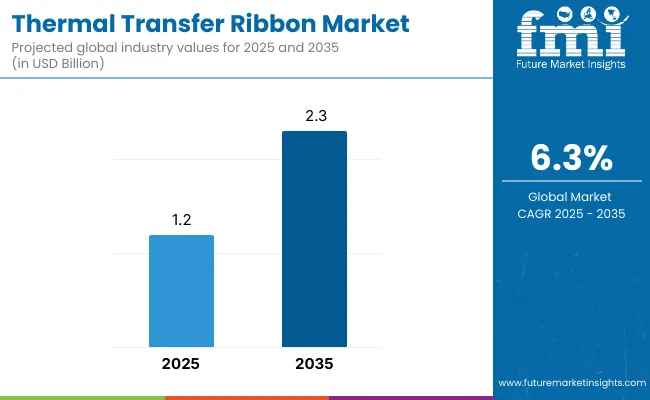

The global thermal transfer ribbon (TTR) market was valued at approximately USD 1.2 billion in 2025 and is projected to grow at a CAGR of 6.3% between 2025 and 2035, reaching up to USD 2.3 billion by 2035.This expansion is driven by rising demand for durable barcode and labeling solutions across industries like retail, logistics, healthcare, and manufacturing.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.2 billion |

| Projected Market Size in 2035 | USD 2.3 billion |

| CAGR (2025 to 2035 ) | 6.3% |

Market growth is further propelled by regulatory requirements for traceability and the accessibility of high-performance and eco-friendly ribbon formulations. In June 2023, Markem-Imaje a global leader in industrial printing and packaging solutions launched the SmartDate Xtra 3530 wax/resin thermal transfer ribbon, specifically engineered for high-resolution, durable printing on paper-based flexible film packaging used in food, beverage, and pharmaceutical industries.

The company highlighted its mission to provide more eco-conscious coding solutions with this ribbon. Alicia Tissot, Global Product Communications Manager at Markem-Imaje, stated, “The SmartDate Xtra 3530 ribbon has been designed to address the growing challenge of manufacturers to find a high-quality, environmentally-friendly coding solution”

Recent innovations in thermal transfer ribbons include eco-friendly wax/resin hybrid formulations, which offer superior durability, print clarity, and resistance to abrasion ideal for food-grade and healthcare applications. Manufacturers are also introducing resin ribbons tailored for extreme environments like electronics, chemicals, and pharmaceuticals.

These advancements align with growing sustainability trends and regulatory demands. Additionally, thermal printing technologies are evolving with high-resolution, near-edge printers, further driving demand for specialized ribbon types.

The thermal transfer ribbon market is expected to experience its fastest growth in the Asia‑Pacific region, propelled by rapid expansion in e-commerce, logistics, and pharmaceutical manufacturing. Countries like China, India, and South Korea are key growth hubs, with manufacturers emphasizing cost-effective, high-performance, and environmentally responsible ribbon solutions.

In mature markets such as North America and Europe, innovation continues in sustainability and integration with smart labeling (e.g., RFID-enabled ribbons, low-smudge prints, and recyclable substrate compatibility).

The market has been segmented based on material type, product type, printer type, end-use industries, and region. By material type, paper, polyester, polypropylene, polyethylene, and other substrates are utilized for their compatibility with various label surfaces, durability, and thermal sensitivity in barcode and label printing.

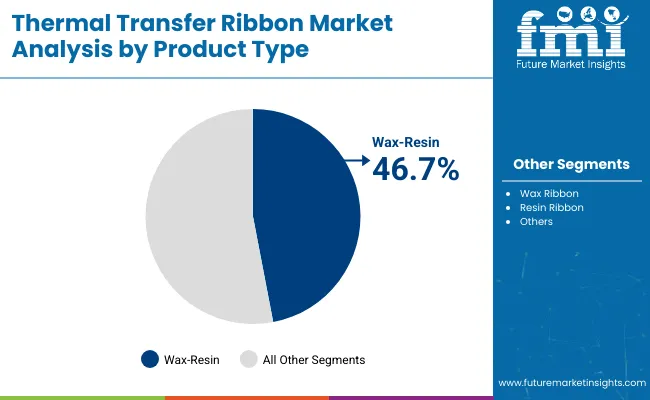

Product type segmentation includes wax ribbon, wax-resin ribbon, and resin ribbon, each engineered for specific printing environments ranging from low-cost general-purpose labeling to high-durability industrial coding. Printer types include desktop, industrial, and mobile printers, reflecting their deployment across logistics hubs, retail counters, and field operations.

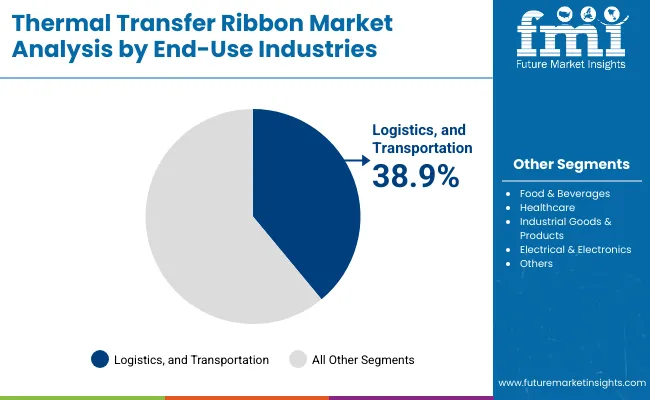

End-use industries encompass food & beverages, healthcare, logistics and transportation, industrial goods & products, electrical & electronics, and others illustrating the widespread demand for thermal transfer ribbons in high-volume, mission-critical labeling applications.

Regional segmentation spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa to capture regional variances in automation, packaging traceability requirements, and barcode compliance regulations.

The wax-resin ribbon segment is projected to capture the largest share of 46.7% in the thermal transfer ribbon market by 2025, due to its ability to offer a balanced combination of print quality, durability, and substrate versatility. These ribbons are engineered by blending wax and resin materials, resulting in sharp, smear-resistant printing that withstands moderate abrasion, chemicals, and temperature fluctuations.

Wax-resin ribbons are widely used for printing on semi-gloss and synthetic labels such as polypropylene (PP), polyethylene (PE), and polyester, making them ideal for applications requiring slightly more resilience than standard wax ribbons. The blend delivers high-definition printing for barcodes, logos, product IDs, and shipping information critical in sectors that demand traceability and readability over time.

This segment’s dominance is further supported by its suitability across various industries, including healthcare, retail, manufacturing, and especially logistics. With the growing demand for flexible printing solutions that are compatible with desktop and industrial printers, and with compliance to global labeling standards (like BS5609 and GHS), wax-resin ribbons remain a preferred choice for both low- and mid-volume users seeking cost-effective yet durable output.

The logistics and transportation segment is expected to lead the end-use industry category with a 38.9% share in 2025, fueled by the rapid expansion of e-commerce, international trade, and supply chain digitization. Thermal transfer ribbons are indispensable in this sector for generating barcodes, tracking labels, and shipping tags that must remain legible and scannable throughout the supply chain.

Wax-resin ribbons are especially preferred in logistics environments due to their ability to produce smudge-resistant, high-contrast prints that adhere to various label materials exposed to warehouse handling, palletization, and outdoor delivery conditions. These ribbons ensure that critical information-such as batch numbers, routing codes, and weight markings remains intact across temperature shifts, moisture exposure, and friction during transportation.

As logistics companies focus on automation and last-mile visibility, the demand for durable labeling solutions is increasing. In addition, the rise in cold-chain logistics and returnable transit packaging has emphasized the need for ribbons compatible with synthetic, waterproof, and high-adhesion label types.

With the global freight and inventory management sectors becoming more technology-driven and efficiency-focused, the logistics and transportation segment will continue to anchor thermal transfer ribbon demand, particularly in high-volume labeling environments.

Environmental Impact, Compatibility Issues, and Raw Material Costs

The key driving factor of thermal transfer ribbon (TTR) market as it can be used for a wide variety of applications including, bar code printing, gold/silver, and others. Whilst many end users are looking for greener solutions, there is still a lack of fully recyclable or compostable alternatives.

Compatibility is yet another issue, because ribbon formulations must be carefully matched to the printer type, label material and surface upon which it will be applied, making sourcing and integration more complex. In addition, fluctuating prices of key raw materials such as wax, resin, and film base materials impact manufacturers' production stability and margins.

Smart Labeling, Durable Printing Solutions, and E-Commerce Growth

Even with these hurdles, the market for thermal transfer ribbon is rising because of an increasing need for robust, long-lasting barcode and label printing in industries such as logistics, manufacturing, pharmaceuticals, and retail.

Thermal transfer printing produces high-resolution, smudge-resistant prints in challenging environmental conditions, making it perfect for applications such as inventory tracking, chemical labeling, and cold chain packaging.

Although the use of smart labeling technologies such as RFID-enabled tags and serialized barcodes that demand high-performance thermal ribbons upsurge opportunities. The expansion of e-commerce, digital supply chains, and last-mile delivery systems is increasing the demand for accurate, scan-friendly labels. At the same time, wax-resin hybrid ribbons and solvent-free coatings are being developed to satisfy both performance and sustainability goals.

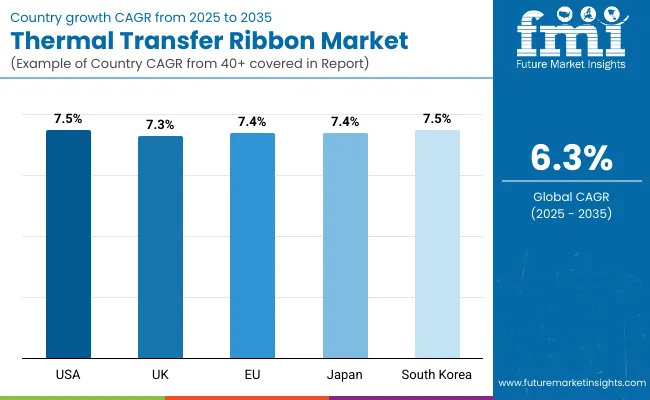

The USA remains the market leader globally, driven by logistics, healthcare and industrial manufacturing demand. E-commerce platforms that demand durable, scannable labels and pharmaceutical companies that need to comply with FDA-mandated traceability and cold chain labeling are also fueling growth. The sustainable ribbon innovations are also picking up steam.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

To comply with export regulations, the UK is focusing on sustainable packaging, warehouse automation, and driving demand for high-performance ribbons. Retailers and logistics companies are adopting low-emission ribbon alternatives and smart inventory labeling to meet net-zero targets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.3% |

Strong growth in EU countries can be attributed to stringent REACH and CLP regulations, particularly in chemical labeling, food traceability, and medical device packaging. Germany, France and the Netherlands are at the forefront of raising the bar to create more sustainable ribbons and closed-loop labeling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.4% |

Demand for resin-enhanced ribbons used in electronic labeling, automotive parts and lab samples is supported by Japan’s automation-heavy industries and precision manufacturing base. The market is also reacting to the demand for compact, high-speed, low-waste and reduced-downtime ribbon systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

High-durability labeling and thermal transfer systems needed for South Korea's rapidly growing e-commerce and semiconductor export sectors. High abrasion resistance hybrid ribbons and smart labelling integrated with warehouse robots and AI scanners are getting towards the end of the path, we are seeing improvements in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Demand for high-quality printing solutions that generate highly durable barcodes and labels have propelled the thermal transfer ribbon market as prominent applications across logistics, retail, manufacturing, and healthcare verticals fuel the growth of the respective market.

Market Forces to Innovate Materials In fact, this shift towards RFID integration, use of color-coded label and environmentally friendly ribbons is pushing the research in the area of resin, wax-resin and near-edge formulations.

These companies are spending money on compatible low-energy prints, recyclable pitcher cores, and pigment additives to deter counterfeits. Print durability, printhead protection, and compliance with regulatory and traceability standards remain tops on the consideration list for both leading consumables manufacturers and for OEM print system suppliers.

The overall market size for the thermal transfer ribbon market was USD 1.2 billion in 2025.

The thermal transfer ribbon market is expected to reach USD 2.3 billion in 2035.

The demand for thermal transfer ribbons is rising due to increasing need for high-quality barcode printing, durable labeling in industrial applications, and growth in retail and logistics sectors. Polyester materials and wax-resin ribbons offer enhanced print quality and durability, further supporting market expansion.

The top 5 countries driving the development of the thermal transfer ribbon market are the USA, China, Japan, Germany, and India.

Polyester materials and wax-resin ribbons are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA