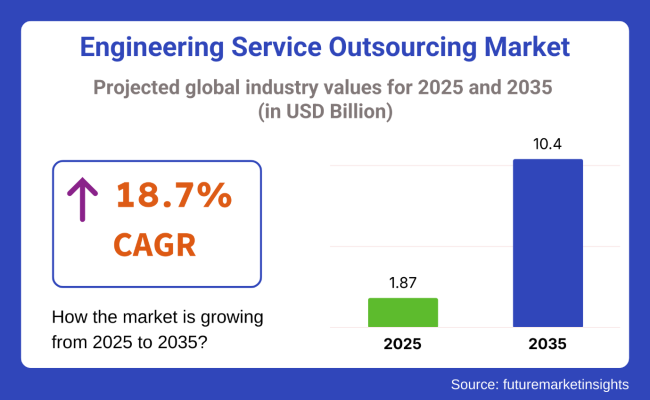

The global engineering service outsourcing market is anticipated to grow from USD 1.87 billion in 2025 to approximately USD 10.40 billion by 2035, registering a CAGR of 18.7% over the forecast period. The estimated market size for 2024 is USD 1.72 billion. Growth in the ESO market is driven by the increasing complexity of engineering projects and the need for cost-effective solutions.

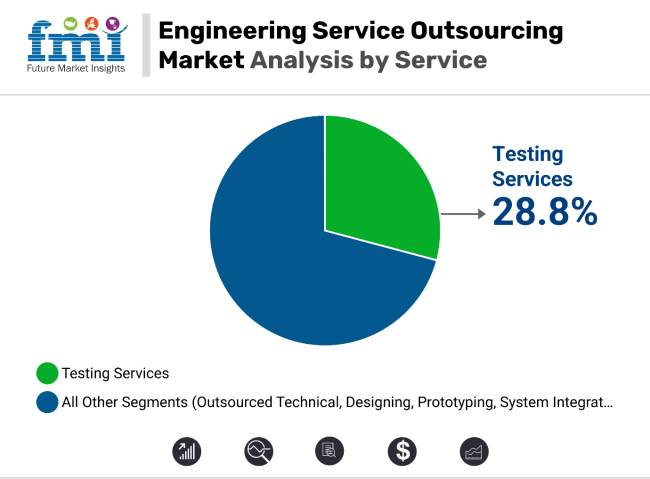

Companies are outsourcing services such as testing, prototyping, and system integration to specialized providers to enhance efficiency and focus on core competencies. The testing services segment holds the largest share at 28.80%, underscoring the critical role of quality assurance in product development.

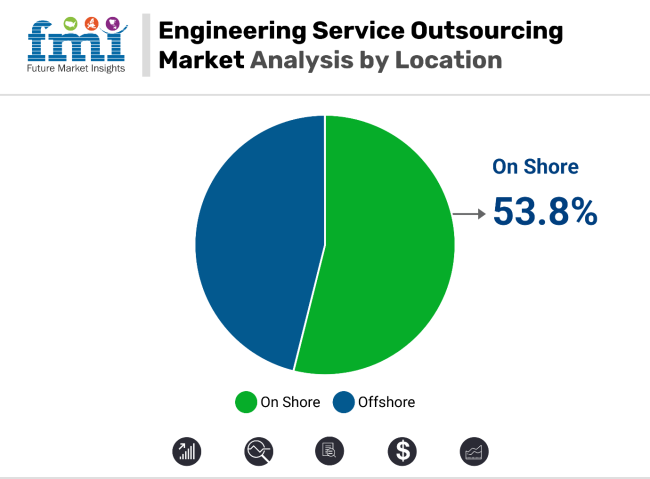

Demand for simulation-based validation, compliance testing, and real-time diagnostics is also growing across regulated industries. In terms of delivery models, the on shore segment is the leading category, capturing 53.80% of the market. This is driven by clients preferring proximity-based collaboration for improved control, data security, and real-time project alignment.

Regionally, Asia Pacific leads the ESO market, accounting for a significant share due to a large pool of skilled engineers and cost efficiencies. In a 2024 interview with Reuters, Sreenivasa Chakravarti, Vice President at Tata Consultancy Services, highlighted the impact of generative AI on engineering services, noting that it has accelerated product development cycles by up to 20%.

This advancement is reshaping the ESO landscape by enhancing productivity and innovation. As industries continue to evolve and implement modifications, the engineering service outsourcing market is poised for sustained growth, driven by technological advancements and the increasing need for specialized engineering services.

The growing emphasis on sustainability and regulatory compliance is also reshaping the ESO market landscape. Industries such as automotive, aerospace, and energy are under pressure to meet stringent environmental standards, prompting the need for outsourced engineering expertise in lightweight material design, energy-efficient systems, and emissions control technologies.

Additionally, digital thread integration-from concept through production to maintenance-is becoming a key value proposition, enabling real-time collaboration and traceability across the product lifecycle. ESO providers that offer capabilities in digital engineering, including model-based systems engineering (MBSE) and AI-driven analytics, are gaining a competitive edge.

This shift is encouraging long-term partnerships between enterprises and engineering service providers, centered around innovation, agility, and shared risk models that support rapid adaptation in a volatile business environment.

The engineering service outsourcing (ESO) market is undergoing a transformation, driven by rising digital complexity, automation, and regulatory compliance demands. Testing services have surfaced as the strategic cornerstone of modern outsourcing, ensuring product safety, reliability, and standards alignment. Meanwhile, the on shore segment is carving out dominance, reflecting a growing emphasis on collaboration, data security, and IP-sensitive project execution.

Testing services are forecast to claim 28.8% of the engineering service outsourcing industry by 2025, reinforcing their role as mission-critical components in high-stakes innovation. As engineered products become more software-defined and safety-critical, outsourced testing has moved beyond traditional quality checks into the realm of advanced validation and simulation.

From autonomous driving systems and aerospace electronics to industrial automation platforms, organizations require exhaustive verification for both software and hardware. Companies like Altran (Capgemini Engineering), Cyient, and Tata Elxsi are using model-based development, hardware-in-the-loop (HIL) testing, and AI-driven analytics to deliver rapid, reliable insights.

This ensures products comply with global standards like ISO 26262, DO-178C, and IEC 61508. What sets testing services apart is their ability to reduce recalls, accelerate time-to-market, and de-risk innovation. As sustainability goals and cost-optimized development cycles converge, testing is increasingly outsourced as a specialized function rather than a back-end necessity. This shift signals a permanent pivot in ESO investment priorities-where companies are betting big on high-performance, high-certainty validation.

By 2025, on shore engineering services are projected to represent 53.80% of the ESO market, driven by the rising need for closer client-supplier collaboration, data governance, and secure IP handling. Unlike traditional offshoring models, on shore outsourcing offers real-time alignment, geographical convenience, and direct integration with internal teams-key advantages for complex, iterative engineering projects.

Industries such as aerospace, defense, and medical devices require engineering work that’s tightly regulated, highly confidential, and often bound by national compliance standards. Firms like Infosys, HCLTech, and Accenture have expanded their on shore delivery centers to cater to such high-trust clients, offering localized talent and industry-aligned processes.

Additionally, agile and DevOps frameworks demand high responsiveness and frequent iteration, which is more effectively executed within the same time zone or physical region. On shore models also support hybrid workforce dynamics, ensuring engineering continuity amid disruptions like pandemics or geopolitical tensions. As product cycles compress and regulatory scrutiny tightens, the on shore ESO model is not just a fallback-it’s fast becoming the frontline strategy for innovation-first enterprises.

The engineering service outsourcing (ESO) market is witnessing robust expansion driven by digital engineering, cost optimization needs, and global R&D collaboration. While opportunities emerge across EVs, semiconductors, and healthcare equipment, challenges such as IP risks and cross-border compliance complexity persist. Despite promising growth, vendor fragmentation and price-based competition remain pressing concerns in low-cost outsourcing hubs.

Digital Transformation in Industries Accelerates ESO Adoption Worldwide

Industries such as automotive, aerospace, and manufacturing are undergoing digital transformation, accelerating the need for specialized engineering support. With product lifecycles shortening and time-to-market pressures increasing, companies are outsourcing design, prototyping, and testing to engineering service providers to stay competitive.

Advanced technologies like AI/ML, digital twins, and IoT are expanding the scope of outsourced services. Emerging players from India and Eastern Europe are leveraging domain expertise and scalable talent pools to meet demand. The cost-efficiency and access to multidisciplinary talent are further strengthening ESO adoption across North America and Europe. The market is expected to maintain a strong upward trajectory over the next decade as digital engineering becomes central to innovation strategies.

Data Security and IP Compliance Issues Pose Major Challenges

A primary challenge in the ESO market lies in safeguarding intellectual property (IP) and ensuring regulatory compliance across jurisdictions. Sensitive designs, prototypes, and proprietary algorithms are routinely exchanged between clients and third-party service providers. This creates vulnerability to IP theft, data breaches, and unintentional leaks, especially when outsourcing to low-cost destinations with lax enforcement.

Additionally, differing data protection laws such as GDPR, India’s DPDP Act, and the USA Cloud Act complicate data-sharing frameworks. As a result, companies are forced to invest heavily in cybersecurity protocols, data localization practices, and partner vetting-slowing down onboarding and increasing operational costs. These complexities remain a deterrent, especially for high-stakes engineering projects in aerospace, defense, and semiconductors.

EVs and Semiconductors Create High-Value Growth Opportunities

The global shift toward electric vehicles (EVs), smart infrastructure, and semiconductor innovation is generating high-value engineering outsourcing opportunities. EV component design, battery management systems, embedded software, and thermal simulations are being outsourced by OEMs to reduce internal R&D loads. Similarly, semiconductor firms are leveraging ESO partners for chip architecture, testing automation, and system validation.

Healthcare device manufacturers are also turning to ESO for mechanical design, compliance support, and system integration. Providers offering domain-specific capabilities and IP-led services are gaining traction. Companies that can offer bundled solutions across mechanical, electrical, and software domains stand to benefit significantly from these evolving demand pockets.

Fragmented Vendor Ecosystem Undermines Long-Term Value Delivery

The ESO landscape is highly fragmented, with a mix of Tier 1 multinational players and numerous regional or niche providers. While this fragmentation creates competitive pricing, it also leads to inconsistent service quality, skill mismatches, and scalability issues for clients managing multiple vendors.

Some regions suffer from high attrition rates, affecting project continuity and IP security. Additionally, price-driven competition in emerging economies often leads to overpromising and under-delivery. Clients are increasingly looking to consolidate their vendor base and seek end-to-end engineering solutions from fewer, reliable partners. This vendor rationalization trend threatens smaller firms that lack vertical specialization or global delivery capabilities.

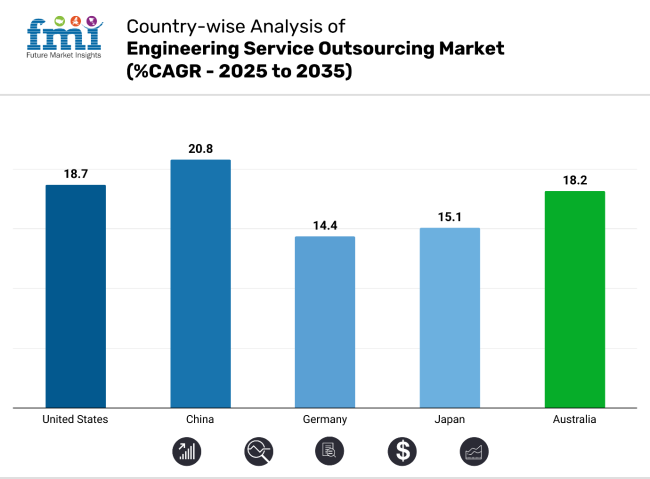

The engineering service outsourcing (ESO) market is on a trajectory of hypergrowth, reshaping global design, simulation, and prototyping. While China and the United States lead demand with advanced tech capabilities, Germany, Japan, and Australia are scaling delivery frameworks to support industries spanning automotive, electronics, aerospace, and healthcare R&D.

The United States engineering service outsourcing market is projected to grow at a remarkable CAGR of 18.7% from 2025 to 2035, driven by aggressive digitization in the aerospace, automotive, and healthcare sectors. USA enterprises are no longer just seeking cost reductions-they’re outsourcing to access global pools of specialized engineering talent in areas like AI-driven simulations, embedded systems, and digital twin development.

As product innovation cycles shrink, firms increasingly rely on overseas partners for real-time design iterations, compliance engineering, and virtual prototyping. A noticeable shift is seen in nearshoring strategies, particularly with Latin American firms offering high-skill, English-proficient engineers.

The USA is also deepening ESO engagements through joint ventures and cross-border R&D labs. With rising complexity in defense and green energy systems, the USA is expected to remain a primary demand driver for high-value ESO partnerships.

With a blazing CAGR of 20.8%, the China engineering service outsourcing market is quickly positioning itself as both a top consumer and an emerging powerhouse in delivery. Industrial giants across electronics, electric vehicles, and smart infrastructure are outsourcing functions such as mechanical CAD modeling, plant layout simulations, and control system design to gain flexibility and speed.

China’s government-backed initiatives for advanced manufacturing and smart cities are creating a pull effect for engineering service providers specializing in process digitization and IoT architecture. In parallel, China-based engineering firms are beginning to export services to Southeast Asia and Africa, supported by robust investments in 5G, robotics, and industrial AI. With a vast engineering talent pool and rapid tech scalability, China is rewriting the global ESO narrative.

The Germany engineering service outsourcing market is expected to grow steadily at a CAGR of 14.40% through 2025-2035, propelled by the country’s relentless push for automation, Industry 4.0, and electric mobility. While German manufacturers are renowned for precision engineering, rising R&D costs and labor shortages are nudging companies to collaborate with global ESO providers, particularly for tasks involving 3D modeling, embedded software, and electrical systems.

Partnerships are increasingly shaped by quality alignment and IP protection-two aspects central to Germany’s ESO adoption. The automotive sector leads outsourcing demand, with Tier 1 suppliers outsourcing ECU designs and vehicle simulation work to firms in India and Eastern Europe. As Germany ramps up investments in green hydrogen and advanced robotics, demand for specialist engineering services is expected to scale alongside.

The Japan engineering service outsourcing market is forecast to rise at a CAGR of 15.10% from 2025 to 2035, with a strong pull from high-tech sectors like robotics, consumer electronics, and smart manufacturing. Traditionally cautious about outsourcing, Japanese firms are increasingly embracing ESO to meet rising demands for mechatronics integration, semiconductor process design, and microcontroller programming.

Local shortages of design engineers and tighter project timelines are prompting strategic outsourcing-especially to India, Vietnam, and Thailand. Japan is also driving demand for ESO in sectors like space exploration and healthtech devices, where engineering agility is paramount.

Emphasis remains on long-term vendor relationships, process transparency, and superior documentation. As Japan accelerates toward fully digital factories and AI-infused manufacturing ecosystems, ESO will become a critical lever in its industrial transformation.

The Australia engineering service outsourcing market is set to grow at a CAGR of 18.20% through 2025-2035, powered by evolving needs in mining automation, defense technologies, and infrastructure design. While the local engineering talent pool is relatively small, demand is growing exponentially for specialized services like geotechnical simulations, structural CAD, and BIM modeling. Australian firms are engaging ESO vendors in India, the Philippines, and South Africa to handle detailed design, drafting, and product validation.

Sectors like oil & gas and renewable energy are contributing to outsourcing volume, especially in projects that require fast-track turnaround or regulatory compliance across regions. There’s also a rise in university-industry collaboration where outsourced engineering work complements local innovation efforts. As digital transformation policies mature under federal R&D frameworks, Australia is poised to deepen its ESO footprint across both public and private sectors.

Tier 1 countries in the industry include dominant global IT and engineering giants such as HCL Technologies, Infosys, Wipro, and Tech Mahindra. These firms offer comprehensive end-to-end solutions across sectors like automotive, aerospace, and telecom. Their strategies emphasize digital engineering, AI-driven platforms, and large-scale R&D investments.

For instance, HCLTech has expanded its engineering capabilities through strategic acquisitions, enhancing its presence in the global communication service providers market. Tier 2 companies include Tata Elxsi, Capgemini Engineering, and Alten Group. The focus of these companies is on specialized verticals and niche markets. Tata Elxsi, for example, has been enhancing its offerings in design and technology services, particularly in the automotive and healthcare sectors.

Tier 3 firms include Entelect and AKKA Technologies cater to regional markets, emphasizing agility and cost-effective solutions. AKKA, in particular, has a strong foothold in the European market, offering engineering consultancy services across various industries. The ESO market is moderately consolidated, with Tier 1 companies holding significant shares due to their global reach and continuous innovation.

Entry barriers are high, stemming from substantial capital requirements, technological expertise, and the need for established distribution networks. However, opportunities exist for specialized players to thrive in niche segments by offering customized solutions, agile services, and leveraging digital tools to enhance project delivery, responsiveness, and client satisfaction across increasingly complex engineering landscapes.

Success in the engineering service outsourcing (ESO) market hinges on continuous technological innovation, enabling improvements in service delivery, efficiency, and integration capabilities. Collaborating with other companies and research institutions drives innovation and expands market share.

In December 2024, HCLTech finalized the acquisition of specific assets from Hewlett Packard Enterprise's Communications Technology Group (CTG), a strategic move that enhances HCLTech’s engineering capabilities and expands its presence in the global communication service providers market.

This acquisition includes industry-leading intellectual property, engineering and R&D talent, and client relationships with top global communication service providers. The deal also integrates over 1,500 product engineering specialists from CTG, supporting agile methodologies and nearshore delivery needs across various countries. This development was officially announced in HCLTech's press release on December 2, 2024.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 1.72 billion |

| Current Total Market Size (2025) | USD 1.87 billion |

| Projected Market Size (2035) | USD 10.40 billion |

| CAGR (2025 to 2035) | 18.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Services Analyzed (Segment 1) | Outsourced Technical Services, Designing Services, Prototyping Services, System Integration Services, Testing Services, Other Services |

| Locations Analyzed (Segment 2) | Onshore, Offshore |

| Applications Analyzed (Segment 3) | Aerospace, Automotive, Industrial, Consumer Electronics, Semiconductors, Healthcare, Telecom |

| Regions Covered | North America; Europe; Asia Pacific; Middle East and Africa; Latin America |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, Poland, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the ESO Market | HCL Technologies, Tata Elxsi, Entelect, Tech Mahindra Limited, Infosys Limited, Wipro Limited, Capgemini Engineering, Alten Group, AKKA |

| Additional Attributes | Dollar sales driven by digital twin demand, offshore delivery growing faster, design services seeing higher traction, semiconductors fueling testing needs, Asia Pacific leading market share, healthcare sector gaining outsourcing focus |

By service, the segmentation is into outsourced technical services, designing services, prototyping services, system integration services, testing services, and other services.

By location, the segmentation is into onshore and offshore.

By application, the segmentation is into aerospace, automotive, industrial, consumer electronics, semiconductors, healthcare, and telecom.

By region, the segmentation is into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The market is expected to reach USD 1.87 billion in 2025.

Sales in the market are projected to grow steadily, reaching approximately USD 10.40 billion by 2035.

China is anticipated to lead with a CAGR of 20.80% during the forecast period.

Testing Services segment dominates the industry.

Major companies include HCL Technologies, Tata Elxsi, Entelect, Tech Mahindra Limited, Infosys Limited, Wipro Limited, Capgemini Engineering, Alten Group, and AKKA.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Location, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Service, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Location, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Attractiveness by Service, 2024 to 2034

Figure 18: Global Market Attractiveness by Location, 2024 to 2034

Figure 19: Global Market Attractiveness by Application, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Service, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Location, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 37: North America Market Attractiveness by Service, 2024 to 2034

Figure 38: North America Market Attractiveness by Location, 2024 to 2034

Figure 39: North America Market Attractiveness by Application, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Service, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Location, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Service, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Location, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Location, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Service, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Location, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Location, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Service, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Location, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Service, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Location, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Service, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Location, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Service, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Location, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Service, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Location, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Service, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Location, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Location, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Location, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Location, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Service, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Location, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Chaos Engineering Platform Market Size and Share Forecast Outlook 2025 to 2035

Civil Engineering Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA