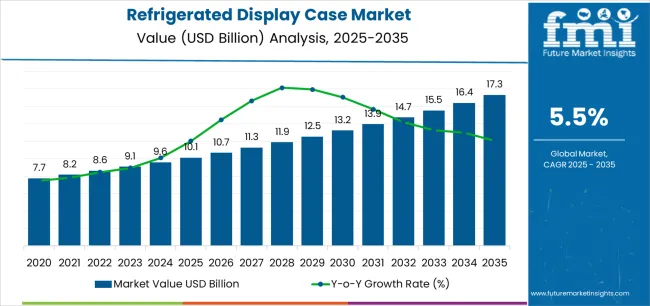

The Refrigerated Display Case Market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 17.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The Refrigerated Display Case market is experiencing significant growth, driven by the rising demand for energy-efficient and high-performance refrigeration solutions across retail and food service sectors. Increasing consumer preference for fresh and visually appealing products has LED businesses to adopt advanced display cases that combine temperature control with aesthetic design. Technological advancements in cooling systems, including improved compressors, energy-efficient insulation, and digital monitoring, are enhancing operational efficiency and reducing energy consumption.

The growth of supermarkets, convenience stores, and quick-service restaurants is further supporting adoption, as operators seek solutions that ensure product freshness while attracting customer attention. Regulatory standards for food safety and energy efficiency are encouraging manufacturers to innovate in design, materials, and functionality.

Integration of remote monitoring and smart controls is improving maintenance, reducing downtime, and optimizing operational costs As foodservice and retail industries continue to expand globally, the Refrigerated Display Case market is poised for sustained growth, with opportunities emerging from increasing investments in energy-efficient, customer-friendly, and technologically advanced refrigeration systems.

| Metric | Value |

|---|---|

| Refrigerated Display Case Market Estimated Value in (2025 E) | USD 10.1 billion |

| Refrigerated Display Case Market Forecast Value in (2035 F) | USD 17.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

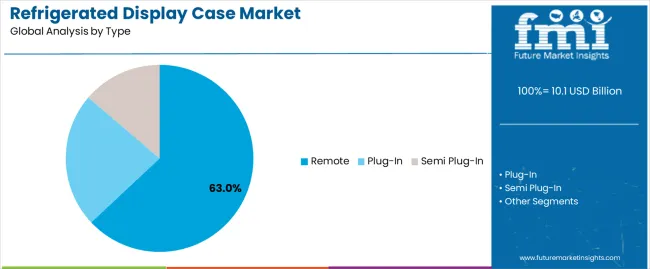

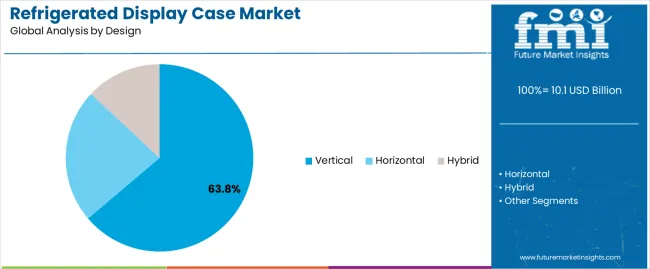

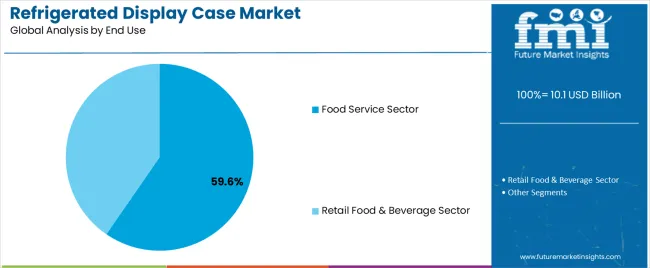

The market is segmented by Type, Design, and End Use and region. By Type, the market is divided into Remote, Plug-In, and Semi Plug-In. In terms of Design, the market is classified into Vertical, Horizontal, and Hybrid. Based on End Use, the market is segmented into Food Service Sector and Retail Food & Beverage Sector. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The remote type segment is projected to hold 63.0% of the market revenue in 2025, establishing it as the leading type. Growth in this segment is being driven by the ability to place compressors and cooling units remotely, which reduces noise, optimizes space utilization, and improves temperature stability in display areas. Remote systems are preferred in large-scale retail and food service environments where operational efficiency, maintenance accessibility, and energy savings are critical.

The flexibility to integrate with various display designs, including vertical and horizontal cases, further supports adoption. Advanced monitoring systems allow real-time diagnostics, predictive maintenance, and energy consumption optimization, strengthening operational reliability.

Growing demand for fresh and perishable products in supermarkets, convenience stores, and restaurants has reinforced the need for remote refrigeration systems As businesses increasingly prioritize energy efficiency, product visibility, and operational flexibility, the remote type segment is expected to maintain its market leadership, supported by technological innovation and widespread deployment across commercial and food service sectors.

The vertical design segment is anticipated to account for 63.8% of the market revenue in 2025, making it the leading design category. Its growth is being driven by superior visibility and accessibility of products, which enhances customer engagement and encourages impulse purchases. Vertical display cases provide optimized shelving, lighting, and airflow, ensuring uniform temperature distribution and maintaining product freshness.

Their compact footprint allows efficient use of floor space, which is particularly valuable in high-traffic retail and food service environments. Integration with remote compressors and smart controls enhances energy efficiency and reduces operational costs.

The increasing preference for visually appealing product presentation, coupled with regulatory requirements for food safety and hygiene, has reinforced adoption As retailers and food service operators continue to focus on maximizing display efficiency while maintaining product quality, vertical designs are expected to retain their leading position, supported by ongoing innovations in energy-efficient cooling technologies, lighting, and ergonomic shelving solutions.

The food service sector is projected to hold 59.6% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is being driven by the increasing demand for quick-service restaurants, catering operations, and institutional kitchens, which require efficient and reliable refrigerated display solutions to ensure food freshness and compliance with safety standards.

Refrigerated display cases enable operators to present perishable items attractively while maintaining optimal temperatures, improving customer satisfaction and reducing spoilage. Integration with remote compressors and vertical designs allows for efficient space utilization, energy savings, and operational flexibility.

The adoption of smart monitoring systems enhances predictive maintenance, reduces downtime, and provides data-driven insights for inventory and operational management As the global food service industry expands and consumer expectations for freshness, convenience, and visual appeal increase, the sector’s reliance on technologically advanced refrigerated display cases is expected to reinforce its leading position, driving sustained market growth.

Energy-efficiency and Sustainable are the Present Themes in this Market

Manufacturers are crafting refrigerated showcases that are better for the environment. They use LED lights, better compressors, and thick insulation for this purpose. This helps them to cut down on energy use and costs. They are also resorting to more environmentally friendly materials and coolants.

It's all about going green and being mindful of our planet's health. There is also a preference for sustainable materials. Consumers and businesses are asking for equipment made from materials that come with no harm and create no harm when disposed of.

Improvements in insulations and other features support these goals. For instance, AHT launched propane-based refrigerated cabinets (R290) in October 2025. The new KALEA units have an energy consumption range from class B to D. This depends on their model and configuration options. These new units have set energy efficiency, sustainability, and design standards.

Food Service Industry is Booming Because People are Changing their Dining Habits

The food industry is buzzing these days, with cafes, restaurants, and bakeries all hopping because people are changing their eating habits. These places are about showing off their mouthwatering food options in those refrigerated open display cases to lure in customers.

With more consumers opting to dine out, the demand for refrigerated display cases is shooting up, driving the market forward. Plus, as cafes and restaurants strive to set themselves apart and create memorable dining experiences, they're splurging on top-notch display cases, further fueling market growth.

New Warehouses and Production Factories Emerge Globally

As more people crave fresh foods like dairy, meat, seafood, and produce, companies selling commercial refrigerated display cases need bigger warehouses. This lets those stock more deli cases or beverage coolers to meet different store needs. Various food options make businesses more competitive and help build better relationships with customers looking for all-in-one refrigeration solutions.

With the market growing, they might need even more space to keep up with demand. For instance, in March 2025, Blue Star announced the expansion of its manufacturing facilities for refrigerated display cases in Dadra and Sri City. On the other hand, AHT Cooling Systems GmbH launched a new factory in China in February 2025. The new pop ups can boost revenues in the industry.

| Segment | Remote (Type) |

|---|---|

| Value Share (2025) | 63.00% |

Remote type segment holds the top refrigerated display case market shares in 2025. Remote type display cases keep stores cooler and quieter, making shopping more comfortable.

These systems use fancy tech to save energy and lower costs, while also making sure everything stays compliant with environmental rules. They're flexible too, letting retailers adjust easily to changes and even predict when maintenance is needed. This helps in operational savings, which aids demand.

| Segment | Vertical (Design) |

|---|---|

| Value Share (2025) | 63.80% |

Vertical refrigerator display cases are great because they save space by using up and down rooms instead of spreading out. This means shops can show more stuff without taking up lots of floor space.

Plus, they're easy to adjust to fit different-sized products, so shops can display all sorts of things like drinks, sandwiches, and desserts. These refrigerated showcases also keep everything at the right temperature and look modern. Overall, they're a smart choice for shops to show off their products and make shopping easier for customers.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.30% |

| Germany | 1.40% |

| Japan | 9.90% |

| China | 6.50% |

| India | 6.10% |

Demand for refrigerated display cases in the United States to surge at a 1.30% CAGR through 2035. American people want healthier and more convenient food options. That's why stores and restaurants are getting more refrigerated deli cases to show off fresh foods and special items. These cases also make sure the food stays safe and at the right temperature.

New technology is making these cases smarter and using less energy. Also, more people are shopping online in the United States. So, businesses are buying commercial refrigerated display cases that keep food fresh. It's all about making sure consumers get what they want, whether they're shopping in the store or online.

Sales of refrigerated display cases in Germany to increase at a 1.40% CAGR until 2035. In Germany, businesses are centering on eco-friendly refrigerated display cases to follow strict rules and adhere to green mandates. They are using tech like RFID and blockchain to make sure food is safe and traceable. Also, with more people living in cities, smaller stores are popping up, asking for compact displays.

Individuals in Germany love their fresh, extravagant foods, so displays are made to show off these products in style. Stores are also using digital screens and mobile technologies to get customers involved. Lastly, they're working hard to cut down on food waste, making displays that help keep food fresh for longer.

The refrigerated display case market growth in Japan is assessed at a 9.90% CAGR till 2035. In Japan, stores are getting smaller because there isn't much space in big cities. So, they're using these special cases that are compact but showcase a lot of products. Japanese people really care about having fresh and good-quality food, so stores are making sure the refrigerated showcases keep food fresh and look nice.

As more older people and single-person households are shopping, stores are offering smaller portions and ready-made meals. The government is also making sure that the food is safe by requiring special features in the display cases. Overall, stores in Japan are focusing on making shopping easy, fun, and safe for everyone.

Refrigerated display case demand in China to rise at a 6.50% CAGR until 2035. In China, as cities grow bigger and more people shop in modern stores, there's a vast demand for refrigerated display cases. Chinese people care a lot about food safety, so businesses are making sure these cases meet high standards.

The government is also helping by encouraging companies to invest in better storage and transport for food. Also, with more people wanting swanky imported foods, stores are getting fancier display cases to show them off.

Refrigerated display case sales in India to amplify at a 6.10% CAGR through 2035. In India, more big shops are popping up in cities because people there are earning more and want to buy things from nice, organized stores.

People want their food to be safe and easy to get, so stores are getting special fridges that are clean and save energy. And since everyone cares about the environment, companies are making refrigerated display cabinets that don't use too much energy and are good for the planet.

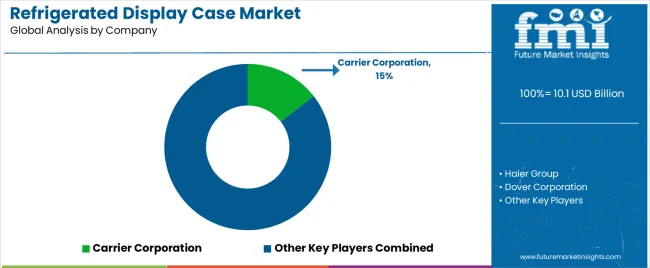

In the refrigerated display case market, top companies like Hussmann Corporation, Carrier Corporation, Danfoss A/S, Haier Group, Dover Corporation, and others are competing against each other. They're all trying to come up with better and more efficient technologies to embed these display cases. They focus on making products that use less energy and are customizable.

Recent Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.03 billion |

| Projected Market Size (2035) | USD 17.63 billion |

| CAGR (2025 to 2035) | 5.80% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| By Type | Plug-In Refrigerated Display Cases, Semi Plug-In Refrigerated Display Cases, and Remote Refrigerated Display Cases |

| By Design | Vertical Refrigerated Display Cases, Horizontal Refrigerated Display Cases, and Hybrid Refrigerated Display Cases |

| By End Use | Food Service Sector and Retail Food & Beverage Sector |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Carrier Corporation, Frigoglass SAIC, Epta S.p.a. Refrigeration, Dover Corporation, Haier Group, Arneg S.p.A, Illinois Tool Works, Daikin Industries, Ltd., Fagor Industrial, and Danfoss A/S |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The global refrigerated display case market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the refrigerated display case market is projected to reach USD 17.3 billion by 2035.

The refrigerated display case market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in refrigerated display case market are remote, plug-in and semi plug-in.

In terms of design, vertical segment to command 63.8% share in the refrigerated display case market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multi-Deck Refrigerated Display Cases Market Growth – Trends & Forecast 2025 to 2035

Countertop Warmers & Display Cases Market – Food Presentation & Preservation 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Trailer Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Transport Market Size and Share Forecast Outlook 2025 to 2035

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Ice Cream Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Casein Market Analysis - Size, Share, and Forecast 2025 to 2035

Case Coders Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Case Material Market Size and Share Forecast Outlook 2025 to 2035

Casein Hydrolysate Market Size, Growth, and Forecast for 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA