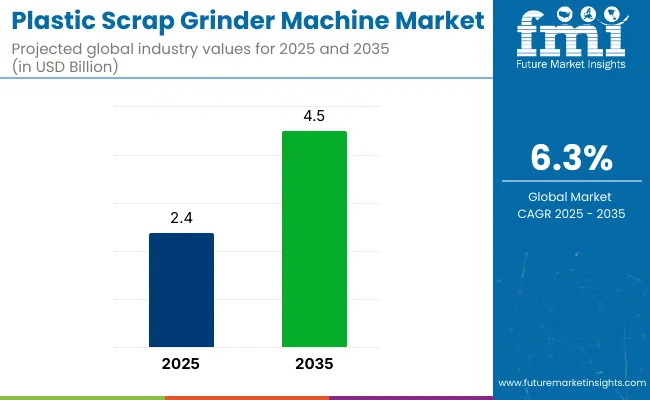

The global plastic scrap grinder machine market is valued at USD 2.4 billion in 2025 and is poised to reach USD 4.5 billion by 2035, reflecting a CAGR of 6.3%. Growth is being driven by stricter environmental regulations, rising adoption of automation, and increased recycling initiatives. Moreover, demand is being supported by industries seeking energy-efficient grinding solutions to align with sustainability goals while reducing operational costs across production facilities.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 2.4 billion |

| 2035 Market Value | USD 4.5 billion |

| CAGR (2025 to 2035) | 6.3% |

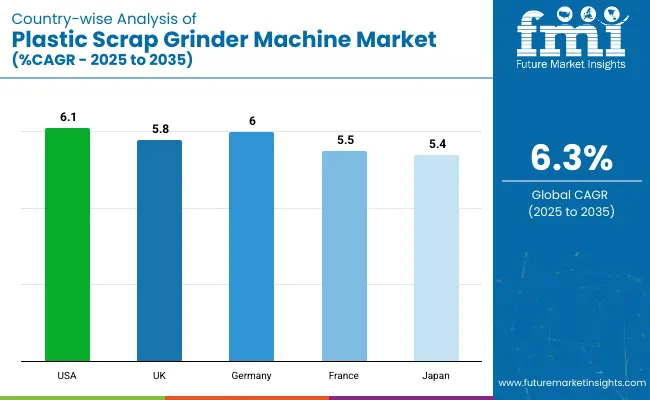

The USA is expected to register the highest CAGR of 6.1%, driven by strict plastic waste management regulations and rapid adoption of automated grinding technologies. Germany follows with a CAGR of 6.0%, supported by strong sustainability initiatives and Industry 4.0 automation.

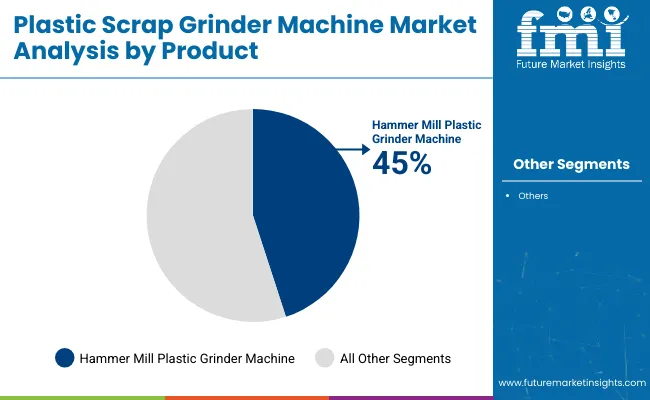

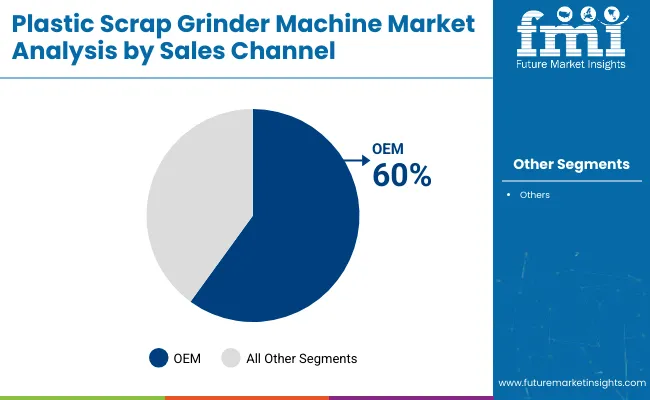

The UK, with a CAGR of 5.8%, is witnessing steady growth due to its focus on sustainability policies, stricter plastic waste recycling regulations, and the adoption of energy-efficient grinding technologies. By sales channel, the OEM segment is expected to hold a 60% market share in 2025. The hammer mill grinder segment is projected to maintain its dominance, with a market share of 45% in 2025, due to its high grinding efficiency and versatility across various plastic types.

The plastic scrap grinder machine market holds a moderate share across its parent markets. Within the plastic recycling equipment market, it commands a significant 20-25% share due to its core role in size reduction. In the broader recycling machinery market, its share is around 10-12%, given the presence of various other recycling machines.

It contributes about 15% to the plastic waste management market, particularly in pre-processing stages. Within the industrial shredding and grinding equipment market, the share stands at 8-10%. Overall, plastic scrap grinders are essential in closed-loop plastic processing, especially where high throughput and material reusability are critical.

Recent government regulations in the market include strict plastic waste management laws and recycling mandates. The USA has enforced Extended Producer Responsibility (EPR) and EPA’s RCRA rules to boost demand for recycling machinery. The EU introduced its Circular Economy Action Plan, requiring 55% of plastic packaging waste to be recycled by 2030. India’s Plastic Waste Management Rules (2022) mandate 50% recycling of plastic packaging waste by 2025. China’s Five-Year Plan promotes circular economy targets, driving upgrades to grinder machines.

The plastic scrap grinder machine market is segmented by product, capacity, sales channels, and region. By product type, the market is segmented into single shaft plastic grinder machine, double shaft plastic grinder machine, rotary blade plastic grinder machine, and hammer mill plastic grinder machine.

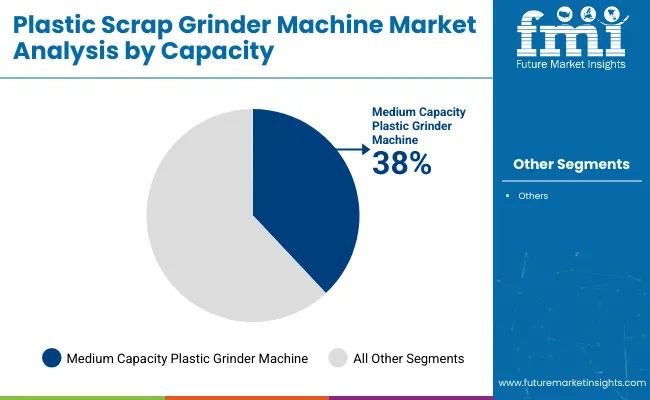

By capacity, it is classified into small capacity plastic grinder machine, medium capacity plastic grinder machine, and large capacity plastic grinder machine. By sales channel, it is divided into OEM and aftermarket. By region, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Hammer mill plastic grinder machines are leading the product segment and are expected to hold a 45% share in 2025, driven by their high efficiency and versatility in processing different plastic types.

Medium-capacity plastic grinder machines are emerging as the most lucrative in this segment, holding a market share of around 38% in 2025.

OEM sales channels are expected to dominate the segment, with a market share of nearly 60% in 2025.

The plastic scrap grinder machine market is experiencing steady growth, driven by stricter plastic waste management regulations. Rising adoption of automated and energy-efficient grinding solutions, and the growing demand from the recycling and manufacturing industries for reliable and high-performance equipment.

Recent Trends in the Plastic Scrap Grinder Machine Market

Challenges in the Plastic Scrap Grinder Machine Market

The USA leads the plastic scrap grinder machine market with a projected CAGR of 6.1%, driven by strict EPR laws and recycling infrastructure investments. Germany follows closely at 6.0%, supported by EU circular economy directives and demand for IoT-enabled grinders.

The UK ranks third with a 5.8% CAGR, fueled by government incentives and eco-focused machinery. France and Japan trail slightly at 5.5% and 5.4% respectively, with growth driven by compact, energy-efficient models and AI integration. Overall, the USA and Germany show the strongest momentum due to regulatory push and technological adoption, while Japan and France maintain steady, sustainability-led growth.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA plastic scrap grinder machine demand is projected to grow at a CAGR of 6.1% from 2025 to 2035.

The UK plastic scrap grinder machine sales are projected to grow at a CAGR of 5.8% from 2025 to 2035.

Sales of plastic scrap grinder machine in Germany are expected to grow at a CAGR of 6.0% from 2025 to 2035.

Sales of plastic scrap grinder machines in France are forecasted to register a CAGR of 5.5% from 2025 to 2035.

Plastic scrap grinder machine revenue in Japan is expected to expand at a CAGR of 5.4% from 2025 to 2035.

The plastic scrap grinder machine market is moderately consolidated, with key players like Vecoplan AG, Cumberland Engineering, Rapid Granulator AB, ZERMA Machinery & Recycling Technology, and GENOX Recycling Tech Co., Ltd. leading the industry. These companies focus on innovation, strategic partnerships, and global expansion to maintain their competitive edge.

Vecoplan AG has emphasized sustainability and technological advancement, showcasing its commitment to eco-friendly recycling solutions. Cumberland Engineering, a division of ACS Group, continues to lead in size reduction equipment, offering a broad range of granulators and shredders. ZERMA Machinery & Recycling Technology provides comprehensive solutions to plastic waste processing. GENOX Recycling Tech Co., Ltd. is actively participating in global exhibitions, showcasing its innovative recycling machines.

Recent Plastic Scrap Grinder Machines Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.4 billion |

| Projected Market Size (2035) | USD 4.5 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020-2024 |

| Projections Period | 2025-2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Product Type | Single Shaft Plastic Grinder Machine, Double Shaft Plastic Grinder Machine, Rotary Blade Plastic Grinder Machine, Hammer Mill Plastic Grinder Machines |

| By Capacity | Small Capacity Plastic Grinder Machine, Medium Capacity Plastic Grinder Machine, Large Capacity Plastic Grinder Machine |

| By Sales Channel | OEM, Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Vecoplan AG, Cumberland Engineering, Rapid Granulator AB, ZERMA Machinery & Recycling Technology, Avadh Industries, Archana Extrusion Machinery Manufacturing, GEEPLAST INDIA, Shree Momai Rotocast Containers Pvt. Ltd., WEIMA Maschinenbau GmbH, Jordan Reduction Solutions, Herbold Meckesheim GmbH, Panchal Plastic Machinery Pvt. Ltd., Shini Plastics Technologies, Inc., NGR (Next Generation Recyclingmaschinen), GENOX Recycling Tech Co., Ltd., Amey Engineers, Wiscon Envirotech Inc., Raj Electricals, Harden Machinery Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By product, the market is segmented into single shaft plastic grinder machine, double shaft plastic grinder machine, rotary blade plastic grinder machine, and hammer mill plastic grinder machine.

In terms of capacity, the market is segmented into small capacity plastic grinder machine, medium capacity plastic grinder machine, and large capacity plastic grinder machine.

By sales channels, the market is segmented into OEM and aftermarket.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market is valued at USD 2.4 billion in 2025.

The market is expected to reach USD 4.5 billion by 2035.

The market is projected to grow at a CAGR of 6.3% from 2025 to 2035.

Hammer mill plastic grinder machines are expected to hold 45% market share in 2025.

OEM sales channels are expected to account for nearly 60% market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA