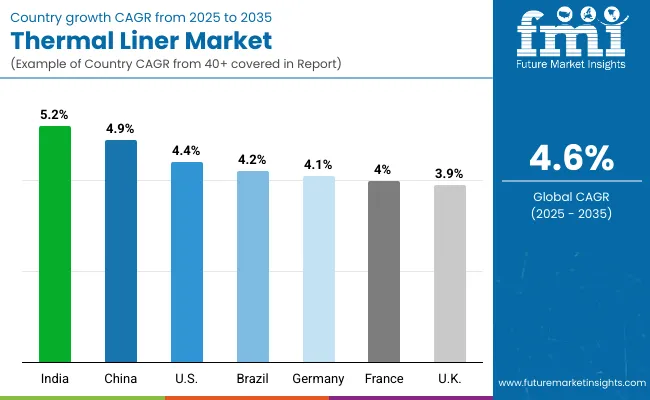

The thermal liner market is expected to grow from USD 1.6 billion in 2025 to USD 2.5 billion by 2035, resulting in a total increase of USD 0.9 billion over the forecast decade. This represents a 56.3% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.6%. Over ten years, the market grows by 1.6 times.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 4.6% |

In the first five years (2025-2030), the market progresses from USD 1.6 billion to USD 2.0 billion, contributing USD 0.4 billion, or 44.4% of total decade growth. This phase is shaped by rising demand in food, pharmaceuticals, and chemical transport, driven by the need for consistent temperature control. Regulatory requirements for cold chain compliance further boost adoption in developed regions.

In the second half (2030-2035), the market grows from USD 2.0 billion to USD 2.5 billion, adding USD 0.5 billion, or 55.6% of the total growth. This acceleration is supported by the adoption of advanced reflective materials, lightweight insulation composites, and reusable liner designs. Growing global e-commerce in temperature-sensitive goods strengthens the market, with innovations focusing on sustainability and reduced carbon footprint in logistics.

From 2020 to 2024, the thermal liner market expanded from USD 1.3 billion to USD 1.5 billion, driven by growth in temperature-sensitive logistics across pharmaceuticals, food, and specialty chemicals. Nearly 70% of revenue came from established packaging firms supplying high-performance insulation materials for bulk containers and transport. Leaders such as Insulated Products Corporation, Thermal Shipping Solutions, and IPC Pack emphasized lightweight thermal fabrics, moisture barriers, and quick-deploy designs. Competitive differentiation focused on multi-layer reflective insulation, compliance with cold-chain regulations, and easy installation, while IoT temperature monitoring remained secondary. Service-based monitoring accounted for less than 15% of total value as most buyers opted for product-only purchases.

By 2035, the thermal liner market will reach USD 2.5 billion, growing at a CAGR of 4.60%, with smart insulation solutions accounting for over 40% of market value. Competition will rise as providers offer liners with embedded sensors, cloud-linked temperature logs, and AI-based spoilage prediction. Established manufacturers are transitioning to hybrid models, pairing physical liners with subscription-based monitoring platforms for continuous compliance assurance. Emerging entrants such as TP Solutions, CargoSafe, and Cold Chain Technologies are gaining share with recyclable materials, modular fit systems, and enhanced performance against extreme temperature fluctuations, targeting global cold-chain expansion.

The growing demand for temperature-controlled logistics in food, pharmaceuticals, and chemical transport is driving growth in the thermal liner market. These liners help maintain consistent internal temperatures, protecting goods from spoilage and quality degradation. Rising global trade, e-commerce, and stricter regulations on cold chain compliance are further accelerating adoption.

Liners made with reflective insulation, multi-layer barriers, and moisture-resistant materials are gaining traction for their ability to reduce thermal exchange and condensation. Easy installation, reusability, and compatibility with standard containers enhance cost efficiency. Sustainability-focused designs using recyclable materials are also appealing to companies aiming to meet environmental goals while ensuring shipment integrity.

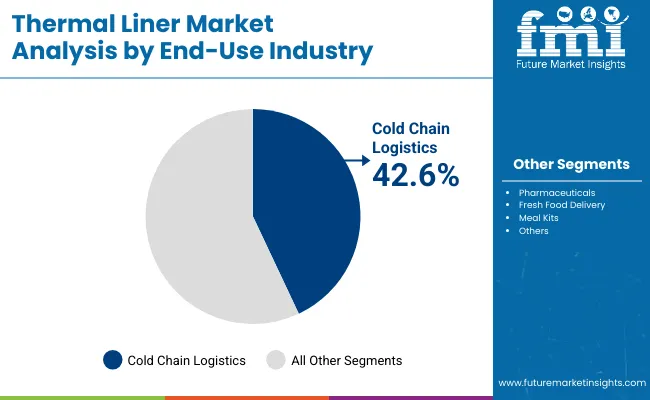

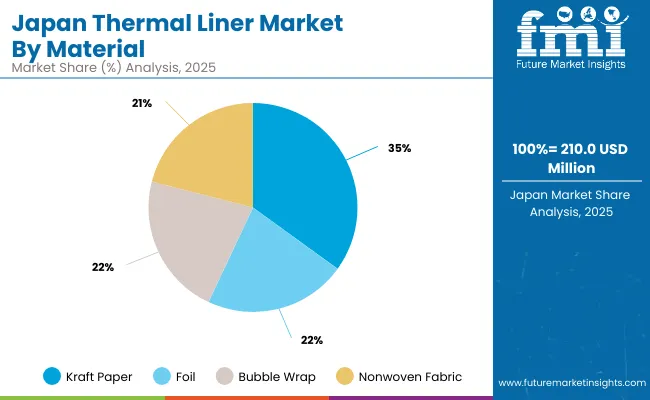

The market is segmented by material, layer type, form, application, end-use industry, and region. Material segmentation includes kraft paper, foil, bubble wrap, and nonwoven fabric, each offering distinct insulation and protective properties. Layer type covers single layer and multi-layer (2-5 layers), enhancing thermal resistance and durability. Form includes roll, sheet, die-cut, and bag insert, enabling customization for varied packaging needs. Applications comprise box lining, pallet covers, thermal envelopes, and insulated liners, ensuring temperature control during transit. End-use industries include cold chain logistics, pharmaceuticals, fresh food delivery, and meal kits. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

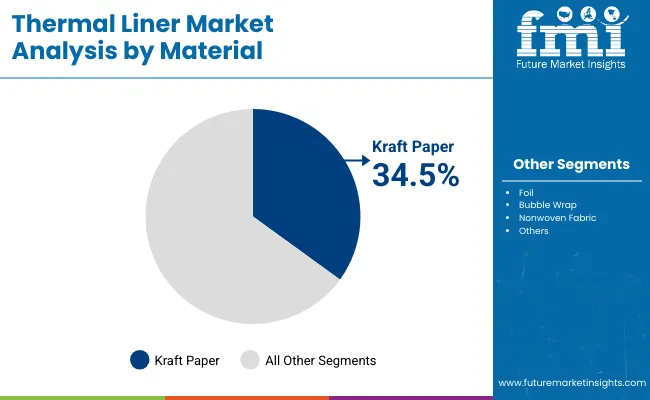

Kraft paper is projected to account for 34.5% of the market in 2025, supported by its eco-friendly profile, biodegradability, and recyclability. Its natural fiber strength provides sufficient tear resistance and insulation when combined with thermal coatings or layered composites. The material’s cost-effectiveness makes it attractive for large-scale packaging needs.

Adoption is rising in cold chain and e-commerce packaging, where brands seek to reduce plastic use while maintaining product protection. Kraft-based liners can be customized in thickness and barrier properties to match specific temperature retention requirements. Printing compatibility also enables branding without compromising thermal performance.

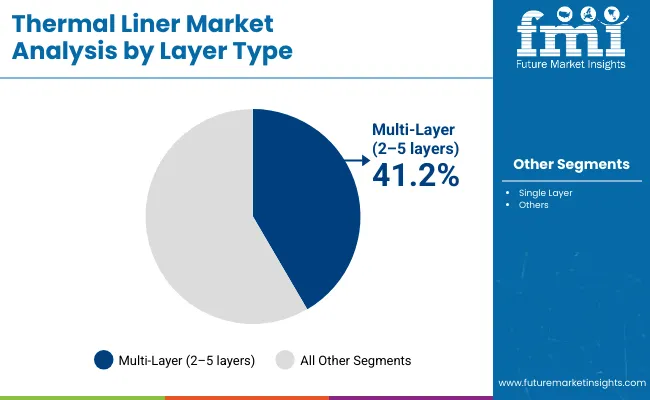

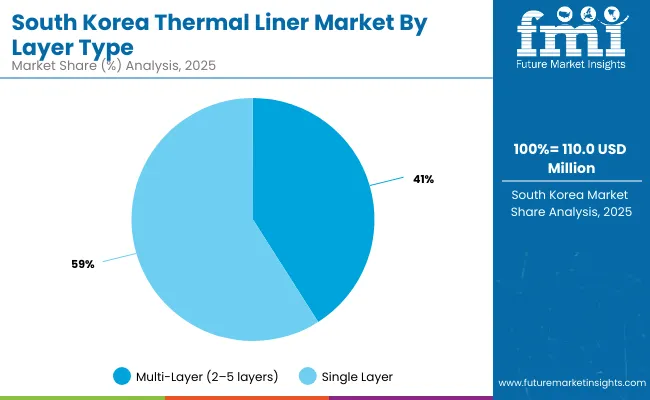

Multi-layer liners, consisting of two to five layers, are forecast to hold a 41.2% share in 2025 due to their superior insulation capabilities. Combining materials such as foil, bubble wrap, and nonwovens enhances heat reflection and moisture resistance, ensuring temperature stability over extended transit times.

These liners are increasingly used in high-value shipments where temperature deviation risks spoilage or product degradation. Their layered construction also improves puncture resistance and durability. The segment benefits from growing demand in pharmaceutical and perishable food logistics, where compliance with strict temperature control standards is mandatory.

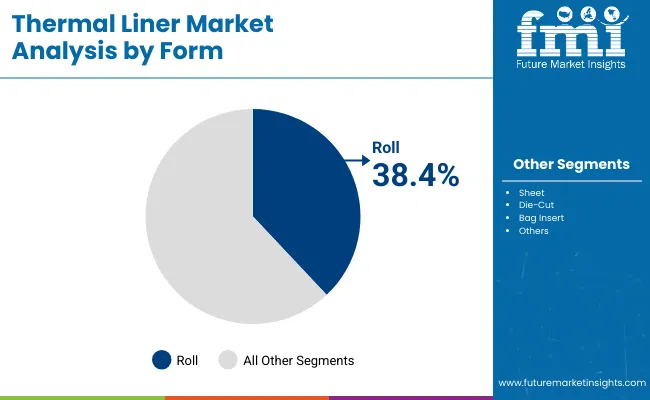

Roll-form thermal liners are expected to capture a 38.4% market share in 2025, offering versatile application for various packaging configurations. Rolls allow on-site cutting and fitting to custom box sizes, reducing waste and inventory requirements. They are suitable for high-volume operations requiring quick adjustments.

Industries benefit from the reduced lead time associated with roll-based supply, enabling faster fulfilment. Roll liners are compatible with automated packaging equipment, improving production efficiency. Their adaptability makes them popular in third-party logistics and distribution hubs handling diverse product categories.

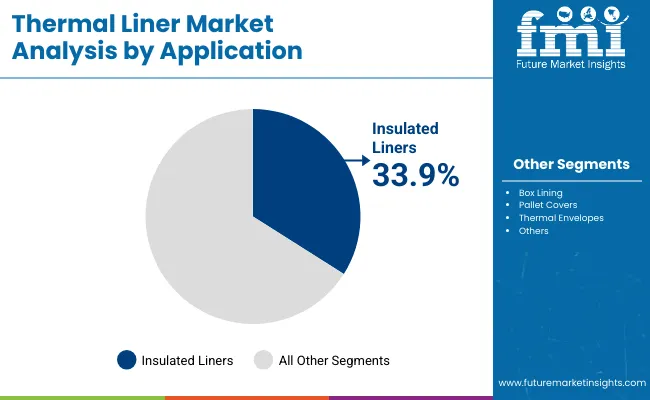

Insulated liners are projected to hold a 33.9% share in 2025, favoured for their ability to maintain internal temperatures during long-haul or multi-stop deliveries. These liners often combine reflective surfaces with insulating cores to reduce thermal exchange.

They are critical in preventing spoilage for temperature-sensitive goods such as fresh produce, seafood, and biologics. Lightweight construction minimizes shipping costs, while foldable designs optimize storage space. As cold chain networks expand, insulated liners remain integral to meeting regulatory and quality assurance requirements.

Cold chain logistics is expected to represent 42.6% of market demand in 2025, fuelled by rising global trade in temperature-sensitive goods. Thermal liners help maintain product integrity from origin to destination, mitigating risks associated with temperature fluctuations.

Adoption is accelerating in food, pharmaceutical, and biotechnology supply chains. Liners are used alongside refrigerated transport to enhance protection during handling and last-mile delivery. The push for extended shelf life and international exports ensures strong growth prospects for this segment.

The thermal liner market is expanding as demand grows for temperature-controlled packaging in food, pharmaceuticals, chemicals, and e-commerce sectors. These liners help maintain product integrity during transit by providing insulation against extreme temperatures. However, high material costs and disposal challenges hinder broader adoption. Technological advances in lightweight, recyclable insulation materials and increased cold chain logistics demand are shaping future growth.

Cold Chain Expansion, Product Protection, and Regulatory Compliance Driving Adoption

Thermal liners are essential for safeguarding temperature-sensitive goods such as vaccines, frozen foods, and specialty chemicals. Their multilayer insulation design minimizes heat transfer, maintaining product quality during extended shipping durations. Growth in global cold chain infrastructure and stricter temperature compliance regulations are boosting demand across export-oriented industries. E-commerce grocery delivery and meal kit services increasingly adopt thermal liners to ensure freshness. These liners also help reduce reliance on costly refrigerated transport, making them a cost-effective packaging alternative.

High Material Costs, Disposal Concerns, and Limited Reusability Restraining Growth

The use of advanced insulating materials such as metallized films, foils, and high-performance foams increases manufacturing costs, limiting adoption among price-sensitive businesses. Disposal and recycling challenges due to mixed-material construction raise sustainability concerns, particularly in regions with strict waste regulations. Limited reusability for certain liners adds to packaging waste and reduces cost efficiency. Additionally, shipping carriers face volumetric weight considerations, as some thermal liners increase package size, leading to higher freight charges. These challenges impact the market’s penetration in low-margin sectors.

Sustainable Materials, Lightweight Designs, and Smart Monitoring Trends Emerging

Manufacturers are introducing eco-friendly thermal liners made from recyclable, compostable, or bio-based materials to address environmental concerns. Lightweight designs are reducing shipping costs while maintaining insulation performance. Integration of smart temperature loggers and IoT-enabled tracking within liners is enhancing shipment monitoring, allowing real-time alerts for temperature deviations. Flexible foldable designs improve storage efficiency and reduce logistical footprints. As global trade in temperature-sensitive goods rises, these innovations are positioning thermal liners as critical components of sustainable and high-performance cold chain packaging systems.

The global thermal liner market is growing steadily, supported by increasing demand for temperature-sensitive goods transport, e-commerce expansion, and pharmaceutical cold chain requirements. Asia-Pacific is emerging as a strong growth hub, with India and China leading adoption due to rising exports of perishables and healthcare products. Developed markets like the USA, Germany, and Japan are focusing on high-performance insulation materials, lightweight designs, and eco-friendly thermal liners to meet evolving regulatory and sustainability targets.

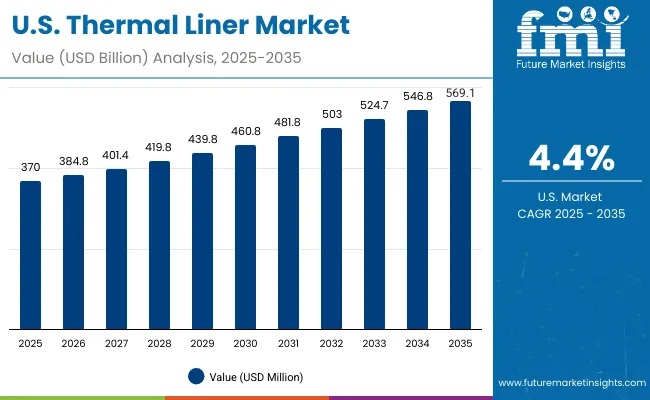

The USA market is projected to grow at a CAGR of 4.4% from 2025 to 2035, supported by surging demand in food, beverage, and biopharma logistics. Cold chain efficiency has become critical, driving adoption of high-R-value liners that maintain stable temperatures for long-haul trucking and last-mile deliveries. Manufacturers are also introducing recyclable, multi-layer liners to align with packaging waste reduction goals and sustainability mandates.

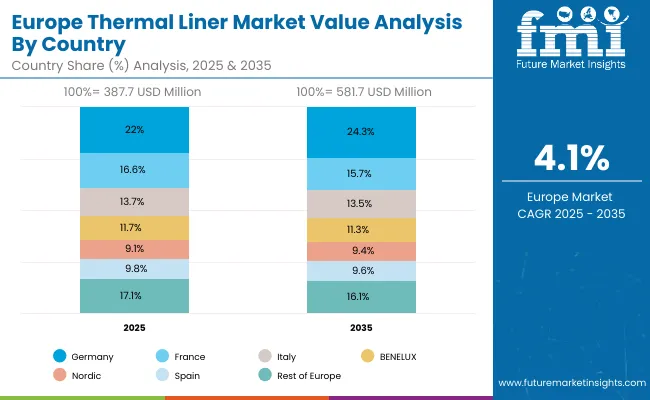

Germany’s market is expected to expand at a CAGR of 4.1%, anchored by its strong export-driven industrial base and strict EU regulations on food safety and chemical logistics. The country’s automotive and chemical sectors are steadily adopting thermal liners to protect sensitive parts and hazardous shipments under controlled temperatures. Innovation is concentrated on reusable, puncture-resistant liners that reduce lifecycle costs and provide extended durability in multi-trip applications.

The UK thermal liner market is forecast to grow at a CAGR of 3.9% from 2025 to 2035, supported by rising exports of chilled foods, pharmaceuticals, and premium beverages. Small and medium exporters are turning to pre-fitted liners that reduce packaging times while boosting efficiency in fast-moving logistics. Sustainability initiatives are further accelerating the adoption of biodegradable insulation layers as companies strive to meet carbon reduction targets.

China’s thermal liner market is projected to grow at a CAGR of 4.9%, driven by expanding exports of fresh produce and the rapid growth of cross-border e-commerce. Domestic producers are scaling up production of low-cost, high-performance liners that enable better preservation of perishable shipments. Government-led logistics modernization policies and cold chain infrastructure upgrades are reinforcing liner adoption across sectors.

India is expected to record the fastest growth at a CAGR of 5.2% from 2025 to 2035, driven by pharmaceutical exports, dairy logistics, and the need to combat temperature fluctuations in its tropical climate. SMEs and cooperatives are adopting affordable, reusable liners to reduce spoilage losses and ensure product quality. The country’s focus on enhancing cold chain infrastructure is further fuelling adoption.

Japan’s market is projected to grow at a CAGR of 4.3%, driven by seafood, confectionery, and precision electronics exports that demand stable thermal protection. Compact and lightweight liners are preferred for air freight shipments, where space efficiency is a priority. Manufacturers are also introducing breathable, moisture-resistant liners that balance thermal stability with product preservation.

South Korea’s thermal liner market is expected to expand at a CAGR of 3.9% from 2025 to 2035, supported by strong exports of K-food, cosmetics, and temperature-sensitive chemicals. Lightweight liner designs are in demand to reduce international shipping costs and improve container utilization. The country’s emphasis on high-quality exports is also spurring adoption of durable liner solutions.

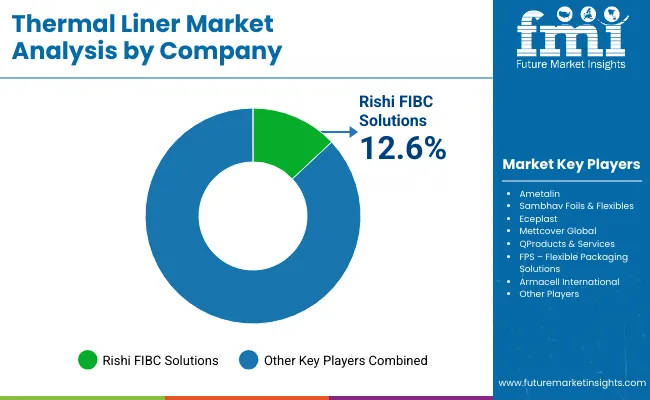

The thermal liner market is moderately fragmented, with bulk packaging specialists, insulation material innovators, and temperature-controlled logistics providers competing across food, beverage, pharmaceutical, and chemical transport applications. Global leaders such as Rishi FIBC Solutions, Ametalin, and Sambhav Foils & Flexibles hold notable market share, driven by advanced thermal barrier materials, moisture resistance, and compliance with international shipping standards. Their strategies increasingly emphasize customization, recyclability, and high-performance insulation for varied climate conditions.

Established mid-sized players including Eceplast, Mettcover Global, and QProducts & Services are supporting adoption of multi-layer liners featuring reflective foil, bubble insulation, and vapor barrier technology. These companies are especially active in containerized freight, cold chain distribution, and specialty cargo, offering rapid-deploy designs, reduced condensation risk, and improved transit temperature stability for sensitive goods.

Specialized solutions providers such as FPS - Flexible Packaging Solutions and Armacell International focus on tailored insulation systems for regional transporters and niche industries. Their strengths lie in modular liner design, lightweight yet durable materials, and integration with data loggers or smart monitoring devices to track in-transit temperature, ensuring product integrity and reduced spoilage risk.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Material | Kraft Paper, Foil, Bubble Wrap, Nonwoven Fabric |

| By Layer Type | Single Layer, Multi-Layer (2-5 layers) |

| By Form | Roll, Sheet, Die-Cut, Bag Insert |

| By Application | Box Lining, Pallet Covers, Thermal Envelopes, Insulated Liners |

| By End-Use Industry | Cold Chain Logistics, Pharmaceuticals, Fresh Food Delivery, Meal Kits |

| Key Companies Profiled | Rishi FIBC Solutions, Ametalin, Sambhav Foils & Flexibles, Eceplast, Mettcover Global, QProducts & Services, FPS - Flexible Packaging Solutions, Armacell International |

| Additional Attributes | Rising demand for temperature-controlled packaging to ensure product integrity in cold chain logistics, increasing adoption of multi-layer liners for extended insulation performance, shift toward recyclable and eco-friendly materials such as kraft paper and nonwoven fabrics, growth in e-commerce-driven fresh food and meal kit deliveries, and enhanced product designs enabling ease of installation, storage efficiency, and compatibility with varied container types. |

Nonwoven Fabric

The global thermal liner market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the thermal liner market is projected to reach USD 2.5 billion by 2035.

The thermal liner market is expected to grow at a CAGR of 4.6% between 2025 and 2035.

The key layer types in the thermal liner market include single layer and multi-layer (2-5 layers).

The multi-layer (2-5 layers) segment is projected to account for the highest share of 41.2% in the thermal liner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Direct Thermal Linerless Providers

Insulated Thermal Box Liners Market

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA