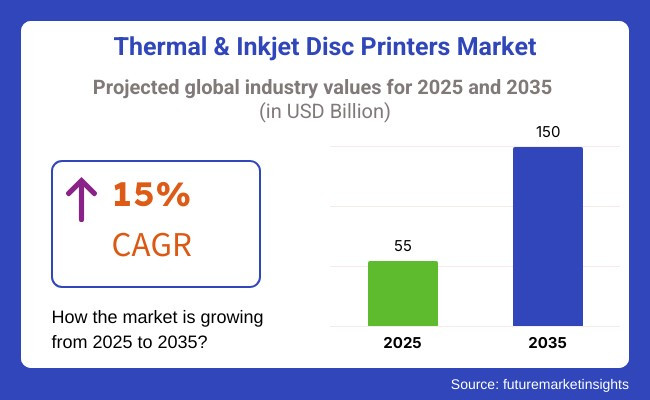

The thermal & inkjet disc printers market is likely to reach USD 55 billion in 2025 and expand to USD 150 billion by 2035, reflecting a CAGR of 15.0% during the forecast period. Firms are employing more high-speed thermal and inkjet disc printing technologies to maximize productivity and maximize data storage solutions. Investments in high-resolution printing, automation, and cloud-based printing services will also spur development.

Businesses and consumers utilize thermal and inkjet disc printers for hassle-free data archiving, media creation, and professional disc labeling in industries like healthcare, media, education, and government agencies. The application of AI-driven automation, high-end color management, and IoT-enabled remote printing will also enhance the quality and efficiency of printing.

Additionally, the development in disc print technology, such as UV-cured inkjet print, high-speed thermal transfer mechanisms, and ecological ink formulations, is transforming the industry. With an increasing demand for secure data protection, high-standard disc labeling, and economical print, companies are concentrating on efficient energy-saving printing systems, harsh environment printing solutions, and cloud-based printing machines.

The thermal & inkjet disc printers market continues to change with the help of technological advancements, the establishment of digitization trends, and the constant need for physical media storage and distribution. Consumers are more inclined towards high-quality and personalized prints for their own use. In contrast, companies and commercial printing find the key to high-speed, durable, and cost-effective solutions for mass disc production.

Printed media industry has a significant role in the use of these devices to brand, create albums and distribute movies, in which they need to have both scalability and superior print resolution. Moreover, the health care and educational sectors are the ones that need durability, not high cost, and safety through the labeling of data storage and patients' records.

At the same time, retailers and commercial printers are in search of high-productivity, low-cost machines for the accomplishment of a wide range of printing tasks. With the rise in the use of automated systems and UV-resistant inks, the sector is anticipated to flourish by the introduction of novel solutions in different industries.

| Company | Contract Value (USD Million) |

|---|---|

| Xerox Holdings and Lexmark International | Approximately USD 1,450 - 1,550 |

| Seiko Epson Corporation | Approximately USD 190 - 210 |

In December 2024, Xerox Holdings announced its agreement to acquire Lexmark International for approximately USD 1,450 - 1,550 million. This strategic move aims to bolster Xerox's core printing business and expand its global footprint, particularly in the Asia-Pacific region. The acquisition is expected to be completed in the second half of 2025.

In January 2025, Seiko Epson Corporation unveiled plans to invest approximately USD 190 - 210 million in research and development. This investment focuses on innovating its thermal and inkjet disc printing technologies to meet evolving demands and maintain a competitive edge.

These developments reflect a trend towards consolidation and innovation in the thermal and inkjet disc printers market, as companies seek to enhance their technological capabilities through strategic acquisitions and investments.

Between 2020 and 2024, the thermal and inkjet disc printers market remained relevant in media production, archival storage, and professional duplication despite the rise of digital distribution. Businesses and government agencies relied on disc printing for secure data storage and branding. Manufacturers improved print resolution, automation, and eco-friendly ink technologies, while compact, high-speed printers gained traction.

Advancements in dye-sublimation and UV-cured inks enhanced durability, but declining consumer interest and competition from USB and cloud storage posed challenges. Companies responded with cost-efficient, multifunctional printers, and cloud-based print management.

From 2025 to 2035, AI-driven automation, quantum encryption, and sustainable materials will reshape the industry. AI-powered printers will optimize print quality and ink usage, while quantum encryption and blockchain authentication will enhance security and prevent counterfeiting.

Eco-friendly materials will drive biodegradable and recyclable disc printing solutions. Smart disc technology with NFC and DRM will enable hybrid physical-digital content access. Autonomous robotic disc printing will improve efficiency for corporate and archival storage needs.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter environmental regulations (RoHS, REACH) pushed manufacturers to adopt eco-friendly inks and recyclable discs and reduced emissions in production. | AI-driven, sustainable printing solutions leverage biodegradable printing materials, energy-efficient disc production, and AI-optimized waste reduction for eco-conscious media distribution. |

| AI-powered printers optimized print resolution, ink distribution, and automated quality checks, reducing errors and material waste. | AI-native, self-learning disc printers autonomously adjust print settings, predict maintenance needs, and enable real-time color calibration for enhanced precision and longevity. |

| The rise of streaming services led to declining consumer demand for printed discs while professional archival and industrial applications continued to grow. | AI-powered, ultra-high-resolution disc printing solutions focus on specialized markets such as archival storage, medical imaging, government security, and niche collectible media. |

| Businesses and independent media producers adopted on-demand disc printing for custom content, reducing inventory and production costs. | AI-enhanced, decentralized disc production networks enable real-time, on-demand printing with AI-driven content personalization, smart print scheduling, and automated quality assurance. |

| Inkjet and thermal printers improved disc print quality, UV resistance, and scratch protection for long-term durability. | AI-powered, nanotech-enhanced disc printing solutions provide ultra-durable, anti-fade, waterproof prints with AI-driven surface protection and adaptive color rendering technologies. |

| Network-connected disc printers enabled remote print monitoring, automated job scheduling, and predictive maintenance. | AI-driven, 6G-integrated printing ecosystems support real-time print job synchronization, AI-assisted maintenance alerts, and seamless cloud-based workflow automation for industrial-scale production. |

| AI-driven security features, including encrypted serial codes and anti-piracy watermarks, enhanced disc authenticity. | AI-native, blockchain-secured disc authentication ensures tamper-proof, traceable media production, enabling real-time digital rights management (DRM) enforcement and counterfeiting prevention. |

| Manufacturers focused on energy-efficient printers, reduced ink waste, and recyclable disc materials to minimize environmental impact. | AI-driven, carbon-neutral disc printing platforms integrate renewable energy, AI-powered ink optimization, and smart recycling programs for sustainable media printing. |

| Secure, long-term data storage applications in healthcare, military, and corporate environments continued to drive demand for high-durability printed discs. | AI-enhanced, archival-grade disc printing solutions provide real-time data integrity verification, AI-powered security encoding, and quantum-resistant encryption for next-gen digital storage. |

| Businesses explored blockchain-backed serialization for authenticating limited-edition and collectible discs. | AI-integrated, decentralized printing networks enable real-time digital rights tracking, smart contract-based content licensing, and AI-driven, trustless media distribution models. |

The Thermal & Inkjet Disc Printers Market is dealing with several pressure points such as technological obsolescence, dispossession of goods, supply chain vulnerabilities, compliance with regulations, and a newer version of competition- digital storage solutions.

The sole biggest issue is the decline that leads people to use less printed material due to the availability of other alternatives like cloud storage, USB, and streaming. Thus, the consumption of digital materials, which are getting popular, is cutting down the need for disc printers, and therefore, the manufacturers are put in a position of having to extend their product portfolio.

Supply chain bottlenecks can thwart the availability of printer components like ink cartridges, thermal ribbons, and print heads. Geopolitical issues, raw material shortages, and manufacturing delays can be the causes of production slowdowns and expense increases.

The sector has some regulatory issues mainly due to concerns of environmental pollution. Sustainability laws, such as waste disposal, environmental emissions, and recyclable material issues obligate the ink and thermal printing processes. Not complying could lead to penalties and restrictions in product sales.

Moreover, the emergence of other printing technologies, such as disc laser etching and digital transfer methods, has also become a problem. The companies that are not innovating sufficiently might have issues staying in the industry, which is gradually declining.

On the other hand, the paper suppliers can open new channels for the technology of disc printing by utilizing it in various sectors, which in turn will lead to higher printer efficiency. Then they can promote their printers to the markets where they can serve such needs like the professional media production, medical imaging, and archival storage industries.

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

| USA | 7.0% |

| European Union | 7.1% |

| Japan | 7.1% |

| South Korea | 7.3% |

USA thermal & inkjet disc printers market-Growth is due to the adoption & growth of advanced disc printing technology applications among businesses, media production companies, and individuals. Companies manufacture high-resolution thermal and inkjet disc printers to provide durability and high-quality results during the production process at a low cost of operation.

The need for affordable and reliable high-quality disc printing solutions fuels growth, especially due to the rise in global entertainment and media and the demand for software and archival printing. This high-resolution print will last 40-80 years without degrading, which is why production houses will choose these thermal disc printers for DVDs and Blu-rays.

Software firms widely use inkjet disc printers to distribute software in mass quantities, while educational institutions utilize disk printing technologies to create archival copies of crucial data. Regulatory policies also drive companies towards reliable and secure printing solutions. FMI is of the opinion that the USA. is slated to grow at 7.0% CAGR during the study period.

Growth Factors in USA

| Key Drivers | Details |

|---|---|

| High-Resolution Disc Printing | They use high-precision inkjet thermal disc printers for print quality. |

| Entertainment & Software | Disc printers are typically used by film studios and software companies to produce media at scale. |

Thermal & inkjet disc printers market in the UK as high-resolution disc printing finds its way into enterprises and creative industries for branding, media distribution, and digital preservation. Inkjet disc printer offers detailed graphics for better branding, and thermal disc printing is a robust labeling solution that is long-lasting and smudge-free. On-demand disc production needs to expand through retail, education, and entertainment segments.

As national libraries and archival institutions capture data efficiently, government measures supporting digital media preservation also contribute to market adoption. Industry leaders innovate eco-friendly ink systems and fully automated disc printing systems for maximum productivity and sustainability. FMI is of the opinion that the USA. market is slated to grow at 7.0% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Media & Marketing | Disc printing provides businesses the best way to get their brand out there and promote their products. |

| Eco-Friendly Printing | It is developed by companies as sustainable ink solutions for minimize the impact on environment. |

The EU thermal & inkjet disc printers market keeps growing steadily, and enterprises, educational institutions, and media houses here adopt high-efficiency disc printing technology. The premium inkjet disc printers for commercial media production, education, and corporate training market is dominated by Germany, France, and Italy.

The EU maintains rigorous environmental and data-security regulations, driving companies to drum up solid, sustainable, GDPR-compliant disc printing solutions. The implementation of inkjet technology opens up new avenues for cost-efficient and high-quality printing, positioning high-speed disc production within reach of diverse industries. FMI is of the opinion that the European Union market is slated to grow at 7.1% CAGR during the study period.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| Regulatory Compliance> | Enterprises invest in eco-friendly and GDPR-compliant printing solutions. |

| Educational Integration | Universities and schools also use disc printers for coursework and archiving. |

Japan's market for Thermal & Inkjet Disc Printers is expanding as companies and individuals embrace high-resolution disc printing for professional media production and software distribution, as well as auxiliary and archival data, such as in-house disc printing. Indian Engineers solve the Ingenuity with compact disc printers optimized for advanced ink utilization and high-speed printing, catering to Japan's precision-centric industries.

The gaming and music production industries employ high-quality disc printing to improve branding and extend the life of a product. Film corporation also invests in efficient archival solutions, utilizing thermal disc printers to ensure long-term, secure data archiving.

Popular disc graphics utilities include Japanese companies like Sony and Epson, which often provide innovative printing technologies for discs and even ultra-high resolution and ink efficiency for data printing. FMI is of the opinion that the Japan is slated to grow at 7.1% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Gaming & Music Industry | The companies use a high-quality disc printing for branding and media productions. |

| Software & IT Solutions | Software companies print discs with inkjet technology. |

Telecommunications Canadian businesses are collaborating with media companies to purchase automated, fast, and AI-optimized disc printing technologies, which are boosting the growth of the South Korea thermal & inkjet disc printers market. Consequently, this is expected to spur the demand for long-life media disc printing solutions, thanks to the government backing of data digital content preservation projects.

Artisan Bears and Objective Sonic Solutions combine thermal and inkjet discs with AI optimization for more efficient production. Demand for high-resolution disc printing is fueled by the gaming and entertainment sectors, which require quality print capabilities for excellent branding and print durability.

Using Samsung inkjet technology, South Korean manufacturers such as Samsung and LG produce next-gen print systems for discs with greater efficiency. FMI is of the opinion that the South Korea is slated to grow at 7.3% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Gaming & Entertainment | The industry uses disc printing for high-quality branded results. |

| Government Support | Government encourages digital preservation and media archiving. |

Black monochrome ribbons dominate, with a 40.3% share due to their high cost-effectiveness and duration; black monochrome ribbons are often used in large-volume industrial and commercial printing applications. That high contrast with long longevity makes the ribbons indispensable and also used with barcode printing, logistics, and retail labeling. Multiple industries, including healthcare (medical supplies), manufacturing (packaging), and e-commerce (shipping and inventory) use monochrome black ribbons for labeling.

If applications requiring high-readability, long-lasting tags, wristbands or labels are needed then there is high-performance ribbons available from companies like Zebra Technologies and Honeywell with features like quality ultra-sharp print, along with smudge resistance.

The color ribbon segment is expected to grow due to the rising need for quality branding, safe identification, and customized printing solutions that help hold about 59.7% share in the year 2025. In banking, government, hospitality, and other sectors, color ribbons are used to print ID cards, financial documents, and promotional materials. This increase is driven by the high adoption of advanced card printers for employee badges, driver's licenses, and access cards.

Two of the leaders in this high-definition color printing - Entrust and HID Global - take ID badges a step further by enhancing security by embedding UV and holographic elements into IDs. Increasing focus on digital payment systems and personalized customer experience in retail is the major factor driving the segment, which is the increasing demand for wider and multi-color printed material in retail.

Considering the value-added activities, OEM ribbons are charged a higher price. OEM ribbons account for 51.2% of the share in 2025 due to their premium quality, compatibility, and reliability. The advantages of OEM ribbons: They are made specifically for branded printers, so they get the best performance, longest life from the printhead, and lowest cost of maintenance. Industries, including healthcare, logistics, and government agencies, use OEM ribbons for mission-critical applications where accuracy and durability are essential.

Premium Thermal Transfer Ribbons is supplied and offered by high-quality manufacturers responsible for OEM suppliers such as Zebra Technologies, Honeywell Toshiba, etc., which leads to high-resolution prints, smudge resistance, and permanence at its superior. Zebra's 5095 Resin Ribbon is widely used in the industry for high-temperature and chemical-resistant labels, reinforcing dependence on OEM products.

The aftermarket ribbon segment accounted for 48.8% share in 2025 due to their cost-effectiveness, availability, and expansion of various third-party manufacturing abilities that led in the growth of this segment. OEM aftermarket ribbon: Managed services for Restaurants, small retailers, and warehouse management services are taking OEM sensors from the OEM to reduce the TCO

Companies like Armor-IIMAK and DNP offer professional aftermarket ribbons with new formulations that hold or even exceed OEM matching quality at a competitive price. This segment is also witnessing a rise in demand as third-party suppliers are providing eco-friendly and biodegradable items, and the introduction of recyclable ribbon materials is driving the growth.

The thermal & inkjet disc printers market continues to evolve as industries seek high-quality, cost-effective disc labeling solutions for media production, data storage, and professional archival needs. Automation, high-resolution printing, and durable ink formulations are key factors driving advancements. Companies are focusing on improving print speed, color accuracy, and efficiency to cater to commercial disc publishing and large-scale duplication requirements.

Leading players such as Primera Technology, Rimage Corporation, and Epson are driving competition with innovations in inkjet and thermal printing, ensuring high-definition disc labeling and automated publishing solutions. Microboards Technology and Vinpower Digital add to the competitiveness by offering scalable disc duplication systems and industrial-grade printing technologies.

As demand shifts toward higher efficiency, cost-effective ink solutions, and automation, companies will focus on improving print durability, expanding AI-driven quality control, and enhancing integration with digital workflows. Future competition will revolve around technological innovation, sustainability in printing materials, and seamless compatibility with evolving optical media applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Primera Technology | 25-30% |

| Rimage Corporation | 18-22% |

| Epson | 12-17% |

| Microboards Technology | 8-12% |

| Vinpower Digital | 5-9% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Primera Technology | Provides high-quality inkjet disc printers, automated disc publishing solutions, and durable print technology. |

| Rimage Corporation | Develops thermal disc printing solutions, on-demand publishing systems, and high-volume disc duplication. |

| Epson | Specializes in inkjet disc printing with advanced color accuracy, high-speed output, and cost-effective ink systems. |

| Microboards Technology | Focuses on professional-grade disc duplication, automated printing, and large-scale media production. |

| Vinpower Digital | Offers industrial disc printing, inkjet and thermal-based solutions, and high-capacity publishing systems. |

Key Company Insights

Primera Technology (25-30%)

Primera Technology leads the disc printing market by offering high-resolution inkjet printing, automated disc labeling, and cost-efficient publishing solutions.

Rimage Corporation (18-22%)

Rimage Corporation enhances the market with thermal disc printing technology, secure on-demand publishing, and high-volume duplication systems.

Epson (12-17%)

Epson provides inkjet disc printers that offer vibrant color accuracy, fast printing speeds, and cost-effective ink solutions for media production.

Microboards Technology (8-12%)

Microboards Technology specializes in professional-grade disc duplication, automated printing, and scalable media production systems.

Vinpower Digital (5-9%)

Vinpower Digital delivers industrial disc printing solutions, inkjet and thermal-based label printing, and high-capacity publishing automation.

Other Key Players (15-25% Combined)

Several companies contribute to advancements in disc printing technology, high-resolution inkjet printing, and automated publishing, including:

The market includes monochrome black, color, and photo ribbons.

The market covers OEM and aftermarket suppliers.

The market comprises direct thermal printing, thermal transfer printing, and dye-sublimation printing.

The market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industry is slated to reach USD 55 billion in 2025.

The industry is predicted to reach a size of USD 150 billion by 2035.

Key companies include Primera Technology, Rimage Corporation, Epson, Microboards Technology, Vinpower Digital, All Pro Solutions, TEAC Corporation, Disc Makers, Clover Systems, and Verity Systems.

South Korea is expected to record the highest CAGR of 7.3% during the forecast period.

Monochrome black ribbons remain widely used.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 04: Global Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 06: Global Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 07: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 08: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 09: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Ribbon Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Ribbon Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Ribbon Supplier, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Ribbon Supplier, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 04: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 05: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 06: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 07: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 09: Global Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 21: Global Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 23: Global Market Attractiveness by Technology, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 45: North America Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 47: North America Market Attractiveness by Technology, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Ribbon Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Ribbon Supplier, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Ribbon Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Ribbon Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Ribbon Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ribbon Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Ribbon Supplier, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Ribbon Supplier, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Ribbon Supplier, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ribbon Supplier, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Ribbon Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Ribbon Supplier, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA