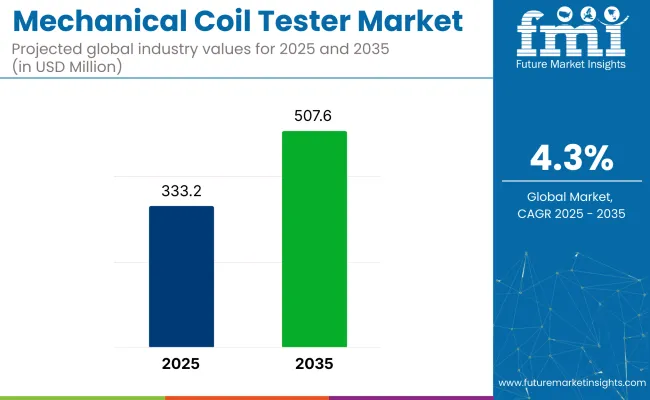

The mechanical coil tester market is expected to reach a valuation of USD 333.2 million in 2025 and USD 507.6 million by 2035 at a CAGR of 4.3% over the forecast period. Mechanical coil testers play a critical role in evaluating the strength, elasticity, and fatigue life of coil springs and similar mechanical components.

As industries such as automotive, aerospace, heavy machinery, and electronics place greater emphasis on quality control and component performance, the demand for precise and reliable testing equipment continues to grow. The industry, while niche, forms an essential component of industrial testing infrastructure globally.

The industry is characterized by ongoing technological improvements, particularly in automation and the digitization of test processes. Mechanical coil testers are increasingly being integrated with digital measurement systems, real-time data analytics, and software-driven control interfaces, allowing for more accurate, repeatable, and efficient testing processes.

These advancements are crucial as manufacturers strive to meet stricter safety and performance standards. Additionally, the adoption of Industry 4.0 practices is encouraging the use of smart testing devices, where mechanical coil testers are networked into broader production and quality assurance systems. As per the NASSCOM report on India Industry 4.0 Adoption, digital technologies are projected to register 40% of total manufacturing expenditure by 2025 as compared to 20% of expenditure in 2021.

A major driver of industry growth is the continued expansion of the automotive sector, where coil springs are critical for suspension systems. As vehicle manufacturers prioritize ride comfort, durability, and performance, they require rigorous testing of spring components under various load conditions. Similarly, in the aerospace industry, the need for lightweight yet high-performance components has led to increased adoption of mechanical coil testers to verify product integrity.

Other contributing factors include the rise of electric vehicles, increased infrastructure development, and greater emphasis on regulatory compliance. As global manufacturing output continues to grow, so too will the need for dependable mechanical coil testing solutions.

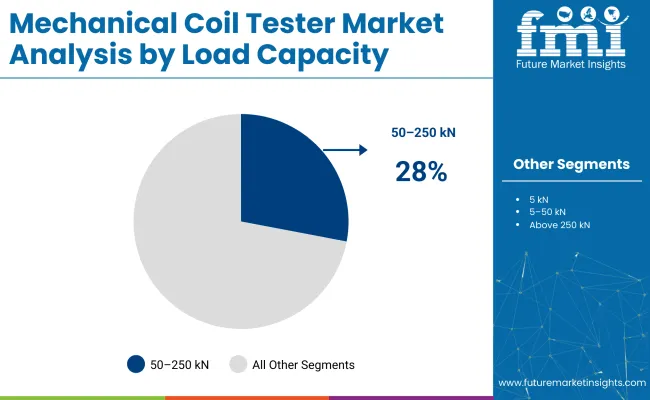

The 50-250 kN load capacity segment dominates the industry due to its versatility and cost-effectiveness for testing various coil springs. Hydraulic drive systems lead the industry because of their precision, durability, and suitability for diverse testing applications, while the automotive sector drives demand with its focus on quality and safety in coil spring testing.

The 50-250 kN load capacity is expected to dominate the product segment with a 28% industry share in 2025.

The hydraulic segment is anticipated to lead the application category with a 46% industry share in 2025, primarily due to its superior power, precision, and reliability in handling a wide range of testing applications.

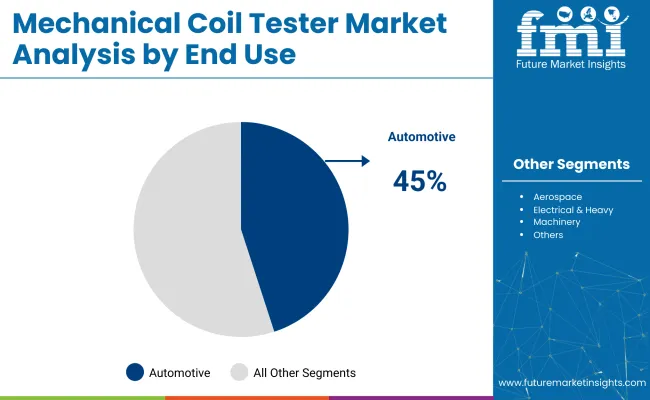

The automotive sector dominates the industry, holding approximately 45% of the total industry share in 2025. This dominance stems from the critical role coil springs play in vehicle suspension systems, which directly impact ride comfort, handling, and safety.

The industry is growing rapidly due to increasing demand from the automotive and aerospace sectors, driven by quality assurance and technological advancements. However, high initial investment and maintenance challenges may slow growth, though emerging industries and innovations in testing methods offer new opportunities.

Rising Product Demand from the Automotive Industry

The industry is primarily driven by increasing demand from the automotive and aerospace industries, where coil springs are critical for suspension and structural components. Rising focus on quality assurance, safety standards, and regulatory compliance compels manufacturers to adopt advanced testing solutions.

Additionally, the growing production of electric and hybrid vehicles is boosting the need for precise and reliable coil testing equipment. Technological advancements such as automation, digitization, and integration with Industry 4.0 are also enhancing testing accuracy and operational efficiency, further fueling industry growth.

High Initial Investment May Hamper Market Growth

Despite steady growth, the industry faces challenges like high initial investment costs for advanced testing systems and the need for skilled operators. Maintenance requirements and calibration complexities can also pose hurdles, especially for small and medium-sized enterprises.

However, emerging markets in Asia-Pacific offer significant opportunities due to expanding manufacturing activities and infrastructure development. Furthermore, increasing adoption of non-destructive testing methods and AI-powered analytics presents new avenues for innovation, enabling manufacturers to improve testing speed, reduce errors, and optimize product quality.

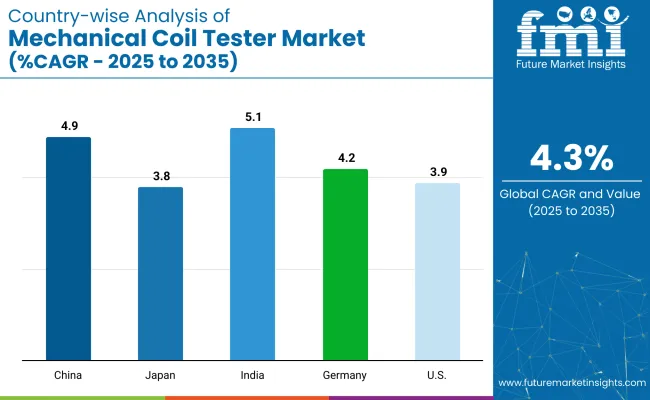

The industry study identifies key trends across major countries, including the United States, China, India, Japan, and Germany. Manufacturers in these regions can align strategies around automation, evolving quality standards, and rising demand from the automotive and aerospace sectors to boost dollar sales, share, and product innovation.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.9% |

| Japan | 3.8% |

| India | 5.1% |

| Germany | 4.2% |

| United States | 3.9% |

The United States industry is estimated to grow at a 3.9% CAGR during the study period.

The industry in China is projected to grow at a 4.9% CAGR between 2025 and 2035.

The industry in India is expected to witness a 5.1% CAGR during the forecast period.

The industry in Japan is anticipated to grow at a 3.8% CAGR from 2025 to 2035.

The industry in Germany is estimated to expand at a 4.2% CAGR during the study period.

Leading Company -ZwickRoell Market Share-25%

The industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players like ZwickRoell, Qingdao AIP Intelligent Instrument Co., Ltd., and ADMET Universal Testing Systems lead the industry with high-precision testing technologies, versatile testing solutions, and strong global distribution networks across industries like automotive, aerospace, and manufacturing.

Key players such as Blue Star Engineering & Electronics Ltd., Shimadzu Corporation, and Presto Group provide specialized testing equipment for various industrial applications and focus on regional and specific industry needs. Emerging players, including Siward Crystal Technology Co., Ltd., offer cost-effective and innovative testing solutions for niche applications and smaller industries.

Recent Mechanical Coil Tester Market Development

In March 2025, Shimadzu Scientific Instruments opened a new R&D center in Boston, focusing on customer-oriented development to expand business in the pharmaceutical field.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 333.2 million |

| Projected Industry Size (2035) | USD 507.6 million |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and units |

| Load Capacity Analyzed (Segment 1) | Up to 5 kN , 5 - 50 kN , 50 - 250 kN , and above 250 kN |

| Drive Type Analyzed (Segment 2) | Electromechanical, Hydraulic, And Servo-Electric |

| End Use Analyzed (Segment 3) | Automotive, Aerospace, Electrical & Heavy Machinery, Electronics & Appliances, Research & Certification Labs, And Other Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | ZwickRoell , Qingdao AIP Intelligent Instrument Co., Ltd., ADMET Universal Testing Systems, Blue Star Engineering & Electronics Ltd., Shimadzu Corporation, and Presto Group. |

| Additional Attributes | Dollar sales, share, pricing trends, and regulatory impacts. |

In terms of load capacity, the industry is classified into Up to 5 kN, 5-50 kN, 50-250 kN, and above 250 kN.

With respect to drive type, the industry is divided into electromechanical, hydraulic, and servo-electric.

In terms of end use, the industry is classified into automotive, aerospace, electrical & heavy machinery, electronics & appliances, research & certification labs, and other manufacturing.

From the regional standpoint, the industry is segregated into Latin America, Asia Pacific, the Middle East & Africa, North America, and Europe.

The industry is valued at USD 333.2 million in 2025.

The industry is forecast to reach USD 507.6 million by 2035.

ZwickRoell is the leading player in the industry with a 25% market share.

The industry is projected to grow at a CAGR of 4.3%.

The automotive sector holds 45% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mechanical Shaft Seal Market Size and Share Forecast Outlook 2025 to 2035

Mechanical And Electronic Fuzes Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Locks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mechanical Performance Tuning Components Market Growth - Trends & Forecast 2025 to 2035

Mechanical Ventilator Market - Demand & Growth Outlook 2025 to 2035

Mechanical Seals Market Growth - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in the Mechanical Locks Industry

Mechanical Keyboard Market

Electromechanical Timers Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Mechanical Analyzer Market

Chemical Mechanical Planarization Market Growth – Size & Forecast 2025 to 2035

5G Electromechanical RF Switch Market Size and Share Forecast Outlook 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Micro-Electro Mechanical Systems Market Size and Share Forecast Outlook 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA