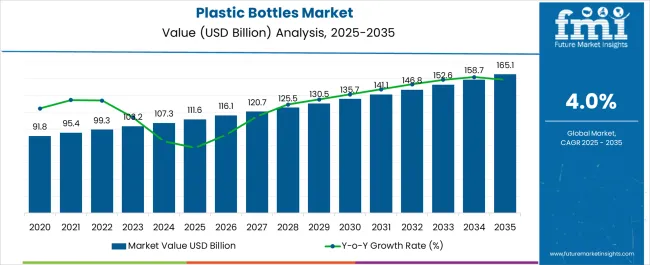

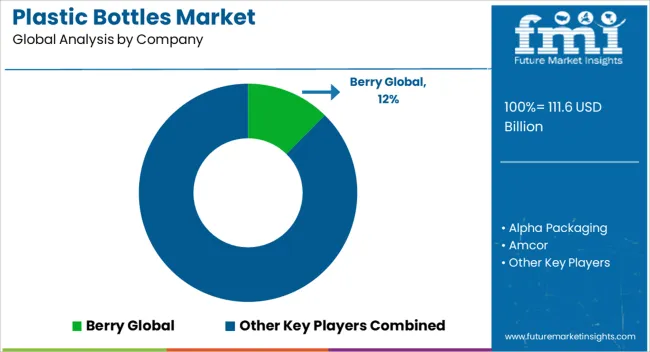

The Plastic Bottles Market is estimated to be valued at USD 111.6 billion in 2025 and is projected to reach USD 165.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Bottles Market Estimated Value in (2025 E) | USD 111.6 billion |

| Plastic Bottles Market Forecast Value in (2035 F) | USD 165.1 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The plastic bottles market is expanding steadily, supported by rising consumption of packaged products and the versatility of plastics in meeting diverse end-use requirements. Industry updates and packaging company reports have emphasized the strong demand from the food and beverage industry, where lightweight, cost-efficient, and durable packaging remains essential. PET and other polymer innovations have reinforced sustainability goals by enabling recycling and lightweight bottle design.

Growth in urbanization, convenience-oriented consumer lifestyles, and expansion of retail distribution channels have further accelerated adoption. Additionally, advancements in resin technology and investments in circular economy initiatives have encouraged large-scale use of recycled content in plastic bottles, helping manufacturers align with global sustainability commitments.

Strategic partnerships between resin producers, packaging firms, and consumer goods companies are strengthening supply chains and accelerating innovation. Looking ahead, demand will be influenced by the shift toward recyclable PET bottles, increasing use of large-capacity formats, and continuing dominance of beverage packaging, which collectively define the market’s future growth path.

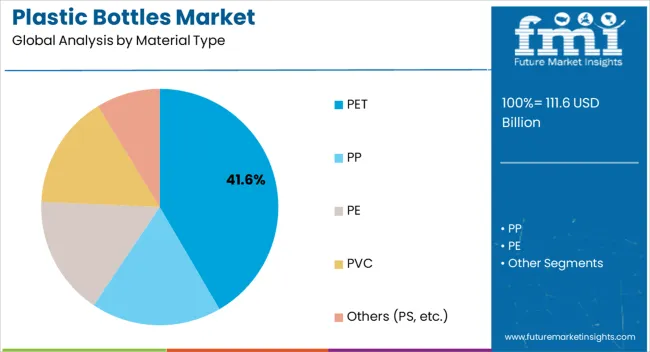

The PET segment is projected to contribute 41.6% of the plastic bottles market revenue in 2025, maintaining its leadership as the preferred material. Growth in this segment has been shaped by PET’s unique combination of clarity, strength, and lightweight characteristics, making it ideal for packaging sensitive consumables.

Industry data has highlighted PET’s superior recyclability compared to other plastics, which has enabled its adoption in closed-loop recycling systems. Additionally, its barrier properties against moisture and gases have made it indispensable in beverage and personal care packaging.

Manufacturing innovations, including the use of bio-based PET and advanced molding technologies, have further enhanced the sustainability and performance of PET bottles. Regulatory support for recycling initiatives and consumer demand for eco-friendly packaging have reinforced PET’s market position, ensuring continued dominance within the material category.

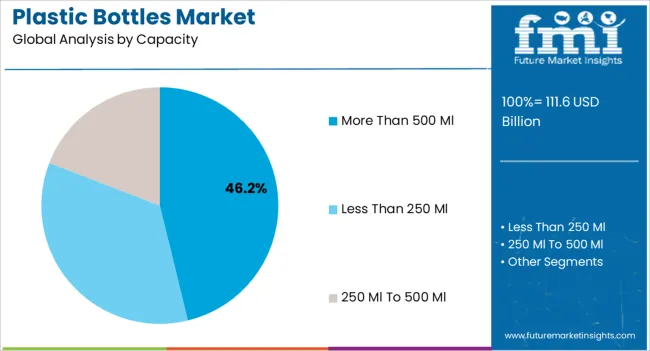

The more than 500 ml segment is projected to account for 46.2% of the plastic bottles market revenue in 2025, reflecting the rising demand for larger packaging formats. This segment’s prominence has been supported by consumer preference for bulk packaging in beverages, household products, and industrial applications, which offer cost savings and reduced packaging waste.

Market observations have shown that large-capacity bottles are favored in both retail and institutional settings, driven by value-conscious purchasing and convenience in storage and handling. Advances in bottle design have allowed manufacturers to produce lightweight yet durable large containers, reducing material usage while preserving product integrity.

Furthermore, the increasing popularity of multi-serving beverage products and family-sized packs has reinforced demand for this capacity category. With ongoing emphasis on cost efficiency, consumer convenience, and sustainability, the more than 500 ml segment is expected to retain its market leadership.

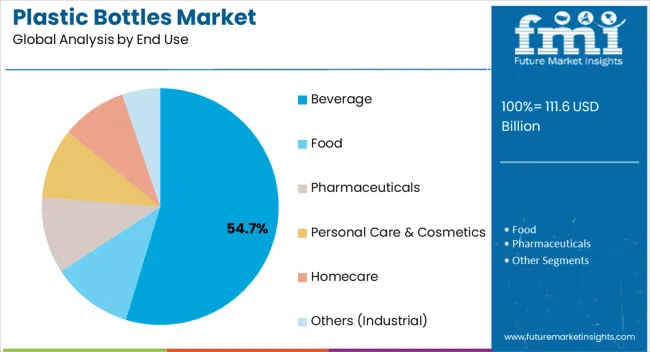

The beverage segment is projected to capture 54.7% of the plastic bottles market revenue in 2025, establishing itself as the dominant end-use category. This segment’s growth has been anchored by the extensive use of plastic bottles in water, carbonated drinks, juices, and dairy products, driven by their lightweight, shatterproof, and portable nature.

Beverage companies have increasingly relied on PET bottles to ensure product safety, shelf stability, and consumer convenience. Industry reports have highlighted significant investments in returnable and recyclable bottle systems, particularly by global beverage brands, to align with environmental commitments.

Expanding consumer demand for ready-to-drink and on-the-go beverages has further amplified adoption. Additionally, innovations such as tethered caps and lightweight preforms have supported compliance with regulatory mandates while reducing production costs. As global beverage consumption continues to rise, particularly in emerging markets, the beverage segment is expected to sustain its leadership within the plastic bottles market.

The plastic bottles industry has demonstrated steady resilience and growth from 2020 to 2025. This upward trajectory underscores its adaptability to changing consumer preferences and technological advancements.

Moving forward, we anticipate this favorable trend to continue, with a projected CAGR of 4.2%. This adjusted growth rate aligns with the industry's maturity and evolving consumer preferences. As the plastic bottle sector evolves, this rate reflects its enduring stability and potential for sustained expansion.

Short-term Analysis of Plastic Bottles Market from 2020 to 2025

The plastic bottles market experienced a CAGR of 4.1% from 2020 to 2025. This market expanded from USD 91.8 billion in 2020 to USD 111.6 billion in 2025. Key drivers during this phase included increased consumer demand for packaged beverages, the convenience of plastic bottles, and sustainability initiatives promoting recyclability.

The market's adaptability to changing consumer preferences and innovations in bottle design and materials played pivotal roles in this growth. The short-term analysis underscores the market's agility in responding to evolving trends and the enduring consumer appeal of plastic bottles.

Mid-term Analysis of Plastic Bottles Market from 2025 to 2035

In the mid-term, the market value is estimated to be worth USD 111.6 billion in 2025 and is projected to reach USD 165.1 billion by 2035. From 2025 to 2035, the plastic bottles market is expected to maintain steady growth.

During this phase, factors such as sustainable packaging practices, advancements in lightweight bottle designs, and the growing demand for bottled water are expected to sustain steady growth. Additionally, consumer awareness of the environmental impact of plastic bottles is anticipated to drive innovations in recyclability and eco-friendly materials. Increasing environmental awareness is boosting the plastic bottle recycling market, as sustainable practices gain momentum. The mid-term analysis reflects the market's stability and its alignment with evolving sustainability trends.

Long-term Analysis of Plastic Bottles Market from 2035 to 2035

In the long-term analysis spanning 2035 to 2035, the plastic bottles market is projected to reach a substantial USD 155.2 billion. This prolonged growth trajectory is underpinned by several factors, including ongoing efforts to reduce single-use plastic waste through recycling and circular economy initiatives.

Innovations in biodegradable plastics and alternative packaging solutions are also expected to contribute to the market's expansion. Furthermore, the enduring consumer preference for the convenience and affordability of plastic bottles is likely to sustain demand. The long-term analysis underscores the industry's commitment to sustainability and its potential for significant growth well into the future.

In this dedicated section, FMI Analysts conduct a comprehensive analysis of the plastic bottles industry. We delve into key segments, providing valuable insights into prevailing consumer preferences and emerging market trends that shape the industry's trajectory. In a period marked by substantial growth and transformation, grasping the significance and consequences of these segments is vital for industry participants and stakeholders alike.

| Attributes | Details |

|---|---|

| Top Material Type | PE |

| Market Share in 2025 | 34.3% |

High-performance PE plastic, with a substantial market share of 34.3% in 2025, spearheads the plastic bottle industry. This dominance can be attributed to its remarkable durability, excellent chemical resistance, and widespread applicability across various sectors. Particularly in demanding applications like pharmaceuticals and industrial chemicals, high-performance PE plastic bottles have emerged as the preferred choice. Their ability to withstand extreme conditions, coupled with a focus on sustainability through recyclability, positions this segment as a frontrunner in the market's evolution. The blow-molded plastic bottles market is poised for expansion as industries seek cost-effective and lightweight packaging solutions.

| Attributes | Details |

|---|---|

| Top End Use | Food |

| Market Share in 2025 | 36.1% |

The food packaging segment stands tall, with a market share of 36.1% in 2025, making it a pivotal force in the plastic bottles industry. Its prominence stems from the perpetual demand for convenient and hygienic food storage solutions. Consumers prioritize freshness and safety, and plastic bottles designed for food meet these criteria efficiently. Additionally, innovative designs that enhance shelf appeal and ensure product integrity have further bolstered this segment's dominance. Amidst evolving dietary trends and global food consumption patterns, food packaging remains a dynamic and influential market force.

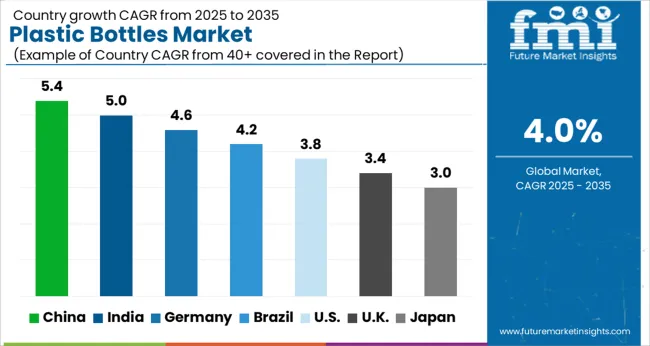

In this exclusive segment, our team of FMI analysts ventures into the intricate tapestry of the plastic bottles market with a global perspective. We delve into the market's multifaceted landscape, peering through the lens of individual countries to unveil the distinct dynamics at play. This journey unveils the diverse opportunities and developing trends that can be instrumental in molding the future of the plastic bottle industry on a global scale.

| Country | Market Share in 2025 |

|---|---|

| United States | 21.3% |

| Canada | 3.1% |

In North America, the United States pharmaceutical plastic bottles market emerges as a trailblazer in the global plastic bottles market, boasting a substantial 21.3% market share in 2025. The growth is underpinned by a robust shift towards sustainable plastic solutions. As environmental concerns take center stage, manufacturers are increasingly adopting recyclable materials and innovative eco-friendly designs. Consumer demand for eco-conscious packaging aligns perfectly with this trend, propelling the United States market forward.

Canada, with a 3.1% market share in 2025, is also making strides in sustainability but at a more measured pace. While eco-friendly initiatives are on the rise, the market here is marked by a pragmatic approach. Canadian consumers prioritize the reduction of single-use plastics, which has led to innovative solutions like reusable bottles. The country's commitment to recycling and a gradual transition towards sustainable packaging solutions contribute to its steady growth.

| Country | Market Share in 2025 |

|---|---|

| Germany | 4.3% |

| United Kingdom | 2.8% |

| Spain | 2.0% |

| France | 1.6% |

| Italy | 1.2% |

In Europe, Germany commands a 4.3% market share in 2025, driven by a relentless pursuit of innovation. The German market is characterized by a penchant for cutting-edge technologies, leading to the development of advanced plastic bottle designs. Consumers here favor smart and user-friendly packaging, which has fueled the adoption of features like tamper-evident caps and interactive labels. The strong presence of the automotive and pharmaceutical industries further boosts demand for specialized plastic bottles.

The United Kingdom, with a 2.8% market share in 2025, stands out as a leader in embracing sustainability within the plastic bottles market. The driving force behind this growth is the rising environmental consciousness among consumers, which has prompted a notable shift towards recyclable materials and a reduction in plastic waste. Additionally, the surge in eCommerce has created a heightened demand for secure and efficient packaging solutions, further bolstering the plastic bottles market in the region.

Spain, contributing 2.0% to the market in 2025, demonstrates steady growth driven by evolving consumer preferences and the expansion of various industries. The Spanish market distinguishes itself with its adaptability and a clear preference for cost-effective packaging solutions. Spanish consumers favor practical and economically viable packaging options that align with their lifestyle choices and economic considerations.

France, holding a 1.6% market share, places significant emphasis on quality and aesthetics within the plastic bottles industry. This market caters to discerning consumers, particularly in the pharmaceutical and cosmetics sectors, where unique and high-performance packaging designs thrive. The growth in France's plastic bottles market is sustained by a firm commitment to delivering packaging solutions that are visually appealing and functionally efficient.

Italy, with a 1.2% market share, adopts a well-rounded approach by prioritizing both sustainability and innovation. Its strategic geographical location near key European manufacturing hubs enables agile responses to evolving trends and consumer demands. The Italian market seamlessly integrates eco-conscious practices with cutting-edge packaging solutions, resulting in a dynamic and responsive market landscape.

| Country | Market Share in 2025 |

|---|---|

| China | 15.5% |

| India | 7.2% |

| Japan | 5.4% |

| South Korea | 3.3% |

| Thailand | 1.9% |

China dominates the Asia Pacific with an impressive 15.5% market share in 2025. This commanding position stems from factors such as rapid urbanization and the expanding middle class. With the middle class seeking an array of consumer products, the plastic bottles market has experienced a substantial boost. Furthermore, China is placing a growing emphasis on sustainability, leading manufacturers to invest in recyclable materials and environmentally responsible packaging, aligning perfectly with the evolving preferences of Chinese consumers.

India plastic bottle market is thriving, holding a substantial 7.2% market share. Key drivers include the country's food and beverage industry's rapid expansion and heightened hygiene awareness. These factors are significantly boosting the demand for plastic bottles. Additionally, the surge in eCommerce activities in India has resulted in an increased need for secure and dependable packaging solutions, further fueling the market's growth.

Japan, with its mature market, maintains a 5.4% market share in 2025. Japanese consumers highly value unique designs and high-performance packaging solutions, emphasizing innovation and quality. Significant demand generators for plastic bottles include the pharmaceutical and cosmetic industries. Japan's market reflects a discerning consumer base that sets a premium on packaging excellence.

South Korea, mirroring Japan's preference for high-quality packaging, contributes to the region with a 3.3% market share. South Koreans prioritize packaging that is sophisticated and aesthetically appealing. Industries such as cosmetics and hygiene, where presentation and functionality are paramount, favor plastic vessels, contributing to their prevalence in the market.

Thailand, holding a 1.9% market share in the plastic bottles sector, exhibits consistent growth driven primarily by the thriving tourism and hospitality industries. Plastic bottles are preferred for on-the-go consumption due to their portability and convenience. As Thailand advances its recycling infrastructure, sustainability is emerging as a significant factor shaping the market's evolution, aligning with global trends in responsible packaging.

The plastic bottles industry is marked by intense competition, with several prominent players vying for dominance. The most compelling opportunity lies in the sustainable packaging trend. Investors and industry players can capitalize on this by shifting towards eco-friendly materials, promoting recycling practices, and innovating in sustainable packaging solutions. Consumer and regulatory preferences are increasingly favoring sustainable options, making this a strategic move to secure long-term growth and success in the industry.

The key players in the plastic bottles industry face substantial challenges, primarily stemming from stringent environmental regulations and the growing scrutiny of single-use plastics. Navigating these challenges necessitates substantial investments in sustainable production practices and alternative materials. Furthermore, competition from alternative packaging materials such as glass and metal demands continuous innovation to maintain market share

The adoption of recycled plastics offers a promising avenue, with companies investing in closed-loop recycling systems and consumer education. The rise of eCommerce has generated a demand for specialized packaging solutions, opening doors for innovation. Customization and personalization trends also provide scope to cater to niche markets, fostering consumer loyalty.

The global plastic bottles market is estimated to be valued at USD 111.6 billion in 2025.

The market size for the plastic bottles market is projected to reach USD 165.1 billion by 2035.

The plastic bottles market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in plastic bottles market are pet, pp, pe, pvc and others (ps, etc.).

In terms of capacity, more than 500 ml segment to command 46.2% share in the plastic bottles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Plastic Hot and Cold Pipe Market Size and Share Forecast Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA