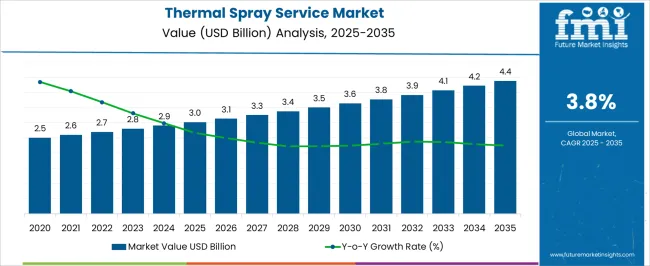

The thermal spray service market is valued at USD 3 billion in 2025 and is projected to touch USD 4.4 billion by 2035, charting a CAGR of 3.8%. The growth curve observed from 2025 to 2035 portrays a gradual yet steady incline, reflecting a demand pattern that is not explosive but consistently positive. From USD 3 billion in 2025 to USD 3.6 billion by 2030, the rise is incremental, yet the shape of the curve signals a stable market presence across industries where protective coatings and surface modifications are indispensable.

Such a curve underlines reliability, suggesting that thermal spray services are not positioned as cyclical or trendy solutions but as long-term essentials in aerospace, automotive, and energy sectors where durability and performance enhancement remain central. By 2035, the thermal spray service market achieves USD 4.4 billion, demonstrating that even moderate CAGR markets carry significant weight when viewed through the lens of industrial adoption.

The curve shape, spanning USD 3 billion to USD 4.4 billion, is relatively linear, which indicates that while breakthrough spikes may not occur, the steady confidence of industries in thermal spray coatings is undeniable. I find this pattern reflective of how industries often prioritize proven, dependable processes over speculative solutions.

| Metric | Value |

|---|---|

| Thermal Spray Service Market Estimated Value in (2025 E) | USD 3.0 billion |

| Thermal Spray Service Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The thermal spray service market has built a decisive position across its parent sectors, with its value stemming from its ability to extend component life, improve performance, and reduce operational costs in heavy-duty applications. Within the industrial coatings market, thermal spray services contribute about 20–22%, as industries turn to these treatments for protection against wear, corrosion, and high temperatures. In the aerospace components market, the share reaches nearly 25–28%, since turbine blades, landing gear, and critical engine parts rely heavily on thermal spray for enhanced durability. The automotive parts and equipment market records around 15–17% share, with demand driven by engine components, transmission systems, and exhaust parts that face constant stress. Oil and gas equipment shows nearly 18–20% share, as drilling tools, valves, and pumps are increasingly coated to withstand abrasive and corrosive environments.

In the power generation equipment market, the segment accounts for approximately 12–14%, with turbines and boilers frequently requiring protective coatings. While skeptics may point to the high upfront costs of thermal spray processes, the operational savings and reduced downtime achieved by coated components make these services indispensable. Thermal spray has transitioned from being a niche service to an essential element of industrial maintenance strategies, firmly embedding itself as a driver of reliability and operational efficiency across multiple industries.

The thermal spray service market is experiencing steady expansion, supported by increasing demand for surface protection and performance enhancement across multiple industries. Advancements in spraying technologies have improved coating precision, durability, and thermal resistance, making thermal spray a preferred method in aerospace, automotive, energy, and manufacturing sectors. Industrial maintenance activities have risen globally, driven by the need to extend the lifespan of critical components exposed to wear, corrosion, and extreme temperatures.

Additionally, the shift toward cost-efficient refurbishment over full replacement of industrial parts has further fueled adoption. Industry collaborations, as highlighted in corporate press releases, have focused on integrating automation and robotics into thermal spray processes, enhancing efficiency and consistency.

The market is poised for continued growth, with innovations in coating materials and environmentally compliant processes catering to evolving regulatory standards and industry requirements.

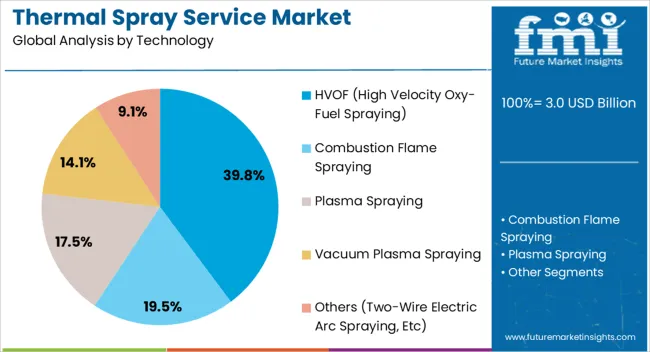

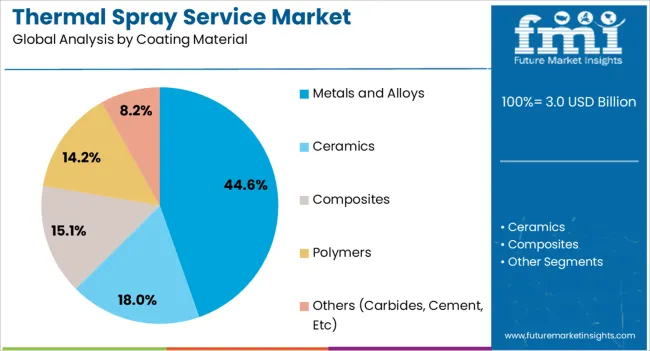

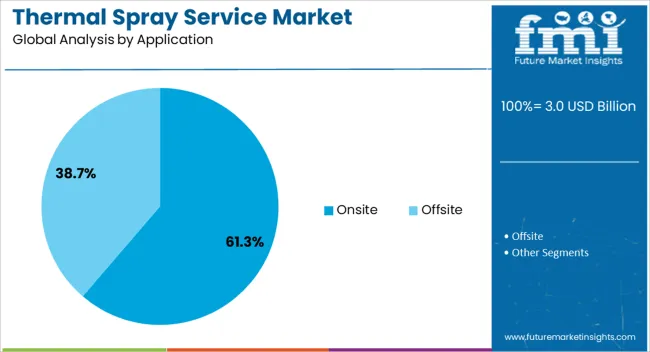

The thermal spray service market is segmented by technology, coating material, application, end-use, and geographic regions. By technology, thermal spray service market is divided into HVOF (High Velocity Oxy-Fuel Spraying), Combustion Flame Spraying, Plasma Spraying, Vacuum Plasma Spraying, and Others (Two-Wire Electric Arc Spraying, Etc). In terms of coating material, thermal spray service market is classified into Metals and Alloys, Ceramics, Composites, Polymers, and Others (Carbides, Cement, Etc). Based on application, thermal spray service market is segmented into Onsite and Offsite. By end-use, thermal spray service market is segmented into Aerospace, Automotive, Electronics, Biomedical, Manufacturing, Oil & Gas, Energy & Power, and Others (Medical devices, Etc). Regionally, the thermal spray service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HVOF segment is projected to account for 39.8% of the thermal spray service market revenue in 2025, maintaining its lead in technology adoption. This growth has been driven by the process’s ability to produce dense, well-bonded coatings with superior wear and corrosion resistance.

Industries with critical rotating and high-load components have favored HVOF due to its capability to apply coatings that significantly enhance service life while maintaining dimensional tolerances. Additionally, the method’s efficiency in applying metals, alloys, and carbides has broadened its industrial applicability.

Continuous refinements in HVOF equipment and nozzle designs have improved coating quality and process control, further solidifying its position in the market. The increasing adoption of HVOF in aerospace and energy sectors for high-performance applications continues to sustain its dominance in the technology category.

The Metals and Alloys segment is projected to hold 44.6% of the thermal spray service market revenue in 2025, establishing itself as the primary coating material choice. This preference is driven by the versatility of metals and alloys in providing both protective and functional surface properties.

Industrial users have adopted these materials for their ability to resist oxidation, thermal degradation, and mechanical wear in demanding environments. Alloy-based coatings offer the flexibility to tailor compositions to specific performance requirements, supporting applications in aerospace turbine parts, automotive components, and heavy machinery.

Supply chain improvements and advancements in alloy powder manufacturing have ensured consistent quality, enabling widespread deployment. The segment’s growth is also supported by its compatibility with various thermal spray techniques, including HVOF and plasma spraying, enhancing its adaptability across industries.

The Onsite segment is projected to command 61.3% of the thermal spray service market revenue in 2025, holding the largest share among application settings. Its dominance has been supported by the operational advantages of performing coating services directly at the client’s facility.

Onsite thermal spraying eliminates the need for dismantling and transporting large or fixed equipment, reducing downtime and associated costs. This approach has been especially valued in sectors such as power generation, petrochemicals, and marine, where equipment size and operational schedules make offsite service impractical.

Mobile thermal spray units and portable equipment innovations have further enhanced the efficiency of onsite operations, enabling high-quality coatings in challenging environments. As industries continue to prioritize maintenance efficiency and operational continuity, the Onsite segment is expected to maintain its market leadership.

The thermal spray service market is expanding as industries demand durable, high-performance coatings for critical applications. Growth is supported by opportunities in aerospace and energy, while trends point toward eco-friendly and nanostructured solutions. However, high costs and a shortage of skilled professionals remain challenges. Despite these barriers, the market outlook is favorable, driven by the need for advanced surface protection solutions that ensure equipment reliability, minimize downtime, and extend operational lifespan across multiple sectors.

The demand for thermal spray services is rising as industries increasingly adopt advanced coating solutions to extend the lifespan of critical components. Sectors such as aerospace, automotive, energy, and oil & gas rely heavily on coatings that resist corrosion, wear, and high temperatures. Thermal spray processes, including plasma spraying, HVOF, and flame spraying, provide effective protection compared to conventional methods. This demand is driven by industries seeking performance improvements, reduced downtime, and cost savings in equipment replacement, positioning thermal spray services as an essential part of maintenance strategies.

Opportunities are growing with the expansion of aerospace and energy industries, where high-performance coatings are vital. Turbine engines, drilling equipment, and industrial machinery require superior wear and heat resistance, creating lucrative prospects for service providers. Emerging economies investing in aerospace infrastructure and renewable energy systems also represent untapped markets. Service providers are increasingly focusing on value-added offerings such as tailored coating solutions and turnkey maintenance services. The potential for cross-industry applications allows companies to diversify and strengthen their portfolio, making aerospace and energy hotspots for market growth.

A noticeable trend in the market is the shift toward eco-friendly thermal spray coatings that minimize environmental impact without compromising performance. Customers are prioritizing coatings that reduce hazardous emissions and waste generation during application. There is also a move toward advanced nanostructured coatings, which provide superior mechanical properties and thermal stability. Digital monitoring and automation technologies are being integrated into thermal spray processes, enhancing precision and consistency. These trends highlight the growing importance of innovation, with companies developing sustainable and high-performance coatings to meet evolving industrial expectations.

One of the major challenges in the thermal spray service market is the high cost of services, which may deter small and medium-sized enterprises from adoption. The process requires specialized equipment and materials, making pricing less competitive compared to alternative solutions. Another critical challenge is the shortage of skilled technicians, as thermal spray processes demand expertise for consistent results. Moreover, intense competition among service providers increases pricing pressure. Addressing these challenges will require investments in workforce training, improved efficiency, and highlighting the long-term cost savings of advanced coatings.

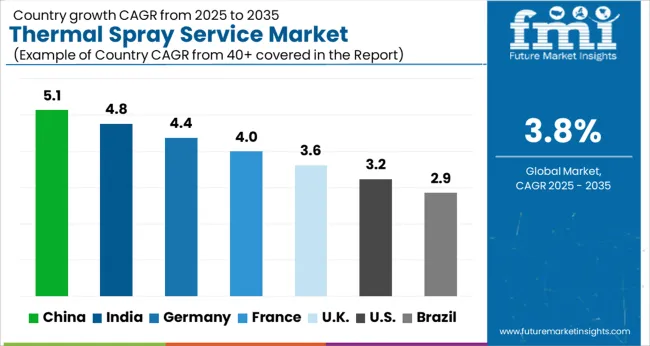

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The global thermal spray service market is anticipated to grow at a CAGR of 3.8% from 2025 to 2035. China is leading with a CAGR of 5.1%, followed by India at 4.8% and Germany at 4.4%. The United Kingdom and the United States record moderate growth at 3.6% and 3.2%, respectively. Growth is driven by demand for wear-resistant and corrosion-resistant coatings across aerospace, automotive, power generation, and oil & gas industries. Emerging economies such as China and India continue to adopt thermal spray services due to industrial expansion, while developed markets like Germany, the UK, and the USA emphasize advanced coating technologies for high-performance applications. This report highlights the top-performing countries among 40+ analyzed markets.

The thermal spray service market in China is projected to expand at a CAGR of 5.1%. Industrial growth in aerospace, automotive, and energy sectors supports rising demand for protective coatings. Rapid expansion of manufacturing capabilities and increased adoption of advanced surface technologies are driving service providers to expand capacity. With the government pushing for high-quality industrial output, coatings that improve efficiency, wear resistance, and lifespan of machinery have gained traction. China’s large-scale infrastructure development and export-oriented production create strong demand for thermal spray services across multiple industrial applications.

The thermal spray service market in India is expected to grow at a CAGR of 4.8%. Expanding industrial manufacturing and a growing base in aerospace, automotive, and power sectors drive demand. Rising awareness of cost savings through improved machinery lifespan makes thermal spray coatings a preferred choice. Infrastructure projects and investments in heavy machinery further enhance adoption. India’s oil & gas and energy industries are also adopting coating services to minimize maintenance costs. With industries seeking efficiency and longevity, the thermal spray services market is gaining steady momentum in India.

The thermal spray service market in Germany is forecasted to grow at a CAGR of 4.4%. Demand is driven by the country’s strong aerospace, automotive, and engineering industries. German companies emphasize advanced thermal spray technologies, including plasma and HVOF coatings, for precision applications. Industrial automation and high standards of manufacturing quality push the adoption of durable coatings that extend machinery life and reduce downtime. Germany’s focus on high-performance materials and export-driven industries ensures continued reliance on thermal spray services. With a mature but innovative industrial environment, demand remains stable and technologically advanced.

The thermal spray service market in the United Kingdom is projected to expand at a CAGR of 3.6%. Demand comes primarily from aerospace, energy, and marine sectors. Companies are adopting advanced coatings to improve performance, reduce wear, and extend service life of machinery. Modernization of power infrastructure and ongoing investments in renewable energy support service adoption. The UK’s aerospace sector, with its global presence, remains a strong consumer of thermal spray services. While growth is slower compared to Asia, steady investments in innovation keep the UK market competitive.

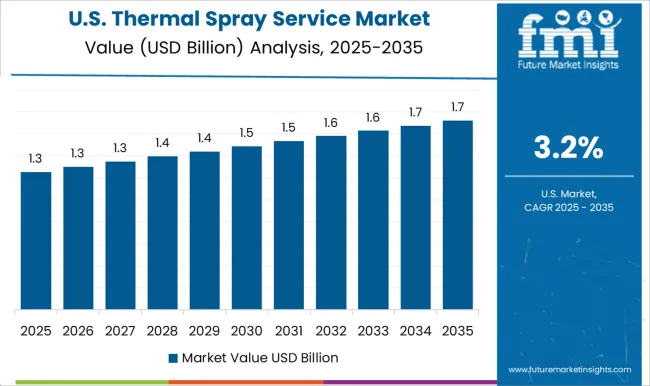

The thermal spray service market in the United States is forecasted to grow at a CAGR of 3.2%. Strong demand arises from aerospace, defense, automotive, and energy sectors. With industries prioritizing cost reduction and extended equipment lifespan, thermal spray coatings have become widely adopted. Growth in aerospace and defense applications strengthens the USA market, while oil & gas and power generation continue to be important contributors. Service providers are focusing on advanced technologies, including plasma spray and cold spray, to meet performance requirements. Although growth is moderate compared to Asia, the USA market is driven by scale and advanced technological adoption.

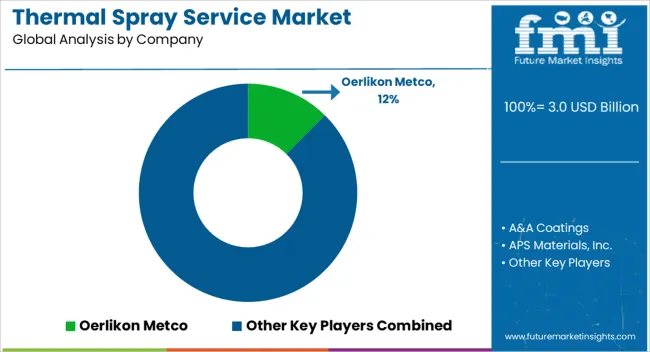

The thermal spray service market is shaped by global leaders such as Oerlikon Metco, Praxair Surface Technologies, and Bodycote plc, who compete through their broad portfolios and global service networks. Their brochures highlight coating durability, corrosion resistance, and efficiency under extreme conditions, which appeals to aerospace, automotive, and power generation sectors. Curtiss-Wright Surface Technologies and Kennametal Stellite emphasize performance-driven solutions tailored for mission-critical applications, often showcasing their expertise in extending component lifecycles. Mid-sized firms like APS Materials, Inc., A&A Coatings, and ASB Industries, Inc. position themselves as specialists, with brochures stressing adaptability, faster turnaround times, and customization. Competition is closely tied to communicating value in brochures, where reliability, performance under stress, and material flexibility are positioned as differentiators. Niche operators including Plasma-Tec, Inc., Thermal Spray Technologies, Inc., and TST Engineered Coating Solutions highlight specialized coating techniques and bespoke projects, securing contracts by underlining precision and responsiveness. Flame Spray SpA and F.W. Gartner Thermal Spraying rely on heritage and proven expertise, showcasing brochures that detail industry certifications and track records. Höganäs AB leverages its material science background to push powder-based spray solutions, while TWI Ltd promotes R&D-driven coating services that highlight technical leadership. Brochures across the sector focus heavily on extending operational performance, compliance with demanding industry standards, and reducing total cost of ownership. Competitive pressure continues to intensify, with success hinging on brochure narratives that effectively convey both technological strength and proven industry credibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Technology | HVOF (High Velocity Oxy-Fuel Spraying), Combustion Flame Spraying, Plasma Spraying, Vacuum Plasma Spraying, and Others (Two-Wire Electric Arc Spraying, Etc) |

| Coating Material | Metals and Alloys, Ceramics, Composites, Polymers, and Others (Carbides, Cement, Etc) |

| Application | Onsite and Offsite |

| End-Use | Aerospace, Automotive, Electronics, Biomedical, Manufacturing, Oil & Gas, Energy & Power, and Others (Medical devices, Etc) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oerlikon Metco, A&A Coatings, APS Materials, Inc., ASB Industries, Inc., Bodycote plc, Curtiss-Wright Surface Technologies, F.W. Gartner Thermal Spraying, Flame Spray SpA, Höganäs AB, Kennametal Stellite, Plasma-Tec, Inc., Praxair Surface Technologies, Inc., Thermal Spray Technologies, Inc., TST Engineered Coating Solutions, and TWI Ltd |

| Additional Attributes | Dollar sales by coating type (ceramic, metal, polymer) and application (aerospace, automotive, energy, medical) are key metrics. Trends include rising demand for wear-resistant and corrosion-protective coatings, growth in industrial refurbishment, and adoption in high-performance components. Regional adoption, technological advancements, and industry-specific requirements are driving market growth. |

The global thermal spray service market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the thermal spray service market is projected to reach USD 4.4 billion by 2035.

The thermal spray service market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in thermal spray service market are hvof (high velocity oxy-fuel spraying), combustion flame spraying, plasma spraying, vacuum plasma spraying and others (two-wire electric arc spraying, etc).

In terms of coating material, metals and alloys segment to command 44.6% share in the thermal spray service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA