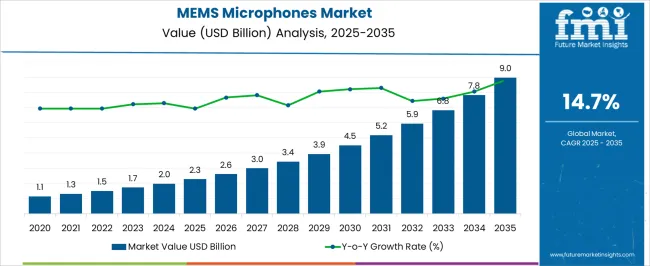

The MEMS Microphones Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period.

| Metric | Value |

|---|---|

| MEMS Microphones Market Estimated Value in (2025 E) | USD 2.3 billion |

| MEMS Microphones Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The MEMS microphones market is gaining strong traction, supported by the increasing integration of voice-enabled technologies and advanced audio systems across consumer electronics. Industry announcements and semiconductor reports have highlighted continuous innovation in MEMS microphone design, focusing on miniaturization, multi-microphone arrays, and low-power operation. Mobile device manufacturers and smart electronics brands are scaling adoption of MEMS microphones to improve voice clarity, noise cancellation, and hands-free user experiences.

The market is also benefitting from growing demand in wearables, smart home devices, and automotive infotainment systems, where compact and high-performance microphones are essential. Strategic investments in wafer-level packaging and enhanced signal-to-noise ratio designs have improved product performance while reducing manufacturing costs.

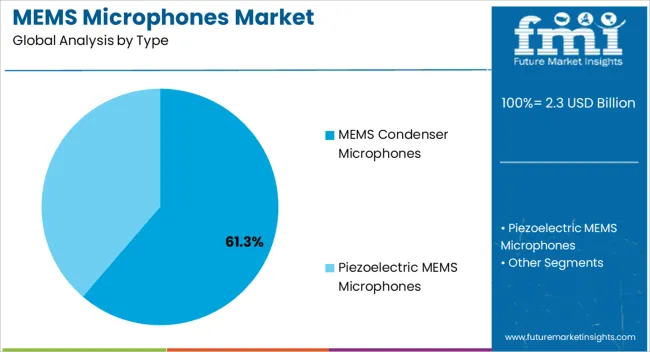

Looking forward, the proliferation of voice assistants, augmented reality (AR), and virtual reality (VR) applications is expected to further accelerate MEMS microphone usage. Segmental momentum is being led by MEMS Condenser Microphones due to their high acoustic sensitivity, and Mobile Devices as the primary application, reflecting their dominance in global consumer electronics demand.

The MEMS Condenser Microphones segment is projected to hold 61.30% of the MEMS microphones market revenue in 2025, maintaining its position as the leading type segment. Growth of this segment has been driven by the superior acoustic sensitivity and wide frequency response of condenser-based MEMS designs, making them well-suited for high-fidelity audio capture.

Semiconductor research and product announcements have emphasized advancements in multi-microphone arrays and digital output capabilities, which enhance speech recognition and directional audio performance. These microphones have been widely integrated in mobile devices, hearables, and voice-controlled electronics due to their compact size, low power consumption, and consistent reliability.

Additionally, continuous improvements in wafer-level manufacturing have enabled high-volume production at lower costs, supporting broader adoption. As consumer demand for enhanced audio experiences intensifies, particularly in immersive technologies, the MEMS Condenser Microphones segment is expected to sustain its market leadership.

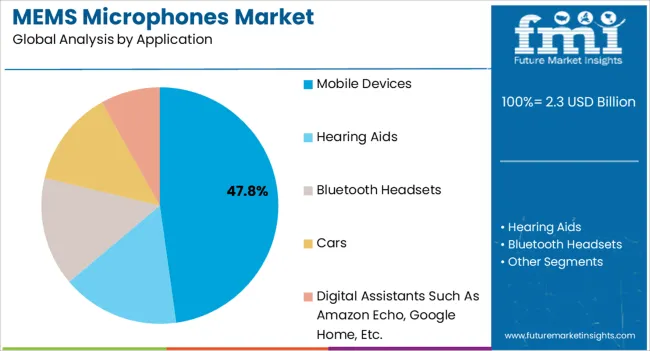

The Mobile Devices segment is projected to account for 47.80% of the MEMS microphones market revenue in 2025, reinforcing its role as the dominant application segment. Growth of this segment has been propelled by the rapid expansion of smartphones, tablets, and wearables, which rely on MEMS microphones for voice commands, video recording, and communication functions.

Mobile device manufacturers have increasingly adopted multi-microphone configurations to improve active noise cancellation, enhance call quality, and enable advanced features such as 3D audio capture. Industry updates have pointed to rising consumer expectations for premium sound quality in compact devices, driving integration of high-performance MEMS microphones.

Furthermore, the proliferation of voice assistants and AI-driven mobile applications has strengthened demand for precise and reliable audio input technologies. With the mobile ecosystem continuing to dominate global consumer electronics usage, the Mobile Devices segment is expected to retain its leading share in the MEMS microphones market.

Based on the report's regional analysis, North America is dominating the MEMS microphones market, with a share of 34%, owing to many well-established factories located there.

The region is expected to register a significant CAGR over the forecast period due to continued advancements in smartphones, hearing aids, and other consumer electronics, as well as the growing adoption of IoT and VR devices in.

The MEMS Microphone is projected to anticipate a high number of adoption rates given the region's high smartphone penetration rates and the already sizable consumer electronics market in the United States.

The adoption rate of MEMS microphone technology is probably going to increase significantly as the smartphone market is one of the most aggressive adopters of the technology.

One of the biggest manufacturers of smartphones located in the United States is Apple, and it has included MEMS microphones in several iPhone models.

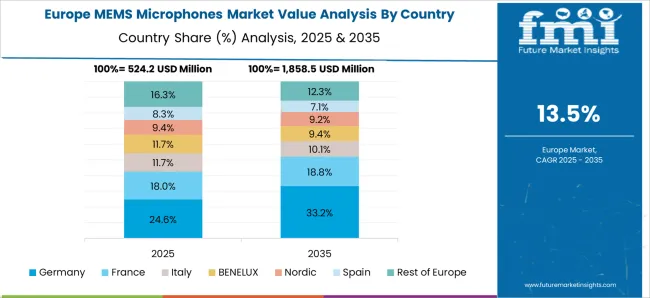

The Europe market is also expected to grow considerably with a share of 23%, because virtual reality is still in its early stages. Several hackathons are taking place frequently to popularize the technology in the Middle East and Africa’s markets, thus driving demand for MEMS microphones there.

MEMS microphone prices are assumed to decrease over the forecast period, and the profit margins for manufacturers are anticipated to decrease subsequently. Nonetheless, MEMS microphones are likely to be used in a multitude of industries and end-use verticals, including automotive, agriculture, telepresence, industrial manufacturing, oil & gas, construction, and medical telemetry, among others.

MEMS microphones are expected to be shipped in great numbers over the forecast period as a result.

Piezoelectric provides a great SNR due to the usage of scandium-doped AIN film, which also benefits in sound dampening. Among the key roles of piezoelectric products is that they contribute to regular productivity and are significantly less prone to degradation even after extended use.

The piezoelectric market is expected to gain pace over the projected period due to the high demand for piezoelectric era-primarily based microphones to be employed in audio devices such as portable intelligent speakers and automotive infotainment systems. As a result, piezoelectric MEMS microphones are likely to increase rapidly in the future years.

SensiBel AS (Oslo, Norway), a startup developing MEMS microphones, has raised €15 million (roughly USD 16 million) in a funding round that was co-founded by Trumpf Ventures. Other investors included Skagerak Capital, Investinor, The European Council's EIC Fund, and SINTEF Venture IV.

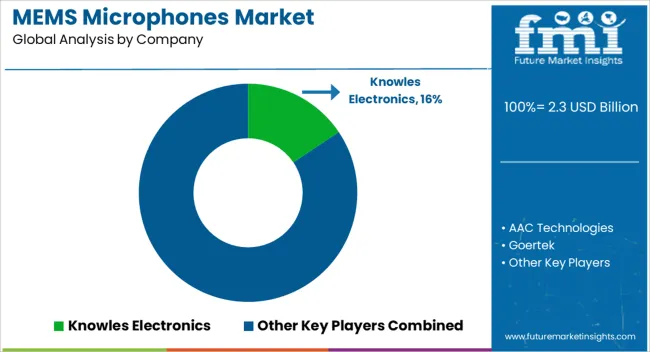

Some of the leading companies operating in the global MEMS microphones market include Knowles Electronics, LLC., AAC Technologies, Goertek, BSE Co., Ltd., STMicroelectronics, Analog Devices, Inc., Hosiden Corporation, Mouser Electronics, Inc., NeoMEMS Technologies Inc., and Akustica Inc.

There are few powerful players in the market, which is highly condensed. To stay competitive, the key players are focusing on investing in research and development activities and building partnerships with established companies. They are also developing their distribution strategies, which involve collaborating with distributors to reach a wider market.

Several manufacturers are also emphasizing extending their international networks of partners. This strategy is successful as it enables them to expand their market reach gradually. DB Unlimited signed distribution agreements with Symmetry Electronics and Master Electronics, while CUI Inc. signed an agreement with Arrow Electronics.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 14.7% from 2025 to 2035 |

| MEMS Microphones Market Expected Market Value (2025) | USD 2.3 billion |

| MEMS Microphones Market Anticipated Forecast Value (2035) | USD 9.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; The Middle East & Africa (MEA) |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Knowles Electronics; LLC.; AAC Technologies; Goertek; BSE Co., Ltd.; STMicroelectronics; Analog Devices, Inc.; Hosiden Corporation; Mouser Electronics, Inc.; NeoMEMS Technologies Inc.; Akustica Inc. |

| Customization | Available Upon Request |

The global MEMS microphones market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the MEMS microphones market is projected to reach USD 9.0 billion by 2035.

The MEMS microphones market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in MEMS microphones market are MEMS condenser microphones and piezoelectric MEMS microphones.

In terms of application, mobile devices segment to command 47.8% share in the MEMS microphones market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MEMS Oscillators Market Size and Share Forecast Outlook 2025 to 2035

MEMS Probes Market Size and Share Forecast Outlook 2025 to 2035

MEMS Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microdisplay Market Analysis - Size and Share Forecast Outlook 2025 to 2035

MEMS Sensor Market - Applications & Growth Forecast 2025 to 2035

MEMS Inkjet Heads Market Growth – Trends and Forecast 2025-2035

Mems Market

Automotive MEMS Market Size and Share Forecast Outlook 2025 to 2035

Automotive MEMS Sensors Market Growth - Trends & Forecast 2025 to 2035

Wide Temperature MEMS Oscillator Market Size and Share Forecast Outlook 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA