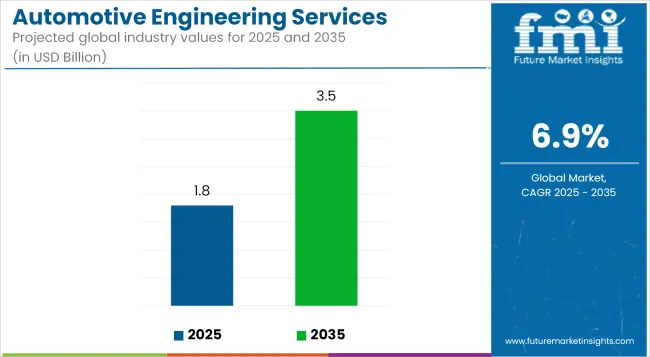

The global automotive engineering services market is projected to grow from USD 1.8 billion in 2025 to over USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% during the forecast period.

This growth is being fueled by the increasing reliance of original equipment manufacturers (OEMs) on outsourced engineering support, particularly in the domains of electrification, simulation, and digital architecture development.

Engineering tasks such as electric vehicle (EV) powertrain design, model-based systems engineering, and calibration of embedded control systems are being increasingly delegated to external partners. The adoption of connected and autonomous technologies has intensified the need for specialized expertise, resulting in a growing volume of vehicle integration and embedded software development being outsourced. Digital twin modeling techniques are being implemented during early-stage vehicle design to improve validation accuracy and reduce dependency on physical prototypes.

In January 2024, a range of software solutions was introduced by HARMAN Automotive, a subsidiary of Samsung Electronics, to accelerate the development of software-defined vehicles. The tools were positioned to enhance safety and scalability across digital cockpit and advanced driver-assistance systems (ADAS). In the official company release, it was emphasized that the shift toward software-centric vehicle architecture is requiring closer cooperation between OEMs and digital engineering specialists.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Industry Value (2035F) | USD 3.5 billion |

| CAGR (2025 to 2035) | 6.9% |

Ecolab expanded its engineered automotive services to include process optimization solutions targeting EV component manufacturing. Its offerings have been tailored to improve sustainability and efficiency in surface treatment and parts cleanliness, reflecting the evolving demands of next-generation production environments.

As the complexity of modern vehicle systems has increased, validation, compliance testing, and real-time simulation are being carried out through agile external engineering frameworks. Cloud-enabled environments are being used to collect live vehicle data, run simulation cycles, and validate system performance under dynamic operating conditions.

The automotive engineering services market is expected to be increasingly shaped by these digital advancements. As OEMs continue to adopt software-defined platforms, the role of engineering service providers is anticipated to become even more integral to ensuring faster development timelines, regulatory compliance, and reduced costs across both conventional and electrified vehicle programs.

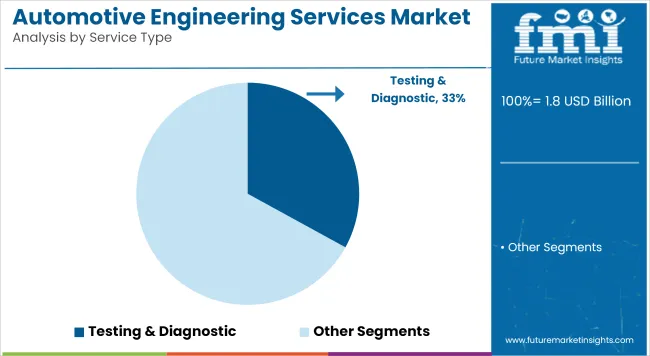

Testing & diagnostic services are projected to lead the global automotive engineering services market, contributing approximately 33% of total market revenue in 2025. Over the forecast period from 2025 to 2035, the segment is forecast to grow at a CAGR of 7.2%, marginally exceeding the global market average of 6.9%.

As vehicle architecture becomes increasingly complex with the integration of advanced electronics, autonomous features, and stringent emission norms, demand for comprehensive testing and validation services has surged.

OEMs and Tier-1 suppliers are prioritizing end-to-end testing across functional domains, including noise, vibration, and harshness (NVH), crashworthiness, thermal performance, and cybersecurity. Growing regulatory mandates related to passenger safety, emissions, and vehicle homologation are also compelling automakers to outsource specialized diagnostic testing to engineering service providers.

The use of digital twins, hardware-in-the-loop (HIL), and over-the-air (OTA) testing frameworks has further expanded the scope of these services, enabling faster time-to-market and reduced development costs. Key players are investing in test automation and simulation-backed diagnostics to improve efficiency across vehicle platforms and shorten product development cycles.

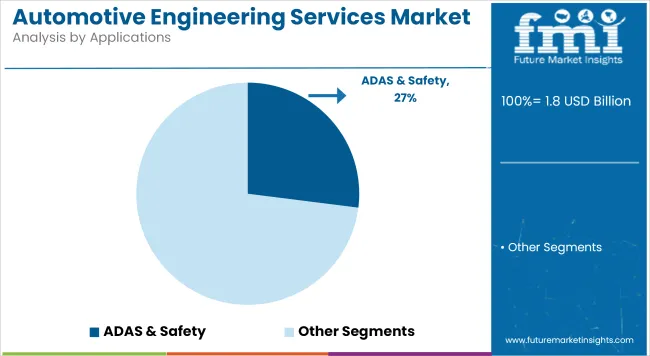

The ADAS & safety segment is expected to hold the largest application share-approximately 27%-in the automotive engineering services market by 2025, with the segment projected to grow at a CAGR of 7.4% through 2035. The ongoing transition toward autonomous and semi-autonomous vehicles is increasing the reliance on external engineering expertise to support sensor integration, control algorithm development, and system validation.

Automakers are investing heavily in lane-keeping assist, adaptive cruise control, emergency braking, and pedestrian detection systems, all of which require robust engineering, testing, and simulation. The complexity of integrating lidar, radar, cameras, and ECUs has led to growing collaboration with engineering service firms capable of delivering embedded software, vehicle dynamics analysis, and cross-domain validation.

Moreover, the pressure to meet Euro NCAP and NHTSA safety ratings has made ADAS performance engineering a strategic priority for global automotive brands. Increasing urbanization and the push for zero-accident mobility are further reinforcing the significance of ADAS engineering across all vehicle segments, from luxury to mass-market platforms.

Challenges

High R&D Costs and Complex Regulations

Automotive Engineering Services Market is Home to Several Challenges Because of High R&D (Research & Development) Cost Related to Advanced Vehicle Design, Electrification, and Autonomous Technologies On the other hand, with manufacturers focused on cutting edge solutions like electric (EV) powertrains, ADAS (Advanced Driver Assistance Systems), and lightweight materials, the engineering service providers need to invest a lot in new capabilities, which pushes their operating costs higher.

Requirements around emissions, safety and cybersecurity vary widely across the global automotive ecosystem and can be challenging for companies to navigate. The need to tailor vehicles to regional regulations adds to the cost and length of time associated with developing a new vehicle for marketers.

Opportunities

Growth in Electric and Autonomous Vehicle Development

The market for Automotive Engineering Services Market is also driven by major opportunities in information and communication technology with regards to electric and autonomous driving vehicles. Auto manufacturers and startups are outsourcing engineering services to shorten timelines for EV platforms, battery optimization, and advanced safety system integration.

Furthermore, the demand for connected vehicle solutions, software-driven automotive designs, and AI-powered mobility services is driving the need for specialized engineering expertise. Companies that focus on software-defined vehicles, digital twin technology, and smart mobility solutions will gain a competitive edge in the evolving automotive landscape.

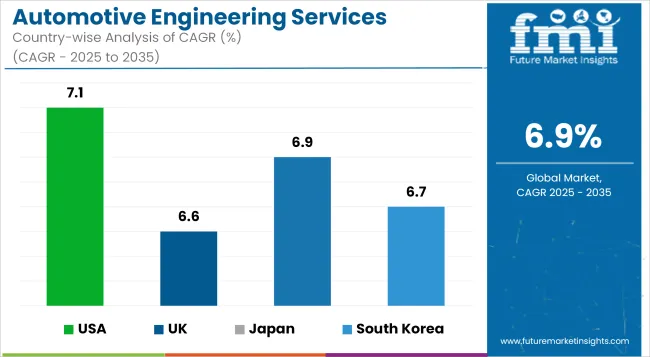

Steadily increasing automotive engineering services market is driven by accelerating electric vehicle (EV) development, surging investments in autonomous driving technology and hasty government regulation on emission and safety.

Major manufacturers including General Motors, Ford, and Tesla are pouring hundreds of millions of dollars into vehicle electrification, lightweight materials, and advanced driver-assistance systems (ADAS), driving a booming demand for engineering solutions across the vehicle design, testing and validation workflows.

The Biden administration’s drive towards EV adoption and investments in smart infrastructure also fuel applications of engineering services in battery technology, powertrain optimization and connectivity solutions. Further, organizations are increasingly turning to AI, IoT and cloud computing to enable better simulation, predictive maintenance and digital twin technology for vehicles, fueled by growing consumer demand for personalized and software-defined vehicles.

With large-scale automotive R&D centers located in Michigan, California, Texas, and regional entities involving OEMs, startups, and tech giants, the USA is providing the future of mobility engineering. Over-the-air (OTA) updates, whose integration, along with 5G connectivity and cybersecurity solutions, presents an addressable market for software engineering services in modern vehicle.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The UK automotive engineering services market is growing gradually, driven by the fast transition to EV manufacturing, increasing need for sustainable automotive solutions and the country’s robust presence in high-performance vehicle engineering. The UK government’s 2035 ban on new petrol and diesel vehicles is pushing automotive R&D in areas like battery technology, electric powertrains and lightweight structures.

It is a growing area for high performance EVs and hybrid vehicles, led by luxury marques such as Jaguar Land Rover, Aston Martin and Bentley that are demanding the type of advanced engineering services including aerodynamics, design with AI and intelligent vehicle testing. Software-driven engineering innovations are also being driven by the emergence of AI-powered autonomous vehicles and connected mobility solutions.

The UK's tight focus on motorsport engineering, and specific areas such as Formula 1 and performance vehicle research, is propelling advancements in aerodynamic simulation, material science and hybrid powertrain development.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

Automotive Engineering Services Market in Europe automotive engineering services market is expected to witness an annual growth for the forecast period 2023 to 2030.The scope of data includes all existing automotive engineering services over the last few years.

The European Green Deal and Euro 7 emissions standard are creating new regulations pushing automakers to develop zero-emission and energy-efficient vehicles, inducing a strong demand for EV battery technology, hydrogen fuel cells, and lightweight materials engineering services.

Innovations in ADAS, autonomous driving and AI-integrated vehicle software are being led mainly by Germany, France and Italy which are major automotive hubs. European automakers like Volkswagen, BMW, and Stellantis are pouring billions into next-generation vehicle platforms and need cutting-edge vehicle testing, powertrain and aerodynamics expertise.

EU government focus on smart city initiatives and connected mobility infrastructure further drives demand for engineering services in areas such as vehicle-to-everything (V2X) communication, 5G integration, and IoT-supported predictive maintenance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

The automotive engineering services market in Japan is expanding on the back of technological advancements in hybrid and electric vehicle development, high government regulations on vehicle safety standards, and greater investment in artificial intelligence powered mobility solutions.

The pioneering work being done by Japanese automakers (Toyota, Honda, and Nissan) in solid state battery research, autonomous driving technology, and hydrogen fuel cell vehicles is generating a demand for breakthrough engineering solutions.

The Japanese government’s goal of carbon neutrality by 2050 is one of many factors urging the industry to embrace innovative powertrain development, make use of sustainable materials, and adopt energy-efficient manufacturing processes.

The country’s strong focus on robotics and enhanced integration with AI in automotive design is also fostering demand for a more machine-learning-based approach to simulation and predictive maintenance engineering.

Japan’s aging population is another population-driving investment category, considering the country is already the destination of choice for so much ADAS and safety-enhancing engineering solutions, with a particular focus on collision prevention, driver monitoring, and automated braking systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The automotive engineering services market in South Korea is rapidly growing, owing to its dominance in producing electric and automated vehicles, breakthroughs in batteries, and robust investments in smart mobility systems. With global automakers such as Hyundai, Kia and Genesis spearheading the EV transition, the demand for engineering expertise in lightweight design, aerodynamics, and AI powered vehicle controls is high.

The Korean government’s push for zero-emission transportation is additionally driving investment in hydrogen fuel cell vehicles, necessitating state-of-the-art engineering services for gas cell optimization and energy efficiency. What’s more, South Korea’s tech-driven ecosystem, bolstered by Samsung and LG’s progress in automotive electronics, is going to fuel next-gen, in-car connectivity and smart infotainment engineering.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

AKKA Technologies (17-21%)

A major player in automotive engineering services, AKKA provides full-stack vehicle development, including autonomous driving software and electrification strategies.

Alten Group (14-18%)

Alten is leading the shift towards software-driven mobility, focusing on cloud-connected vehicles and digital twin modelling.

Bertrandt AG (11-15%)

Bertrandt specializes in safety-critical systems, including crash simulations, aerodynamics optimization, and lightweight vehicle structures.

FEV Group (9-13%)

FEV is a key innovator in powertrain electrification and hydrogen fuel cell technology, supporting OEMs in sustainable mobility solutions.

Ricardo PLC (7-11%)

Ricardo is developing advanced propulsion systems and AI-powered simulation platforms to support next-generation vehicle engineering.

Other Key Players (27-37% Combined)

Several global engineering service providers and automotive technology firms contribute to innovations, including:

The overall market size for automotive engineering services market was USD 1.8 billion in 2025.

The automotive engineering services market is expected to reach USD 3.5 billion in 2035.

The expansion of the automotive engineering services market will be driven by the increasing focus on vehicle electrification, autonomous driving technologies, and digitalization, supported by the growing demand for advanced design, testing, and simulation solutions.

The top 5 countries which drives the development of automotive engineering services market are USA, European Union, Japan, South Korea and UK

ADAS & Safety Engineering Services to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Location, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Applications, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Location, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Applications, 2023 to 2033

Figure 23: Global Market Attractiveness by Location, 2023 to 2033

Figure 24: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Applications, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Location, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Applications, 2023 to 2033

Figure 48: North America Market Attractiveness by Location, 2023 to 2033

Figure 49: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Applications, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Location, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Applications, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Location, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Applications, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Location, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Applications, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Location, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Applications, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Location, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Applications, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Location, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Applications, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Location, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Applications, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Location, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Applications, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Location, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Applications, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Location, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Applications, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Location, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Location, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Location, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Location, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Applications, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Location, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA