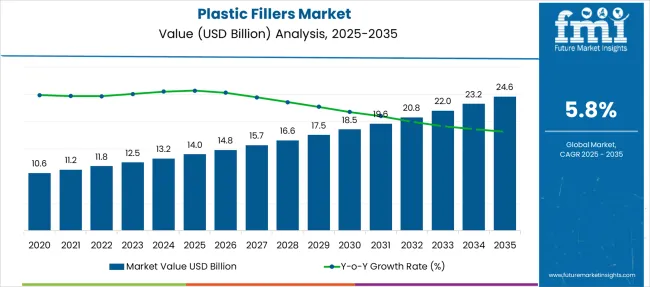

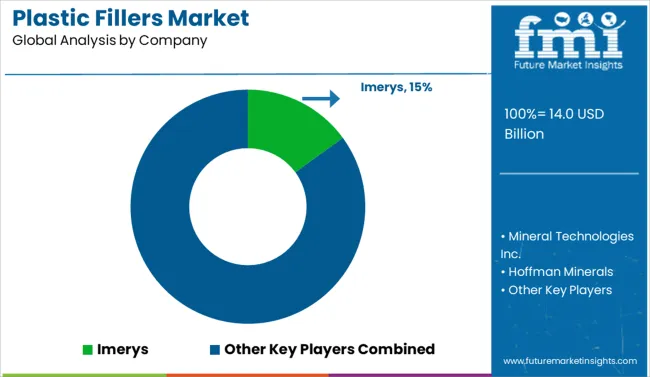

The Plastic Fillers Market is estimated to be valued at USD 14.0 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Fillers Market Estimated Value in (2025 E) | USD 14.0 billion |

| Plastic Fillers Market Forecast Value in (2035 F) | USD 24.6 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The plastic fillers market is progressing steadily as industries prioritize cost optimization, material performance enhancement, and environmental sustainability. Adoption of fillers in plastics is being driven by their ability to improve mechanical properties, reduce polymer content, and lower overall production costs.

Evolving regulatory frameworks favoring lightweight and recyclable materials are encouraging manufacturers to integrate advanced fillers into diverse plastic applications. Future growth is anticipated to be shaped by innovation in filler materials, growing penetration in emerging economies, and rising demand from industries such as automotive, packaging, and construction.

Enhanced awareness of material circularity and functional benefits provided by fillers is expected to support wider acceptance and development of high value applications in the coming years.

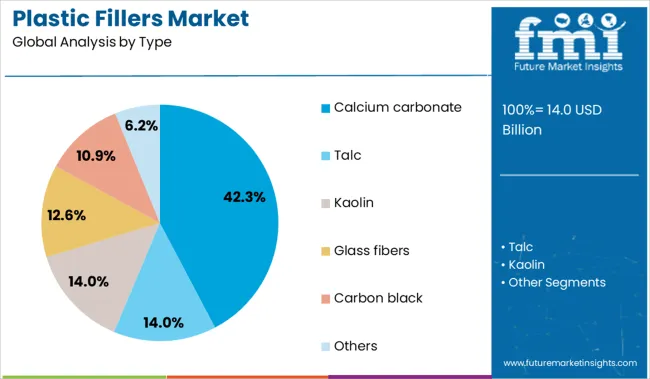

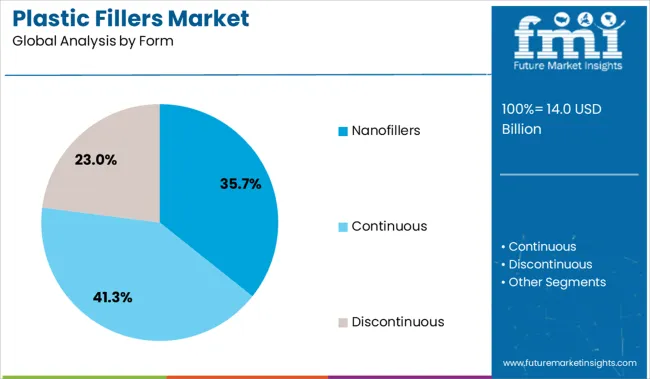

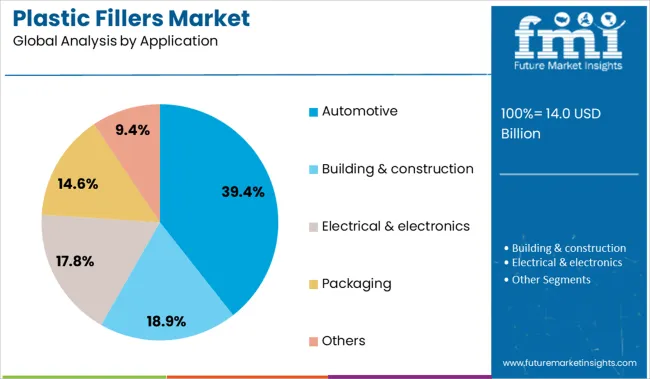

The plastic fillers market is segmented by type, form, application, and geographic regions. The plastic fillers market is divided by type into Calcium carbonate, Talc, Kaolin, Glass fibers, Carbon black, and Others. In terms of the form of the plastic fillers, the market is classified into Nanofillers, Continuous, and Discontinuous. Based on the application, the plastic fillers market is segmented into Automotive, Building & construction, Electrical & electronics, Packaging, and Others. Regionally, the plastic fillers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type calcium carbonate is projected to hold 42.3% of the total market revenue in 2025 making it the leading type segment. This leadership has been attributed to its high availability low cost and favorable mechanical properties when blended with various polymers.

Its ability to enhance rigidity improve surface finish and reduce shrinkage in plastic products has strengthened its appeal across industries. Manufacturers have increasingly preferred calcium carbonate to meet both economic and performance requirements while ensuring compliance with environmental norms by reducing virgin polymer use.

Its widespread suitability across commodity and engineering plastics and its established processing compatibility have further consolidated its position as the dominant type segment in the market.

When segmented by form nanofillers are expected to account for 35.7% of the market revenue in 2025 securing the leading position within this category. Their dominance has been supported by the superior barrier strength thermal stability and mechanical reinforcement they provide at lower loadings compared to traditional fillers.

Adoption has been propelled by increasing demand for high performance plastics in advanced applications where precision and durability are critical. Innovations in nanotechnology and improved dispersion techniques have enhanced the cost effectiveness and consistency of nanofillers enabling wider commercial use.

Manufacturers have also leveraged their ability to achieve weight reduction and superior end product properties which has reinforced their role as the most preferred form segment.

Segmented by application automotive is forecast to capture 39.4% of the market revenue in 2025 establishing itself as the top application segment. This leadership has been underpinned by the automotive industry’s focus on lightweight materials to improve fuel efficiency and meet stringent emission standards.

The integration of fillers in plastic components has enabled weight reduction without compromising strength and functionality making them indispensable in vehicle interiors exteriors and under the hood parts. Increasing production of electric and hybrid vehicles coupled with the emphasis on cost competitive durable materials has further accelerated adoption.

The ability of fillers to enhance thermal stability noise dampening and aesthetic quality of automotive plastics has solidified the automotive segment’s position as the leading application domain in the market.

Rising demand for cost-effective material enhancement and performance improvement in plastics drives growth. Opportunities exist in biobased filler innovation, lightweight composites, and tailored solutions for automotive, packaging, and construction industries.

Plastic fillers such as calcium carbonate, talc, glass fibers, and silica are increasingly used to reduce resin consumption while enhancing properties like stiffness, impact resistance, and thermal stability. Industries including automotive, consumer goods, and packaging use fillers to meet performance targets at lower material cost. These additives improve processing behavior and dimensional accuracy in end products. As manufacturers look to optimize part weight and recyclability, filler materials provide a way to balance environmental goals with engineering needs. In regions with mature polymer sectors, cost pressure and product standardization continue to drive filler consumption, especially in bulk applications such as films, molded containers, and structural components requiring consistent performance and durability.

Opportunities are expanding for biobased fillers such as cellulose fiber, rice husk powder, and other agricultural residues that enhance environmental profiles while maintaining performance. These fillers are gaining favor among packaging, furniture, and construction manufacturers aiming to increase renewable content and lower carbon footprint. Custom-engineered filler grades designed for UV resistance, thermal shielding, or flame resistance open new use cases in electronics, roofing, and automotive interiors. Lightweight composite formulations using hollow spheres or fiber blends further enable weight reduction without compromising strength. Collaborations between resin producers and filler suppliers are driving development of modular material systems with consistent dispersion and compatibility. Markets with abundant agricultural waste and supportive policy frameworks are becoming important growth zones for eco-friendly filler integration.

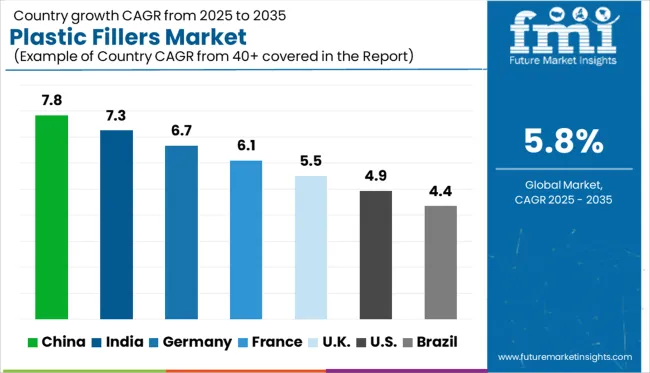

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global plastic fillers market is expected to expand at a CAGR of 5.8% from 2025 to 2035, driven by demand for cost-effective material reinforcement, lightweighting trends, and increasing use of fillers in automotive, packaging, and consumer goods. BRICS economies are at the forefront, with China growing at 7.8% due to large-scale polymer production, rising plastic compounding demand, and infrastructure-led industrial growth. India follows at 7.3%, fueled by expanding packaging and automotive sectors and increased mineral filler adoption. Germany, as part of the OECD, maintains a solid 6.7% CAGR, supported by engineering plastics and sustainability initiatives. Meanwhile, the UK (5.5%) and the US (4.9%) reflect mature markets focusing on product innovation and recycled content integration. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

A projected CAGR of 7.8% reflects China continuing to dominate plastic filler usage, driven by scale in packaging, automotive, and electronics sectors. High-volume production benefits from low raw material costs and strong domestic supply chains, enabling wider substitution of expensive resins than in the United States. Bulk mineral fillers such as calcium carbonate, talc, and precipitated silica are standard, optimizing weight and cost. Digital filler mixing and dispersion systems support consistency. In contrast to Germany, the focus in China remains on cost efficiency rather than high mechanical performance.

India is forecast to maintain a CAGR of 7.3%, aligning closely with China but focusing on affordability and scale among producing nations. Domestic manufacturers of plastic goods increasingly rely on filler-heavy compounds to meet cost requirements in housing, consumer durables, and packaging. Unlike UK converters that seek functional or bio-based fillers, Indian processors prioritize substitution to reduce resin costs. Industrial clusters in Gujarat and Maharashtra are integrating filler supply chains with additive manufacturing operations. Local startups are developing functional filler blends to support value-added products.

A CAGR of 6.7% highlights Germany leading Europe in precision and performance use of plastic fillers, notably in the automotive and electromechanical sectors. Fillers such as talc, mica, glass fiber, and calcium carbonate enhance structural stability and thermal resistance in engineering polymers. Compared to Chinese or Indian price-driven strategies, German converters emphasize traceability, certification, and mechanical strength. Use in polypropylene and polyester blends supports reduced shrinkage and reinforced part performance. The focus on lightweight composites in transport and construction underscores the value of high-quality filler materials.

The UK plastic filler sector is projected to grow at a CAGR of 5.5%, reflecting steady demand for lightweight and sustainable additives. While growth trails Asia, the UK market stands out for innovation in recycled-content materials and biodegradability. Fillers support both rigid and flexible packaging, with manufacturers seeking solutions for eco-focused brands. Compared to Germany, where technical performance is priority, UK producers increasingly use inert fillers to optimize carbon footprint. Brexit trade shifts have driven more localized filler sourcing and blending operations.

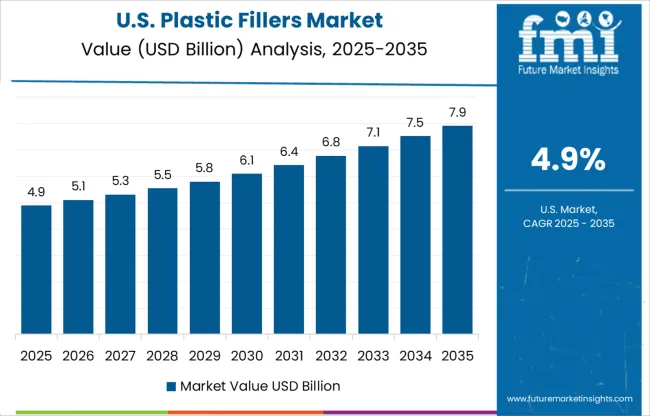

Growth in the United States plastic filler market is expected at a CAGR of 4.9%, shaped by demand in high-performance plastic applications and stringent regulatory requirements. Functional fillers that add flame resistance, UV stability, color retention, and electrical conductivity are gaining ground, in contrast to India and China where bulk cost drivers dominate. Heavy reliance on engineered polymer grades means filler loading remains modest. Converters also face pressure to adopt food-contact-safe and medical-grade certified additives, which limits use of inexpensive mineral filler alternatives.

The plastic fillers market is moderately consolidated, with global players holding significant shares while regional and specialized firms contribute to a competitive landscape. Imerys leads the market with a strong focus on mineral-based fillers like calcium carbonate and talc. Close competitors such as Mineral Technologies Inc., Omya AG, and Huber Engineered Materials emphasize innovation in surface-treated and high-performance fillers. Companies like BASF SE, Avient Corporation, and The Dow Chemical Company leverage polymer expertise to integrate functional additives. Meanwhile, Hoffman Minerals and LKAB Group serve niche industrial applications. Strategic R&D, cost optimization, and sustainable sourcing are key factors shaping supplier dynamics.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.0 Billion |

| Type | Calcium carbonate, Talc, Kaolin, Glass fibers, Carbon black, and Others |

| Form | Nanofillers, Continuous, and Discontinuous |

| Application | Automotive, Building & construction, Electrical & electronics, Packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Imerys, Mineral Technologies Inc., Hoffman Minerals, LKAB Group, Huber Engineered Materials, Omya AG, BASF SE, Avient Corporation, Johnson & Johnson (for their specialized plastic filler products), and The Dow Chemical Company |

| Additional Attributes | Dollar sales by filler type, polymer type, and end-use industry; regional trends influenced by plastic consumption patterns, manufacturing hubs, and cost reduction goals; innovation in functional, lightweight, and eco-friendly fillers; cost dynamics shaped by supply chain efficiency and material substitution; environmental impact through reduced virgin plastic usage; and emerging use cases in biodegradable plastics, packaging, automotive interiors, and construction panels. |

The global plastic fillers market is estimated to be valued at USD 14.0 billion in 2025.

The market size for the plastic fillers market is projected to reach USD 24.6 billion by 2035.

The plastic fillers market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in plastic fillers market are calcium carbonate, _ground, _precipitated, talc, kaolin, glass fibers, carbon black and others.

In terms of form, nanofillers segment to command 35.7% share in the plastic fillers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA