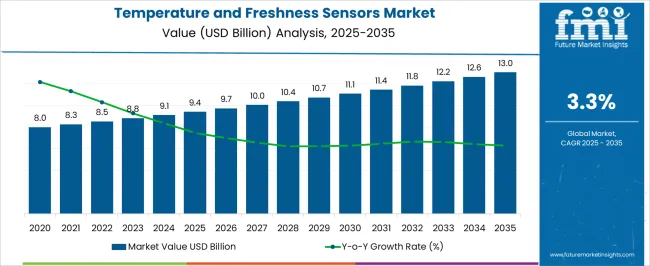

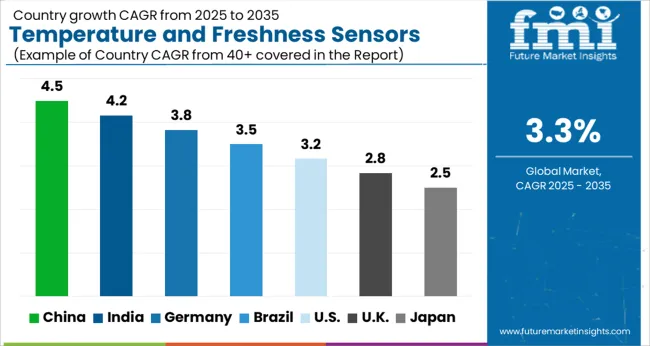

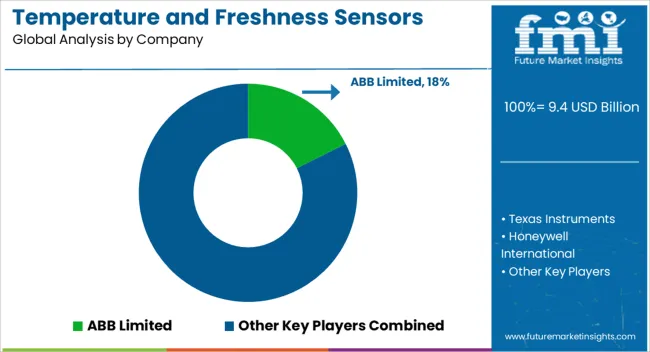

The Temperature and Freshness Sensors Market is estimated to be valued at USD 9.4 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Temperature and Freshness Sensors Market Estimated Value in (2025 E) | USD 9.4 billion |

| Temperature and Freshness Sensors Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The temperature and freshness sensors market is experiencing robust growth. Increasing demand for real-time monitoring, enhanced quality control, and automation across industries is driving market expansion. Current trends are characterized by technological advancements in sensor accuracy, miniaturization, and integration with IoT-enabled systems.

Regulatory focus on product safety and environmental standards has further encouraged adoption. The future outlook is shaped by growing applications in automotive, food, and pharmaceutical sectors, along with rising industrial automation and smart manufacturing initiatives. Continuous innovation in sensor materials and design is improving performance under varying operational conditions.

Growth rationale is supported by the ability of sensors to provide precise and reliable data, enabling operational efficiency, product quality assurance, and compliance with stringent industry standards Expansion of global supply chains, increasing awareness among end-users, and investment in research and development are expected to sustain adoption, driving steady revenue growth and broad-based market penetration over the forecast period.

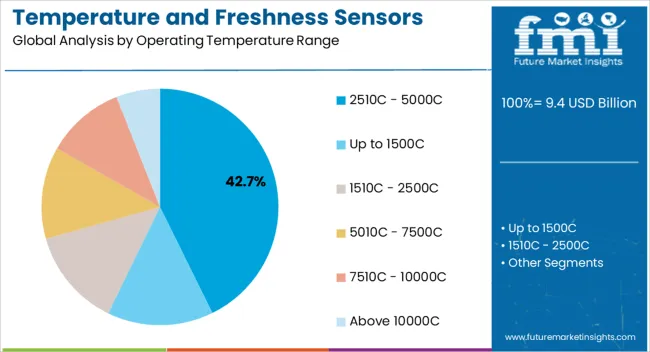

The 25–100°C range segment, representing 42.70% of the operating temperature range category, has been leading due to its suitability for a wide array of industrial and commercial applications. Adoption has been supported by consistent performance in monitoring ambient and moderate process temperatures.

Reliability and accuracy under standard operating conditions have reinforced preference among manufacturers and end-users. Production processes have been optimized to maintain sensor stability and durability over prolonged usage.

Integration with automated control systems and IoT platforms has further enhanced the segment’s market acceptance Growth is expected to continue as industrial processes increasingly demand precise temperature measurement to ensure safety, product quality, and operational efficiency, thereby maintaining the segment’s dominant share within the market.

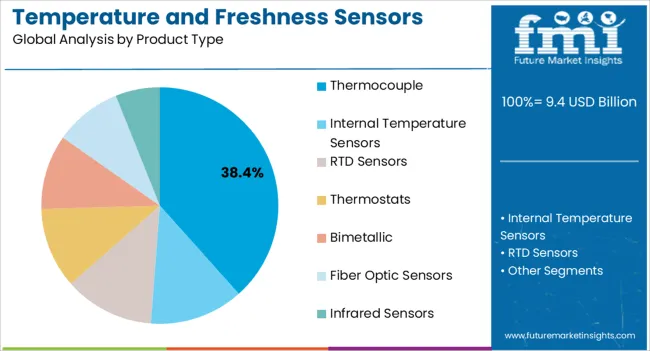

The thermocouple segment, holding 38.40% of the product type category, has emerged as the leading product owing to its versatility, high accuracy, and cost-effectiveness across multiple industrial applications. Adoption has been driven by its capability to measure a wide temperature range and compatibility with automated monitoring systems.

Long-term reliability, robustness in harsh environments, and ease of integration with control units have reinforced market preference. Technological advancements in sensor materials and calibration techniques have improved performance and operational lifespan.

Strategic deployment in manufacturing, automotive, and processing industries has strengthened market penetration Continued innovation, along with growing demand for precise temperature measurement in critical processes, is expected to sustain the segment’s market share and support overall market growth.

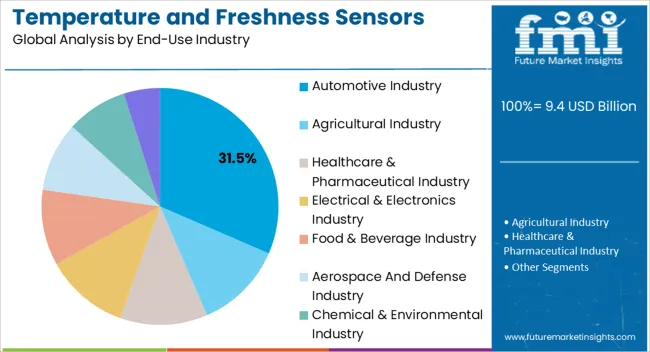

The automotive industry segment, accounting for 31.50% of the end-use category, has maintained dominance due to the critical role of temperature and freshness sensors in vehicle safety, engine efficiency, and battery management systems. Adoption has been driven by stringent regulatory standards, increasing integration of electronics, and rising demand for electric and hybrid vehicles.

Reliability under high-vibration and variable temperature conditions has reinforced preference among OEMs and automotive suppliers. The segment has benefited from close collaboration between sensor manufacturers and automotive companies to develop tailored solutions.

Future growth is expected as automotive electrification and connected vehicle technologies expand, ensuring sustained contribution of this segment to the overall market share.

From 2020 to 2025, the global temperature and freshness sensors market experienced a CAGR of 2.8%, reaching a market size of USD 8,783.1 Million in 2025.

From 2020 to 2025, the global temperature and freshness market witnessed steady growth due to increased demand in the healthcare sector for the preservation and transportation of vaccines during the Covid-19 crisis, and rising adoption by the food and beverage industry due to increased consumption and stringent government regulations.

Additionally, emerging research and development have led to the adoption of IoT and nanotechnology, reducing the size and improving the efficiency of sensors. This progress has pushed manufacturers to invest in sensor manufacturing facilities that include temperature and freshness sensors.

Future Forecast for Temperature and Freshness Sensors Market

Looking ahead, the global temperature and freshness sensors market is expected to rise at a CAGR of 3.5% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 12,389.4 Million.

The temperature and freshness sensors market is expected to continue its growth trajectory from 2025 to 2035, driven by driven by several factors. First off, given the significance of dependable cold chain systems during public health emergencies, the rising need for vaccine preservation and transportation in the healthcare industry is probably just going to continue.

Furthermore, due to strict government requirements on food safety and quality, the usage of these sensors in the food and beverage sector is predicted to increase even further. Additionally, it is projected that ongoing developments in IoT and nanotechnology will provide sensors that are even more effective and compact, further accelerating their use across a variety of sectors.

Wireless sensors, have witnessed an increase in consumption owing to their adaptability and size reduction, especially across North America, East Asia and Europe.

The market is also likely to witness significant growth in the Asia Pacific region due to the presence of significant developing economies such as China and India, which are some of the biggest sensors manufacturing facilities across the world. However, the initial high costs of purchasing temperature and freshness sensors could render them inaccessible across several underdeveloped parts of the region, thereby hampering the market growth.

| Particulars | Value CAGR |

|---|---|

| Smart Packaging Market | 4.5% |

| Active, Smart, and Intelligent Packaging Market | 9.8% |

Temperature and freshness sensors play a crucial role in India's expansive agricultural and food-processing sector. These sensors are instrumental in monitoring and ensuring the quality and safety of perishable goods, which is of utmost importance in this industry. According to India Brand Equity Foundation (IBEF), the Indian agricultural sector is predicted to increase to USD 9.4 billion by 2025.

Furthermore, According to India Brand Equity Foundation (IBEF), the Indian food market will generate USD 9.4 billion in revenue and the market is anticipated to expand at a CAGR of 7.23% between 2025-27. During transportation, temperature and freshness sensors are essential for monitoring the conditions in which perishable goods are transported.

India’s growing population and the increasing demand for high-quality food products have led to a greater emphasis on maintaining the freshness and integrity of agricultural produce throughout the supply chain. Thus, this will have a positive impact on the Indian temperature and freshness sensors market.

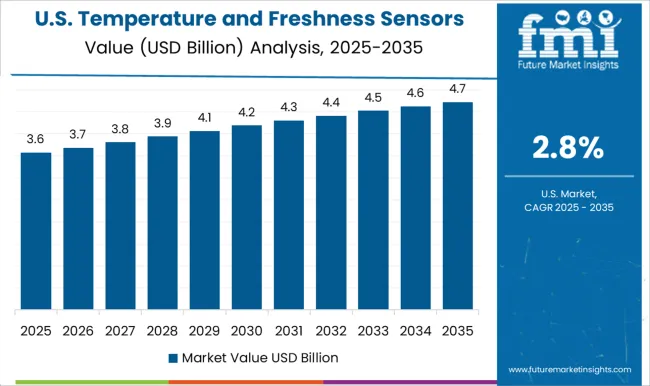

The temperature and freshness sensors market in the United States is expected to witness growth due to the increasing demand for cold chain storage facilities especially pharmaceutical and healthcare industries and food and beverage industries.

The temperature and freshness sensors market in China is expected to grow prominently due to the increasing number of key players in the country such as Shenzhen TOPOS Sensor Technology Co, LTD. and others. Moreover, the rapid growth of the Chinese economy will present lucrative opportunities for additional investments and expansion by both present and upcoming players.

| Product Type | Value CAGR |

|---|---|

| Thermocouple | 3.5% |

| RTD Sensors | 4.9% |

Insight into Key Product Type Stimulating Growth of Temperature and Freshness Sensors Market

The thermocouple segment is expected to dominate the temperature and freshness sensors market with a CAGR of 3.5% from 2025 to 2035. This segment captures a significant market share in 2025 due to its stability and easy maintenance requirements.

Thermocouple temperature and freshness sensors have a wide operating temperature range, opting them very effective. Additionally, its strong sensitivity, accuracy, and durability help to expand its market. The increasing demand for highly sensitive and good accuracy sensors has resulted in manufacturers investing in thermocouple temperature and freshness sensors with multiple features and functions.

| End-use Industry | Value CAGR |

|---|---|

| Electrical and Electronics Industry | 4.8% |

| Food & Beverage Industry | 5.7% |

The food & beverage industry segment is expected to dominate the temperature and freshness sensors market with a CAGR of 5.7% from 2025 to 2035. Food producers and suppliers can adhere to stringent quality requirements and regulations because of temperature and freshness sensors.

In addition to ensuring that products are stored, transported, and displayed at the ideal temperature and humidity levels, they help in preventing the formation of hazardous microorganisms. This helps to preserve the products nutritional value, flavor, and extending its shelf life.

The temperature and freshness sensors market is competitive on the region, with numerous players competing for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Companies invest hugely in research and development to patent & introduce innovative products that offer enhanced efficiency, reliability, and cost-effectiveness. Product innovation enables companies to differentiate themselves from their competitors and cater to the evolving needs of customers.

Strategic Partnerships and Collaborations

Key players in the industry often form strategic partnerships and collaborations with manufacturers to develop custom products that cater to the manufacturer’s requirements. Such flexibility of the players allows them to gain more customers.

Key Developments in the Temperature and Freshness Sensors Market

The global temperature and freshness sensors market is estimated to be valued at USD 9.4 billion in 2025.

The market size for the temperature and freshness sensors market is projected to reach USD 13.0 billion by 2035.

The temperature and freshness sensors market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in temperature and freshness sensors market are 2510c - 5000c, up to 1500c, 1510c - 2500c, 5010c - 7500c, 7510c - 10000c and above 10000c.

In terms of product type, thermocouple segment to command 38.4% share in the temperature and freshness sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Temperature Controlled Packaging Boxes Market

Temperature Sensing Foley Catheter Market

Temperature Calibrator Market

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

RTD Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA