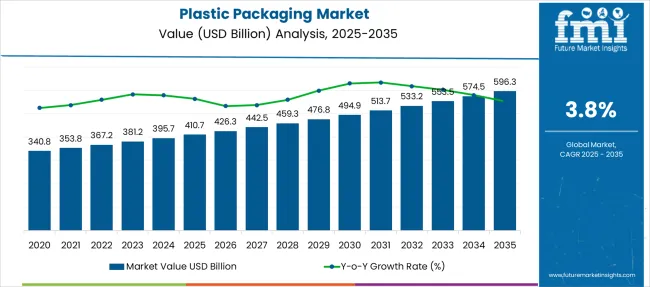

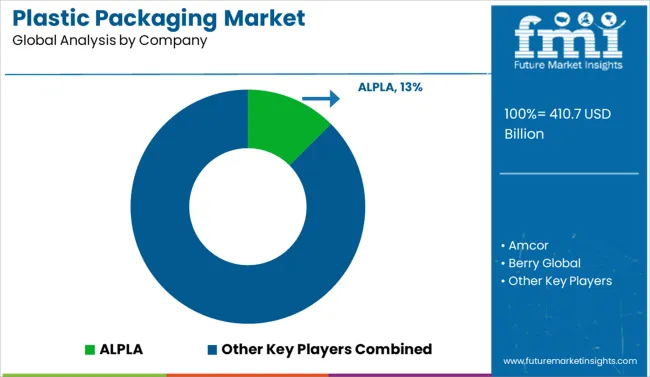

The Plastic Packaging Market is estimated to be valued at USD 410.7 billion in 2025 and is projected to reach USD 596.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. Based on the market report, incremental layering shows USD 85.6 billion added during 2025–2030, averaging USD 17 billion yearly, driven by e-commerce and food service packaging demand. Between 2030–2035, the pace reduces to USD 100 billion over five years, but contribution shifts toward specialized films and barrier materials, accounting for 35% of added value. YoY growth volatility narrows from 4.2% (2025) to 3.2% (2035), signaling progressive market normalization.

Layering highlights a gradual shift: rigid plastics drop from 52% share in 2025 to 48% by 2035, while flexible packaging increases by 7%, aided by cost-efficiency trends. Geographically, Asia-Pacific contributes over 42% of incremental growth, driven by urban retail penetration and higher per capita consumption. Incremental mapping shows that margins will compress post-2030, requiring scale-based efficiencies and new polymer blends to sustain profitability.

Unlike volatile sectors, this market shows a predictable, moderately rising curve, reflecting its essential role in food, beverages, pharmaceuticals, and consumer goods. Rather than sudden spikes, growth is tied to consumption trends, retail dynamics, and evolving regulations.

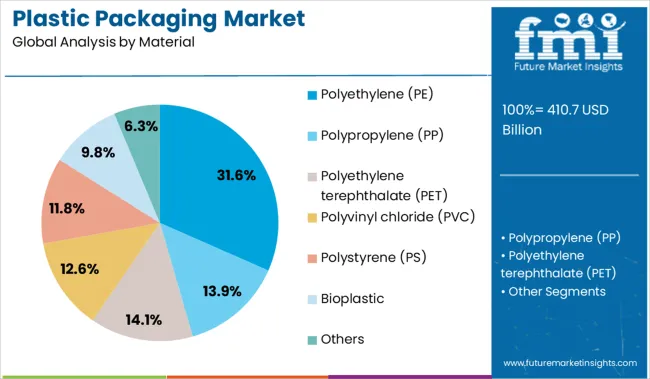

Polyethylene (PE) remains the leading material with 31.6% share in 2025, supported by its versatility and durability across flexible and rigid formats. Asia-Pacific drives most of the expansion, propelled by packaged food demand and manufacturing intensity, while North America and Europe sustain momentum with lightweight designs and recycling-focused product lines.

The curve indicates a steady incline with minimal deviation, but a noticeable gradient shift may emerge after 2029 as bio-based plastics, recyclable multilayer films, and advanced barrier coatings become widely adopted. Strategic innovation is shifting toward downgauging, smart labeling integration, and returnable packaging systems. For long-term positioning, competitive advantage will come from closed-loop recycling investments and regulatory compliance capabilities, given the increasing bans on non-recyclable plastics.

| Metric | Value |

|---|---|

| Plastic Packaging Market Estimated Value in (2025 E) | USD 410.7 billion |

| Plastic Packaging Market Forecast Value in (2035 F) | USD 596.3 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

Regulatory pressures around sustainability have led to increased investment in recyclable and bio-based plastics, while innovation in barrier properties and design flexibility continues to support product integrity and shelf appeal. The growth of e-commerce and on-the-go consumption habits has further driven the need for tamper-evident, leak-proof, and impact-resistant packaging. Additionally, global brands are actively collaborating with packaging manufacturers to develop closed-loop solutions and minimize their environmental footprint.

Despite rising scrutiny on plastic waste, the market outlook remains strong as technological advancements and recycling infrastructure improvements position plastic packaging as a scalable and adaptable solution for evolving packaging needs across sectors.

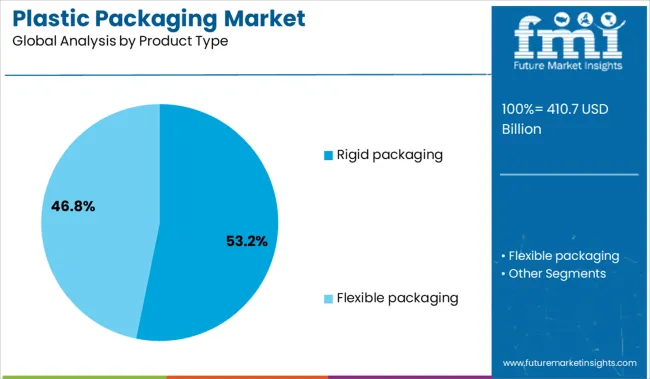

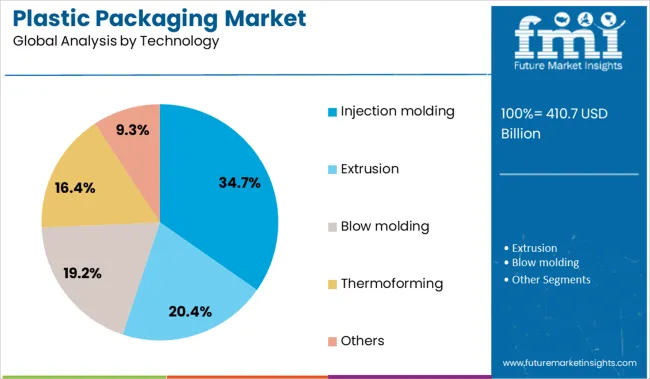

The plastic packaging market is segmented by material, product type, technology, end-use industry, and region. By material, it includes polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), polystyrene (PS), bioplastic, and other materials, addressing diverse performance requirements. In terms of product type, the segmentation covers rigid packaging such as bottles and jars, containers, trays and pallets, IBC and drums, caps and closures, and other formats, as well as flexible packaging including wraps and films, bags, pouches, and additional designs. Based on technology, the market comprises injection molding, extrusion, blow molding, thermoforming, and other manufacturing methods.

By end-use industry, it spans food and beverages, healthcare, industrial applications, consumer goods, and other sectors. Regionally, the market encompasses North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The polyethylene segment is anticipated to contribute 31.60% of the total market revenue by 2025 within the material category, making it the leading material used in plastic packaging. This is driven by its excellent moisture barrier properties, flexibility, and cost effectiveness, which make it suitable for a broad range of applications, including food packaging, industrial wraps, and personal care products.

Polyethylene’s compatibility with various forming technologies and its ability to be produced in different densities have further reinforced its adaptability. Additionally, increased efforts in recycling and the development of recyclable mono material structures using polyethylene have supported its continued use amid rising sustainability concerns. The material's ease of processing and robust mechanical strength remain key drivers of its dominance in the plastic packaging market.

The rigid packaging segment is expected to hold 53.20% of the total market revenue by 2025 within the product type category, positioning it as the most prominent segment. This is due to its superior strength, product protection, and extended shelf life capabilities, which are critical for packaging perishable and high-value items.

Rigid formats such as bottles, containers, and jars offer structural integrity and better stackability for transportation and retail display. The growth of the food and beverage industry, particularly in ready-to-consume segments, has further elevated demand for rigid packaging solutions.

Furthermore, its compatibility with advanced labeling and sealing technologies enhances product branding and security. These benefits have positioned rigid packaging as a reliable and preferred choice across consumer and industrial packaging applications.

The injection molding segment is projected to account for 34.70% of total market revenue by 2025 under the technology category, making it the leading manufacturing technique in plastic packaging. This prominence is driven by its ability to produce complex shapes with high precision, minimal waste, and repeatable consistency.

The method supports rapid mass production of rigid packaging formats such as caps, closures, trays, and containers. Additionally, the integration of automation and multi-cavity molds has improved efficiency and reduced production costs for manufacturers.

Injection molding also enables the use of recycled and bio-based resins, aligning with sustainability goals without compromising on performance. As demand increases for durable, high-quality packaging across industries, this technology remains essential in supporting innovation, speed to market, and cost efficiency in plastic packaging production.

Rigid formats contribute around 60 percent of volume across beverage, personal care, food and industrial segments. Flexible and film packaging continue to gain share. Asia which holds the largest unit demand is followed by North America and Europe. Single-serve formats, e-commerce deliveries, and liquid bottles account for 45 percent of global output. Sustainability-linked resin substitution and on-pack labeling regulations influence material choice and design specification trends.

E-retail growth and brand-specific on-the-go formats are increasing demand for resealable, lightweight plastics. From 2022 to 2024, unit shipments tied to e-commerce grew by 18%. Polyfilm mailers and protective sleeves represent 25% of that increase, especially in apparel and cosmetics. Beverage and personal care companies have scaled PET and HDPE use, raising container production by 12% due to product-specific lining and sealing upgrades. Retail-ready kits now include shelf display elements, cutting secondary packaging time by 15%. Tamper-proof bands, smart tracking labels, and easy-pour nozzles have driven refill pouch adoption by 6% in Southeast Asia and Latin America.

Cost exposure and recycling constraints continue to disrupt plastic packaging operations. PET, PVC, and polypropylene resins fluctuated by 14-22% quarterly in 2023 across key production zones. Under 30% of rigid packaging waste is recovered in developing regions due to limited sortation, weak reverse logistics, and low-margin recovery channels.

Regional labeling requirements have extended launch timelines by 4-6 weeks, especially where QR and multilingual compliance apply. Local bans on certain polymers and pressure from foodservice clients have driven rapid testing of biodegradable formats, although approval delays restrict rollout. These constraints narrow supplier options and increase conversion risks during packaging redesigns.

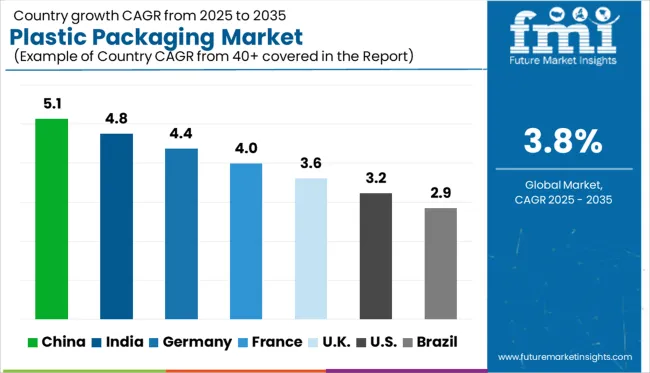

| Countries | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The global plastic packaging market is projected to expand at a CAGR of 3.8% between 2025 and 2035. China (BRICS) reports the highest growth among the listed countries at 5.1%, showing continued industrial demand across fast-moving consumer goods and pharmaceuticals. France (OECD) follows at 4.0%, supported by steady output in food-grade and flexible packaging.

The UK records 3.6%, nearly in line with the global rate, driven by retail and e-commerce needs. The United States (OECD) posts 3.2%, showing slower uptake across segments undergoing regulatory shifts. Brazil (BRICS) records 2.9%, affected by fluctuations in raw material costs and varying packaging standards. The report includes insights from over 40 countries, with the top five shown below.

China records a 5.1% growth rate in the plastic packaging market, exceeding the global average of 3.8%. Expansion is centered on multilayer pouches for personal care, laminated sachets in FMCG, and heat-shrink labels for beverage units. High-output extruder lines are being commissioned in export-driven provinces. Manufacturers are retooling with resin reactors capable of handling ethylene-vinyl blends for better barrier performance.

Scalable molding lines for monomer-controlled containers are gradually replacing legacy systems. Major urban zones are also using anti-counterfeit barcoding embedded within flexible film substrates. Traders are consolidating upstream sourcing of polymer feedstocks, shifting reliance away from Southeast Asian suppliers. Logistic hubs have invested in reel-fed machines compatible with film rolls exceeding 4,000 meters.

France posts a 4.0% plastic packaging market growth rate, outperforming the global benchmark of 3.8%. Growth has stemmed from regulatory preferences for mono-material forms and refillable packaging shells. Food processors are transitioning to thermoformed trays with adjustable cavity settings. Demand for spouted pouch products increased among health supplement firms and baby food units.

Heat-sealing performance for PET films was improved by blending with low-crystallinity copolymers. Contract fillers are using wraparound labeling units with inline tamper-evidence applications. French resin importers expanded propylene sourcing agreements with North Africa, aiming to support custom blow-molding projects in four regions. End-users prefer pouch closures that support ultrasonic sealing compatibility. Flexographic printing has replaced gravure in 31% of printed output across southern units.

United Kingdom reports a 3.6% growth rate in plastic packaging, just under the global average of 3.8%. Uptake centers around child-resistant packs in pharma, flexo-labeled meat trays, and e-commerce packaging. Blister packs have been reconfigured using PVdC coatings for vapor barrier control. Molding facilities have upgraded over 250 injection heads to support batch-wise mold conversion.

RFID-embedded packaging units are tracked across two major logistics corridors. Film manufacturers launched matte-finish laminated rolls for private-label frozen goods. Multilayer pouches are being phased out of retail beverage refills, with monolayer PET back in rotation. Contract fillers added UV-cured digital print lines to reduce turnaround cycles for specialty SKUs. Resin buyers have reopened bulk storage hubs near northern port cities.

Brazil posts a 2.9% growth rate in the plastic packaging market, trailing the global average of 3.8%. Regional consumption is strongest in packaged meats, processed sugar, and personal hygiene items. High-output shrink wrap units have replaced boxed formats in beverage shipments. Molded HDPE containers with built-in valves are being used for insecticide refills.

Pre-washed resin pellets made from urban waste are used in over 100 manufacturing plants. Retailers have reconfigured detergent pouches to minimize laminate layers. Rigid tub production has slowed, while demand for sealed lidding films on portion-control packs has increased. Some inland processors switched to steam-based sealing lines to cut electric load. Resin procurement is slowly shifting toward bio-based blends imported from Argentina.

The plastic packaging market in 2025 continues to expand across food, pharmaceutical, personal care, and industrial sectors, driven by product protection, shelf stability, and lightweight logistics. ALPLA retains leadership, leveraging a broad global manufacturing network and advanced blow molding and injection systems for diversified applications. Amcor, Berry Global, and Mondi dominate high-volume flexible and rigid packaging formats, focusing on scalability and material efficiency. CCL Industries, Constantia Flexibles, and ProAmpac provide premium specialty films and labeling solutions engineered for compliance with branding and stringent regulatory mandates.

Barrier packaging for temperature-sensitive and perishable goods is an area where Graham Packaging, Huhtamaki, and Sealed Air excel, using multilayer laminates and active barrier technologies. Retention strategies revolve around technical innovation, optimized material sourcing, and cost-competitive high-volume production, which collectively raise entry thresholds for emerging players. Strong capital requirements and integration complexity further deter smaller firms. Evolving demands for intelligent packaging, enhanced traceability, and supply chain compatibility continue to reshape procurement priorities in this segment.

Key Developments in the Plastic Packaging Market

| Item | Value |

|---|---|

| Quantitative Units | USD 410.7 Billion |

| Material | Polyethylene (PE), Polypropylene (PP), Polyethylene terephthalate (PET), Polyvinyl chloride (PVC), Polystyrene (PS), Bioplastic, and Others |

| Product Type | Rigid packaging, Bottles & jars, Containers, Trays & pallets, IBC & drums, Caps & closures, Others, Flexible packaging, Wraps & films, Bags, Pouches, and Others |

| Technology | Injection molding, Extrusion, Blow molding, Thermoforming, and Others |

| End Use Industry | Food & beverages, Healthcare, Industrial, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ALPLA, Amcor, Berry Global, Bischof and Klein, CCL Industries, Constantia Flexibles, Coveris, EPL, Gerresheimer, Graham Packaging, Greif, Huhtamaki, Mondi, Novolex, Pactiv Evergreen, ProAmpac, Sealed Air, Silgan Holdings, Sonoco Products, TC Transcontinental, and Winpak |

| Additional Attributes | Dollar sales by resin type and packaging format, growing demand in food and beverage applications, stable consumption across personal care and household products, innovations in recyclable materials and lightweighting technologies support compliance with circular economy targets |

The global plastic packaging market is estimated to be valued at USD 410.7 billion in 2025.

The market size for the plastic packaging market is projected to reach USD 596.3 billion by 2035.

The plastic packaging market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in plastic packaging market are polyethylene (pe), polypropylene (pp), polyethylene terephthalate (pet), polyvinyl chloride (pvc), polystyrene (ps), bioplastic and others.

In terms of product type, rigid packaging segment to command 53.2% share in the plastic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Competitive Overview of Plastic Jar Packaging Companies

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Plastic Healthcare Packaging Providers

Bioplastic Packaging Bag Market Growth – Demand & Forecast 2025 to 2035

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

PCR Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Flexible Plastic Packaging Manufacturers

Single-Use Plastic Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA