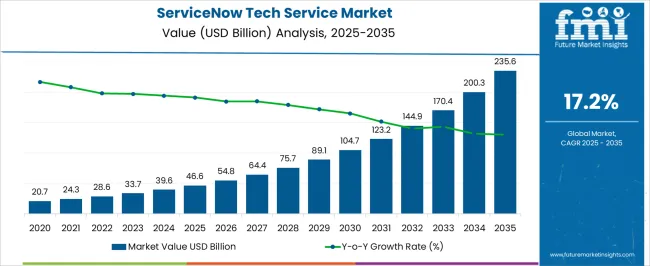

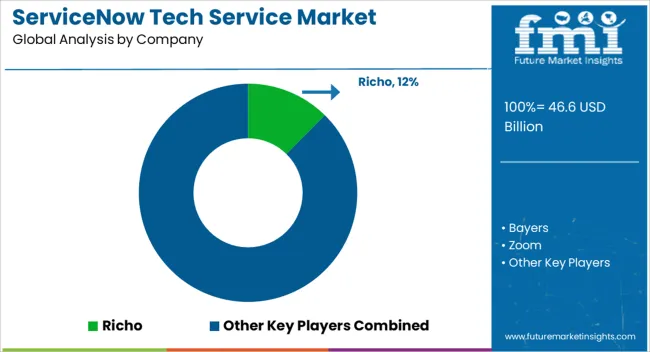

The ServiceNow Tech Service Market is estimated to be valued at USD 46.6 billion in 2025 and is projected to reach USD 235.6 billion by 2035, registering a compound annual growth rate (CAGR) of 17.2% over the forecast period.

| Metric | Value |

|---|---|

| ServiceNow Tech Service Market Estimated Value in (2025 E) | USD 46.6 billion |

| ServiceNow Tech Service Market Forecast Value in (2035 F) | USD 235.6 billion |

| Forecast CAGR (2025 to 2035) | 17.2% |

The ServiceNow tech service market is advancing steadily, driven by rising enterprise adoption of digital workflows and integrated service management platforms. Organizations are prioritizing operational resilience, automation, and enhanced employee experience, which has increased demand for ServiceNow’s IT service capabilities. Press releases and financial disclosures from leading enterprises have emphasized investments in workflow digitization, AI-driven service management, and cross-departmental collaboration tools, positioning ServiceNow as a key enabler of enterprise transformation.

Increasing regulatory compliance requirements and the need for secure, scalable cloud-based platforms have further reinforced adoption. Large enterprises, in particular, are leveraging ServiceNow to streamline IT, HR, and customer workflows under a unified architecture.

Moreover, financial services and other regulated industries are intensifying reliance on digital service platforms to meet customer expectations while managing risk and compliance. Looking ahead, the market is poised for continued growth as ServiceNow expands capabilities through AI copilots, low-code platforms, and industry-specific solutions, reinforcing its role in enterprise digital strategy.

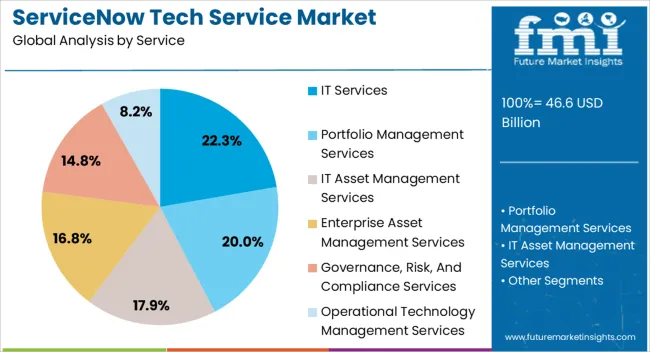

The IT Services segment is projected to account for 22.3% of the ServiceNow tech service market revenue in 2025, reflecting its position as a foundational use case for the platform. Growth of this segment has been supported by enterprise reliance on IT service management (ITSM) for incident handling, asset visibility, and infrastructure monitoring.

ServiceNow’s IT workflows have been deployed to improve service desk efficiency, automate ticket resolution, and integrate with broader cloud ecosystems. Enterprises have increasingly adopted IT services on ServiceNow to ensure business continuity, reduce downtime, and enhance user experience.

Additionally, AI-driven features such as predictive analytics and virtual agents have elevated ITSM capabilities, further strengthening demand. As digital transformation accelerates, IT Services are expected to remain a critical entry point for organizations leveraging ServiceNow for wider enterprise workflow integration.

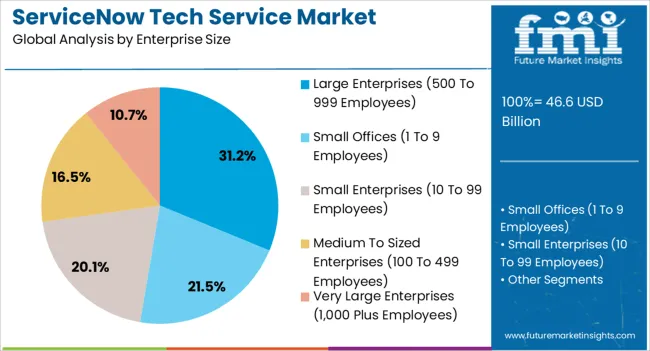

The Large Enterprises (500 to 999 Employees) segment is projected to hold 31.2% of the ServiceNow tech service market revenue in 2025, securing its leading share among enterprise size categories. This segment’s dominance has been influenced by the complexity of operations in mid-to-large organizations, where workflow automation and digital service management are essential for efficiency.

Annual reports and earnings briefings have noted that large enterprises are adopting ServiceNow to unify IT, HR, and customer service workflows, thereby reducing operational silos. The ability of ServiceNow to scale with enterprise growth, integrate across legacy systems, and support compliance frameworks has further boosted adoption in this category.

Cost optimization strategies and the need for measurable ROI from digital transformation initiatives have also driven investment in ServiceNow among these enterprises. As competitive pressures rise, large enterprises are expected to continue prioritizing workflow digitization, sustaining this segment’s leadership in adoption.

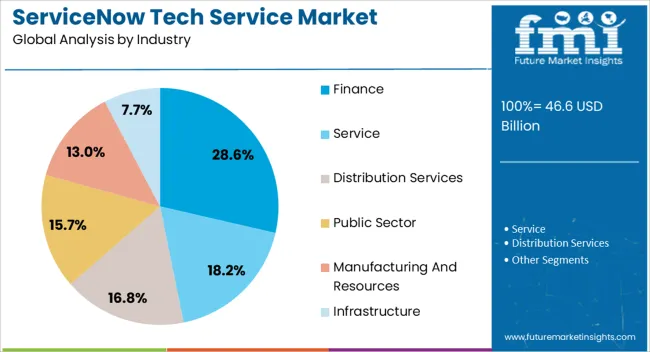

The Finance segment is anticipated to contribute 28.6% of the ServiceNow tech service market revenue in 2025, maintaining its role as the leading industry vertical. This segment’s strength has been shaped by the high regulatory, operational, and customer experience demands of financial institutions.

Banks, insurance providers, and investment firms have adopted ServiceNow to enhance compliance reporting, secure data handling, and customer-facing workflows. Industry disclosures and analyst commentaries have highlighted increasing investment in cloud-based platforms that can reduce manual processes and streamline governance frameworks.

Financial enterprises have favored ServiceNow for its ability to integrate risk management, regulatory adherence, and customer engagement solutions under a unified service architecture. Additionally, the sector’s strong focus on operational resilience and cyber risk mitigation has accelerated adoption. As digital banking, fintech integration, and customer expectations for seamless digital services continue to grow, the Finance segment is expected to sustain its leadership in ServiceNow adoption.

Cloud-Based Solutions Drive the Industry, Focusing on the Growing Need for Flexible ServiceNow Deployment

Cloud computing has become very popular among organizations, providing more flexibility in the deployment options and scalability of ServiceNow solutions. The transition to cloud computing provides businesses with lower infrastructure costs, easier maintenance, and hassle-free access to ServiceNow features, which is a driving force for growth.

Growth of ServiceNow Ecosystem Augments Market Prospects and Adoption

The ServiceNow eco-system, made of integrators, partners, and third-party developers, is the key to market expansion and adoption. Through the connectivity of various partners, organizations obtain a broad spectrum of choices, which facilitate the implementation of ServiceNow and provide momentum for industry development.

Increase in the Demand for Integrated ITSM and ESM Solutions, Serving Complex Service Needs.

Organizations opt for ITSM and ESM solution integration to address service delivery complexity. By ServiceNow integrating the entire set range of ITSM and ESM capabilities, enterprises can unify operations, automate procedures, and boost communication across departments in order to lead the demand.

Incorporation of ServiceNow Self-Service Portals and Chatbots Also Improves User Experience

Implementing user-friendly self-service portals or chatbots into ServiceNow technology improves user experience and stimulates market development. Self-help is an ability for organizations to offer users to resolve typical problems without assistance, while chatbots can provide personalized assistance and automate service interactions, increasing efficiency and customer satisfaction.

The Integration with Third-Party Apps Increases the ServiceNow Performance and Market Share

ServiceNow's broad integration features with third-party solutions and systems greatly help expand the market and the number of adopters. This platform can seamlessly connect diverse workflows, automate processes, and boost productivity which in turn leads to the exploration of new opportunities and consequently market growth.

| Segment | Estimated Market Share in 2025 |

|---|---|

| IT Asset Management Services | 22.30% |

| Large Enterprises (500 to 999 employees) | 31.20% |

The ServiceNow tech service segment gives organizations the advantage of having their IT infrastructure managed promptly, as shown by the fact that the share of 22.30% is held by IT asset management services in 2025. This emphasis can be considered an indicator of rising IT environment complexity, as organizations strive to find ways to make better use of their resources and cut costs.

ServiceNow platforms provide a fully featured, integrated set of applications including the capabilities of asset inventory, license management, and cost savings tools. ServiceNow tech providers who provide these capabilities leverage the increased demand to provide implementation, configuration, and integration services that effectively deploy these functionalities while making them suit each client's unique needs.

Through ServiceNow service utilization, the company will achieve greater visibility and control over its IT assets and will ultimately ensure compliance with all the regulations and maximize the return on investment from the IT infrastructure investments.

Large enterprises, due to their IT infrastructure complexity and a wide variety of technological resources, are the most important target segment for ServiceNow tech service providers. This is visible in the fact, that there is a large share of 31.20% of this segment in 2025. The competence of ServiceNow platforms in terms of the variety of functions they offer is ideally meant to meet the needs of these large enterprises.

ServiceNow’s tech service providers are the ones who make sure to ensure the successful implementation of the platform within large enterprises. They provide customized implementation and configuration services that mold the system to the unique workflows of each client. Besides this, these service providers offer ongoing help and integration services which are crucial factors in the proper functioning of the ServiceNow platform in complex business environments and large enterprises.

They do this by offering highly targeted solutions for the particular challenges and possibilities that can be faced by large-scale IT installation. Therefore, ServiceNow tech service providers have a strategic position as key partners in ensuring the effectiveness of ServiceNow for this critical segment of the market.

| Country | United States |

|---|---|

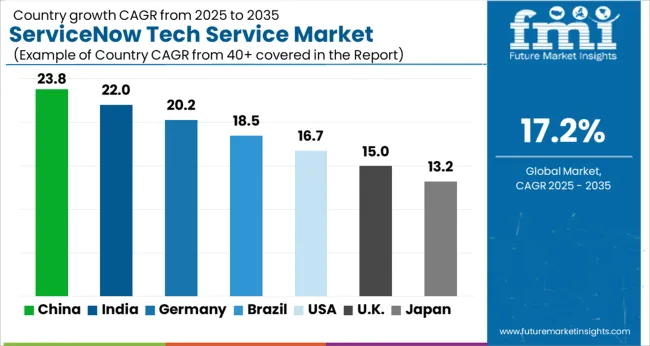

| CAGR till 2035 | 14.40% |

The United States, being a driver of IT infrastructure and a large ServiceNow base, expects a gradual but constant growth of the ServiceNow tech services with the forecasted CAGR of 14.40% up to 2035. This impetus is in turn fueled by the expanding ServiceNow functionalities that are being implemented by large enterprises.

These firms need a unique set of skills for implementation, customization, and maintenance that are required to bring the platform to its full potential. Nevertheless, the American market conveys a situation that, at the same time is positive and negative. Although a huge number of users create a market with a scale and scope, the environment of the market is also increasingly competitive and the reason for this is the many established service providers.

Innovation is the guarantor of the superiority of the business in the face of the changeability of the environment. Concentrating on service possibilities, automation needs and integration facilities with current enterprise tools is the key thing to success.

| Country | Australia |

|---|---|

| CAGR till 2035 | 21.10% |

Australia's ServiceNow tech services industry is set to achieve a CAGR of 21.10% until 2035. This is driven by a confluence of factors in line. Australia is demonstrating a considerable uptake of ServiceNow, mostly among medium enterprises.

Unlike the bigger enterprises which are usually self-sufficient due to the in-house technological departments, these smaller entities often lack the skills to fully exploit the functionalities of the platform, resulting in a high demand for tech services.

The government of Australia is an active promoter of digital transformation projects which in turn is seeing an increased adoption of ServiceNow across different sectors. The synergy of these two trends makes Australia an ideal place for ServiceNow tech service providers to thrive, which opens up many opportunities for expansion and customization to the unique needs of the rapidly growing mid-range companies.

| Country | Japan |

|---|---|

| CAGR till 2035 | 12.30% |

Japan's ServiceNow tech service market is a very interesting topic, expected to grow at a CAGR of 12.30% until 2035. This development corroborates a slow but gradual yet rising acceptance of ServiceNow technology. The IT culture of Japan is deeply embedded in the tradition of standard procedures and creating high-level, customized specialization.

Whilst the organizations are convinced of the advantages of the ServiceNow platform, they normally need the specialized assistance of implementers and configurators to make sure the platform is in harmony with the existing processes. As the need for adapting to these new technologies evolves, there is a growing demand for tech service providers who fill the gap between the old and the new.

As more people with a digital mindset take place in the work environment, the adoption of ServiceNow will increase. This will create a new opportunity for tech service providers.

| Country | China |

|---|---|

| CAGR till 2035 | 18.10% |

China's ServiceNow IT services market holds great potential and it is expected to have a CAGR of 18.10% until 2035. It is the IT infrastructure and the service now user base that are on a rapid expansion in China, as well as the government which is actively advertising and promoting digital transformation projects.

Local players are also in the race to create solutions which are conforming with ServiceNow solutions; thus, the speed of the platform implementation will increase.

Despite this, the humongous and intricate nature of the Chinese market still presents problems. As tech service providers endeavor to provide customized offerings that satisfy the needs of various industries, they have to strategize well so that they can operate within the dynamic regulations. Even though there are these difficulties, the China market shows us the huge opportunities for the tech services providers from ServiceNow with their localized solutions.

| Country | Germany |

|---|---|

| CAGR till 2035 | 13.00% |

Germany's ServiceNow tech services market is likely to register moderate but consistent growth at a CAGR of 13.00% until 2035. This growth shows that the German economy has an emphasis on the optimization of resources and the effectiveness of their organizations. The current users of ServiceNow are making efforts to automate their processes, integrate their systems, and use analytics, so they demand services from tech that can further optimize the platform.

Moreover, the German market has well-established IT service providers pushing their ServiceNow service offerings to the edge. To compete in this very competitive environment, there is a need to focus on quality of service with a very strong emphasis on security and compliance, which are the primary concerns for German companies.

In the ServiceNow tech service sector, new startups are emerging at an impressive rate, they come with new approaches that are changing the rules of the game and breaking the dominance of the old players. The new entities that are providing a specialized solution to the market are enriching the service provider ecosystem by solving some specific problems related to the ServiceNow platform.

Among the many sectors that startups are targeting, automation is the biggest one. They are creating tools that will self-perform routine tasks within the ServiceNow system which might be user provisioning, incidents management, and workflow approvals. It does not only speed up work processes but also takes away IT personnel from routine tasks so that they can be devoted to more strategic goals.

Also, startups are establishing market products in data migration to ServiceNow, integration with other enterprise tools, and customized reporting solutions. This niche specialist makes it possible for them to meet specific customer needs and create their position among a lot of other existing ServiceNow tech service providers.

The established players such as Accenture, Deloitte, and IBM have been in this ServiceNow tech service industry for a long and continue to dominate by using their extensive experience and knowledge in digital transformation services.

This is a sector dominated by some industrial magnates who offer one-stop solutions that are tailor-made to the particular requirements of their customers, spanning different sectors such as IT service management and enterprise cloud solutions. Thus, the market is not only supplied by large players but also by small firms and new entrants, that focus on a narrow area, e.g. workflow automation or customer service management.

The competitiveness of the market is driven by the accelerated pace of technological innovation as well as the increasing demand for integrated industry management solutions. Companies allocate a substantial amount of money to R&D to keep up with the latest technological trends and include new functions based on the principles of artificial intelligence, machine learning, and predictive analytics in their platforms.

Firstly, strategic partnerships and collaborations were mainly common among the companies that are trying to expand their service offerings and take the lead in the market. Due to the fact the market is in constant development, the leading players need to have agility, innovation, and a range of value-added services to be successful in the ServiceNow tech services market.

Recent Developments in the ServiceNow Tech Service Industry

The global servicenow tech service market is estimated to be valued at USD 46.6 billion in 2025.

The market size for the servicenow tech service market is projected to reach USD 235.6 billion by 2035.

The servicenow tech service market is expected to grow at a 17.2% CAGR between 2025 and 2035.

The key product types in servicenow tech service market are it services, portfolio management services, it asset management services, enterprise asset management services, governance, risk, and compliance services and operational technology management services.

In terms of enterprise size, large enterprises (500 to 999 employees) segment to command 31.2% share in the servicenow tech service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fintech As A Service Market Size and Share Forecast Outlook 2025 to 2035

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Fintech-as-a-Service Platform Market

Senior Tech Services Market Size and Share Forecast Outlook 2025 to 2035

Talent Acquisition and Staffing Technology and Service Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Technical Insulation Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA