The Postoperative Panniculus Retractor Market is valued at USD 116.81 million in 2025. As per FMI's analysis, the Postoperative Panniculus Retractor Industry will grow at a CAGR of 6.8% and reach USD 225.60 million by 2035.

In 2024, the industry witnessed steady growth driven by a combination of clinical need, product innovation, and procedural volume. A key factor was the rise in abdominal and bariatric surgeries, particularly in North America and Western Europe, which created increased demand for postoperative panniculus retractors.

Healthcare providers focused more on reducing surgical site infections, leading to a preference for single-use retractors with antimicrobial coatings. Surgeons showed growing interest in retractors designed for easier handling, minimal tissue trauma, and compatibility with advanced surgical drapes.

In addition, smaller players entered the industry offering cost-effective solutions, particularly in emerging economies. Hospital procurement patterns also shifted slightly, with greater emphasis on value-based purchasing, influencing retractor design and pricing models.

Looking ahead to 2025 and beyond, the industry is likely to benefit from the expansion of outpatient surgical centres and the increasing adoption of minimally invasive techniques. As surgical technologies continue to evolve, manufacturers are expected to invest in retractors that integrate with digital surgical tools and offer enhanced patient safety. The growing burden of obesity-related conditions worldwide will continue to act as a long-term driver of industry demand.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 116.81 million |

| Industry Value (2035F) | USD 225.60 million |

| CAGR (2025 to 2035) | 6.8% |

The Postoperative Panniculus Retractor Industry is on a steady growth path, driven by the rising number of abdominal and bariatric surgeries worldwide. The key driver is the growing demand for safer, more efficient postoperative recovery tools that reduce complications and improve surgical outcomes. Medical device manufacturers and innovative surgical tool providers stand to benefit most, while traditional retractor suppliers may lose ground if they fail to adapt to evolving clinical needs.

Innovate for Safety and Efficiency

Invest in the development of next-generation retractors that prioritize patient safety, ease of use, and compatibility with minimally invasive procedures to meet growing clinical demands.

Align with Shifting Surgical Landscapes

Adapt product offerings to support the increasing number of outpatient and bariatric surgeries by tailoring solutions to specific surgical settings and patient profiles.

Expand Through Strategic Partnerships

Pursue partnerships with surgical centres and OEMs, and consider M&A opportunities to strengthen distribution networks and accelerate access to high-growth emerging industries.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays in product approvals | Medium - High |

| Price pressure from low-cost competitors | High - Medium |

| Slower-than-expected adoption in outpatient settings | Medium - Medium |

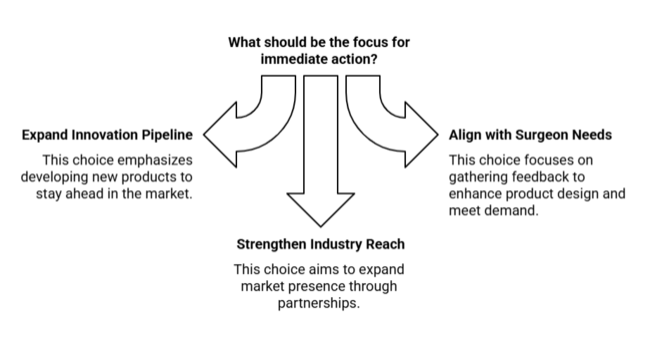

| Priority | Immediate Action |

|---|---|

| Expand Product Innovation Pipeline | Run feasibility on antimicrobial, single-use retractor materials |

| Align with Surgeon Needs | Initiate OEM feedback loop on ergonomic design and hybrid demand |

| Strengthen Industry Reach | Launch after market channel partner incentive pilot in key regions |

To stay ahead, companies must double down on innovation that aligns with the shift toward outpatient and minimally invasive surgeries. This means accelerating R&D for safer, disposable panniculus retractors, while embedding surgeon feedback loops into product design cycles. The intelligence indicates rising demand in emerging industries and increasing price sensitivity-necessitating a hybrid approach that balances high-performance products with cost-effective variants.

Strategic partnerships and targeted M&A can fast-track regional penetration, while investment in digital integration (e.g., smart surgical kits) will set early movers apart. This roadmap calls for agile product strategies, deeper clinical collaboration, and a sharper focus on global distribution efficiency.

| Country | Policies, Regulations, and Certification Impact |

|---|---|

| United States | In the United States, postoperative panniculus retractors are regulated by the FDA as Class I or II medical devices. Manufacturers must comply with Quality System Regulation (21 CFR Part 820) and typically require 510(k) clearance before marketing. HIPAA compliance is also required if the device involves patient data. |

| United Kingdom | In the UK, manufacturers must follow the post-Brexit UKCA marking requirement instead of the CE mark. The Medicines and Healthcare products Regulatory Agency (MHRA) oversees compliance under the UK Medical Devices Regulations 2002, and a conformity assessment is necessary before devices are marketed. |

| France | France enforces the EU Medical Device Regulation (MDR 2017/745), under which postoperative retractors must have CE certification through a Notified Body such as GMED. Manufacturers are required to submit clinical evaluations and maintain post- industry surveillance. |

| Germany | Germany adheres to the EU MDR and mandates CE marking for postoperative retractors. The Federal Institute for Drugs and Medical Devices (BfArM) monitors safety, clinical evidence, labeling, and biocompatibility. |

| Italy | Italy follows the EU MDR and requires CE-marked devices to be registered in the Italian Ministry of Health's medical device database before commercialization. Post- industry activities are also regulated. |

| South Korea | South Korea classifies postoperative retractors as Class II medical devices under the Ministry of Food and Drug Safety (MFDS). Manufacturers must secure Korea Good Manufacturing Practice (KGMP) certification and provide relevant clinical data. |

| Japan | In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates surgical devices under the PMD Act. Approval involves submission of Summary Technical Documentation (STED), and sometimes, local clinical trials. |

| China | The National Medical Products Administration (NMPA) classifies these devices as Class II and mandates submission of clinical evaluation reports, along with compliance to Chinese national testing standards. |

| Australia-NZ | In Australia, the Therapeutic Goods Administration (TGA) requires inclusion of the device in the Australian Register of Therapeutic Goods (ARTG), with adherence to essential principles. In New Zealand, Medsafe enforces the Medicines Act and requires post- industry surveillance activities. |

The panniculus retractor market is segmented by product type, application, end user, and region. By product, the industry includes adjustable panniculus retractors and fixed panniculus retractors, designed to offer varying degrees of flexibility and stability during surgical procedures.

Based on application, the market is divided into bariatric surgeries, plastic and reconstructive surgeries, excess skin removal, and minimizing surgical trauma-each representing key clinical scenarios where soft tissue retraction is essential for visibility and precision. In terms of end user, the market is segmented into hospitals, ambulatory surgical centers, and specialty clinics, with hospitals accounting for the largest share due to the high volume of complex surgical interventions performed in these settings. Regionally, the industry is analyzed across

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA), capturing variations in surgical volumes, healthcare investment, and procedural trends across developed and emerging economies.

The Adjustable Panniculus Retractors segment has the highest growth potential, with a projected CAGR of 7.2%. This is the highest segment in the Product category, driven by increasing demand for customizable solutions that enhance surgical precision and reduce complications. These retractors are highly favoured in bariatric and plastic surgeries due to their flexibility, providing better post-surgical outcomes.

As hospitals and surgical centres move toward more tailored procedures, adjustable retractors offer substantial benefits in minimizing complications during surgery. Given the growing preference for precision in surgeries, this segment is expected to outpace others in growth, leveraging advancements in surgical techniques and patient care.

In the Applicationcategory, Bariatric Surgeries is the fastest-growing segment, expected to grow at a CAGR of 8.0%, the highest among all applications. This segment is witnessing a surge in demand due to the increasing global prevalence of obesity and rising awareness of bariatric procedures. With more people opting for weight loss surgeries and better post-surgery care, the demand for specialized tools like panniculus retractors is accelerating.

Bariatric surgeries also require precise surgical tools to ensure optimal results, which positions this segment for continued growth, especially in regions where obesity rates are rising. As surgical technology advances, the industry for panniculus retractors in bariatric surgeries will expand rapidly.

The Ambulatory Surgical Centres (ASCs) segment is projected to have the highest growth rate, with a CAGR of 7.4%, making it the leading sub-segment in End-User applications. The rapid expansion of ASCs, driven by the increasing shift toward outpatient care, is driving demand for efficient, cost-effective surgical tools.

ASCs benefit from shorter patient recovery times and lower operational costs, making them an attractive option for surgical procedures, including those requiring panniculus retractors. With advancements in minimally invasive surgery and the rise of outpatient procedures, ASCs will play a critical role in the future growth of the Postoperative Panniculus Retractor Industry.

Postoperative panniculus retractor industry in the United Statesis anticipated to grow at 7.3% CAGR from 2025 to 2035 due to strong demand for advanced postoperative tools, higher surgical volumes, and favourable FDA pathways that streamline industry entry.

The adoption of minimally invasive procedures is growing, which contributes to the rising need for post-surgical recovery devices such as panniculus retractors. The US has a robust healthcare infrastructure that facilitates the use of cutting-edge technologies, ensuring that the industry for these devices continues to thrive. Additionally, with an aging population and rising obesity rates, the demand for effective postoperative care solutions is expected to further increase.

Sales in the United Kingdom are anticipated to grow at 6.5% CAGR from 2025 to 2035 due to the post-Brexit regulatory adjustments and NHS funding constraints, which create steady but slightly below-average industry growth. Despite these challenges, there is continued focus on enhancing post-surgical outcomes, which keeps the demand for postoperative devices like panniculus retractors growing at a moderate pace.

The NHS remains a key player in the healthcare landscape, and private healthcare adoption also supports demand for advanced surgical tools. However, budget constraints may limit the speed of technological adoption in certain regions.

In France sales are anticipated to grow at 6.7% CAGR from 2025 to 2035, as EU MDR compliance introduces more regulatory complexity, but advancements in surgery and a demand for improved post-operative care help maintain steady growth near the global average.

France has one of the most sophisticated healthcare systems in Europe, and as the population ages, the need for effective postoperative care devices continues to rise. Although regulatory requirements may slow down some industry players, the strong demand for high-quality healthcare solutions helps maintain a favourableindustry environment for panniculus retractors.

The industry in Germany is anticipated to grow at 7.0% CAGR from 2025 to 2035, driven by high investments in surgical innovation and fast-track hospital programs that make it a strong growth industry. Germany has a well-developed healthcare system with a focus on technological innovation and improved patient outcomes, both of which boost the demand for advanced postoperative care devices.

The growing emphasis on minimally invasive procedures and a high surgical volume in the country ensures sustained demand for devices like panniculus retractors, supporting growth at a rate slightly above the global average.

Italy sales are expected to grow at 6.2% CAGR from 2025 to 2035 due to public sector limitations and moderate surgical infrastructure, which contribute to a below-average industry growth rate. Although Italy’s healthcare system is evolving, budgetary constraints and slower adoption of new technologies in public hospitals could limit rapid growth in the postoperative care industry.

However, private healthcare facilities, particularly in larger urban areas, continue to invest in advanced surgical tools, which supports steady growth for devices like panniculus retractors.

Postoperative panniculus retractor industry in South Korea is anticipated to grow at 7.1% CAGR from 2025 to 2035, driven by the rapid digitalization of healthcare and the increasing adoption of robotic-assisted surgery, which pushes growth above the global average.

South Korea has been at the forefront of integrating advanced technology into healthcare, and with its well-established medical infrastructure, the demand for innovative postoperative care devices is expected to increase significantly. As the healthcare system focuses on improving patient outcomes, the industry for panniculus retractors continues to benefit from this technological transformation.

InJapansales are anticipated to grow at 5.9% CAGR from 2025 to 2035, due to conservative adoption cycles, cost sensitivity, and regulatory stringency that slow down the uptake of new surgical equipment. While Japan has a rapidly aging population and a strong demand for healthcare solutions, the country’s cautious approach to new medical technologies and the high cost of advanced devices hinder rapid industry growth. As a result, the demand for postoperative devices like panniculus retractors grows at a slower pace compared to other countries.

Sales in China are anticipated to grow at 8.3% CAGR from 2025 to 2035, fueled by aggressive expansion in tertiary care, medical device manufacturing incentives, and a booming surgical population. China’s healthcare system is undergoing rapid transformation, with significant investments in medical technology and infrastructure.

The country’s large population and the increasing prevalence of obesity-related surgeries create substantial demand for advanced postoperative care solutions, ensuring the highest growth rate for panniculus retractors in the global industry.

In Australia and New Zealandthe sector are expected to grow at 6.6% CAGR from 2025 to 2035, supported by both countries' advanced healthcare systems and increasing adoption of minimally invasive surgical procedures. While the industries are smaller in comparison to other regions, the demand for high-quality postoperative care solutions continues to rise as the population ages.

Additionally, the well-established healthcare infrastructure in these countries promotes the adoption of advanced medical devices like panniculus retractors, contributing to steady growth in the industry. However, growth may be tempered by relatively stable industry conditions compared to faster-growing regions.

The postoperative panniculus retractor industry is characterized by a fragmented landscape, with numerous players striving to innovate and capture industry share. Top companies compete by focusing on competitive pricing strategies, continuous product innovation, strategic partnerships, and geographic expansion to strengthen their positions.

These players also aim to enhance their technological capabilities and expand their customer base to maintain a competitive edge. With growing demand for advanced surgical tools and the rising need for minimally invasive surgeries, companies in this sector are increasingly aligning their strategies to meet the evolving needs of healthcare providers, aiming for industry leadership through innovation and efficiency.

Laborie leads the panniculus retractor industry with a commanding 21.2% market share, propelled by its advanced surgical retraction solutions and dominant presence in minimally invasive procedures. The company’s strategic acquisitions across urology and gynecology segments have reinforced its leadership, while continuous innovation in design and usability has made its products widely adopted by surgical teams globally.

TZ Medical, Inc. holds an 18.5% share, standing out for its high-performance retractors tailored for abdominal and reconstructive surgeries. Its proprietary rib-spreading and soft tissue retraction technologies have earned trust among surgeons seeking precision and ergonomic ease, making it a go-to brand in complex procedures.

GSquared Medical captures 15.8% of the market with a strong focus on post-bariatric and hernia repair surgeries. The company is known for its patented, modular, and adjustable retractor systems that enhance intraoperative control and visibility, particularly valued in body contouring and revision surgeries.

Medtronic holds a 12.4% share, offering an integrated surgical solutions portfolio. Its retractors are widely used in postoperative wound management and abdominal wall reconstruction, benefiting from the company’s broader ecosystem in surgical devices and clinical support.

Stryker commands 9.7% of the industry, primarily through its powered retraction systems. These systems are designed to reduce surgeon fatigue in prolonged procedures, particularly in orthopedic and reconstructive applications, positioning Stryker as a leader in surgical ergonomics.

B. Braun maintains a 7.3% market share, offering cost-effective and reusable retractors, especially popular in emerging markets. The company focuses on value-driven innovation and physician training programs to enhance adoption across lower-resource settings.

Teleflex accounts for 5.9% of the industry and is known for its hybrid retractor systems, which combine manual and mechanical features to provide greater flexibility during procedures. Its product versatility caters to both general and specialty surgeries.

CooperSurgical holds a 4.6% share and focuses primarily on gynecological and obstetric applications. Its retraction systems are designed to meet the anatomical and procedural needs specific to women’s health, giving it a niche but valuable market position.

Integra LifeSciences commands 3.2% of the market, specializing in retractors for neurosurgery and complex reconstructive operations. The company’s solutions are often used in high-precision environments where tissue management is critical.

Johnson & Johnson holds a 2.4% share in the retractor industry. Leveraging its extensive surgical portfolio, the company provides retraction devices used across general and plastic surgery, often integrated into its broader suite of procedural kits and surgical systems.

the industry is segmented into adjustable panniculus retractors and fixed panniculus retractors

the industry is divided into bariatric surgeries, plastic and reconstructive surgeries, excess skin removal and minimizing surgical trauma

the industry is segmented into hospitals, ambulatory surgical centers, specialty clinics

the industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa (MEA)

The industry is expected to grow at a CAGR of 6.8%, reaching USD 225.60 million by 2035.

Rising bariatric surgeries, infection control needs, and minimally invasive surgical trends are key demand drivers.

Manufacturers are innovating retractors with antimicrobial coatings and ergonomic designs for safer, faster surgeries.

The expansion of outpatient centers is boosting demand for compact, efficient retractors tailored to shorter procedures.

Investing in product innovation, forming strategic partnerships, and targeting emerging industries are critical for growth.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 26: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 31: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Table 36: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Product

Table 38: Middle East and Africa Market Volume (Units) Analysis and Forecast 2017 to 2033, by Product

Table 39: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Application

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by End User

Figure 01: Global Market Volume (Units), 2017 to 2022

Figure 02: Global Market Volume (Units) and Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Global Postoperative Panniculus Retractor, Pricing Analysis per unit (US$), in 2022

Figure 04: Global Postoperative Panniculus Retractor, Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 06: Global Market Forecast and Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 20: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 22: North America Market Value Share, by Product (2023 E)

Figure 23: North America Market Value Share, by Application (2023 E)

Figure 24: North America Market Value Share, by End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: United States Market Value Proportion Analysis, 2022

Figure 31: Global Vs. United States Growth Comparison, 2022 to 2033

Figure 32: United States Market Share Analysis (%) by Product, 2022 and 2033

Figure 33: United States Market Share Analysis (%) by Application, 2022 and 2033

Figure 34: United States Market Share Analysis (%) by End User, 2022 and 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison, 2022 to 2033

Figure 37: Canada Market Share Analysis (%) by Product, 2022 and 2033

Figure 38: Canada Market Share Analysis (%) by Application, 2022 and 2033

Figure 39: Canada Market Share Analysis (%) by End User, 2022 and 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42: Latin America Market Value Share, by Product (2023 E)

Figure 43: Latin America Market Value Share, by Application (2023 E)

Figure 44: Latin America Market Value Share, by End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison, 2022 to 2033

Figure 52: Mexico Market Share Analysis (%) by Product, 2022 and 2033

Figure 53: Mexico Market Share Analysis (%) by Application, 2022 and 2033

Figure 54: Mexico Market Share Analysis (%) by End User, 2022 and 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison, 2022 to 2033

Figure 57: Brazil Market Share Analysis (%) by Product, 2022 and 2033

Figure 58: Brazil Market Share Analysis (%) by Application, 2022 and 2033

Figure 59: Brazil Market Share Analysis (%) by End User, 2022 and 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison, 2022 to 2033

Figure 62: Argentina Market Share Analysis (%) by Product, 2022 and 2033

Figure 63: Argentina Market Share Analysis (%) by Application, 2022 and 2033

Figure 64: Argentina Market Share Analysis (%) by End User, 2022 and 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 67: Europe Market Value Share, by Product (2023 E)

Figure 68: Europe Market Value Share, by Application (2023 E)

Figure 69: Europe Market Value Share, by End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 73: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: United Kingdom Market Value Proportion Analysis, 2022

Figure 76: Global Vs. United Kingdom Growth Comparison, 2022 to 2033

Figure 77: United Kingdom Market Share Analysis (%) by Product, 2022 and 2033

Figure 78: United Kingdom Market Share Analysis (%) by Application, 2022 and 2033

Figure 79: United Kingdom Market Share Analysis (%) by End User, 2022 and 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison, 2022 to 2033

Figure 82: Germany Market Share Analysis (%) by Product, 2022 and 2033

Figure 83: Germany Market Share Analysis (%) by Application, 2022 and 2033

Figure 84: Germany Market Share Analysis (%) by End User, 2022 and 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison, 2022 to 2033

Figure 87: Italy Market Share Analysis (%) by Product, 2022 and 2033

Figure 88: Italy Market Share Analysis (%) by Application, 2022 and 2033

Figure 89: Italy Market Share Analysis (%) by End User, 2022 and 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison, 2022 to 2033

Figure 92: France Market Share Analysis (%) by Product, 2022 and 2033

Figure 93: France Market Share Analysis (%) by Application, 2022 and 2033

Figure 94: France Market Share Analysis (%) by End User, 2022 and 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison, 2022 to 2033

Figure 97: Spain Market Share Analysis (%) by Product, 2022 and 2033

Figure 98: Spain Market Share Analysis (%) by Application, 2022 and 2033

Figure 99: Spain Market Share Analysis (%) by End User, 2022 and 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison, 2022 to 2033

Figure 102: Russia Market Share Analysis (%) by Product, 2022 and 2033

Figure 103: Russia Market Share Analysis (%) by Application, 2022 and 2033

Figure 104: Russia Market Share Analysis (%) by End User, 2022 and 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison, 2022 to 2033

Figure 107: BENELUX Market Share Analysis (%) by Product, 2022 and 2033

Figure 108: BENELUX Market Share Analysis (%) by Application, 2022 and 2033

Figure 109: BENELUX Market Share Analysis (%) by End User, 2022 and 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 112: East Asia Market Value Share, by Product (2023 E)

Figure 113: East Asia Market Value Share, by Application (2023 E)

Figure 114: East Asia Market Value Share, by End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison, 2022 to 2033

Figure 122: China Market Share Analysis (%) by Product, 2022 and 2033

Figure 123: China Market Share Analysis (%) by Application, 2022 and 2033

Figure 124: China Market Share Analysis (%) by End User, 2022 and 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison, 2022 to 2033

Figure 127: Japan Market Share Analysis (%) by Product, 2022 and 2033

Figure 128: Japan Market Share Analysis (%) by Application, 2022 and 2033

Figure 129: Japan Market Share Analysis (%) by End User, 2022 and 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison, 2022 to 2033

Figure 132: South Korea Market Share Analysis (%) by Product, 2022 and 2033

Figure 133: South Korea Market Share Analysis (%) by Application, 2022 and 2033

Figure 134: South Korea Market Share Analysis (%) by End User, 2022 and 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 137: South Asia Market Value Share, by Product (2023 E)

Figure 138: South Asia Market Value Share, by Application (2023 E)

Figure 139: South Asia Market Value Share, by End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison, 2022 to 2033

Figure 147: India Market Share Analysis (%) by Product, 2022 and 2033

Figure 148: India Market Share Analysis (%) by Application, 2022 and 2033

Figure 149: India Market Share Analysis (%) by End User, 2022 and 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison, 2022 to 2033

Figure 152: Indonesia Market Share Analysis (%) by Product, 2022 and 2033

Figure 153: Indonesia Market Share Analysis (%) by Application, 2022 and 2033

Figure 154: Indonesia Market Share Analysis (%) by End User, 2022 and 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison, 2022 to 2033

Figure 157: Malaysia Market Share Analysis (%) by Product, 2022 and 2033

Figure 158: Malaysia Market Share Analysis (%) by Application, 2022 and 2033

Figure 159: Malaysia Market Share Analysis (%) by End User, 2022 and 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison, 2022 to 2033

Figure 162: Thailand Market Share Analysis (%) by Product, 2022 and 2033

Figure 163: Thailand Market Share Analysis (%) by Application, 2022 and 2033

Figure 164: Thailand Market Share Analysis (%) by End User, 2022 and 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 167: Oceania Market Value Share, by Product (2023 E)

Figure 168: Oceania Market Value Share, by Application (2023 E)

Figure 169: Oceania Market Value Share, by End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison, 2022 to 2033

Figure 177: Australia Market Share Analysis (%) by Product, 2022 and 2033

Figure 178: Australia Market Share Analysis (%) by Application, 2022 and 2033

Figure 179: Australia Market Share Analysis (%) by End User, 2022 and 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison, 2022 to 2033

Figure 182: New Zealand Market Share Analysis (%) by Product, 2022 and 2033

Figure 183: New Zealand Market Share Analysis (%) by Application, 2022 and 2033

Figure 184: New Zealand Market Share Analysis (%) by End User, 2022 and 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 186: Middle East and Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 187: Middle East and Africa Market Value Share, by Product (2023 E)

Figure 188: Middle East and Africa Market Value Share, by Application (2023 E)

Figure 189: Middle East and Africa Market Value Share, by End User (2023 E)

Figure 190: Middle East and Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East and Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 193: Middle East and Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 194: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison, 2022 to 2033

Figure 197: GCC Countries Market Share Analysis (%) by Product, 2022 and 2033

Figure 198: GCC Countries Market Share Analysis (%) by Application, 2022 and 2033

Figure 199: GCC Countries Market Share Analysis (%) by End User, 2022 and 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison, 2022 to 2033

Figure 202: Türkiye Market Share Analysis (%) by Product, 2022 and 2033

Figure 203: Türkiye Market Share Analysis (%) by Application, 2022 and 2033

Figure 204: Türkiye Market Share Analysis (%) by End User, 2022 and 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison, 2022 to 2033

Figure 207: South Africa Market Share Analysis (%) by Product, 2022 and 2033

Figure 208: South Africa Market Share Analysis (%) by Application, 2022 and 2033

Figure 209: South Africa Market Share Analysis (%) by End User, 2022 and 2033

Figure 210: Northern Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs Northern Africa Growth Comparison, 2022 to 2033

Figure 212: Northern Africa Market Share Analysis (%) by Product, 2022 and 2033

Figure 213: Northern Africa Market Share Analysis (%) by Application, 2022 and 2033

Figure 214: Northern Africa Market Share Analysis (%) by End User, 2022 and 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Postoperative Pain Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Cervical Retractors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA