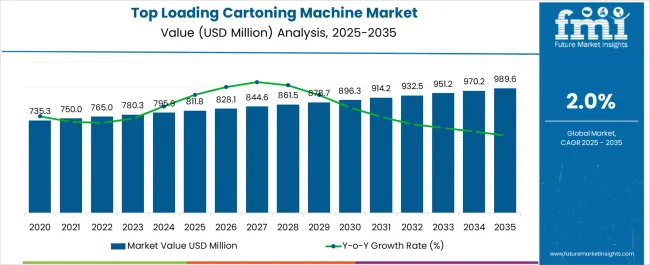

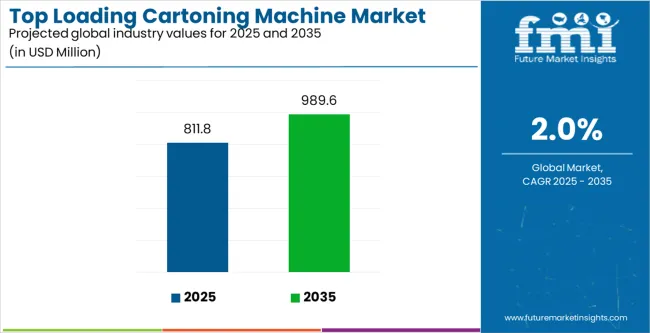

The top loading cartoning machine market is expected to grow from USD 811.8 million in 2025 to USD 989.6 million by 2035, reflecting an absolute increase of USD 177.8 million at a CAGR of 2.0%. Growth is supported by rising demand for efficient packaging automation, particularly in food, pharmaceuticals, and consumer goods, where precision, hygiene, and speed are critical. Companies are investing in high-speed machines equipped with servo-driven systems, modular designs, and intelligent control interfaces to reduce downtime and improve adaptability to varying product dimensions.

A key driver lies in the integration of automation technologies that enhance output quality while lowering labor dependency. As production cycles become shorter, machines with quick changeover capabilities and low error margins are being prioritized. The food industry’s emphasis on hygienic and safe packaging and the pharmaceutical sector’s stringent compliance requirements are boosting adoption of advanced cartoning systems. Sustainability is also shaping equipment choices, with manufacturers offering eco-friendly packaging compatibility and energy-efficient machine designs.

Regionally, North America and Europe maintain strong adoption due to established packaging industries and regulatory mandates for safety and labeling compliance. Asia-Pacific is positioned for faster growth, driven by expanding packaged food consumption, increasing pharmaceutical production, and greater investments in automated packaging facilities in China and India. Latin America and the Middle East are witnessing gradual adoption, largely driven by the modernization of consumer goods supply chains and retail distribution.

| Metric | Value |

|---|---|

| Top Loading Cartoning Machine Market Estimated Value in (2025 E) | USD 811.8 million |

| Top Loading Cartoning Machine Market Forecast Value in (2035 F) | USD 989.6 million |

| Forecast CAGR (2025 to 2035) | 2.0% |

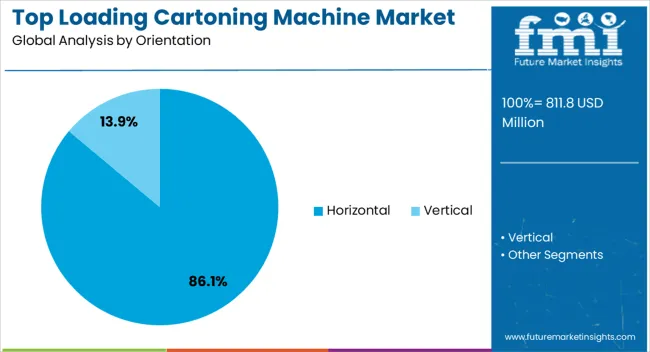

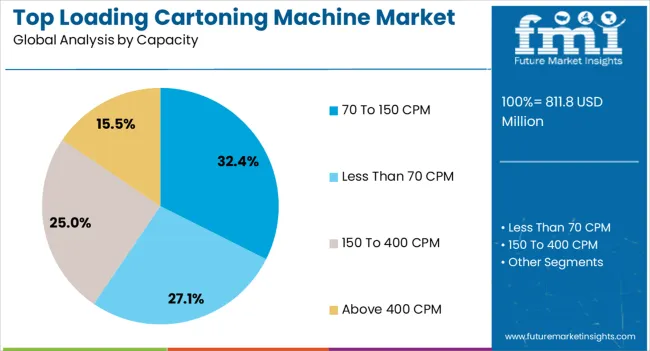

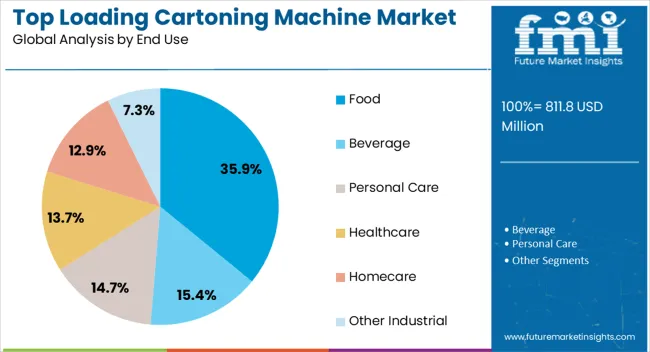

The market is segmented by Orientation, Capacity, and End Use and region. By Orientation, the market is divided into Horizontal and Vertical. In terms of Capacity, the market is classified into 70 To 150 CPM, Less Than 70 CPM, 150 To 400 CPM, and Above 400 CPM. Based on End Use, the market is segmented into Food, Beverage, Personal Care, Healthcare, Homecare, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The horizontal orientation segment is projected to hold 86.1% of the market revenue in 2025, establishing it as the leading orientation type. Growth in this segment is being driven by the flexibility and efficiency offered in handling a wide range of product shapes and sizes. Horizontal machines facilitate faster loading, precise carton alignment, and reduced product damage, which are critical for maintaining quality in high-speed production lines.

Their modular and automated designs enable integration with upstream and downstream packaging equipment, improving overall line efficiency. Additionally, ease of maintenance, adaptability to various carton dimensions, and compatibility with diverse industries such as food, personal care, and pharmaceuticals reinforce adoption.

The high throughput capacity, coupled with consistent operational reliability, strengthens the preference for horizontal machines among manufacturers As packaging demands grow in complexity and speed, horizontal orientation is expected to continue dominating the top loading cartoning machine market, supported by innovations in automation, robotics, and control systems.

The 70 to 150 CPM capacity segment is expected to account for 32.4% of the market revenue in 2025, making it the leading capacity category. Its prominence is driven by the ability to balance production efficiency with operational flexibility, making it suitable for medium to high-volume packaging lines. Machines in this capacity range enable manufacturers to achieve consistent throughput while handling diverse product types without compromising on carton quality or alignment.

Automation features, including programmable logic controls and servo systems, support faster changeovers and reduce downtime, enhancing productivity. This capacity range is preferred in industries where moderate to high-speed packaging is required, particularly in food and consumer goods sectors.

The combination of reliability, ease of integration, and adaptability to varying production requirements has strengthened its market position As manufacturers continue to focus on optimizing production speed, reducing labor dependence, and ensuring packaging accuracy, the 70 to 150 CPM capacity segment is expected to maintain its leading share in the top loading cartoning machine market.

The food segment is projected to hold 35.9% of the market revenue in 2025, positioning it as the leading end-use industry. Growth in this segment is being driven by the increasing demand for packaged food products, rising consumer preference for convenience, and stringent hygiene standards that require reliable packaging solutions. Top loading cartoning machines enable precise, efficient packaging of diverse food items, maintaining product integrity and extending shelf life.

Features such as automated feeding, gentle product handling, and flexible carton adjustments are particularly valued in the food industry to minimize damage and ensure consistent quality. Adoption is further supported by the need to meet high-speed production requirements, reduce labor costs, and comply with food safety regulations.

As the packaged food market expands globally, manufacturers are increasingly investing in scalable and adaptable top loading cartoning machines to support operational efficiency and product differentiation Continuous technological advancements, including integration with vision systems and intelligent controls, are expected to sustain growth in the food segment, reinforcing its leadership in the market.

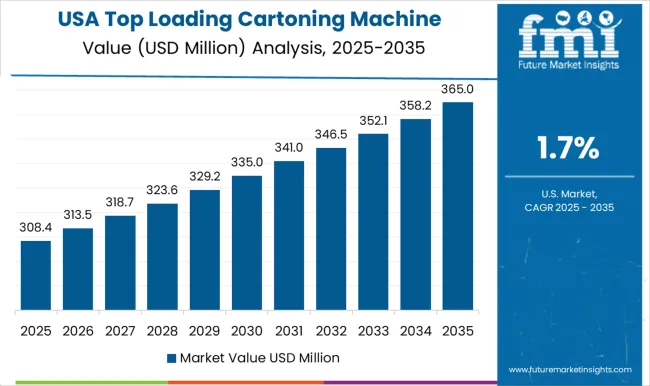

Reflecting a 1.4% historical CAGR, sales of top loading cartoning machines experienced sluggish expansion from 2020 to 2025. The market exhibited a potential worth USD 811.8 million in value terms as of 2025.

The market demand surged due to the emergence of the E-commerce platform. The requirement for advanced packaging of goods during the pandemic period surged the subject market. Also, innovative packaging solutions were surging the market.

Customization was another market driver propelling the market growth in the historical period. Due to customized packaging solutions required for different industries during this period, the demand surged.

| Historical CAGR from 2020 to 2025 | 1.40% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 2.00% |

The forecasted period focused more on integrating cutting-edge technology with traditional packaging solutions. Due to technological advancement, efficient packaging solutions can be given to industries like the pharmaceutical sector, the food and beverage industry, and many more. Hence, this is the prime market driver.

Changing consumer perspective is another key market demand in the forecasted period. Consumers are relying on sustainable solutions. The packaging industry is propelled as sustainable packaging can efficiently meet changing consumer demands.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| The United States of America | 0.7% |

| Italy | 1.2% |

| Spain | 2.3% |

| China | 3.3% |

| India | 4.1% |

| Category | Orientation - Horizontal |

|---|---|

| Market Share in 2025 | 86.1% |

| Market Segment Drivers |

|

| Category | End Use - Food |

|---|---|

| Market Share in 2025 | 35.9% |

| Market Segment Drivers |

|

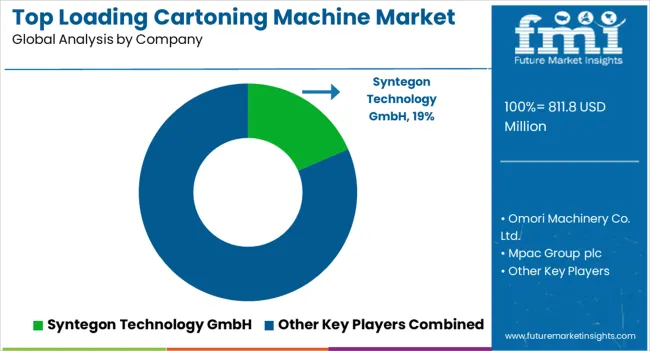

Various marketers mark their positions in the competitive landscape of the top loading cartoning machine market. Due to their cluttered presence in the market, the competitive force exerted on individual players is substantial.

To withstand this competition, organizations must adhere to innovative market expansion strategies like strategic partnerships, mergers and acquisitions, diversification, product development and innovation, and so on. These key strategies allow an individual to penetrate the market more deeply.

The new entrant must adopt changing market dynamics to help the new business induce a differentiator. Differentiating the product portfolio is the key suggested strategy for the new entrants to gain a significant competitive advantage.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 795.9 million |

| Projected Market Valuation in 2035 | USD 1.09 billion |

| Value-based CAGR 2025 to 2035 | 2.00% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million/billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Orientation, Capacity, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Syntegon Technology GmbH; Omori Machinery Co. Ltd.; Mpac Group plc; R.A Jones; Tetra Pak International S.A.; Rovema GmbH; Cama Group; Econocorp Inc.; PMI Cartoning, Inc.; Bradman Lake Group Ltd.; ADCO Manufacturing |

The global top loading cartoning machine market is estimated to be valued at USD 811.8 million in 2025.

The market size for the top loading cartoning machine market is projected to reach USD 989.6 million by 2035.

The top loading cartoning machine market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in top loading cartoning machine market are horizontal and vertical.

In terms of capacity, 70 to 150 cpm segment to command 32.4% share in the top loading cartoning machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Top Bottom Packaging Box Market from 2024 to 2034

Global Topical Pain Relief Market Insights – Size, Trends & Forecast 2024-2034

Topical Applicator Market Growth & Pharmaceutical Innovations 2024-2034

Atopic Dermatitis Treatment Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

NetOps Market Size and Share Forecast Outlook 2025 to 2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

Phytopathological Disease Diagnostics Market Forecast and Outlook 2025 to 2035

Acetophenone Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Pain Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Panniculus Retractor Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA