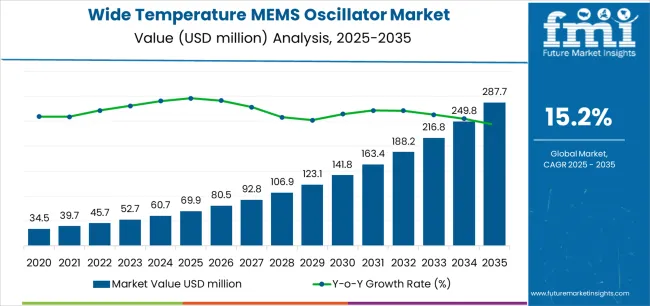

The global wide temperature MEMS oscillator market is projected to grow from USD 69.9 million in 2025 to approximately USD 287.8 million by 2035, recording an absolute increase of USD 217.9 million over the forecast period. This translates into a total growth of 311.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 15.2% between 2025 and 2035. The overall market size is expected to grow by more than 4.1X during the same period, supported by the accelerating adoption of MEMS-based timing solutions across harsh environment applications, the rapid expansion of industrial IoT infrastructure requiring temperature-resilient components, and the increasing demand for reliable frequency control devices in automotive electronics operating across extreme temperature ranges.

The expansion is further reinforced by superior performance characteristics of MEMS oscillators, including enhanced shock and vibration resistance, faster start-up times compared to traditional quartz solutions, and programmable frequency capabilities enabling design flexibility and reduced component inventory requirements. Electronic equipment manufacturers across industrial automation, automotive systems, telecommunications infrastructure, and consumer electronics are increasingly transitioning from conventional crystal oscillators to MEMS-based alternatives that deliver consistent performance across wide temperature ranges typically spanning -40°C to +125°C or beyond. The market benefits from continuous miniaturization trends in electronic assemblies, growing complexity of timing architectures in advanced semiconductor devices, and substantial cost reduction in MEMS fabrication processes, making these solutions economically viable for mainstream applications. Rising deployment of edge computing systems, 5G telecommunications infrastructure, and autonomous vehicle platforms is compelling designers to adopt timing solutions that maintain precise frequency stability despite exposure to harsh thermal conditions, mechanical stress, and electromagnetic interference. The industrial sector's digital transformation initiatives and increasing integration of sensors and connected devices in manufacturing operations are driving sustained demand for robust timing components capable of reliable operation in challenging industrial environments without requiring environmental protection measures or frequency compensation circuits.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 69.9 million |

| Market Forecast Value (2035) | USD 287.8 million |

| Forecast CAGR (2025-2035) | 15.2% |

| INDUSTRIAL & AUTOMOTIVE DEMANDS | TECHNOLOGY ADVANTAGES | PERFORMANCE REQUIREMENTS |

|---|---|---|

| Industrial IoT Expansion: Rapid proliferation of industrial IoT deployments across manufacturing, energy, and infrastructure sectors driving demand for temperature-resilient timing components capable of reliable operation in harsh factory environments. | Superior Reliability Performance: MEMS oscillators delivering enhanced shock and vibration resistance compared to traditional quartz crystals, eliminating mechanical failure modes and reducing warranty costs in demanding applications. | Temperature Stability Requirements: Stringent frequency stability specifications across wide temperature ranges necessitating timing solutions that maintain precise performance without external compensation circuits or environmental protection. |

| Automotive Electronics Growth: Increasing electronic content in vehicles with advanced driver assistance systems, infotainment platforms, and electrification creating sustained demand for timing solutions operating across automotive temperature ranges. | Frequency Programmability: Programmable frequency capability enabling design flexibility, reduced component SKU count, and simplified supply chain management while supporting rapid prototyping and design iteration cycles. | Space-Constrained Designs: Aggressive miniaturization trends in electronic assemblies driving adoption of compact MEMS oscillators offering smaller footprints and thinner profiles compared to equivalent quartz solutions. |

| Harsh Environment Applications: Growing deployment of electronic systems in demanding conditions including outdoor telecommunications infrastructure, oil and gas monitoring, and aerospace applications requiring components with extreme temperature tolerance. | Rapid Start-up Characteristics: Significantly faster start-up times compared to quartz solutions reducing system boot latency and enabling power-efficient duty cycling strategies in battery-powered applications. | Long-Term Reliability Standards: Industrial and automotive applications demanding components with proven long-term aging characteristics and predictable performance degradation supporting extended product lifecycles and warranty requirements. |

| Category | Segments Covered |

|---|---|

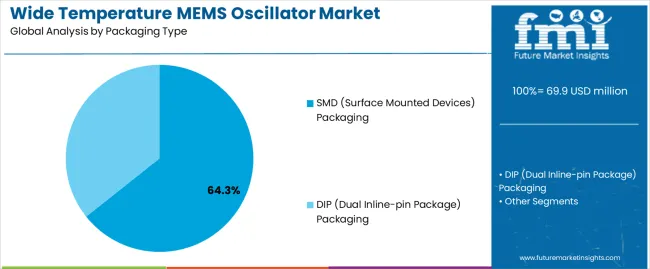

| By Packaging Type | SMD (Surface Mounted Devices) Packaging, DIP (Dual Inline-pin Package) Packaging |

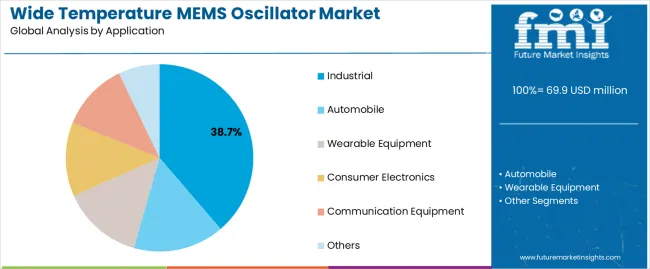

| By Application | Industrial, Automobile, Wearable Equipment, Consumer Electronics, Communication Equipment, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| SMD (Surface Mounted Devices) Packaging |

|

| DIP (Dual Inline-pin Package) Packaging |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Industrial |

|

| Automobile |

|

| Communication Equipment |

|

| Consumer Electronics |

|

| Wearable Equipment |

|

| Others |

|

| Region | Status & Outlook 2025-2035 |

|---|---|

| Asia Pacific |

|

| North America |

|

| Europe |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

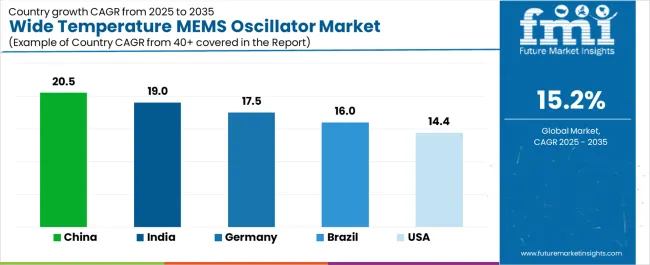

| Country | CAGR (2025-2035) |

|---|---|

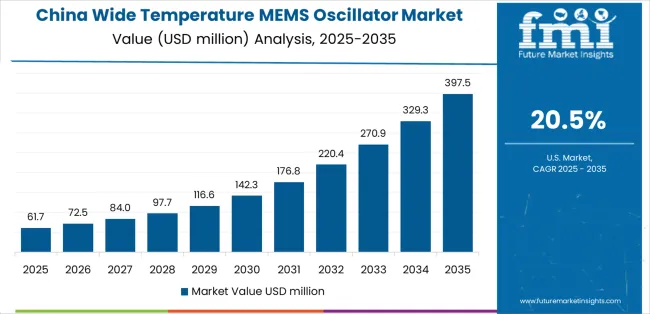

| China | 20.5% |

| India | 19% |

| Germany | 17.5% |

| Brazil | 16% |

| USA | 14.4% |

Revenue from wide temperature MEMS oscillators in China is projected to exhibit exceptional growth with a market value of USD 108.4 million by 2035, driven by the country's position as the world's largest electronics manufacturer producing over 60% of global consumer electronics and comprehensive industrial automation expansion with government-supported smart manufacturing initiatives creating substantial opportunities for temperature-resilient timing components. The country's massive automotive production exceeding 25 million vehicles annually and rapid electric vehicle adoption with production surpassing 6 million units are creating sustained demand for automotive-grade MEMS oscillators. Major electronics manufacturers including Huawei, Xiaomi, BYD, and countless industrial equipment producers establishing comprehensive local supply chains for critical components.

Revenue from wide temperature MEMS oscillators in India is expanding to reach USD 79.8 million by 2035, supported by rapidly growing electronics manufacturing base with government production-linked incentive schemes attracting substantial foreign investment and domestic industrial expansion creating opportunities for timing component suppliers. The country's emerging position as a global manufacturing alternative to China with increasing electronics exports and growing domestic consumption driving sustained demand for components. Major electronics manufacturers and automotive companies including Tata Motors, Mahindra, and international companies establishing local operations requiring comprehensive component supply chains.

Demand for wide temperature MEMS oscillators in Germany is projected to reach USD 73.4 million by 2035, supported by the country's leadership in industrial automation and manufacturing technology with companies including Siemens, Bosch, and countless Mittelstand manufacturers driving continuous innovation in factory automation and process control systems. German automotive industry including Mercedes-Benz, BMW, Volkswagen Group, and comprehensive tier-one supplier base maintaining stringent quality standards and advancing vehicle electrification and autonomous driving capabilities. The market characterized by emphasis on quality, reliability, and long-term performance over cost optimization.

Revenue from wide temperature MEMS oscillators in Brazil is growing to reach USD 67.1 million by 2035, driven by the country's position as Latin America's largest industrial economy with substantial manufacturing base in automotive, industrial equipment, and telecommunications infrastructure. Brazilian automotive production exceeding 2 million vehicles annually and growing electronics manufacturing sector creating sustained demand for timing components. Market characterized by focus on cost-effective solutions balanced with acceptable reliability standards for local operating conditions.

Demand for wide temperature MEMS oscillators in the USA is projected to reach USD 60.7 million by 2035, driven by the country's leadership in advanced telecommunications infrastructure with major 5G network deployments, massive data center concentrations supporting cloud computing and edge processing, and automotive electronics innovation particularly in electric vehicles and autonomous driving systems. American technology companies including major telecommunications providers, data center operators, and automotive manufacturers maintaining sophisticated component procurement strategies and emphasizing supply chain resilience.

Demand for wide temperature MEMS oscillators in the UK is projected to reach USD 54.2 million by 2035, supported by advanced telecommunications infrastructure, significant industrial equipment manufacturing base, and growing automotive electronics content despite overall production volume challenges. British telecommunications sector including major network operators and equipment manufacturers maintaining sophisticated timing requirements for 5G infrastructure and fiber optic networks. Market characterized by emphasis on quality and reliability in telecommunications and industrial applications.

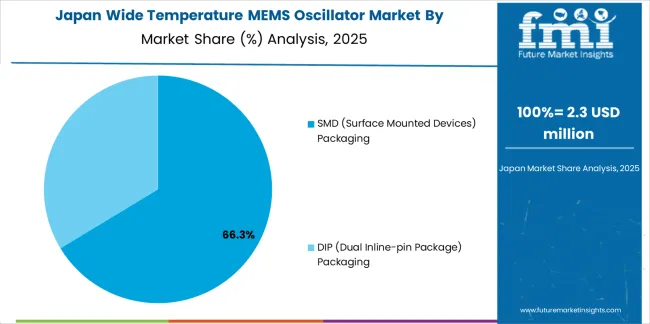

Demand for wide temperature MEMS oscillators in Japan is projected to reach USD 47.9 million by 2035, driven by the country's reputation for electronics manufacturing excellence with major automotive manufacturers including Toyota, Honda, Nissan, and comprehensive industrial equipment producers maintaining stringent quality standards. Japanese electronics industry characterized by emphasis on miniaturization, power efficiency, and long-term reliability creating natural alignment with MEMS oscillator advantages. Market features strong domestic MEMS oscillator manufacturing capabilities with companies developing advanced timing solutions.

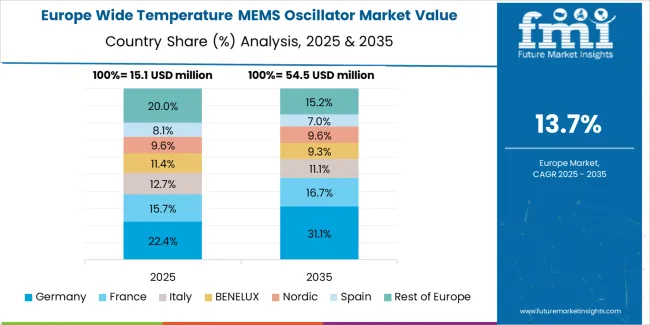

The wide temperature MEMS oscillator market in Europe is projected to grow from USD 13.1 million in 2025 to USD 53.8 million by 2035, registering a CAGR of 15.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, reaching 29.1% by 2035, supported by its dominant industrial automation sector and premium automotive manufacturing base including major companies like Siemens, Bosch, and German automotive manufacturers requiring high-quality timing solutions.

France follows with a 16.7% share in 2025, projected to reach 17.2% by 2035, driven by established telecommunications infrastructure, aerospace industry presence, and growing industrial IoT adoption across manufacturing sectors. The United Kingdom holds a 15.3% share in 2025, expected to stabilize at 15.6% by 2035, supported by telecommunications sector strength, industrial equipment manufacturing, and automotive electronics engineering capabilities. Italy commands a 13.8% share, while Spain accounts for 11.4% in 2025, both benefiting from industrial automation adoption and growing automotive electronics content. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 14.4% to 14.9% by 2035, attributed to increasing industrial automation in Nordic countries and growing electronics manufacturing in Eastern European nations including Poland, Czech Republic, and Hungary where automotive and industrial equipment production is expanding.

Japanese wide temperature MEMS oscillator operations reflect the country's exacting quality standards and sophisticated manufacturing excellence. Major electronics and automotive manufacturers including Toyota, Honda, Sony, and Panasonic maintain rigorous supplier qualification processes that significantly exceed international standards, requiring extensive reliability testing, comprehensive thermal characterization, and detailed quality documentation that can require 24-36 months to complete. This creates substantial barriers for new timing component suppliers but ensures consistent performance supporting zero-defect manufacturing philosophies and extended product lifecycles.

The Japanese market demonstrates unique technical requirements, with significant emphasis on ultra-precise frequency stability, stringent aging characteristics, and comprehensive environmental testing protocols extending beyond typical automotive and industrial standards. Companies require specific MEMS oscillator specifications including enhanced temperature compensation algorithms, superior phase noise performance, and long-term stability characteristics that differ from Western applications, driving demand for specialized engineering capabilities and continuous technical collaboration throughout product development.

Regulatory oversight through Ministry of Economy, Trade and Industry and industry associations including Japan Electronics and Information Technology Industries Association emphasizes comprehensive component qualification and traceability requirements that surpass most international standards. The supplier qualification system requires extensive manufacturing process documentation, proven long-term reliability data, and demonstrated capability for continuous improvement, creating advantages for timing component manufacturers with transparent production systems and comprehensive quality management capabilities.

Supply chain management focuses on long-term partnership relationships rather than purely transactional procurement approaches. Japanese electronics and automotive manufacturers typically maintain decade-long supplier relationships, with annual performance reviews emphasizing quality consistency, technical innovation, and continuous cost reduction through value engineering. This stability supports investment in specialized MEMS oscillator development and advanced process technologies tailored to Japanese specifications, while creating challenges for new market entrants seeking to establish customer relationships in this quality-focused market.

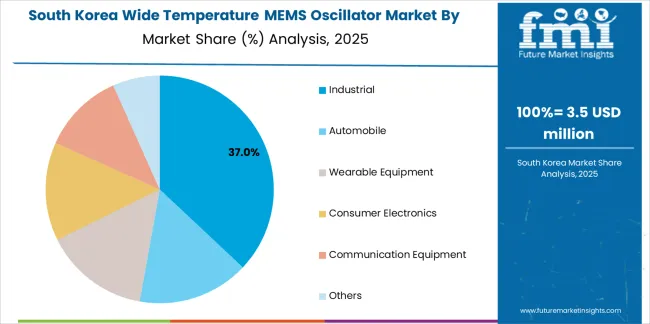

South Korean wide temperature MEMS oscillator operations reflect the country's advanced electronics manufacturing sector and export-oriented business model. Major electronics manufacturers including Samsung Electronics, SK Hynix, and LG Electronics alongside automotive companies including Hyundai Motor Company and Kia Corporation drive sophisticated timing component procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and competitive pricing for their diverse product portfolios spanning consumer electronics, telecommunications equipment, automotive systems, and industrial applications across global manufacturing operations.

The Korean market demonstrates particular strength in high-volume manufacturing efficiency and rapid technology adoption capabilities, with electronics companies producing hundreds of millions of devices annually requiring reliable timing components. This scale creates demand for cost-effective MEMS oscillator solutions while maintaining acceptable quality standards for competitive global markets. Korean electronics manufacturers increasingly developing advanced capabilities in 5G telecommunications equipment, automotive electronics, and industrial automation systems requiring sophisticated timing solutions.

Regulatory frameworks emphasize comprehensive product quality and safety compliance, with Korean Agency for Technology and Standards and telecommunications regulations maintaining rigorous component certification requirements. This creates preference for timing component suppliers demonstrating proven track records and comprehensive quality management systems. The regulatory environment particularly favors suppliers with relevant international certifications and demonstrated capability in high-volume manufacturing supporting aggressive product launch schedules.

Supply chain efficiency remains critical given Korea's concentrated electronics manufacturing and rapid product development cycles. Electronics manufacturers increasingly pursue strategic partnerships with timing component suppliers capable of supporting fast-paced innovation cycles, flexible capacity allocation, and technical collaboration during product development. Domestic MEMS oscillator adoption accelerating as Korean manufacturers recognize advantages in programmability, compact size, and reliability, while price sensitivity remains significant factor in purchasing decisions for consumer electronics applications.

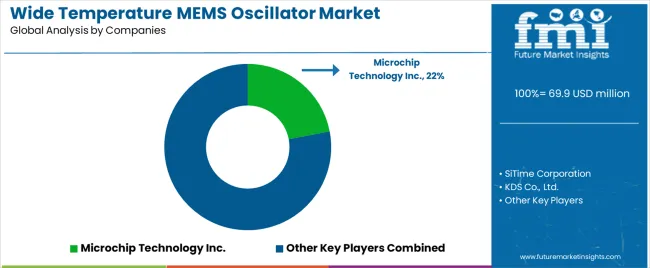

The wide temperature MEMS oscillator market exhibits concentrated leadership among specialized timing component manufacturers with substantial MEMS fabrication expertise, while traditional quartz oscillator suppliers increasingly develop competitive MEMS offerings to defend market positions. Market dynamics favor established players with proven reliability track records, comprehensive automotive qualifications, and established relationships with major electronics manufacturers across industrial, automotive, and telecommunications sectors.

Several distinct competitive archetypes define market structure: pure-play MEMS timing specialists leveraging advanced silicon MEMS technology and programmable architectures to disrupt traditional quartz markets; integrated device manufacturers incorporating MEMS oscillators into broader timing and frequency control portfolios; established quartz oscillator suppliers developing MEMS capabilities to offer comprehensive timing solutions; and fabless MEMS designers partnering with foundries for production while focusing on design innovation and application engineering support.

Competitive differentiation increasingly centers on technical performance parameters including frequency stability across temperature, phase noise characteristics, and aging performance, alongside commercial factors including programmability benefits, automotive qualification breadth, and technical support capabilities throughout design-in process. Switching costs remain moderate as many applications allow direct replacement of quartz oscillators with MEMS alternatives following validation, though automotive and industrial applications require extensive qualification creating natural barriers protecting incumbent suppliers.

Price competition intensifies in consumer electronics and standard industrial applications while automotive and telecommunications segments maintain value-based pricing supported by stringent performance requirements and qualification investments.

Technology roadmaps emphasize continued miniaturization with sub-1mm package development, enhanced frequency stability approaching quartz performance levels, and integrated solutions combining MEMS oscillators with power management and temperature compensation. Strategic imperatives include securing design wins in high-growth automotive ADAS and electrification applications, expanding industrial IoT presence through distributor partnerships and reference design programs, and building comprehensive automotive qualification portfolios spanning AEC-Q100 grades and extended temperature ranges.

Market consolidation potential exists as larger semiconductor companies may acquire specialized MEMS timing capabilities to broaden product portfolios, while established players continue expanding through technology licensing and foundry partnerships enabling capacity scaling without substantial capital investment.

| Items | Values |

|---|---|

| Quantitative Units | USD 69.9 million |

| Packaging Type | SMD (Surface Mounted Devices) Packaging, DIP (Dual Inline-pin Package) Packaging |

| Application | Industrial, Automobile, Wearable Equipment, Consumer Electronics, Communication Equipment, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, and other 35+ countries |

| Key Companies Profiled | Microchip, SiTime, KDS, Jauch Quartz, YXC, Abracon |

| Additional Attributes | Dollar sales by packaging type and application, regional demand (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), competitive landscape, MEMS technology capabilities, automotive qualification achievements, and advanced manufacturing processes driving performance enhancement, miniaturization progress, and reliability improvement |

The global wide temperature MEMS oscillator market is estimated to be valued at USD 69.9 million in 2025.

The market size for the wide temperature MEMS oscillator market is projected to reach USD 287.7 million by 2035.

The wide temperature MEMS oscillator market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in wide temperature MEMS oscillator market are smd (surface mounted devices) packaging and dip (dual inline-pin package) packaging.

In terms of application, industrial segment to command 38.7% share in the wide temperature MEMS oscillator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wide Mouth Jars Market Size and Share Forecast Outlook 2025 to 2035

Widefield Imaging Systems Market Insights - Growth & Forecast 2025 to 2035

Wide Bandgap Semiconductors Market Analysis – Growth & Forecast 2025 to 2035

Wide Mouth Bottles Market – Trends & Forecast 2025 to 2035

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

WiMAX (Worldwide Interoperability For Microwave Access) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA