The demand for thermal interface materials and pads increased with the growing needs of the consumer electronics and automotive industries in 2024. As high-performance computing hardware continued to grow with the adoption of electric vehicles and data centers, the development of advanced thermal management products gained traction. Industry leaders concentrated on improving material efficiency or introducing graphene-based thermal pads to improve heat dissipation.

The industry is expected to grow steadily through 2025, driven by the rapid expansion of EV manufacturing and the continuous advancement of semiconductor technology in modern vehicles. “These advances in nanotechnology and phase-change materials are expected to spur investments that will significantly increase thermal conductivity performance.

Additional rules and regulations governing electronic devices, aimed at improving operational efficiency and reducing energy costs, will drive demand for sustainable and high-performance thermal interface materials.

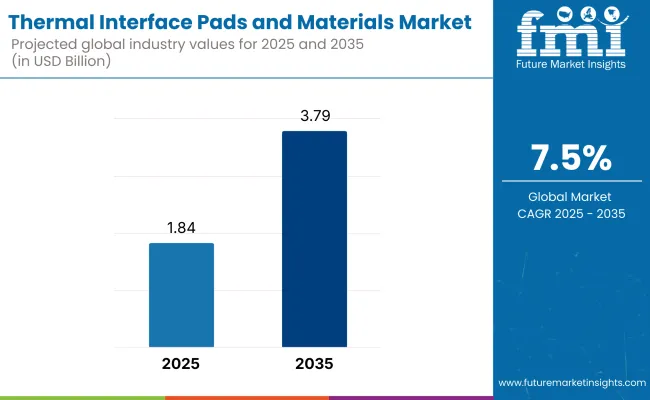

Beyond 2025, the industry is projected to follow a steady growth trajectory, driven by continued miniaturized electronics development and 5G network penetration. And things like AI-driven cooling and flexible thermal pads for wearables will gradually make their way into the landscape over the next ten years. The market for thermal interface pads and materials is anticipated to reach USD 1.84 billion by 2025, growing at a CAGR of 7.5% to reach USD 3.79 billion by 2035.

Key Priorities of Stakeholders:

Consensus Priorities:

Regional Variance:

Adopting Sophisticated Technologies

High Variance across Regions:

ROI Perspectives:

Material Choices

Worldwide Consensus:

Regional Difference:

Price Sensitivity

Shared Concerns:

Regional Pricing Preferences:

Problems in the supply chain and value chain

Manufacturers:

Distributors:

End-Users (Industrial Operators):

Future Investment Priorities

Global Alignment:

Investment Priority By Region:

The Impact of Regulations on Industry Forces

Divergences and Emerging Industry Trends

High Consensus Areas:

Key Regional Differences:

Strategic Insight:

There is no one-size-fits-all marketing strategy. Organizations are required to align their product ranges.

Full findings of the survey available in the full report. Request a Sample.

| Country | Government Regulations & Mandatory Certifications |

|---|---|

| United States | DOE efficiency standards for energy, EPA RoHS compliance, and OSHA workplace safety standards have influence on production processes and materials used. Relevant certifications include UL 94 (Flammability Rating), ASTM D5470 (Thermal conductivity testing), IPC-4101 (Electronic material cert) |

| United Kingdom | UK REACH limits the use of hazardous materials in thermal materials, just as EU REACH does. Certifications: BS EN 45545 (fire protection of rail applications), ISO 9001 (quality management certification) |

| France | The product complies with EU RoHS and REACH regulations, which impose strict controls on hazardous substances in electronic materials and their disposal. Certifications: NF Mark (a factory certificate for the compliance of industrial materials to French standards), CE Marking (the directive for sales in the EU). |

| Germany | Material efficiency: TÜV SÜD, EU Eco-design regulations; strict environmental legislation with regards to TIMs for industrial and automotive applications. Certifications: VDE (safety certification), DIN 4102 (fire safety compliance). |

| Italy | The company is in compliance with the EU-wide REACH and RoHS (Restriction of Hazardous Substances) regulations, as well as additional energy efficiency obligations for industrial use. Certifications: CE Marking, EN 60695 (flammability test). |

| South Korea | K-REACH mandates chemical safety compliance for manufacturers registering and evaluating chemicals in TIMs. Certifications: KOSHA (occupational safety compliance), KC Mark (Korean Certification for industrial safety) |

| Japan | Regulations under the of the Chemical Substances Control Law (CSCL) limit dangerous contents in TIMs. METI is responsible for compliance. Certifications: JIS (Japanese Industrial Standards), PSE Mark (safety standard for electrical material) |

| China | The China RoHS mechanism prevents hazardous materials; the MIIT regulations govern electronic products. No. Certifications: CCC (China Compulsory Certification), GB Standards (Chinese national standards for industrial safety). |

| Australia & New Zealand | The product is in compliance with the Australian NCC (National Construction Code) for fire-resistant materials in industrial use, specifically in New Zealand. Certifications: RCM (Regulatory Compliance Mark), AS/NZS 3000 (electrical safety standards) |

| India | Regulatory bodies like BIS (Bureau of Indian Standards) oversee industrial materials while the E-Waste Management Rules responsibly manage disposal. Certifications: IS 10810 (safety for thermal materials), BIS Certification (mandatory for electronic components). |

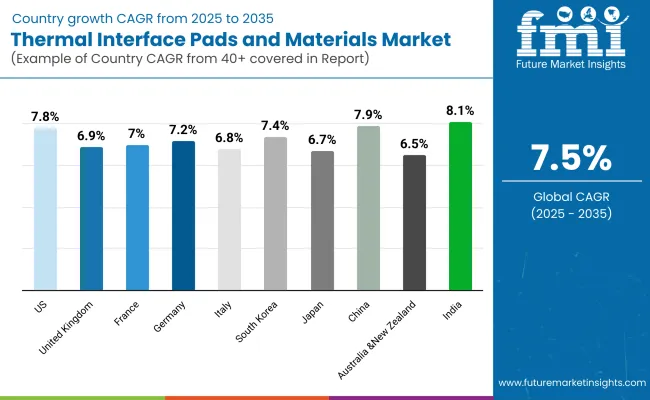

This industry in the USA is aggressively growing at a CAGR of 7.8% from 2025 to 2035 due to high demand for computing, EV, and aerospace applications and projected market share of USD 709.1 million by 2035. Prominent semiconductor and electronics manufacturers, with strong R&D footprints, are driving innovation in thermal management solutions.

Rigorous efficiency targets from the DOE and the EPA are driving manufacturers to turn to highly conductive, recyclable materials. Additionally, the demand for graphene-based and phase-change thermal management materials is on the rise in the industry.

It is critical to follow a material performance certification that includes UL 94, ASTM D5470 for thermal conductivity insulation properties, and IPC-4101 to guarantee the performance and safety of the materials; achieving this goal becomes a priority.

The thermal interface materials industry in the United Kingdom would grow at a CAGR of 6.9% between 2025 and 2035, driven by stringent regulatory control and sustainability initiatives. Along with EU RoHS, the UK REACH regulation involves limiting toxic substances in thermal items and complying with environmental and safety standards.

Growth is fuelled by 5G infrastructure expansion, automotive electrification and industrial automation, where heat dissipation matters. Product certification: UK manufacturers must also get BS EN 45545 and CE markings for product certification.

Low-carbon The adoption of heat dissipation materials (TIMs) is also being driven by government incentives aimed at improving energy efficiency in electronics and industrial applications. United Kingdom's projected market share of USD 189.93 million, with a 5.9% CAGR during the forecast period.

The thermal interface materials industry in France is expected to grow at a CAGR of 7.0% in the period 2025 to 2035, underpinned by healthy automotive, semiconductor, and consumer electronics industry growth. The country also adheres to union directives such as the REACH and RoHS, emphasizing the need for non-toxic or sustainable (~70% PV) material use in industrial applications.

Government incentives for EV manufacturers as well as semiconductor providers are boosting the growth of the high-performance thermal interface pads. Manufacturers conducting business in France are required to comply with NF Mark and CE certification. In addition, stringent waste disposal regulations facilitate thermal material recycling and disposal, ensuring sustainable business practices in the industry.

Germany, the leading global industry in automotive, industrial automation, and semiconductor cooling technologies, is estimated to register a 7.2% CAGR from 2025 to 2035. Germany enforces EU RoHS, REACH, and TÜV SÜD standards, requiring manufacturers to ensure energy efficiency and material safety.

High-performance thermal pads used in EV batteries and power electronics are a core component in fast-growing electric vehicle electrification, and this is a strong focus area.

The focus is on high-performance thermal pads. Industrial materials applied to mission-critical applications are also required to have VDE and DIN 4102 fire rating certifications. There is growing momentum towards the development of sustainable and recyclable TIMs, and many companies are investing in biodegradable and hybrid materials.

The industry in Italy is expected to grow at a CAGR of 6.8% in the boom between 2025 and 2035, driven by the push for electric vehicles, renewable energy installations, and industrial automation. The industry comply with EU-wide REACH and RoHS in this country to ensure safe and robust thermal management.

Currently, Italian companies interested in marketing electronic and industrial products must reach CE Marking and EN 60695 for thermal materials. The goal of the EU Green Transition Plan is to push Italy towards low-carbon technology improvement modules (TIMs), leading to more studies on ceramics and phase-change materials to increase heat dissipation in high-power electronics.

During 2025 to 2035, the 5G infrastructure segment in the semiconductor, display technology, and 5G infrastructure industries is anticipated to spur strong demand in South Korea, which is expected to maintain a CAGR of 7.4% in the industry. K-REACH laws require producers to register and assess the safety of chemicals used in thermal products in the nation.

Industrial safety requires KC Mark certification, while workplace safety standards must adhere to KOSHA regulations. South Korea's investment in AI-based cooling technologies and miniaturized TIMs for handheld devices opens new growth opportunities. The trend is scaling to graphene-based and hybrid polymer-metal TIMs to meet increased performance needs.

Japan's industry is growing steadily, fuelled by increasing demand for compact, high-efficiency thermal solutions for consumer electronics and automotive applications, with an estimated CAGR of 6.7% through 2025 and 2035. Japan’s Chemical Substances Control Law (CSCL) and METI regulations address the need for safe material use in electronic components.

The product must be approved with JIS and PSE Mark certifications. However, Japan embraces nanomaterial-based TIMs less conservatively, and the country expects R&D in ultra-thin and phase-change thermal materials to drive further progress. One of the major factors driving TIM adoption in the automotive sector is the production of hybrid and electric vehicles.

Between 2025 and 2035, the thermal interface industry in China will witness a CAGR of 7.9% and is also among the fastest-growing in other geographies. Driven by emerging semiconductor manufacturing, EV adoption, and rapid industrialization, China has issued RoHS and MIIT regulations that dictate the safety and efficacy of thermal materials for electronics.

Compliance with CCC (China Compulsory Certification) and GB Standards is mandatory. As a result, demand for high-performance carbon and graphene heat dissipation materials (TIMs) is increasing as large stakeholders invest in AI, data centers, and high-performance computing.

The country is also aiming to localize its supply chain of raw materials to reduce its dependence on imports. In the Asia Pacific region China is projected to hold a market share of USD 985.65 million by 2025.

The Australian and New Zealand industries are expected to witness a 6.5% CAGR during 2025 to 2035 due to government regulations pertaining to energy efficiency, industrial safety, and renewable energy technology. Incitement 1: The National Construction Code (NCC) in Australia; AS/NZS 3000 electrical safety standards require the application of thermal management solutions across the construction and industrial sectors.

Electronic components must achieve RCM (Regulatory Compliance Mark) certification. The region is also increasing investment in solar, which results in alternate electronic cooling solutions and heat-resistant TIMs for advanced applications like mining, defense, and aerospace.

The industry in India is projected to grow at a CAGR of 8.1% through 2025 to 2035, supported by rapid growth in electronics fabrication, data facilities, and EV manufacturing. India uses BIS (Bureau of Indian Standards) and E-Waste Management Rules to protect the electronic materials. TIMs used in electronic products and power devices must be IS 10810 certified.

Increasing investments in semiconductor manufacturing and 5G networks are driving demand for cost-effective, high-performance TIMs. Policy initiatives such as the “Make in India” and Production Linked Incentive (PLI) schemes are encouraging domestic manufacturing of TIMs, as part of efforts to reduce imports.

The thermal grease is the primary segment of the industry, which contributes a significant share based on its high thermal conductivity, and it finds a large application for consumer electronics, vehicle motors, and industrial power devices.

Its use is wide since it can fill nanoscale air gaps found between heat sinks and electronic components, enabling efficient heat transport. Thermal greases made of silicone and metal oxide remain on top due to their unparalleled heat transfer efficiency.

However, due to the automatic phase transition from solid to liquid at a designated temperature, Phase-change materials (PCMs) are rapidly emerging as the fastest-growing segment, offering superior thermal performance and efficiency.

They're becoming a hit in the high-performance computing, 5G telecom and power electronics sectors, where keeping cool is the name of the game when it comes to avoiding overheating.

Thermal pads are still used a lot, but their growth is slower because newer, better thermal interface materials, such as graphene-enhanced thermal solutions and hybrid phase-change greases, are being used more in high-power applications that require efficient heat dissipation.

Insulated Gate Bipolar Transistors (IGBTs) are the most popular type of product. These devices are used in many high-voltage situations, such as in electric vehicles (EVs), renewable energy systems, and industrial motor drives. IGBTs can be switched at high currents with small heat losses, making it an essential unit in the power electronics.

As energy-efficient technologies on the automotive and industrial automation front come into increasing demand, IGBTs still keep their hold. MOSFETs (Metal-Oxide-Semiconductor Field Effect Transistors) are, however, experiencing the greatest increase overall, and in particular among consumer devices and low-power applications.

As demand for high-frequency and miniaturized power conversion applications increases, MOSFETs are replacing traditional transistors in 5G base stations, power management ICs, and smartphones. GaN and silicon carbide (SiC) are two examples of wide-bandgap semiconductor materials that are getting better and are helping MOSFETs grow in high-speed, high-efficiency switching applications. Sophisticated power systems are gradually superseding thyristors and power transistors with more efficient and thermally more stable devices.

The consumer electronics application segment is the most dominant segment due to the large amount of thermal interface material used in the manufacturing of smartphones, laptops, game consoles, and wearables. Thanks to chipset and processor miniaturization trends, efficient thermal management is no longer just a consideration; it is crucial to preventing overheating and ensuring a lengthy life cycle for the devices.

With thinner, more powerful devices driving the need for advanced heat management solutions, high-performance thermal materials, such as nano-filled greases and phase change materials, are essential.

That said, telecom equipment is the largest growth segment on account of the worldwide 5G rollout and the growing deployment of high-frequency networking devices. The expanding telecom infrastructure demands advanced thermal solutions from data centers and base stations that can handle heat generated by high-power antennas, RF (radiofrequency) devices, and fiber-optic hardware.

Power supply units also have excellent growth potential, especially for renewable energy inverters, battery management systems, and industrial automation. These applications require high thermal stability and effective heat dissipation.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regular industry growth driven by increasing demand for consumer electronics, electric vehicles (EVs), and industrial automation. | AI-enabled 5G data centers and high-performance computing have driven faster growth. |

| Production and price were affected by supply chain disruptions resulting from the COVID-19 pandemic and semiconductor shortages. | More focus on supply chain resiliency and local manufacturing to reduce dependence on imports. |

| The use of other conventional thermal management materials (TIMs) (such as thermal grease and pads) remained dominant. | The field is rapidly transitioning to state-of-the-art TIMs such as phase change materials, graphene-based options, and hybrid metal-polymer interfaces. |

| Compliance with RoHS, REACH, and other environmental regulations limited the choice of material. | Stricter sustainability regulations lead to increased demand for environmentally friendly, reusable, and low-carbon materials. |

| Demand for Efficient Heat Dissipation in Power Electronics is Growing from EV Growth and Renewable Energy | The development of smart villages, with their reliance on energy-efficient infrastructure, is increasing demand for advanced thermal management systems. |

| There is a growing use of AI-optimized cooling systems and intelligent thermal solutions in data centers and telecom infrastructure. | AI-driven self-learning thermal management systems move into the mainstream across verticals to enable energy efficiency and performance. |

The Thermal Interface Pads and Materials Industries categorized under the Electronic Components and Materials Industry, especially the thermal management solutions used in electronic components in the consumer electronics, automotive, telecommunications, and industrial segments. Due to its direct relationship with heat dissipation in high-performance products, it has a high degree of interconnection with semiconductor, power electronics, and energy-related industries.

The world's industrialization, digitization, and electrification trends constitute an industry. Growing demand for consumer electronics, electric vehicles (EVs), renewable energy, and data centers drives growth. Emerging technologies, including AI, 5G, and IoT, require reliable and efficient thermal management solutions. Industry functions are influenced by supply chain disruptions, raw material price volatility, stringent environmental regulations (RoHS, REACH), and more.

Investments in next-generation materials (graphene, phase change, hybrid metal-polymer) and sustainability-focused innovations will drive long-term growth. While production is primarily concentrated in the Asia-Pacific region, North America and Europe are leading in the development of high-performance thermal solutions.

The leading corporations focus on higher-performance materials, including graphene-impregnated heat dissipation materials and phase-change materials, to differentiate themselves. Cost leadership vs. premium performance is a dominant battleground; at one end, some focus on mass industry price points, and at another, others target new solutions for EVs, data centers, and 5G infrastructure.

Businesses are forming partnerships with EV and semiconductor firms, expanding their reach beyond North America and Asia-Pacific. In a competitive environment, sustainability-focused R&D, in-country production centers, and AI-based solutions are emerging as key growth strategies.

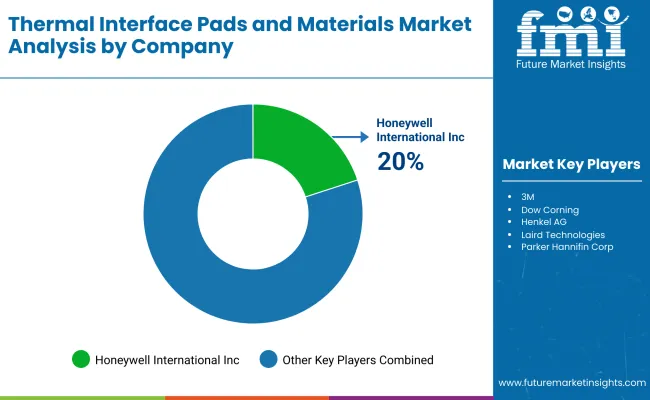

Honeywell International Inc.

Industry Share: ~20-25%

Honeywell, a world leader in advanced materials, provides the highest-performance thermal interface pads for electronics, automotive, and aerospace industries. Its focus on sustainability and innovation has led it to become one of the top players.

Parker Hannifin Corporation

Industry Share: ~15-20%

One of the dominant players is Parker Hannifin, which offers a wide range of thermal interface materials, including pads for application in industries requiring effective thermal management. Its strong R&D capabilities and partnerships have helped them attain a significant industry share.

Henkel AG & Co. KGaA

Industry Share 15-18%

Henkel is a top thermal management materials manufacturer known for premium thermal pads and thermal adhesive. It is focused on expanding its product portfolio and entering developing industries, which has led to rapid growth.

3M Company

Industry Share: ~12-15%

Among the thermal interface materials industry key players, 3M is an important player which provides innovative thermal management solutions. By concentrating more on energy efficiency and sustainable use of its products, it has remained competitive.

Laird Performance Materials

Industry Share: ~10-12%.

Specializing in specific high-performance applications in automotive and electronic fields, Laird develops thermal management material pads. It has grabbed a giant chunk of the industry due to its expertise in customization and high-tech materials.

Fujipoly

Industry Share: ~8-10%

Fujipoly is a top manufacturer of thermal interface pads, best known for its high-performing elastomeric pads. Focusing on innovation and development in the global industry has positioned Fujipoly among its fiercest competitors.

Momentive Performance Materials, Inc.

Industry share: ~5-8%

Momentive also offers a range of thermal interface materials, including pads, for industrial applications. Its focus on creating eco-friendly and high-performance products has allowed it to carve a niche in the industry.

2024 led to a significant shift in the thermal management materials and pads industry, driven by a growing focus on efficient thermal management products across the electronics, automotive, and renewable energy industries.

Honeywell International Inc. launched a new line of green thermal interface pads to meet the growing compliance requirements for sustainability. The pads are made of recyclable materials and feature improved thermal conductivity, which addresses the needs of high-performance electronics.

Parker Hannifin Corporation has increased its production capacity in Asia with the grand opening of a new manufacturing plant in South Korea. The expansion is designed to address the growing need for thermal mangement materials in Asia, particularly in electronics and automotive. The facility is staffed with cutting-edge equipment for producing premium thermal pads and materials with optimal efficiency.

Henkel AG & Co. KGaA has confirmed that it is entering a strategic partnership with a leading electric vehicle (EV) manufacturer to design custom thermal interface materials for next-generation EV battery systems. The collaboration highlights Henkel's commitment to innovation as well as its focus on the rapidly growing EV industry.

The most recent series of thermally conductive pads has been introduced with enhanced performance and durability for aerospace and defense industry applications from 3M Company. They are designed for use in extreme temperatures for specialized aerospace applications.

Laird Performance Materials acquired a smaller competitor that specialized in advanced heat dissipation solutions, broadening its product portfolio and strengthening its industry presence. Laird says the acquisition will allow it to offer customers a broader portfolio of performance materials.

Fujipoly established local distributors in Europe to increase industry coverage for distribution centers. This move aims to capitalize on the increasing consumption of thermal interface materials across Europe's automotive and industrial sectors.

Momentive Performance Materials Inc. invested in R&D for the development of next-generation thermal interface pads with enhanced thermal conductivity and lower environmental impacts. These technological improvements aim to make the company more competitive in the marketplace.

These strengths enable solid opportunities in future power electronics, especially in EV battery management systems, HPC, and 5G infrastructure. High-power, compact devices require improved heat dissipation, which can be achieved through further R&D in graphene and phase-change materials.

Data centers consume more energy than ever, and now is the time for stakeholders to lean into AI-based thermal management solutions to better design and operate them for energy efficiency. In automotive, strategic partnerships prospect business for EV manufacturers, while thermal performance will be a key differentiator for battery safety and life and so garner long-term contracts.

With tough EU, USA, and APAC regulations, the industry will need investment in low-carbon manufacturing processes and recyclable thermal materials to comply with regulations and sustainability and remain competitive. Regional manufacturing hubs will mitigate supply chain risk by reducing dependency on volatile semiconductor and raw material industries.

To offer predictive maintenance, product reliability, and customer loyalty, OEMs must add intelligent thermal monitoring capabilities to their power electronics.

The industry is segmented into thermal grease, phase change material, thermal pads and others

It is segmented into thyristor, IGBT, mofset and power transistors

It is fragmented into consumer electronics, telecom equipment, power supply units and others

The industry is fragmented among North America, Latin America, Europe, Asia Pacific, Middle East and Africa

These materials are most heavily relied on in industries such as consumer electronics, electric motors, telecom, powerful electronics, and data centers for efficient heat dissipation.

It is also in line with international environmental regulations to reduce electronic waste.

These technologies enable predictive maintenance and early failure detection in extreme temperature environments.

Graphene has excellent thermal conductivity, flexibility, and toughness, so it is a good fit for next-generation power electronics and miniaturized devices.

Supply chain disruptions, trade obstacles, and changes in regional manufacturing are affecting procurement strategies and production costs.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spring Market Size and Share Forecast Outlook 2025 to 2035

Thermal Printing Market Analysis - Size, Share & Forecast 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thermal Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulated Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA