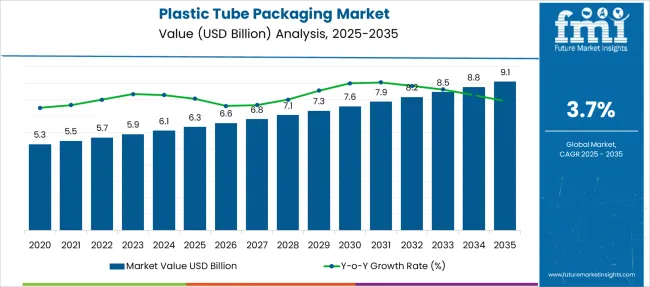

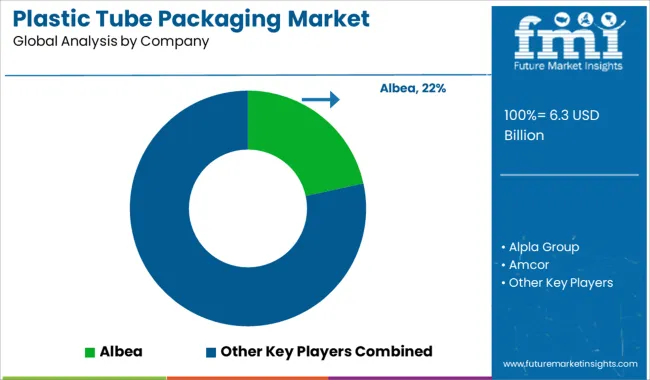

The Plastic Tube Packaging Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Tube Packaging Market Estimated Value in (2025 E) | USD 6.3 billion |

| Plastic Tube Packaging Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The plastic tube packaging market is expanding due to growing demand for convenient and efficient packaging solutions across cosmetics, pharmaceuticals, and personal care industries. Consumers are increasingly seeking products that offer ease of use and portability, driving preference for flexible packaging formats.

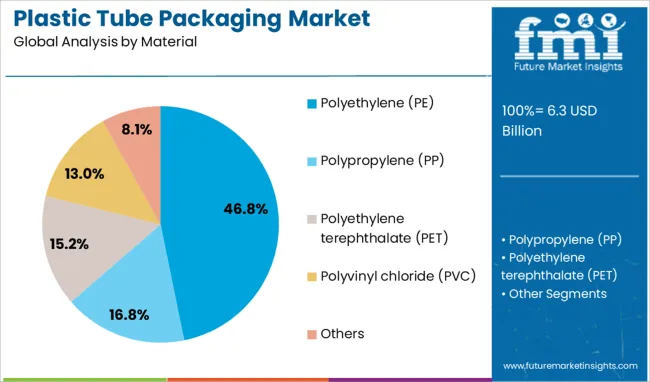

Sustainability considerations have influenced material selection, with polyethylene (PE) favored for its recyclability and cost-effectiveness. Industry trends show innovation in tube design aimed at reducing material usage without compromising durability.

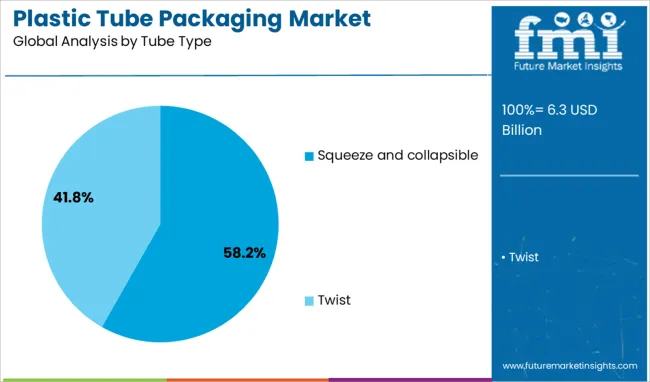

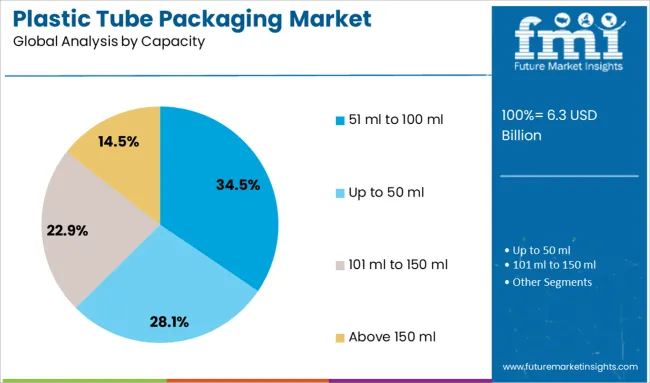

The rise in small and medium-sized product offerings has further stimulated demand for tubes with capacities tailored for travel and trial purposes. Growing e-commerce penetration and the need for tamper-evident packaging have also contributed to market growth. Future development is expected to focus on enhancing barrier properties and incorporating environmentally friendly materials. Segmental growth is projected to be driven by the use of Polyethylene material, squeeze and collapsible tube types, and tube capacities ranging from 51 ml to 100 ml.

The plastic tube packaging market is segmented by material, tube type, capacity, and application and geographic regions. By material of the plastic tube packaging market is divided into Polyethylene (PE), Polypropylene (PP), Polyethylene terephthalate (PET), Polyvinyl chloride (PVC), and Others. In terms of tube type of the plastic tube packaging market is classified into Squeeze and collapsible and Twist. Based on capacity of the plastic tube packaging market is segmented into 51 ml to 100 ml, Up to 50 ml, 101 ml to 150 ml, and Above 150 ml. By application of the plastic tube packaging market is segmented into Skin care, Oral & personal care, Sealants & adhesives, Lubricants, Pharmaceuticals, Household products, Food, and Others. Regionally, the plastic tube packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyethylene segment is projected to hold 46.8% of the plastic tube packaging market revenue in 2025, positioning it as the leading material type. PE has been widely adopted due to its flexibility, chemical resistance, and cost efficiency. It allows manufacturers to produce lightweight tubes that are easy to handle and transport.

Additionally, PE’s recyclability supports growing sustainability initiatives within the packaging industry. The material’s versatility makes it suitable for a variety of product formulations ranging from creams to gels and ointments.

Consumer acceptance of PE tubes has been strengthened by their durability and ability to maintain product integrity. As brands continue to seek economical and environmentally responsible packaging options, the Polyethylene segment is expected to sustain its market dominance.

The Squeeze and Collapsible tube type segment is projected to contribute 58.2% of the market revenue in 2025, establishing itself as the most favored tube design. This segment has grown due to the convenience it offers consumers in dispensing controlled amounts of product with minimal waste.

The ergonomic design supports ease of use, especially for viscous and semi-solid formulations. Manufacturers have focused on optimizing tube wall thickness and collapsibility to improve user experience and reduce residual product left inside the tube.

These tubes are widely used in personal care, cosmetics, and pharmaceutical sectors due to their portability and hygienic dispensing. The rising trend of on-the-go consumption and travel-size packaging has further driven the adoption of squeeze and collapsible tubes. This segment is expected to continue leading the market due to its practicality and consumer appeal.

The 51 ml to 100 ml capacity segment is projected to hold 34.5% of the plastic tube packaging market revenue in 2025, marking it as the leading size category. This range is favored for balancing product volume and portability, making it ideal for both retail and travel applications.

Packaging within this capacity meets consumer demands for convenience without compromising on sufficient product supply. The segment has been supported by regulatory guidelines and airline travel restrictions that encourage compact and lightweight packaging solutions.

Brands targeting premium and mid-tier consumer segments have focused on this capacity to appeal to daily use and sample-size requirements. As demand for personal care and pharmaceutical products in smaller formats continues to grow, the 51 ml to 100 ml segment is expected to maintain its market leadership.

The plastic tube packaging market is expanding due to strong demand from cosmetics, pharmaceuticals, and personal care sectors. Market growth is driven by the convenience of squeezable formats and rising adoption in healthcare ointments. Manufacturers are prioritizing barrier-protected and customized tubes to meet brand-specific requirements. Automation and digital printing capabilities are transforming production, enhancing flexibility for short runs. However, raw material cost volatility, strict plastic regulations, and growing preference for eco-friendly alternatives pose significant challenges. Companies offering recyclable tubes and integrated design solutions are positioned to maintain competitiveness in this evolving packaging segment.

The market has grown substantially with higher consumption of personal care and pharmaceutical products requiring secure, hygienic packaging. In 2024, squeezable plastic tubes dominated cosmetic skincare and oral care segments due to portability and controlled dispensing. Healthcare ointments and medicated gels continued to favor plastic tubes for safety and barrier performance. Emerging economies in Asia-Pacific recorded increased adoption as e-commerce expanded the reach of beauty and wellness products. It is strongly believed that robust performance in convenience-oriented formats will sustain momentum, especially where brand aesthetics and shelf appeal influence consumer purchase decisions.

The development of laminated and multi-layer tubes has created significant opportunities in markets where product integrity is critical. In 2025, several manufacturers introduced tubes featuring enhanced oxygen and light barriers for premium cosmetics and dermatological treatments. The ability to combine protective properties with high-quality graphics and tactile finishes positions these formats as a preferred solution for luxury packaging. It is considered that producers investing in advanced barrier technologies and automated high-speed manufacturing systems will capture value in personal care, therapeutic, and nutraceutical packaging segments.

A noticeable trend is the integration of digital printing and modular production technologies to meet rising demand for customized tube designs. In 2024, short-run printing gained traction among niche beauty brands seeking rapid turnaround without compromising quality. Automated systems for decoration, capping, and quality checks improved manufacturing efficiency, supporting large-scale runs alongside bespoke projects. It is widely believed that suppliers with in-house printing capabilities and flexible automation will maintain a strong edge as personalization becomes a dominant packaging strategy in competitive consumer product markets.

The market faces significant restraints from volatile resin pricing, evolving recycling standards, and scrutiny over single-use plastics. In 2024, multiple regions introduced mandates for recycled content, pushing manufacturers to adapt to complex material sourcing and certification requirements. High raw material costs combined with the capital needed for recycling infrastructure created margin pressures. Competition from paper-based and biodegradable tube alternatives has further increased. It is considered that companies adopting material innovation, cost-optimized processes, and closed-loop recycling partnerships will be better positioned to counter these challenges and maintain profitability.

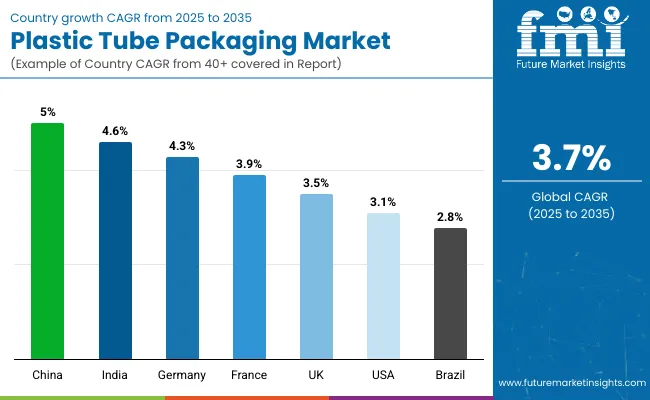

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global plastic tube packaging market is projected to grow at a CAGR of 3.7% from 2025 to 2035. China leads with 5.0%, followed by India at 4.6% and Germany at 4.3%. The United Kingdom records 3.5%, while the United States posts 3.1%. Growth is fueled by demand in personal care, pharmaceuticals, and food sectors, along with innovations in lightweight and recyclable plastic solutions. China and India dominate due to strong cosmetics and healthcare consumption, while Germany emphasizes premium laminated tube technology. The UK and US prioritize sustainable plastic packaging aligned with evolving consumer preferences.

The plastic tube packaging market in China is projected to grow at 5.0%, driven by robust demand in beauty and oral care segments. Laminated and co-extruded plastic tubes dominate high-volume production. Manufacturers invest in digital printing technology for brand customization. Expanding e-commerce platforms accelerate adoption of durable and lightweight tube packaging for shipping efficiency.

The plastic tube packaging market in India is forecast to grow at 4.6%, supported by growth in personal care, OTC drugs, and food segments. Squeeze tubes dominate applications in creams and gels. Manufacturers develop cost-effective, recyclable plastic materials to meet sustainability targets. Rising penetration of organized retail and pharmacy chains boosts demand for user-friendly packaging formats.

The plastic tube packaging market in Germany is projected to grow at 4.3%, driven by demand for high-barrier tubes in cosmetics and healthcare. Multi-layer co-extruded tubes dominate premium product segments. Manufacturers adopt eco-design strategies incorporating post-consumer recycled (PCR) content. EU regulatory compliance accelerates adoption of sustainable packaging practices among local brands.

The plastic tube packaging market in the UK is expected to grow at 3.5%, driven by innovation in flexible and lightweight tubes for personal care. Flip-top closure tubes dominate convenience-driven packaging designs. Manufacturers integrate bio-based plastics to meet environmental objectives. Growth in premium skincare brands strengthens demand for visually appealing, customizable tube packaging.

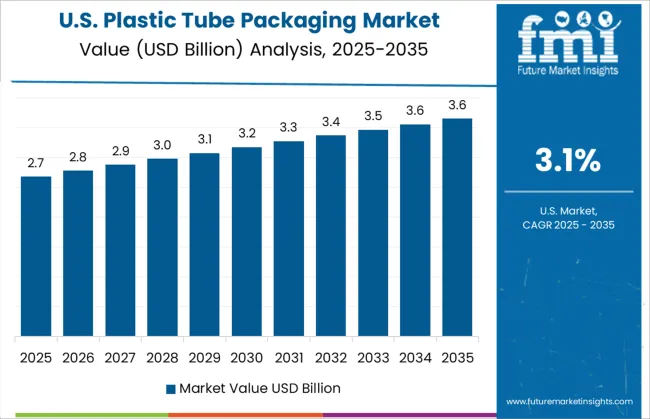

The plastic tube packaging market in the US is projected to grow at 3.1%, supported by strong demand in pharmaceuticals, nutraceuticals, and cosmetics. Stand-up tubes dominate for OTC drugs and health supplements. Manufacturers invest in advanced barrier layers to extend product shelf life. Growing preference for on-the-go formats reinforces the need for portable, squeezable tube designs.

The plastic tube packaging market is moderately consolidated, with Albea recognized as a leading player due to its comprehensive portfolio of laminated and extruded tubes designed for personal care, pharmaceutical, and food applications. The company’s global manufacturing footprint and innovation in lightweight, recyclable tube solutions strengthen its leadership position.

Key players include Alpla Group, Amcor, Antilla Propack, Aphena Pharma Solutions, Berry Global, CCL Industries, EPL, Evergreen Resources, HCT Group, Hoffmann Neopac, Huhtamaki, I.TA Plastics Tube, Kaufman Container, Petro Packaging Company, Pirlo Holding, Sonoco Products, Tubapack, VisiPak, and Weltrade. These companies specialize in high-quality tubes incorporating barrier properties, customizable shapes, and advanced decoration techniques for branding.

Market growth is driven by increasing demand from cosmetics, personal care, and pharmaceutical sectors due to convenience and cost-efficiency. Leading manufacturers are investing in sustainable materials such as bio-based plastics and PCR (post-consumer recycled) resins, alongside innovations in airless dispensing systems for product protection. Digital printing and smart labeling technologies are gaining traction for enhancing customization and consumer engagement. Asia-Pacific remains the fastest-growing region due to rising consumption in beauty and healthcare markets, while North America and Europe continue to lead in sustainable packaging adoption.

In 2024, brands in the plastic tube packaging market accelerated the adoption of bioplastics and recyclable materials to meet eco-friendly goals. Demand for compostable tubes and recycling-ready designs surged in cosmetics and healthcare, driven by strict environmental regulations and increasing consumer preference for sustainable packaging alternatives worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Material | Polyethylene (PE), Polypropylene (PP), Polyethylene terephthalate (PET), Polyvinyl chloride (PVC), and Others |

| Tube Type | Squeeze and collapsible and Twist |

| Capacity | 51 ml to 100 ml, Up to 50 ml, 101 ml to 150 ml, and Above 150 ml |

| Application | Skin care, Oral & personal care, Sealants & adhesives, Lubricants, Pharmaceuticals, Household products, Food, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Albea, Alpla Group, Amcor, Antilla Propack, Aphena Pharma Solutions, Berry Global, CCL Industries, EPL, Evergreen Resources, HCT Group, Hoffmann Neopac, Huhtamaki, I.TA Plastics Tube, Kaufman Container, Petro Packaging Company, Pirlo Holding, Sonoco Products, Tubapack, VisiPak, and Weltrade |

| Additional Attributes | Dollar sales segmented by material type (plastic, aluminum, laminated, paperboard), product type (squeeze/collapsible, twist, stick), and application (cosmetics/personal care \~40%, pharmaceuticals \~25%, food & beverage \~20%). Regional demand trends show North America with the largest share and Asia-Pacific as the fastest-growing region. Innovations include bio-based tubes, recyclable designs, and AI-driven production. |

The global plastic tube packaging market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the plastic tube packaging market is projected to reach USD 9.1 billion by 2035.

The plastic tube packaging market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in plastic tube packaging market are polyethylene (pe), polypropylene (pp), polyethylene terephthalate (pet), polyvinyl chloride (pvc) and others.

In terms of tube type, squeeze and collapsible segment to command 58.2% share in the plastic tube packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Plastic Transistors Market Size and Share Forecast Outlook 2025 to 2035

Plastic Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA