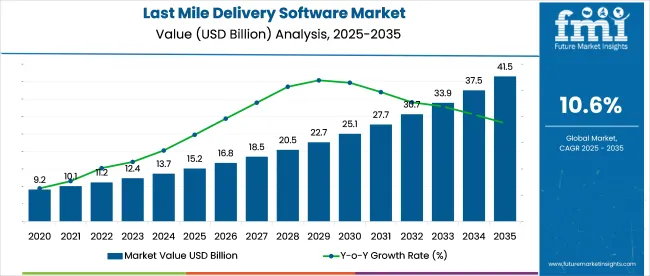

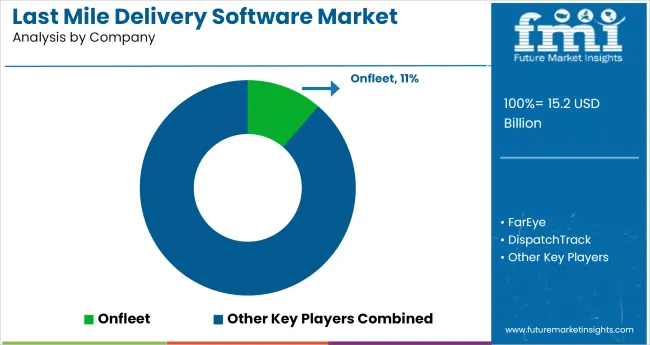

The last mile delivery software market is set to reach USD 41.5 billion by 2035, rising from USD 15.2 billion in 2025, with a CAGR of 10.6%. Cloud-based platforms are leading this growth, driven by rising e-commerce volumes in Asia-Pacific.

| Attributes | Value |

|---|---|

| Industry Size (2025) | USD 15.2 billion |

| Projected Industry Size (2035) | USD 41.5 billion |

| CAGR (2025 to 2035) | 10.6% |

Efficiency losses from blind handoffs in B2B and B2C channels are being addressed through software-led visibility and real-time routing. Advanced orchestration, control tower integration, and autonomous vehicle scheduling are expected to cut costs by up to EUR 25 billion annually. Load bundling trends are pushing demand for tools that optimize delivery consolidation and minimize turnaround waste.

In June 2025, Greek last-mile delivery firm Svuum partnered with Far Eye to digitize its logistics operations, achieving a 50% reduction in operational costs and a 95% first-attempt delivery rate. Since launching in 2021, Svuum has completed over 3 million deliveries. FarEye’s AI-powered route optimization, control tower visibility, and real-time tracking tools have transformed Svuum’s delivery infrastructure. Seamless API integrations and driver management apps have improved scalability and reduced inefficiencies.

This partnership reflects a broader shift in Greek logistics, where companies like Svuum are leveraging last-mile delivery software to enhance customer experience and operational efficiency in a growing eCommerce environment (Logistics Business, 2025).

The last mile delivery software market holds an estimated 6.7% share of the logistics and transportation management market, reflecting its critical role in final-mile optimization. Within the supply chain management software market, it accounts for about 4.9%, driven by growing integration needs across inventory, fulfillment, and delivery stages. In the fleet management software space, it commands approximately 5.5%, supported by its routing, driver tracking, and delivery scheduling capabilities.

As part of the e-commerce enablement technology market, it contributes around 7.8%, given rising B2C delivery volumes and consumer expectations. Within the warehouse and distribution automation market, its share is 3.2%, mainly through integration with dispatch and fulfillment workflows. These shares highlight its importance across multiple digital logistics ecosystems

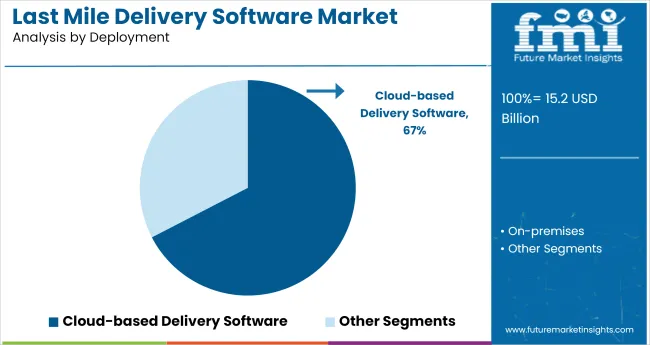

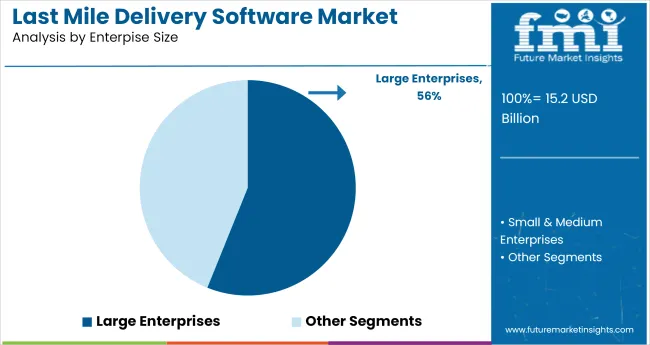

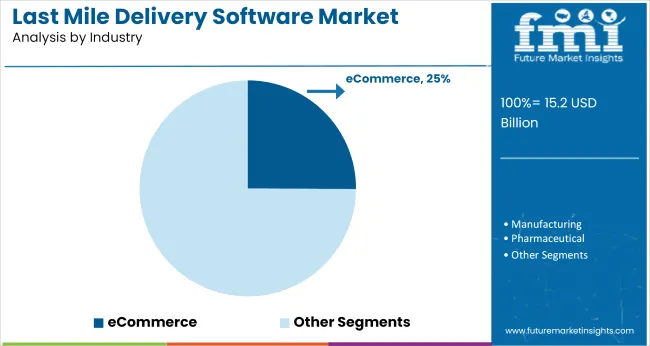

The industry is segmented by deployment model, enterprise size, and industry vertical. Cloud-based platforms are expected to lead deployment preferences with a 67.4% share in 2025. Large enterprises are projected to dominate usage by enterprise size, holding a 56.1% share. Within industry applications, the e-commerce sector is anticipated to account for 25.1% of total demand. Strong adoption is being observed across North America, Western Europe, and East Asia, driven by logistics digitization and multi-node fulfillment optimization.

Cloud-based delivery software is projected to account for 67.4% of total deployments in 2025. Logistics operators are increasingly selecting cloud models due to their ease of integration, reduced capital expenditure, and scalability. These platforms allow for seamless updates, real-time fleet visibility, and improved delivery coordination across hubs.

The demand for API-based solutions and multi-tenant logistics control systems has increased significantly among third-party delivery providers. Cloud systems also support rapid onboarding of gig economy drivers and facilitate dynamic delivery rerouting, which is essential in densely populated and traffic-sensitive delivery zones.

Large enterprises are projected to hold a 56.1% share of the market in 2025. Their high-volume distribution, diverse geographic coverage, and internal fleet management needs are prompting increased investment in logistics platforms.

These organizations require robust reporting tools, real-time alerts, and customer-facing tracking dashboards, which are integrated into enterprise-grade systems. Businesses in retail, telecom, and manufacturing are adopting advanced route optimization engines and predictive ETA models. Many have integrated AI-powered modules into their fulfillment workflows to meet rising delivery speed expectations and maintain cost efficiency.

The e-commerce sector is expected to contribute 25.1% of the total industry share in 2025. Delivery software platforms are being deployed to handle complex customer expectations around same-day or next-day fulfillment, address accuracy, and live tracking. Retailers are using these systems to optimize vehicle loads, reduce delivery times, and automate failed delivery recovery processes.

Direct-to-consumer brands and marketplaces are deploying route sequencing engines to reduce cost-per-drop. The sharp growth in micro-fulfillmentcenters and dark stores is further driving reliance on delivery management software across leading e-commerce ecosystems.

Adoption of last mile delivery software has expanded across logistics networks under pressure from e-commerce volumes and customer expectations for real-time visibility. While investment momentum is strong across North America, Asia, and the GCC corridor, infrastructure fragmentation and fulfillment inefficiencies still pose limitations for smaller carriers and cross-border operators.

Surge in On-Demand Fulfillment Drives Software Uptake

Last mile delivery software deployment is rising as retailers shift toward decentralized fulfillment hubs and same-day delivery. In 2024, over 52% of large-format retailers in North America integrated route optimization software into their dispatch systems.

In Southeast Asia, e-grocery services in cities like Bangkok and Jakarta showed a 26% reduction in delivery turnaround times through real-time fleet tracking. Advanced platforms with AI-driven task assignment and traffic-aware routing now account for 39% of enterprise software contracts in the EU logistics sector.

Legacy Systems and Infrastructure Gaps Limit Expansion

While software penetration is accelerating among tech-first firms, bottlenecks persist in industries where legacy ERPs dominate. In Latin America, only 14% of mid-tier logistics operators use cloud-native dispatch systems, slowing visibility across last mile legs.

African metros reported a 31% failed-delivery rate in 2023 due to address inaccuracy and driver mismatch. Rising API integration costs and fragmented telecom coverage in rural corridors have stalled deployment of real-time proof-of-delivery solutions.

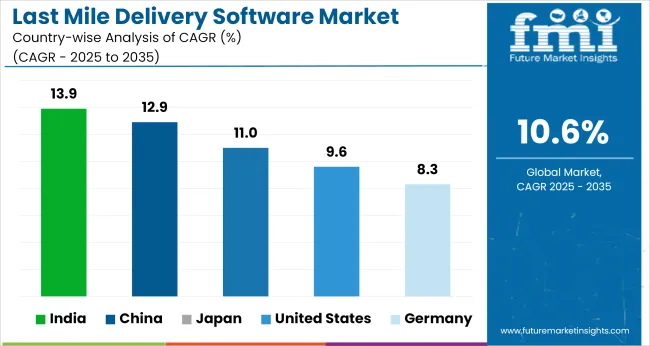

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 9.6% |

| China | 12.9% |

| India | 13.9% |

| Germany | 8.3% |

| Japan | 11.0% |

The global last mile delivery software market is projected to expand at a CAGR of 10.6% from 2025 to 2035, with BRICS countries outpacing this trajectory. India leads at 13.9%, exceeding the global average by 3.3 percentage points.

Growth is supported by rapid adoption of route automation tools across small and medium retail networks, as well as expanded use of plug-and-play logistics APIs by local delivery aggregators. China follows at 12.9%, where integrated delivery ecosystems and autonomous fleet trials are accelerating demand.

Japan, part of the OECD, slightly surpasses the global rate at 11.0%, driven by robotic sorting hubs and AI-based route optimization within dense city zones. The United States grows at 9.6%, just below the global average, hindered by decentralized logistics networks and low interoperability among mid-size couriers. Germany records 8.3%, weighed down by strict data regulations and dependence on legacy warehousing systems. ASEAN countries are increasingly adopting mobile-native delivery solutions tailored for compact fulfillment footprints.

Demand for last mile delivery software in the United States is projected to grow at a CAGR of 9.6% from 2025 to 2035. Strong e-commerce infrastructure, demand for hyper-local delivery, and regulatory incentives are driving adoption across logistics, retail, and food delivery sectors. Predictive analytics, route optimization, and customer-facing delivery tracking are being integrated into platforms at scale. Urban congestion fees and emissions caps are pushing retailers to adopt eco-routing features. Autonomous delivery pilots and subscription-based logistics software are further reshaping B2C fulfillment.

Sales of last-mile delivery software in China is forecast to expand at a CAGR of 12.9% through 2035. Super-app ecosystems such as Meituan and JD.com are integrating dynamic routing, temperature-sensitive tracking, and courier scoring features into their logistics workflows.

Urban delivery efficiency is being enhanced by micro-depots and electric vehicle optimization. Delivery density in major cities necessitates platforms that manage simultaneous batch delivery, real-time ETA recalculation, and rider visibility for consumers.

India is projected to lead with a CAGR of 13.9% from 2025 to 2035, the highest globally. Mobile-first logistics SaaS platforms are proliferating across Tier 2 and Tier 3 cities, supporting vernacular interfaces and low-data usage. Quick-commerce startups and hyperlocal aggregators are using software to compress fulfillment time and coordinate dense micro-zone deliveries. Dynamic rerouting capabilities during monsoon disruptions and festival congestion have become essential for delivery platforms.

Demand for last mile delivery software in Germany is set to grow at a CAGR of 8.3% from 2025 to 2035. The need to comply with EU environmental zoning laws and fleet electrification mandates is pushing demand for delivery routing software with built-in emissions optimization.

Cold-chain verticals, especially pharma and perishable food, require integrated compliance tracking and timestamped delivery logs. Retailers are adopting hybrid delivery models combining cargo bikes, vans, and pick-up points, which require orchestrated route coordination.

Japan is expected to see a CAGR of 11.0% through 2035, supported by high urban density, aging populations, and growing demand for punctual, contactless deliveries. Software platforms are integrating with building access systems for timed locker access, delivery windows, and robotic courier entry.

Real-time delivery updates and dynamic geofencing are being used to support pedestrian couriers and high-rise deliveries. Logistics innovation is backed by government initiatives under Society 5.0, promoting AI-integrated routing and delivery optimization.

In the last mile delivery software market, leading companies are driving growth through AI-based dispatch systems, mobile-first routing platforms, and sector-specific delivery orchestration. Onfleet, FarEye, and DispatchTrack are widely adopted across grocery, pharmacy, furniture, and QSR segments due to their ability to support dynamic routing, real-time visibility, and proof-of-delivery workflows.

Route4Me, Zeo Route Planner, and Routific are favored by SMEs for their lightweight deployment, cost-efficiency, and flexible fleet coordination. OneRail and project44 serve high-complexity verticals like healthcare and telecom, offering API-based integrations, SLA compliance, and predictive delivery insights. Urbantz and Dispatch Science are gaining traction in urban logistics across Europe by optimizing electric vehicle fleets, multi-stop routes, and delivery locker management.

Competitive pressure is rising from SaaS-native startups offering low-code customization and real-time data analytics. To maintain differentiation, industry leaders are aligning product roadmaps around ERP connectivity, delivery precision, and carrier benchmarking to support both enterprise scalability and localized agility.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 15.2 billion |

| Projected Industry Size (2035) | USD 41.5 billion |

| CAGR (2025 to 2035) | 10.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million licenses for volume |

| Deployments Analyzed (Segment 1) | Cloud-based, On-premises |

| Enterprise Sizes Analyzed (Segment 2) | Small & Medium Enterprises, Large Enterprises |

| Industries Analyzed (Segment 3) | Courier Express & Parcel, Retail & FMCG, Transportation, E-commerce, Manufacturing, Pharmaceutical, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Saudi Arabia, UAE, South Africa |

| Key Players | Onfleet, FarEye, DispatchTrack, Route4Me, OneRail, Urbantz, project44, Zeo Route Planner, Routific, Dispatch Science |

| Additional Attributes | Dollar sales by deployment and enterprise size, increased adoption of cloud-native routing platforms, rising demand from e-commerce and parcel industries, automation in route optimization, growing preference for real-time delivery visibility tools |

In terms of deployment, the industry is divided into cloud-based and on-premises.

In terms of enterprise size, the industry is divided into small & medium enterprises and large enterprises.

The industry is classified by industry as courier express & parcel, retail & FMCG, transportation, e-commerce, manufacturing, pharmaceutical, and others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The industry is projected to reach USD 15.2 billion in 2025.

The industry is expected to grow at a CAGR of 10.6% from 2025 to 2035.

Cloud-based deployment is expected to capture 67.4% of the market in 2025.

The Asia Pacific region, particularly China and India, is projected to show strong growth.

The industry is projected to reach USD 41.5 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Last Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Electric Last Mile Delivery Vehicle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

First Mile Logistics Delivery Software Market Size and Share Forecast Outlook 2025 to 2035

First Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA