The technical coil coatings market demonstrates steady expansion from 2025 to 2035 because manufacturers require corrosion-reductive coatings which combine vitality efficiency and attractive durability for building, kitchen equipment, and car industries. Coil processing receives metal substrates including steel and aluminum for application of protective industrial coatings which maintain product consistency before manufacturing.

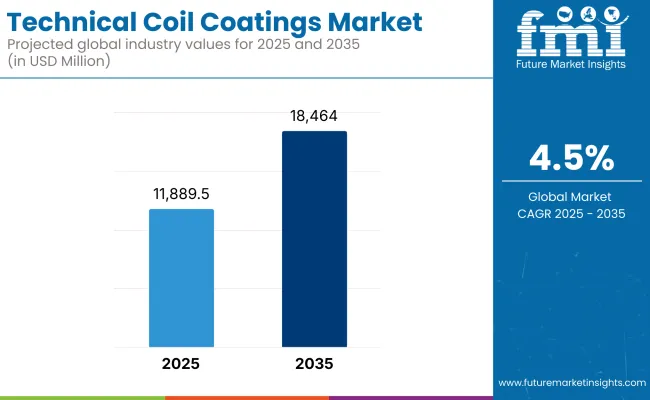

Roofing panels together with home appliances wall cladding and vehicle components undergo increased use because industry demands better durability along with design flexibility and reduced maintenance expenses. The market will expand from USD 11,889.5 million in 2025 to USD 18,464 million as it grows at a CAGR of 4.5% between 2025 and 2035.

Productivity in coating formulations using UV-curable systems as well as high-performance fluoropolymers and low-VOC products enables sustainable maintenance while supporting environmental compliance. Manufacturers continue to pursue the development of smart coatings with anti-bacterial properties and anti-graffiti protection and reflective abilities despite facing materials cost volatility and changing industry specifications.

The market drivers of modular construction and rising need for energy-efficient buildings and pre-coated metal appliances accelerate product development in the market. Coil coatings find broader application scope in industrial and architectural domains as manufacturers deliver products that resist temperature changes while withstanding chemicals and mechanical pressures.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11,889.5 million |

| Industry Value (2035F) | USD 18,464 million |

| CAGR (2025 to 2035) | 4.5% |

Technical coil coatings require segmentation according to resin types and end-use industries which respectively affect product functionality and use applications. Resinous materials used in coil coatings consist of polyester, polyurethane as well as polyvinylidene fluoride (PVDF) and epoxy which manufacturers choose based on performance needs and finish specifications.

The pre-coated metals serve construction together with appliances and transportation sectors alongside the general industrial fabrication due to their ability to simplify manufacturing while reducing waste and producing better-looking products. The segments demonstrate how fast manufacturing alongside extended product life and adaptable performance benefits become possible through metal coating utilization.

The residential market and appliances sector within North America maintain consistent market demand. Roofing systems in both countries benefit from energy-saving coatings while home appliances require finish coatings with high durability specifications.

The European market supports coil coatings for both sustainable building practices and environmentally friendly product manufacturing. Germany, Italy, and the UK advance high-performance, low-emission coatings for architectural and commercial buildings.

Rapid infrastructure growth alongside appliance manufacturing activities together drive the Asia-Pacific region to become the dominant market player in terms of volume. Four nations in Asia-Pacific including China, India, Japan and South Korea use their funds to build modern coil coating line facilities that serve multiple industrial and residential demands.

Challenge: Volatile Raw Material Costs and Regulatory Compliance Burden

A challenge to the technical coil coatings market is the rising prices of raw materials like polyester resins, titanium dioxide, and solvents that directly affect production costs and profit margins. These coatings must pass stringent performance requirements for corrosion resistance, UV durability and chemical protection, in addition to regional VOC and hazardous air pollutant (HAP) regulations.

Balancing high-performance formulations with changing environmental mandates has hamstrung manufacturers, particularly in North America and Europe. Disparate global regulatory frameworks make it even more challenging to standardize products for the world market, resulting in multiple product variants and greater costs for compliance and commercialize across the globe.

Opportunity: Energy-Efficient Buildings, Appliance Durability, and Smart Coatings

Despite regulatory pressures, technical coil coatings are in great demand in construction, HVAC, and white goods sectors for improved durability, aesthetics, and energy performance. Trend Setting Reflective and Cool roofing coatings like Agnew's are gaining momentum to reduce heat absorption providing tremendous energy savings. Scratch resistance, stain protection, and color retention are major drivers in appliances and metal furniture.

With rising expectations from consumers, new R&D investments in anti-microbial, anti-fingerprint, and self- healing properties are gaining traction. Market growth Modern pre-painted metal to meet the growing demand are highly developed the coating technologies that are both eco-friendly and multifunctional and round to supplement urbanization and high-performance pre-painted metal.

From 2020 to 2024, consumption of coil-coated metals grew steadily across construction panels, home appliances and industrial components. Polyester-based systems remained the gold standard, driven by low cost and reasonable durability. But increasing prices for raw materials and scrutiny over the environments led to seeking low-VOC, chrome-free, and high-solids option.

Moving towards 2025 to 2035, the open market will move towards the adoption of smart and sustainable coatings for coils which will provide functionalities such as self-cleaning, solar reflectivity and corrosion inhibition among others. Next-gen advanced formulations, bio-based resins, and digital color-matching technologies will be at the heart of these technical coatings for exterior panels, energy systems, and high-wear applications.

Market Shifts: Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with VOC limits and REACH standards. |

| Technological Advancements | Dominated by polyester, SMP, and PVDF-based systems. |

| Sustainability Trends | Limited recycling and solvent recovery integration. |

| Market Competition | Led by established paint and coatings manufacturers. |

| Industry Adoption | Common in construction, HVAC, and consumer appliances. |

| Consumer Preferences | Demand for color stability, corrosion resistance, and gloss retention. |

| Market Growth Drivers | Boosted by urban construction and appliance production. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Shift toward zero-VOC, chrome-free, and bio-based coating requirements. |

| Technological Advancements | Emergence of smart coatings, self-healing resins, and antimicrobial finishes. |

| Sustainability Trends | Push for waterborne, high-solids, and recyclable coil coating systems. |

| Market Competition | Entry of green-tech innovators and smart materials developers. |

| Industry Adoption | Expands to EV battery housings, smart panels, and solar infrastructure. |

| Consumer Preferences | Shift to multi-functional, environmentally safe, and adaptive surface coatings. |

| Market Growth Drivers | Accelerated by sustainability mandates, energy-efficient designs, and smart building trends. |

The USA technical coil coatings market is growing at a steady pace, attributed to the increasing demand for HVAC systems, appliances, and architectural cladding. The coatings offer corrosion resistance, UV protection, and because these coatings are used for aluminum and steel coils used in exterior panels and ducting systems.

Homeowners can now expect to save on their paint costs, courtesy of energy-efficient, fast Coating Lines now being adopted by USA manufacturers offering polyester, PVDF, and silicone-modified coatings. The sustainable construction and LEED-compliant material are also driving low VOC and chromium free coating technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

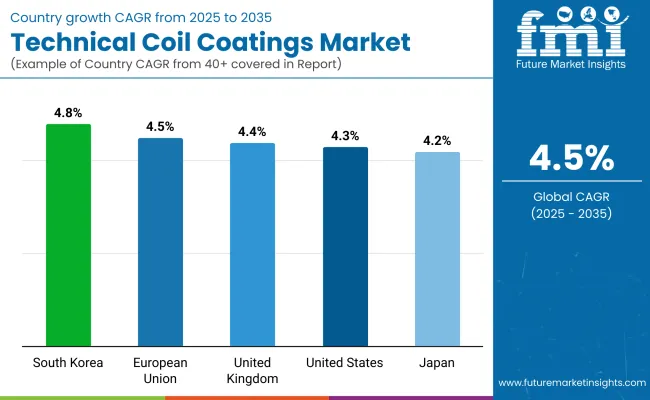

| USA | 4.3% |

Demand for pre-coated metal in applications such as roofing, wall cladding, and transportation infrastructure is supporting the growth of this market in the United Kingdom. Coil coating systems with anti-graffiti, antimicrobial and solar-reflective properties are gaining traction with UK-based businesses looking to satisfy vibrant urban health and sustainability targets.

As regulations around emissions and material recyclability tighten, UK manufacturers have been investing in water-based and high-solids formulations that adhere to local and EU environmental standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

The European Union provides a developed and large-scale market for technical coil coatings, with a focus on applications in the automotive, white goods, and green building materials. Adoption is being driven by countries like Germany, France, and Belgium, thanks to advancements in coating chemistry and new continuous process lines.

In the EU, demand is oriented toward multipurpose coatings, having higher weather resistance, chemical inertness, and formability. Regulatory adherence to REACH and the Green Deal is driving low-toxicity coatings and high-recyclability metal substrates.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

The Japanese technical coil coatings market is witnessing stable growth owing to the presence of robust appliance and electronics sectors in the country. Pre-painted metals are also used in the casing of refrigerators, washing machines and consumer electronics for cosmetic appearance and preventing rust.

Japanese manufacturers focus on ultra-smooth finishing, fingerprint resistance, and advanced coating technologies. The increase in the utilization of solar-reflective coil coatings in residential and commercial structures is also being driven by energy conservation and smaller building designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Well-supported by its budding shipbuilding, home appliances, and automotive markets, South Korea is witnessing a healthy growth in its technical coil coatings market. And coil-coated metals are being used by local producers for structural panels, furniture, and commercial refrigeration systems.

The adoption of nano-ceramic and fluoropolymer coatings for high corrosion and chemical resistance are also being observed in the market. Tailoring coil coating innovations to global standards of quality and aesthetics, South Korean companies have a highly export-oriented focus.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

As industries seek dependable, attractive, and long-lasting coatings for metal substrates across the architectural, industrial, and consumer industries, the technical coil coatings market remains appealing and includes the architectural, industrial, and consumer industries. Applied to rolled sheets of metal before fabrication, these coatings improve corrosion resistance, enhance the metal surface finish, and increase the product’s lifespan.

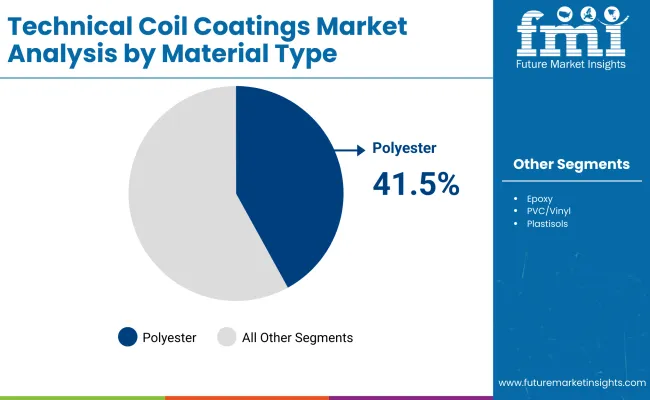

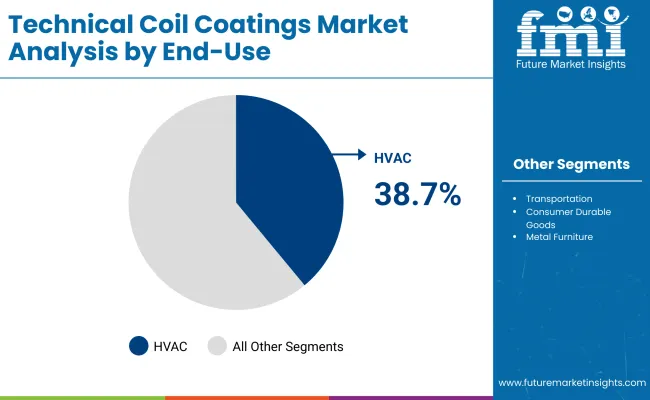

Synthetic type is expected to continue its dominance owing to their excellent weather resistance, color retention, and cost-effectiveness such as polyester-based coil coatings. By end use, the HVAC industry accounted for the largest share of demand, for example through coated coils to protect metal parts exposed to heat, humidity and corrosive environments. Taken together, these segments highlight a market defined by durability, energy efficiency and design flexibility.

With energy-efficient buildings and durable appliances becoming the bidding, technical coil coatings have a crucial importance in performance engineering. Polar difference in their usages, polyester coatings give manufacturers the option to get a balance between function and feature, while HVAC applications need durable finishes that withstand effects of thermal and moisture stress.

| Material Type | Market Share (2025) |

|---|---|

| Polyester | 41.5% |

Polyester coatings dominate the material type segment, as they provide the manufacturers with a balanced solution to meet the performance and aesthetic needs. These coatings are designed to withstand UV degradation, moisture, and environmental stress, with great performance in both exterior and interior applications.

Due to its excellent flexibility and adhesion, polyester provides considerable support for various forming and stamping processes to maintain the integrity of the protective layer. Polyester coil coatings are applied to metal sheets that will be used for roofing, cladding, and appliance bodies, as well as ventilation equipment because they have a high gloss, are available in many colours and are easy to form.

Polyester coatings provide a highly balanced performance mix and are significantly cheaper than high-end fluoropolymers such as PVDF, and these factors have gained praise in different industries. These coatings help retain the integrity of surfaces over a multitude of climates, where they will inevitably be resistant to chalking and fading. Suppliers are also rolling out modified polyester formulations with added scratch resistance, anti-graffiti and energy-reflective pigments.

Meanwhile, polyester-based coil coatings are still among the most widely used materials in a wide range of applications, with end-users calling for low-maintenance, sustainable materials that offer long-lasting value.

| End Use Segment | Market Share (2025) |

|---|---|

| HVAC | 38.7% |

The HVAC industry accounts for the largest share of the technical coil coatings market in the end-use segment owing to its dependence on coated metal parts for heat exchangers, ducts, air handling units, and condenser coils. These components work in moisture-drenched environments where condensation, temperature cycling, and airborne contaminants threaten to cause corrosion.

The presence of coil coatings helps shield the system shielding for durability, longer service life, and thermal efficiency. To impede the formation of rust, provide aesthetic appeal, and help meet environmental and energy to standards, HVAC manufacturers apply polyester and hybrid coatings.

While buildings are embracing greening technologies and demanding a more robust performance of their HVAC systems, coated components reduce both energy loss and maintenance costs. Coated coils are also used in smart HVAC units for commercial and residential properties, in addition to traditional systems.

Coatings also allow HVAC manufacturers to supply pre-painted metal parts that require no additional surface treatment on assembly. With global demands on air conditioning and ventilation set to offshoot in general particularly in developing economies the HVAC sector’s dependency on high-quality coil coatings is going to be fuelling centre stage towards market growth.

The global coil coatings market is important for crucial surface treatment applications in building and construction, automotive, appliance, HVAC, and industrial equipment industries. Common applications for metal coil coatings include these coatings are applied to metal coils, typically steel and aluminum coils, during pre-fabrication offering corrosion resistance, mechanical durability, UV protection, and surface aesthetics tailored to a building’s design.

The use of technical coil coatings, therefore, increases the performance and service life of pre-painted metal products, making them an indispensable component in highly engineered surroundings. The need for Advanced Coatings with heat resistance, chemical resistance, and environmental sustainability, are accelerating as end-user industries adopt high-strength lightweight metals and sustainable building materials.

The market comprises specialty coating formulators, paint system integrators, and chemical multinationals competing on longevity of the coating, process efficiency, and formulation friendly to the environment.

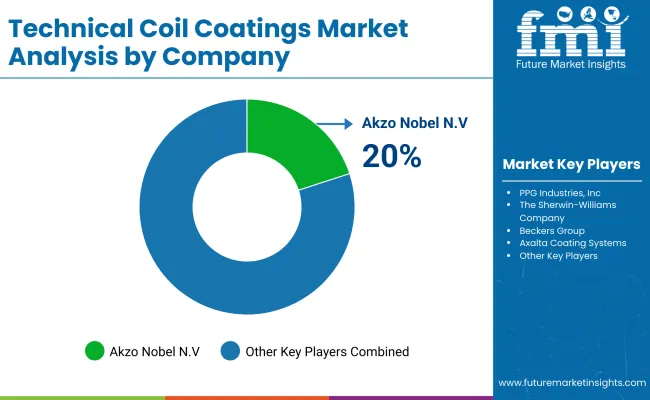

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Akzo Nobel N.V. | 20-24% |

| PPG Industries, Inc. | 15-19% |

| The Sherwin-Williams Company | 12-16% |

| Beckers Group | 9-13% |

| Nippon Paint Holdings Co., Ltd. | 7-11% |

| Axalta Coating Systems | 6-10% |

| Other Companies (combined) | 18-26% |

| Company Name | Key Offerings/Activities |

|---|---|

| Akzo Nobel N.V. | Launched high-durability coil coatings for solar reflectivity and scratch resistance in 2025. |

| PPG Industries, Inc. | Expanded its DURANAR® and ENVIROCRON® lines with advanced corrosion resistance for industrial panels in 2024. |

| Sherwin-Williams Company | Introduced low-VOC coil coatings optimized for HVAC and appliance applications in 2025. |

| Beckers Group | Rolled out UV-resistant technical coatings for pre-coated metal roofing and façades in 2024. |

| Nippon Paint Holdings | Developed multi-layer coil coating systems for automotive and commercial refrigeration units in 2024. |

| Axalta Coating Systems | Released heat-resistant technical coil coatings tailored for ovens and high-temperature enclosures in 2025. |

Key Company Insights

Akzo Nobel N.V.

Akzo Nobel leads the high-performance, architectural, and industrial metal sheet application parts of the technical coil coatings market. Its innovations include energy-reflective surfaces and UV-blocking pigments, as well as long-lasting surface protection for outside.

PPG Industries, Inc.

PPG delivers advanced coil coatings to support demanding performance attributes such as extreme weather resistance, chemical protection and formability through its DURANAR® and ENVIROCRON® brands. The company provides products for both architectural cladding in high-rise buildings as well as the industrial enclosure markets.

The Sherwin-Williams Company

Sherwin-Williams' conventional and sustainable coil coatings boast ultra-low-VOC materials, improved durability and other benefits for appliances, HVAC equipment and fabricated metal products. Its solutions, systems increase regulatory compliance and energy productivity.

Beckers Group

Commenting on the acquisition Beckers SA a fourth generation family-owned company is a global market leader in coil coating for exterior construction applications, enabling weather-stable, colourfast finishes for roofing and façades. Its tech focuses on lifecycle durability and surface gloss retention in harsh conditions.

Nippon Paint Holdings Co., Ltd.

Providing specialized coil coatings with multipurpose properties such as anti-bacterial, anti-condensation, and anti-corrosion features, Nippon Paint offers technical coil coatings that can be positioned for layered performance features. Its coatings are largely used in commercial refrigeration and pre-painted automotive components.

Axalta Coating Systems

Axalta offers high-temperature coil coatings designed for thermal enclosures and industrial ovens. Its technical solutions provide thermal stability, abrasion resistance, and compatibility with advanced metal substrates.

Other Key Players (18-26% Combined)

Numerous regional manufacturers and niche specialists contribute to the technical coil coatings market with customized solutions, industry-specific formulations, and local distribution networks:

The overall market size for the technical coil coatings market was USD 11,889.5 million in 2025.

The technical coil coatings market is expected to reach USD 18,464 million in 2035.

The increasing demand for durable and corrosion-resistant coatings, rising adoption in heating, ventilation, and air conditioning systems, and growing use of polyester coatings in metal finishing fuel the technical coil coatings market during the forecast period.

The top 5 countries driving the development of the technical coil coatings market are the USA, UK, European Union, Japan, and South Korea.

Polyester coatings and HVAC applications lead market growth to command a significant share over the assessment period.

Table 01: Global Market Size (US$ Mn) and Volume (Tons) Forecast by Region, 2012 – 2027

Table 02: Global Market Size (US$ Mn) and Volume (Tons) Forecast by Technology, 2012 – 2027

Table 03: Global Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2012 – 2027

Table 04: Global Market Size (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 05: Global Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 06: Global Market Size (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 07: Global Market Size (US$ Mn) Forecast by End-use, 2012 – 2027

Table 08: Global Market Volume (Tons) Forecast by End-use, 2012 – 2027

Table 09: North America Market Value (US$ Mn) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 10: North America Market Value (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 11: North America Market Value (US$ Mn) and Volume (Tons) Forecast by Product type, 2012 – 2027

Table 12: North America Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 13: North America Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 14: North America Market Value (US$ Mn) and Volume (Tons) Forecast by Technology, 2012 – 2027

Table 15: North America Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 16: North America Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 17: Latin America Technical Market Value (US$ Mn) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 18: Latin America Market Value (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 19: Latin America Market Value (US$ Mn) and Volume (Tons) Forecast by Product type, 2012 – 2027

Table 20: Latin America Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 21: Latin America Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 22: Latin America Market Value (US$ Mn) and Volume (Tons) Forecast by Technology, 2012 – 2027

Table 23: Latin America Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 24: Latin America Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 25: Western Europe Technical Market Value (US$ Mn) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 26: Western Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 27: Western Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Product Type, 2012 – 2027

Table 28: Western Europe Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 29: Western Europe Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 30: Western Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Technology, 2012 – 2027

Table 31: Western Europe Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 32: Western Europe Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 33: Eastern Europe Technical Market Value (US$ Mn) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 34: Eastern Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 35: Eastern Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Product Type, 2012 – 2027

Table 36: Eastern Europe Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 37: Eastern Europe Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 38: Eastern Europe Market Value (US$ Mn) and Volume (Tons) Forecast by Technology, 2012 – 2027

Table 39: Eastern Europe Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 40: Eastern Europe Market Value (US$ Mn) and Volume (Tons) Forecast by End Use, 2012 – 2027

Table 41: APEJ Technical Market Value (US$ Mn) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 42: APEJ Market Value (US$ Mn) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 43: APEJ Market Value (US$ Mn) and Volume (Tons) Forecast By Product type, 2012 – 2027

Table 44: APEJ Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 45: APEJ Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 46: APEJ Market Value (US$ Mn) and Volume (Tons) Forecast By Technology, 2012 – 2027

Table 47: APEJ Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Table 48: APEJ Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Table 49: MEA Technical Market Value (US$ Mn) and Volume (Tons) Forecast By Country, 2012 – 2027

Table 50: MEA Market Value (US$ Mn) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 51: MEA Market Value (US$ Mn) and Volume (Tons) Forecast By Product type, 2012 – 2027

Table 52: MEA Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 53: MEA Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 54: MEA Market Value (US$ Mn) and Volume (Tons) Forecast By Technology, 2012 – 2027

Table 55: MEA Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Table 56: MEA Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Table 57: Japan Market Value (US$ Mn) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 58: Japan Market Value (US$ Mn) and Volume (Tons) Forecast By Product type, 2012 – 2027

Table 59: Japan Market Value (US$ Mn) Forecast by Material Type, 2012 – 2027

Table 60: Japan Market Volume (Tons) Forecast by Material Type, 2012 – 2027

Table 61: Japan Market Value (US$ Mn) and Volume (Tons) Forecast By Technology, 2012 – 2027

Table 62: Japan Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Table 63: Japan Market Value (US$ Mn) and Volume (Tons) Forecast By End Use, 2012 – 2027

Figure 01: Global Historical Market Size (US$ Mn) and Volume (Tons) Analysis, 2012-2021

Figure 02: Global Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis, 2022-2027

Figure 03: Global Market BPS Analysis by Region – 2012, 2022 & 2027

Figure 04: Global Market Y-o-Y Projections by Region, 2012-2027

Figure 05: North America Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 06: Latin America Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 07: Western Europe Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 08: Eastern Europe Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 09: APEJ Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 10: MEA Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 11: Japan Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 12: Global Market

Figure 13: Global Market BPS Analysis by Technology, 2012, 2022 & 2027

Figure 14: Global Market Y-o-Y Projections by Technology, 2012-2027

Figure 15: Global Market Absolute $ Opportunity by Liquid Coating segment 2012 to 2021 and 2027

Figure 16: Global Market Absolute $ Opportunity by Powder Coating 2012 to 2021 and 2027

Figure 17: Global Market Absolute $ Opportunity by Electronic Coating 2012 to 2021 and 2027

Figure 18: Global Market Attractiveness Analysis By Technology

Figure 19: Global Market BPS Analysis by Product Type – 2012, 2022 & 2027

Figure 20: Global Market Y-o-Y Projections by Product Type, 2012 – 2027

Figure 21: Global Market Absolute $ Opportunity by Topcoats segment 2012 to 2021 and 2027

Figure 22: Global Market Absolute $ Opportunity by Primers 2012 to 2021 and 2027

Figure 23: Global Market Absolute $ Opportunity by Backing Coats 2012 to 2021 and 2027

Figure 24: Global Market Absolute $ Opportunity by Others 2012 to 2021 and 2027

Figure 25: Global Market Attractiveness Analysis By Product Type

Figure 26: Global Market BPS Analysis by Material Type – 2012, 2022 & 2027

Figure 27: Global Market Y-o-Y Projections by Material Type, 2012 – 2027

Figure 28: Global Market Absolute $ Opportunity by Polyester segment 2012 to 2021 and 2027

Figure 29: Global Market Absolute $ Opportunity by Epoxy 2012 to 2021 and 2027

Figure 30: Global Market Absolute $ Opportunity by PVC 2012 to 2021 and 2027

Figure 31: Global Market Absolute $ Opportunity by Acrylic 2012 to 2021 and 2027

Figure 32: Global Market Absolute $ Opportunity by Polyurethane 2012 to 2021 and 2027

Figure 33: Global Market Absolute $ Opportunity by PVDF 2012 to 2021 and 2027

Figure 34: Global Market Absolute $ Opportunity by Silicone 2012 to 2021 and 2027

Figure 35: Global Market Attractiveness Analysis By Material Type

Figure 36: Global Market BPS Analysis by Application – 2012, 2022 & 2027

Figure 37: Global Market Y-o-Y Projections by Application, 2012 – 2027

Figure 38: Global Market Absolute $ Opportunity by Steel segment, 2012 to 2021 and 2027

Figure 39: Global Market Absolute $ Opportunity by Aluminum segment, 2012 to 2021 and 2027

Figure 40: Global Market Attractiveness Analysis By Application

Figure 41: Global Market BPS Analysis by End-use – 2012, 2022 & 2027

Figure 42: Global Market Y-o-Y Projections by End-use, 2012 – 2027

Figure 43: Global Market Absolute $ Opportunity by Transportation segment 2012 to 2021 and 2027

Figure 44: Global Market Absolute $ Opportunity by Consumer Durable Goods 2012 to 2021 and 2027

Figure 45: Global Market Absolute $ Opportunity by HVAC 2012 to 2021 and 2027

Figure 46: Global Market Absolute $ Opportunity by Metal Furniture 2012 to 2021 and 2027

Figure 47: Global Market Absolute $ Opportunity by Others 2012 to 2021 and 2027

Figure 48: Global Market Attractiveness Analysis By End-use

Figure 49: North America Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 50: North America Market Y-o-Y Growth Projections by Country, 2013-2027

Figure 51: North America Market Attractiveness Analysis by Country, 2022,2027

Figure 52: U.S. Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 53: Canada Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 54: North America Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 55: North America Market Attractiveness by Application, 2022-2027

Figure 56: North America Market Attractiveness by Application, 2022-2027

Figure 57: North America Market Share and BPS Analysis by Product Type – 2012, 2022 & 2027

Figure 58: North America Market Attractiveness by Product Type, 2022-2027

Figure 59: North America Market Attractiveness by Product Type, 2022-2027

Figure 60: North America Market Share and BPS Analysis by Material – 2012, 2022 & 2027

Figure 61: North America Market Y-o-Y Growth Projections by Material, 2013-2027

Figure 62: North America Market Attractiveness by Material, 2022-2027

Figure 63: North America Market Share and BPS Analysis by Technology – 2012, 2022 & 2027

Figure 64: North America Market Y-o-Y Growth Projections by Technology, 2013-2027

Figure 65: North America Market Attractiveness by Technology, 2022-2027

Figure 66: North America Market Share and BPS Analysis by End Use – 2012, 2022 & 2027

Figure 67: North America Market Y-o-Y Growth Projections by End Use, 2013-2027

Figure 68: North America Market Attractiveness by End Use, 2022-2027

Figure 69: Latin America Technical Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 70: Latin America Technical Market Y-o-Y Growth Projections by Country, 2013-2027

Figure 71: Latin America Technical Market Attractiveness Analysis by Country, 2022-2027

Figure 72: Brazil Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 73: Mexico Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 74: Rest of Latin America Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 75: Latin America Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 76: Latin America Market Attractiveness by Application, 2022-2027

Figure 77: Latin America Market Attractiveness by Application, 2022-2027

Figure 78: Latin America Market Share and BPS Analysis by Product Type – 2012, 2022 & 2027

Figure 79: Latin America Market Attractiveness by Product Type, 2022-2027

Figure 80: Latin America Market Attractiveness by Product Type, 2022-2027

Figure 81: Latin America Market Share and BPS Analysis by Material – 2012, 2022 & 2027

Figure 82: Latin America Market Y-o-Y Growth Projections by Material, 2013-2027

Figure 83: Latin America Market Attractiveness by Material, 2022-2027

Figure 84: Latin America Market Share and BPS Analysis by Technology – 2012, 2022 & 2027

Figure 85: Latin America Market Y-o-Y Growth Projections by Technology, 2013-2027

Figure 86: Latin America Market Attractiveness by Battery Technology, 2022-2027

Figure 87: Latin America Market Share and BPS Analysis by End Use – 2012, 2022 & 2027

Figure 88: Latin America Market Y-o-Y Growth Projections by End Use, 2013-2027

Figure 89: Latin America Market Attractiveness by End Use, 2022-2027

Figure 90: Western Europe Technical Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 91: Western Europe Technical Market Y-o-Y Growth Projections by Country, 2013-2027

Figure 92: Western Europe Technical Market Attractiveness Analysis by Country, 2022-2027

Figure 93: Germany Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 94: France Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 95: Italy Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 96: Spain Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 97: U.K. Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 98: Rest of Western Europe Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 99: Western Europe Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 100: Western Europe Market Attractiveness by Application, 2022 – 2027

Figure 101: Western Europe Market Attractiveness by Application, 2022 – 2027

Figure 102: Western Europe Market Share and BPS Analysis by Product Type – 2012, 2022 & 2027

Figure 103: Western Europe Market Attractiveness by Product Type, 2022 – 2027

Figure 104: Western Europe Market Attractiveness by Product Type, 2022 – 2027

Figure 105: Western Europe Market Share and BPS Analysis by Material – 2012, 2022 & 2027

Figure 106: Western Europe Market Y-o-Y Growth Projections by Material, 2013 – 2027

Figure 107: Western Europe Market Attractiveness by Material, 2022 – 2027

Figure 108: Western Europe Market Share and BPS Analysis by Technology – 2012, 2022 & 2027

Figure 109: Western Europe Market Y-o-Y Growth Projections by Technology, 2013 – 2027

Figure 110: Western Europe Market Attractiveness by Technology, 2022 – 2027

Figure 111: Western Europe Market Share and BPS Analysis by End Use – 2012, 2022 & 2027

Figure 112: Western Europe Market Y-o-Y Growth Projections by End Use, 2013 – 2027

Figure 113: Western Europe Market Attractiveness by End Use, 2022 – 2027

Figure 114: Eastern Europe Technical Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 115: Eastern Europe Technical Market Y-o-Y Growth Projections by Country, 2013 – 2027

Figure 116: Eastern Europe Technical Market Attractiveness Analysis by Country, 2022 – 2027

Figure 117: Russia Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 118: Poland Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 119: Rest of Eastern Europe Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 120: Eastern Europe Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 121: Eastern Europe Market Attractiveness by Application, 2022 – 2027

Figure 122: Eastern Europe Market Attractiveness by Application, 2022 – 2027

Figure 123: Eastern Europe Market Share and BPS Analysis by Product Type – 2012, 2022 & 2027

Figure 124: Eastern Europe Market Attractiveness by Product Type, 2022 – 2027

Figure 125: Eastern Europe Market Attractiveness by Product Type, 2022 – 2027

Figure 126: Eastern Europe Market Share and BPS Analysis by Material – 2012, 2022 & 2027

Figure 127: Eastern Europe Market Y-o-Y Growth Projections by Material, 2013 – 2027

Figure 128: Eastern Europe Market Attractiveness by Material, 2022 – 2027

Figure 129: Eastern Europe Market Share and BPS Analysis by Technology – 2012, 2022 & 2027

Figure 130: Eastern Europe Market Y-o-Y Growth Projections by Technology, 2013 – 2027

Figure 131: Eastern Europe Market Attractiveness by Technology, 2022 – 2027

Figure 132: Eastern Europe Market Share and BPS Analysis by End Use – 2012, 2022 & 2027

Figure 133: Eastern Europe Market Y-o-Y Growth Projections by End Use, 2013 – 2027

Figure 134: Eastern Europe Market Attractiveness by End Use, 2022 – 2027

Figure 135: APEJ Technical Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 136: APEJ Technical Market Y-o-Y Growth Projections by Country, 2013 – 2027

Figure 137: APEJ Technical Market Attractiveness Analysis by Country, 2022 – 2027

Figure 138: China Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 139: India Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 140: ASEAN Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 141: ANZ Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 142: Rest of APEJ Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 143: APEJ Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 144: APEJ Market Attractiveness by Application, 2022 – 2027

Figure 145: APEJ Market Attractiveness by Application, 2022 – 2027

Figure 146: APEJ Market Share and BPS Analysis By Product Type – 2012, 2022 & 2027

Figure 147: APEJ Market Attractiveness By Product Type, 2022 – 2027

Figure 148: APEJ Market Attractiveness By Product Type, 2022 – 2027

Figure 149: APEJ Market Share and BPS Analysis By Material – 2012, 2022 & 2027

Figure 150: APEJ Market Y-o-Y Growth Projections By Material, 2013 – 2027

Figure 151: APEJ Market Attractiveness By Material, 2022 – 2027

Figure 152: APEJ Market Share and BPS Analysis By Technology – 2012, 2022 & 2027

Figure 153: APEJ Market Y-o-Y Growth Projections by Technology, 2013–2027

Figure 154: APEJ Market Attractiveness By Technology,

Figure 155: APEJ Market Share and BPS Analysis By End Use – 2012, 2022 & 2027

Figure 156: APEJ Market Y-o-Y Growth Projections by End Use, 2013 – 2027

Figure 157: APEJ Market Attractiveness By End Use, 2022 – 2027

Figure 158: MEA Technical Market Share and BPS Analysis By Country – 2012, 2022 & 2027

Figure 159: MEA Technical Market Y-o-Y Growth Projections By Country, 2013 – 2027

Figure 160: MEA Technical Market Attractiveness Analysis By Country, 2022 – 2027

Figure 161: GCC Countries Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 162: Turkey Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 163: South Africa Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 164: Rest of MEA Technical Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 165: MEA Market Share and BPS Analysis By Application – 2012, 2022 & 2027

Figure 166: MEA Market Attractiveness By Application, 2022 – 2027

Figure 167: MEA Market Attractiveness By Application, 2022 – 2027

Figure 168: MEA Market Share and BPS Analysis By Product Type – 2012, 2022 & 2027

Figure 169: MEA Market Attractiveness By Product Type, 2022–2027

Figure 170: MEA Market Attractiveness By Product Type, 2022–2027

Figure 171: MEA Market Share and BPS Analysis By Material – 2012, 2022 & 2027

Figure 172: MEA Market Y-o-Y Growth Projections By Material, 2013–2027

Figure 173: MEA Market Attractiveness By Material, 2022–2027

Figure 174: MEA Market Share and BPS Analysis By Technology – 2012, 2022 & 2027

Figure 175: MEA Market Y-o-Y Growth Projections by Technology, 2013–2027

Figure 176: MEA Market Attractiveness By Technology, 2022–2027

Figure 177: MEA Market Share and BPS Analysis By End Use – 2012, 2022 & 2027

Figure 178: MEA Market Y-o-Y Growth Projections by End Use, 2013–2027

Figure 179: MEA Market Attractiveness By End Use, 2022–2027

Figure 180: Japan Market Share and BPS Analysis By Application – 2012, 2022 & 2027

Figure 181: Japan Market Attractiveness By Application, 2022–2027

Figure 182: Japan Market Attractiveness By Application, 2022–2027

Figure 183: Japan Market Share and BPS Analysis By Product Type – 2012, 2022 & 2027

Figure 184: Japan Market Attractiveness By Product Type, 2022–2027

Figure 185: Japan Market Attractiveness By Product Type, 2022–2027

Figure 186: Japan Market Share and BPS Analysis By Material – 2012, 2022 & 2027

Figure 187: Japan Market Y-o-Y Growth Projections By Material, 2013–2027

Figure 188: Japan Market Attractiveness By Material, 2022–2027

Figure 189: Japan Market Share and BPS Analysis By Technology – 2012, 2022 & 2027

Figure 190: Japan Market Y-o-Y Growth Projections by Technology, 2013–2027

Figure 191: Japan Market Attractiveness By Technology, 2022–2027

Figure 192: Japan Market Share and BPS Analysis By End Use – 2012, 2022 & 2027

Figure 193: Japan Market Y-o-Y Growth Projections by End Use, 2013–2027

Figure 194: Japan Market Attractiveness By End Use, 2022–2027

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Demand for Coil Coatings in EU Size and Share Forecast Outlook 2025 to 2035

Functional Coil Coatings Market Analysis – Size, Share & Forecast 2025 to 2035

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Technical Insulation Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Coiled Tubing Market Analysis by Service, Operation, Application and Region Through 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coil Assisted Flow Diverters Market – Growth, Demand & Forecast 2025 to 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Coil Winding Machine Market Growth – Trends & Forecast 2024 to 2034

Technical Fluids Market

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Recoilless Disruptor Market Size and Share Forecast Outlook 2025 to 2035

Geotechnical Instrumentation And Monitoring Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA