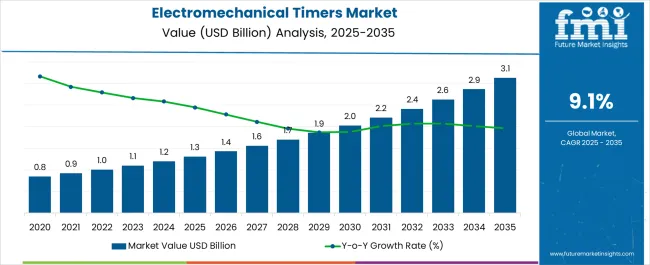

The Electromechanical Timers Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

| Metric | Value |

|---|---|

| Electromechanical Timers Market Estimated Value in (2025E) | USD 1.3 billion |

| Electromechanical Timers Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The Electromechanical Timers market is experiencing sustained growth, driven by increasing demand for precise timing solutions in industrial, commercial, and consumer applications. These timers are widely used to control sequential operations, automate processes, and improve operational efficiency across manufacturing and industrial settings. Adoption is supported by the robustness, reliability, and cost-effectiveness of electromechanical designs, which are preferred in environments with harsh operating conditions or where electronic alternatives may be susceptible to interference.

Rising industrial automation, expansion of manufacturing facilities, and the need for energy-efficient process management are further fueling market growth. Technological enhancements, including improved contact mechanisms, adjustable timing ranges, and modular designs, are increasing versatility and ease of integration into existing systems.

Regulatory compliance, safety standards, and the need for precise process control are also driving adoption in critical sectors As industries prioritize operational efficiency and reliability, the market for electromechanical timers is expected to continue expanding, supported by both established and emerging industrial ecosystems.

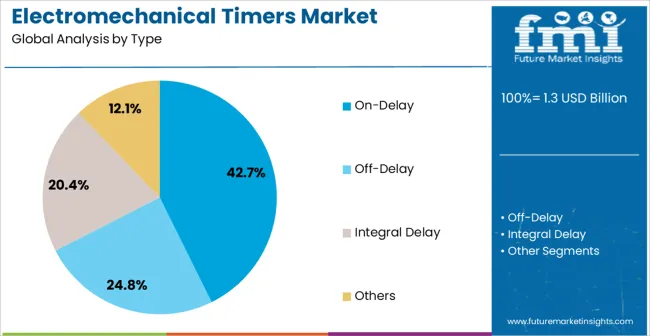

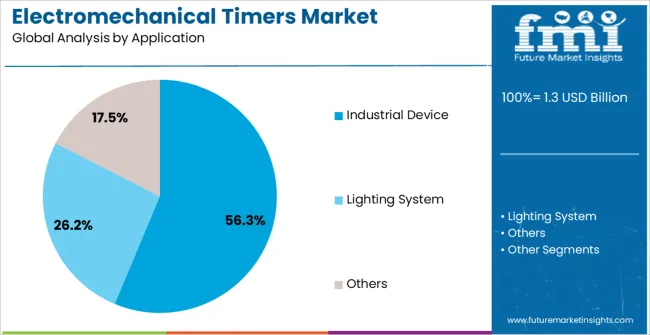

The electromechanical timers market is segmented by type, application, and geographic regions. By type, electromechanical timers market is divided into On-Delay, Off-Delay, Integral Delay, and Others. In terms of application, electromechanical timers market is classified into Industrial Device, Lighting System, and Others. Regionally, the electromechanical timers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-delay type segment is projected to hold 42.7% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is driven by the widespread requirement for timed delay functions in industrial control, automation, and sequential operations. On-delay timers provide precise control over the start of a process, allowing equipment to operate safely and efficiently while preventing premature activation or damage.

Their reliability, ease of installation, and minimal maintenance requirements have strengthened adoption across multiple sectors, including manufacturing, energy, and utilities. The ability to integrate with industrial control panels and PLCs without extensive modifications enhances versatility.

Advances in mechanical components, adjustable time ranges, and compact designs have further improved usability and performance As industries continue to automate processes and prioritize operational safety and efficiency, the on-delay timer segment is expected to maintain its market leadership, supported by consistent reliability, operational flexibility, and cost-effectiveness across industrial applications.

The industrial device application segment is anticipated to account for 56.3% of the market revenue in 2025, making it the largest application category. Its growth is being driven by the increasing demand for precise timing control in industrial machinery, manufacturing equipment, and automation systems. Electromechanical timers are deployed to manage sequential operations, ensure safety interlocks, and optimize process timing, which improves overall operational efficiency.

Industrial applications benefit from the durability, reliability, and environmental tolerance of electromechanical timers, which function effectively in harsh or high-temperature environments. Integration with control systems and automation platforms enables seamless process synchronization and real-time monitoring, enhancing productivity and reducing downtime.

Regulatory compliance and safety requirements further reinforce the importance of reliable timing devices in industrial operations As manufacturing and industrial automation continue to expand globally, the industrial device segment is expected to remain the primary driver of market growth, supported by ongoing demand for reliable, scalable, and precise timing solutions.

A cruise ship is a passenger ship that is used for pleasure trips, where the journey and the ship amenities offered are part of the whole experience. The ship will visit several different destinations i.e. ports of calls along the way. Transportation is not the main purpose as several cruise lines return to their originating port after the voyage. There are even some ‘cruises to nowhere’ trips which simply sail for 2-3 nights without any port of call. Cruise liners have become a massive part of the tourism industry.

There are several different types of cruises like mainstream cruise ships, luxury cruise ships, adventure cruise ships, expedition cruise ships, glacier cruise ships and river cruise ships. Glacier cruises mainly operate in the far upper regions of the Earth. Hence, places like Alaska, Canada, Norway, Sweden, Finland, and Iceland are the most popular destinations for tourists seeking the wonders of glacier cruises.

Glaciers are truly one of Mother Nature’s most spectacular sights, especially when a tidewater glacier is seen at the end of its life cycle, plummeting into the ocean. The dense glacier blocks are visible from miles away as shining white fields of snow or mesmerising shades of blue from up-close as they absorb all visible light except the short, blue spectrum.

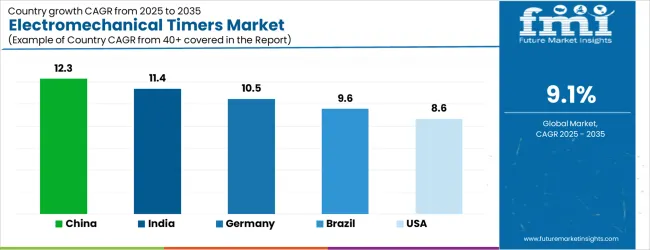

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| Brazil | 9.6% |

| USA | 8.6% |

| UK | 7.7% |

| Japan | 6.8% |

The Electromechanical Timers Market is expected to register a CAGR of 9.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.3%, followed by India at 11.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.8%, yet still underscores a broadly positive trajectory for the global Electromechanical Timers Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.5%. The USA Electromechanical Timers Market is estimated to be valued at USD 445.5 million in 2025 and is anticipated to reach a valuation of USD 445.5 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 71.2 million and USD 43.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | On-Delay, Off-Delay, Integral Delay, and Others |

| Application | Industrial Device, Lighting System, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

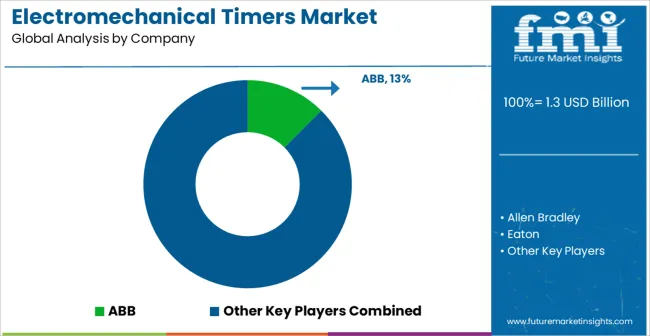

| Key Companies Profiled | ABB, Allen Bradley, Eaton, Alstom Grid, Littelfuse, LOVATO ELECTRIC, KÜBLER GmbH, Marsh Bellofram, CASTELL SAFETY INTERNATIONAL, ELETTROMECCANICA CDC s.r.l., DWYER, ELKO, EMAS, GHISALBA, and Artidor Explosion Safety B.V. |

The global electromechanical timers market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the electromechanical timers market is projected to reach USD 3.1 billion by 2035.

The electromechanical timers market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in electromechanical timers market are on-delay, off-delay, integral delay and others.

In terms of application, industrial device segment to command 56.3% share in the electromechanical timers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Electromechanical RF Switch Market Size and Share Forecast Outlook 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA