modes are expected to capture a 66.0% share of the refrigerated vending machine market in 2025, making them the most preferred transaction method. This trend reflects global shifts toward digital commerce, mobile wallets, and card-based payments, especially in urban and institutional environments.

Cashless vending enhances hygiene, speeds up transactions, and minimizes theft or currency-handling issues. It also allows machines to operate in cash-restricted or unattended zones with greater profitability.

With the rise of fintech integration, QR code-based, contactless, and NFC-enabled vending machines are becoming the standard.

The food services sector is projected to hold a 38.0% share of the refrigerated vending machine market in 2025, positioning it as the top end-use segment. Growth in this area is fueled by rising demand for convenient, hygienic, and around-the-clock food access in high-traffic environments.

Institutions like corporate campuses, hospitals, airports, and educational facilities are using refrigerated vending machines to supplement or replace canteen infrastructure. These machines enable fast service delivery of sandwiches, salads, dairy items, and other perishables without staffing overhead.

Enhanced freshness control and smart replenishment cycles have improved consumer trust in machine-dispensed food offerings.

The refrigerated vending machine market is expanding due to rising demand for convenient access to fresh food, beverages, and perishable products. Global shipment volumes exceeded 3.2 million units in 2024, with North America and the Asia Pacific representing nearly 60% of total installations. Increasing consumer preference for healthy and ready-to-eat products, coupled with the growth of office complexes, schools, and transit hubs, is driving adoption. Machines offering advanced temperature control, energy efficiency, and smart payment systems are increasingly preferred. Automated inventory tracking and IoT integration improve operational efficiency.

Consumer preference for on-the-go meals and chilled beverages is a key driver for refrigerated vending machine adoption. A single machine can serve 800–1,200 users monthly, depending on location and foot traffic. North America accounts for over 35% of demand, while Asia Pacific is expanding at 7–9% annually due to urbanization and workforce growth. Smart vending machines with IoT-based inventory management reduce restocking time by up to 20% and improve customer satisfaction. Companies are investing in energy-efficient refrigeration systems that consume 15–20% less power, addressing rising operational costs. Public spaces, corporate offices, and schools increasingly integrate these machines to meet demand for chilled food and beverages.

Integration of IoT, remote monitoring, and digital payment systems is enhancing machine efficiency and user experience. Machines with real-time temperature monitoring prevent spoilage, improving shelf life by 10–15%. High-capacity, modular designs enable placement in offices, hospitals, and transit hubs with varying space requirements. Energy-efficient compressors and LED lighting reduce electricity consumption by 15–20%, supporting cost-effective operation. AI-driven predictive maintenance minimizes downtime, ensuring machine uptime of approximately 95%. Manufacturers are developing machines with flexible refrigeration zones to cater to beverages, fresh fruits, and ready-to-eat meals. Smart features combined with compact design expand market reach and drive adoption in urban and semi-urban areas.

Asia Pacific accounts for over 40% of refrigerated vending machine installations due to rising office complexes, shopping centers, and transit hubs. Annual growth in India, China, and Japan ranges between 7–9%. Urbanization, workforce expansion, and increasing demand for convenient chilled food drive adoption. Integration of cashless payment systems, QR codes, and mobile app connectivity is becoming standard. Deployment in hospitals, universities, and high-traffic transit hubs is expanding, while compact machines with energy-efficient refrigeration appeal to small businesses. Manufacturers are investing in localized production and distribution networks to meet regional demand, reducing delivery lead times by 15–20%.

Advanced refrigerated vending machines require an initial investment of USD 5,000–15,000 per unit depending on capacity, smart features, and refrigeration type. Maintenance, including servicing compressors, cooling systems, and sensors, adds 8–12% annually to operational costs. Machines require software updates and predictive maintenance to maintain uptime above 90%. Older models consume 15–20% more energy, increasing operational expenses. Limited availability of technical service personnel in semi-urban and rural regions can slow expansion. Manufacturers and operators must balance upfront capital, energy efficiency, and maintenance planning to ensure profitability while maintaining consistent temperature control for perishable items.

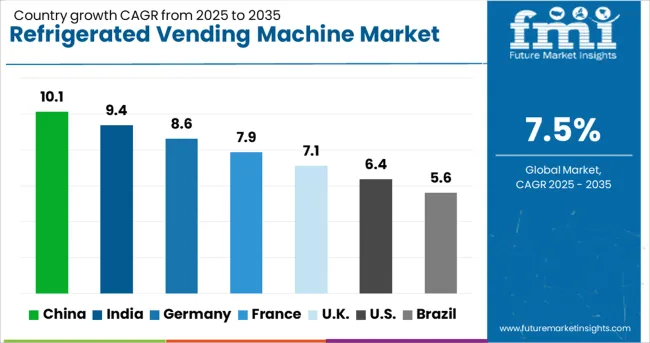

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global refrigerated vending machine market is projected to grow at a CAGR of 7.5% through 2035, fueled by rising demand for contactless food and beverage access, urban convenience infrastructure, and technological integration in retail automation. Among BRICS nations, China leads with 10.1% growth, driven by widespread deployment in transit hubs, integration of AI-based inventory systems, and support for smart city retail. India follows at 9.4%, supported by the modernization of retail kiosks, increasing consumption of cold beverages, and digital payment integration. In the OECD region, Germany posts 8.6% growth, reflecting innovation in energy-efficient cooling and smart replenishment systems. The United Kingdom, growing at 7.1%, sees adoption in workplaces, campuses, and public transport hubs. The United States, at 6.4%, remains a mature market with focus on healthy vending options, IoT connectivity, and sustainable cooling solutions. This report includes insights on 40+ countries; the top five markets are shown here for reference.

In China, the refrigerated vending machine market is growing at a CAGR of 10.1%, fueled by increased deployment across public transportation hubs, office complexes, and residential compounds. Vendors are placing machines stocked with ready-to-eat meals, fresh beverages, and cold snacks in subway stations, schools, and hospitals. Manufacturers are offering multi-compartment models with temperature zones for different product categories. Urban demand has led to the rise of touchscreen-enabled machines supporting mobile wallet payments, QR scanning, and real-time stock tracking. Supply chains have been adjusted to ensure chilled goods are replenished faster, reducing spoilage risks. Local assembly and component sourcing have helped reduce equipment costs for new market entrants. Distribution partners are also integrating real-time diagnostics to prevent equipment failures and maintain cooling performance across varying climates, especially in southern regions.

India’s refrigerated vending machine market is rising at a CAGR of 9.4%, with adoption growing in airports, educational campuses, and gated communities. The demand for cold snack and beverage options outside conventional retail stores has pushed machine installations across Tier 1 and Tier 2 cities. Operators are favoring energy-efficient compressors and modular designs that suit space-limited indoor locations. Machines are being stocked with regional cold drinks, yogurt cups, and single-serve fruit packs to align with local consumption patterns. Vending startups are leasing compact units to malls and business parks, offering real-time refill services and remote machine tracking. Manufacturers are also supplying tamper-proof glass doors and reinforced insulation to maintain cooling even during power fluctuations. Extended warranty programs and on-site service networks have helped increase adoption among mid-sized operators.

The refrigerated vending machine market in Germany is growing at a CAGR of 8.6%, supported by rising consumer preference for on-the-go cold meals. Machines are increasingly found in railway stations, university campuses, and coworking spaces, offering chilled sandwiches, wraps, and fresh drinks. Operators are deploying machines with touchless interfaces and multiple cooling layers to preserve different product types. Manufacturers are offering plug-in, low-noise variants ideal for quiet office environments and indoor waiting areas. Cold-chain service providers have adjusted logistics routes to support faster replenishment during workdays. With strong hygiene expectations, machine interiors are being built with antimicrobial materials and automated cleaning features. Cafeteria alternatives in business parks have adopted these machines to serve flexible workforce schedules.

The refrigerated vending machine market in United Kingdom is growing at a CAGR of 7.1%, driven by demand in transport stations, gyms, and shared housing facilities. Consumers increasingly rely on vending machines to access chilled beverages, protein shakes, and meal boxes during off-peak hours. Business parks and health clubs are integrating machines that stock healthy pre-packaged items under proper cooling. Domestic suppliers are offering built-in alarm systems to indicate internal temperature fluctuations, ensuring product safety. Refill schedules are being optimized through route mapping software that tracks machine sales and identifies restock priorities. Models with bright LED interiors and anti-condensation glass panels are being used in public-facing environments to enhance product visibility.

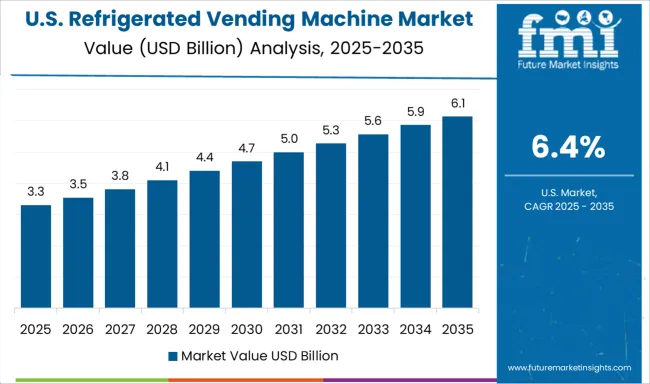

In United States, the refrigerated vending machine market is expanding at a CAGR of 6.4%, supported by rising demand in office buildings, transit stations, and hospital lobbies. Employers are placing machines stocked with salads, yogurt, and cold brews in employee lounges to provide 24/7 access to chilled food. Machines are increasingly linked to backend systems that track sales and alert for restocking. Manufacturers are supplying units that support cardless payment options and quick ID verification for workplace accounts. Schools and libraries are also adding smaller models for students and staff. With rising concern over freshness, refrigerated units are designed to deliver consistent cooling in both summer and winter climates. Onsite repairs and predictive maintenance tools are helping reduce downtime for high-traffic machines.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Operating Mode | Smart and Conventional |

| Payment Mode | Cashless and Cash |

| End Use | Food services and Retails |

| Distribution Channel | Offline, Online, E-commerce, and Company Website |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fuji Electric, Azkoyen, Bharat Refrigerations, Bianchi Vending, Crane Merchandising, Dover, FAS International, Heatcraft Worldwide Refrigeration, Rheavendors, Rockwell Industries, RS Hughes, Seaga Manufacturing, Vendcraftz, Vendekin Technologies, and Westomatic Vending Services |

| Additional Attributes | Dollar sales vary by product type and deployment, with beverage machines dominating, and fresh/food units growing fastest. Asia‑Pacific leads volume, while North America holds highest value. Pricing fluctuates with energy and refrigeration tech costs. Growth accelerates via IoT-enabled smart systems, contactless payments, healthy snack options, and energy-efficient refrigeration under food safety and sustainability mandates. |

The global refrigerated vending machine market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the refrigerated vending machine market is projected to reach USD 14.4 billion by 2035.

The refrigerated vending machine market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in refrigerated vending machine market are smart and conventional.

In terms of payment mode, cashless segment to command 66.0% share in the refrigerated vending machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Vending Machines Market

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Vending Machine Suppliers

Medical Vending Machines Market

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Vending Massage Chair Payment Solution Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Refrigerated Display Case Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA