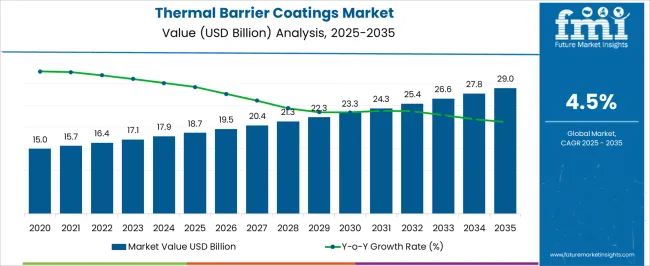

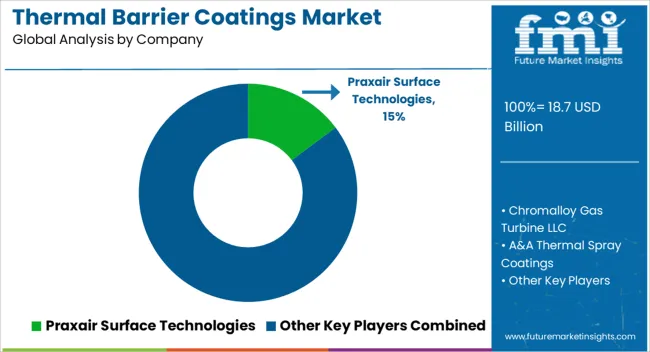

The thermal barrier coatings market is estimated to be valued at USD 18.7 billion in 2025 and is projected to reach USD 29.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The thermal barrier coatings (TBC) market is valued at USD 18.7 billion in 2025 and is expected to reach USD 29.0 billion by 2035, with a CAGR of 4.5%. From 2021 to 2025, the market grows from USD 15.0 billion to USD 18.7 billion, passing through intermediate values of USD 15.7 billion, 16.4 billion, 17.1 billion, and 17.9 billion. This early growth phase reflects steady progress, driven by increasing demand for TBCs in industries such as aerospace, automotive, and power generation. The growing need for components with enhanced durability and resistance to high temperatures propels TBC adoption in gas turbine engines and advanced machinery.

Between 2026 and 2030, the market experiences a gradual acceleration, moving from USD 18.7 billion to USD 23.3 billion, with values progressing through USD 19.5 billion, 20.4 billion, 21.3 billion, and 22.3 billion. This mid-phase growth reflects wider adoption of thermal barrier coatings in emerging markets, driven by industrial expansion and technological advancements in coating materials. From 2031 to 2035, the market reaches USD 29.0 billion, passing through USD 24.3 billion, 25.4 billion, 26.6 billion, and 27.8 billion. The late growth curve reflects maturation, with innovation in coating performance, cost reduction, and growing regulatory focus on energy efficiency and sustainability contributing to continued market expansion in this phase.

| Metric | Value |

|---|---|

| Thermal Barrier Coatings Market Estimated Value in (2025 E) | USD 18.7 billion |

| Thermal Barrier Coatings Market Forecast Value in (2035 F) | USD 29.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

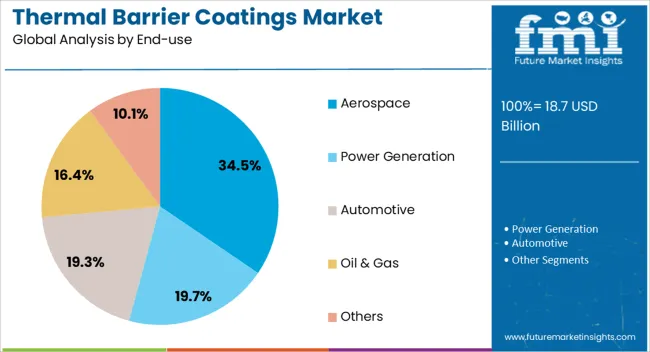

The aerospace and defense market is the largest contributor, accounting for approximately 30-35%, as TBCs are vital in high-performance applications such as jet engines and turbine components. The increasing demand for advanced materials that can withstand high temperatures in these sectors significantly drives TBC adoption. The automotive market follows with around 20-25%, where TBCs are used in engine components, exhaust systems, and turbochargers to enhance fuel efficiency and reduce emissions. With rising fuel efficiency standards and stricter emissions regulations, the demand for TBCs in automotive applications continues to grow.

The power generation market contributes about 18-22%, as TBCs are crucial for the performance and longevity of gas turbines and other high-temperature equipment in power plants. With an increasing focus on energy efficiency, particularly in gas-based power plants, the demand for TBCs continues to rise. The industrial equipment market accounts for approximately 12-15%, as TBCs help extend the lifespan and enhance the performance of machinery and processing units operating in high-temperature environments. Finally, the oil and gas market contributes around 10-12%, with TBCs being used to protect equipment in extreme temperature conditions, particularly in exploration, drilling, and refining operations.

The thermal barrier coatings (TBC) market is expanding steadily, driven by rising demand for high-performance protective solutions in high-temperature environments across critical industries. These coatings play a vital role in enhancing the efficiency and durability of components exposed to extreme heat, such as turbine blades and engine parts.

The aerospace and energy sectors are particularly significant contributors, where TBCs enable improved fuel efficiency and reduced maintenance intervals. Technological advancements in coating materials and application methods are further elevating market adoption, particularly with a focus on minimizing thermal conductivity and improving oxidation resistance.

The growing emphasis on sustainability and operational cost reduction has led manufacturers to prioritize advanced ceramic materials and precision application techniques. As global infrastructure and defense modernization programs expand, along with continued investments in gas turbine technologies, the demand for reliable and efficient thermal barrier coatings is expected to remain strong

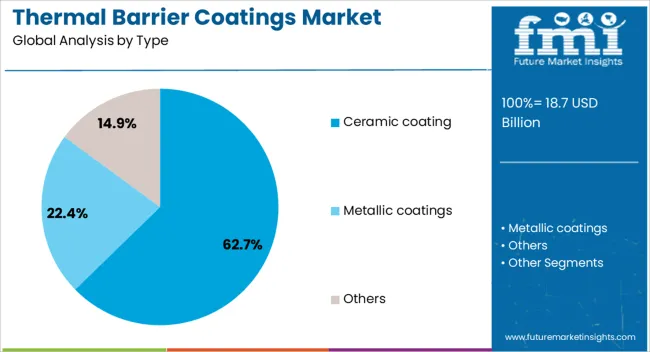

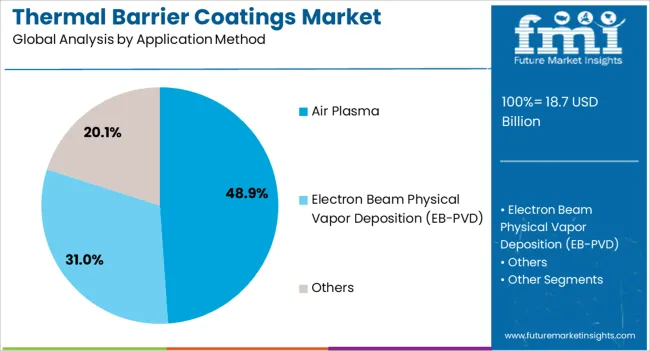

The thermal barrier coatings market is segmented by type, application method, end-use, and geographic regions. By type, thermal barrier coatings market is divided into ceramic coating, metallic coatings, and others. In terms of application method, thermal barrier coatings market is classified into air plasma, electron beam physical vapor deposition (EB-PVD), and others. Based on end-use, thermal barrier coatings market is segmented into aerospace, power generation, automotive, oil & gas, and others. Regionally, the thermal barrier coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ceramic coating segment dominates the type category with a commanding 62.7% market share, reflecting its superior thermal resistance and protective capabilities in harsh operating conditions. Ceramic materials are particularly valued for their ability to withstand high temperatures while maintaining structural integrity, making them essential in applications such as gas turbines, internal combustion engines, and aerospace components.

The segment's growth is supported by ongoing innovations in material composition, including rare earth and composite ceramics, which offer improved phase stability and extended service life. Additionally, the shift toward more energy-efficient propulsion systems has heightened the need for coatings that can tolerate higher operating temperatures without degradation.

Ceramic coatings continue to be the material of choice for OEMs and maintenance providers seeking performance reliability in demanding environments. The segment is projected to maintain its lead as technological developments drive the adoption of next-generation ceramic-based solutions

Air plasma emerged as the leading application method with a 48.9% share, driven by its versatility, cost-effectiveness, and ability to deposit high-performance coatings with precise control. The technique is widely used in both OEM production and component refurbishment, allowing the deposition of complex ceramic layers with strong adhesion properties and controlled porosity.

Air plasma spraying is favored for its relatively low equipment costs compared to other methods like electron beam or HVOF, making it accessible to a broad range of end users. The method also enables in-situ repairs and coatings over large surface areas, which is critical for high-volume industries such as power generation and aerospace.

Ongoing enhancements in plasma torch design and automation technologies have further improved coating consistency and thermal performance. The segment is expected to sustain its dominance due to its compatibility with a wide variety of materials and its adaptability for advanced surface engineering applications

The aerospace segment leads the end-use category with a 34.5% share, owing to the sector’s critical reliance on thermal barrier coatings for performance, safety, and efficiency. These coatings are indispensable in protecting turbine engines, combustors, and afterburners from extreme heat, thus extending component life and enabling higher operating temperatures.

As the aerospace industry prioritizes fuel efficiency and emissions reduction, the demand for high-performance TBCs has intensified. The segment’s growth is also supported by increasing aircraft production rates, rising maintenance, repair, and overhaul (MRO) activities, and the deployment of next-generation engines.

Military and commercial aviation programs continue to invest in advanced coating solutions to meet stringent performance and regulatory requirements. The strategic importance of aerospace technology in national defense and international travel ensures that this segment remains a key driver in the thermal barrier coatings market’s ongoing development

TBCs are used to protect components like turbine blades, combustion chambers, and exhaust systems from heat-related damage. The market is driven by advancements in coating technologies, the increasing demand for energy efficiency, and the rising need for high-performance materials in extreme environments. However, challenges such as high manufacturing costs, the complexity of coating application processes, and performance limitations under extreme operating conditions may hinder market growth. Opportunities exist in the development of next-generation coatings with enhanced thermal resistance, durability, and environmental performance.

The thermal barrier coatings market is significantly driven by the growing demand for high-performance materials in industries like aerospace and power generation. TBCs are essential in protecting components that operate in extreme temperatures, such as turbine blades and combustion chambers, from thermal damage and wear. As the aerospace sector pushes the boundaries of efficiency with advanced jet engines and gas turbines, the demand for robust, heat-resistant coatings is increasing. In the power generation industry, TBCs are used to improve the efficiency and longevity of turbines and engines, especially in gas-fired power plants. The increasing focus on performance and operational efficiency in these industries is expected to drive sustained growth in the TBC market.

The thermal barrier coatings market faces challenges related to high production costs, application complexity, and material performance. The process of applying TBCs, such as electron beam physical vapor deposition (EB-PVD) and plasma spraying, is expensive and requires specialized equipment and expertise. These high costs can make TBCs less attractive for industries with tight budgets or those looking to scale production. Furthermore, while TBCs provide excellent thermal protection, there are performance limitations, particularly in extreme environments where mechanical stresses, oxidation, and erosion can affect the coating’s effectiveness. The need for coating materials that offer better durability without adding excessive weight remains a significant challenge. Overcoming these issues through advanced material development and cost-reduction strategies will be crucial for market growth.

Opportunities in the thermal barrier coatings market lie in the development of next-generation coatings and the expansion into emerging markets. There is a growing demand for TBCs with enhanced properties, such as improved thermal resistance, greater durability, and better environmental performance, especially in aerospace and automotive sectors. New coatings that can withstand more aggressive operating conditions, offer higher protection with thinner layers, and maintain efficiency over longer periods are being developed. Emerging markets, particularly in Asia-Pacific and the Middle East, present significant growth potential as industrialization and infrastructure development increase, leading to higher demand for high-performance materials. Manufacturers that can offer innovative solutions to meet the evolving needs of these markets are likely to capture a significant share of the global TBC market.

The thermal barrier coatings market is witnessing trends in coating technologies, durability enhancements, and environmental performance. Innovations in deposition techniques and material composition are improving the quality and performance of TBCs. Coatings that offer higher resistance to heat and environmental degradation are being developed to increase the lifespan of critical components in high-temperature environments. With growing environmental concerns, there is a trend toward developing coatings with fewer environmental impacts, such as reduced use of harmful chemicals and better recyclability. Manufacturers are also focusing on improving the coating's ability to perform under mechanical stresses, oxidation, and thermal cycling, which are critical for the longevity and efficiency of the coated components.

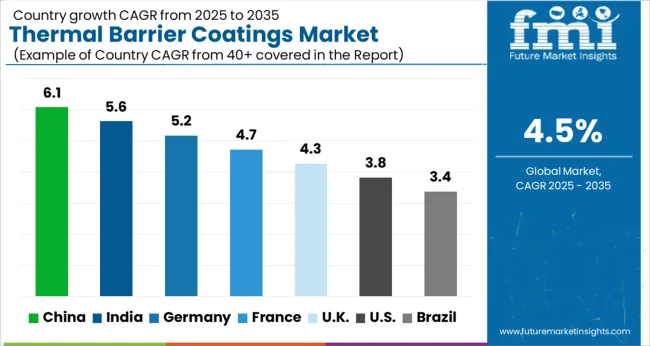

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global thermal barrier coatings market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads with the highest growth rate of 6.1%, followed by India at 5.6% and Germany at 5.2%. The UK and USA show more moderate growth rates of 4.3% and 3.8%, respectively. The market is driven by the increasing demand for high-performance coatings in aerospace, automotive, and power generation sectors, as industries strive to improve the efficiency, durability, and performance of critical components. The push for energy efficiency and emissions reduction continues to shape market dynamics. The analysis includes over 40+ countries, with the leading markets detailed below.

The thermal barrier coatings (TBC) market in China is set to grow at a CAGR of 6.1% from 2025 to 2035. This growth is primarily driven by the expanding aerospace, automotive, and energy industries. With China being a major player in both aircraft manufacturing and automotive production, the demand for high-performance coatings that can protect components from extreme temperatures is increasing. The rapidly growing energy sector, with a strong focus on enhancing the efficiency of power generation equipment, is boosting TBC demand. TBCs are critical for improving the durability and operational efficiency of turbines, engines, and other high-temperature components. China's focus on reducing emissions and optimizing fuel efficiency further drives the demand for advanced coatings. As industries in China continue to innovate and expand, TBCs are becoming essential for ensuring the performance and longevity of critical machinery.

The thermal barrier coatings market in India is projected to grow at a CAGR of 5.6% from 2025 to 2035. The market growth is being driven by the expansion of industries such as aerospace, automotive, and power generation. India’s growing aerospace and automotive sectors are increasingly adopting thermal barrier coatings to improve the performance and efficiency of engines, turbines, and other critical components. TBCs play a crucial role in protecting machinery from extreme heat, improving durability and operational life. India’s focus on energy efficiency and reducing emissions is further spurring the demand for high-performance coatings in the power generation industry. The increasing industrialization and rising demand for advanced technologies also contribute to the market growth. As the country moves toward improving the overall quality and performance of manufacturing processes, the adoption of thermal barrier coatings is set to rise significantly.

The thermal barrier coatings market in Germany is expected to grow at a CAGR of 5.2% from 2025 to 2035. Germany’s strong automotive, aerospace, and power generation sectors are driving the demand for TBCs. The country is home to some of the world’s leading automotive and aerospace manufacturers, who require advanced coatings for high-temperature components to enhance performance and durability. Germany’s emphasis on improving energy efficiency and reducing emissions is boosting the adoption of TBCs in power generation and industrial applications. TBCs are essential for improving the efficiency of turbines and engines, which aligns with Germany's focus on clean and efficient energy production. The demand for TBCs in industrial sectors, such as automotive and aerospace, is expected to rise as companies seek to enhance the performance of their critical components.

The UK’s thermal barrier coatings market is projected to grow at a CAGR of 4.3% from 2025 to 2035. The growth is driven by the increasing adoption of TBCs in the aerospace, automotive, and power generation sectors. As the UK continues to invest in advanced aerospace and automotive technologies, the demand for TBCs is expected to rise. TBCs are essential for enhancing the durability and performance of critical components such as turbines, engines, and exhaust systems. The UK government’s push for energy-efficient technologies and stricter emissions regulations further drives the market for TBCs. In addition, the automotive sector’s focus on improving fuel efficiency and reducing emissions is spurring the adoption of advanced coatings.

The USA thermal barrier coatings market is expected to grow at a CAGR of 3.8% from 2025 to 2035. The USA remains a major player in industries such as aerospace, automotive, and power generation, all of which drive the demand for high-performance coatings. TBCs are essential for protecting components from extreme temperatures, enhancing their operational efficiency and longevity. The growth of the aerospace and automotive sectors in the USA is a significant factor in the increased adoption of TBCs. The USA government’s push toward clean energy and emission reduction strategies is further boosting the demand for energy-efficient coatings. The growing trend of adopting advanced materials and coatings to optimize machinery performance is expected to continue fueling market growth.

The thermal barrier coatings (TBC) market is intensely competitive, driven by demand in aerospace, automotive, and energy sectors. Praxair Surface Technologies leads the market, offering high-performance coatings that improve efficiency and durability in turbine engines and industrial equipment. Their focus is on providing advanced materials that offer superior heat resistance, contributing to longer service life and reduced operational costs. Chromalloy Gas Turbine LLC competes by specializing in coatings for gas turbine engines, with a strong emphasis on improving engine performance and efficiency. Their coatings are marketed as critical to increasing power output and fuel efficiency in aviation and power generation applications.

A&A Thermal Spray Coatings and H.C. Starck Solutions provide high-quality thermal barrier coatings used in high-temperature applications. A&A Thermal Spray Coatings focuses on custom coatings that meet specific customer requirements, while H.C. Starck Solutions emphasizes innovation and precision in their coating technologies. MesoCoat Inc. competes by offering advanced, durable coatings for industries such as aerospace and defense, with an emphasis on reducing wear and corrosion.

The Fisher Barton Group provides coatings designed to enhance the durability of industrial components, while ASB Industries, Inc. specializes in applying coatings that improve the performance and lifespan of parts exposed to extreme temperatures. Metallisation Ltd., Aremco Products, Inc., and Bodycote plc are key players in the market, offering thermal barrier coatings used in a variety of applications. Metallisation Ltd. specializes in metal spray coatings, while Aremco Products focuses on providing heat-resistant coatings for ceramics and metals. Bodycote’s coatings are marketed as highly durable, supporting industries that require maximum protection against heat and wear.

Oerlikon Metco, TST Coatings, Inc., and Flame Spray Coating Company also offer specialized coatings, focusing on innovation and cost-effective solutions to meet customer demands in high-temperature environments. Product brochures from these companies highlight key features such as exceptional thermal resistance, wear protection, and enhanced component longevity. Many brochures focus on the ability of TBCs to reduce energy consumption, lower maintenance costs, and extend the operational life of machinery, particularly in high-demand sectors like aerospace and energy.

| Items | Values |

|---|---|

| Quantitative Units | USD 18.7 billion |

| Type | Ceramic coating, Metallic coatings, and Others |

| Application Method | Air Plasma, Electron Beam Physical Vapor Deposition (EB-PVD), and Others |

| End-use | Aerospace, Power Generation, Automotive, Oil & Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Praxair Surface Technologies, Chromalloy Gas Turbine LLC, A&A Thermal Spray Coatings, H.C. Starck Solutions, MesoCoat Inc., The Fisher Barton Group, ASB Industries, Inc., Metallisation Ltd., Aremco Products, Inc., Bodycote plc, Oerlikon Metco, TST Coatings, Inc., Flame Spray Coating Company, APS Materials Inc., and Air Products and Chemicals, Inc. |

| Additional Attributes | Dollar sales of coatings span metallic, ceramic, and composite types, applied in aerospace, industrial, power, and automotive sectors. Growth is driven by extreme-environment performance needs, with strong adoption across North America, Europe, and Asia-Pacific. |

The global thermal barrier coatings market is estimated to be valued at USD 18.7 billion in 2025.

The market size for the thermal barrier coatings market is projected to reach USD 29.0 billion by 2035.

The thermal barrier coatings market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in thermal barrier coatings market are ceramic coating, metallic coatings and others.

In terms of application method, air plasma segment to command 48.9% share in the thermal barrier coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA