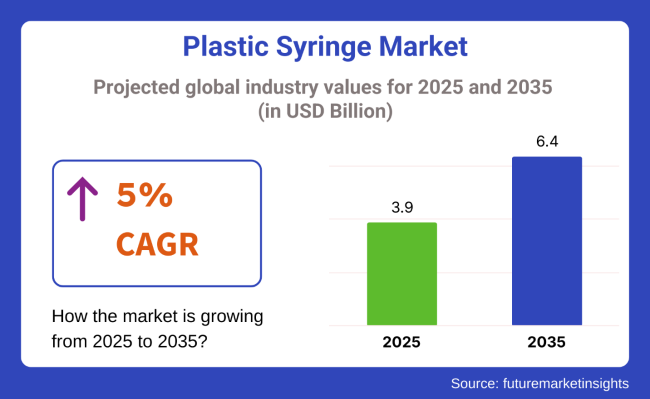

The plastic syringe market is projected to grow from USD 3.9 billion in 2025 to USD 6.4 billion by 2035, registering a CAGR of 5% during the forecast period. Sales in 2024 reached USD 3.7 billion, reflecting growing demand driven by increasing healthcare needs and the widespread use of injectable therapies.

Increasing demand for disposable medical devices, rising prevalence of chronic diseases, and the expansion of vaccination programs globally drives the growth. The shift towards single-use syringes for enhanced safety and infection control further propels market expansion.

Plastic syringes are predominantly made from materials like polypropylene (PP), polyethylene (PE), and polycarbonate (PC), with PP being the most commonly used due to its durability and cost-effectiveness. The market is segmented into various types, including hypodermic syringes, oral syringes, and prefilled syringes.

Prefilled syringes are gaining traction owing to their convenience and reduced risk of contamination, especially in the administration of vaccines and insulin. The growing trend of self-administration of drugs at home has also increased the demand for user-friendly syringe designs.

Gerresheimer, an innovative systems and solutions provider and global partner for the pharma, biotech and cosmetics industries, has successfully completed an expansion and modernization project at its Lohr site with a total investment volume of around EUR 100 million after more than two years of planning and construction.

“Our investments in cutting-edge production technology, such as the new facility in Lohr, secure the future,” explains Dietmar Siemssen, CEO of Gerresheimer AG. “With state-of-the-art facilities for high-value products, we are strengthening our competitiveness, securing long-term jobs in the region and making significant progress toward our ambitious sustainability goals.”

The plastic syringe market is witnessing innovations aimed at enhancing safety and sustainability. Manufacturers are developing syringes with safety features like retractable needles to prevent needle stick injuries.

Additionally, there's a growing focus on producing syringes using recyclable materials to reduce environmental impact. The integration of smart technologies, such as dose-tracking and connectivity features, is also emerging, aiming to improve patient compliance and monitoring.

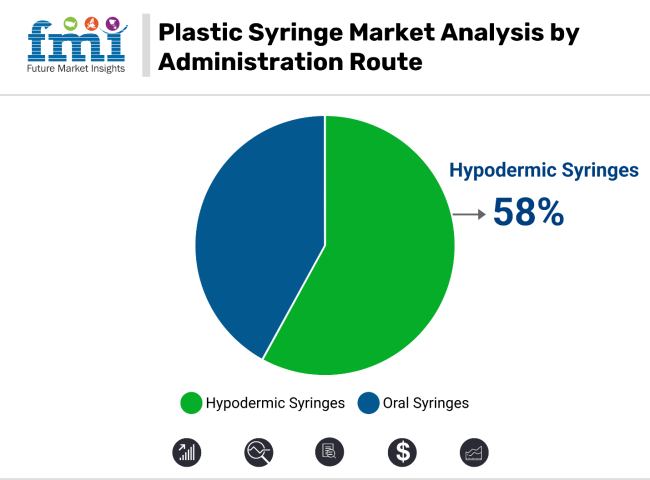

Hypodermic syringes are expected to hold a commanding 58% share of the plastic syringe market by 2025, owing to their critical role in the safe and precise administration of medications, vaccines, and diagnostic fluids. Designed for penetration through the skin and into veins or muscles, these syringes are widely used across hospitals, clinics, and home care environments.

Plastic hypodermic syringes offer advantages including sterility, affordability, disposability, and minimal risk of cross-contamination. Their adaptability to a wide range of needle gauges and volumes makes them indispensable in various medical applications, including anesthesia delivery, blood draws, and immunizations. The COVID-19 pandemic and subsequent emphasis on vaccination infrastructure have further accelerated their adoption, leading to increased investments in production capacity and inventory stockpiling.

Regulatory agencies and healthcare providers continue to promote the use of safety-engineered and auto-disable hypodermic syringes to prevent needle-stick injuries and ensure one-time usage. Additionally, advancements in material composition-such as BPA-free and latex-free plastics-enhance safety for both users and patients. With continued global efforts to expand access to basic and preventive healthcare, the demand for hypodermic plastic syringes will remain robust, particularly in immunization programs, emergency care, and chronic disease management.

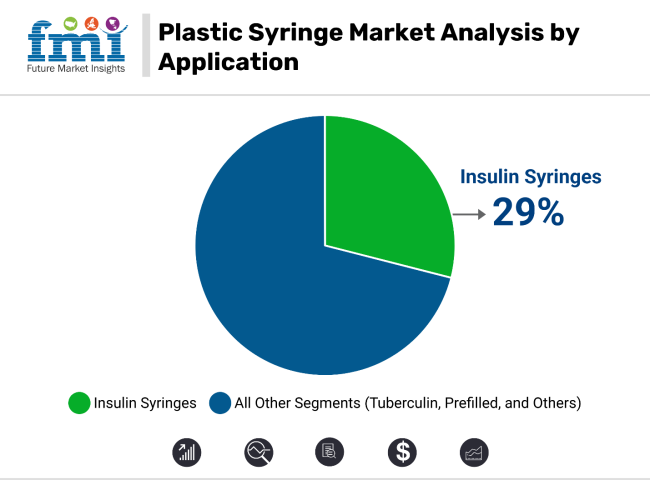

Insulin syringes are projected to account for 29% of the plastic syringe market by 2025, driven by the growing global prevalence of diabetes and the widespread shift toward self-administered therapy. Designed specifically for subcutaneous injection of insulin, these syringes feature finer needles, clear dosage markings, and low dead space to ensure accurate and pain-minimized delivery for diabetic patients.

Plastic insulin syringes are typically used multiple times per day by Type 1 and insulin-dependent Type 2 diabetics, making ease of use and cost-efficiency paramount. These syringes are available in various barrel capacities-commonly 0.3 ml, 0.5 ml, and 1 ml-and are compatible with U-100 insulin concentrations, supporting safe and accurate dosing.

The rise of home-based healthcare, greater public awareness of diabetes management, and improvements in diabetic education programs are fueling demand for user-friendly injection devices. While insulin pens and pumps are gaining traction, insulin syringes remain the preferred option in many regions due to their affordability and insurance coverage.

With the diabetic population on the rise, insulin syringes will continue to play a vital role in accessible, daily disease management, especially in emerging economies where disposable plastic syringes provide a cost-effective solution for chronic care.

Increase in Health Issues

A vast population around the world suffers from chronic diseases such as diabetes, which requires insulin shots. The aging population increases the demand as older people need frequent medical care.

Healthcare is improving in developing countries, leading to more hospitals and clinics that need syringes. Vaccination programs for children and adults also create a steady need for syringes.

Safe Use of Syringes and New Treatments

Syringes need to be used only once to avoid infections, which makes the demand for them even higher. The COVID-19 pandemic showed how quickly the demand for syringes can rise when there is a need for mass vaccination.

Medicines, such as cancer drugs and biologics, need to be injected, which increases the use of syringes. More people are also giving themselves injections at home, which leads to more demand for easy-to-use syringes.

Technological Advancements in Syringe Design

New technology is improving syringe design and driving the market ahead. A major innovation is the advent of safety syringes that help prevent needle stick injuries. These syringes have features such as retractable needles or built-in safety measures, making them safer for both doctors and patients.

Also, better materials and manufacturing methods are making plastic syringes more reliable and high-quality, which is increasing their demand in healthcare.

Plastic Medical Wastes is Harmful for the Environment

The growing environmental concern over plastic medical waste is becoming a significant challenge. Hospitals and clinics discard millions of plastic syringes daily, creating mountains of non-biodegradable trash. Many countries are pushing healthcare facilities to reduce plastic waste, and some are exploring alternatives or recycling programs.

This environmental pressure could slow down market growth as healthcare providers look for more sustainable options or ways to reduce syringe usage where possible.

High Cost of Advanced Syringe Technologies

Another factor slowing down the plastic syringe market is the high cost of new technologies. Advanced syringes, such as safety syringes, prevent needle injuries, and smart syringes that track medicine delivery, can be much more expensive than regular syringes.

This higher price can make it hard for hospitals and clinics, especially in developing countries, to buy them. Many healthcare providers have tight budgets and may choose to stick with cheaper, traditional syringes instead. Because of this, the growth of the plastic syringe market can be limited by the high costs of these newer, safer options.

Safety Syringes with Retractable Needles

Safety syringes prevent accidental needle sticks, which are dangerous for healthcare workers. After using these needles, the needle automatically pulls back into the barrel of the syringe, making it impossible to reuse and safer to dispose of.

Many hospitals are switching to safety syringes, even though they cost more because they protect the healthcare personnel from injuries and potential infections. It is more trending in the developed countries that have stricter worker safety regulations.

| Countries | CAGR |

|---|---|

| USA | 4.8% |

| UK | 4.5% |

| Germany | 11.1% |

| China | 5.2% |

| India | 5.5% |

The USA accounts for 28.2% value share in the global market, and is expected to reach a CAGR of 4.8% over the forecast period. The plastic syringe market in USA is growing because of a focus on healthcare and safety.

The USA Food and Drug Administration (FDA) has set strict guidelines for medical devices, including syringes, which encourages manufacturers to develop safer and more effective products. Additionally, the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, increases the demand for injectable medications.

The trend towards home healthcare is also significant, as more patients prefer self-injection for convenience. Furthermore, the COVID-19 pandemic highlighted the importance of vaccination, leading to heightened production and distribution of syringes for mass immunization programs.

UK is expected to witness a CAGR of 4.5% during the forecast period. This growth is mainly because of efforts by the National Health Service (NHS) to ensure patient safety and better care. The NHS encourages the use of single-use syringes to avoid infections and make sure medicine is given safely.

The increasing focus on preventive healthcare and vaccination programs has also raised the demand for syringes. Also, as the population gets older, more people need medical treatments, leading to higher demand for syringes. The government's efforts to improve healthcare services are also helping the market grow.

The plastic syringe market in Germany is expected to grow at a positive CAGR during the forecast period. The growth is witnessed due to a strong healthcare system and focus on patient safety. The country has strict rules for medical devices to make sure syringes are of high quality. The rising number of chronic diseases such as diabetes and cancer is increasing the need for injectable medications.

Germany is also known for its advanced healthcare technology, which drives new designs and safety features for syringes. The focus on vaccination programs, especially during the COVID-19 pandemic, has increased the demand for syringes. Plus, the growing trend of home healthcare, where patients give themselves medicine, is driving the need for easy-to-use syringes.

China is expected to grow at a CAGR of 5.2% during the forecast period. China's plastic syringe market is growing quickly because of its large population and increasing healthcare needs. The government has invested a lot in healthcare to make medical services more accessible.

Programs like the Healthy China 2030 initiative encourage better healthcare practices, such as vaccination and managing chronic diseases, which increases the demand for syringes. The growth of private hospitals and clinics also adds to this demand as they need a constant supply of syringes for medical procedures. Also, more people are becoming aware of hygiene and safety in healthcare, leading to more use of single-use syringes.

India is expected to grow at a CAGR of 5.5% during the forecast period. In India, the plastic syringe market is growing because both chronic diseases and the population are increasing. The government has started several health programs such as the National Health Mission to improve healthcare access and quality.

This includes promoting vaccinations and maternal health, which drives the need for syringes. The growth of healthcare facilities, such as private hospitals and clinics has accelerated the need for medical supplies. Also, more people are opting for self-medication and home healthcare, where they manage their own health.

| Company Name | Expertise |

|---|---|

| Retrago | Focuses on automatic retractable syringes |

| Apiject Systems Corp. | Specializes in single-use, pre-filled plastic syringes using blow-fill-seal (BFS) technology, capable of high-volume production to efficiently address global vaccination needs. |

| Credence MedSystems | Develops syringes with built-in safety features, such as self-retracting needles, and collaborates with pharmaceutical manufacturers for integrated drug delivery systems. |

Several strategies are used by the syringe companies to grow. Their focus is on innovation by developing new types of syringes, like safety-engineered and pre-filled syringes, to meet the needs of healthcare providers and patients.

They also invest in marketing campaigns to raise awareness about the benefits of their products. Collaborating with hospitals, clinics, and pharmacies is another key strategy, as it helps companies understand customer needs and build strong relationships.

Additionally, many companies are exploring sustainable practices, such as recycling programs, to address environmental concerns and attract eco-conscious consumers. Overall, these strategies aim to improve product quality, increase sales, and enhance customer satisfaction in the syringe market.

The plastic syringe market is segmented into administration route, application, and region.

By administration route, the market is sub-segmented into hypodermic syringe, and oral syringe

By application, the market is sub-segmented into tuberculin syringe, insulin syringe, prefilled syringe, and others

By region, the market is sub-segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa

The plastic syringe market was valued at USD 3.9 billion in 2025.

The market is predicted to reach a size of USD 6.4 billion by 2035.

Some of the key companies manufacturing plastic syringes include Becton, Dickinson and Company, Braun Medical Inc., Gerresheimer AG, Terumo Corporation, and others.

The U.S. is a prominent hub for plastic syringe manufacturers, which is expected to grow at a CAGR of 4.8% over the forecast period 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Administration Route, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Administration Route, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Administration Route, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Administration Route, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Administration Route, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Administration Route, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Administration Route, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Administration Route, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Administration Route, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Administration Route, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Administration Route, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Administration Route, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Administration Route, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Administration Route, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Administration Route, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Tube Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA