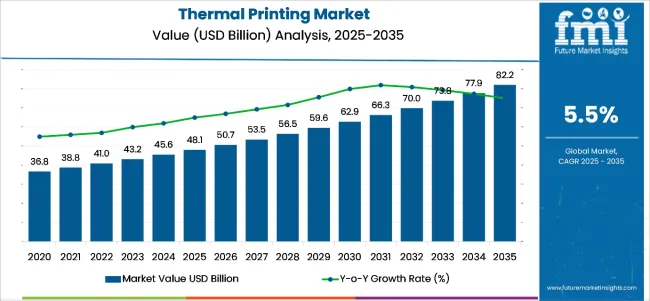

The global thermal printing market is projected to witness significant growth over the forecast period from 2025 to 2035. The market is valued at USD 48.1 billion in 2025 and is likely to reach approximately USD 82.2 billion by 2035, which shows a CAGR of 5.5%.

This growth reflects the increasing adoption of thermal printing technologies across diverse industries such as retail, logistics, healthcare, and transportation. Thermal printing is favored due to its superior speed, durability, and low operational costs compared to conventional printing technologies. The market expansion is also supported by the widespread need for efficient printing solutions that enable high-volume printing with minimal maintenance.

One of the primary driving factors of the market is the growing demand for labeling and barcode printing solutions across various end-use sectors. The retail and e-commerce industries, in particular, are embracing thermal printing for price tags, packaging labels, and receipts, driven by the rapid rise of online shopping and omnichannel retail platforms.

In logistics and warehousing, the need for accurate tracking and inventory management has boosted the adoption of thermal printers for shipping labels, product tracking, and warehouse automation. The healthcare sector is also increasingly relying on thermal printing for printing prescriptions, patient wristbands, and medical labels that require clarity and durability under different environmental conditions.

Additionally, technological advancements in thermal printing materials and devices are playing a crucial role in shaping market trends. Developments such as BPA-free thermal paper, energy-efficient printers, and mobile printing devices have made thermal printing more sustainable and versatile. Furthermore, industries are shifting towards high-speed, portable, and wireless thermal printers that cater to the demand for on-the-go printing solutions.

Growing concerns regarding product authenticity and traceability, especially in the food and pharmaceutical sectors, are encouraging companies to invest in thermal printing solutions that support serialization and anti-counterfeiting measures. These factors collectively ensure a robust growth outlook for the global thermal printing market over the next few years.

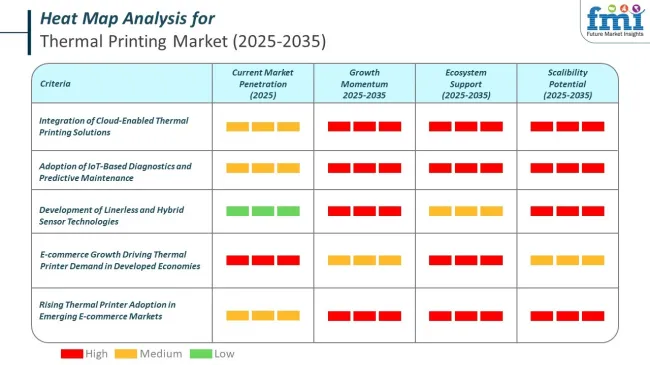

Thermal printing is undergoing rapid transformation with innovations focused on performance, eco-sustainability, and smart connectivity. Companies are actively integrating cloud, mobile, and AI-based features into hardware to stay competitive across evolving end-user needs.

The global e-commerce boom is significantly influencing the thermal printing market. As online shopping activity intensifies, demand for efficient labeling and shipping documentation continues to rise. Thermal printers offer speed, accuracy, and low maintenance, making them ideal for warehouse, logistics, and delivery operations.

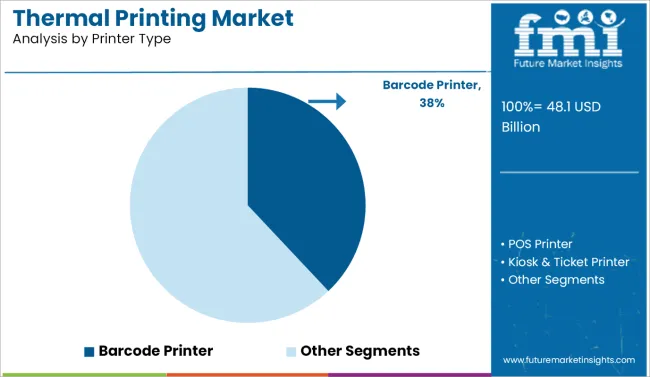

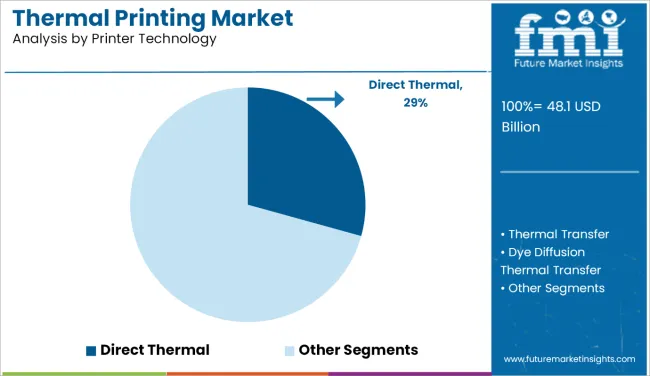

The global thermal printing market is segmented by printer type, printing technology, industry, and region. Based on printer type, the market includes barcode printers, POS printers, kiosk & ticket printers, RFID printers, and card printers. By printing technology, the market is categorized into direct thermal, thermal transfer, and dye diffusion thermal transfer. In terms of industry, the market covers retail & wholesale, transportation & logistics, healthcare, travel & hospitality, media & entertainment, manufacturing, government, and others (education, utilities, banking, and public services). Regionally, the market is divided into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The barcode printer segment is forecast to register the fastest growth in the thermal printing market, expanding at a CAGR of 8.9% between 2025 and 2035. This strong growth trajectory is primarily attributed to the increasing demand for efficient inventory management, product tracking, and supply chain automation across industries such as e-commerce, logistics, healthcare, and manufacturing.

With companies focusing on operational accuracy and real-time visibility, barcode printers have become essential equipment for labeling products, packages, and components. The integration of RFID features into barcode labels is further enhancing their functionality, supporting the demand for smarter warehouse and logistics operations.

POS (Point of Sale) printers, on the other hand, maintain a significant market share owing to their widespread use in retail, food service, and hospitality sectors. These printers are indispensable for receipt printing, billing, and transaction records at checkouts and counters.

Their stable growth is supported by the expansion of supermarkets, convenience stores, and cafes globally. Kiosk & ticket printers are also emerging as key devices, especially with the growing adoption of self-service kiosks in sectors such as transportation, entertainment, and government services. These printers enable the quick issuance of tickets, boarding passes, and service receipts, contributing to customer convenience and reduced service time.

RFID printers are witnessing a gradual but steady adoption curve, mainly in applications that require detailed asset tracking, access control, and product authentication. However, their relatively higher initial cost compared to standard barcode printers has limited their mass deployment, particularly among small and medium enterprises.

Card printers continue to serve niche applications in the banking, government, and corporate sectors, where they are used for the issuance of secure ID cards, payment cards, and access badges. Although this segment enjoys stable demand, its growth potential is relatively lower compared to other printer categories due to its specialized use case.

| Printer Type | CAGR (2025 to 2035) |

|---|---|

| Barcode Printer | 8.9% |

The direct thermal segment is expected to hold the largest market share of 29% in 2025. This dominance is driven by its widespread adoption across industries such as retail, logistics, healthcare, and hospitality. Direct thermal printers are preferred because they offer cost-effective, fast, and reliable printing solutions without the need for additional consumables like ribbons, toner, or ink.

These printers are especially popular for short-life labeling applications such as shipping labels, receipts, and price tags. Their simplicity of operation, low maintenance needs, and lower total cost of ownership make them the ideal choice for businesses that require high-volume, everyday printing.

The thermal transfer segment continues to cater to applications that demand more durable and long-lasting prints. This technology uses ribbons to transfer ink onto media, producing images that are resistant to heat, moisture, chemicals, and abrasion.

As a result, thermal transfer printers are commonly used in industrial environments, product identification, laboratory labeling, and chemical drum marking, where durability and readability over time are essential. Despite their higher running costs compared to direct thermal printers, they remain a preferred choice for specialized printing tasks requiring permanent labeling.

Dye diffusion thermal transfer (D2T2) printers, although a smaller part of the overall market, find application in high-quality image printing, particularly in photo printing, secure ID cards, and specialty applications. This technology provides superior image resolution, color vibrancy, and sharpness, making it suitable for personalized items, photographic output, and government or financial ID card production.

However, the higher operational cost and slower print speeds limit their adoption in industrial and commercial label printing, keeping their market share modest compared to direct thermal and thermal transfer technologies.

| Printer Technology | Share (2025) |

|---|---|

| Direct Thermal | 29% |

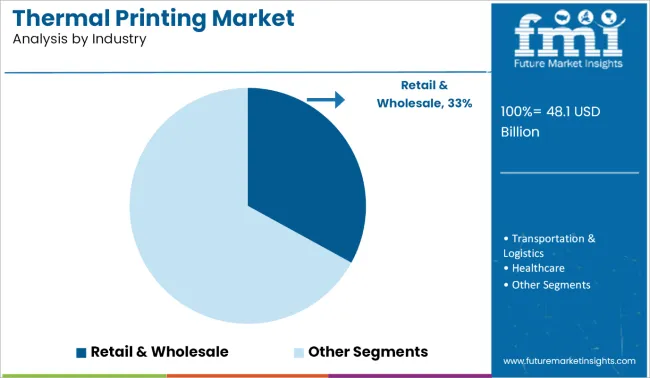

The retail & wholesale segment accounts for 33.3% share. Thermal printers are extensively used in the retail and wholesale industry due to their speed, reliability, and cost-effectiveness. These printers use heat-sensitive paper, eliminating the need for ink or toner, which reduces maintenance costs and downtime. This makes them ideal for high-volume environments like supermarkets, warehouses, and point-of-sale (POS) systems.

In fast-paced retail settings, efficiency is crucial. Thermal printers can produce receipts, labels, and barcodes quickly, allowing for faster customer service and streamlined operations. Their compact size also makes them easy to integrate into tight checkout counters or mobile setups.

| Industry | Share (2025) |

|---|---|

| Retail & E-commerce | 33.3% |

The transportation & logistics segment is expected to witness the fastest growth in the thermal printing market. This segment is expected to grow at a CAGR of 7.6% from 2025 to 2035. This growth is primarily fueled by the booming e-commerce sector, which demands efficient warehousing, inventory management, and real-time tracking of goods. The widespread use of barcode and RFID labels for shipping, parcel tracking, and supply chain transparency has significantly boosted the adoption of thermal printers in logistics hubs, distribution centers, and freight operations globally.

The retail & wholesale sector continues to dominate the market in terms of volume demand due to its extensive requirement for price tags, product labels, and receipts. Thermal printing technology is integral to point-of-sale systems, shelf labeling, and promotional tagging in supermarkets, hypermarkets, and specialty stores.

The healthcare industry is also increasingly adopting thermal printing solutions for patient identification wristbands, specimen labeling, prescription printing, and medical device tracking. This is driven by the need for error-free, durable, and legible labels in hospital and laboratory environments to ensure patient safety and regulatory compliance.

The travel & hospitality sector leverages thermal printers for boarding passes, baggage tags, tickets, and guest identification cards to enhance operational efficiency and customer experience. In the media & entertainment industry, thermal printing supports ticketing, event passes, and backstage identification, particularly for concerts, theaters, and large venues. Manufacturing industries employ thermal printers for product labeling, asset tracking, and inventory control, ensuring smooth production and logistics workflows.

Government agencies utilize thermal printing for document processing, ID cards, and secure labeling for sensitive materials. The 'Others' category includes education, utilities, and other service sectors where thermal printing serves niche but essential functions such as document handling, examination papers, and utility billing.

| Industry | CAGR (2025 to 2035) |

|---|---|

| Transportation & Logistics | 7.6% |

The industry is experiencing rapid growth as demand for high-speed, affordable, and long-lasting printing solutions increases in the industry. In the retail and e-commerce industry, companies value rapid printing, affordability, and customizable label flexibility to enhance point-of-sale processes and supply chain management.

The healthcare industry demands high-durability prints, compliance with regulations, and clear barcode labeling to ensure patient safety and monitoring of medical inventories. Logistics and transportation companies highlight high-speed and durable printing to track shipments, inventory monitoring, and warehouse labeling.

The manufacturing industry needs highly customized and extremely robust prints to maintain industrial standards, guaranteeing conformity and operational performance. In hospitality, the industry is extensively used for receipts, billing, and ticketing, with a focus on cost savings and customization. With the progress in wireless connectivity, RFID-compatible thermal printers, and environmentally friendly printing technologies, the industry is growing across diverse industries.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| Zebra Technologies | Approximately USD 120 |

| Honeywell International | Approximately USD 85 |

| SATO Holdings Corporation | Approximately USD 60 |

| Toshiba TEC Corporation | Approximately USD 95 |

The industry has experienced significant growth driven by technological advancements and strategic collaborations throughout 2024 and into early 2025. The deployment of Zebra Technologies'thermal printing solutions in hundreds of stores by an international retailer signifies the technology's role in enhancing inventory management and customer service.

Honeywell International's transaction with a national logistics firm also reinforces the necessity of proper labels and expedited processing in distribution facilities. SATO Holdings Corporation partnered with a healthcare organization to implement the industry solutions for patient identification and labeling of medication, underscoring the core role of the industry in patient safety and business efficiency.

Thermal printers, on the other hand, are being used in manufacturing, as seen with Toshiba TEC Corporation's adoption of the technology on production lines, demonstrating its ability to automate labeling processes and decrease downtime. These strides reflect a broader industry trend toward leveraging advanced thermal printing solutions to improve accuracy, efficiency, and safety across an array of industries.

Another route that leads to an increase in demand is the widespread use in industrial operations like hospitals, retail sectors, and transportation. Nevertheless, the diversion of thermal paper and print heads in the global industry because of a lack of raw materials can result in production problems. Companies have to find alternative sourcing strategies to cover the possible impacts of manufacturing delays as well as cost surges.

The digital documentation and cloud-based solutions have assumed a new trajectory that depicts a threat to the industry. Companies increasingly go to digital paper systems, thus the management of printed receipts, labels, and invoices can be decreased. The industry manufacturers should not fall behind the competition and thus use their resources on the research of hybrid technologies that combine the digital and physical printing technologies.

Ecological responsibility, environmental regulation, and sustainability are driving the industry in a new direction. Thermal paper with BPA and other chemicals has been banned in several regions, forcing manufacturers to develop new coatings and recyclable materials. Eco-friendly printing technologies, such as direct thermal recyclable paper, are convenient for the industry; achieving both revenue and cost targets is a problem.

As thermal printers connect to cloud-based systems and IoT networks, cybersecurity worries are on the rise. The problems arising from the use of unapproved printing devices may result in data breaches and operational disturbances. It is necessary to establish strong security protocols, encrypt data, and carry out regular software updates to ensure business and customer information remains safe.

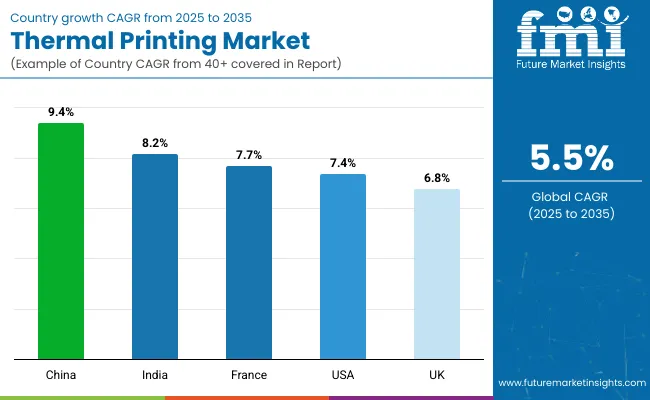

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| France | 7.7% |

| UK | 6.8% |

| China | 9.4% |

| India | 8.2% |

The USA leads the industry because of its highly advanced e-commerce sector, sophisticated logistics infrastructure, and robust healthcare and manufacturing adoption. Thermal barcode and label printing are utilized by giants such as Amazon, Walmart, and FedEx to maximize operational efficiency and facilitate accurate order fulfillment. Hospitals and pharmaceutical firms utilize printing on patient wristband labels, prescription labels, and medical record documentation.

With increasing automation in supply chains and warehouses, the need for thermal printers equipped with RFID also increases. The USA also has strict regulatory requirements in healthcare and food labeling, forcing companies to invest in rugged, high-quality image thermal printing, and forcing the country to be a dominant force in global industry growth.

FMI is of the opinion that the USA industry is slated to grow at 7.4% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| E-Commerce Growth | Thermal printers are employed by retailers such as Amazon and Walmart to print barcodes and labels to improve logistics and delivery precision. |

| Healthcare Adoption | Hospitals and pharmacies employ these to print prescription labels, patient wristbands, and medical records. |

| Supply Chain Automation | The solutions that integrate RFID automate warehouse operations and inventory management. |

| Regulatory Compliance | Regulatory labeling for healthcare and food industries demands high-quality solutions. |

China's industry is expanding rapidly with the fast-evolving e-commerce industry, industrialization, and government encouragement towards digitalization. Top e-commerce portals like Alibaba and JD.com generate high demand for barcode and shipping label printers. Logistics and warehousing are increasing, which requires quick, automated labeling and traceability solutions.

Companies apply RFID and smart labeling technology to enhance efficiency and traceability. Moreover, the supportive government policies towards digital payments and paperless transactions have once more stimulated the adoption of thermal receipt printers in bank and retail spaces. With advancements in technology and domestic production, China remains an increasingly robust growth industry.

FMI is of the opinion that the China industry is slated to grow at 9.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Growing E-Commerce | Alibaba, JD.com, and other websites spur significant demand for barcode and shipping label printers. |

| Smart Labeling Adoption | Fostering industries to accept RFID and intelligent labels to drive supply chains into greater efficiency. |

| Digital Payment Growth | Government support for paperless transactions encourages thermal printer usage across retail and banking. |

| Logistics and Warehousing | Automatic identification and labeling applications enhance large-scale logistics business efficiency. |

India's industry is growing due to growing e-commerce, enhanced digitalization, and expanding retail acceptance. Online giants like Flipkart, Amazon India, and other e-players are creating demand for label and barcode printers for warehouse and logistics management.

The supermarket and quick-service restaurant businesses are gradually depending on thermal receipt printers to make billing hassle-free. Drug packaging, as well as hospital records in the pharmaceutical and drug businesses, need it. Government initiatives towards digitalization, supplemented by growing indigenous manufacturing capacity and foreign investment, make India a developing hub for thermal printing solutions.

FMI is of the opinion that the Indian industry is slated to grow at 8.2% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| E-Commerce Expansion | Amazon India and Flipkart fuel demand for barcode and shipping label printers in logistics. |

| Retail Sector Expansion | Supermarkets and QSRs use thermal receipt printers for easy transactions. |

| Healthcare and Pharmaceuticals | Hospitals and pharma companies use it for labeling and medical charts. |

| Digitalization Initiatives | Government initiatives encourage the application of it in administrative and financial services. |

The French industry grows as the retail, logistics, and manufacturing industries increasingly use automated printing. Supermarkets and chain stores apply thermal printers for billing and stock control. Logistics companies apply barcode and RFID-printers to improve package tracking and warehouse management.

Companies use smart labeling to meet traceability and environmental responsibility requirements imposed by the European Union. Its prime focus is on innovation in technology as well as premier-class printing hardware, and that is why France is a lucrative industry for innovations.

FMI is of the opinion that the French industry is slated to grow at 7.7% CAGR during the study period.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Retailing Demand | Supermarkets and chain stores use thermal printers to bill and track stock accurately. |

| Logistics Effectiveness | Firms adopt thermal printing solutions to enhance package traceability and automated warehouse operations. |

| Industrial Compliance | Compliance with European regulations stimulates intelligent labeling and RFID-tagged printing solutions. |

| Sustainability Trends | Companies are concerned with environmentally friendly technologies that fit into environmental agendas. |

The UK industry is growing steadily with growing retail use, regulatory labeling, and warehouse automation. Supermarkets and large retailers apply them to increase check-out speed and stock management.

The healthcare industry relies on pharmaceutical labeling and patient identification through thermal printing. With growing e-commerce, logistics businesses are investing in high-speed printing technology for order fulfillment. Food and drug safety legislation also increases the demand for high-resolution printing technologies.

FMI is of the opinion that the UK industry is slated to grow at 6.8% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| In-store Adoption | Large retail outlets and supermarkets use printing for invoices and stock management. |

| Logistics Expansion | Delivery networks and warehouses utilize high-speed thermal printers to label accurately. |

| Healthcare Adoption | Prescription label printing and patient wristband printing need thermal printers for hospitals and pharmacies. |

| Regulatory Norms | Food safety and pharma compliance mandates drive investments in improved printing. |

The industry is currently blossoming with features that are one of the fastest, most durable, and cost-effective printing techniques in retail, logistics, healthcare, manufacturing, etc. Industries adopt such technologies, and further investments are being made to install thermal printers with RFID technology, mobile printing, and cloud-based printing technologies to meet increasing demands for automation and traceability.

Leaders in the industry, like Zebra Technologies, Honeywell International, Seiko Epson, Toshiba Tec, and SATO Holdings, employ advanced thermal printers, barcode labeling solutions, and industrial-grade printing systems. Mid-sized and emerging players, however, aggressively compete in the industry through the provision of low-cost, region-specific thermal printing solutions.

Industry evolution stems from the introduction of eco-friendly printing technology, BPA-free thermal paper innovations, and AI-automated management in print. Smart labeling, IoT-enabled print monitoring, and sustainable packaging solutions are the dominating trends within the industry framework.

Strategic underpinnings include technology integration and regulatory conformity vis- -vis end-to-end supply chain efficiencies. With high-speed industrial printers and cloud-based print management in conjunction with environmentally conscious material choices, a player positions itself in the most favorable space in this fast-evolving the industry marketplace.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.1 billion |

| Projected Market Size (2035) | USD 82.2 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Printer Type | Barcode Printer, POS Printer, Kiosk & Ticket Printer, RFID Printer, and Card Printer |

| By Printing Technology | Direct Thermal, Thermal Transfer, and Dye Diffusion Thermal Transfer |

| By Industry | Retail & Wholesale, Transportation & Logistics, Healthcare, Travel & Hospitality, Media & Entertainment, and Manufacturing, Government |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East, and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Zebra Technologies Corporation, Honeywell International Inc., Seiko Epson Corporation, Toshiba Tec Corporation, SATO Holdings Corporation, Brother Industries, Ltd., Star Micronics Co., Ltd., BIXOLON Co., Ltd., Fujitsu Ltd., and TSC Auto ID Technology Co., Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

| Customization and Pricing | Available upon request |

By printer type, the segment is categorized into barcode printer, POS printer, kiosk & ticket printer, RFID printer, and card printer.

By printing technology, the segment is classified into direct thermal, thermal transfer, and dye diffusion thermal transfer.

By industry, the segment is categorized into retail & wholesale, transportation & logistics, healthcare, travel & hospitality, media & entertainment, manufacturing, government, and others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The industry is projected to reach USD 48.1 billion in 2025.

The industry is projected to reach USD 82.2 billion by 2035, growing at a CAGR of 5.5%.

The key players include NCR Corporation, Honeywell International Inc., Zebra Technologies Corporation, Fujitsu Limited, HP Development Company, L.P., Seiko Epson Corporation, Toshiba Tec Corporation, Brother Industries, Ltd., Star Micronics Co., Ltd., NEC Corporation, and Advantech Co., Ltd.

North America and Asia-Pacific, driven by increasing demand in retail, healthcare, and logistics industries.

Direct thermal printing dominates due to its cost-effectiveness and extensive applications in barcode labeling, ticketing, and receipts.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Printer Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 17: Global Market Attractiveness by Printer Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Printing Technology, 2023 to 2033

Figure 19: Global Market Attractiveness by Industry, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 37: North America Market Attractiveness by Printer Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Printing Technology, 2023 to 2033

Figure 39: North America Market Attractiveness by Industry, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Printer Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Printing Technology, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 77: Europe Market Attractiveness by Printer Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Printing Technology, 2023 to 2033

Figure 79: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Printer Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Printing Technology, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Printer Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Printing Technology, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Printer Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Printing Technology, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Printer Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Printer Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Printer Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Printer Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 157: MEA Market Attractiveness by Printer Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Printing Technology, 2023 to 2033

Figure 159: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Thermal Printing Market Insights - Demand & Growth 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Korea Thermal Printing Market – Trends & Forecast 2025 to 2035

Market Share Insights of Leading Direct Thermal Printing Film Providers

The thermal printing Market in Western Europe is segmented by printer type, printing technology, industry and country from 2025 to 2035.

Demand for Direct Thermal Printing Film in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Direct Thermal Printing Film in USA Size and Share Forecast Outlook 2025 to 2035

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA