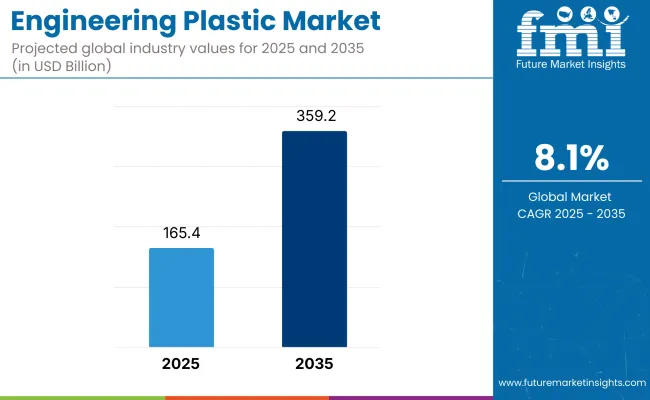

The engineering plastic marketis valued at USD 165.4 billion in 2025 and will most probably record a CAGR of 8.1% during 2025 to 2035. The valuation of this industry will be worth USD 359.2 billion by 2035. One of the key drivers driving the growth is the increased need for lightweight materials and durability in applications from industries such as the automotive, electronics, and construction sectors.

These plastics have improved thermal stability, mechanical properties, and chemical resistance and have become indispensable substitutes for metals and conventional polymers in many applications. The rapid growth of industrial automation and electric mobility is contributing significantly to driving growth.

For electric vehicles, these plastics offer significant benefits, such as reducing component weight, improving fuel economy, and enhancing design flexibility. Their growing application in metal replacement in under-the-hood automotive parts also reduces carbon emissions and furthers world sustainability objectives.

The consumer electronics industry is increasingly turning to these plastics for housings, connectors, and display components. Electrical insulation and flame retardancy characteristics enable consistent and reliable device performance. As devices continue to miniaturize, engineering plastics balance structural strength and design innovation, which is propelling their wider use in smartphones, tablets, and wearables.

In the healthcare industry, the demand for high-performance plastics for diagnostic equipment, drug delivery systems, and surgical instruments is opening new opportunities for engineering plastic manufacturers. These plastics are formulated to have high biocompatibility and sterilization standards and are, therefore, ideal for use in modern healthcare applications.

The food and beverage sector also enjoys the benefits of their hygienic and high-barrier characteristics in packaging uses. Growth in polymer engineering over the long term, supported by increasing R&D spending and global manufacturing change, is projected to support long-term sales expansion. The Asia-Pacific region, led by China and India, will continue to dominate production and consumption owing to a robust industrial base and rising disposable income.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 165.4 billion |

| Industry Value (2035F) | USD 359.2 billion |

| CAGR (2025 to 2035) | 8.1% |

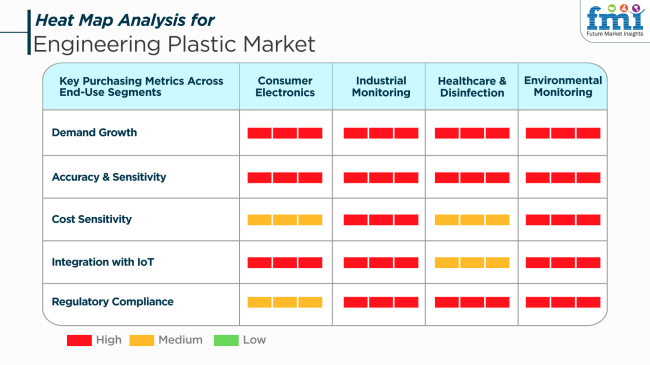

ngineering plastics are gaining prominence across various industrial sectors due to their multi-dimensional performance characteristics. In consumer electronics, lightweight and fire-resistant materials have become a necessity for developing compact and safe devices. Demand remains high due to evolving design requirements and the integration of smart technologies.

Industrial monitoring applications require higher precision and thermal resistance. In these instances, these plastics deliver excellent precision in adverse working conditions. Good intercompatibility with IoT infrastructure also drives application growth in process automation enclosures and sensors.

Key Purchasing Metrics Across End-Use Segments

On the medical and disinfectant side, biocompatibility and sterility resistance of the material provide safe use in reusable and disposable items. Conversely, environmental monitoring instruments benefit from corrosion-resistant character, especially in external and chemically unstable environments. All fields prominently incorporate regulatory standards, and in most instances, these plastics are able to meet these stringent standards without difficulties.

Between the years 2020 and 2024, the industry witnessed stable growth with mounting demand for products such as automobiles, electronics, and consumer electronics. Demand for high-strength, high-performance, and lightweight materials has led to traditional materials like glass and metal replacing these plastics. There was also a growing emphasis on sustainability, which saw manufacturers look for recyclable and bio-based alternative plastics.

From 2025 to 2035, the industry is likely to be influenced by technological developments and changing consumer trends. The incorporation of smart technologies, including sensors and conductive materials, into these plastics is expected to create new opportunities in the electronics and automotive industries. Additionally, increased emphasis on circular economy values will also drive innovations in recycling technology and the production of sustainable materials. Asia-Pacific and Latin America emerging economies are projected to be strong growth drivers fueled by industrialization and increasing consumer demand.

Comparative Market Shift Analysis: Engineering Plastic Market

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Automotive parts, electronics, household appliances | Smart electronics, electric cars, green packaging |

| Research and development of high-performance thermoplastics | Focus on bio-based and recyclable plastics |

| Constrained utilization of smart technologies | Use of sensors and conductive materials |

| Lightweight and strong material demands | Focus on the principles of circular economy and sustainability |

| Domination of old markets in North America and Europe | Dramatic expansion in the Asia-Pacific region and Latin America |

| Adoption of green legislation | Stepped-up regulation that promotes environmental best practices |

The industry faces a number of strategic and operational risks that can impact its long-term trajectory. The price volatility of raw materials, specifically petrochemical derivatives, is one of the critical concerns. As these plastics are largely oil-derived, fluctuation in the price of crude oil can impact the cost of production and profit margins, especially for small- and medium-level producers.

Another major threat is the increased regulatory attention to plastic waste and sustainability. Global requirements to limit the use of plastics and promote circular economy practices may compel manufacturers to think outside the box with biodegradable or recyclable alternatives, which could reshape cost bases and R&D strategies. Adapting to such new environmental norms is a continuous worry.

Geopolitical tensions and uncertainty over trade, particularly between major economies, also disrupt global supply chains. Predominant raw material and plastic producers such as China can face export controls, which will influence the supply of materials to other markets. Diversification of sources and strategic partnerships are, therefore, likely to become increasingly integral to the industry's forward strategy.

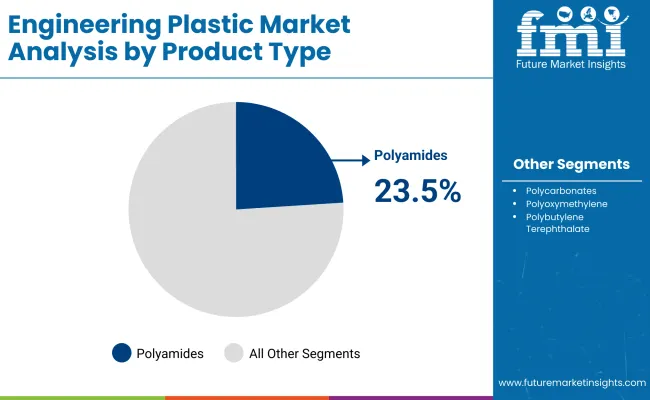

Polyamides will lead the industry in 2025, with a share of 23.5%. Polycarbonates are projected to account for 15%. Versatility, performance characteristics, and the ability to adapt to many industries are driving these two segments.

An important sub-segment for polyamides in automotive, industrial, and electronics field applications is PA6 and PA66. They have excellent mechanical strength, abrasion resistance, and thermal stability. Examples of vehicles in which glass-reinforced polyamide is used for under-the-hood components like engine covers, air intake manifolds, and oil pans are BMW and Ford. BASF (Ultramid®), DuPont (Zytel®), and LANXESS (Durethan®) are the eminent players in this segment.

These companies concentrate on the production of lightweight and strong polyamides to assist automotive OEMs with emission legislation and fuel efficiency. In contrast, companies like Schneider Electric and Siemens use PA66 in circuit breakers and for cable insulation owing to its flame retardance and electrical resistance in electrical applications.

Polycarbonate is prized for its clarity, good impact, and heat resistance. Automotive and other applications include automotive lamps, electronic housing, and medical devices. The Makrolon® brand of Covestro AG and the LEXAN™ brand of SABIC are prominent in this space. In the automotive industry, Hyundai and Toyota use polycarbonate materials in the manufacture of high-performance headlamp lenses and sunroofs to maintain light weight and high optical clarity.

In consumer electronics, Apple and Samsung use polycarbonate blends in their device casings for strength and sleek looks. Polycarbonate's biocompatibility suits medical applications such as blood reservoirs, filter housings, and oxygenators; Becton Dickinson and Medtronic have used it in disposables.

The leading chemical companies like these segments due to their high margin returns and alignment with long-term trends such as electrification, lightweight, and medical innovation. The flexibility of polyamides and polycarbonates is set to drive their adoption across global high-performance, safety-critical applications.

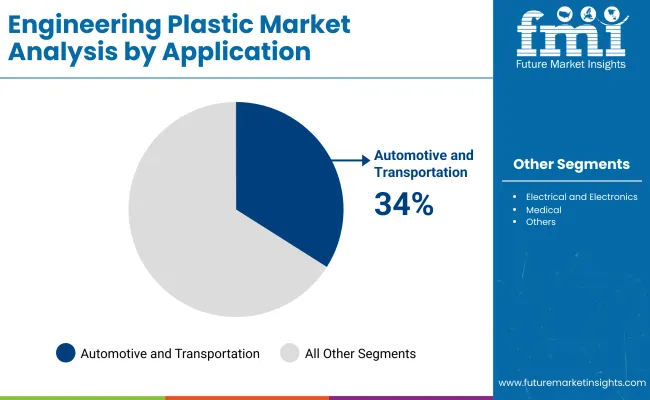

By application, the automotive and transportation application segment will have a share of 34%, followed by the electrical and electronics segment, which will have 25% in 2025. Ongoing interests in performance efficiency, miniaturization, and sustainability drive demand from these segments.

Engineering plastics are preferred in automotive and transportation for their low weight and mechanical strength. Automakers such as Volkswagen, General Motors, and Tesla use engineering plastics in components, such as engine covers, air intake manifolds, bumpers, and fuel systems.

Substituting these materials for conventional metals would make the car lighter and, hence, improve the fuel efficiency and battery efficiency of electric vehicles. The suppliers here are BASF (Ultramid®), DuPont (Zytel®), and Celanese, which provide materials designed to withstand very high levels of heat, chemical exposure, and mechanical stress for critical applications.

Engineering plastics fulfill key functions of safety, flame retardance, and insulation of high-performance equipment in electrical and electronics. Polycarbonates, PPS (polyphenylene sulfide), and LCP (liquid crystal polymers) are used by companies like Samsung, LG, and Panasonic in the housing of smartphones, circuit boards, and connectors.

For example, specialty plastics such as those provided by retailers like SABIC or Solvay can be used to produce small, heat-resistant components in laptops, wearables, and 5G telecommunication infrastructures according to the requirements of particular thermal and electrical protocols. In addition to this, they are used for the manufacture of switchgear and circuit protection devices from Schneider Electric and ABB, which have exhibited proven dimensional stability and arcing resistance.

These applications show how engineering plastics have made it possible for engineers to incorporate the regulatory or performance requirements in previously fast-paced industries. The ongoing push for electrification, digitalization, and new-age sustainable mobility will add further to such demands in these rapidly growing industries.

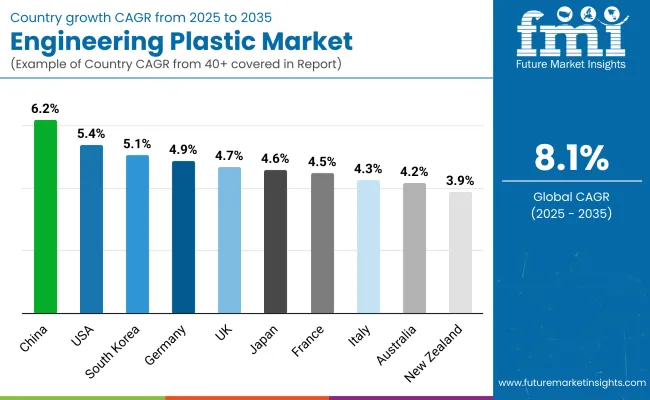

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.7% |

| France | 4.5% |

| Germany | 4.9% |

| Italy | 4.3% |

| South Korea | 5.1% |

| Japan | 4.6% |

| China | 6.2% |

| Australia | 4.2% |

| New Zealand | 3.9% |

The USA is anticipated to register a CAGR of 5.4% during the period 2025 to 2035 due to the strong demand from the automotive, aerospace, and electrical sectors. Increasing opportunities in high-performance thermoplastics and the rising application of lightweight materials in automobile production are major drivers of growth. Energy-saving policies triggering regulations are also favoring the application of these plastics in green designs.

Major industry players like DuPont, Celanese Corporation, and Solvay are heavily investing in R&D to propel product portfolios and improve application flexibility. The growth is also driven by the transition to electric vehicles and intelligent electronics, with these plastics playing key strengths in durability, heat resistance, and design flexibility.

The UK will grow at a CAGR of 4.7% during the period between 2025 and 2035, underpinned by increasing demand from the automotive and electrical industries. Focus on recyclable and lightweight materials still drives market frontiers. Government-led clean energy solutions are also adding value to the market offering.

Industry players like Victrex and BASF are expanding manufacturing capabilities and collaborating to meet changing industrial needs. Consolidation of technology in the manufacturing of precision-engineered components for medical and telecommunications applications is also driving steady regional sales growth.

France is anticipated to record a 4.5% CAGR over the forecast period. Growing uses in automobile interiors, engine parts, and electric enclosures are favoring market performance. Increasing demand for the recyclability of materials and lightweight composites is one with regional environmental legislation.

Such companies as SABIC and Arkema adhere to the designing of thermoplastic technologies and the strengthening of supply chains. Growth in the aerospace sector and technological innovation of high-heat-resistant polymers are expected to offer stable domestic and foreign market demand.

Germany is projected to grow at a CAGR of 4.9% from 2025 to 2035. Expansion is driven by robust vehicle exports and advanced manufacturing infrastructure, with engineering plastics playing an important role in under-the-hood parts and structural elements. Additive manufacturing improvements also allow for the creation of customized plastic components.

Market players like Evonik Industries and Covestro are driving innovation in polyamides and polycarbonates. Heavy investment in the development and implementation of green raw materials is driving Germany to be the hub for plastic manufacturing in the European Union.

Italy is expected to register a 4.3% CAGR throughout the decade as the demand increases for home appliances, auto parts, and industrial machinery. Domestic manufacturers are embracing high-performance plastics to fulfill changing safety and efficiency requirements.

Regional demand is addressed by international players like RadiciGroup and DSM Engineering Materials, which are targeting bioplastics and polymer blending technology. Development is also driven by research and development in electric mobility and circular economy framework in Italian manufacturing.

South Korea is expected to log a CAGR of 5.1% during 2025 to 2035. Sudden technology developments and extensive integration with the electronics and semiconductor sectors are key growth drivers. Engineering plastics are the critical constituents of miniaturized, heat-stable electronic equipment.

Large companies like LG Chem and Lotte Chemical are investing in advanced compounding and creating international distribution networks. Greater electric vehicle production and smart device penetration are also driving demand.

Japan is expected to grow at a CAGR of 4.6% over the forecast period with stable industrial demand and precision manufacturing technology development. The use of robotics, medical equipment, and electric vehicles keeps broadening the material's uses.

Major players like Toray Industries, Mitsubishi Engineering-Plastics, and Sumitomo Chemical are emphasizing performance characteristics and reducing environmental footprint. High reliability and miniaturization demands of consumer electronics generate steady demand throughout Japan.

China will dominate the engineering plastic market with a CAGR of 6.2% during the years 2025 to 2035. The massive production capacity and needs of industries like construction, automotive, and electronics drive expansion. Government policies encouraging green technology and industrial automation further raise growth prospects.

Industry leaders such as Kingfa Sci & Tech Co., BASF-YPC Company, and Sinopec are making significant investments in innovation and capacity growth. Green manufacturing and plastic recycling engineering focus also support long-term regional growth.

The Australian engineering plastic market is expected to expand at a CAGR of 4.2% through 2035, led by the construction, mining, and infrastructure industries. Increased application in pipes, protective equipment, and heavy machinery components is propelling demand.

Firms like Integrated Polymer Solutions and multinational corporations' local subsidiaries are increasing capacities to address growing industrial demand. Low-emission building materials and green techniques compliance are driving higher applications of engineered thermoplastics in civil engineering and public infrastructure.

New Zealand is expected to see a CAGR of 3.9% in the engineering plastic market during the coming decade. Domestic production is limited, with strong import channels supporting demand for water management systems, packaging, and agriculture.

The industry is growing steadily, with firms utilizing engineered plastics on account of their mechanical strength and resistance to corrosion. Sustained advances in sustainable design methods and renewable energy infrastructure are likely to promote additional applications in the long run.

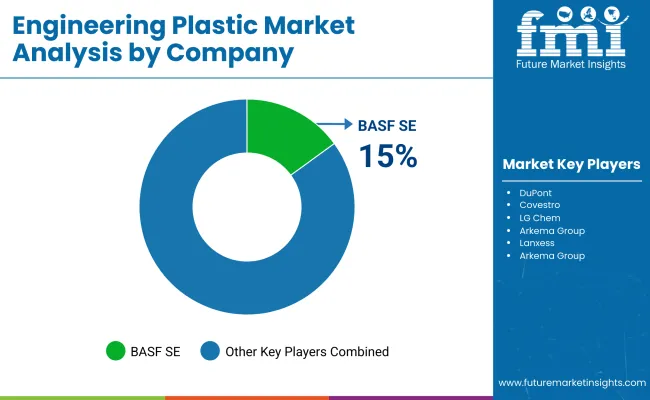

The industry is intensely competitive, with tidal waves of material innovation, performance applications, and manufacturing efficiency propelled by multinational chemical corporations. BASF SE, DuPont and Covestro have strong footholds due to their extensive product portfolios and technological advances. These companies serve the automotive, electronics, and industrial manufacturing industries and focus on developing high-performance polymers with improved durability, thermal resistance, and mechanical strength.

Asian manufacturers spearheading the demand for engineering plastics in consumer electronics and automotive components include LG Chem and Mitsubishi Engineering-Plastics Corporation. While exhibiting cost benefits via its integrated production, LG Chem is also paying attention to polycarbonate and specialty resin applications of aluminum-lightweight automotive materials, which Mitsubishi Engineering-Plastics specializes in.

Some players in Europe, such as Arkema Group and Asahi Kasei Corporation, are providing options for specialty engineering plastics, including high-performance polyamides and fluoropolymers. These companies invest substantially in R&D to develop sustainable alternatives with high recyclability. On the other hand, DSM N.V. and Lanxess have shifted their major focus of development toward green alternatives, especially bio-based and recyclable plastics aimed at complying with the circular economy trends in material science.

Through acquisitions and collaborations, Celanese Corporation is steadily increasing its footprint and presence in the industrial and medical engineering plastics domains. At the same time, reducing weight and increasing strength are key motivators for manufacturers to make continuous improvements in their products to serve the aerospace, automotive and electronics industries.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| BASF SE | 15-19% |

| DuPont | 12-16% |

| Covestro | 10-14% |

| LG Chem | 8-12% |

| Arkema Group | 6-10% |

| Others (combined) | 35-45% |

| Company Name | Key Offering and Activities |

|---|---|

| BASF SE | Leading producer of polyamides, polyoxymethylene, and thermoplastic polyurethanes for high-performance applications. |

| DuPont | Develops high-strength polymers for automotive, aerospace, and industrial uses. |

| Covestro | It specializes in polycarbonate and polyurethane-based engineering plastics for structural applications. |

| LG Chem | Manufactures high-quality ABS and polycarbonate resins for automotive and electronics. |

| Arkema Group | Produces specialty polyamides and high-performance fluoropolymers. |

Key Company Insights

BASF SE (15-19%)

A key leader in polyamide and polyurethane engineering plastics, focusing on industrial, automotive, and aerospace-grade applications.

DuPont (12-16%)

Expands material science capabilities to support advanced manufacturing and high-performance plastics for lightweight automotive and industrial sectors.

Covestro (10-14%)

Strengthens its position through innovation in polycarbonates and thermoplastic polyurethane solutions for sustainable manufacturing.

LG Chem (8-12%)

Integrates vertically to ensure cost-effective production of advanced engineering plastics for consumer electronics and automotive industries.

Arkema Group (6-10%)

Invests in specialty engineering plastics and bio-based alternatives, aligning with sustainability goals and high-performance material trends.

Other Key Players

The segmentation is into polyamides, polycarbonates, polyoxymethylene, polybutylene terephthalate, acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile, high-performance polymers, fluoropolymers, polymethyl methacrylate, and others, offering a wide array of engineering plastics tailored to diverse industrial requirements.

Applications span across automotive and transportation (including interiors and safety, exteriors and structural, engine and mechanical, and others), electrical and electronics (consumer appliances, electronic products, and others), construction (glazing and sky lighting, pipes and fittings, and others), medical (diagnostic and drug delivery systems, medical devices, and others), industrial and machinery, packaging, and others, reflecting the versatility and demand for engineering plastics across key sectors.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, highlighting a robust global presence and region-specific growth dynamics.

The valuation of this industry is estimated to be worth USD 165.4 billion in 2025.

Sales are projected to grow significantly, reaching USD 359.2 billion by 2035, driven by increasing demand across various industries such as automotive, electronics, and construction.

China is expected to experience a CAGR of 6.2%, fueled by rising industrialization and demand for high-performance plastics.

Polyamides are leading the trend due to their excellent mechanical properties and broad application in automotive and electronics.

Key players include Arkema Group, Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro, DSM N.V., DuPont, Lanxess, LG Chem, and Mitsubishi Engineering-Plastics Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Chaos Engineering Platform Market Size and Share Forecast Outlook 2025 to 2035

Civil Engineering Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA