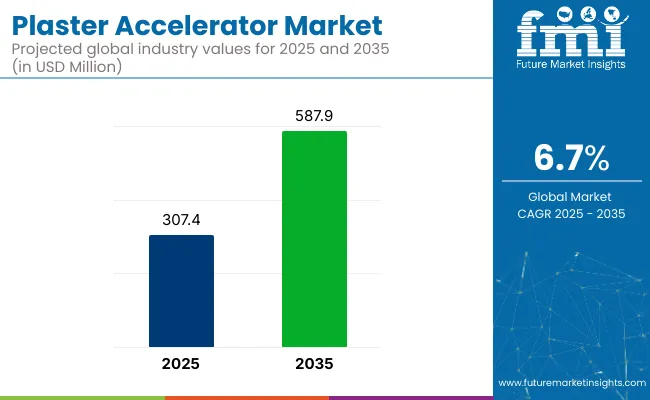

The plaster accelerator market is valued at USD 307.4 million in 2025 and is poised to reach USD 587.9 million by 2035, reflecting a CAGR of 6.7%. This growth is being driven by a heightened demand for fast-setting plaster solutions, increased urban development, and the adoption of prefabricated construction techniques. The incorporation of green building codes and low-VOC construction materials has also been supporting this surge in demand, especially across residential and commercial sectors.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 307.4 million |

| Market Size (2035) | USD 587.9 million |

| CAGR (2025 to 2035) | 6.7% |

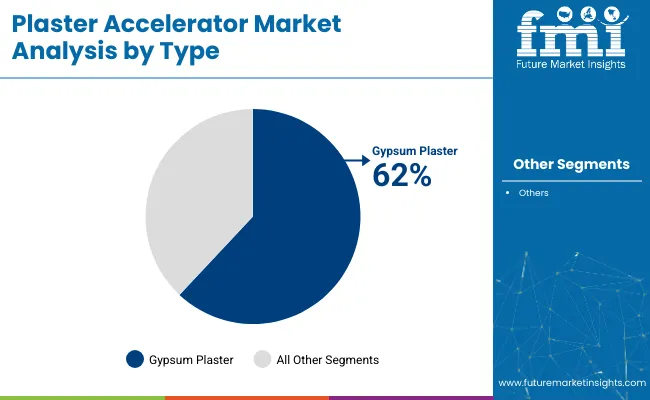

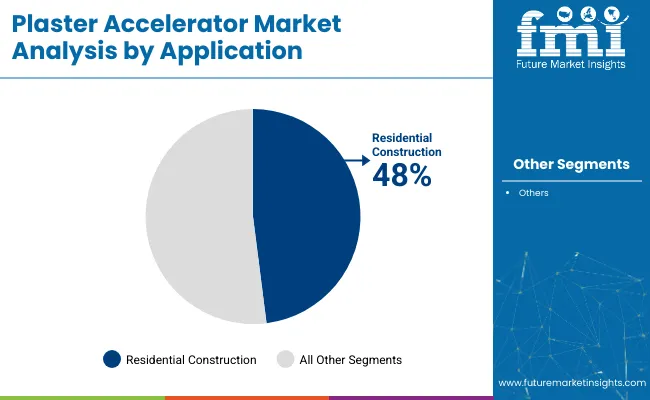

The gypsum plaster sub-segment is projected to dominate the type segment with a 62% market share through 2025, driven by its efficiency, fast setting times, and superior finish. The residential construction sector is expected to lead the application category with a 48% share, reflecting rising housing initiatives and interior renovation activities.

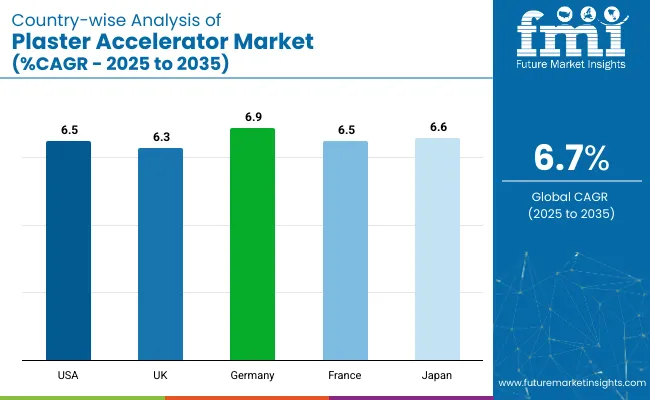

Within product types, factory-fabricated gypsum plasterboards are being widely adopted, especially in modular construction, making them the top-performing segment. Regionally, the USA is forecasted to maintain the highest revenue share, while the Germany is anticipated to emerge as the fastest-growing country with a CAGR of 6.9%.

Meanwhile, the integration of AI-assisted plaster optimization, bio-based accelerators, and real-time performance monitoring is redefining market competitiveness. Companies that align their strategies with sustainable building goals and construction digitization are expected to be rewarded with long-term growth and market presence. Rapid urbanization and eco-compliant infrastructure plans are also expected to fuel continuous demand for advanced plaster accelerator solutions globally.

Advanced manufacturing techniques have been increasingly adopted to enhance the efficiency and consistency of plaster accelerator production. High-performance additives with improved shelf life, lower emissions, and faster curing profiles have been introduced to meet regulatory and performance standards. Strategic collaborations between chemical manufacturers and construction firms have also been formed to develop custom formulations suited for specific climate zones and regional construction practices.

The market is segmented by type, application, and region. By type, the market is divided into gypsum plaster and non gypsum plaster. Based on application, the market is categorized into residential, commercial, industrial, and infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa.

Gypsum plaster is projected to lead the type segment, accounting for 62% of the global market share in 2025. It has been widely adopted due to its fast-setting nature, smooth surface finish, and reduced shrinkage, making it a preferred choice for interior wall applications in both residential and commercial construction.

The residential construction segment is expected to dominate the application category, securing 48% of the global market share by 2025. The segment's expansion has been fueled by urban housing developments, home improvement activities, and demand for fast-setting materials that reduce construction time and cost.

The market is experiencing consistent growth, driven by rising demand for fast-setting construction materials, increased adoption of modular and prefabricated building techniques, and regulatory support for sustainable, low-emission additives.

Recent Trends in the Plaster Accelerator Market

Challenges in the Plaster Accelerator Market

The USA plaster accelerator market is expected to grow at a CAGR of 6.5% from 2025 to 2035. This growth is being supported by increased demand for rapid-setting plaster in new residential and commercial construction, along with significant advancements in green building technologies.

The UK plaster accelerator market is projected to expand at a CAGR of 6.3% during the forecast period. Rising investments in sustainable construction and government incentives for low-carbon buildings are fueling demand for fast-setting plaster formulations.

Germany’s plaster accelerator market is forecasted to grow at a CAGR of 6.9% from 2025 to 2035. The country's focus on high-performance construction solutions and adherence to stringent environmental standards have driven the use of gypsum-based accelerators.

The plaster accelerator market in France is anticipated to grow at a CAGR of 6.5% over the forecast period. Restoration of heritage buildings, expansion of residential housing, and government initiatives for sustainable urban growth have supported the demand for eco-compliant and fast-setting plaster products.

Japan’s plaster accelerator market is projected to grow at a CAGR of 6.6% from 2025 to 2035. The country’s commitment to smart city infrastructure and earthquake-resilient building materials is encouraging the adoption of moisture-resistant and rapid-setting plaster accelerators.

The plastic accelerator market is moderately consolidated, with several publicly listed global leaders holding substantial market shares, while regional innovators and specialty chemical firms continue to diversify offerings. Competitive dynamics are being shaped by investments in eco-friendly additives, integration of AI in formulation optimization, and strategic shifts toward high-margin specialty applications. Capacity expansion, M&A activity, and downstream partnerships are being employed to enhance market presence and technology.

Tier-one firms, such as SABIC, BASF SE, Dow Inc., LyondellBasell, and Covestro AG, are competing through large-scale investments in polymer additives, including antioxidants, curing agents, and light stabilizers used in plastic acceleration and recycling enhancement. These companies have been strengthening their additive portfolios with AI-enabled R&D platforms, modular manufacturing upgrades, and compliance-aligned formulations for packaging, automotive, and electronics markets.

Additionally, companies like LG Chem, Westlake Corp., Eastman Chemical, Arkema SA, and Lanxess AG have been advancing niche segments with next-generation plasticisers, nucleating agents, epoxy accelerators, and UV-stable modifiers. Many of these players are aligning product strategies with circular economy targets, scaling up bio-based or non-phthalate alternatives to meet sustainability demands. Strategic acquisitions, customer-specific additive solutions, and regional supply security have been emphasized as key drivers of competitive advantage.

Recent Plaster Accelerator Industry News:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 307.4 million |

| Projected Market Size (2035) | USD 587.9 million |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions / Volume in metric tons |

| By Type | Gypsum Plaster, Non-Gypsum Plaster |

| By Application | Residential, Commercial, Industrial, Infrastructure |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | SABIC, BASF SE, Dow Inc., LyondellBasell, Covestro AG, LG Chem, Westlake Corp., Eastman Chemical, Arkema SA, Lanxess AG |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is expected to reach USD 587.9 million by 2035.

The global market is projected to grow at a CAGR of 6.7% during this period.

Gypsum plaster is expected to lead with a 62% market share in 2025.

Residential segment is expected to account for 48% of the market in 2025.

Germany is anticipated to be the fastest-growing country, with a CAGR of 6.9% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Plaster Market Trends – Growth, Demand & Forecast 2024-2034

Earthen Plasters Market Size and Share Forecast Outlook 2025 to 2035

Gypsum-free Plaster Market Size and Share Forecast Outlook 2025 to 2035

Accelerator Cards Market

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Shotcrete Accelerators Market

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Vulcanization Accelerators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA