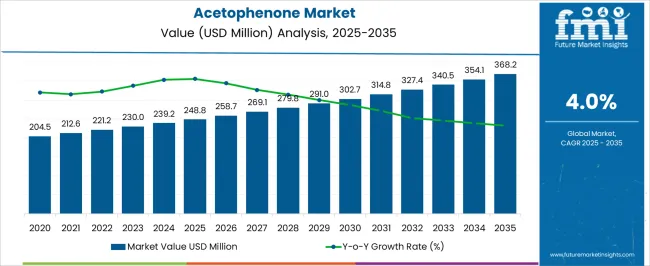

The Acetophenone Market is estimated to be valued at USD 248.8 million in 2025 and is projected to reach USD 368.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Acetophenone Market Estimated Value in (2025 E) | USD 248.8 million |

| Acetophenone Market Forecast Value in (2035 F) | USD 368.2 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The acetophenone market is progressing steadily, supported by its diverse applications across fragrance, pharmaceutical, and industrial sectors. Industry disclosures and chemical industry journals have highlighted that demand is being fueled by the increasing use of acetophenone as a key intermediate in the synthesis of resins, pharmaceuticals, and perfumes.

Rising global consumption of fine chemicals, coupled with growing demand for luxury fragrances and personal care products, has significantly influenced market expansion. Additionally, production methods have been refined to improve yield efficiency, ensuring reliable supply at scale. In the pharmaceutical industry, acetophenone continues to serve as a critical intermediate in manufacturing sedatives and other active compounds, reinforcing its industrial relevance.

Future growth is likely to be driven by sustainable production technologies and regulatory support for cleaner chemical processes, as well as the rising demand for flavors and fragrances in emerging economies. The market’s momentum is expected to remain anchored by cumene process acetophenone as the dominant type and flavors & fragrances as the leading application area.

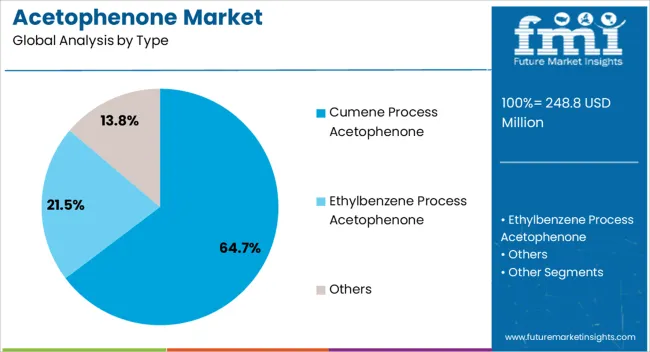

The Cumene Process Acetophenone segment is projected to account for 64.7% of the acetophenone market revenue in 2025, securing its position as the leading type. This dominance has been underpinned by the cost-effectiveness, scalability, and maturity of the cumene-based synthesis pathway. Chemical manufacturing reports have indicated that producers favor this method due to its high yield, established industrial know-how, and integration with broader petrochemical operations.

The segment also benefits from the ready availability of cumene as a feedstock, which supports consistent and large-scale output. Furthermore, industrial adoption has been reinforced by the stability of the process and its suitability for meeting diverse downstream demand across resins, pharmaceuticals, and fragrances.

While alternative processes are gaining interest in niche applications, the cumene route remains the preferred choice for producers focused on efficiency and reliability. These advantages have ensured the continued leadership of cumene process acetophenone in the global market.

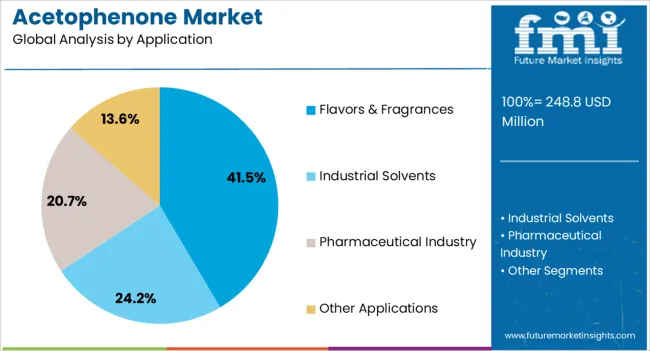

The Flavors & Fragrances segment is projected to contribute 41.5% of the acetophenone market revenue in 2025, maintaining its position as the primary application area. Growth of this segment has been influenced by rising global consumption of luxury perfumes, cosmetics, and personal care products where acetophenone functions as an essential ingredient. Reports from the fragrance industry have emphasized the role of acetophenone as a fixative and intermediate in producing aromatic compounds, driving its demand in both fine and mass-market formulations.

Additionally, increasing consumer preference for premium lifestyle products in emerging markets has expanded the consumption base for fragrance ingredients. Food and beverage sectors have also integrated acetophenone into flavoring applications, further strengthening its usage profile.

The segment’s leadership is reinforced by continuous innovation in fragrance compositions and the expansion of global supply chains that deliver acetophenone to key consumer goods manufacturers. With rising disposable incomes and lifestyle-driven consumption patterns, the flavors & fragrances segment is expected to remain the cornerstone of demand growth in the acetophenone market.

Acetophenone, an organic compound with a molecular formula of C6H5C (O) CH3, is used in fragrances, pharmaceuticals, toiletries, food, and beverages. It can be obtained naturally or synthetically, serving as a precursor for various compounds.

The demand for acetophenone is fueled by its application in resins, pharmaceuticals, food and beverages, and consumer goods. In addition, rising disposable income in emerging economies contributes to this demand.

The development of the acetophenone industry is envisioned to be substantial across sectors such as polymer manufacturing. Furthermore, it is set to see growth in fragrance development with consistent maturation predicted. The need for painkillers and antipyretics in the pharmaceutical sector drives demand. Also, acetophenone's use in aroma compositions for cosmetics, toiletries, and fragrances also contributes to the expansion of these chemicals.

The applications of acetophenone in polymer synthesis, food and beverage flavoring, and chemical synthesis enhance market expansion. They do so by enhancing material qualities and stimulating market growth.

The acetophenone market has historically developed at a CAGR of 3%. However, sales are gradually budding, displaying a CAGR of 4% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 3% |

Lockdown measures and decreased consumer demand for lifestyle items have hurt the acetophenone industry during the epidemic. However, economic activity and relaxation point to a comeback in the upcoming years.

The market growth of the commodity sector may be impacted by health hazards associated with its use. These hazards include skin irritation and potential ocular damage. Oral exposure to certain products can cause sedative effects, haematological issues, and a weak pulse. These effects can reduce usage preference and potentially hinder growth in the forthcoming decade.

Prices for raw materials have an impact on acetophenone manufacturing, which might affect profitability and market growth. Health and safety requirements can hinder market development by raising worries about exposure and handling, while environmental rules may increase the cost of compliance.

Acetophenone is gaining new applications in agrochemicals, dyes, and polymers, offering growth opportunities for businesses. Investment in research and development, as well as focusing on sustainability and eco-friendly production processes, can lead to acetophenone market growth.

The chemical's diverse applications in medicine, biotechnology, and plant disease management offer opportunities for manufacturers. They can develop its analgesic, hypnotic, and insomnia treatments and improve resistance to plant infections.

Research and Development on Acetophenone Leads to Technical Advances

The demand for acetophenone in several sectors is rising due to advances in technology, along with continuous research and development projects trying to enhance manufacturing procedures and discover new uses.

In the chemical sector, an emphasis on sustainable practices has resulted from regulatory demands and environmental concerns. As acetophenone is most reactive with various liquids such as water, alcohol, fats and others, the chemical manufacturers develops novel products featuring acetophenone.

Businesses are looking toward more environmentally friendly production techniques and substitutes. The pharmaceutical industry's growing dependence on acetophenone as an important phase in drug production is a notable trend. The use of acetophenone is increasing due in part to high-performance polymers and resins used in the automotive and building industries.

Demand for Luxury Perfumes Flourishes Acetophenone Industry

The demand for luxurious fragrances, shifting perceptions of human nature, and the evolution of the consumer goods sector are the leading aspects behind the promotion of the perfume and fragrance industry.

The Hazardous Substances Data Bank (HSDB) because of its high water solubility and biodegradability classifies Acetophenone as a hazardous chemical. This makes it a more ecologically friendly option and increases the market for fragrance products. These are used to extract scents from honey, almonds, strawberries, cherries, and jasmine.

Given the importance of fragrances in women's beauty kits and the rise in demand for men's perfumes, Acetophenone demand is anticipated to be propelled by the demand for high-end perfumes and other cosmetics goods in Europe and Asia Pacific.

Parkinson’s Patient Pool Caters the Demand for Acetophenone

Acetophenone is envisioned to boost significantly in the pharmaceutical industry as it becomes more common in tablets, and there is a distinguished demand for anticonvulsants.

For instance, tolcapone, an anti-inflammatory drug prescribed to patients with Parkinson's disease, is made with it by the pharmaceutical industry. The rising patient pool of Parkinson's is bound to push up chemical demand and market revenue. The rationale behind this is its capacity to lower inflammation.

The demand for acetophenone in pharmaceutical applications is anticipated to rise as it is applied in the synthesis of drugs. These include pyrrobutamine, benmoxin, acifran, pridinol, trihexyphenidyl, biperiden, procyclidine, cycrimine, and mesuximide.

In the section that follows, detailed analyses of the industry segments for acetophenone are given. Nevertheless, in 2025, there is going to be ample demand for cumene process acetophenone. On the other hand, demand for acetophenone is boosted as an industrial solvent.

| Attributes | Details |

|---|---|

| Top Product Type | Cumene Process Acetophenone |

| Revenue share in 2025 | 52.5% |

In 2025, demand for cumene process acetophenone is projected to account for 52.5% of the industry share. An essential step in the synthesis of acetophenone from cumene is oxidizing cumene with air in an alkaline environment. Along with acetophenone, this exothermic process also produced alpha-methyl styrene (AMS) and dimethylphenylcarbinol (DMPC).

Cumene-based compounds, such as acetophenone and DMPC AMS, are projected to become far greater in demand. These substances are essential to the manufacturing of pharmaceuticals, oils, waxes, polymers, cosmetics, and other goods for everyday use.

| Attributes | Details |

|---|---|

| Top Application | Acetophenone for Industrial Solvents |

| Revenue share in 2025 | 34.2% |

As an industrial solvent, acetophenone is anticipated to hold a remarkable share of the sector, accounting for around 34.2% in 2025. Manufacturers are developing novel chemicals that can be used as chemical solvents. This is an essential item in multiple industries.

The demand for acetophenone for industrial cleaning solvents is developing due to its specialty solvent for plastics and resins. With rising product consumption from multiple sectors such as healthcare, where thorough cleaning is required, demand for acetophenone-based industrial solvents is growing. Public awareness of cleanliness in emerging nations is also contributing to this trend.

Chemical manufacturers are at the forefront of innovation, developing high-quality cleaning solvents. These solvents employ acetophenone, a chemical renowned for its property to dissolve into water easily. Its highly concentrated nature makes it ideal for metal and ground surface cleaning, marking a significant promotion in the industry.

The demand for acetophenone is increasing in several industries all over the globe. The different regions develop a various range of needs for the chemical as demand from Asian countries such as China and India is augmenting in the upcoming decade. On the other hand, the demand from Germany and the United Kingdom develops at a minuscule pace. The demand for 3-nitro acetophenone from the United States is anticipated to create a subtle consumer base.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 2.2% |

| Germany | 1.9% |

| China | 4.5% |

| India | 5.9% |

| United Kingdom | 1.6% |

The fashion brands in the United States are developing a sophisticated demand for 3-nitro acetophenone for the production of fragrances. Consumers in the United States appear to be fond of fruity-flavored aromas. The demand for fragrances with hints of almond, orange, cherry, honeysuckle, jasmine, and strawberry is constructing a significant consumer base.

With a CAGR of 2.2% in the upcoming decade, the acetophenone market in the United States is anticipated to boost owing to the widespread use of acetophenone. The fragrance makers in the United States are investing in innovation and technological advancements in acetophenone production for novel scents.

The acetophenone market in Germany is projected to report a CAGR of 1.9%, compelled by the emerging acceptance rate of food additives, which significantly influences industry development.

Within the German food additive economy, food fortification is becoming more and more popular. There is a national trend toward consumers looking for meals with extra advantages. This is propelling food producers to employ acetophenone-based food additives. For instance, the sector is witnessing the addition of acetophenone fortification to dairy goods, drinks, and breakfast cereals.

Numerous foods, such as apples, apricots, bananas, cattle, cheese, cauliflower, cherries, and tomatoes, naturally contain the chemical acetophenone. Germany-based food and beverage producers create artificial tastes and flavor enhancers create Acetophenone-containing synthetic additives.

Acetophenone sales in China are predicted to register a 4.5% CAGR by 2035 because of the emerging development of consumer goods such as detergent, soaps, lotions, and creams.

Manufacturers in China are demonstrating their adaptability by experimenting with different liquid-based products, such as lotions and gels. They leverage the high solubility of acetophenone in water, alcohol, glycerol, fatty oils, ether, and chloroform. This flexibility is in response to the growing consumer preference for fruit-flavored, aqua-based beauty products, a trend that is shaping the market and creating a chic consumer base.

As one of the earliest pioneers of pharma research and development, the United Kingdom is on the edge of the cliff. Its acetophenone market is set to surge at a CAGR of 1.6% from 2025 to 2035.

Owing to the solubility of acetophenone with alcohol, glycerol, fatty oils, ether, and chloroform, pharmaceutical researchers are catering to research and development for 3-nitro acetophenone-based medications. This is especially relevant for medications for diseases like Parkinson's, which are prevalent in the United Kingdom.

In the past few years, India has witnessed a ripple of industrialization. Thus, demand for acetophenone is anticipated to reach a peak at a CAGR of 5.9% between 2025 and 2035, as these industries demand high-quality industrial solvents.

Acetophenone's potential for broad application is demonstrated by its adaptability in the fragrance business in India, especially in the production of perfumes and colognes. In India's pharmaceutical sector, acetophenone is a useful chemical intermediate that is used in the manufacture of many different medicinal chemicals.

Acetophenone demand is compelled by Indian consumer preferences, notably for scents and flavors-driven items, including food, personal care, and fragrances. The market is stable since there is a constant demand for items containing acetophenone as expenditure rises.

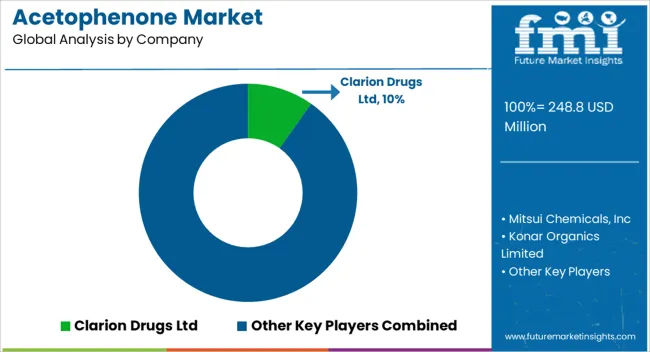

Market players are strategically focusing on three key areas: launching new products, collaborating with existing manufacturers, and acquiring small to medium-scale manufacturers. These moves are shaping the competitive landscape of the acetophenone industry.

The market players are investing significant capital in the research and development of a variety of products featuring acetophenone. As consumer preference towards aromatic products continues to evolve in such a dynamic ecosystem, technological innovations in acetophenone production are essential to keep pace with these changes.

The growing uses of acetophenone in perfumes, medicines, and other industries propel innovation in the acetophenone market in addition to market trends. The acetophenone industry's future is being shaped by market trends, which presents a positive picture for all of the major participants.

Recent Developments in the Acetophenone Sector

The industry is categorized into cumene process acetophenone, ethylbenzene process acetophenone, and others, based on product type.

Acetophenone is mainly applied for the production of industrial solvents, pharmaceuticals, flavours, and fragrances, along with others.

The industry is examined across key regions including North America, Latin America, Europe, East Asia, South Asia, Oceania, as well as Middle East and Africa.

The global acetophenone market is estimated to be valued at USD 248.8 million in 2025.

The market size for the acetophenone market is projected to reach USD 368.2 million by 2035.

The acetophenone market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in acetophenone market are cumene process acetophenone, ethylbenzene process acetophenone and others.

In terms of application, flavors & fragrances segment to command 41.5% share in the acetophenone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chloroacetophenone Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA