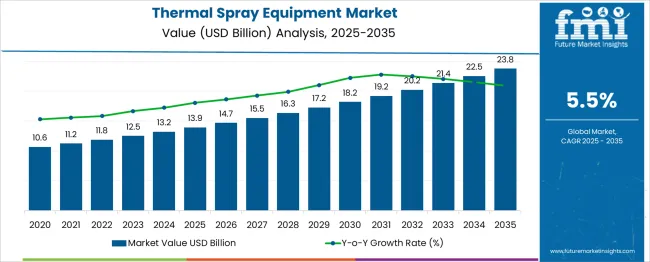

The Thermal Spray Equipment Market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. A 10-year growth comparison highlights a balanced yet slightly accelerating trajectory driven by increased demand for wear-resistant and corrosion-protective coatings across aerospace, automotive, energy, and industrial machinery sectors. In the first half of the period (2025–2030), the market moves from USD 13.9 billion to USD 18.2 billion, contributing approximately USD 4.3 billion, or 43% of the total incremental growth, fueled by heightened adoption of thermal spray processes in aerospace maintenance, engine components, and energy infrastructure applications.

The second half (2030-2035) delivers a stronger contribution of USD 5.6 billion, taking the market from USD 18.2 billion to USD 23.8 billion, which equals 57% of total growth, driven by automation in coating systems, advancements in high-velocity oxygen fuel (HVOF) technology, and expansion of thermal spray in medical implants and semiconductor manufacturing. Opportunities in this phase will favor suppliers integrating robotic process automation, energy-efficient spray systems, and digital monitoring tools to enhance precision and reduce operational costs, positioning them strongly in a market transitioning toward performance-driven coating solutions.

| Metric | Value |

|---|---|

| Thermal Spray Equipment Market Estimated Value in (2025 E) | USD 13.9 billion |

| Thermal Spray Equipment Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The thermal spray equipment segment commands significant niche share across multiple industrial coating and repair sectors. Within the surface coating and protection equipment market, it holds 15–17%, as thermal spray systems are widely adopted for high-performance surface finishes in industrial environments. In the industrial wear-resistant and surface engineering tools market, share increases to 12–14%, where thermal spray competes with welding overlays and plating for durability-critical parts.

Contribution to the aerospace and defense deposition market stands at 18–20%, reflecting its essential role in engine component refurbishment, heat resistant coatings, and airframe maintenance. In the automotive engine and component repair equipment segment, thermal spray systems contribute 8–10%, driven by demand for cost-effective engine rebuilds and enhanced corrosion protection. Within the larger advanced manufacturing equipment market, share is 5–6%, as thermal spray tools integrate into additive manufacturing and hybrid machining workflows. Intense demand from industries requiring high-temperature protection, friction reduction, and repair of mission-critical assets continues to drive adoption. Innovations such as high-velocity oxygen fuel (HVOF) systems, robotic spray integration, and nanostructured powder coatings enhance precision, efficiency, and coating performance, positioning thermal spray equipment as a key enabler in high-performance surface treatment and industrial refurbishment.

The growing need for enhanced wear resistance, corrosion protection, and thermal insulation has positioned thermal spray as a preferred method for component life extension and performance enhancement.

Advancements in material science, combined with the integration of robotics and automation, are enabling greater process precision and repeatability. Additionally, sustainability pressures and cost considerations are influencing industries to adopt thermal spray processes as an alternative to traditional electroplating or hard chrome methods.

As infrastructure investment rises globally and high-performance machinery becomes more integral to productivity, the market is projected to benefit from rising replacement cycles and equipment upgrades. The increasing adoption of thermal spray in emerging economies, supported by technical training initiatives and capital equipment investments, further reinforces the growth trajectory of this sector..

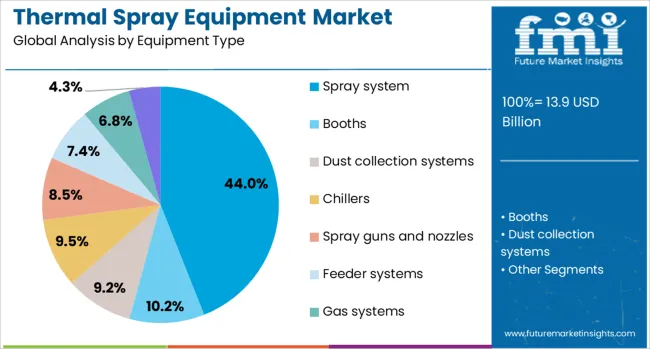

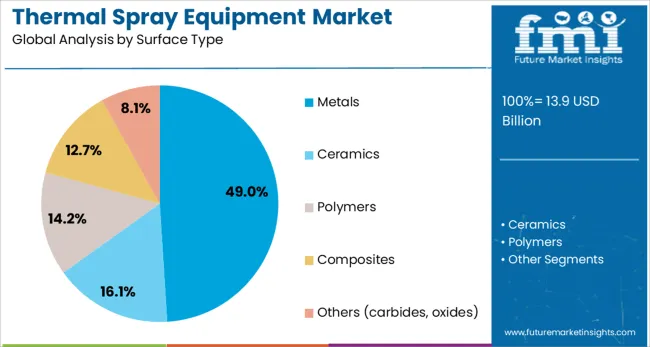

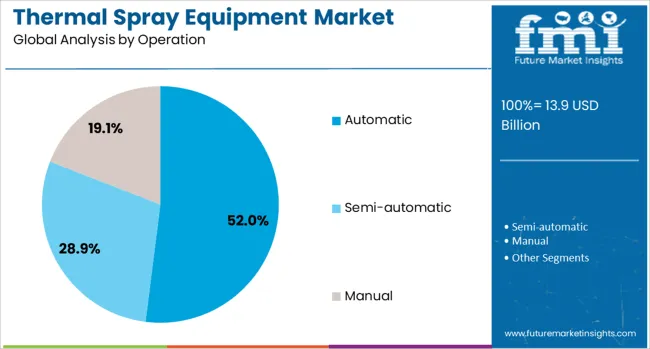

The thermal spray equipment market is segmented by equipment type, surface type, operation, end use industry, distribution channel and geographic regions. The thermal spray equipment market is divided into equipment types, such as Spray systems, Booths, Dust collection systems, Chillers, Spray guns and nozzles, Feeder systems, Gas systems, and Others (gas detection systems). The surface type of the thermal spray equipment market is classified into Metals, Ceramics, Polymers, Composites, and Others (carbides, oxides). The operation of the thermal spray equipment market is segmented into Automatic, Semi-automatic, and Manual. By end-use industry, the thermal spray equipment market is segmented into Aerospace, Automotive, Electronics, Biomedical, Manufacturing, Oil and gas, Energy and power, and Others (Medical devices, etc.). By distribution channel of the thermal spray equipment market is segmented into Direct and Indirect. Regionally, the thermal spray equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spray system subsegment within the equipment type segment is expected to hold 44% of the Thermal Spray Equipment market revenue share in 2025, emerging as the leading category. This dominance has been attributed to the integral role spray systems play in the core application of thermal coating processes.

These systems have been preferred due to their ability to deliver consistent coating thickness, efficient material usage, and compatibility with a wide range of feedstock materials including ceramics, metals, and polymers. The scalability of spray systems across manual and automated configurations has made them versatile for both small-scale workshops and large industrial operations.

Furthermore, the growing use of high-performance components in aerospace and power generation sectors has created demand for reliable and precise coating equipment, which spray systems are equipped to provide. Technological advancements in nozzle design and process control interfaces have enhanced their operational accuracy, contributing to their continued leadership in the equipment type category..

The metals subsegment under the surface type segment is projected to command 49% of the Thermal Spray Equipment market revenue share in 2025, indicating its leading position in the category. This growth has been driven by the widespread use of metal substrates across multiple high-value industries including automotive, aerospace, and heavy engineering.

The ability of thermal spray processes to significantly improve the functional characteristics of metal components such as hardness, corrosion resistance, and heat tolerance has made this method increasingly essential. Metals offer excellent adhesion properties for a variety of coating materials, enabling manufacturers to enhance component performance without altering base material properties.

Additionally, the rising focus on refurbishing and remanufacturing metal parts to reduce costs and environmental impact has led to increased adoption of thermal spray techniques. The segment continues to benefit from the demand for durable protective coatings on turbine blades, engine parts, and industrial tools, positioning metals as the preferred surface type in the market..

The automatic subsegment within the operation segment is anticipated to account for 52% of the Thermal Spray Equipment market revenue share in 2025, leading the segment by a significant margin. This has been driven by the manufacturing sector’s increasing emphasis on precision, productivity, and repeatability.

Automation has enabled tighter control over spray parameters, resulting in improved coating uniformity and reduced material waste. The shift toward smart manufacturing and digitalization has further encouraged the integration of programmable spray robots and CNC systems, allowing for consistent execution of complex geometries and high-volume production.

Labor cost optimization and safety considerations have also accelerated the move toward automatic thermal spray systems, especially in industries where harsh environments or high-temperature processes are involved. As industrial stakeholders seek to maintain quality standards while scaling operations, the automatic operation mode has emerged as a critical enabler, contributing directly to enhanced throughput and long-term process reliability..

Thermal spray equipment refers to systems that deposit coatings via molten or heated materials using processes such as plasma spray, high-velocity oxy-fuel, and flame spray. These systems are used in aerospace, automotive, power generation, and industrial machinery to enhance wear, corrosion, or thermal resistance. Requirements for surface performance improvement, cost-effective repair options, and component longevity have influenced industry demand. Suppliers offering modular spray systems with automated control, precise material metering, and robust nozzle designs have been competitive. Equipment enabling repeatable coating quality, flexible powder or wire feedstock usage, and streamlined maintenance continues to guide procurement by OEMs and maintenance providers.

Growth in thermal spray adoption has been supported by expanding application in engine component refurbishment, turbine blade protection, and wear-resistant industrial parts. Reduced downtime and lower replacement cost through in‑situ coating restoration have made the technology attractive for maintenance operations. Enhanced surface hardness, oxidation resistance, and thermal insulation offered by coated surfaces have extended equipment lifespan in challenging environments. Manufacturers seeking improved performance under high-temperature or abrasive conditions continue to specify thermal spray systems. Automated spray nozzles and programmable coating sequence features have reinforced demand by precision coating service providers and end users requiring consistent process results.

Adoption has been restricted by high initial investment in thermal spray systems incorporating plasma generators, high-pressure gas supplies, or specialized powder feeders. Operation requires skilled technicians trained in coating parameter control, safety protocols, and material handling, increasing entry barriers for small firms. Compliance with health and safety guidelines due to fume generation and particulate exposure adds regulatory overhead. Process repeatability can be affected by feedstock quality variation, nozzle wear, or inconsistent gas flow. Integration into automated manufacturing lines demands matched conveyor systems and robot arms, driving system complexity. Limited regional availability of certified consumables may restrict uniform performance in global installations.

Opportunities are being realized in service-based spraying models where equipment is leased or supplied as a turn‑key coating solution for repair shops and industrial maintenance teams. Integration of spray systems with robotic arms and in-line inspection systems enhances automation and throughput. Growth in demand for corrosion-resistant coatings in offshore, marine, and petrochemical sectors is expanding specification needs. Collaborative development with feedstock material suppliers for application‑specific powders or wires supports improved surface properties. Expansion of mobile spray units that service field repair sites and infrastructure installations offers flexibility. Bundled offerings including predictive maintenance, process consulting, and spare part supply provide recurring value for providers.

Current trends include the adoption of digital control interfaces with real‑time monitoring of spray parameters such as current, voltage, gas pressure, and coating thickness. Automated powder or wire metering systems with closed‑loop feedback improve coating repeatability. Emerging feedstock formats such as agglomerated nanoparticle powders and ceramic composite wires enhance surface performance. Integrated systems featuring robotic platforms for precise spray pattern control and minimal overspray are gaining acceptance among high-value coating users. Efforts to reduce energy consumption via optimized plasma torch designs and pre-heating mechanisms are underway. Standardization of interface controls supporting multi-vendor system interoperability is influencing supplier roadmaps.

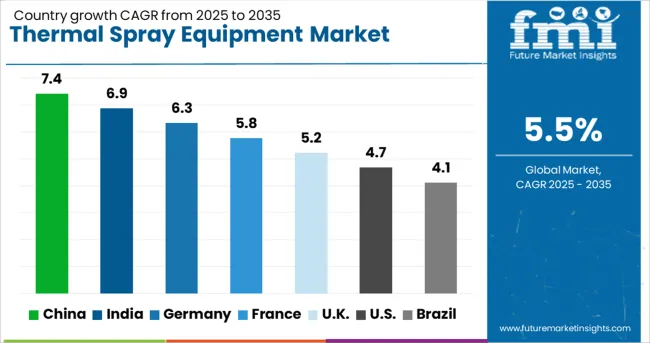

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

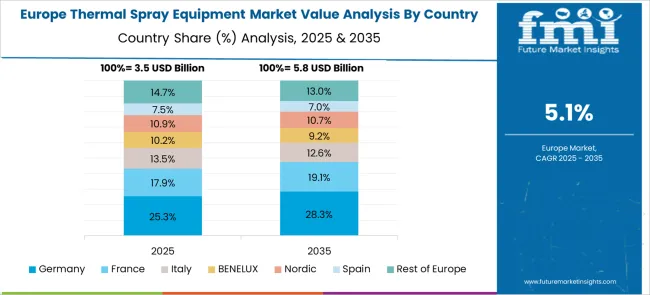

The thermal spray equipment market is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by rising demand in aerospace, automotive, energy, and medical sectors. China leads with 7.4%, driven by industrial expansion and aerospace manufacturing, while India follows at 6.9% due to infrastructure development and demand for wear-resistant coatings. Among developed markets, Germany grows at 6.3%, supported by precision engineering and automotive components, whereas the United Kingdom posts 5.2% and the United States records 4.7%, led by advanced thermal spray technologies and repair services for critical industries. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 7.4% through 2035, driven by expanding industrial and manufacturing sectors. Strong adoption of thermal spray equipment is evident in aerospace, power generation, and automotive industries, where high-performance coatings enhance wear resistance and thermal stability. Domestic suppliers are introducing cost-competitive systems, while global brands are investing in advanced robotic spraying solutions for large-scale manufacturing. Rapid infrastructure growth and renewable energy projects, particularly wind turbine components, further accelerate demand. E-commerce channels and industrial distribution networks improve accessibility for small and mid-scale enterprises, solidifying China’s leadership in the global thermal spray equipment landscape.

India is forecasted to post a CAGR of 6.9% through 2035, supported by infrastructure development and rising adoption of advanced coatings in automotive, railways, and energy sectors. Thermal spray technology is increasingly applied for corrosion protection and wear resistance in turbines, valves, and heavy-duty components. Domestic manufacturers are expanding their product portfolios with cost-effective systems to cater to SME requirements, while partnerships with global players enhance technical capabilities. Increased focus on renewable energy and high-speed rail projects strengthens demand for thermal spray coatings. Government-backed initiatives promoting industrial automation create further opportunities for innovative spraying equipment across multiple industries.

Germany is expected to grow at a CAGR of 6.3% through 2035, driven by demand from automotive, aerospace, and medical device manufacturing sectors. High adoption of thermal spray coatings in engine components and orthopedic implants underlines the country’s focus on precision engineering. Manufacturers are introducing advanced plasma and HVOF (High-Velocity Oxygen Fuel) spraying systems for applications requiring superior adhesion and corrosion resistance. The presence of a robust automotive supply chain and ongoing investments in turbine technology further amplify growth. Research and development in eco-friendly coating materials adds another dimension to market opportunities, positioning Germany as a leading hub for premium-grade thermal spray solutions.

The United Kingdom is projected to post a CAGR of 5.2% through 2035, supported by aerospace maintenance, automotive component repair, and defense applications. Thermal spray systems are widely deployed for engine restoration and surface protection in aerospace and energy sectors. Manufacturers are focusing on compact, automated spraying units suitable for smaller-scale operations. Increased demand for gas turbine refurbishment in power generation boosts the adoption of HVOF and plasma spray processes. Collaborations with research institutes are enhancing innovation in coating materials, creating pathways for advanced applications in industrial and medical fields. E-commerce platforms and distributor networks further aid market expansion across the region.

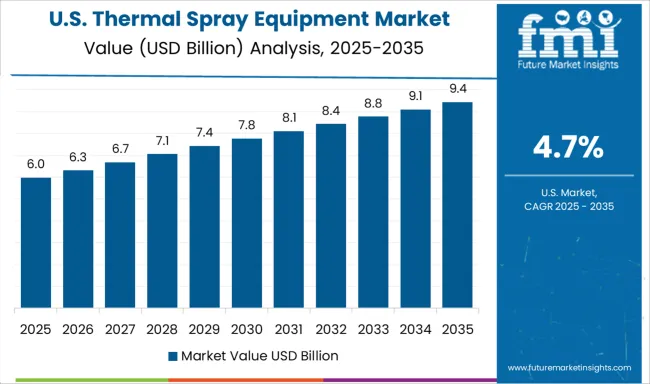

The United States is forecasted to achieve a CAGR of 4.7% through 2035, driven by demand for thermal spray solutions in aerospace, defense, and oil & gas sectors. Market growth is centered on high-value applications requiring wear resistance, corrosion protection, and thermal barriers. Manufacturers are investing in digitalized spraying systems and robotic automation, enhancing precision and operational efficiency. Advanced applications in medical implants and industrial gas turbines further support growth. Strategic partnerships with aerospace OEMs and defense contractors ensure consistent demand, while increasing focus on localized production boosts domestic supply capabilities. With a strong aftermarket for component repair, the US remains a key adopter of advanced thermal spray technologies.

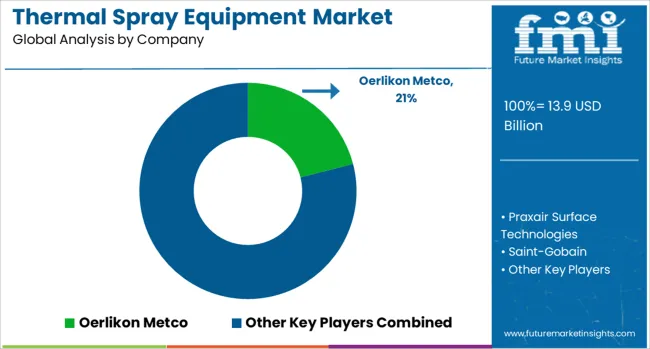

The thermal spray equipment market is dominated by major global players such as Oerlikon Metco, Praxair Surface Technologies, Saint-Gobain, Plasma-Tec Inc., Metallisation Ltd., Sulzer Ltd., and Flame Spray Technologies BV. Oerlikon Metco leads with comprehensive thermal spray systems for industrial applications, including aerospace, automotive, energy, and medical sectors, offering integrated solutions combining hardware, consumables, and coating services. Praxair Surface Technologies focuses on high-performance thermal spray systems designed to enhance wear resistance, corrosion protection, and thermal barrier performance for critical components in gas turbines and heavy machinery.

Saint-Gobain leverages its expertise in advanced materials to provide thermal spray equipment optimized for high-precision coating processes, catering to demanding aerospace and defense requirements. Plasma-Tec Inc. specializes in turnkey thermal spray systems and custom-engineered solutions for specialized industrial coatings, while Metallisation Ltd. and Flame Spray Technologies BV emphasize portable and fixed spray systems that offer versatility across diverse industries, including oil and gas, marine, and general engineering. Sulzer Ltd. differentiates itself through large-scale service capabilities and system upgrades tailored for maintenance and repair operations. Competitive strategies include continuous R&D investment to enhance coating precision, automation integration for process consistency, and development of hybrid systems compatible with both plasma and flame spray techniques. Future growth in this market will be driven by demand for wear- and corrosion-resistant coatings in aerospace, energy, and automotive industries, along with expansion into additive manufacturing and 3D surface coating applications. Companies focusing on automation, IoT-enabled monitoring, and environmentally friendly coating technologies are expected to strengthen their market positions.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.9 Billion |

| Equipment Type | Spray system, Booths, Dust collection systems, Chillers, Spray guns and nozzles, Feeder systems, Gas systems, and Others (gas detection systems) |

| Surface Type | Metals, Ceramics, Polymers, Composites, and Others (carbides, oxides) |

| Operation | Automatic, Semi-automatic, and Manual |

| End Use Industry | Aerospace, Automotive, Electronics, Biomedical, Manufacturing, Oil and gas, Energy and power, and Others (Medical devices, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oerlikon Metco, Praxair Surface Technologies, Saint-Gobain, Plasma-Tec Inc., Metallisation Ltd., Sulzer Ltd., and Flame Spray Technologies BV |

| Additional Attributes | Dollar sales by equipment type (flame spray systems, plasma spray systems, HVOF systems, arc spray systems) and end-use application (aerospace, automotive, energy, industrial machinery), with demand fueled by performance-driven surface enhancement needs. Regional dynamics highlight North America and Europe as mature markets with strong aerospace and energy sectors, while Asia-Pacific records significant growth from expanding manufacturing and infrastructure development. Innovation trends include robotic thermal spray systems, digital controls for precision coating, and advanced material feedstock integration for high-performance surface engineering. |

The global thermal spray equipment market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the thermal spray equipment market is projected to reach USD 23.8 billion by 2035.

The thermal spray equipment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in thermal spray equipment market are spray system, _plasma, _twin arc, _flame spray, _hvof, _powder flame spray, _others (vacuum, etc.), booths, dust collection systems, chillers, spray guns and nozzles, feeder systems, gas systems and others (gas detection systems).

In terms of surface type, metals segment to command 49.0% share in the thermal spray equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA