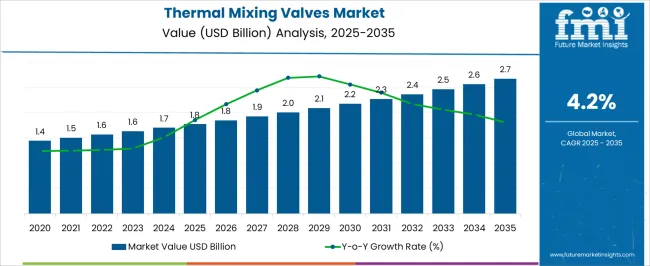

The thermal mixing valves market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

Adoption is being concentrated in domestic hot water systems where scald risk control and stable outlet temperatures are required across healthcare, education, hospitality, and multifamily assets. Preference is seen for thermostatic mixing valves certified under ASSE 1017 at plant level and ASSE 1070 at point of use, with EN 1111 and EN 1287 guiding selections in Europe. Facility managers value tight temperature bands, fail safe shutoff, lead free compliance, and easy maintenance access for strainers and check valves. In retrofit work, compact bodies, union ends, and recirculation friendly layouts shorten downtime, which strengthens contractor preference and supports steady procurement through MEP wholesalers.

From 2030 to 2035, value is expected to widen from roughly USD 2.2 billion to USD 2.7 billion, adding about USD 0.5 billion and maintaining a 4.2 percent CAGR over the full window. Later period gains are projected to come from replacement cycles, public building upgrades, and central mixing stations paired with heat pump water heaters and high efficiency boilers. Legionella risk management programs favor validated thermal disinfection routines and mixers with documented recovery times, which elevates premium models with reliable thermostatic elements and durable springs. Product selection is influenced by tamper resistant settings, accurate low flow performance, dirt tolerant cartridges, and spare part availability through regional distributors. Contractors tend to prioritize valves that integrate with balancing valves and recirculation loops without complex rework. With codes and insurance requirements keeping anti scald protection non negotiable, demand appears resilient across both new construction and renovation, and price mix benefits where certifications and service responsiveness are proven.

| Metric | Value |

|---|---|

| Thermal Mixing Valves Market Estimated Value in (2025 E) | USD 1.8 billion |

| Thermal Mixing Valves Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

Within the global mixing valves market, thermal mixing valves occupy a modest share of approximately 10%, reflecting their specific role among a broader array of valves used across industries. In the industrial thermostatic control valves market, which includes three-way flow controllers and mixing systems for energy, chemical, and hygiene applications, the share contributed by thermal mixing valves is around 5%, indicative of their more limited industrial penetration. Within the HVAC and plumbing components market, their presence rises to roughly 15%, as these valves are increasingly mandated for temperature regulation and safety in building plumbing systems. In the residential and commercial building safety equipment market, thermal mixing valves account for about 20%, driven by widespread adoption for scald prevention and compliance with temperature-control codes.

Finally, within the green and energy-efficient controls market, where sustainability and efficient energy use are key, thermal mixing valves contribute nearly 8%, thanks to their capacity to reduce water waste and improve system efficiency. Overall, these figures reveal that thermal mixing valves are a niche segment in broader valve categories yet play a much larger role within building safety and efficiency-focused markets, underlining how their importance rises in contexts where regulated temperature control and energy savings are critical.

The market is experiencing consistent growth, driven by the increasing emphasis on water safety, temperature control, and energy efficiency in plumbing systems. The adoption of these valves has been supported by stricter building codes, heightened awareness of scald prevention, and the growing integration of smart control mechanisms.

The ability of thermal mixing valves to maintain a stable output temperature regardless of fluctuations in supply water temperature has made them a preferred choice in residential, commercial, and industrial applications. Expansion in urban housing, combined with upgrades in public infrastructure, is creating sustained demand across both developed and developing markets.

Technological advancements in valve design are enhancing performance and reducing maintenance requirements, further boosting market penetration As end users and regulators focus more on water conservation and safe delivery systems, thermal mixing valves are expected to remain an essential component of modern plumbing solutions, with increasing opportunities for integration into advanced building automation systems.

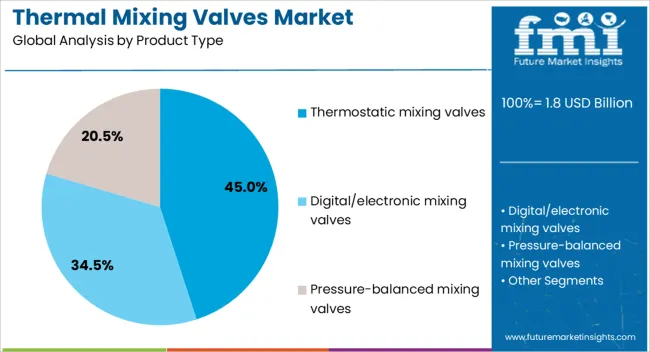

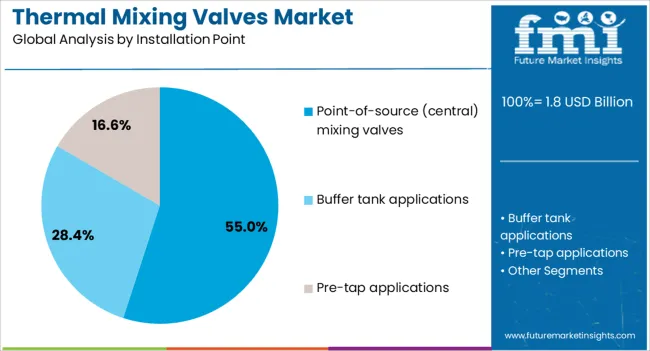

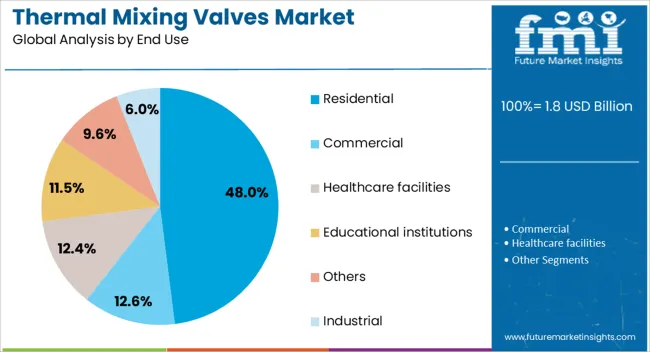

The thermal mixing valves market is segmented by product type, installation point, end use, distribution channel, and geographic regions. By product type, thermal mixing valves market is divided into thermostatic mixing valves, digital/electronic mixing valves, and pressure-balanced mixing valves. In terms of installation point, thermal mixing valves market is classified into point-of-source (central) mixing valves, buffer tank applications, and pre-tap applications. Based on end use, thermal mixing valves market is segmented into residential, commercial, healthcare facilities, educational institutions, industrial, and others. By distribution channel, thermal mixing valves market is segmented into indirect and direct. Regionally, the thermal mixing valves industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermostatic mixing valves segment is projected to account for 45% of the market revenue share in 2025, making it the dominant product type. This growth has been supported by their precision in maintaining consistent water temperature and their critical role in preventing scalding incidents. Adoption has been reinforced by compliance with stringent safety regulations and plumbing codes that mandate temperature control in water distribution systems.

These valves are widely implemented in healthcare facilities, educational institutions, and residential properties due to their reliability and ease of integration. Their capacity for quick response to fluctuations in hot and cold water supply ensures enhanced user safety and comfort.

Energy efficiency benefits, achieved by reducing unnecessary heating, further contribute to their appeal The segment's leadership has also been strengthened by increasing retrofitting projects in older buildings, where upgrading to thermostatic technology provides immediate safety and operational benefits without extensive system modifications.

The point-of-source (central) mixing valves segment is anticipated to hold 55% of the market revenue share in 2025, securing its position as the leading installation point category. Growth in this segment has been attributed to the ability of central mixing systems to deliver temperature-controlled water to multiple outlets from a single location, enhancing both safety and operational efficiency.

Centralized control reduces the complexity of individual outlet regulation and ensures consistent temperature across the distribution network. This approach is particularly beneficial in large buildings and institutional facilities, where it simplifies maintenance and monitoring.

The preference for centralized systems has been supported by their compatibility with advanced monitoring technologies and integration with building management systems Additionally, cost efficiencies are realized through reduced installation of multiple point-of-use devices, making central mixing valves a practical solution for large-scale projects seeking long-term reliability and compliance with safety standards.

The residential segment is expected to command 48% of the thermal mixing valves market revenue share in 2025, emerging as the largest end-use category. This growth is being driven by the increasing demand for enhanced safety features in domestic hot water systems, alongside rising awareness of scald prevention in households with children and elderly individuals. Homeowners are increasingly investing in systems that provide precise temperature control while conserving energy and water.

The widespread adoption of thermostatic technology in residential settings has been reinforced by updated plumbing codes and regulations that prioritize user safety. Additionally, the growth of new housing developments and renovations is contributing to steady installation rates.

Manufacturers are offering compact, aesthetically compatible designs that align with modern home layouts, further encouraging adoption The integration of these valves into residential water heating systems has become a standard in many regions, ensuring the segment's continued dominance in the overall market.

The thermal mixing valves market is advancing as water safety, hygiene, and efficiency remain priorities in residential, healthcare, and commercial facilities. Opportunities are expanding in healthcare and hospitality, while trends emphasize smart integration and energy-efficient plumbing designs. High costs, installation complexity, and competition from low-cost substitutes remain challenges. In my opinion, manufacturers who innovate with durable, precise, and user-friendly designs while maintaining cost efficiency will secure long-term growth, making thermal mixing valves a critical component of modern water management systems worldwide.

Demand for thermal mixing valves has been reinforced by the need for consistent water temperature control in residential, commercial, and healthcare facilities. These valves ensure safety by preventing scalding and delivering precise temperature regulation, making them integral to plumbing systems. Rising construction activity and growing emphasis on water efficiency have increased adoption across housing, hotels, and institutional buildings. In my opinion, demand will remain strong as end users prioritize comfort, safety, and compliance with water safety regulations, pushing manufacturers to supply reliable and durable mixing solutions..

Opportunities are emerging in healthcare and hospitality, where strict hygiene and safety standards mandate advanced water management systems. Hospitals are adopting thermal mixing valves to reduce risks of scalding and bacterial growth in plumbing, while hotels are integrating them to enhance guest safety and comfort. Opportunities also exist in retrofitting projects for aging infrastructure, where upgrades are required to meet modern safety codes. I believe that manufacturers offering valves with advanced temperature accuracy, durability, and easy maintenance will capture significant opportunities in these high-value sectors.

Trends in the thermal mixing valves market highlight integration with smart building systems and energy-efficient plumbing designs. Demand for valves compatible with digital monitoring and automated controls is growing, especially in large-scale facilities seeking to optimize water heating and reduce wastage. Manufacturers are focusing on compact designs with improved corrosion resistance to enhance service life. In my opinion, the move toward smart integration signifies that the market is evolving beyond conventional plumbing components, with advanced features becoming critical for differentiation and long-term adoption across modern infrastructure projects.

Challenges in this market are tied to high installation costs and complexity, which limit adoption among smaller projects and budget-sensitive users. Retrofitting existing systems often requires significant labor and technical expertise, creating additional barriers. Maintenance of valves in large-scale facilities also adds operational costs, deterring some buyers. Competition from low-cost alternatives with limited precision creates further challenges for premium valve manufacturers. In my assessment, the market will favor suppliers who can offer cost-efficient, easy-to-install, and durable valves, as these characteristics will address key pain points faced by contractors and facility managers.

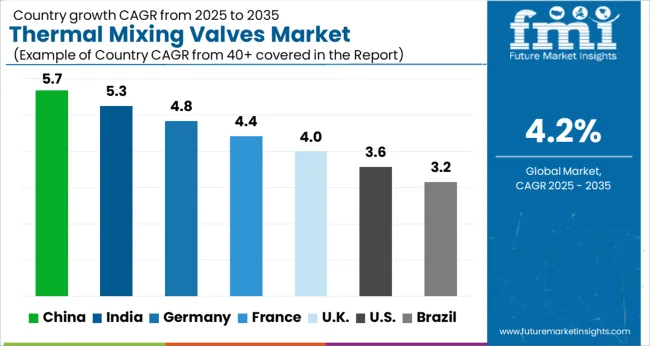

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global thermal mixing valves market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads with a growth rate of 5.7%, followed by India at 5.3%, and France at 4.4%. The United Kingdom records a growth rate of 4%, while the United States shows the slowest growth at 3.6%. Demand is driven by rising construction activity, stricter safety regulations on water heating systems, and growing use of energy-efficient plumbing solutions. Emerging economies such as China and India are experiencing stronger growth from infrastructure projects and residential expansion, while mature markets like the USA and UK focus on retrofitting older systems and compliance with water safety standards.

The thermal mixing valves market in China is projected to grow at a CAGR of 5.7%. Rapid urbanization and significant investments in residential and commercial construction are major growth drivers. Government emphasis on improving water safety standards in public and private buildings is encouraging widespread adoption of mixing valves. Rising demand for energy-efficient plumbing systems and advanced sanitary fittings is further boosting market expansion. The presence of both domestic manufacturers and international suppliers ensures competitive pricing and a growing variety of products tailored for large-scale infrastructure projects.

The thermal mixing valves market in India is expected to grow at a CAGR of 5.3%. Rising urban housing demand, rapid infrastructure development, and government initiatives in smart cities contribute significantly to adoption. The hospitality and healthcare sectors are increasingly installing thermal mixing valves to meet safety and efficiency standards. Growing consumer awareness about water temperature control and scald prevention is also driving demand in residential markets. With expanding plumbing and sanitation projects, particularly in urban areas, India presents strong opportunities for both domestic and global manufacturers.

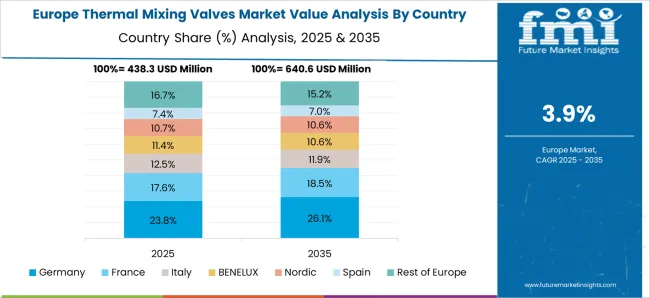

The thermal mixing valves market in France is projected to grow at a CAGR of 4.4%. Strong regulations regarding water temperature safety in residential and healthcare facilities are driving consistent demand. Adoption is also supported by France’s commitment to energy efficiency in building systems, where mixing valves play a crucial role in reducing energy consumption. Renovation projects in residential housing and commercial buildings are increasing the replacement demand. Consumer preference for advanced plumbing fixtures with higher durability and safety features further strengthens the market outlook.

The thermal mixing valves market in the UK is projected to grow at a CAGR of 4%. Growth is primarily driven by compliance with water safety standards and retrofitting older plumbing systems. Rising consumer demand for scald prevention and energy efficiency in water heating systems supports market expansion. Increased adoption of thermal mixing valves in healthcare facilities, nursing homes, and hospitality establishments ensures steady demand. Innovation in plumbing products and the presence of European manufacturers offering advanced solutions are also key factors shaping the market’s trajectory.

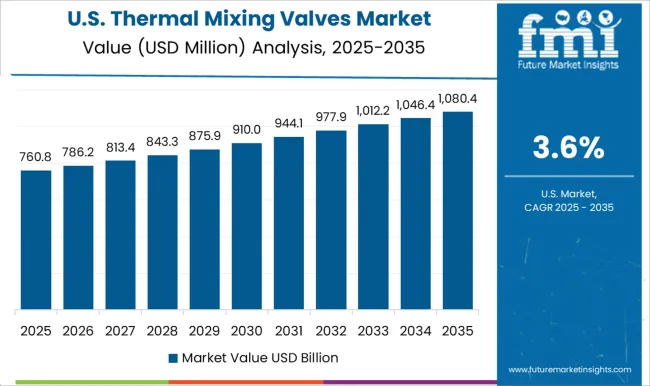

The thermal mixing valves market in the USA is projected to grow at a CAGR of 3.6%. While growth is slower compared to emerging economies, steady demand is sustained by residential renovations, replacement of outdated plumbing systems, and compliance with water temperature safety regulations. Increasing use in healthcare, education, and public infrastructure projects contributes to stable market expansion. Manufacturers are focusing on developing valves with improved energy efficiency and durability to meet consumer expectations. The market is also supported by growing awareness of scald prevention and the importance of water management solutions.

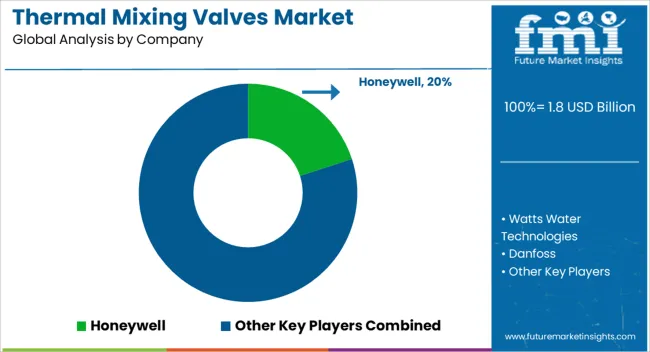

Competition in the thermal mixing valves market has been shaped by a group of established manufacturers known for their expertise in fluid control and building safety systems. Honeywell has been recognized for its advanced engineering and integration of thermal mixing solutions across residential, commercial, and industrial applications, where emphasis has been placed on temperature stability and compliance with safety standards. Watts Water Technologies has been driving competition by offering a broad portfolio of plumbing and heating products, where thermal mixing valves have been promoted as essential components for healthcare, hospitality, and residential hot water systems. Danfoss has been leveraging its wide presence in heating and cooling technologies, embedding thermal mixing valves into energy-efficient building solutions and positioning itself as a reliable global supplier.

Caleffi has been establishing authority with Italian precision manufacturing, tailoring its valve range for professional installers and contractors who prioritize reliability, compact design, and ease of service. Giacomini has been strengthening its footprint with specialized valve solutions that combine tradition with innovation, addressing domestic hot water systems as well as district heating networks. MTS has been focusing on consistent valve technology for industrial and institutional requirements, emphasizing dependable performance in facilities where hot water regulation is critical for safety and efficiency. Distinct positioning has been observed across these players, influencing market rivalry through product breadth, technical innovation, and distribution reach. Honeywell and Danfoss have been identified as system-integrated leaders, where thermal mixing valves are marketed as part of wider building management ecosystems.

Watts Water Technologies has been balancing cost efficiency with global distribution, ensuring strong availability for contractors and wholesale networks. Caleffi and Giacomini have been emphasizing craftsmanship and technical specialization, appealing to installers who prioritize reliability and long service life. MTS has been seen as more application-specific, focusing on industrial-grade designs tailored for sectors requiring continuous safety assurance. The competitive environment has therefore been shaped by how effectively each brand can meet expectations for safety compliance, ease of installation, and adaptability to both domestic and commercial applications. Market perception has been leaning toward suppliers that combine reliable engineering with long-term service support, creating strong brand loyalty across construction and facility management stakeholders.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Product Type | Thermostatic mixing valves, Digital/electronic mixing valves, and Pressure-balanced mixing valves |

| Installation Point | Point-of-source (central) mixing valves, Buffer tank applications, and Pre-tap applications |

| End Use | Residential, Commercial, Healthcare facilities, Educational institutions, Others, and Industrial |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell, Watts Water Technologies, Danfoss, Caleffi, and Giacomini |

| Additional Attributes | Dollar sales by product type (point-of-use vs master mixing valves), Dollar sales by application (residential, commercial, healthcare, industrial), Trends in hot water safety and scald prevention, Use in hospitals, hotels, and multi-family housing, Growth of thermostatic technology integration, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global thermal mixing valves market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the thermal mixing valves market is projected to reach USD 2.7 billion by 2035.

The thermal mixing valves market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in thermal mixing valves market are thermostatic mixing valves, digital/electronic mixing valves and pressure-balanced mixing valves.

In terms of installation point, point-of-source (central) mixing valves segment to command 55.0% share in the thermal mixing valves market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Management Market Size and Share Forecast Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA