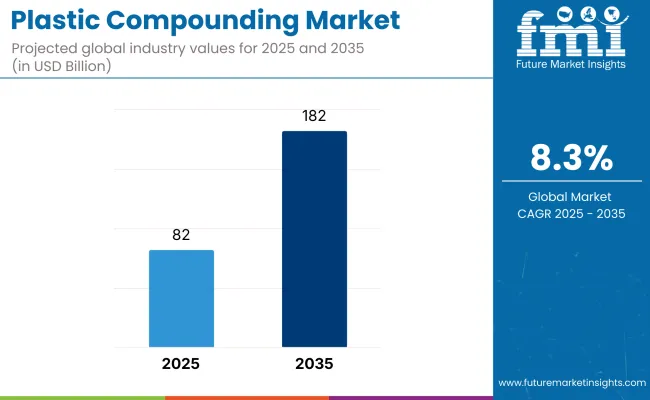

The plastic compounding market is valued at USD 82.0 billion in 2025 and is expected to reach USD 182.0 billion by 2035, advancing at an 8.3% CAGR throughout the forecast period.

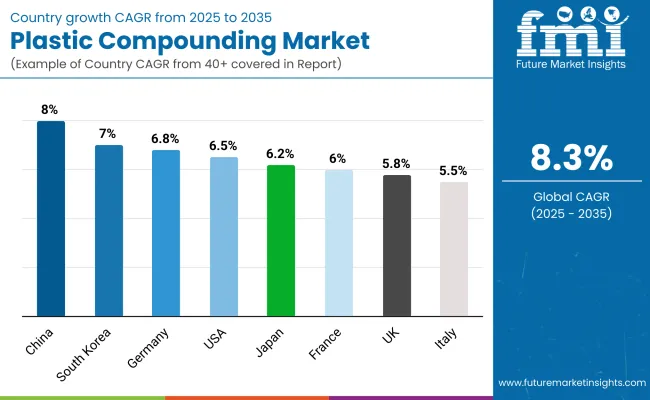

Within the plastic compounding market, the United States remains the most lucrative country in 2025 thanks to entrenched automotive and packaging clusters. Meanwhile, China is poised to be the fastest-growing national market from 2025 to 2035 as EV assembly plants, appliance production, and infrastructure spending keep resin demand surging.

Across industries, regulatory pushes for vehicle light-weighting, single-use-plastic curbs, and net-zero commitments are reshaping the plastic compounding market. OEMs prioritise halogen-free flame retardants, mechanically recycled PP, and bio-based polyesters. Feed-stock volatility and the steep capex of advanced recycling restrain smaller converters, but automation and AI-driven inline quality controls are lifting yields and compressing scrap rates.

Key trends steering the plastic compounding market include graphene-enhanced conductivity packs, low-VOC colour masterbatches for health-care disposables, and regionalised toll-compounding hubs that slash logistics emissions.

Looking ahead, the plastic compounding market is set to pivot toward mass-customised, circular-ready polymers. By 2030, chemical-recycling inputs are forecast to cover 15 % of global compound tonnage, while digital product passports will trace every pellet’s carbon intensity.

EV battery housings will shift to long-glass-fibre PP and PA 6/66 hybrid matrices, cutting weight 25 % versus die-cast aluminium. Compounding firms that embed closed-loop take-back, deploy green-hydrogen-fed extrusion lines, and co-develop drop-in resins with 3D-printing bureaus will capture outsized share through 2035

Demand for heat-resistant, metal-replacement grades is accelerating as EV drivetrains, 5G base-stations, and lightweight aerospace structures expand. While PP retains volume leadership for its low cost and balanced properties, polyamide (PA 6/66 & PA 12) compounds reinforced with short and long glass fibres are projected to post the steepest gains. Additive packages delivering flame-retardancy, hydrolysis resistance, and laser-weldability further boost adoption in battery enclosures and power-electronics housings.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| High-Performance Polyamide Compounds | 10.2% |

The automotive segment already absorbs more than one-third of global plastic compounding market volumes, and electrification deepens that pull. Lightweight PP-TPO fascia, glass-filled PA radiator end-tanks, and carbon-black-free conductive ABS housings dominate the bill of materials for EV platforms. Construction follows, leveraging PVC and PE blends for pipes, window frames, and insulation. Medical devices and renewable-energy blades are emerging hot spots, but EVs remain the headline growth engine through 2035.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Electric-Vehicle Components | 9.5% |

Future Market Insights' latest survey among stakeholders in the sector identified some new trends that are transforming the market. Industry executives pointed out that the demand for sustainable and high-performance plastic compounds is higher than ever before due to increasing environmental regulations and customer demand for eco-friendly products.

Most of the respondents pointed towards a significant move towards bio-based and recycled plastic blends, with more than 60% of the manufacturers actively investing in R&D to improve the quality and performance of these materials. Companies are also developing sophisticated additive formulations to enhance durability, flexibility, and thermal resistance in different end uses.

The second of the survey's most important findings was the growing importance of automation and AI in compounding operations for plastics. Almost 70% of the respondents had plans to implement smart manufacturing techniques, including AI-based quality assurance and predictive maintenance, to improve productivity and minimize waste.

As the industry develops further, businesses which invest proactively in sustainable supplies, automation, and local models of production shall be best set up for lasting success.

To stay ahead of the competition in the industry for compounding plastics, contact Future Market Insights now and gain access to expert opinion and strategic recommendations.

Government regulations and mandatory certifications significantly influence the industry, varying across countries. Below is an overview of select countries:

| Country/Region | Impact of Government Regulations and Mandatory Certifications |

|---|---|

| European Union | The EU enforces stringent regulations to minimize plastic pellet loss, exemplified by the Operation Clean Sweep (OCS) Europe Certification Scheme. This initiative mandates companies across the plastics supply chain to adhere to best practices in pellet management, aiming to prevent environmental contamination. |

| United States | The USA has implemented comprehensive controls on exports and reexports to certain countries, including Cuba, Iran, and Syria, affecting the polymers & plastics industry. Additionally, environmental labeling programs, both mandatory and voluntary, are in place to ensure product compliance with environmental standards. |

| Japan | Importers must submit import notices and relevant export certificates for plastic products, ensuring compliance with the Food Sanitation Act. Non-compliant products face re-exportation, destruction, or diversion to non-food uses. |

| Australia | The National Framework for Recycled Content Traceability guides the collection and sharing of information about recycled materials. This voluntary framework aims to boost confidence in recycled materials by setting consistent expectations across the supply chain. |

These regulations and certifications underscore a global trend towards sustainability and environmental responsibility in the industry.

| Time Period | Evaluation |

|---|---|

| 2020 to 2024 | The industry experienced steady growth, with a CAGR of around 2% from 2018 to 2022, accelerating further in 2023. The industry saw increased adoption of the product in automotive, construction, and packaging. Regulatory pressures led to a shift toward bio-based and recycled plastic compounds. The COVID-19 pandemic initially disrupted supply chains but later accelerated the demand for plastics in medical and hygiene applications. Automation and AI integration in manufacturing started gaining traction, improving efficiency and reducing costs. The automotive sector, particularly the shift towards electric vehicles (EVs), played a crucial role in driving demand for lightweight, high-performance plastic compounds. |

| 2025 to 2035 | The industry is expected to grow at a robust CAGR of 8.3%, reaching approximately USD 182 billion by 2035. Advancements in polymer technology, increasing regulatory restrictions on single-use plastics, and the rising demand for high-performance engineering plastics will be key drivers. AI and automation will become mainstream in production processes, reducing waste and improving product consistency. The automotive industry, particularly EVs, will continue to be a major consumer, while aerospace and renewable energy sectors will also boost demand. Asia-Pacific and Latin America will witness strong investments in plastic compounding due to expanding industrial and infrastructure projects. Sustainability, recyclability, and the circular economy will dominate trends, pushing companies toward eco-friendly and biodegradable compounds. |

| Countries | CAGR |

|---|---|

| USA | 6.5% |

| UK | 5.8% |

| France | 6.0% |

| Germany | 6.8% |

| Italy | 5.5% |

| South Korea | 7.0% |

| Japan | 6.2% |

| China | 8.0% |

The USA boasts a well-developed plastic compounding, fueled by strong automotive, construction, and packaging industries. The nation's emphasis on technology and green practices has created growing demand for high-performance and recyclable plastic compounds. Government policies supporting infrastructure growth and the revival of manufacturing operations are likely to further drive the industry. Furthermore, the increasing focus on electric vehicles (EVs) is expected to boost demand for lightweight materials, which will favorably affect the plastic compounding industry.

In the UK, demand from the automotive and packaging sectors determines the industry for plastic compounding. Increased usage of lightweight materials in vehicle manufacturing due to the UK's push for less carbon emissions drives growth. Shift in the packaging industry to utilize environment-friendly and recyclable material also encourages the utilization of premium plastic mixes. Bureaucratic challenges and the need to abide by environmental standard requirements might restrain growth slightly, however.

The French plastic compounding industry is favorably backed by its strong automotive and aerospace industries. The emphasis of the country on sustainability and innovation has resulted in the creation of bio-based and high-performance plastic blends. Government initiatives favoring circular economy projects and investment in renewable energy projects are likely to propel demand for high-technology plastic materials. Market growth also comes from the post-pandemic restoration of the construction industry.

Germany is the engineering powerhouse with a keen demand for plastic compounds in both its automotive and machinery sectors. The transition towards e-mobility and energy efficiency has brought about an increase in the usage of light-weight and durable plastic materials. Recyclable and green plastic compounds are preferred to be produced and utilized under its stringent environmental legislation, further intensifying industry growth.

Italy's plastic compounding industry is dominated by the automotive and fashion industries. Demand for beautiful and functional plastic parts in automotive design and high-end packaging stimulates the industry. Economic downturns and pressures from regulations to minimize plastic waste are a threat. Despite this, recycling activities and the application of bio-plastics offer opportunities for industry growth.

South Korea's electronics and automotive sectors are heavy consumers of plastic compounds. The country's focus on technology and smart manufacturing processes drives the need for high-performance plastic materials. Green technology and sustainable development public policies also promote the use of green plastic compounds, driving expansion.

The plastic compounding business in Japan is fueled by the automotive, electronics, and robotics industries in the country. Miniaturization and precision manufacturing demand high-performance plastic compounds with improved properties. Green chemistry and recycling technologies, also prioritized in the nation, further drive the general trend towards circular economy practices, expanding access to the plastic compounding business.

China, being an industrial hub, has a rapidly growing plastic compounding sector. Demand for plastic compounds is boosted by growth in automotive, construction, and consumer goods sectors. State support of infrastructure growth and urbanization is also fueling the industry. Nevertheless, tougher environmental laws and the need to implement sustainable strategies are inducing a shift towards sustainable and recyclable plastic compounds.

In 2024, the industry for plastic compounding witnessed significant strategic actions by industry players, reflecting a dynamic and evolving landscape. Borealis AG, a leading player in the industry, added to its state-of-the-art mechanical recycling capacity through the acquisition of Integra Plastics AD, a Bulgarian post-consumer waste converter into high-quality polyolefin recyclates. The April 2024 acquisition contributed more than 20,000 metric tons to Borealis recycling capacity, underscoring the company's dedication to sustainable solutions.

In December 2024, American packaging giant Pactiv Evergreen merged with Charlotte, North Carolina-based packaging industry leader Novolex in a USD 6.7 billion takeover. The strategic acquisition is expected to strengthen Novolex's market share and diversify its offerings in the food packaging business. The deal is expected to be completed mid 2025.

Amcor, the Australian packaging giant, hogged the headlines in 2024 with its proposed acquisition of Berry Global Group in a scrip merger worth USD 8.4 billion. The tie-up is designed to make Amcor the world's largest plastic packaging firm, with combined annual sales of around USD 23.9 billion. The acquisition is set to deliver substantial cost synergies and expand Amcor's position in North America, Western Europe, and emerging economies.

Abu Dhabi's national oil company, ADNOC, made a strategic bid for German chemicals group Covestro, which is famous for material innovations such as MDI, TDI, and polycarbonate. The offer of USD 14.4 billion is a reflection of ADNOC's vision to increase its presence in gas and petrochemicals through Covestro's technological capabilities in sustainable technologies and global footprint.

Plastic compounding industry falls under the chemical and materials industry as a whole, and within the specific sector of plastics and polymer processing. The industry is intricately connected with industries that use advanced plastic compounds with specified properties, including automotive, construction, packaging, electronics, and consumer goods.

At a macro-economic level, the plastic compounding industry is influenced by world industrial expansion, trade policy, environmental policies, and technology. The industry is boosted by growing industrialization, especially in developing economies such as China, India, and Southeast Asia, where growing disposable incomes and urbanization drive demand for plastic-based products. Moreover, the trend towards electric vehicles (EVs) and light-weighting in the automotive sector is a significant driver of industry opportunities.

Yet, macroeconomic issues like volatile crude oil prices, affecting raw material prices, and supply chain disruptions internationally still plague stability. Geopolitics and trade bans on plastic waste exportation also affect consumption and production tendencies.

Furthermore, stringent environmental legislation and sustainability targets are compelling a transition toward bio-based and recycled plastic materials, with corporations heavily investing in circular economy projects.In spite of these issues, the industry has prospects for sustained growth with the support of technology developments, growing infrastructure expenditure, and need for high-performance plastic solutions in core industries.

Growth in Sustainable Plastic Compounding

With mounting regulatory strain and demand from consumers for environmentally friendly products, stakeholders must invest in recycled and biodegradable plastic blends. Firms can utilize chemical recycling to mature the quality of recycled plastics so that they are appropriate for high-performance use. Collaborations with waste management companies can provide regular raw material supplies, while cost stability and adherence to changing sustainability regulations can ensure compliance.

Leveraging Electric Vehicle (EV) Growth

The trend in the automotive sector towards lightweight materials for EVs is an attractive opportunity. Stakeholders need to develop high-performing polypropylene (PP) and polycarbonate (PC) grades that outperform peers in flame retardancy, thermal stability, and weight savings. Growth over the long term can be driven through strategic partnerships with automotive original equipment manufacturers (OEMs) to manufacture customized blends of polymers for battery enclosures and lightweight structural components.

High-Performance Polymer Development for Electronics

With the introduction of 5G, AI, and miniaturized electronics, conductive and heat-resistant polymer compounds are highly sought after. Processing polyamide (PA) and polyether ether ketone (PEEK) compounds with improved electrical insulation and thermal stability will help to capture market share in semiconductor, circuit board, and wearable technology industries.

With respect to product outlook, the segment is classified into polyethylene (PE), polypropylene (PP), thermoplastic vulcanizates (TPV), thermoplastic polyolefins (TPO), poly vinyl chloride (PVC), polystyrene (PS), polyethylene terephthalate (PET), polybutylene terephthalate (PBT), polyamide, polycarbonate, acrylonitrile butadiene styrene (ABS), and others.

In terms of application outlook, the segment is divided into automotive, building & construction, electrical & electronics, packaging, consumer goods, industrial machinery, medical devices, optical media, and others.

In terms of region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Growing demand in the automotive, construction, and packaging sectors and developments in high-performance and sustainable polymers are major drivers.

Firms are moving towards renewables and recycling-based products to deal with environmental regulations and consumers' demands for sustainable products.

Improved properties of materials in terms of strength, flexibility, and resistance to heat benefit automotive, electronics, medical, and packaging sectors.

Tight control over the disposal of plastic wastes and recycling processes is driving the manufacturers toward environmentally friendly manufacturing methods and alternative raw materials.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Outlook, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application Outlook, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Outlook, 2023 to 2033

Figure 17: Global Market Attractiveness by Application Outlook, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Outlook, 2023 to 2033

Figure 35: North America Market Attractiveness by Application Outlook, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Outlook, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application Outlook, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Outlook, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application Outlook, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Outlook, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application Outlook, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Outlook, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application Outlook, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Outlook, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application Outlook, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Outlook, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Outlook, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Outlook, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Outlook, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Outlook, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application Outlook, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Outlook, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application Outlook, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Hot and Cold Pipe Market Size and Share Forecast Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA