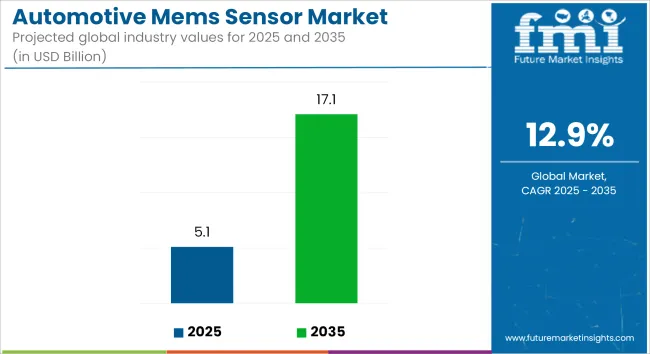

The Automotive MEMS Sensor Market is expected to reach USD 17.1 billion by 2035, up from an estimated USD 5.1 billion in 2025. A CAGR of 12.9% is projected between 2025 and 2035. This expansion is being driven by the scaling of MEMS-based gyroscopes, accelerometers, and pressure sensors in advanced driver assistance systems (ADAS), safety modules, and infotainment systems. Strong demand is being observed for sensor fusion platforms that support vehicle intelligence and automated functionality.

In May 2024, TDK Corporation introduced a new 6-axis MEMS inertial measurement unit (IMU) optimized for automotive safety. The device, as confirmed by TDK’s Automotive MEMS team, was designed to deliver stable performance over temperature shifts, helping manufacturers meet ISO 26262 functional safety standards. The launch was reported by Telematics Wire as a response to the increased sensitivity and precision required by autonomous systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.1 billion |

| Industry Value (2035F) | USD 17.1 billion |

| CAGR (2025 to 2035) | 12.9% |

Startups are also contributing to MEMS innovation. In January 2025, Omnitron Sensors secured USD 13 million in Series A funding to scale MEMS manufacturing using its proprietary SWS (Structural Wave Sensing) process. The company stated on its official blog that the new fabrication method can support “automotive-grade durability while significantly lowering cost per die,” marking a step toward volume deployment in safety-critical environments.

Sheba Microsystems made headlines in May 2024 with the launch of Sharp-7, the world’s first MEMS autofocus system designed for automotive cameras. According to the company’s press release covered by BusinessWire, the system allows for real-time focus adjustments and enhances machine vision clarity under dynamic driving conditions. This innovation is expected to enhance situational awareness in ADAS and autonomous driving stacks.

Miniaturization of sensors continues to support ECU integration and real-time data processing. MEMS technologies are being adopted in lane detection, airbag deployment, vehicle tilt sensing, and digital mapping. Increasing emphasis on functional safety, real-time monitoring, and driver support systems is expected to keep MEMS sensor investments strong across Tier 1 and Tier 2 automotive ecosystems throughout the forecast period.

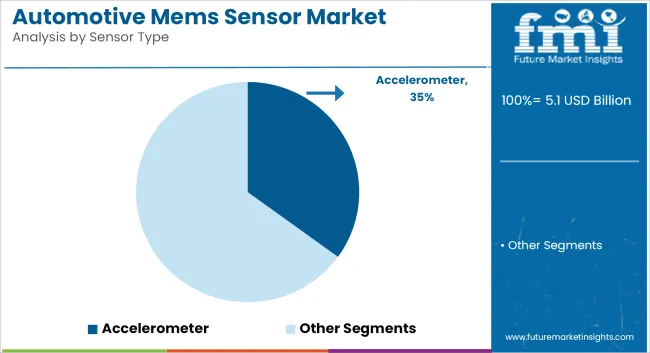

Accelerometers are projected to account for the largest share of the global automotive sensor market by 2025, contributing approximately 35% of total revenue. This segment is expected to grow at a CAGR of 13.2% from 2025 to 2035, marginally above the overall industry growth rate of 12.9%. These sensors are integral to applications involving vehicle stability, crash detection, rollover prevention, and advanced suspension systems.

Accelerometers are widely used in airbag deployment systems, electronic stability control (ESC), tire pressure monitoring systems (TPMS), and anti-lock braking systems (ABS). As OEMs integrate more advanced driver assistance systems (ADAS) and transition toward semi-autonomous driving, demand for high-sensitivity multi-axis accelerometers has surged.

MEMS-based accelerometers, known for their small footprint and durability, are being deployed in growing numbers across electric and internal combustion engine vehicles alike. Their expanding use in ride dynamics optimization and battery health monitoring further reinforces their leading market position.

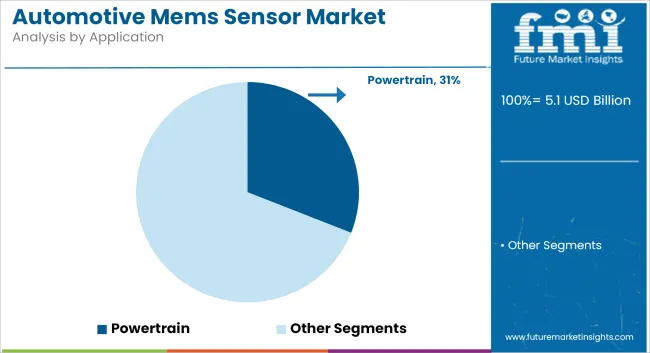

The powertrain segment is expected to remain the largest application area for automotive sensors, contributing approximately 31% of global revenue in 2025, with a forecast CAGR of 13.4% through 2035. With increasing electrification, stricter emission standards, and a shift toward efficiency-first designs, automotive powertrains are relying more heavily on advanced sensor networks.

Sensors embedded in powertrain systems support functions such as fuel injection control, exhaust after treatment monitoring, turbocharger regulation, and electric motor performance analysis. Pressure sensors and gyroscopes are playing a pivotal role in optimizing combustion, torque distribution, and thermal management. Moreover, the rise of hybrid and battery electric vehicles (BEVs) has added new complexity to powertrain design, necessitating precision sensors to manage inverter temperatures, motor speed, and battery cell conditions.

As automakers push for real-time diagnostics and predictive maintenance, the powertrain segment is set to become the most sensor-intensive domain across both conventional and next-generation vehicle architectures.

High Costs and Regulatory Complexities

The market faces challenges associated with high production costs, stringent regulatory approvals, and integration complexities. Automotive MEMS sensor manufacturers must comply with ISO 26262 (Functional Safety) and UNECE regulations, leading to increased development costs and longer certification timelines.

Accuracy and Reliability in Harsh Environments

MEMS sensors operate in extreme temperatures, vibrations, and electromagnetic interference, posing challenges in ensuring long-term reliability, calibration stability, and real-time performance accuracy for safety-critical applications.

Growing Demand for ADAS and Autonomous Vehicles

The rapid adoption of Advanced Driver Assistance Systems (ADAS) and self-driving technologies is fueling demand for high-precision MEMS sensors. Companies investing in multi-sensor fusion and AI-driven MEMS integration will benefit from the growing need for enhanced vehicle perception and safety systems.

Advancements in Smart Mobility and Electrification

The rise of electric vehicles (EVs), connected cars, and predictive maintenance technologies is driving innovation in MEMS gyroscopes, accelerometers, pressure sensors, and inertial measurement units (IMUs). These advancements enable smart diagnostics, real-time monitoring, and optimized energy efficiency.

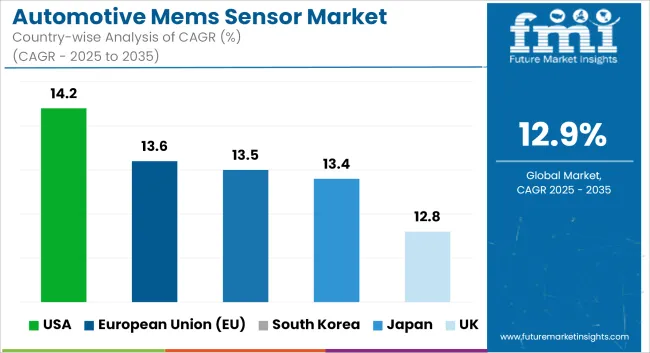

The USA automotive MEMS sensor market is witnessing substantial growth due to the increasing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies. Major automotive and semiconductor companies, including Tesla and Texas Instruments, are investing in next-generation MEMS sensors for enhanced safety, navigation, and performance monitoring.

Government regulations on vehicle safety, such as mandates for electronic stability control (ESC) and tire pressure monitoring systems (TPMS), are further driving market expansion. Additionally, the integration of MEMS sensors in connected car ecosystems is fueling demand for high-performance sensor solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.2% |

The UK automotive MEMS sensor market is growing due to the rising demand for high-precision sensing solutions in autonomous vehicles, smart mobility applications, and electric cars. With a strong presence of luxury and performance vehicle manufacturers such as Jaguar Land Rover, the demand for MEMS-based accelerometers, gyroscopes, and pressure sensors is increasing. Government-backed investments in autonomous vehicle development and stricter emissions regulations are driving innovation in MEMS sensor technologies. Additionally, collaborations between automotive manufacturers and AI-driven sensor analytics firms are expanding the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.8% |

Germany, France, and Italy are leading the European automotive MEMS sensor market, driven by the presence of major automakers such as Volkswagen, BMW, and Renault. The growing focus on electrification, safety regulations, and autonomous vehicle research is accelerating MEMS sensor integration in European vehicles. The European Union's strong regulatory framework on vehicle safety, including mandates for automatic emergency braking (AEB) and lane departure warning systems, is boosting demand for MEMS sensors. Additionally, innovations in microfabrication and sensor fusion technologies are expanding market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 13.6% |

Japan’s automotive MEMS sensor market is expanding due to the country’s leadership in automotive electronics and sensor miniaturization. Companies such as Toyota, Honda, and Denso are investing in MEMS-based sensor technologies to enhance vehicle safety, fuel efficiency, and automation. The increasing adoption of hybrid and electric vehicles in Japan is fueling demand for MEMS sensors for battery management, motion sensing, and vehicle stability control. Additionally, advancements in AI-integrated sensor systems are driving new market innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.4% |

South Korea’s automotive MEMS sensor market is growing rapidly, driven by Hyundai and Kia’s push for smart vehicle technology and autonomous driving solutions. The country’s leadership in semiconductor manufacturing, with companies like Samsung and SK Hynix, is further boosting the development of high-precision MEMS sensors for automotive applications. Government incentives for electric and connected vehicle technologies, along with increasing investments in ADAS and self-driving cars, are fueling market expansion. Additionally, advancements in sensor fusion and AI-driven data analytics are expected to enhance MEMS sensor capabilities in next-generation vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.5% |

Robert Bosch GmbH (18-22%)

STMicroelectronics (14-18%)

Infineon Technologies AG (12-16%)

Texas Instruments Inc. (8-12%)

NXP Semiconductors (5-9%)

Other Key Players (35-45% Combined)

Several semiconductor and automotive electronics manufacturers contribute to MEMS sensor advancements, focusing on high-precision sensing, sensor miniaturization, and AI-driven data processing:

The overall market size for the Automotive MEMS Sensor Market was USD 5.1 Billion in 2025.

The market is expected to reach USD 17.1 Billion in 2035.

The demand will be fueled by the rising integration of advanced driver assistance systems (ADAS), increasing adoption of electric and autonomous vehicles, growing focus on vehicle safety and emissions control, and advancements in sensor miniaturization and performance.

The top five contributors are the USA, European Union, Japan, South Korea, and the UK.

Accelerometers and gyroscopes, primarily used in vehicle stability control and airbag deployment systems, are anticipated to command a significant market share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Sensor Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Sensor Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Sensor Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Sensor Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Sensor Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 176: MEA Market Attractiveness by Sensor Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 178: MEA Market Attractiveness by Application, 2023 to 2033

Figure 179: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA