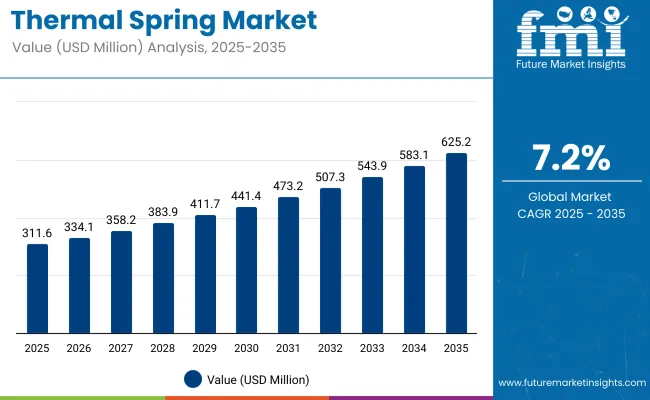

The Thermal Spring Market is expected to record a valuation of USD 311.6 million in 2025 and USD 625.2 million in 2035, with an increase of USD 313.6 million, which equals a growth of 100.6% over the decade. The overall expansion represents a CAGR of 7.2% and a 2X increase in market size.

Thermal Spring Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 311.6 million |

| Market Forecast Value in (2035F) | USD 625.2 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 311.6 million to USD 441.4 million, adding USD 129.8 million, which accounts for 41.4% of the total decade growth. This phase records steady adoption in hydration & refreshment, sensitive skin relief, and post-dermatological procedure recovery, driven by the demand for natural wellness products. Thermal water sprays / face mists dominate this period as they cater to over 38.7% of global sales.

The second half from 2030 to 2035 contributes USD 183.8 million, equal to 58.6% of total growth, as the market jumps from USD 441.4 million to USD 625.2 million. This acceleration is powered by premium & luxury spa-sourced offerings, AI-driven personalization in beauty treatments, and integration with hybrid wellness kits in home-spa ecosystems. 100% pure thermal spring water products lead in the ingredient segment with 43.6% share, while premium-tier products steadily expand their footprint across emerging markets such as China and India.

From 2020 to 2024, the Thermal Spring Market grew from USD 240.5 million to USD 298.3 million, driven primarily by facial care adoption, especially thermal water sprays and moisturizing creams. During this period, the competitive landscape was dominated by Avène, La Roche-Posay, and Vichy, which together controlled nearly 58% of revenue.

These leaders focused on dermatologically tested formulations, brand heritage, and clinical endorsements to maintain consumer trust and premium positioning. Competitive differentiation relied on skin sensitivity expertise, therapeutic branding, and strong dermatology channel partnerships. Emerging spa and ingestible wellness formats had limited traction, contributing less than 8% of total market value.

Demand for thermal spring products is projected to expand to USD 311.6 million in 2025, with the revenue mix gradually diversifying as professional/spa treatments and emerging ingestible beauty formats grow to over 15% share by 2035. Traditional leaders face rising competition from Asian premium skincare brands and digital-first wellness companies offering subscription-based routines and personalized recommendations.

Major incumbents are pivoting toward multi-format product lines, combining topical, ingestible, and spa treatments to retain relevance. Competitive advantage is shifting from product heritage alone to ecosystem strength, cross-category integration, and science-backed consumer personalization.

In the USA, Japan, and parts of Europe, thermal spring formulationsespecially 100% pure thermal spring water spraysare increasingly prescribed or recommended by dermatologists for post-procedure recovery, sensitive skin relief, and chronic skin conditions. This medical endorsement shifts them from being “luxury wellness” to quasi-therapeutic products, expanding their reach into pharmacy and hospital retail channels, where purchase frequency and trust are significantly higher.

Thermal spring products are now embedded into bundled “spa + home care” packages sold at wellness resorts and thermal tourism outlets. This cross-selling not only captures tourists at high-spend moments but also creates repeat demand when travelers continue using the same branded products at homeeffectively extending the thermal spring experience beyond the spa environment.

The Thermal Spring Market is segmented by product type, function, ingredient, price tier, distribution channel, and region. Product types include facial care, body care, hair & scalp care, professional/spa products, post-procedure aftercare, and emerging formats, reflecting the breadth of applications from daily skincare to therapeutic treatments. Functional segmentation covers hydration & refreshment, sensitive skin relief, soothing & anti-irritation, anti-aging & skin repair, post-dermatological procedure recovery, and relaxation & wellness, catering to both cosmetic and dermatological needs.

By ingredient, the market is classified into 100% pure thermal spring water, mineral-enriched thermal water, thermal water with botanical actives, and thermal water with dermatological actives, addressing varying purity levels and performance benefits.

Price tier segmentation includes mass market, masstige, and premium/luxury, reflecting consumer willingness to pay for provenance and brand prestige. Distribution channels span pharmacies/drugstores, e-commerce, beauty specialty retailers, hotels & spas, department stores, and wellness tourism outlets. Regionally, the market covers North America, Asia-Pacific, and Europe, with country-level focus on the USA, China, Japan, Germany, the UK, and India.

| Product Type | Value Share% 2025 |

|---|---|

| Facial Care | 55.4% |

| Others | 44.6% |

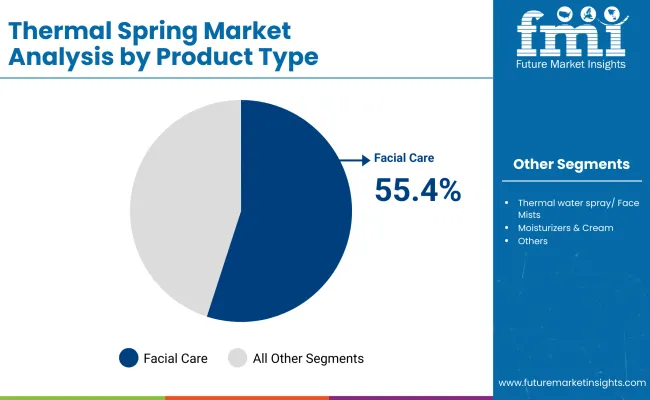

The facial care segment is projected to contribute 55.4% of the Thermal Spring Market revenue in 2025, maintaining its position as the leading product type. This dominance is driven by the popularity of thermal water sprays, mists, moisturizers, and serums formulated for sensitive skin, hydration, and dermatological aftercare. Consumers increasingly prioritize facial products enriched with pure thermal spring water for their soothing and anti-irritation benefits, particularly in urban markets where pollution and environmental stressors heighten skin sensitivity.

Growth in the facial care segment is further supported by premiumization trends and brand storytelling around spa origins and mineral-rich sources, appealing to both mass and luxury buyers. With expanding online availability and targeted dermatologist endorsements, facial care products continue to capture brand loyalty and repeat purchases, ensuring the segment’s stronghold in the market through 2035.

| Functions | Value Share% 2025 |

|---|---|

| Hydration & refreshment | 31.2% |

| Others | 68.8% |

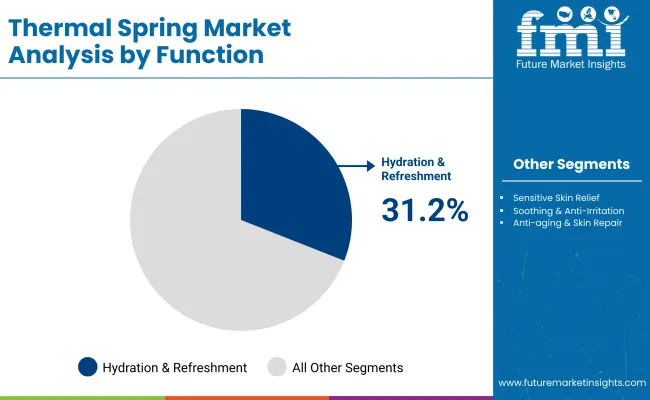

The hydration & refreshment segment is expected to account for 31.2% of the Thermal Spring Market in 2025, driven by its role as the primary appeal of thermal spring water formulations. Products in this category leverage the natural mineral composition of thermal water to deliver instant skin revitalization, making them highly attractive for daily skincare routines and on-the-go use. This function resonates strongly in both hot and dry climates, where skin dehydration is a common concern, as well as in urban areas where environmental stress impacts skin health.

The segment’s growth is further propelled by the rise of multifunctional sprays and mists that combine hydration with soothing, cooling, and antioxidant benefits. Marketing campaigns emphasizing the “fresh-from-the-source” purity of thermal spring water have amplified its premium image, while the convenience of application supports frequent, habitual use. As consumer demand for sensorial, skin-refreshing experiences grows, hydration & refreshment products are poised to retain a significant share of functional demand in the market.

| Ingredient | Value Share% 2025 |

|---|---|

| 100% pure thermal spring water | 43.6% |

| Others | 56.4% |

The 100% pure thermal spring water segment is projected to capture 43.6% of the Thermal Spring Market in 2025, maintaining its position as a cornerstone ingredient in premium skincare. Its appeal stems from being directly sourced from protected geothermal springs, ensuring a naturally mineral-rich profile that is unaltered by additives. This purity factor resonates strongly with health-conscious consumers seeking clean-label and nature-derived products, particularly in sensitive skin care where formulation transparency is crucial.

The segment benefits from strong brand narratives centered on origin, heritage, and scientific validation of skin-soothing benefits. Leading players have invested in traceability and sustainability measures to further strengthen consumer trust. With rising global interest in authenticity and wellness-driven beauty, 100% pure thermal spring water is expected to remain a leading formulation base in both standalone sprays and integrated skincare products.

Post-Procedural Dermatology Adoption

A growing number of dermatologists are prescribing thermal spring water-based products as part of recovery protocols following procedures such as laser resurfacing, chemical peels, and microneedling. The naturally mineral-rich composition of thermal waters offers anti-inflammatory and soothing benefits that accelerate skin healing, making them a trusted post-treatment solution. This medical endorsement is not just boosting credibility but also expanding the market into the clinical skincare segment, ensuring a steady and specialized demand stream from aesthetic clinics and medical spas.

Wellness Tourism Integration

Thermal spring resorts and wellness destinations are increasingly integrating branded skincare lines into their in-house spa treatments and gift shops. This approach enables guests to experience the benefits during their stay and then continue the regimen at home, effectively transforming a one-time spa visit into ongoing product consumption. By bridging the gap between in-person wellness experiences and daily skincare routines, brands are creating a lasting connection that fuels repeat purchases and strengthens consumer loyalty.

Mineral Composition Variability Across Sources

The mineral content of thermal spring water can vary significantly depending on its geographic origin, impacting product consistency and efficacy. For multinational brands, this variability complicates formulation and quality control, often requiring additional processing to standardize the composition. However, this can dilute the perceived “pure origin” appeal that is central to the product’s marketing narrative, making it a delicate balance between maintaining authenticity and meeting global regulatory and performance standards.

Hybrid Spa-to-Home Formats

A rising trend in the market is the development of hybrid formats that connect professional spa treatments with complementary home-care products. Brands are launching curated kits containing both in-spa therapies and matching take-home items formulated with the same thermal spring water. This not only extends the results of professional treatments but also reinforces brand familiarity and loyalty, creating a seamless product experience that bridges the luxury spa environment and the consumer’s personal skincare routine.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 10.4% |

| USA | 3.5% |

| India | 11.2% |

| UK | 6.5% |

| Germany | 4.9% |

| Japan | 8.1% |

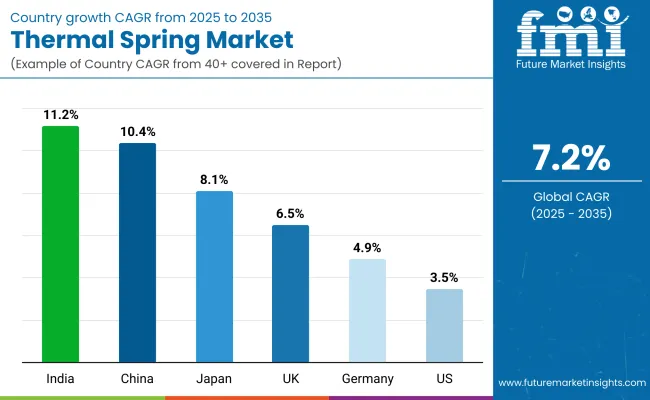

India is projected to lead growth with the highest CAGR of 11.2%, driven by the rapid expansion of premium skincare retail channels and rising consumer awareness of mineral-based wellness products. China follows closely with a CAGR of 10.4%, supported by the booming wellness tourism industry and the integration of thermal spring products into luxury spa offerings. Japan’s steady growth at 8.1% reflects strong domestic demand for sensitive-skin formulations and the influence of traditional ones culture.

The UK, with a CAGR of 6.5%, benefits from increasing adoption of spa-inspired self-care routines, while Germany’s moderate growth at 4.9% is linked to its established therapeutic spa tradition and medical skincare applications. The USA shows slower expansion at 3.5%, reflecting a mature market where growth is largely driven by niche positioning, clinical endorsements, and premium product launches targeting wellness-focused consumers.

| Year | USA Thermal Spring Market (USD Million) |

|---|---|

| 2025 | 79.1 |

| 2026 | 83.9 |

| 2027 | 88.5 |

| 2028 | 94.3 |

| 2029 | 99.7 |

| 2030 | 105.2 |

| 2031 | 112.4 |

| 2032 | 119.1 |

| 2033 | 126.3 |

| 2034 | 133.9 |

| 2035 | 141.9 |

The USA thermal spring market is projected to expand from USD 79.1 million in 2025 to USD 141.9 million by 2035, registering a steady CAGR of 3.5%. This growth is underpinned by increasing adoption of thermal water-based products for hydration, sensitive skin relief, and post-procedure recovery, with demand spanning both consumer and professional channels. Distribution gains are being driven by pharmacies, e-commerce platforms, and spa outlets, each broadening their portfolios of mineral-rich skincare solutions.

Premium spa-sourced products are resonating with wellness-focused consumers seeking luxury and authenticity, while mass-market brands are capitalizing on competitive pricing and online promotions to capture wider audiences. Furthermore, strategic partnerships between wellness resorts and skincare brands are creating synergistic cross-channel exposure, enhancing brand visibility, and fueling sustained sales momentum.

The Thermal Spring Market in the United Kingdom is projected to grow at a CAGR of 6.5%, driven by an evolving balance between traditional spa culture and the growing demand for clinically proven skincare solutions. Premium spa resorts across the UK are integrating thermal spring-based treatments into wellness packages, attracting both domestic and international visitors. Brands are also focusing on urban consumers by introducing convenient, travel-sized formats suitable for busy lifestyles. Sustainability is emerging as a strong competitive lever, with packaging innovations and ethical sourcing gaining traction among UK buyers.

India’s Thermal Spring Market is forecast to grow at a robust CAGR of 11.2% through 2035, supported by increasing wellness tourism, a surge in domestic spa chains, and the entry of international skincare brands leveraging thermal spring formulations. Rising disposable incomes in tier-2 and tier-3 cities are expanding the consumer base beyond metropolitan areas.

Ayurvedic wellness centers are beginning to integrate thermal spring treatments as a premium add-on, merging traditional Indian therapies with global hydrotherapy trends. Government promotion of medical and wellness tourism is further accelerating infrastructure development in spa resorts and wellness retreats.

The Thermal Spring Market in China is projected to expand at a CAGR of 10.4%, the fastest among major economies, fueled by the country’s booming wellness tourism and consumer preference for natural, mineral-rich skincare. Rapid urbanization and rising middle-class incomes are encouraging premium spa development in metropolitan and emerging cities alike.

Domestic cosmetic brands are increasingly formulating products with thermal spring water, competing with international players through competitive pricing and localized branding. Provincial governments are promoting hot spring resorts as part of eco-tourism strategies, which is boosting year-round demand.

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.4% |

| China | 9.8% |

| Japan | 15.2% |

| Germany | 12.1% |

| UK | 10.9% |

| India | 5.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.7% |

| China | 12.6% |

| Japan | 13.4% |

| Germany | 11.5% |

| UK | 9.8% |

| India | 6.5% |

The Thermal Spring Market in Germany is projected to grow at a CAGR of 4.9%, supported by the country’s strong tradition of balneotherapy and its well-regulated health tourism sector. Many thermal spas are integrated into medical rehabilitation programs, with health insurers partially covering treatments, driving steady domestic demand.

There is also a rise in “medical wellness” resorts combining traditional hydrotherapy with modern treatments, appealing to both local and international visitors. German skincare brands are leveraging thermal water in premium dermocosmetic formulations, targeting sensitive skin and post-procedure recovery.

| USA By Product Type | Value Share% 2025 |

|---|---|

| Thermal water sprays/face mists | 38.7% |

| Others | 61.3% |

In 2025, thermal water sprays and face mists are set to command 38.7% of the USA thermal spring market, underscoring their strong positioning as a preferred product format. Their popularity stems from their multifunctional appealoffering instant hydration, skin soothing, and refreshmentmaking them a staple in both skincare routines and on-the-go applications. The “Others” category, which accounts for the remaining 61.3%, includes moisturizers, creams, serums, and other formulations that incorporate thermal water for targeted benefits such as anti-aging, sensitive skin relief, and post-procedure care.

While sprays and mists dominate impulse and daily-use purchases, the broader category is benefiting from consumers seeking more comprehensive, treatment-oriented thermal water products. This dual demand pattern is expected to drive balanced growth across both segments, with sprays maintaining strong market visibility and “Others” tapping into deeper skincare needs.

| China By Functions | Value Share% 2025 |

|---|---|

| Hydration & refreshment | 34.8% |

| Others | 65.2% |

The Thermal Spring Market in China is valued at USD 30.5 million in 2025, with hydration & refreshment functions leading at 34.8%, while other wellness and therapeutic applications account for 65.2%. The strong position of hydration-focused products stems from the country’s growing urban middle-class, where high air pollution levels and year-round indoor climate control create persistent skin dehydration issues. Premium thermal water sprays, facial mists, and hydration kits are gaining traction in both female and male grooming segments, aided by aggressive marketing on platforms like Tmall and Douyin.

Domestic brands are rapidly innovating by infusing thermal spring water with botanical extracts and probiotics, positioning hydration products as both skincare essentials and lifestyle accessories. Travel-size and refillable formats are particularly appealing to young, mobile consumers, while medical spas and dermatology clinics increasingly recommend these products for post-laser treatment recovery.

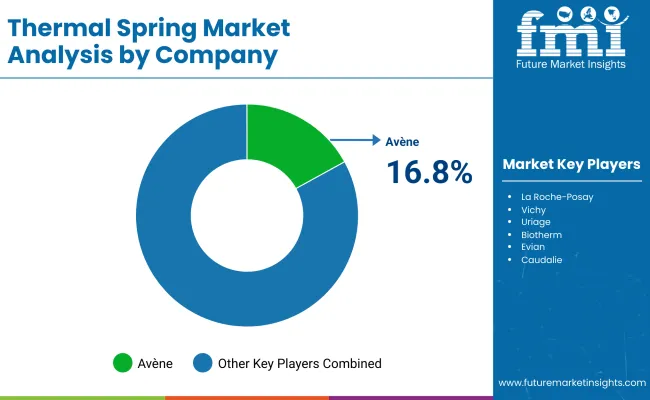

The Thermal Spring Market is moderately fragmented, with a mix of global leaders, premium skincare brands, and niche-focused wellness companies competing for consumer attention. Avène leads globally with a 16.8% value share in 2025, leveraging its strong dermatological positioning and heritage in pure thermal spring water formulations. Its dominance is reinforced by medical endorsements and extensive distribution across pharmacies, dermatology clinics, and premium retail channels.

Close competitors like La Roche-Posay, Vichy, and Uriage focus on medically tested formulations enriched with minerals, often targeting sensitive skin and post-treatment care. Luxury skincare brands such as Biotherm, Caudalie, and Shu Uemura differentiate through high-end branding, spa-inspired rituals, and integration of thermal spring water into anti-aging and hydration lines. Evian has carved out a niche with its hydration mists, catering to travel, sports, and on-the-go refreshment segments.

Natural and botanical-driven labels such as Jurlique and Bioderma are tapping into clean beauty trends, blending thermal water with plant-based actives. Competitive differentiation is increasingly moving beyond pure thermal water content toward multifunctional products combining hydration, skin barrier repair, and environmental protection. Marketing strategies emphasize scientific validation, sustainability in packaging, and personalization to maintain brand loyalty in an increasingly crowded market.

Key Developments in Thermal Spring Market

| Item | Value |

|---|---|

| Quantitative Units | USD 311.6 Million |

| Product Type | Facial Care, Thermal water sprays / face mists, Moisturizers & creams, Serums & essences, Cleansers & toners, Body Care, Lotions & creams, Body washes & shower gels, Bath salts & soaks, Hair & Scalp Care, Shampoos & conditioners, Scalp treatments & sprays, Professional / Spa Products, In-spa treatments (wraps, packs, masks), Post-procedure aftercare products, Emerging Formats, Ingestible beauty (thermal mineral supplements), Hybrid wellness kits (spa + home care sets) |

| Functions | Hydration & refreshment, Sensitive skin relief, Soothing & anti-irritation, Anti-aging & skin repair, Post-dermatological procedure recovery, Relaxation & wellness |

| Ingredient | 100% pure thermal spring water, Mineral-enriched thermal water, Thermal water + botanical actives, Thermal water + dermatological actives |

| Distribution Channel | Pharmacies / drugstores, E-commerce (DTC, marketplaces), Beauty specialty retailers, Hotels & spas, Department stores, Wellness tourism outlets (resorts, thermal spa gift shops) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Avène, La Roche- Posay, Vichy, Uriage, Biotherm, Evian, Caudalie, Shu Uemura, Jurlique, Bioderma GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by product type and function, adoption trends in wellness tourism and spa-based therapies, rising demand for multi-functional thermal water products (hydration + skin repair), sector-specific growth in dermatology, personal care, and luxury wellness, revenue segmentation by premium, masstige, and mass-market tiers, integration with AI-driven skin analysis and personalized beauty regimens, regional trends influenced by climate, skin sensitivity prevalence, and spa culture, and innovations in mineral enrichment, hybrid formats (cosmetic + nutraceutical), and eco-friendly packaging technologies. |

The global Thermal Spring Market is estimated to be valued at USD 311.6 million in 2025.

The market size for the Thermal Spring Market is projected to reach USD 625.2 million by 2035.

The Thermal Spring Market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in the Thermal Spring Market are Facial Care, Body Care, Hair & Scalp Care, Professional / Spa Products, and Emerging Formats.

In terms of functions, the Hydration & Refreshment segment is expected to command 31.2% share of the Thermal Spring Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA