The global thermal management technologies market is poised for steady growth, driven by the increasing demand for efficient heat dissipation solutions across industries such as electronics, automotive, aerospace, and renewable energy. As devices become smaller, more powerful, and more energy-intensive, effective thermal management is critical to maintaining performance, reliability, and safety.

Key technologies include advanced heat sinks, thermal interface materials, heat spreaders, and liquid cooling systems. With the rise of electric vehicles, 5G infrastructure, and data centers, along with advancements in materials and design, the demand for thermal management technologies is set to rise steadily through 2035.

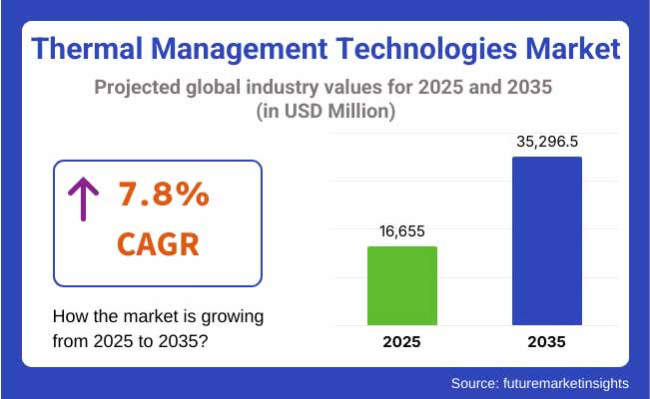

In 2025, the global thermal management technologies market is estimated at approximately USD 16,655.0 Million. By 2035, it is projected to grow to around USD 35,296.5 Million, reflecting a compound annual growth rate (CAGR) of 7.8%.

Thermal management technologies are highly demanded in North America where electronics industry is robust, electric vehicles adoption rate is increasing and strong investments in data centers and renewable energy projects are made. The United States and Canada lead in the development and adoption of advanced thermal solutions to meet increased demand across multiple sectors.

Europe is another major market, with emphasis on sustainability, energy efficiency and advanced manufacturing. Especially in the automotive and aerospace segments, leading countries like Germany, the United Kingdom, and France are among the early adopters of advanced thermal management solutions. Market growth in this region is also supported by the push for electric mobility and stringent environmental regulations.

This segment is poised to experience the fastest growth in thermal management technologies in the Asia-pacific region, primarily due to rapid industrialization, robust industrial and consumer electronics demand as well as substantial investment in the development of electric vehicles and renewable grid infrastructure.

Countries like China, Japan and South Korea are pushing demand for advanced thermal solutions backing their booming technology sectors. The region has a strong manufacturing base and Growing usage of high-performance thermal materials will drive market growth across the globe over the decade.

Challenges

High Development Costs, Material Limitations, and Integration Complexities

The thermal management technologies market is confronted with challenges, as development costs for cutting-edge cooling systems, heat dissipation materials, and AI-driven temperature regulation solutions can be significant. The increasing need for optimum thermal management in electric vehicles (EVs), data centers, and high electric performance electronics is prompting manufacturers to invest heavily in research & development (R&D), thereby augmenting overall expenditures.

Given the conventional thermal interface materials (TIMs) used in 3D HICs typically follow thermal greases, phase change materials and graphite sheet, these materials are subject to degradation over time and eventually can decrease heat dissipation ability.

Furthermore, strict integration limitations are faced where electronic components undergo miniaturization, and high-power density systems demand highly-engineered thermal solutions where ensuring even cooling without compromising performance or design replicas is quite challenging.

Opportunities

Growth in EVs, AI-Driven Cooling Solutions, and Sustainable Thermal Materials

Energy-efficient cooling devices, rapid expansion of electronic controls and electronic components, increasing need for premium technology for longer battery life to cater to demand for EV charging, rapid needs for sustainable Thermal management materials & solutions, AI-focused cooling devices, higher energy consumption of devices, increase in market demand, and demand for reducing journey cost in automotive segment are the primary driving forces for the thermal management market.

Increasing use of high-energy-density batteries and fast-changing technologies is driving demand for liquid cooling systems, phase change materials (PCMs) and advanced thermal coatings in EV batteries and power electronics.

AI-driven real-time thermal monitoring is also facilitating predictive temperature regulation, optimizing data centers, industrial automation, and aerospace applications cooling in the process. The market demand for sustainable and recyclable thermal interface materials (TIMs) is also creating opportunities for novel carbon-neutral, high-performance thermal dissipation solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency standards, RoHS directives, and thermal safety regulations. |

| Consumer Trends | Demand for efficient heat dissipation in high-performance computing (HPC), 5G infrastructure, and EV batteries. |

| Industry Adoption | High use of thermal pastes, heat sinks, and liquid cooling systems in electronics and automotive. |

| Supply Chain and Sourcing | Dependence on silicone-based thermal pastes, aluminum heat sinks, and PCM-based cooling materials. |

| Market Competition | Dominated by electronics manufacturers, automotive cooling solution providers, and industrial HVAC firms. |

| Market Growth Drivers | Growth fueled by data center expansion, rising adoption of EVs, and demand for miniaturized electronics. |

| Sustainability and Environmental Impact | Moderate adoption of low-energy cooling solutions and eco-friendly thermal pastes. |

| Integration of Smart Technologies | Early adoption of IoT-connected thermal sensors, liquid cooling systems for gaming PCs, and smart HVAC controls. |

| Advancements in Heat Dissipation Technologies | Development of graphene-based thermal pads, high-efficiency heat pipes, and PCM-based cooling materials. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral cooling mandates, AI-driven thermal compliance tracking, and sustainable material certifications. |

| Consumer Trends | Growth in AI-driven cooling algorithms, self-regulating thermal coatings, and liquid metal-based heat dissipation solutions. |

| Industry Adoption | Expansion into nanotechnology-based thermal materials, AI-assisted real-time heat regulation, and next-gen graphene-enhanced cooling solutions. |

| Supply Chain and Sourcing | Shift toward bio-based cooling fluids, carbon-neutral thermal insulation, and AI-optimized supply chain tracking. |

| Market Competition | Entry of AI-driven cooling startups, nanomaterial-based thermal innovators, and sustainable cooling system developers. |

| Market Growth Drivers | Accelerated by AI-powered predictive cooling, quantum computing heat dissipation advancements, and next-gen carbon-neutral cooling systems. |

| Sustainability and Environmental Impact | Large-scale shift toward self-healing thermal coatings, carbon-negative cooling technologies, and zero-emission HVAC solutions. |

| Integration of Smart Technologies | Expansion into AI-driven cooling grid management, blockchain-based thermal efficiency tracking, and nanotech-powered thermal regulation systems. |

| Advancements in Heat Dissipation Technologies | Evolution toward AI-enhanced self-regulating cooling materials, bio-inspired thermal management solutions, and heat-to-energy conversion systems. |

Thermal Management Technologies market in the USA continues to grow at a robust pace, logrithming the rise in cooling solution demand amid the electronics sector, electric vehicles (EVs), and data centers. Demand in the market is driven by the growth of use cases such as, high-performance computing (HPC) as well as artificial intelligence (AI) workloads, and advanced battery thermal management systems (BTMS). Moreover, investments in advanced heat dissipation materials and liquid cooling technologies are also aiding industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

The Thermal Management Technologies market in the United Kingdom is driven by the growing adoption of energy-efficient cooling systems in data centers, electric vehicles, and renewable energy applications. The market is being driven by edge computing, advancements in phase change materials (PCMs), and a growing interest in sustainable thermal solutions. Also, strict energy regulations and green building codes are driving trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.7% |

The thermal management technologies market is on the rise in the European Union as various sectors focus on increasing energy efficiency in power electronics, 5G infrastructure, and automotive applications. EV production growth, widespread adoption of thermally conductive polymers, and investment in sustainable cooling solutions are driving the demand. The expansion of the market and this is due to EU regulations that encourage eco-friendly refrigerants and high-efficiency thermal interfaces.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.8% |

The market for thermal management technologies in Japan is characterized by a moderate growth on the back of miniaturized electronics, battery thermal management for hybrid and EVs, semiconductor cooling solutions. Increased demand for nanomaterials, advanced thermal interface materials (TIMs), and heat pipe technologies is contributing to the growth of this market. Moreover, government investment in smart cities and energy-efficient cooling infrastructure supports long-term industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

In South Korea, the thermal management technologies market is growing due to the rise in the semiconductor manufacturing industry, the increasing demand for high-performance thermal solutions in the 5G and AI infrastructure, and the increasing acceptance of advanced cooling technologies in electric vehicles. Demand in the sector is also being boosted by the expansion of battery gig factories and government initiatives for energy-efficient electronics manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

Thermal management technologies market in various sectors can lead to the growth of demand for Thermal Management Technologies. As miniaturization, high-performance computing, electric vehicle (EV) proliferation, and 5G telecommunications all reach their respective, rapid advancements, manufacturers are coming up with new, next-gen thermal management solutions that further optimize energy efficiencies, as well as keep the equipment material sustainable and system reliable.

Market is segmented by Type (Hardware, Software, Interface Products, Substrates), by Application (Computer, Consumer electronics, Automotive electronics, Telecommunication, Renewable energy, Other Applications).

Heat sinks, fans, heat exchangers, liquid cooling systems, and vapor chambers are primarily utilized in high-performance computing, gaming systems, industrial automation, and electric vehicles, which is the reason the Hardware segment accounts for the highest market share. These solutions are often hardware-based, implementing techniques to reduce temperatures, improve efficiency, and maintain consistent performance.

As demand increases for energy-efficient data centers and rapid expansion of EV powertrain systems, and growing adoption of high-performance computing (HPC) applications, semiconductor manufacturers are pushing beyond traditional thermal bottlenecks with new advanced hardware solutions that include liquid immersion cooling, graphene-enhanced heat spreaders and phase-change cooling technologies.

Software also continues to grow significantly, especially in areas of AI-powered thermal modeling, predictive heat management, and simulation-based optimization of cooling systems. And demand for thermal management software that facilitates either time or operational efficiency with predictive maintenance proliferate as industries transition towards smart manufacturing, IoT driven automation and digital twin technologies.

Demand for software-based thermal management is likely to grow, in particular, in data center cooling, semiconductor fabrication, and automotive electronic systems, due to advances in computational fluid dynamics (CFD) modeling, AI-driven thermal analytics, and real-time temperature monitoring solutions.

The consumer electronics segment holds the highest share in the thermal management technologies market because smartphones, tablets, gaming consoles, and portable devices need light-weight, compact, and high-efficiency cooling solutions. As 5G-enabled devices, foldable screens, and high-performance mobile processors are released at an increasing pace, manufacturers are incorporating advanced heat dissipation technologies (vapor chambers, TIMs, cooling algorithms based on AI) into their designs.

Growing global smartphone penetration, rapid adoption of compact high-performance electronics, new products in flexible and wearable technology, and demand for new customers especially ultra-thin thermal management solutions all increase their stronghold in the consumer electronics industry.

The automotive electronics segment is much in demand too, with rapid growth in electric vehicle (EV) battery cooling, engine and powertrain thermal regulation, and advanced driver-assistance systems (ADAS) as key growth drivers. Thermal management technologies are essential for making sure that EV batteries, inverters, and autonomous driving sensors are safe, last long enough, and work efficiently.

As EVs gain traction, regulatory requirements for energy efficiency ramp up, and investment in battery thermal management systems (BTMS) escalates, the need for automotive thermal solutions, including liquid cooling, phase-change materials, and artificial intelligence (AI) heat regulation, is growing.

The thermal management technologies market is growing rapidly due to increasing demand for efficient heat dissipation solutions in electronics, automotive, aerospace, and industrial applications. The rise of AI-powered thermal analysis, next-generation cooling materials, and energy-efficient thermal regulation systems is driving market innovation. Companies are focusing on advanced heat sink designs, liquid cooling systems, and phase-change materials (PCMs) to enhance thermal efficiency, product longevity, and energy optimization.

Market Share Analysis by Key Players & Thermal Management Technology Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Honeywell International Inc. | 18-22% |

| Aavid Thermalloy (Boyd Corporation) | 12-16% |

| Laird Performance Materials | 10-14% |

| Henkel AG & Co. KGaA | 8-12% |

| Parker Hannifin Corporation | 5-9% |

| Other Thermal Management Technology Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Honeywell International Inc. | Develops AI-powered thermal analysis, phase-change materials (PCMs), and high-performance heat dissipation solutions. |

| Aavid Thermalloy (Boyd Corporation) | Specializes in liquid cooling systems, AI-enhanced heat sink design, and advanced vapor chamber cooling technologies. |

| Laird Performance Materials | Provides thermal interface materials (TIMs), AI-driven thermal optimization, and EMI shielding solutions. |

| Henkel AG & Co. KGaA | Focuses on thermally conductive adhesives, AI-assisted cooling gel formulations, and phase-change thermal interface materials. |

| Parker Hannifin Corporation | Offers next-generation cooling solutions for automotive and industrial applications, AI-powered heat transfer coatings, and energy-efficient heat exchangers. |

Key Market Insights

Honeywell International Inc. (18-22%)

Honeywell leads the thermal management market, offering AI-optimized cooling technologies, phase-change thermal solutions, and advanced material-based heat dissipation innovations.

Aavid Thermalloy (Boyd Corporation) (12-16%)

Aavid specializes in liquid cooling and high-efficiency heat sinks, ensuring AI-powered thermal optimization and vapor chamber cooling advancements.

Laird Performance Materials (10-14%)

Laird provides thermal interface materials (TIMs) and EMI shielding solutions, optimizing AI-driven thermal performance analysis.

Henkel AG & Co. KGaA (8-12%)

Henkel focuses on thermally conductive adhesives and cooling gels, integrating AI-assisted material formulation for energy-efficient heat management.

Parker Hannifin Corporation (5-9%)

Parker Hannifin develops automotive and industrial cooling systems, ensuring AI-powered heat exchanger efficiency and sustainable thermal control.

Other Key Players (30-40% Combined)

Several industrial cooling system providers, electronics component manufacturers, and advanced materials companies contribute to next-generation thermal management solutions, AI-powered heat dissipation technologies, and energy-efficient cooling innovations. These include:

The overall market size for the thermal management technologies market was USD 16,655.0 Million in 2025.

The thermal management technologies market is expected to reach USD 35,296.5 Million in 2035.

Growth is driven by the increasing demand for efficient cooling solutions in electronics, rising adoption of electric vehicles (EVs), advancements in thermal interface materials, and expanding applications in data centers and renewable energy systems.

The top 5 countries driving the development of the thermal management technologies market are the USA, China, Germany, Japan, and South Korea.

Hardware Solutions and Consumer Electronics are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA