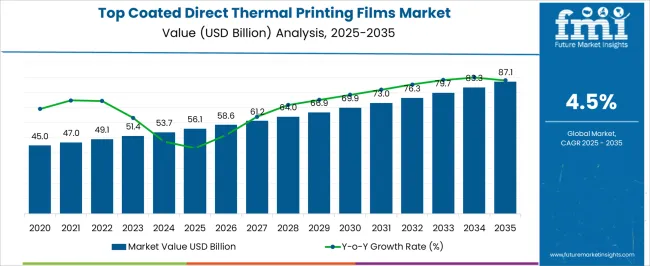

The Top Coated Direct Thermal Printing Films Market is estimated to be valued at USD 56.1 billion in 2025 and is projected to reach USD 87.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Top Coated Direct Thermal Printing Films Market Estimated Value in (2025 E) | USD 56.1 billion |

| Top Coated Direct Thermal Printing Films Market Forecast Value in (2035 F) | USD 87.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Top Coated Direct Thermal Printing Films market is gaining traction globally due to rising requirements for high-resolution, cost-effective labeling solutions across retail, logistics, and industrial domains. The transition from conventional paper-based labels to synthetic films has been driven by the need for longer durability, smudge resistance, and compatibility with high-speed thermal printers.

The increased deployment of thermal films in end-use environments requiring water, oil, and heat resistance has pushed manufacturers toward advanced top-coated variants with improved chemical resistance and image stability. The growth of automated packaging lines, evolving point-of-sale operations, and e-commerce fulfillment has also accelerated the adoption of direct thermal labels that do not require ribbons or toners, thus minimizing equipment downtime and operational complexity.

Furthermore, sustainability goals and plastic waste regulations are encouraging innovation in recyclable and thinner film structures, providing new opportunities for growth As industries prioritize faster turnaround, traceability, and intelligent packaging, top-coated thermal films are expected to become a critical enabler of labeling efficiency and product authentication.

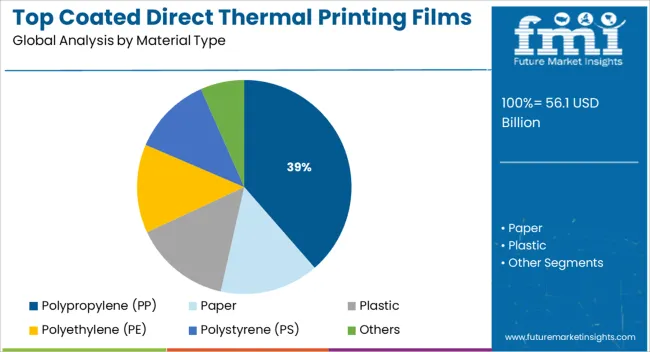

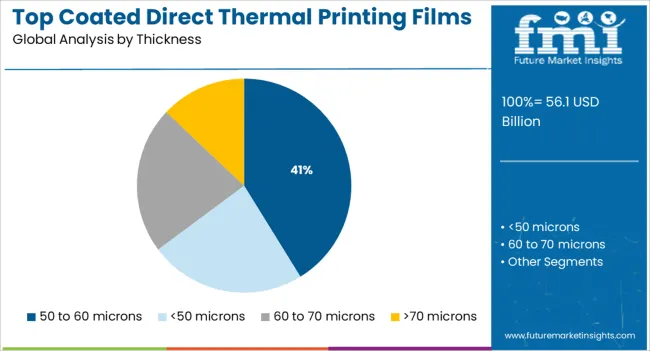

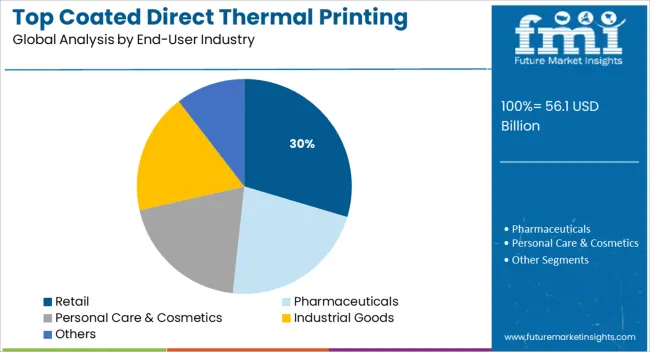

The market is segmented by Material Type, Thickness, and End-User Industry and region. By Material Type, the market is divided into Polypropylene (PP), Paper, Plastic, Polyethylene (PE), Polystyrene (PS), and Others. In terms of Thickness, the market is classified into 50 to 60 microns, <50 microns, 60 to 70 microns, and >70 microns. Based on End-User Industry, the market is segmented into Retail, Pharmaceuticals, Personal Care & Cosmetics, Industrial Goods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polypropylene is expected to hold 38.6% of the revenue share in the Top Coated Direct Thermal Printing Films market in 2025, making it the most preferred material type. This dominance is being driven by polypropylene's excellent durability, flexibility, and moisture resistance, which makes it suitable for both indoor and outdoor labeling applications. The material's compatibility with top coatings enhances print quality and image sharpness, supporting its use in applications requiring barcode accuracy and long-term readability.

Its lightweight nature contributes to reduced material consumption and shipping costs, while its chemical resistance allows performance stability under varying environmental conditions. Polypropylene has also gained traction due to its recyclability and ability to support thinner gauges without compromising mechanical strength.

These properties have aligned well with industry sustainability goals and high-speed packaging requirements As product identification, anti-counterfeiting, and branding demands rise, polypropylene’s adaptability to high-throughput printing environments and automated label applicators continues to reinforce its leading position.

The 50 to 60 microns thickness segment is projected to contribute 41.2% of the revenue share in the Top Coated Direct Thermal Printing Films market by 2025. This thickness range has emerged as the most demanded due to its optimal balance between durability and print performance, making it suitable for retail shelf labels, shipping tags, and warehouse tracking labels. Films within this micron range offer sufficient tear resistance while maintaining flexibility, supporting applications that require surface conformity and robust adhesion.

Their dimensional stability under thermal stress allows consistent print resolution even during high-speed printing operations. The compatibility of 50 to 60 micron films with both flat-head and near-edge printheads has enhanced their operational versatility.

Moreover, this range allows for reduced material use without sacrificing functional properties, contributing to cost savings and sustainability goals Their performance in multi-surface adhesion and resistance to humidity and abrasion continues to support widespread adoption across labeling workflows with rigorous operational demands.

The retail industry is anticipated to account for 29.6% of the total revenue share in the Top Coated Direct Thermal Printing Films market in 2025, making it the most significant end-user segment. Growth in this segment is being driven by the increasing need for real-time price labeling, promotional tagging, and inventory tracking in high-volume retail environments. Retailers are adopting top-coated thermal films for their ability to deliver high-resolution print quality, fast processing speeds, and reduced maintenance in point-of-sale and backroom operations.

The resistance of these films to smudging, light exposure, and surface abrasion ensures label readability throughout the product lifecycle. Retail chains and supermarkets are leveraging these properties to enhance shelf management, product traceability, and customer experience.

As omnichannel retail expands, the demand for accurate and durable labeling across distribution centers and physical stores is further rising The ability to integrate these films into automated label dispensers and thermal printers without requiring ribbons has supported operational efficiency, thereby solidifying their role in modern retail systems.

In the last few years, flexible packaging market has achieved tremendous growth. Top coated direct thermal printing films are mainly used for information printing of images on airline baggage tags, readymade food labels, industrial bar code applications, retail price marking and logistics labels. Barcode printing on the paper is the key application which is offered by top coated direct thermal printing films.

The top coated direct thermal printing films are used in various end-use industries such as, food & beverages, electrical and electronics, retail, industrial goods etc. Top coated direct thermal printing films possess high resistance to heat, water, UV light, and chemicals, among others, as a result of which, the top coated direct thermal printing films market is expected to grow rapidly during the forecast period 2020 to 2025.

Direct thermal printing is the technology used in top coated direct thermal printing films. Top coated direct thermal printable (DTP) films are BOPP based films with a proprietary coating which enables image formation on the films when it comes in direct contact with the thermal printer.

Top coated direct thermal printing films are best suited for the indoor applications where temperatures are below 140 degrees because the image produced by it are heat, light, and chemical sensors.

Due to a highly diversified scope of applications, the top coated direct thermal printing films market is expected to witness a largely positive growth, over the forecast period.

One of the key applications of top coated direct thermal printing films is barcode printing. Over time, emergence of modern retail and trade practices has created an absolute need for real time tracking and identification of products. This is expected to be one of the major contributors to growth of the global top coated direct thermal printing films market. Barcodes find applications in shipping, logistics, and airport bags, among others.

Increased demand for safety and security of the product has in turn, fueled demand for tamper evident packaging solutions, leading to growth in preference for solutions such as barcodes, and ultimately, top coated direct thermal printing films. Top coated direct thermal printing films are cost-effective, compared to other films, and therefore enjoy higher preference.

As compared to films conventionally used for thermal printing, top coated direct thermal printing films are tough and have high resistance, a property which is expected to increase preference for top coated direct thermal printing films, over the forecast period. One demerit for top coated direct thermal printing films is the usage of plastic.

The plastic is required to be replaced in a couple of months, due to damage by exposure to sunlight. This factor might prove to be a hurdle to growth of the global top coated direct thermal printing films market, over the forecast period.

Some of the players operating in the global top coated direct thermal printing films market are - Cosmo Films Ltd, AM Labels, and Mondi Group, among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global top coated direct thermal printing films market is estimated to be valued at USD 56.1 billion in 2025.

The market size for the top coated direct thermal printing films market is projected to reach USD 87.1 billion by 2035.

The top coated direct thermal printing films market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in top coated direct thermal printing films market are polypropylene (pp), paper, plastic, polyethylene (pe), polystyrene (ps) and others.

In terms of thickness, 50 to 60 microns segment to command 41.2% share in the top coated direct thermal printing films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Top Bottom Packaging Box Market from 2024 to 2034

Global Topical Pain Relief Market Insights – Size, Trends & Forecast 2024-2034

Topical Applicator Market Growth & Pharmaceutical Innovations 2024-2034

Atopic Dermatitis Treatment Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

NetOps Market Size and Share Forecast Outlook 2025 to 2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

Phytopathological Disease Diagnostics Market Forecast and Outlook 2025 to 2035

Acetophenone Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Pain Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Panniculus Retractor Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA