The growing trend of oversized and high pixel density displays in different electronic devices will also help to build a strong Display drivers market globally from 2025 to 2035. Display drivers are vital semiconductor devices that control how a pixel is illuminated on a screen, utilized over smartphones, tablets, televisions, automotive displays and industrial monitors.

Market growth is being driven by the growing shift towards energy-efficient and high-performance display technologies, advancements in miniaturization, and flexible display solutions. Additionally, the growing adoption of 5G-enabled devices, surge in a robust investment into automotive infotainment, and increasing regulatory focus on power-efficient semiconductor solutions have also remained instrumental in driving consistent development within the industry.

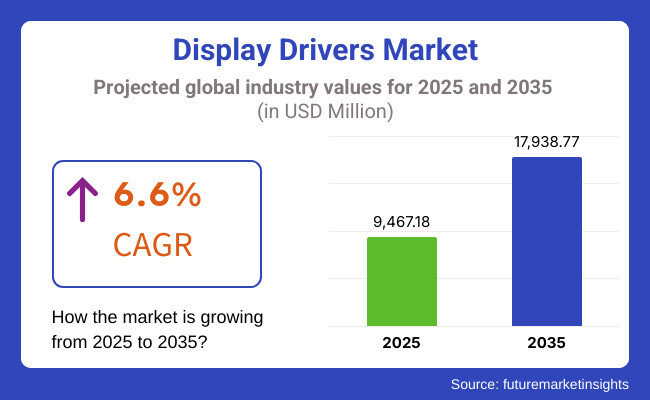

The Display driver’s market size was valued at over USD 9,467.18 million in 2025. It is expected to grow at a CAGR of 6.6% reaching USD 17,938.77 million by 2035. Market growth is largely driven by increasing demand for high-refresh-rate displays, growing penetration of micro-LED and quantum dot technologies, and increasing investments in next-generation display manufacturing.

Market growth is further promoted by the inclusion of AI-enabled image processing, improved energy-efficient drivers, and affordable chip manufacturing technology. The gradual miniaturization of chiplets is also gonna take them down the manufacturing agenda and aid in their market penetration and consumer adoption, such as ultra-low-power display drivers, high-speed display drivers, and AI-enhanced display drivers.

Strong consumer electronics demand, high adoption of advanced display technologies and significant investments in semiconductor manufacturing are driving North America to be a dominating market for display drivers. Next generation display driver ICs are becoming important for high-frame-rate driver development and adapting to AI-powered adaptive brightness control, putting United States, and Canada ahead in its development and commercialization.

Growing demand for high-end televisions, automotive heads-up displays (HUDs), and smart wearable displays are driving the market growth. In addition, the growth of augmented reality (AR) and virtual reality (VR) applications is also leading to product innovation and adoption.

The European market is fueled by the high demand for high-quality displays for automotive applications, governmental initiatives favoring semiconductor research and development, and advancements in flexible and foldable display technology. But countries like Germany, France, and the UK are all focusing on high-performance, low-power display driver development for automotive dashboards, gaming monitors, and medical imaging displays.

While the increased focus on power efficiency, growing use in industrial automation, and continued research into AI-powered display optimizations will drive broader adoption in the market. Furthermore, a slew of applications in aviation displays, smart home interfaces, as well as energy-efficient visual solutions are giving a rise to opportunities for manufacturers and technology providers.

The Display drivers market in the Asia-Pacific region is experiencing the fastest growth, fueled by the need to produce more consumer electronics, a rising demand for smartphones and smart TVs, and increased investment in semiconductor fabrication plants. Fundamentally, China, South Korea, and Japan are all investing a wealth of resources into R&D over the extensive breakthrough and inexpensive, high-functional performance display drivers suited to OLED, AMOLED, and micro-LED.

Increasing demand for flexible and transparent displays, expansion of local semiconductor manufacturing capabilities, structural developments in market regulations, and local government initiatives to bolster domestic chipMakers, are driving regional market expansions. Moreover, the growing awareness of high-refresh-rate gaming monitors and 8K television displays are propelling market penetration.

The presence of leading display panel manufacturers and partnerships with global semiconductor companies are also aiding the market growth.

Continuous improvements in the display technology such as power-efficient semiconductor designing and AI-based image processing will ensure steady growth in the Display drivers markets in coming decades. To enhance all aspects of functionality, market appeal, and long-term functionality, companies are concentrating on innovation in areas such as high-frame-rate drivers, ultra-low-latency chipsets, and miniaturized display control solutions.

These conditions include growing consumer interest in immersive visual experiences, rising digital integration in automotive and industrial visual displays, and changing semiconductor fabrication strategies. Through this cutting-edge combination of artificial intelligence (AI)-based adaptive brightness, quantum dot display drivers and next-gen micro-LED control technologies, we are continuing to drive display efficiency and optimize high-quality displays solutions globally.

Challenge

Supply Chain Disruptions and Semiconductor Shortages

Both semiconductor shortages and global supply chain disruptions are challenges to the Display drivers market. With growing consumer segment display driver integrated circuits (DDICs) demand in both the OLED and LCD markets as well as in automotive displays and industrial applications, manufacturers are under significant pressure.

Also, geopolitical tensions, trade restrictions and raw material shortages lead to extended lead times and production bottlenecks. The solution lies in investing in semiconductor fabrication facilities within national borders, active development of diversified supply networks, and increased production efficiency using advanced IoT and AI in supply chain management.

Rising Manufacturing Costs and Technological Complexity

Displays, OLED, Micro LED, high-refresh rate displays, require driver ICs that are getting more and more sophisticated. The price of creating high performance display drivers capable of improving power efficiency, response times, and ultra high resolution support is on the rise. The trend to adjust & foldable displays similar to smart phone adds more complexity in driver design.

In order to reduce these obstacles, companies have to invest in R&D for energy-efficient and compact driver solutions, while at the same time optimizing production costs through economies of scale and leading-edge fabrication techniques.

Opportunity

Growing Demand for High-Resolution and Energy-Efficient Displays

The growing demand for energy-efficient and high-definition displays across smartphones, smart TVs, gaming monitors and automotive infotainment systems is also a key growth driver. As 8K res, HDR tech, and high-refresh-rate displays roll into town, display driver vendors need to scale their DDIC portfolio to bring out better visual fidelity without draining the battery.

Next-generation display solutions with AI-driven image enhancement and adaptive refresh rate technology will provide all new opportunities for companies that build them around their products.

Expansion of Automotive and AR/VR Applications

A rise in demand for specialized display drivers is driven by the rapid growth of automotive displays, augmented reality (AR), and virtual reality (VR) applications. Dimmable LCDs or OLEDs are becoming common elements in modern cars' in-cabin experience, forcing adoption of advanced driver IC with low latency and high dynamic range.

The growing adoption of AR/VR devices in gaming, healthcare, and industrial applications also presents new opportunities for display driver innovation. Coupled with an expansion of immersive visual technologies that require high-end display performance, companies working on ultra-low-power, high-refresh-rate, and high-contrast display drivers will benefit from this as well.

Analysis of the Display drivers market from 2020 to 2024. Trends from 2025 to 2035 During the years 2020 to 2024, the Display drivers market underwent rapid growth, fueled by the growing adoption of OLED and high-refresh-rate displays in smartphones, televisions, and gaming monitors. But manufacturers faced headwinds from ongoing supply chain issues, semiconductor shortages and surging production costs.

In response, companies streamlined chip designs, invested in cutting-edge fabrication methods, and ramped up production capacity to keep pace with surging demand.

In the years 2025 to 2035, expect groundbreaking innovation in AI-based display optimization, quantum dot display drivers, and ultra-low-power IC design. Future display drivers, e.g., for Micro LED and transparent displays will re-frame the display requirements towards enhanced efficiency and adaptive performance.

Neuromorphic display processing, real-time AI-enhanced visual change, and flexible display controllers will be developed as well. Hence, the industry transformation will be achieved by companies with innovative minds who are redefining AI-assisted display drivers, sustainable semiconductor manufacturing, and next-generation display technologies.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter semiconductor manufacturing regulations and supply chain challenges |

| Technological Advancements | Growth in OLED and high-refresh-rate display drivers |

| Industry Adoption | Increased use in smartphones, gaming monitors, and automotive displays |

| Supply Chain and Sourcing | Dependence on a limited number of semiconductor fabs |

| Market Competition | Dominance of established semiconductor firms in DDIC manufacturing |

| Market Growth Drivers | Demand for high-resolution, HDR, and power-efficient displays |

| Sustainability and Energy Efficiency | Initial focus on reducing power consumption and extending battery life |

| Integration of Smart Monitoring | Limited real-time AI-based display optimization |

| Advancements in Display Innovation | Development of compact, high-efficiency display drivers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven supply chain resilience, government-backed semiconductor initiatives, and sustainable chip production |

| Technological Advancements | Expansion of AI-optimized, neuromorphic, and adaptive refresh rate display drivers |

| Industry Adoption | Mainstream adoption in AR/VR, Micro LED displays, and transparent display applications |

| Supply Chain and Sourcing | Diversification into localized chip production, advanced nanotechnology, and quantum-dot-based driver solutions |

| Market Competition | Rise of AI-powered display driver startups, flexible display controller developers, and ultra-low-power IC firms |

| Market Growth Drivers | Growth in AI-assisted visual processing, quantum dot and Micro LED advancements, and autonomous display adaptation |

| Sustainability and Energy Efficiency | Large-scale implementation of energy-efficient semiconductor materials, AI-driven power management, and recyclable components |

| Integration of Smart Monitoring | AI-powered adaptive display adjustments, real-time eye-tracking enhancements, and intelligent refresh rate control |

| Advancements in Display Innovation | Introduction of neuromorphic vision processing, transparent display controllers, and interactive AI-driven visuals |

The growth in demand for high-performance display solutions, increased adoption of OLED and mini-LED technologies, and the presence of major semiconductor manufacturers are expected to drive the Display drivers market in the United States. With the proliferation of high resolution screens across consumer electronic industries, the market will continue to grow.

Increasing investment in artificial intelligence (AI) supported display processing and development of low-power and high-speed display drivers also drive demand for the display driver IC market. Moreover, implementation of advanced driver ICs for augmented reality (AR) and virtual reality (VR) applications is improving the attractiveness of products.

With changing consumer and commercial needs, companies are also working on devices with energy-efficient and high-refresh-rate display drivers. The growing adoption of display drivers in automotive, gaming, and industrial applications is contributing to the demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The United Kingdom displays an important market for display drivers, emerging traction for advanced display solutions in smart devices and rising investments for semiconductor R& D also enriching the demand of energy-effective displays. Market growth is also being driven by increased focus on sustainable and low-power electronics.

The aid provided by government policies for the innovation of semiconductor manufacturing, along with the various advancements in the AI-driven display controllers are playing an important part in market expansion. Furthermore, innovations like micro-LED and flexible display driver ICs have started gaining traction. Investment is poured also into high-dynamic-range (HDR) display drivers and adaptive refresh rate use.

The growing trend towards ultra-thin and foldable displays is also driving further uptake of the market in the UK. Moreover, the emergence of AR/VR applications and automaker demand for advanced driver ICs in automotive heads-up displays (HUD) is driving adoption as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

Key European Market Players in the Display driver’s space include Germany having recently reported its Semiconductor segment seen around €37 billion in revenue in 2022, achieving a growth percentage of 5.5% YoY, France and Italy display drivers market also growing significantly owing to its increasing investments in automotive display solutions and rising demand for high-resolution industrial and medical displays.

Rapid market expansion is also aided by the European Union's commitment to developing semiconductor technology as well as investments in developing display driver ICs for smart devices and vehicle infotainment systems. Other solutions, such as AI-powered display enhancement technologies, ultra-low-power driver ICs, and mini-LED backlight solutions are enhancing efficiency as well.

Increasing demand from high-refresh-rate gaming monitor, medical imaging display, and digital signage is also pushing the market growth. The opening of OLED production facilities and rising adoption of flexible displays are also believed to drive increased adoption across the EU. Moreover, regulatory support for energy-efficient and recyclable display technologies is fast-tracking innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.5% |

Japan Display drivers market is growing on account of strong knowledge graph in display technology across the country, growing acceptance of OLED and micro-LED displays and an increase in requirement of energy effective display solutions. The increasing demand for high-performance displays in automotive and consumer electronics is propelling the market growth.

Innovation is also driven by the country’s focus on technology innovation and the combination of AI-enabled image processing and high-end touch display controllers. In addition, government regulations regarding energy consumption, as well as growing investments in advanced automotive display with high resolution, are pushing firms to manufacture high-tech driver ICs.

This trend is further fuelling the growth of Japan's electronics market as a rise in demand for compact, high-speed, and ultra-low-power display drivers extends in smart home devices, wearables, and industrial applications. Japan’s investment in quantum dot and micro-LED display technology is also developing the next generation of high-definition screens.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

South Korea will be a growing market for display drivers due to its dominance in OLED manufacturing, the growth in demand for high-refresh-rate gaming displays, and government backing to drive semiconductor advancement.

Market growth is attributable to stringent regulatory acts on energy efficiency as well as increasing deployment of flexible and transparent display systems. Likewise, its efforts to improve display driver performance via AI-based optimization, frame rate control and upgraded touch sensors are enhancing competitiveness.

The rise in display drivers for automotive digital clusters, foldable smartphones, and high-end TVs are powering its implementation globally. Next-generation screens are being accompanied by high-speed, low-power, and high-bit-depth display drivers, and companies are investing in them. This demand is further fueled by the increasing needs for advanced display driver solutions in South Korea as smart cities and AI-based visual interfaces gain traction and become widespread.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Display driver ICs (DDICs) continue to play a critical role in modern electronic displays by facilitating efficient image rendering, optimizing power consumption, and supporting high-resolution output. These ICs are responsible for managing pixel color accuracy, refresh rates, and brightness levels, and are crucial for smartphone and tablet displays, not to mention TV displays.

Both the growing market for high-resolution panels, energy-efficient displays, and HDR (High Dynamic Range) support are driving the advancements needed in advanced DDIC solutions. To satisfy the future requirements of next-generation display technologies, manufacturers are centering on miniaturized, low-power, and AI-augmented DDICs.

Because Touch and Display Driver Integration (TDDI) solutions integrate touch sensing and display control functionalities in a single chip, they are becoming popular; TDDI solutions reduce power consumption and improve the accuracy of touch responses. Thin, and edge-to-edge displays are a key market driver for smartphone, tablet, and automotive displays, the industry - where tightly integrated display technologies that do not impact device form factor performance are especially welcomed.

The rise in adoption of foldable, flexible, and edge-to-edge display technologies has also increased demand for TDDI solutions to enable cost-optimized, compact, and high-performance display architectures.

Smartphones are one of the biggest applications for display driver technologies, with growing demand for OLED and AMOLED units, high-refresh-rate displays, and power-efficient mobile screens. With 5G connectivity, gaming-centric smartphones, and AI-powered display optimization gaining traction, manufacturers are under pressure to develop high-performance and adaptive DDIC and TDDI solutions.

Furthermore, trends for under-display fingerprint sensing, curved screens, and ultra-high-resolution displays have also necessitated next-generation display driver technologies in the smartphone segment.

Automotive displays became an important growth area, as today's vehicles include digital instrument clusters, infotainment displays and head-up displays (HUDs). This shift from conventional analog to completely digital and touch-enabled dashboards would drive the higher implementation of high-performance DDICs and TDDIs.

Moreover, the trends towards autonomous driving, AR dashboards, and multi-display integration have led automakers to devote more resources into energy-efficient, high-brightness and ultra-wide display driver solutions to their next-generation models.

Liquid-Crystal Display (LCD) technology will keep thriving across TVs, laptops, and affordable smartphones, where cost of ownership, longevity and high brightness levels are required. Could there be enough of a next generation resulting in the collapse of OLED displays, which have well-established technology and parameters that differ, particularly in automotive displays, gaming monitors, and commercial signage applications, to become dominant.

The development of mini-LED and micro-LED backlighting has bolstered the performance of LCD panels, driving the need for specialized display driver ICs that can handle more difficult dimming zones and higher refresh rates.

Since its introduction, Organic Light-Emitting Diode (OLED) technology has transformed the display industry, providing other opportunities like deeper blacks, better energy efficiency and higher contrast ratios. The prevalence of OLED panels for smartphones, wearables, high-end televisions and automotive applications has quickly sent demand for high-performance DDIC and TDDI solutions for flexible and foldable displays.

Recent developments in cutting-edge OLED technologies, like transparent and flexible OLED panels, have created opportunities for innovative display driver solutions to prolong display lifetimes, improve power efficiency, and achieve accurate color reproduction.

Increasing demand for high-resolution displays in consumer electronics, automotive, and industrial applications is driving the market growth for Display drivers. Industry efforts also include power-optimized drivers, compatibility with newer embedding display technologies, and even refresh rates for higher visual performance. Core trends are OLED and mini-LED driver advances, energy-efficient ICs, and AI-enabled adaptive display technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novatek Microelectronics Corp. | 17-21% |

| Samsung Electronics Co., Ltd. | 13-17% |

| Himax Technologies, Inc. | 10-14% |

| Synaptics Incorporated | 7-11% |

| Texas Instruments Incorporated | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novatek Microelectronics Corp. | Leading provider of high-performance display driver ICs for OLED and LCD displays. |

| Samsung Electronics Co., Ltd. | Specializes in advanced AMOLED display drivers for smartphones and smart TVs. |

| Himax Technologies, Inc. | Develops power-efficient display drivers with integration for AI and AR applications. |

| Synaptics Incorporated | Offers smart display drivers optimized for touchscreen and IoT-enabled displays. |

| Texas Instruments Incorporated | Focuses on industrial and automotive-grade display driver solutions. |

Key Company Insights

Novatek Microelectronics Corp. (17-21%)

Novatek is also the leader in the Display drivers market, with a variety of high-performance ICs for OLED and LCD screens for smartphones, tablets, and TVs.

Samsung Electronics Co., Ltd. (13-17%)

Incorporating high-refresh-rate technology for high-end consumer electronics, Samsung specializes in AMOLED display driver technology.

Himax Technologies, Inc. (10-14%)

Himax is a provider of AI-enabled, energy-efficient display driver IC with improved performance for AR (Augmented Reality)/VR (Virtual Reality) and automotive areas.

Synaptics Incorporated (7-11%)

Synaptics produces display drivers with a built-in intelligence for touchscreen devices, IoT displays and adaptive visual processing.

Texas Instruments Incorporated (5-9%)

For automotive dashboard displays, industrial monitors, and medical displays, Texas Instruments offers strong display driver solutions.

Other Key Players (35-45% Combined)

The following display driver innovations are by various global and regional manufacturers promoting energy efficiency, high resolution, and excellent integration. Key players include:

The overall market size for display drivers market was USD 9,467.18 Million in 2025.

The display drivers market expected to reach USD 17,938.77 Million in 2035.

Factors such as increasing adoption of high-resolution displays in smartphones, tablets, and TVs, rising demand for OLED and AMOLED panels, growth in automotive and gaming displays, advancements in touch and display driver integration (TDDI), and expanding use of wearable devices will drive the demand for the display drivers market.

The top 5 countries which drives the development of display drivers market are USA, UK, Europe Union, Japan and South Korea.

Chip-on-glass and chip-on-film packaging enhance growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 4: Global Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 5: Global Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Table 6: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 7: North America Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 8: North America Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 9: North America Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 10: North America Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Table 11: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 12: Latin America Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 13: Latin America Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 14: Latin America Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 15: Latin America Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Table 16: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 17: Europe Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 18: Europe Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 19: Europe Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 20: Europe Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Table 21: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 22: Asia Pacific Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 23: Asia Pacific Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 24: Asia Pacific Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 25: Asia Pacific Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Table 26: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 27: Middle East and Africa Market Value (US$ billion) Forecast by Driver Type, 2017 to 2032

Table 28: Middle East and Africa Market Value (US$ billion) Forecast by Devices, 2017 to 2032

Table 29: Middle East and Africa Market Value (US$ billion) Forecast by Package Type , 2017 to 2032

Table 30: Middle East and Africa Market Value (US$ billion) Forecast by Display Technology, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Devices, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 4: Global Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 5: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 6: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 12: Global Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 15: Global Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 18: Global Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 21: Global Market Attractiveness by Driver Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Devices, 2022 to 2032

Figure 23: Global Market Attractiveness by Package Type , 2022 to 2032

Figure 24: Global Market Attractiveness by Display Technology, 2022 to 2032

Figure 25: Global Market Attractiveness by Region, 2022 to 2032

Figure 26: North America Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 27: North America Market Value (US$ billion) by Devices, 2022 to 2032

Figure 28: North America Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 29: North America Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 30: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 31: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 34: North America Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 37: North America Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 40: North America Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 41: North America Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 42: North America Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 43: North America Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 44: North America Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 45: North America Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 46: North America Market Attractiveness by Driver Type, 2022 to 2032

Figure 47: North America Market Attractiveness by Devices, 2022 to 2032

Figure 48: North America Market Attractiveness by Package Type , 2022 to 2032

Figure 49: North America Market Attractiveness by Display Technology, 2022 to 2032

Figure 50: North America Market Attractiveness by Country, 2022 to 2032

Figure 51: Latin America Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 52: Latin America Market Value (US$ billion) by Devices, 2022 to 2032

Figure 53: Latin America Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 54: Latin America Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 55: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 56: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 59: Latin America Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 62: Latin America Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 65: Latin America Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 68: Latin America Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Driver Type, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Devices, 2022 to 2032

Figure 73: Latin America Market Attractiveness by Package Type , 2022 to 2032

Figure 74: Latin America Market Attractiveness by Display Technology, 2022 to 2032

Figure 75: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 76: Europe Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 77: Europe Market Value (US$ billion) by Devices, 2022 to 2032

Figure 78: Europe Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 79: Europe Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 80: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 84: Europe Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 85: Europe Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 87: Europe Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 88: Europe Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 90: Europe Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 93: Europe Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 94: Europe Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 96: Europe Market Attractiveness by Driver Type, 2022 to 2032

Figure 97: Europe Market Attractiveness by Devices, 2022 to 2032

Figure 98: Europe Market Attractiveness by Package Type , 2022 to 2032

Figure 99: Europe Market Attractiveness by Display Technology, 2022 to 2032

Figure 100: Europe Market Attractiveness by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 102: Asia Pacific Market Value (US$ billion) by Devices, 2022 to 2032

Figure 103: Asia Pacific Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 104: Asia Pacific Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 106: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 110: Asia Pacific Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 111: Asia Pacific Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 112: Asia Pacific Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 113: Asia Pacific Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 114: Asia Pacific Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 115: Asia Pacific Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 116: Asia Pacific Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 117: Asia Pacific Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 118: Asia Pacific Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 119: Asia Pacific Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 120: Asia Pacific Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 121: Asia Pacific Market Attractiveness by Driver Type, 2022 to 2032

Figure 122: Asia Pacific Market Attractiveness by Devices, 2022 to 2032

Figure 123: Asia Pacific Market Attractiveness by Package Type , 2022 to 2032

Figure 124: Asia Pacific Market Attractiveness by Display Technology, 2022 to 2032

Figure 125: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 126: Middle East and Africa Market Value (US$ billion) by Driver Type, 2022 to 2032

Figure 127: Middle East and Africa Market Value (US$ billion) by Devices, 2022 to 2032

Figure 128: Middle East and Africa Market Value (US$ billion) by Package Type , 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ billion) by Display Technology, 2022 to 2032

Figure 130: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 131: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 134: Middle East and Africa Market Value (US$ billion) Analysis by Driver Type, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Driver Type, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Driver Type, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ billion) Analysis by Devices, 2017 to 2032

Figure 138: Middle East and Africa Market Value Share (%) and BPS Analysis by Devices, 2022 to 2032

Figure 139: Middle East and Africa Market Y-o-Y Growth (%) Projections by Devices, 2022 to 2032

Figure 140: Middle East and Africa Market Value (US$ billion) Analysis by Package Type , 2017 to 2032

Figure 141: Middle East and Africa Market Value Share (%) and BPS Analysis by Package Type , 2022 to 2032

Figure 142: Middle East and Africa Market Y-o-Y Growth (%) Projections by Package Type , 2022 to 2032

Figure 143: Middle East and Africa Market Value (US$ billion) Analysis by Display Technology, 2017 to 2032

Figure 144: Middle East and Africa Market Value Share (%) and BPS Analysis by Display Technology, 2022 to 2032

Figure 145: Middle East and Africa Market Y-o-Y Growth (%) Projections by Display Technology, 2022 to 2032

Figure 146: Middle East and Africa Market Attractiveness by Driver Type, 2022 to 2032

Figure 147: Middle East and Africa Market Attractiveness by Devices, 2022 to 2032

Figure 148: Middle East and Africa Market Attractiveness by Package Type , 2022 to 2032

Figure 149: Middle East and Africa Market Attractiveness by Display Technology, 2022 to 2032

Figure 150: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Micro Display Market Analysis by Technology, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA