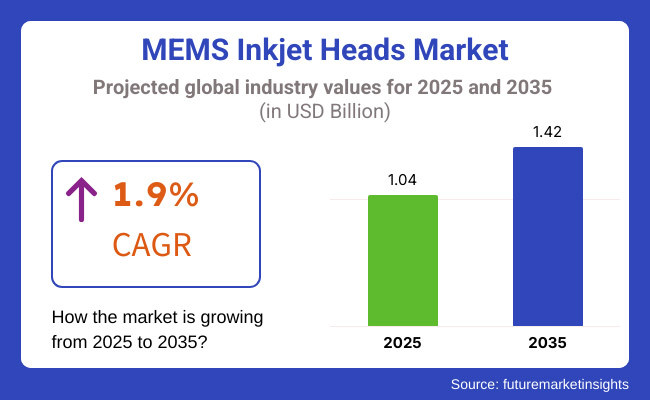

The global MEMS Inkjet Heads market is projected to witness steady growth over the coming years. By 2025, the market size is expected to reach USD 1.04 billion, driven by increasing demand across various printing applications. Looking further ahead, the market is estimated to surpass USD 1.42 billion by 2035, expanding at a 1.9% CAGR between 2025 and 2035.

This growth is fueled by advancements in inkjet printing technology, rising adoption in commercial and industrial printing, and the increasing preference for MEMS-based inkjet heads due to their higher precision, efficiency, and durability compared to traditional inkjet heads.

As the printing industry evolves, MEMS inkjet heads are gaining traction due to their ability to enable high-resolution and high-speed printing while ensuring cost efficiency. Industries such as packaging, textiles, and 3D printing are increasingly adopting MEMS inkjet technology, further boosting market growth. Additionally, ongoing research and development efforts are focused on enhancing print quality, ink compatibility, and sustainability.

The expansion of e-commerce and digital printing solutions is expected to create lucrative opportunities for manufacturers, making MEMS inkjet heads a vital component in the future of digital printing technology.

Between 2020 and 2024, the MEMS inkjet heads market experienced rapid advancements, driven by increasing demand for high-resolution and high-speed printing across industries such as textiles, packaging, and electronics. Manufacturers prioritized precision and durability, developing printheads with finer droplet control, higher firing frequencies, and longer lifespans.

The shift toward eco-friendly printing solutions gained momentum, prompting companies to invest in water-based inks, recyclable materials, and energy-efficient technologies. Digital printing became more cost-effective, reducing material waste and enabling on-demand production with enhanced quality.

From 2025 to 2035, the market is set to advance further, integrating Industry 4.0 technologies and smart printing systems. The adoption of IoT-enabled inkjet heads will allow for real-time monitoring, predictive maintenance, and automation, significantly improving operational efficiency and reducing downtime. Advancements in materials science will expand the range of substrates, enabling versatile printing solutions for industrial and commercial applications.

Collaboration between technology providers and end-user industries will drive customized innovations, particularly in automotive, healthcare, and packaging sectors. The focus on personalization and high-speed production will push companies to develop more efficient, cost-effective, and scalable printing technologies. Emerging AI-powered inkjet systems will further optimize ink usage and image precision, leading to better print quality and reduced operational costs.

Sustainability will remain a key priority, influencing the development of biodegradable inks and energy-efficient printing methods. Governments and regulatory bodies will continue enforcing strict environmental standards, pushing companies to adopt greener technologies. The growing demand for flexible, lightweight, and durable printed materials will encourage further research into next-generation inkjet heads, ensuring sustained market growth and innovation.

In 2024, the global MEMS inkjet heads market is projected to reach approximately USD 1.02 billion, reflecting a steady growth trajectory. This expansion is primarily driven by the escalating demand for high-resolution printing solutions across diverse industries such as textiles, packaging, and electronics. The precision and efficiency offered by MEMS inkjet heads have positioned them as a preferred choice for applications requiring meticulous detail and quality.

The market's growth is further bolstered by the increasing adoption of digital printing technologies, which offer advantages like on-demand printing and reduced waste. Additionally, the trend towards eco-friendly printing solutions has prompted manufacturers to develop water-based inks and energy-efficient technologies, aligning with global sustainability initiatives. Key industry players are focusing on innovation and strategic partnerships to enhance their product offerings and expand their market presence.

Regionally, North America and Europe continue to dominate the market due to stringent quality standards and early technology adoption. However, the Asia-Pacific region is witnessing rapid growth, attributed to increasing industrialization and a burgeoning demand for advanced printing solutions. As industries continue to evolve, the MEMS inkjet heads market is poised for sustained growth, driven by technological advancements and expanding application areas.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for high-resolution industrial printing | High initial investment costs for advanced printheads |

| Rising adoption in packaging, textiles, and electronics | Complexity in maintenance and replacement |

| Advancements in AI, IoT, and automation for smart printing | Limited adoption in certain traditional printing sectors |

| Increasing focus on eco-friendly and sustainable printing solutions | Regulatory challenges related to ink formulations |

| Expansion of e-commerce and customized printing needs | Competition from alternative printing technologies |

The commercial and industrial segment will lead the MEMS inkjet heads market from 2025 to 2035, with businesses in packaging, textiles, electronics, and automotive adopting advanced inkjet technology for high-speed, precision-driven printing. The growing demand for customized and on-demand printing will push manufacturers to enhance printhead durability, ink efficiency, and automation capabilities.

AI-driven smart production lines will integrate MEMS inkjet solutions, optimizing workflow and reducing downtime. Meanwhile, the consumer segment will expand as advancements in MEMS inkjet technology make compact, high-resolution printers more accessible.

The rise of home-based businesses, DIY crafts, and personalized merchandise will drive demand for versatile, energy-efficient devices with IoT-enabled connectivity. Sustainability concerns will influence both segments, leading to the widespread adoption of biodegradable inks, recyclable cartridges, and eco-friendly printing solutions that align with evolving consumer and industry standards.

The North American MEMS inkjet heads market will experience steady growth from 2025 to 2035, driven by increasing demand in commercial printing, packaging, and electronics. The United States will remain a dominant player, benefiting from a strong R&D ecosystem, advanced manufacturing capabilities, and high adoption of digital printing technologies. The shift toward eco-friendly and on-demand printing will fuel investments in water-based inks and AI-driven automation.

Growing demand for smart printing solutions in industrial applications will encourage businesses to integrate IoT-enabled inkjet systems. Sustainability regulations will push companies to adopt recyclable materials and energy-efficient printing methods, ensuring long-term market expansion.

The Latin American MEMS inkjet heads market will grow as industries adopt digital printing for textiles, packaging, and commercial applications. The region will witness rising investments in industrial automation and eco-friendly printing technologies, particularly in Brazil and Mexico, where demand for cost-effective and high-speed printing solutions is increasing.

Local businesses will seek affordable inkjet technologies that balance efficiency and sustainability, prompting manufacturers to develop low-cost, high-quality solutions. E-commerce expansion will drive demand for customized packaging and labeling, while government initiatives supporting green printing and sustainable manufacturing will shape future market trends in the region.

The Western European MEMS inkjet heads market will expand steadily, driven by strong adoption in packaging, textiles, and industrial printing. The United Kingdom, Germany, and France will lead the region, benefiting from technological innovation, sustainability policies, and high consumer demand for personalized products.

The region's emphasis on environmentally friendly printing solutions will push companies to invest in biodegradable inks, UV-curable technologies, and energy-efficient printheads. Manufacturers will focus on integrating AI, IoT, and cloud-based printing solutions to optimize efficiency. The growing need for high-quality, customized printing in sectors like fashion, healthcare, and electronics will further accelerate market growth.

The Eastern European MEMS inkjet heads market will see moderate growth, supported by increasing industrialization and digital transformation in Russia, Poland, and the Czech Republic. Businesses will shift from traditional printing methods to digital inkjet technology, driven by the demand for cost-effective and high-speed solutions.

The packaging and textile industries will adopt MEMS inkjet technology for customized, short-run printing. Local manufacturers will invest in automation and smart printing systems to enhance production efficiency. Government incentives promoting advanced manufacturing and sustainability will encourage businesses to explore water-based inks and recyclable print materials to comply with European environmental regulations.

The South Asia & Pacific MEMS inkjet heads market will experience robust growth due to rapid industrialization and the increasing demand for flexible, on-demand printing solutions. India, Australia, and Southeast Asian countries will drive market expansion, with businesses in packaging, textiles, and commercial printing adopting high-resolution inkjet technology.

The region's booming e-commerce and personalized product sectors will fuel demand for customized labels and packaging. Companies will integrate smart inkjet printing systems to enhance productivity, while sustainability initiatives will encourage the use of low-VOC inks and energy-efficient printing processes to meet rising environmental concerns.

The East Asian MEMS inkjet heads market will dominate global growth, driven by China, Japan, and South Korea. China will lead in industrial inkjet adoption, with major players investing in high-speed, precision-based printing technologies. Japan will focus on miniaturization and smart printing innovations, integrating AI-powered inkjet systems for enhanced automation.

South Korea will drive demand through electronics and semiconductor printing applications, emphasizing ultra-fine printhead technologies. Governments in the region will support sustainable printing initiatives, pushing industries to adopt recyclable ink formulations and water-based printing solutions to align with global green standards.

The Middle East & Africa MEMS inkjet heads market will grow steadily, driven by expanding industrial and commercial printing sectors in the UAE, Saudi Arabia, and South Africa. The demand for customized packaging, textiles, and signage will rise as businesses embrace advanced digital printing solutions.

The region’s focus on smart city development and industrial automation will increase investment in IoT-enabled printing systems. Sustainability initiatives will gain momentum, encouraging companies to adopt eco-friendly inks and energy-efficient technologies. As digital transformation progresses, businesses will integrate high-performance inkjet heads to enhance production capabilities across various sectors.

In 2024, leading players in the MEMS inkjet heads market focused on technological innovation and strategic partnerships to maintain their competitive edge. Companies like Kyocera Corporation introduced advanced inkjet printheads featuring enhanced ink recirculation technology, aiming to boost productivity and print quality across various applications, including textiles and packaging.

Similarly, Seiko Epson Corporation invested in next-generation piezoelectric MEMS technology to improve speed and precision in industrial printing. Such developments underscore a commitment to meeting diverse industry needs through cutting-edge solutions that enhance efficiency and sustainability.

Emerging startups in the MEMS inkjet sector concentrated on niche applications and sustainability. By developing specialized inkjet heads tailored for additive manufacturing and eco-friendly printing, these startups addressed the growing demand for precision and environmental responsibility. Several innovative firms focused on biodegradable and water-based inks, reducing environmental impact while maintaining high print quality.

The rise of customized and on-demand printing solutions also provided startups with opportunities to differentiate themselves, leading to rapid adoption across industries like healthcare, fashion, and electronics. Their agility allowed them to introduce products that cater to specific market segments, positioning themselves as key contributors to industry evolution.

Collaborations between established companies and startups became a notable trend, fostering innovation and expanding market reach. These alliances combined the technological prowess and resources of leading firms with the specialized expertise of startups, accelerating the development of next-generation MEMS inkjet solutions.

Such partnerships not only enhanced product offerings but also facilitated entry into emerging markets, reflecting a strategic approach to growth in the dynamic printing industry. Joint ventures also enabled companies to streamline supply chains and optimize manufacturing processes, ensuring greater scalability and cost efficiency while maintaining high-performance standards.

As competition intensified, market leaders and startups alike invested in artificial intelligence (AI) and automation to refine printing technologies. AI-driven predictive maintenance systems improved operational efficiency by minimizing downtime and extending the lifespan of MEMS inkjet heads.

Companies also integrated IoT-enabled smart printing solutions, enabling remote diagnostics and real-time performance monitoring. These advancements allowed businesses to reduce waste, enhance workflow management, and offer more flexible, high-speed printing solutions to meet the increasing demand for customized and industrial-scale applications.

Growing adoption in industrial printing, packaging, textiles, and electronics is fueling demand, along with advancements in precision and efficiency.

Leading players are integrating AI, IoT-enabled smart printing, and sustainable ink solutions to enhance performance and reduce environmental impact.

Packaging, textiles, healthcare, and additive manufacturing industries rely on MEMS inkjet heads for high-quality, high-speed printing.

Companies are developing biodegradable inks, recyclable cartridges, and energy-efficient printing solutions to meet environmental regulations and industry standards.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 12: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 16: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 20: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 24: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 28: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 32: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ million) by End-Use, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 11: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 14: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 20: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 23: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 26: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 32: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 35: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Western Europe Market Value (US$ million) by End-Use, 2023 to 2033

Figure 38: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 39: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 40: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 41: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Western Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 44: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 45: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 47: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 48: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Eastern Europe Market Value (US$ million) by End-Use, 2023 to 2033

Figure 50: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 51: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 52: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 53: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Eastern Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 56: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 57: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 58: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 59: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia and Pacific Market Value (US$ million) by End-Use, 2023 to 2033

Figure 62: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 63: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 64: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 65: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia and Pacific Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 68: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 69: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 70: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 71: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 72: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by End-Use, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 76: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 80: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 81: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 83: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 84: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ million) by End-Use, 2023 to 2033

Figure 86: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 87: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 88: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 89: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 92: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 93: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 94: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 95: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 96: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MEMS Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

MEMS Probes Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microphones Market Size and Share Forecast Outlook 2025 to 2035

MEMS Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microdisplay Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Headspace Gas Analyzers Market - Trends & Forecast 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

MEMS Sensor Market - Applications & Growth Forecast 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Mems Market

VR Headsets Market Size and Share Forecast Outlook 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Thermal Inkjet Printer Industry

Thermal & Inkjet Disc Printers Market Analysis by Ribbon Type, Supplier, Technology, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA