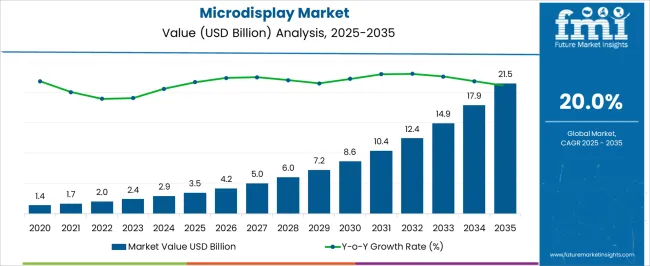

The microdisplay market is estimated to be valued at USD 3.5 billion in 2025. It is projected to reach USD 21.5 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period. Between 2025 and 2030, the market grows from USD 3.5 billion to USD 8.6 billion, contributing USD 5.1 billion in growth, with a CAGR of 19.9%. This early-phase acceleration is driven by increasing demand for microdisplay technology in applications such as augmented reality (AR), virtual reality (VR), and wearables, where high-resolution, compact displays are critical.

The growth is further fueled by the adoption of microdisplays in consumer electronics, including smart glasses, projectors, and automotive heads-up displays. From 2030 to 2035, the market continues to expand from USD 8.6 billion to USD 21.5 billion, contributing USD 12.9 billion in growth, with a slightly higher CAGR of 21.1%. This later-phase acceleration is driven by continued innovations in microdisplay technologies, including OLED and microLED, which offer superior performance and energy efficiency. The widespread adoption of AR/VR devices, smart glasses, and other wearable technologies contributes significantly to this phase. The overall CAGR of 20.0% reflects a rapid expansion of the microdisplay market, with growth accelerating as new applications and advancements in display technology continue to emerge.

| Metric | Value |

|---|---|

| Microdisplay Market Estimated Value in (2025 E) | USD 3.5 billion |

| Microdisplay Market Forecast Value in (2035 F) | USD 21.5 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

Current momentum is driven by growing demand for high-resolution, low-power display technologies, especially in wearable electronics and AR VR headsets. Industry-led announcements and technology roadmaps indicate that Microdisplays are being increasingly integrated into smart glasses, head-mounted displays, and next-generation automotive HUD systems, fostering broader commercial viability.

The future outlook remains strong as OEMs continue to prioritize lightweight, high-brightness, and energy-efficient components that support real-time data visualization. Additionally, the shift toward spatial computing and metaverse applications is expected to play a catalytic role in driving Microdisplay deployments in both enterprise and consumer domains.

Industry insights from investor presentations and component manufacturers further highlight that strong R&D investments and improvements in pixel density and luminance will enable deeper market penetration. As miniaturization and integration trends continue, Microdisplays are anticipated to become central to innovation in visual computing platforms globally.

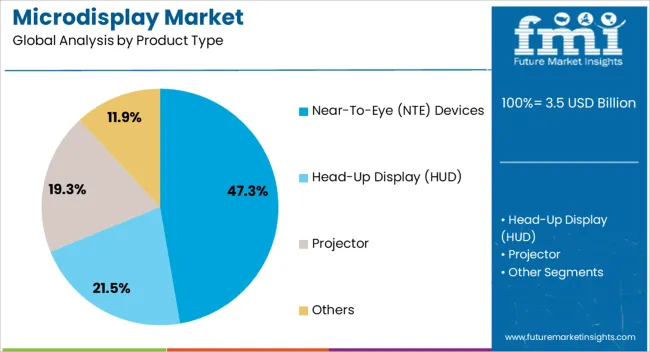

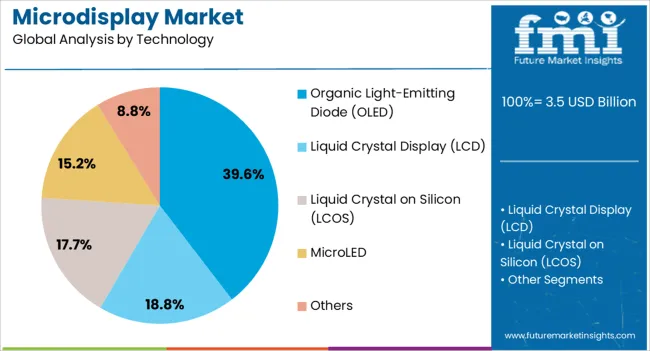

The microdisplay market is segmented by product type, technology, end-use industry, and geographic regions. By product type, the microdisplay market is divided into Near-To-Eye (NTE) Devices, Head-Up Display (HUD), Projector, and Others. In terms of technology, the microdisplay market is classified into Organic Light-Emitting Diode (OLED), Liquid Crystal Display (LCD), Liquid Crystal on Silicon (LCOS), MicroLED, and Others.

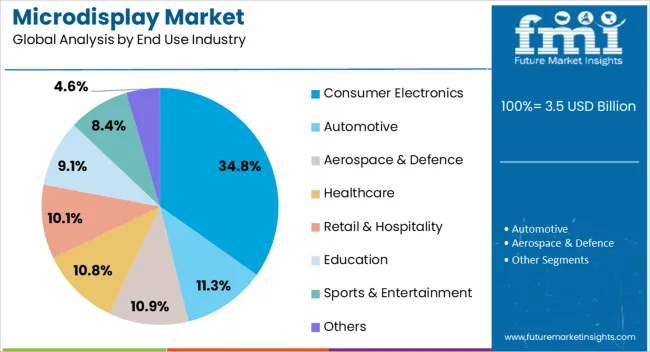

Based on end use industry, the microdisplay market is segmented into Consumer Electronics, Automotive, Aerospace & Defence, Healthcare, Retail & Hospitality, Education, Sports & Entertainment, and Others. Regionally, the microdisplay industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Near To Eye (NTE) devices segment is projected to account for 47.3% of the Microdisplay market revenue share in 2025, securing the leading position among product types. This dominance is attributed to increasing integration of Microdisplays in head-mounted displays, smart glasses, and AR VR wearables, where compact size and high resolution are essential.

Corporate press releases and industry exhibitions have confirmed that consumer and enterprise sectors alike are deploying NTE-based systems for immersive training, virtual collaboration, and gaming. The form factor advantages and energy efficiency of NTE devices have positioned them as the preferred choice for manufacturers seeking to enhance user experience without compromising on mobility or battery life.

Additionally, manufacturers have focused on improving contrast ratios, refresh rates, and field of view to meet rising end user expectations. As demand continues to rise for personalized display technologies in both entertainment and industrial applications, NTE devices are expected to maintain their lead within the Microdisplay market.

The Organic Light Emitting Diode (OLED) segment is estimated to capture 39.6% of the Microdisplay market revenue share in 2025, emerging as the leading technology segment. The growth of OLED-based Microdisplays has been propelled by their superior contrast, wide viewing angles, and faster response times, making them ideal for immersive viewing experiences.

Technology news portals and product development briefings have consistently highlighted OLED’s advantage in producing lightweight and flexible display modules that support compact optical systems. Manufacturers have increasingly shifted towards OLED due to its ability to deliver deeper blacks and reduced motion blur, which are critical for augmented reality and simulation applications.

Further, its self-emissive nature eliminates the need for backlighting, contributing to reduced device weight and power consumption. These benefits have led to widespread incorporation of OLED Microdisplays across wearable electronics, military optics, and medical imaging systems, ensuring its continued leadership in the market.

The consumer electronics segment is forecasted to account for 34.8% of the Microdisplay market revenue share in 2025, standing out as the most dominant end use industry. This leadership is driven by the rapid adoption of AR VR devices, smart wearables, and next-generation gaming platforms that require lightweight, power-efficient display technologies. Technology company roadmaps and investor updates have revealed increasing use of Microdisplays in premium consumer electronics to deliver immersive visual experiences with improved brightness and resolution.

Brands have been leveraging Microdisplays to differentiate their product offerings, particularly in wearables and portable entertainment devices, where miniaturization is a key factor. Furthermore, as consumer interest grows in virtual environments and interactive media, the demand for high-performance Microdisplays is set to increase.

Integration of voice control, gesture recognition, and AI-enhanced user interfaces has further cemented Microdisplays as essential components in modern electronics.

Microdisplays offer the advantage of providing high-quality images in a small form factor, making them ideal for use in headsets, smart glasses, and other portable devices. The growing popularity of VR and AR technologies, along with the rise in demand for smart wearables, is driving market expansion. Despite challenges related to high production costs and the need for continuous innovation, technological advancements in display technology continue to fuel the growth of the microdisplay market.

The key driver of the microdisplay market is the increasing adoption of virtual reality (VR), augmented reality (AR), and wearable devices, which rely on compact and high-resolution display technologies. VR and AR are becoming more mainstream in industries such as gaming, healthcare, and education, where immersive experiences are in demand. Microdisplays, with their ability to deliver high-quality images in a compact size, are essential for these applications. The growing popularity of smart glasses, fitness trackers, and other wearable technologies that require lightweight, high-performance displays is propelling the microdisplay market. As the demand for interactive and immersive experiences grows, microdisplays will continue to play a crucial role in enabling the next generation of VR and AR devices, further driving the market's growth.

A significant challenge in the microdisplay market is the high production cost associated with manufacturing high-quality microdisplays. Producing microdisplays that offer high resolution, brightness, and clarity requires advanced manufacturing techniques and costly materials. This can make microdisplays more expensive than traditional display technologies, limiting their widespread adoption, particularly in cost-sensitive applications. The lifespan of microdisplays, especially OLED-based microdisplays, remains a concern. Over time, these displays can suffer from performance degradation, including reduced brightness and color shift, affecting their long-term usability. Ensuring the durability and longevity of microdisplays while maintaining cost-efficiency is a challenge that manufacturers must overcome to expand the market further.

The microdisplay market presents significant opportunities through technological advancements and the expanding use of microdisplays in emerging applications. Innovations in display technology, such as organic light-emitting diodes (OLEDs) and liquid crystal on silicon (LCoS), are improving the performance and efficiency of microdisplays, enabling higher resolutions, faster refresh rates, and better power efficiency. These advancements are opening new opportunities for microdisplays in applications such as automotive heads-up displays, digital signage, and wearable technology. As VR and AR technologies continue to evolve, microdisplays will become increasingly essential for providing immersive and interactive experiences. The expansion of these technologies into sectors such as healthcare, entertainment, and retail presents long-term growth potential for the microdisplay market.

A prominent trend in the microdisplay market is the integration of microdisplays with augmented reality (AR) and virtual reality (VR) devices, as well as wearable technology. As the demand for AR and VR devices increases, there is a growing need for high-performance, compact displays that offer immersive visual experiences. Microdisplays, particularly OLED-based and LCoS microdisplays, are gaining popularity in these applications due to their ability to deliver high-resolution images with low power consumption. The rise of smart glasses, fitness trackers, and other wearable devices that require miniaturized displays is also contributing to the market's growth. Advancements in miniaturization are making it possible to integrate microdisplays into increasingly smaller form factors, enhancing their potential for use in a variety of innovative applications.

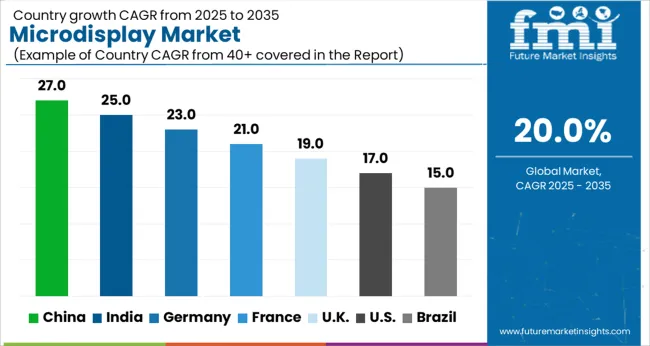

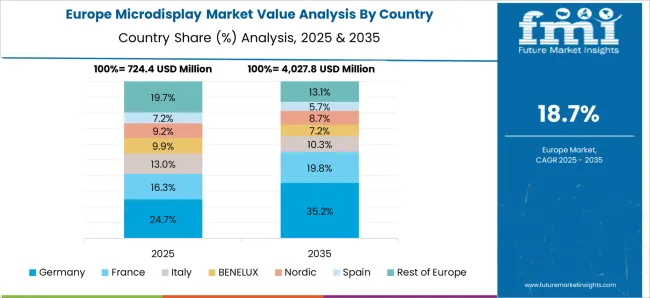

The global microdisplay market is projected to grow at a CAGR of 20% from 2025 to 2035. China leads at 27.0%, followed by India at 25.0%, and Germany at 23.0%, while the United Kingdom records 19.0% and the United States posts 17.0%. The increasing adoption of microdisplays in consumer electronics, AR/VR devices, and wearables in China and India, while more mature markets like the United States and the United Kingdom experience more moderate growth due to established infrastructure and market saturation. The analysis includes over 40+ countries, with the leading markets detailed below.

Demand for microdisplays in China is growing at a 27.0% CAGR through 2035. China’s strong consumer electronics market, coupled with its increasing investments in AR/VR technology, is fueling the demand for microdisplays. The rise in wearable devices, such as smart glasses and head-mounted displays, further accelerates this growth. China’s booming tech industry, along with government support for innovation in electronics, positions the country as a leader in microdisplay adoption. The expanding demand for high-quality, compact displays in mobile devices and gaming systems contributes to market growth

The microdisplays markeyt in India is projected to grow at a 25.0% CAGR through 2035. The expanding electronics sector, particularly in the areas of consumer electronics, AR/VR devices, and wearables, is driving the growth of the microdisplay market. As the demand for smartphones, smartwatches, and other connected devices increases, the need for compact, high-performance displays rises. The growing interest in augmented and virtual reality applications in India’s tech industry is also contributing to the increasing adoption of microdisplays. India’s tech-savvy population and growing disposable income further boost the demand for these advanced technologie

Demand for microdisplays in Germany is growing at a 23.0% CAGR through 2035. Germany’s strong focus on innovation in the electronics and automotive sectors is driving the demand for microdisplays. The growing use of microdisplays in automotive displays, wearable devices, and industrial applications is boosting market growth. Germany’s commitment to high-quality manufacturing and technological advancements in AR/VR and consumer electronics further supports the expansion of microdisplay technologies. With the rise of smart home solutions and connected devices, Germany is positioned as a key adopter of microdisplay technology in Europe.

The UK microdisplay market is expected to grow at a 19.0% CAGR through 2035. The UK’s growing focus on AR/VR technology and the increasing use of microdisplays in consumer electronics and wearables are key factors driving market expansion. The country’s strong technology sector, combined with rising consumer demand for innovative display technologies, further fuels the adoption of microdisplays. Additionally, the UK’s focus on digital transformation and its growing gaming industry contribute to the demand for high-performance microdisplays

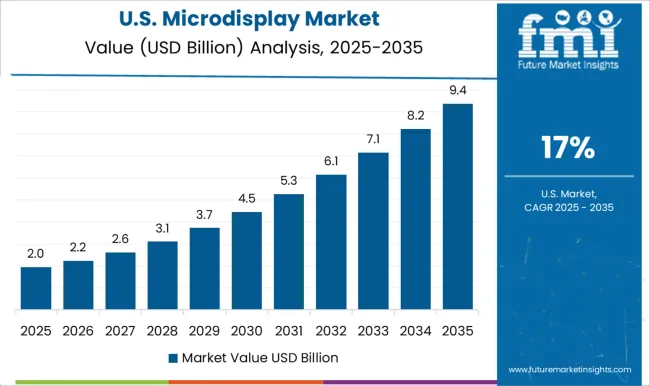

Demand for microdisplays in the USA is projected to grow at a 17.0% CAGR through 2035. The USA market is driven by the increasing adoption of microdisplays in AR/VR devices, wearables, and consumer electronics. As the demand for cutting-edge technology in gaming, healthcare, and automotive sectors continues to rise, microdisplays are becoming essential in providing high-performance and compact solutions. The USA is a leader in technological advancements and is a key market for next-generation displays, contributing to steady growth in the microdisplay market.

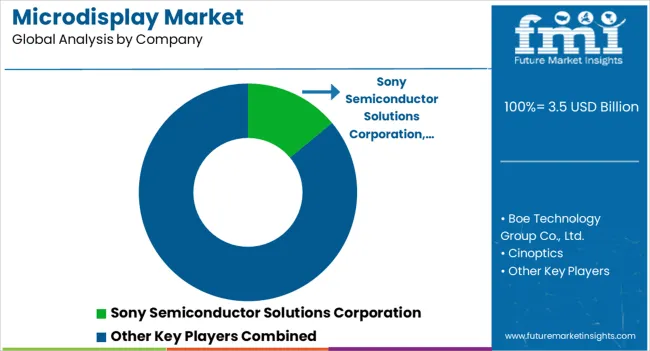

The microdisplay market is driven by leading companies offering high-performance displays for applications in consumer electronics, automotive, medical devices, virtual reality (VR), and augmented reality (AR). Sony Semiconductor Solutions Corporation is a dominant player, providing advanced OLED microdisplays for VR headsets and AR applications, known for their superior resolution, brightness, and energy efficiency. Boe Technology Group Co., Ltd. specializes in high-resolution microdisplay technology and serves industries such as automotive, security, and wearables. Cinoptics and Dresden Microdisplay GmbH focus on providing microdisplay solutions for consumer and professional markets, offering low-power, high-performance displays that cater to both OLED and LCoS (liquid crystal on silicon) technologies. eMagin Corporation is a leader in OLED microdisplays, particularly in VR and AR applications, offering innovative products with high contrast ratios and resolution for immersive experiences.

Himax Technologies, Inc. provides microdisplays for AR glasses, industrial applications, and other optical displays, specializing in low-power solutions for wearables. HOLOEYE Photonics AG offers LCoS-based microdisplays for both research and commercial applications, with a strong emphasis on precision and flexibility. Jasper Display Corp and Kopin Corporation focus on providing high-performance microdisplays for VR headsets, wearable devices, and medical applications, delivering bright, sharp, and efficient products. LG Display Co., Ltd. is a significant player in the microdisplay market, offering OLED-based microdisplays known for their compactness and visual quality. Lumiode, Inc., MicroOLED Technologies, and Omnivision focus on delivering innovative microdisplay technologies for a variety of markets, including automotive, medical imaging, and consumer electronics. Playnitride Inc. and Raontech provide microdisplay solutions with a strong emphasis on new materials and improved production methods. Samsung Display Co., Ltd. continues to lead in microdisplay technology with its high-quality OLED displays used in applications ranging from wearables to AR/VR systems.

SeeYa Technology and Seiko Epson Corporation are recognized for their expertise in microdisplay technologies for use in medical devices, automotive heads-up displays, and projectors. Sensors Unlimited specializes in providing infrared microdisplays used in defense, security, and industrial applications. Shenzhen Anpo Intelligence Technology Co., Ltd. and Shenzhen DJY Display Technology Co., Ltd. focus on the growing demand for affordable microdisplay technologies, offering solutions for consumer electronics and display integration. Silicon Micro Display and Syndiant are known for their advanced light engine solutions and microdisplay modules used in applications like projectors and head-mounted displays.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Product Type | Near-To-Eye (NTE) Devices, Head-Up Display (HUD), Projector, and Others |

| Technology | Organic Light-Emitting Diode (OLED), Liquid Crystal Display (LCD), Liquid Crystal on Silicon (LCOS), MicroLED, and Others |

| End Use Industry | Consumer Electronics, Automotive, Aerospace & Defence, Healthcare, Retail & Hospitality, Education, Sports & Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sony Semiconductor Solutions Corporation, Boe Technology Group Co., Ltd., Cinoptics, Dresden Microdisplay GmbH, eMagin Corporation, Himax Technologies, Inc., HOLOEYE Photonics AG, Jasper Display Corp, Kopin Corporation, LG Display Co., Ltd., Lumiode, Inc., MicroOLED Technologies, Omnivision, Playnitride Inc., Raontech, Samsung Display Co., Ltd, SeeYA Technology, Seiko Epson Corporation, Sensors Unlimited, Shenzhen Anpo Intelligence Technology Co., Ltd., Shenzhen DJY Display Technology Co., Ltd., Silicon Micro Display, Syndiant, and WiseChip Semiconductor Inc |

| Additional Attributes | Dollar sales by product type (OLED microdisplays, LCoS microdisplays, LCD microdisplays) and end-use segments (consumer electronics, automotive, medical devices, AR/VR, military). Demand dynamics are influenced by the growing adoption of AR/VR devices, increasing demand for wearable displays, and the rise in automotive applications for heads-up displays. Regional trends show strong growth in North America and Europe, driven by the demand for immersive technologies in gaming, medical imaging, and automotive displays, while Asia-Pacific is expanding due to technological advancements and large-scale consumer electronics manufacturing. |

The global microdisplay market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the microdisplay market is projected to reach USD 21.5 billion by 2035.

The microdisplay market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in microdisplay market are near-to-eye (nte) devices, head-up display (hud), projector and others.

In terms of technology, organic light-emitting diode (oled) segment to command 39.6% share in the microdisplay market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MEMS Microdisplay Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA