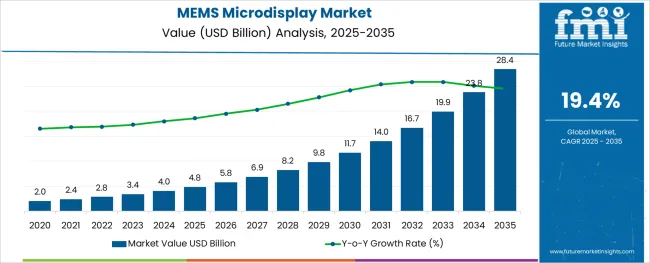

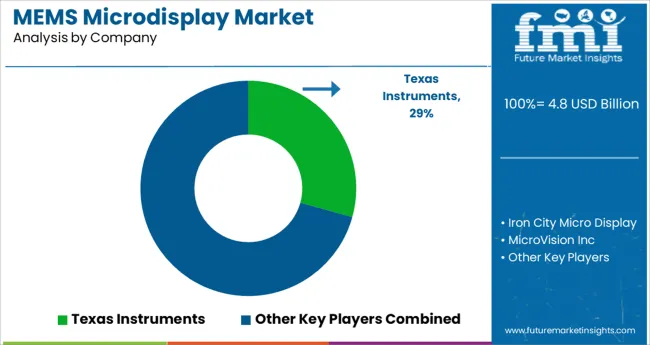

The MEMS Microdisplay Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 28.4 billion by 2035, registering a compound annual growth rate (CAGR) of 19.4% over the forecast period.

The MEMS microdisplay market is growing rapidly, propelled by increasing demand for compact high-resolution displays in wearable and augmented reality devices. Industry trends show that the near-to-eye application segment is driving innovation as consumer electronics and professional devices seek lightweight and energy-efficient display solutions. Developments in display technology, especially organic light-emitting diode (OLED) displays, have significantly enhanced visual performance and color quality while reducing power consumption.

Additionally, advancements in silicon wafer fabrication have enabled higher precision in MEMS components, improving overall display reliability and functionality. The adoption of MEMS microdisplays in sectors such as medical devices, defense, and consumer electronics has expanded, fueled by the need for immersive visualization experiences.

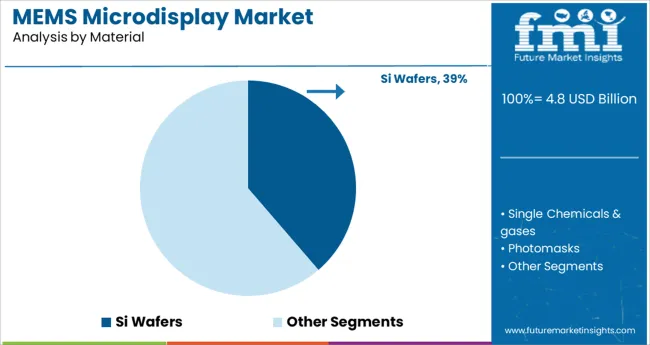

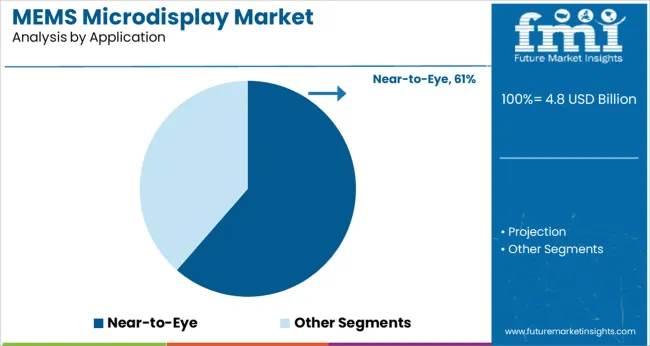

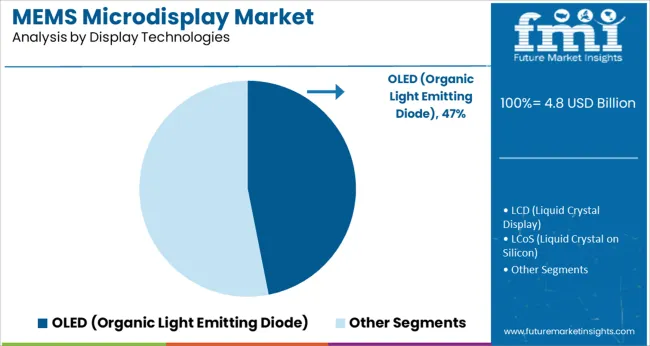

Market growth is expected to continue as augmented reality, virtual reality, and smart glasses gain traction globally. Segmental growth is projected to be led by Si Wafers in material, Near-to-Eye applications, and OLED display technologies.

The market is segmented by Material, Application, and Display Technologies and region. By Material, the market is divided into Si Wafers, Single Chemicals & gases, Photomasks, Glass wafers, and SOI wafers. In terms of Application, the market is classified into Near-to-Eye and Projection.

Based on Display Technologies, the market is segmented into OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), LCoS (Liquid Crystal on Silicon), DLP (Digital Light Processing), and MEMS (Microelectromechanical Systems). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Si Wafers segment is anticipated to hold 38.7% of the MEMS microdisplay market revenue in 2025, maintaining its position as the leading material type. Silicon wafers offer precise microfabrication capabilities essential for MEMS devices, enabling high resolution and miniaturization. Their compatibility with semiconductor manufacturing processes allows for efficient mass production and integration with other electronic components.

The robustness and thermal stability of silicon further enhance device durability and performance.

As manufacturers continue to push the boundaries of display pixel density and device compactness, silicon wafers remain the preferred substrate material in MEMS microdisplay production.

The Near-to-Eye segment is expected to account for 61.4% of the market revenue in 2025, establishing it as the dominant application area. This segment benefits from growing adoption in augmented reality and virtual reality headsets, smart glasses, and heads-up displays. Near-to-eye devices require high brightness, low latency, and compact form factors that MEMS microdisplays efficiently provide.

Increasing consumer interest in immersive technologies and enterprise use cases like training and remote assistance has propelled demand.

The need for lightweight and comfortable wearable displays has further reinforced near-to-eye applications as the primary driver of market growth.

The OLED segment is projected to capture 46.9% of the MEMS microdisplay market revenue in 2025, retaining its leadership in display technologies. OLED technology offers superior contrast ratios, faster response times, and better color accuracy compared to traditional displays. Its ability to be fabricated on flexible substrates enables innovative form factors suited for compact MEMS displays.

Additionally, OLEDs are energy efficient, a critical feature for battery-powered wearable devices.

Continuous improvements in OLED manufacturing have reduced costs and enhanced lifespan, supporting wider adoption in MEMS microdisplays across consumer and industrial applications.

The MEMS microdisplay market has received a lot of traction in the industry.

MEMS microdisplays, also called MEMS screens, are high-resolution screens used in magnified displays, and because of their size are usually used with augmenting optics. Microdisplays can also be used in other simple applications such as projections and near-eye displays.

The Microdisplay market is booming due to the benefits and additional features offered by OLED displays. In addition to their ability to overtake LCD and LCD and LCOS technologies, wearable devices, head-up displays (HUDs), smart glasses, and head-mounted displays (HMDs) have created a demand for microdisplay technology.

Currently, microdisplays are widely used on near-to-eye devices such as HMDs, camcorder viewfinders, video phones, and digital camera viewfinders. Innovative microdisplay technologies are used in areas such as military & defense, aerospace, healthcare, and industrial purposes, which has also driven the growth of the MEMS microdisplay market.

Increased penetration of augmented reality (AR) devices will lead to a demand increase for MEMS microdisplays in the display market. Rising demand from the military and aerospace industries, along with numerous players in the market, has created strong demand for MEMS microdisplays.

The Microdisplay market restraining factor is the shorter shelf life of LCoS, resulting in a lack of acceptance of MEMS microdisplay products. Near-to-eye applications are growing in number, restraining market growth.

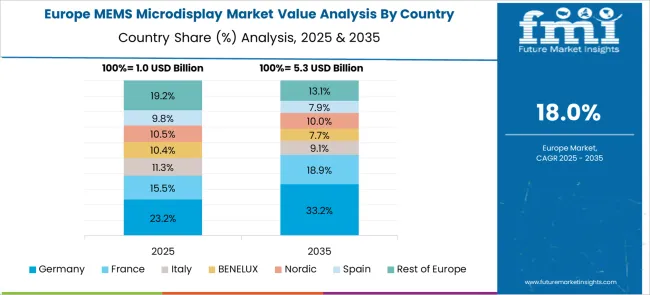

Europe is expected to contribute significantly to the global market over the forecast period.

Currently, the European MEMS microdisplay market is likely to hold a share of 23.2% as it witnesses robust growth, owing to the product’s microlevel resolution and transmissive displays, which drives the adoption.

The demand for MEMS microdisplays is basically governed by the rising demand from the defense and aerospace sectors.

In addition to this, the growing need to bring improvements in the flexibility for defense-related activities and gathering real-time information is necessitating the adoption of MEMS microdisplays in Europe.

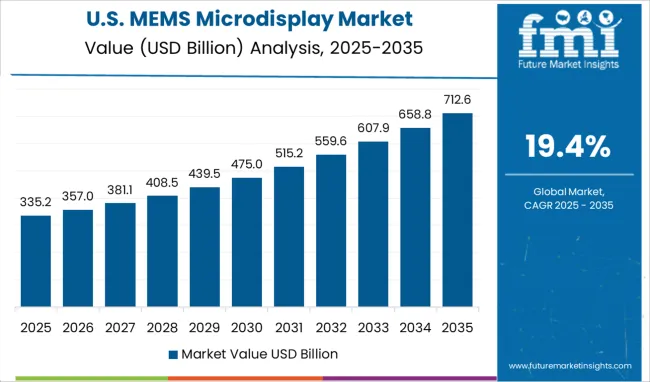

North America is forecasted to dominate the global MEMS microdisplay market with a share of 33.8%, owing to the continuous development of MEMS-based DMDs (digital micromirror devices) that are enabling projection-based display technology to be integrated into a variety of applications.

The ongoing development of MEMS-based DMDs (digital micromirror devices), which is opening up opportunities to incorporate projection-based display technology across various applications is likely to boost the growth of the North American market.

The education sector is increasingly utilizing ICT technology, which is altering traditional classroom instruction and, as a result, spurring regional market expansion.

Increased spending on microdisplay technologies, such as night vision HUDs and thermal imaging, is a result of the USA government's high military spending.

The majority of recent MEMS developments are housed within startups, which is an interesting fact.

When many new MEMS developments were on the verge of crossing the chasm in the 1998 to 1999 time frame, the situation was quite similar to what it is today, when these products are mature MEMS with large volume markets.

Alternatives to TI's Digital Light Processing (DLP) technology are being developed by Miradia Inc. (Santa Clara, California) and Reflectivity Inc. (Sunnyvale, California) for a variety of front- and rear-projection displays.

Up to two additional startups are also pursuing the use of tiny mirrors integrated into microelectromechanical systems (MEMS) to compete with TI's expanding high-end TV and business projector market share.

Some of the leading companies operating in the global MEMS microdisplay market include Texas Instruments, Iron City Micro Display, MicroVision Inc, Cardiocomm Solutions, Casio America, Inc., Cellnovo Limited, Covidien plc, EM Microelectronic-Marin SA, Jawbone Inc. and STMicroelectronics N.V., etc.

MEMS Microdisplay Market companies are now more engaged with promotional activities such as CSR programs, targeted marketing, etc. to boost their global recognition. A trend that is becoming increasingly popular is that these organizations now aim to process economic activities in countries with favorable regulations.

In addition, several key market players in the global MEMS Microdisplay Market have been focused on setting up joint ventures, acquisitions, and/or collaborations in order to expand their respective consumer bases. By doing so, they stand to increase their given market share by being able to cater to these consumers both globally and domestically.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 19.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Application, Display Technologies, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Argentina, Mexico, Brazil, Rest of Latin America, Germany, France, United Kingdom, Spain, Italy, Nordic, Benelux, Rest of Western Europe, Russia, Poland, Rest of Eastern Europe, Australia and New Zealand (A&NZ), China, India, ASIAN, Rest of Asia Pacific, Japan, GCC Countries, North Africa, South Africa, Rest of the Middle East and Africa |

| Key Companies Profiled | Texas Instruments; Iron City Micro Display; MicroVision Inc; Cardiocomm Solutions; Casio America, Inc.; Cellnovo Limited; Covidien plc; EM Microelectronic-Marin SA; Jawbone Inc.; STMicroelectronics N.V |

| Customization | Available Upon Request |

The global mems microdisplay market is estimated to be valued at USD 4.8 billion in 2025.

It is projected to reach USD 28.4 billion by 2035.

The market is expected to grow at a 19.4% CAGR between 2025 and 2035.

The key product types are si wafers, single chemicals & gases, photomasks, glass wafers and soi wafers.

near-to-eye segment is expected to dominate with a 61.4% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MEMS Oscillators Market Size and Share Forecast Outlook 2025 to 2035

MEMS Probes Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microphones Market Size and Share Forecast Outlook 2025 to 2035

MEMS Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

MEMS Sensor Market - Applications & Growth Forecast 2025 to 2035

MEMS Inkjet Heads Market Growth – Trends and Forecast 2025-2035

Mems Market

Automotive MEMS Market Size and Share Forecast Outlook 2025 to 2035

Automotive MEMS Sensors Market Growth - Trends & Forecast 2025 to 2035

Wide Temperature MEMS Oscillator Market Size and Share Forecast Outlook 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA