The thermal profiling system market is forecast to expand from USD 413.2 million in 2025 to USD 673.1 million by 2035, growing at a CAGR of 5.0% over the forecast period. This growth is expected to be supported by increasing demand for real-time temperature mapping across high-precision manufacturing processes in sectors such as electronics, automotive, aerospace, and food processing.

As of 2025, the thermal profiling system market holds a focused yet impactful share across multiple industrial equipment sectors. Within the global temperature monitoring systems market, it contributes approximately 5-6%, driven by demand for high-precision thermal tracking in manufacturing. In the industrial process control market, its share is around 2-3%, as it supports thermal consistency in heat-critical operations.

Within the test and measurement equipment market, thermal profiling systems account for 3-4%, used primarily in quality assurance and R&D. In the electronics manufacturing equipment market, the share stands at about 4-5%, particularly in reflow soldering and PCB production. In the food processing equipment market, thermal profiling holds 1-2%, ensuring compliance with safety standards in baking, roasting, and sterilization processes.

Between 2020 and 2024, the consumption of thermal profiling systems surged due to rapid growth in electronics manufacturing, particularly in SMT (surface-mount technology) and PCB assembly. As quality control tightened post-COVID, manufacturers prioritized real-time thermal monitoring to ensure process consistency and reduce defect rates.

The miniaturization of components and shift toward lead-free soldering further drove demand for precise thermal measurement tools. From 2025 to 2035, the growth trajectory is expected to shift in character. While volume expansion slows in mature regions, demand is projected to rise in developing economies as they scale semiconductor and automotive electronics production. Next-gen materials like SiC and GaN will require advanced profiling systems. The market will transition from volume-driven consumption to innovation-led adoption, with AI-integrated systems and predictive analytics becoming key differentiators.

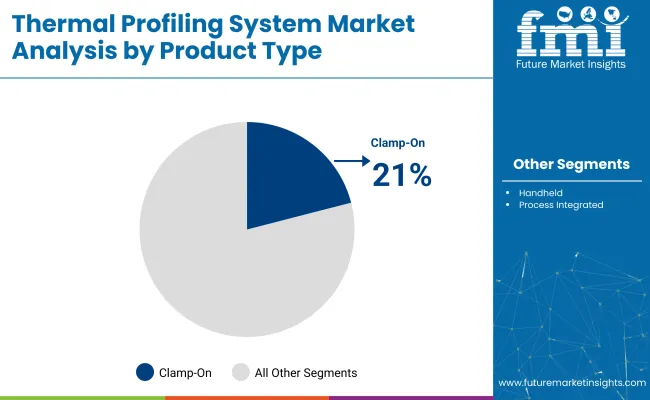

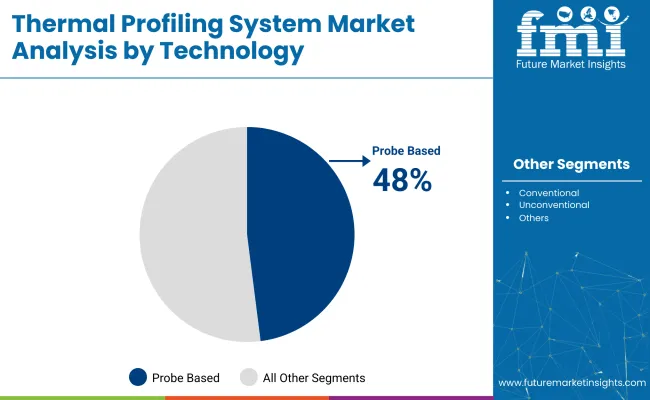

Clamp-on thermal profiling systems are expected to lead the product type segment with a 21% market share by 2025, while probe-based technology is projected to dominate the technology segment with a 48% share.

The clamp-on thermal profiling system is projected to capture 21% of the global market by 2025, making it the fastest-growing product type. Owing to their adaptability and ease of installation.

Consumer electronics and appliances are expected to lead the end-use segment, holding 25% of the market by 2025. Increasing complexity in device design and miniaturization has driven demand for thermal profiling solutions.

Probe-based thermal profiling systems are projected to capture 48% of the technology segment by 2025, owing to their high accuracy and responsiveness in dynamic thermal environments.

The market is gaining momentum due to increasing demand for precision temperature monitoring in electronics manufacturing, food processing, metallurgy, and automotive sectors. These systems help optimize thermal processes by tracking temperature distribution across time and space, ensuring product quality and energy efficiency.

High Adoption in Electronics, Automotive, and Industrial Ovens

Thermal profiling systems are widely used in reflow soldering, heat treatment, and curing processes to verify uniform heat distribution and identify temperature anomalies. In the electronics industry, they ensure proper solder joint formation and prevent overheating. Automotive and industrial users rely on profiling tools to optimize oven performance and improve throughput.

Growth in Food and Pharmaceutical Applications for Process Validation

In food production and pharmaceuticals, thermal profiling is used to validate pasteurization, sterilization, and baking processes. Regulatory requirements demand precise temperature control and documentation. Thermal profiling systems are employed to meet HACCP, FDA, and ISO compliance, making them vital for quality control and safety assurance.

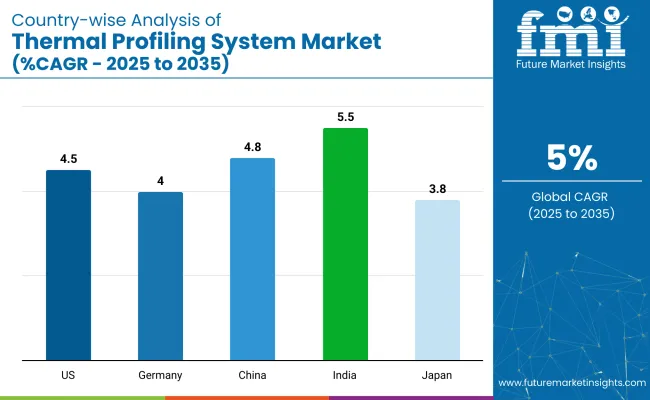

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

| USA | 4.5% |

| India | 5.5% |

| Germany | 4.0% |

| Japan | 3.8% |

India’s momentum is being driven by expansion in electronics assembly, automotive thermal testing, and growing domestic manufacturing. China is scaling up usage in SMT lines and solar panel inspection as part of smart factory initiatives. In contrast, mature economies such as the United States (4.5%), Germany (4.0%), and Japan (3.8%) are expanding at 0.78-0.94x rates.

The USA focuses on aerospace and defense-level profiling with real-time data integration. Germany prioritizes precision testing in EV batteries and PCB manufacturing. Japan’s growth is centered around compact profiling tools for semiconductor fabs. As demand grows for production accuracy and process validation, both high-volume and high-precision countries are shaping the trajectory.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 5.5% through 2035. Growth is being driven by domestic electronics production, auto component testing, and PCB reliability analysis. Local contract manufacturers are installing profiling tools on reflow soldering and wave soldering lines. Government-led initiatives like “Make in India” have created demand for process verification tools in EMS (electronics manufacturing services) clusters. Thermal profiling is also expanding in lithium battery validation and LED production. India’s dual focus on low-cost assembly and automotive testing supports strong domestic uptake.

China is expected to grow at a CAGR of 4.8% between 2025 and 2035. Usage is increasing in smart electronics assembly, solar module fabrication, and heat treatment lines. Large-scale EMS providers are deploying profiling systems to optimize throughput and thermal consistency. Government-backed automation policies have encouraged profiling in mid-size PCB manufacturing zones. Domestic suppliers are building cost-competitive 4-6 channel profilers with built-in data loggers. Growth is led by high-density assembly lines and export-oriented production.

The USA market is projected to grow at a CAGR of 4.5% through 2035. Usage is concentrated in aerospace, military electronics, and automotive electronics manufacturing. Precision profiling during lead-free reflow soldering is a key requirement in defense-grade PCB fabrication. Profilers with thermal mapping and real-time analytics are preferred in R&D and pilot production settings. Domestic suppliers are focusing on robust multi-point systems that comply with IPC standards. The market is shaped by high specification, certification-heavy applications.

Germany is expected to expand at a CAGR of 4.0% between 2025 and 2035. EV battery module testing, precision PCBs, and industrial oven monitoring are key demand segments. Profiling tools are being installed in advanced automotive assembly lines and heat tunnel applications. Local suppliers are offering modular, multi-thermocouple systems for use in energy-efficient reflow processes. EU-compliant process traceability and tight tolerances are shaping demand. Germany's growth is led by its high-value EV and electronics verticals.

Japan’s market is projected to grow at a CAGR of 3.8% from 2025 to 2035. Miniaturized electronics, MEMS devices, and high-density PCBs are major drivers. Profilers are being adopted in compact semiconductor fabs where real-time heat tracking is critical. Demand is rising in medical electronics assembly lines that require precise thermal validation. Domestic OEMs are prioritizing ultra-slim designs with rapid data extraction and localized software support. Japan’s niche demand is shaped by compact design and reliability expectations.

The market is moderately fragmented, with both global and regional players offering advanced thermal monitoring and data acquisition technologies. Tempsens is a major provider, delivering robust profiling systems tailored for industrial furnaces and kilns. KIC Thermal Profiling Solutions is widely recognized for its reflow oven profiling equipment, essential in PCB assembly and electronics manufacturing. Fluke Process Instruments leads with high-precision datalogging tools for temperature mapping in high-heat environments.

Solderstar and Ellab A/S specialize in thermal validation solutions for pharmaceutical and food processing sectors. Emerging brands like iraptor and ThermoWorks cater to niche applications with compact and cost-efficient profiling tools, further diversifying the competitive landscape.

Recent Thermal Profiling System News

In early 2025, Microchip Technology launched the MCP998x sensor family, marking a significant advancement in the thermal profiling system market. These automotive-grade, multi-channel thermal sensors are specifically designed for remote thermal monitoring applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 413.2 million |

| Projected Market Size (2035) | USD 673.1 million |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Product Types Analyzed (Segment 1) | Handheld, Clamp-On, Process Integrated Systems |

| End Uses Analyzed (Segment 2) | Consumer Electronics & Appliances, Heat Treatment, Food & Beverages, 3D Printing, Other Industrial Processes |

| Technologies Analyzed (Segment 3) | Probe-Based, Sensor-Based, Camera-Based Monitoring Systems |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Tempsens, KIC Thermal Profiling Solutions, Fluke Process Instruments, iraptor, ThermoWorks, Reading Thermal, Solderstar, Ellab A/S, Thermo Electric Company, Rehm Thermal Systems, Manncorp Inc. |

| Additional Attributes | Dollar sales by product and technology type, rising demand in electronics and industrial ovens, increased automation in quality monitoring, and integration of thermal systems in smart manufacturing. |

The market is segmented by product type into handheld, clamp-on, and process integrated systems.

Key end-use sectors include consumer electronics and appliances, heat treatment processes, food and beverages, 3D printing, and other industrial processes.

Based on technology, the market is divided into probe-based, sensor-based, and camera-based monitoring systems.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is estimated to be valued at USD 413.2 million in 2025.

The market is expected to reach USD 673.1 million by 2035.

The market is projected to grow at a CAGR of 5.0% from 2025 to 2035.

Probe-based technology is projected to dominate the technology segment with a 48% share in 2025.

Consumer electronics and appliances are expected to lead with a 25% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Thermal System Market Analysis by System Type, Vehicle Type, Application and Region Through 2025 to 2035

Thermal Cleaning System Market Growth - Trends & Forecast 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA