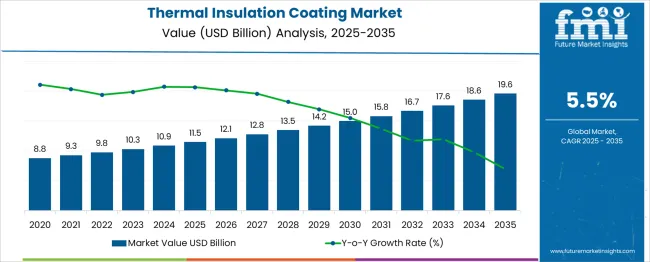

The Thermal Insulation Coating Market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 19.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. During the first five-year phase (2025–2030), the market will increase from USD 11.5 billion to USD 15.0 billion, adding USD 3.5 billion, which accounts for 43.2% of the total incremental growth. This early expansion is driven by growing demand for energy-efficient coating solutions in industrial equipment, pipelines, and building infrastructure, supported by stricter energy conservation regulations and rising maintenance activities in oil & gas facilities. The second half (2030–2035) will contribute USD 4.6 billion, representing 56.8% of incremental growth, signaling continued adoption in advanced applications such as aerospace, automotive, and renewable energy systems. Annual increments during the early years average USD 0.7 billion, with gains accelerating in later years as thermal coatings with nanotechnology, corrosion resistance, and high durability become mainstream. Manufacturers prioritizing innovative formulations, lightweight solutions, and regional production expansion will capture the largest share of this USD 8.1 billion growth opportunity, particularly in Asia-Pacific and North America where infrastructure modernization and energy efficiency projects remain strong drivers.

| Metric | Value |

|---|---|

| Thermal Insulation Coating Market Estimated Value in (2025 E) | USD 11.5 billion |

| Thermal Insulation Coating Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The thermal insulation coating market occupies a specialized but expanding share within multiple industrial and construction-related segments. In the Industrial Coatings Market, it accounts for approximately 5%, as conventional protective coatings still dominate. Within the Building and Construction Materials Market, its share is about 3%, given that insulation is largely addressed through bulk materials like foams and panels. For the Energy Efficiency Solutions Market, thermal insulation coatings represent nearly 6%, as they contribute to reducing heat transfer in industrial and residential structures. In the Protective Coatings Market, its share is around 4%, reflecting growing use for combined thermal and corrosion resistance in harsh environments. Within the Automotive and Transportation Coatings Market, the share is close to 2%, since thermal coatings are applied in niche areas such as engine compartments and exhaust systems. Growth is driven by rising energy costs, increasing focus on temperature regulation, and stringent regulations on energy efficiency. These coatings are gaining traction in oil and gas facilities, chemical plants, power generation units, and infrastructure projects due to their ability to reduce heat loss and improve safety. Advancements in nanotechnology-based coatings and environmentally compliant formulations further enhance adoption, positioning thermal insulation coatings as a critical solution for energy conservation.

The thermal insulation coating market is gaining significant traction due to the global focus on energy conservation, safety compliance, and rising industrial temperature control demands. Growth is being reinforced by stricter emission regulations and cost-reduction strategies across manufacturing, power, and chemical sectors.

Increased adoption of thermal coatings in high-temperature environments has been supported by their multifunctionality—enabling both thermal protection and corrosion resistance without added bulk. Investments in sustainable industrial infrastructure and demand for lightweight alternatives to traditional insulation materials are creating a robust commercial outlook.

Technological advancements in formulation chemistry and application techniques are also expanding the use cases of thermal insulation coatings across temperature ranges and substrate types, paving the way for scalable deployment across sectors.

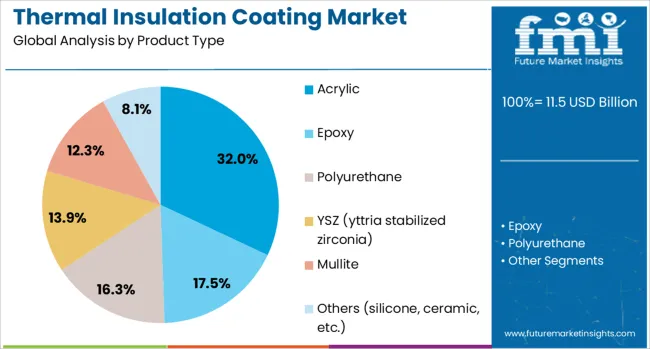

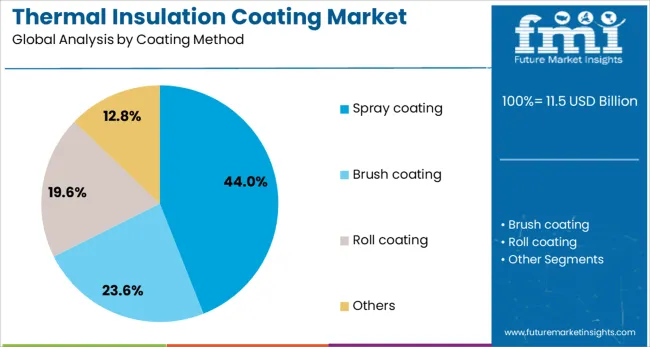

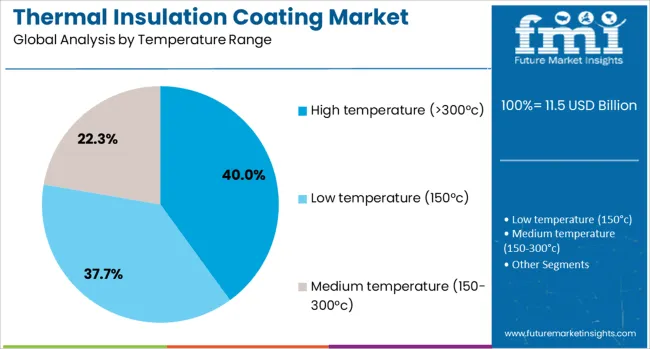

The thermal insulation coating market is segmented by product type, coating method, temperature range, application, end use, and distribution channel and geographic regions. By product type of the thermal insulation coating market is divided into Acrylic, Epoxy, Polyurethane, YSZ (yttria stabilized zirconia), Mullite, and Others (silicone, ceramic, etc.). In terms of coating method of the thermal insulation coating market is classified into Spray coating, Brush coating, Roll coating, and Others. Based on temperature range of the thermal insulation coating market is segmented into High temperature (>300°c), Low temperature (150°c), and Medium temperature (150-300°c).

By application of the thermal insulation coating market is segmented into Heat barrier, Acoustic insulation, Fire protection, Anti-condensation, and Others. By end use of the thermal insulation coating market is segmented into Building & construction, Industrial, Oil & gas, Chemical processing, Power generation, Automotive & transportation, Aerospace & defense, Marine, and Others. By distribution channel of the thermal insulation coating market is segmented into Direct and Indirect. Regionally, the thermal insulation coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Acrylic coatings are expected to contribute 32.00% of the total revenue in the thermal insulation coating market by 2025, emerging as the leading product type. This segment's dominance is being supported by its superior adhesion, UV resistance, and cost-efficiency, especially in moderate to high-temperature industrial settings.

The water-based formulation options and environmental compliance advantages of acrylic coatings have made them a preferred solution in energy plants, refineries, and manufacturing facilities.

The segment has also benefitted from increasing demand for non-toxic, low-VOC coatings aligned with global green building and industrial sustainability standards.

Spray coating is forecast to hold 44.00% of the overall market share in 2025, leading the coating method category. The growth of this segment is being driven by its rapid application speed, uniform layer deposition, and suitability for large-scale industrial surfaces.

Industries requiring minimal downtime and consistent coating thicknesses have increasingly adopted spray-based methods for thermal protection. The method's compatibility with both water- and solvent-based systems has broadened its adoption across indoor and outdoor applications.

Its use has been further reinforced by its cost-effectiveness in covering complex geometries and hard-to-reach surfaces.

The high temperature (>300°C) segment is projected to account for 40.00% of the market revenue in 2025, making it the leading temperature range. This growth is supported by expanding thermal insulation requirements in power generation, petrochemical processing, and heavy manufacturing industries.

As equipment and pipelines operate under extreme heat conditions, the need for coatings that maintain structural integrity and thermal performance has intensified. Products tailored for high-temperature applications have demonstrated strong durability and insulation performance, leading to lower maintenance costs and extended service life of industrial assets.

The shift toward heat-intensive renewable energy and advanced processing operations is expected to reinforce demand in this segment.

The thermal insulation coating market is witnessing growth due to increased demand for energy efficiency and enhanced protection across industrial and infrastructure projects. Growth in 2024 and 2025 was fueled by applications in power generation, oil and gas, and automotive sectors for heat management and corrosion resistance. Opportunities exist in aerospace coatings, marine environments, and smart building materials. Key trends include advanced ceramic-based coatings, nanotechnology integration, and multifunctional thermal barriers. However, high product costs, application complexities, and limited awareness in cost-sensitive regions remain key barriers restricting broader market penetration globally.

The primary growth driver is the growing requirement for effective heat management in industrial operations and structural systems. In 2024 and 2025, demand surged in power plants, chemical processing units, and automotive exhaust systems where temperature regulation and corrosion control are critical. Thermal insulation coatings reduced energy loss and minimized surface degradation, improving operational efficiency. Expansion of infrastructure projects incorporating thermal coatings in pipelines and storage tanks reinforced adoption. These factors confirm that energy optimization and asset protection continue to shape demand for advanced thermal coating solutions globally.

Significant opportunities exist in sectors requiring extreme temperature resistance and lightweight solutions. In 2025, aerospace manufacturers increased adoption of thermal insulation coatings in engine components and fuselage structures for improved performance. Marine vessels and offshore platforms also presented opportunities where corrosion protection and thermal control are vital. Growing interest in thermal coatings for smart construction materials and renewable energy systems opened new avenues for suppliers. These developments suggest that companies investing in specialized formulations for high-performance environments are positioned to secure competitive advantages in this growing segment.

Emerging trends emphasize the development of nanotechnology-enabled coatings and ceramic-based solutions to enhance performance. In 2024, nano-insulation coatings gained popularity for their superior thermal resistance, durability, and thin-film application advantages. Ceramic-filled coatings were increasingly used in industrial furnaces and energy systems to deliver long-term thermal stability under harsh operating conditions. Multifunctional coatings combining thermal insulation with anti-corrosive and water-resistant properties became a focal point for high-value projects. These patterns indicate a market transition toward innovative coating solutions that offer enhanced efficiency and durability across industrial and infrastructure applications.

Market restraints are driven by elevated raw material costs and technical challenges during application. In 2024 and 2025, the premium pricing of advanced ceramic and nano-based coatings limited adoption in price-sensitive markets, particularly in residential and small-scale industrial projects. Application complexities requiring specialized equipment and skilled labor further added to installation costs. Inconsistent performance under extreme environmental conditions also created reluctance among end-users. These challenges underscore the need for cost-optimized formulations, streamlined application processes, and durability improvements to ensure broader acceptance of thermal insulation coatings worldwide.

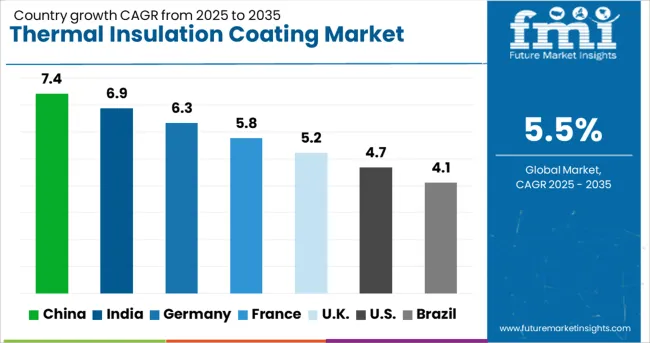

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global thermal insulation coating market is projected to grow at 5.5% CAGR between 2025 and 2035. China leads with 7.4% CAGR, supported by industrial upgrades and the push for energy-efficient infrastructure. India follows at 6.9%, driven by rapid construction and demand for thermal barrier coatings in automotive and power sectors. France records 5.8% CAGR, emphasizing green building compliance and adoption in aerospace applications. The United Kingdom grows at 5.2%, while the United States posts 4.7%, reflecting steady demand in mature markets focusing on sustainable and high-performance coatings for industrial and residential insulation. Asia-Pacific dominates due to cost-effective production and large-scale infrastructure projects, while Europe and North America lead in eco-friendly coating technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The thermal insulation coating market in China is forecasted to grow at 7.4% CAGR, driven by government energy-efficiency mandates and expansion in construction, marine, and industrial sectors. Adoption of ceramic-based coatings for pipelines and storage tanks is rising, along with reflective coatings in commercial buildings. Manufacturers focus on waterborne, low-VOC formulations to meet environmental regulations, while premium coatings with corrosion resistance and thermal stability gain popularity in petrochemical plants. Rising demand in electric vehicle battery enclosures adds a new growth dimension.

The thermal insulation coating market in India is projected to grow at 6.9% CAGR, supported by infrastructure development and strong demand from oil, gas, and power sectors. High-temperature resistant coatings dominate pipelines, refinery equipment, and process vessels. Growing urban construction and the adoption of green building certifications increase use in residential and commercial applications. Local manufacturers develop cost-effective coatings to cater to the price-sensitive market, while global firms introduce advanced polymer-ceramic composites for premium projects.

The thermal insulation coating market in France is expected to grow at 5.8% CAGR, driven by EU energy-efficiency standards and renovation programs in aging infrastructure. Demand for high-performance coatings rises in aerospace, automotive, and building segments. Manufacturers develop nanostructured coatings with superior thermal resistance and low emissivity to support sustainability goals. Advanced spray technologies reduce coating thickness while maintaining insulation efficiency, improving adoption in space-constrained designs.

The thermal insulation coating market in the United Kingdom is forecasted to grow at 5.2% CAGR, supported by retrofitting initiatives and demand for energy-saving solutions in commercial spaces. Coatings with combined benefits of insulation, fire resistance, and water repellence gain traction in building applications. Industrial sectors prioritize coatings designed for corrosion and temperature control in offshore oil facilities and power plants. Partnerships between coating suppliers and construction firms accelerate adoption in large-scale infrastructure projects.

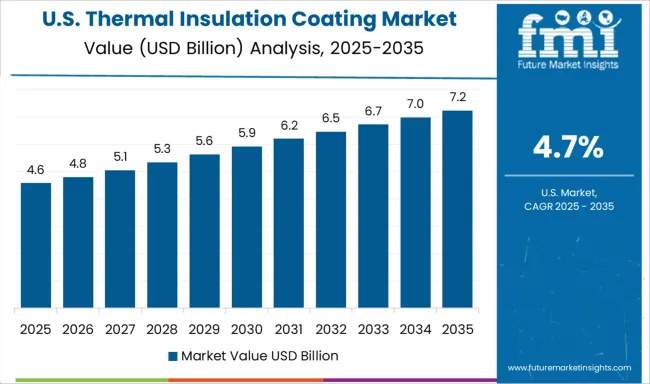

The thermal insulation coating market in the United States is projected to grow at 4.7% CAGR, reflecting stable adoption in mature markets driven by sustainability targets and energy cost reduction. Advanced coatings find applications in industrial equipment, pipelines, and HVAC systems. Demand for ceramic-filled polymer coatings grows in oil and gas infrastructure for high-temperature resistance. Coatings with IR-reflective and low-VOC formulations gain momentum in green-certified construction. Defense and aerospace sectors adopt nanotechnology-based coatings for lightweight thermal protection systems.

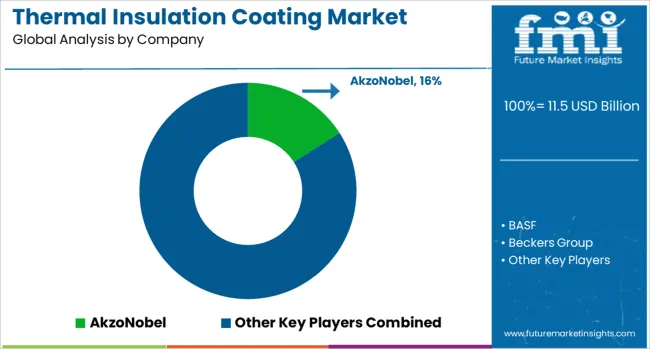

The thermal insulation coating market is dominated by AkzoNobel, which secures its leadership through advanced coating technologies engineered for energy efficiency and surface protection in industrial and commercial applications. AkzoNobel’s dominance is reinforced by its wide product portfolio, global distribution capabilities, and strong focus on performance-based formulations tailored for harsh environments.

Key players such as BASF, PPG Industries, Sherwin-Williams, Nippon Paint Holdings, and Dow Chemical maintain significant market shares by delivering insulation coatings designed for heat management, corrosion resistance, and durability across sectors such as oil and gas, automotive, and construction. These companies emphasize compliance with global performance standards and leverage R&D for innovative, application-specific coatings that enhance thermal efficiency while reducing maintenance costs.

Emerging players including Hempel, Jotun, KCC Corporation, Beckers Group, Morgan Advanced Materials, Rheem Manufacturing, Saint-Gobain, Sto, and Thermo-Guard are strengthening their market position by introducing specialized solutions for building facades, pipelines, and energy systems. Their strategies include improving ease of application, focusing on eco-friendly coating chemistries, and expanding regional production capabilities to cater to growing demand in infrastructure development and retrofitting projects.

Market growth is driven by the rising need for energy conservation, stringent industrial standards for heat management, and increased demand for lightweight insulation alternatives. Innovations in nanotechnology-based coatings and multifunctional thermal barriers are expected to influence future competitive dynamics globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.5 Billion |

| Product Type | Acrylic, Epoxy, Polyurethane, YSZ (yttria stabilized zirconia), Mullite, and Others (silicone, ceramic, etc.) |

| Coating Method | Spray coating, Brush coating, Roll coating, and Others |

| Temperature Range | High temperature (>300°c), Low temperature (150°c), and Medium temperature (150-300°c) |

| Application | Heat barrier, Acoustic insulation, Fire protection, Anti-condensation, and Others |

| End Use | Building & construction, Industrial, Oil & gas, Chemical processing, Power generation, Automotive & transportation, Aerospace & defense, Marine, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel, BASF, Beckers Group, Dow Chemical, Hempel, Jotun, KCC Corporation, Morgan Advanced Materials, Nippon Paint Holdings, PPG Industries, Rheem Manufacturing, Saint-Gobain, Sherwin-Williams, Sto, and Thermo-Guard |

| Additional Attributes | Dollar sales by coating type (ceramic, intumescent, elastomeric) and end-use sector (industrial, commercial, residential), segmented by application (spray, brush, roll). Regional growth varies with stricter fire codes. Buyers demand low-VOC, recyclable formulations. Innovations include nanomaterial-enhanced thermal coatings and fire-rated systems for energy-efficient buildings and industrial heat recovery applications. |

The global thermal insulation coating market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the thermal insulation coating market is projected to reach USD 19.6 billion by 2035.

The thermal insulation coating market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in thermal insulation coating market are acrylic, epoxy, polyurethane, ysz (yttria stabilized zirconia), mullite and others (silicone, ceramic, etc.).

In terms of coating method, spray coating segment to command 44.0% share in the thermal insulation coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thermal Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulated Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA