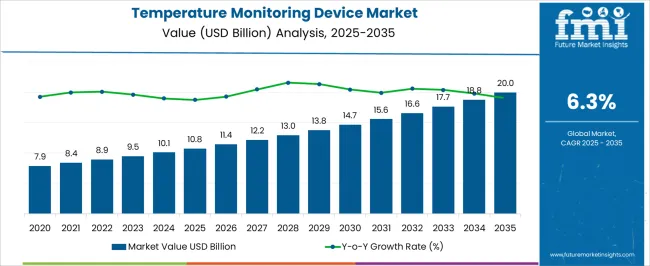

The Temperature Monitoring Device Market is estimated to be valued at USD 10.8 billion in 2025 and is projected to reach USD 20.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Temperature Monitoring Device Market Estimated Value in (2025 E) | USD 10.8 billion |

| Temperature Monitoring Device Market Forecast Value in (2035 F) | USD 20.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The temperature monitoring device market is experiencing robust growth, driven by the increasing emphasis on patient safety, disease monitoring, and expanding applications in healthcare and industrial environments. Technological advancements have enhanced the accuracy, connectivity, and usability of these devices, making them essential tools in both clinical and homecare settings.

Rising prevalence of infectious diseases and heightened focus on early diagnosis have reinforced demand for temperature monitoring solutions. The market is also influenced by the integration of digital and wireless technologies, enabling real-time data tracking and improved healthcare outcomes.

Future expansion will be shaped by the growing adoption of remote monitoring devices, IoT-based healthcare solutions, and the rising trend of personalized care. With ongoing innovations and expanding applications, the market outlook remains favorable.

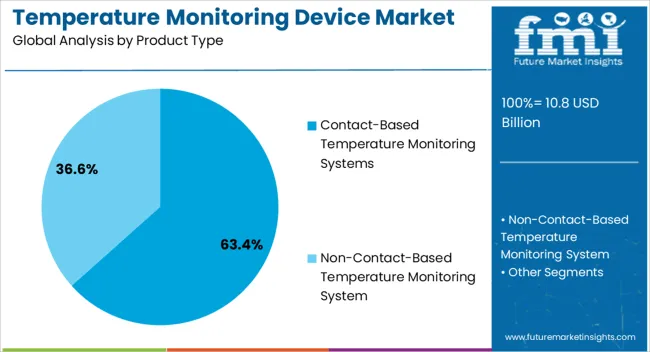

The contact-based temperature monitoring systems segment leads the product type category with approximately 63.4% share, reflecting its widespread adoption in clinical and homecare environments. High accuracy, cost-effectiveness, and established usage protocols contribute to its strong position.

These devices are commonly employed in hospitals, clinics, and households for oral, rectal, and axillary measurements. Their reliability and affordability compared to advanced non-contact systems ensure sustained demand.

With continuous product innovation and broad accessibility, the contact-based systems segment is expected to maintain its dominance.

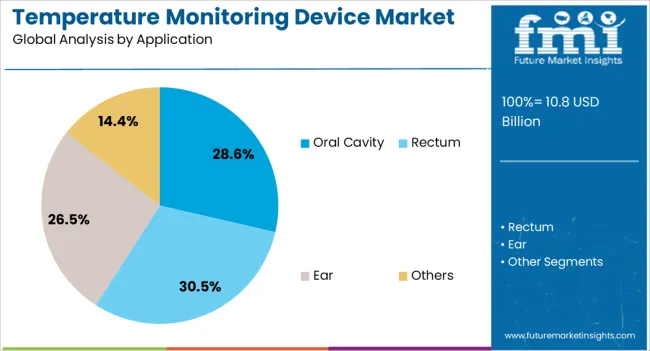

The oral cavity segment holds approximately 28.6% share in the application category, supported by its acceptance as a standard, non-invasive method for measuring body temperature. Oral thermometers are widely used due to their accuracy, ease of use, and suitability for both adults and children.

Their role in routine healthcare monitoring and clinical diagnostics ensures stable demand.

With rising emphasis on home-based monitoring and preventive healthcare, the oral cavity segment is projected to sustain its significant share.

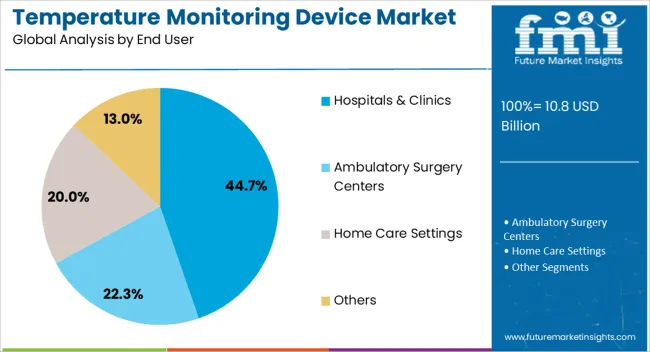

The hospitals & clinics segment accounts for approximately 44.7% share in the end-user category, driven by the high volume of patients requiring continuous and accurate temperature monitoring. Clinical settings rely on these devices for early detection of infections, monitoring treatment effectiveness, and ensuring patient safety during hospitalization.

Expanding healthcare infrastructure and the adoption of advanced monitoring systems have reinforced this segment’s leadership.

With rising patient inflow and the integration of connected monitoring technologies, hospitals and clinics are expected to remain the largest end-users of temperature monitoring devices.

The sales of temperature monitoring devices expanded at a CAGR of 12.7% during the historical period; the temperature monitoring devices market has been witnessing steady growth. The market has been driven by factors such as increasing awareness about the importance of temperature monitoring in various industries, stringent regulatory requirements in sectors like healthcare and food safety, and technological advancements in temperature monitoring devices.

| Data Points | Market Insights |

|---|---|

| Market Value, 2025 | USD 10.80 billion |

| Market Value, 2020 | USD 6.81 billion |

| CAGR 2025 to 2035 | 12.7% |

The COVID-19 pandemic also had an impact on the market, as temperature monitoring became crucial for screening individuals and controlling the spread of the virus. This led to a surge in demand for temperature monitoring devices, particularly infrared thermometers and contactless temperature measurement solutions.

Furthermore, it is necessary to regularly check the temperature of patients with other chronic diseases, particularly when hospitalized. This is because temperature monitoring provides an overview of how well the patient's body is functioning.

The rising patient awareness and rising health consciousness are two additional key drivers of market expansion. There is also an increase in awareness among other industries, including the chemical, food, and pharmaceutical industries. In these businesses, maintaining a certain temperature during various product development phases is a crucial step. Thus, owing to the factors mentioned above, the global temperature monitoring devices market registered a valuation of USD 10.80 billion in 2025.

Rectum temperature monitoring, however, can hamper the growth of the market. To monitor the temperature of the rectum, a temperature catheter is introduced through the anus and several centimeters into the rectum. These devices may not be used due to issues including the prolonged monitoring period, related privacy and discomfort to the patient, the high risk of intestinal injury, and the presence of feces that prevent the thermometer from hitting the intestine wall.

Increasing technical innovation has resulted in the introduction of novel products. For instance, in 2024, American Diagnostics Corporation introduced the Adtemp 429 thermometer, which monitors temperature without making direct contact with the skin and reduces the possibility of cross-contamination.

Thus, it is anticipated that rising consumer demand for quick, sensitive thermometers will help propel the market. Additionally, the production of wearable temperature monitoring devices is the main emphasis of businesses in the market for such devices.

A digital thermometer that is worn on the body measures temperature via touch or patch. It enables continuous temperature monitoring and is connected to smart devices like laptops, tablets, and mobile phones. Wearable temperature monitoring products like the Fitbit and Apple Watch, temperature strips, and temperature patches are frequently used to check the temperature.

| Countries | CAGR |

|---|---|

| The United States | 5.2% |

| China | 4.4% |

| The United Kingdom | 4.7% |

| Japan | 4.1% |

| Germany | 4.6% |

The United Kingdom holds an 18.1% share of the market in 2025 and is projected to display a lucrative CAGR of 4.7% during the forecast period.

The United Kingdom government has placed considerable emphasis on improving food safety. Temperature monitoring is a critical component of food safety, helping to prevent foodborne illness and ensuring that food is safe for consumption. This has created a significant demand for temperature monitoring devices in the food and beverage industry, which contributes to the market growth.

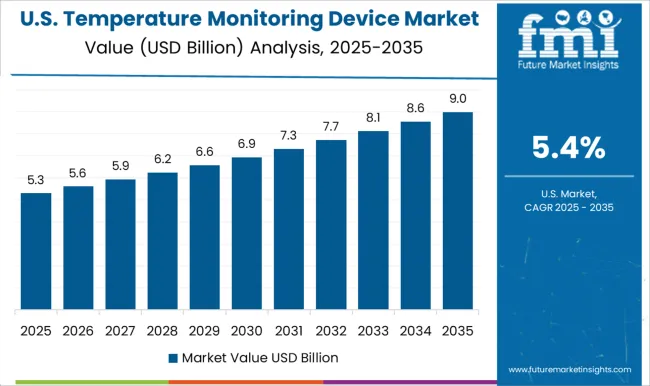

The United States temperature monitoring devices are leading in the North American region, with a market value share of 89.2% in 2025. The market is likely to record a growth of 5.2% through the forecast period.

The market is expanding due to major companies in this area, strategic alliances, and new product launches by these key players. For example, Recon Health unveiled the world's first health patch with core body temperature monitoring in December 2024, powered by the greenTEG CALERA Core Body Temperature Sensor.

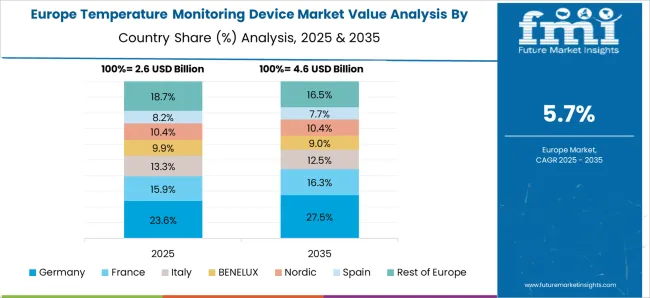

Germany is set to exhibit a CAGR of nearly 4.4% from 2025 to 2035 due to a surge in non-contact temperature sensors in cold chain, food and beverage, and pharmaceuticals, among others.

In Germany, an increase in government efforts increased funding for research and development of temperature monitoring devices, and a rise in innovative products and their approvals drives the market. Additionally, the convenience of modern healthcare systems, ongoing advancements in body temperature monitoring technology, and a considerable increase in demand for progressive healthcare facilities all contribute to the market's expansion.

| Product Type | Non-contact Temperature Monitoring |

|---|---|

| CAGR | 6.0% |

Non-contact-based temperature monitoring systems are expected to register a CAGR of 6.0% by the end of the forecast period, with a market share of about 54.3% in the global market in 2025.

The growing reliance of healthcare professionals on the use of non-contact thermometers to check patients' health conditions is likely to propel the market. The ever-increasing importance of continuous temperature monitoring and the rise in manufacturing and research and development activities are all contributing factors to the growth of the non-contact-based temperature monitoring devices market.

For instance, thirteen states of the United States have banned traditional mercury-in-glass thermometers and are encouraging the use of non-contact thermometers. The government has banned the production and distribution of mercury thermometers.

This is done to remove the possibility of glass thermometer breakage and the subsequent release of environmentally toxic mercury vapor at home. Infrared thermometer sales increased as a result of mercury thermometers being replaced by electronic models.

| Application | Oral Cavity |

|---|---|

| CAGR | 7.2% |

The oral cavity holds a revenue share of 48.4% in 2025 and is expected to display gradual growth, with an estimated rate of 7.2% through 2035. Oral cavity application for temperature monitoring is easy to use and comfortable for the patient. Also, they are more accurate; hence, they hold a significant share of the market.

| End User | Hospitals & Clinics |

|---|---|

| CAGR | 7.3% |

Hospitals and clinics hold the leading market share value of 42.5% in 2025. The rise in the number of government initiatives to assure a high degree of infectious disease preventive measures, as well as an increase in the use of novel body temperature monitoring equipment in hospitals and clinics, drive the growth of this segment.

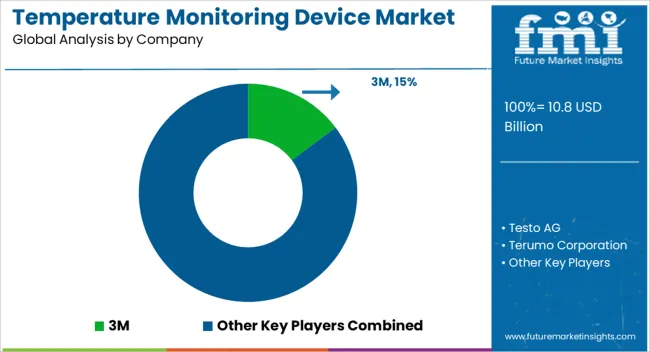

The market for temperature monitoring devices is fragmented, and there exist several local, emerging, and established players within the market sphere.

These companies are using strategies including mergers and acquisitions, partnerships and collaborations, and new product releases to fulfill consumer demand and increase their customer base.

Recent Development

| Attribute | Details |

|---|---|

| Historical Data Available for | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | USD billion for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Argentina, The United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC, and South Africa |

| Key Market Segments Covered | Product Type, Application, End User, and Region |

| Key Companies Profiled | 3M; Testo AG; Terumo Corporation; Siemens AG; Rees Scientific; Omron Healthcare; Monnit Corporation; Honeywell; Deltatrack; Cosinuss GmbH; Abb Ltd.; SensoScientific, Inc.; Omega Engineering; Kelsius, Ltd.; Emerson Electric |

| Pricing | Available upon Request |

The global temperature monitoring device market is estimated to be valued at USD 10.8 billion in 2025.

The market size for the temperature monitoring device market is projected to reach USD 20.0 billion by 2035.

The temperature monitoring device market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in temperature monitoring device market are contact-based temperature monitoring systems and non-contact-based temperature monitoring system.

In terms of application, oral cavity segment to command 28.6% share in the temperature monitoring device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Temperature Controlled Pharmaceutical Packaging Market Trends, Growth, Forecast 2024-2034

Temperature Controlled Packaging Boxes Market

Temperature Sensing Foley Catheter Market

Temperature Calibrator Market

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

RTD Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA