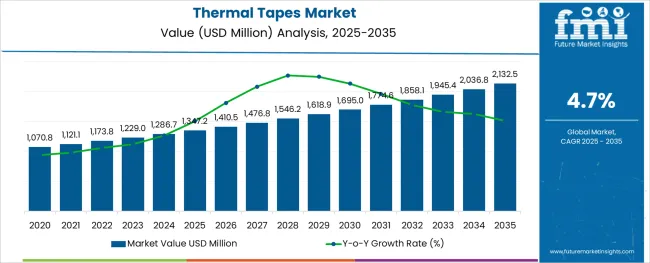

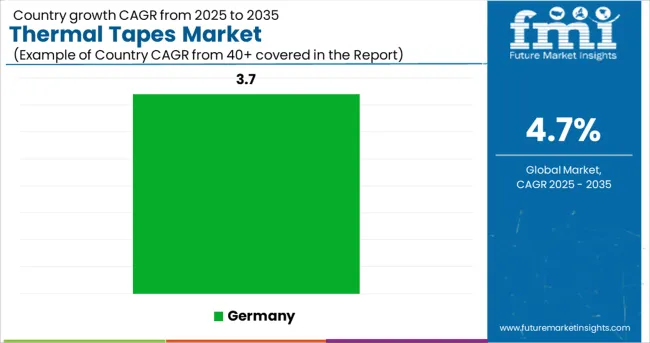

The Thermal Tapes Market is estimated to be valued at USD 1347.2 million in 2025 and is projected to reach USD 2132.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The thermal tapes market is gaining momentum due to increasing demand for advanced thermal management solutions across electronics, automotive, and industrial sectors. With rising device miniaturization, growing adoption of electric vehicles, and expanding use of high performance electronic components, the need for efficient heat dissipation has intensified.

Thermal tapes offer an effective, space saving alternative to traditional thermal pads or pastes, supporting their integration into compact assemblies. Manufacturers are focusing on developing materials that ensure high thermal conductivity, electrical insulation, and mechanical stability under varying environmental conditions.

The transition toward energy efficient and durable thermal solutions is also reinforced by environmental regulations and stringent quality standards. As industries prioritize operational safety, component longevity, and system performance, the thermal tapes market is positioned for sustained growth across diverse high heat applications.

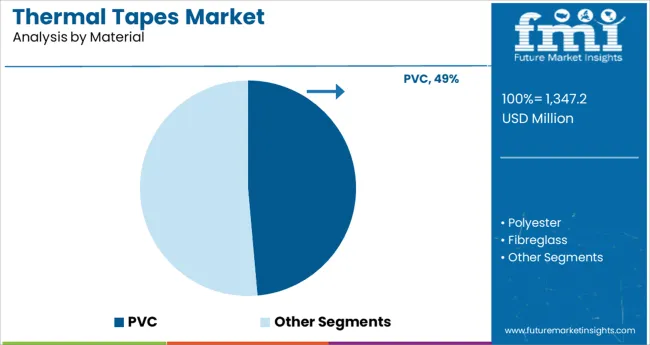

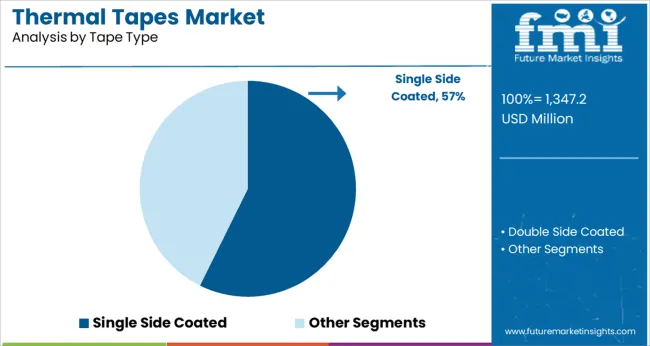

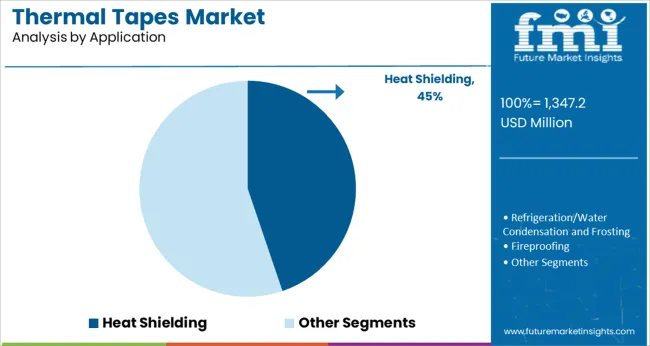

The market is segmented by Material, Tape Type, Application, and End Use and region. By Material, the market is divided into PVC, Polyester, Fibreglass, and Polyamide. In terms of Tape Type, the market is classified into Single Side Coated and Double Side Coated. Based on Application, the market is segmented into Heat Shielding, Refrigeration/Water Condensation and Frosting, Fireproofing, and High Temperature Protection. By End Use, the market is divided into Electrical & Electronics, Automotive, Aviation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PVC segment is projected to contribute 48.60% of total market revenue by 2025 within the material category, making it the leading material type. This dominance is attributed to its superior heat resistance, electrical insulation properties, and cost effectiveness.

PVC based thermal tapes are widely used in applications where a balance of thermal performance and affordability is required. Their ability to maintain dimensional stability under thermal stress makes them suitable for both industrial and electronic environments.

Additionally, PVC offers flexibility, flame retardance, and compatibility with various substrates, contributing to its extensive adoption. Its versatile performance in demanding temperature ranges has strengthened its position as the most utilized material in the thermal tapes market.

The single side coated segment is expected to hold 57.30% of total market revenue by 2025 in the tape type category, establishing it as the dominant format. This growth is driven by its widespread use in applications requiring direct adhesive contact on one surface while maintaining insulation on the other.

It is commonly used in electronics, automotive thermal shielding, and component assembly, where targeted heat control is essential. The configuration allows for easy application, reliable adhesion, and improved process efficiency.

Manufacturers prefer this type for its reduced production complexity and compatibility with automated assembly lines. As industries prioritize thermal management with simplified integration, the single side coated format continues to gain preference, making it the market leading tape type.

The heat shielding segment is projected to account for 44.80% of total market revenue by 2025 under the application category, making it the top use case. This is driven by increasing thermal demands in automotive under hood applications, electronic enclosures, and machinery systems.

Thermal tapes used in heat shielding are valued for their lightweight, high thermal resistance, and ease of installation compared to bulky traditional methods. As electric and hybrid vehicles demand compact and efficient thermal solutions, the role of thermal tapes in protecting heat sensitive components is expanding.

Additionally, heat shielding contributes to improved system performance and durability, especially in confined or high vibration environments. These advantages have established heat shielding as the largest and fastest growing application within the thermal tapes market.

The global thermal tapes market witnessed a CAGR of 3.8% during 2020 to 2024 and reached USD 1,078.5 Million in 2024 from USD 1070.8.0 Million in 2020.

Thermal tapes are made of porous foam and cloth backing material that provides a thermal barrier between two surfaces. These tapes can be made with different types of backing and adhesives that support the surfaces. In thermal tapes, cloth, woven fabric, fiberglass, glass, fluoropolymer, foam, metal, and foil sheets are used as backing materials whereas, for adhesive acrylic, rubber, silicon, ceramic and other material are used. Thermal tapes are routinely required by different industries as well as military organizations of several countries.

Thermal tape has been widely used in a number of applications in the industrial and manufacturing sectors. The application of thermal tapes in the field of electrical and electronic appliances proves to be prominent in the current market scenario considering the vast market for these appliances.

Nowadays, technology has become the most important part of people’s lives, and everyone is glued to their phones and laptops. The continuous operation of these devices such as mobiles, televisions, and laptops creates a lot of heating problems which in turn affects the performance of the device. A lot of people are struggling with the heating of mobile phones and consumers had faced a lot of accidents while using these phones.

The application of thermal tape in computers and LEDs is encouraging the thermal tape market as technology has become a crucial part of our lives. This gains the demand for safe and sound systems with upgraded performance by consumers. Thus, this will enhance the sales of thermal tapes market.

The most significant applications of thermal tapes include preventing water condensation and frosting systems lines, fireproofing, high-temperature protection, general heat shielding, and prevention. With the development in infrastructure and living standards all over the world, these tapes have a huge market in heat protection and shielding on an everyday basis.

Thermal tapes play an essential part in the manufacturing process which is an evergreen market. The demand for thermal tapes can never be out in the manufacturing sector because thermal protection plays a crucial role in the manufacturing sector.

The piping section in the industrial sector all over the world requires thermal tapes which creates a huge demand for the tapes. Thermal tapes cover an unlimited market in the field of oil and gas, manufacturing, aerospace, power section, wastewater department, and food and beverages.

Well, there are other options available in the market that can replace thermal tape such as thermal paste but the thermal tapes being more convenient to use, the demand for thermal tapes can never fall out.

The major application of thermal tape includes all electronic devices such as computers, televisions, printers and scanners, mobiles, etc. Thermal tapes are widely used in electronic devices to adhere small chips on computer motherboards, heat sinks video display cards or panels of backlight modules.

As the usage of electronics increased and the size decreased with improvement in their performance, the need for highly thermal conductive tapes has increased for heat dissipation. The most common application of thermal tapes are heat sinks, heat dissipation modules, CPU Microprocessor heat dissipation, LED lamps lanterns, etc. and these applications dominate the global market.

Thermal tapes are being considered for various end-use industries and applications considering the progressive designing future. The automotive industry is believed to be moving towards electric vehicles considering the environmental footprint of carbon emissions. Also despite the negative effect of covid-19 on economic growth, Asia Pacific has shown a remarkable gain in the automotive sector, and the thermal tapes market is forecasted to flourish in the future.

Increased usage of electronics such as mobile phones, laptops, computers, and tablets generating the market scope of thermal tape in the future. Making calls, videos, online shopping, and social media are never going to stop, as a result, thermal tapas will play a major role for the proper functioning of these devices. All these segments will create a larger market for thermal tapes in the future. The electrical & electronics segment is anticipated to register a CAGR of 4.9%

According to the Lamart Corporation, battery coating is going to power the future of electric vehicles. As per the article published by A Washington Post, an electric car requires a high amount of energy that demands the best insulation material for the batteries to improve its performance. Thus, this will be creating a greater opportunities for thermal tapes market

Germany is estimated to hold a promising CAGR of 3.7% in Europe during the forecast period. Europe and Germany are creating opportunities for the thermal tape market in the future as demand for electric mobility has been increasing.

Climate change is one factor affecting the electric vehicle market and this can prove to be an opportunity for the thermal tape market to expand in Germany and Europe. An announcement has been made by Britain for banning petrol and diesel car by 2040 which further pushed the need for electrical mobility. Technology development in the field of thermal tapes is anticipated to become an essential component of the automotive sector.

According to the International Agency Research (IEA), Europe’s new electric car generation has been doubled to 1.4 billion having a market share of 10%. A surge in electric car registrations has been seen in Europe despite the slow economic growth during the pandemic. Battery Electric Vehicles accounted for 54% of electric vehicle registrations in europium countries. Germany registered 395 000 new electric cars and France registered 185 000.

Considering the current scenario of climate change, depletion of natural resources, ozone layer conditions, and greenhouse gases, an electric vehicle is the future of the automotive industry, especially in China. According to International Energy Agency (IEA), 3.3 million electric vehicles have been sold in china.

The electric cars market share of China remained at the worlds largest that i.e. 1286.7 million in 2024. In 2024, 2.7 million Battery electric vehicles have been sold in China which amounts to 82% of new electric cars sold in China.

As per the report published by International Agency Research, China offers a broad variety of electric vehicles comprising around 300 models which are 50% more than that of Europe and United States. China is estimated to register a CAGR of nearly 5.6% during 2025 to 2035.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Tape Type, Application, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Scapa Industrial; I.M. Technologies; JBC technologies; H.B. Fuller; MBK Tape Solutions; Berry Global; KIC; 3M Science; Coroplast Tape; Rogers Corporation; Duraco; Intertape Polymer Group; Lamart Corporation; Mactac Alintic Company; Nitto; Tessa; McAllister Mills; T Global Technology; Avery Dennison; LINTEC Corporation; AI Technology INC; Stokvis Tapes |

| Customization & Pricing | Available upon Request |

The global thermal tapes market is estimated to be valued at USD 1,347.2 million in 2025.

It is projected to reach USD 2,132.5 million by 2035.

The market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types are pvc, polyester, fibreglass and polyamide.

single side coated segment is expected to dominate with a 57.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Transfer Tapes Market

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA