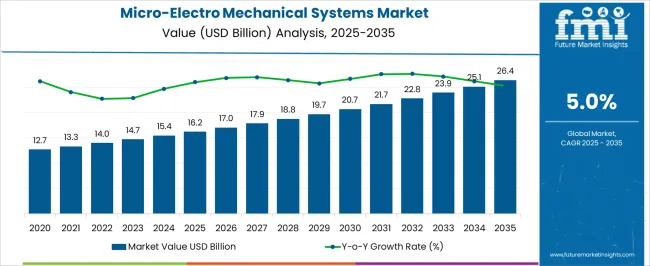

The Micro-Electro Mechanical Systems Market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Micro-Electro Mechanical Systems Market Estimated Value in (2025 E) | USD 16.2 billion |

| Micro-Electro Mechanical Systems Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Micro-Electro Mechanical Systems market is witnessing robust growth due to the rising integration of miniaturized components in next-generation devices and systems. MEMS technology is gaining traction across industries as it provides high precision, low power consumption, and compact design, making it indispensable for advanced applications. The widespread adoption of connected devices, smart wearables, and IoT ecosystems is creating a sustained demand for MEMS components.

Increasing investments in autonomous vehicles, consumer electronics, and industrial automation are further shaping the trajectory of the market. Continuous advancements in microfabrication and sensor fusion technologies are enabling improved performance and broader application potential. Governments and enterprises are also investing heavily in infrastructure modernization, which relies on MEMS-enabled solutions for efficiency, safety, and monitoring.

The expansion of 5G networks and the growing demand for miniaturized sensors in healthcare diagnostics and monitoring are reinforcing market opportunities With industries seeking highly reliable and scalable solutions, the MEMS market is expected to continue its upward momentum, supported by innovations in manufacturing processes, material science, and integration techniques.

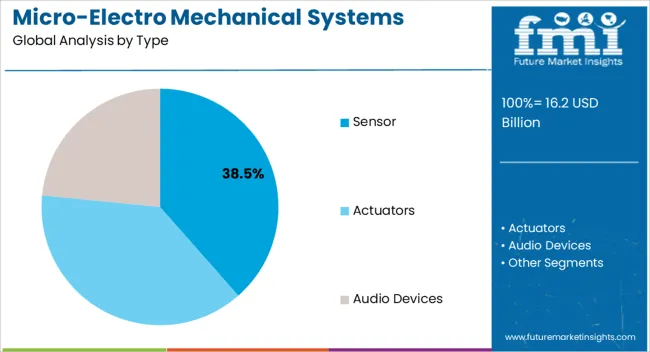

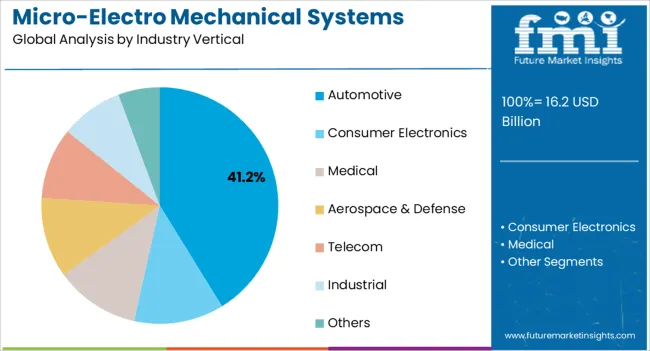

The micro-electro mechanical systems market is segmented by type, industry vertical, and geographic regions. By type, micro-electro mechanical systems market is divided into Sensor, Actuators, Audio Devices, and Switches. In terms of industry vertical, micro-electro mechanical systems market is classified into Automotive, Consumer Electronics, Medical, Aerospace & Defense, Telecom, Industrial, and Others. Regionally, the micro-electro mechanical systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sensor type segment is projected to hold 38.5% of the MEMS market revenue in 2025, underscoring its role as the leading product category. Growth in this segment is primarily driven by the increasing integration of MEMS sensors in consumer electronics, including smartphones, wearables, and gaming devices. These sensors are vital for applications such as motion detection, pressure measurement, and environmental monitoring, which are essential in delivering enhanced user experiences.

In the automotive industry, MEMS sensors are extensively used for safety applications such as airbag deployment, tire pressure monitoring, and stability control systems. Their compact size, high accuracy, and cost efficiency make them highly adaptable across diverse applications.

The rise of smart cities and connected infrastructure further supports demand, with MEMS sensors playing a key role in traffic management, structural monitoring, and environmental tracking As new applications in healthcare and industrial automation emerge, the versatility and scalability of MEMS sensors are expected to strengthen their dominant market position, ensuring long-term growth prospects.

The automotive industry vertical segment is anticipated to account for 41.2% of the MEMS market revenue in 2025, making it the leading end-use industry. This dominance is being driven by the growing adoption of advanced driver assistance systems, electric vehicles, and autonomous driving technologies, all of which rely on MEMS-based components for precision and safety. MEMS sensors and actuators are widely used in vehicles to monitor pressure, motion, temperature, and fluid dynamics, enhancing both performance and safety standards.

The rapid shift toward electrification and intelligent mobility solutions is further boosting demand for MEMS devices that can provide real-time monitoring and predictive maintenance. Automotive manufacturers are increasingly integrating MEMS for functions such as navigation, energy management, and in-cabin comfort systems.

Regulatory mandates on vehicle safety and emission reduction are also encouraging wider deployment of MEMS solutions As the automotive industry transitions into a new era of connectivity and autonomy, the demand for highly reliable, miniaturized, and energy-efficient MEMS components is expected to maintain this segment’s leadership in the market.

According to the latest market survey conducted by Future Market Insights, the global micro-electromechanical systems market is relishing a market valuation of US$ 67.2 Billion in 2025 and is all set to expand with a CAGR of 10.1% during the 2025 to 2035 period.

| Market Size 2025 | US$ 67.2 Billion |

| Market Size 2035 | US$ 175.9 Billion |

| Value CAGR (2025 to 2035) | 10.1% |

| Collective Value Share: Top 3 Countries (2025E) | 45% - 50% |

In order to take use of both the mechanical and electrical qualities of silicon, semiconductor integrated circuits (ICs) incorporate micro-electro-mechanical systems (MEMS). The movements detected by these MEMS include angular motion, acceleration, pressure, and magnetic fields. Microelectromechanical systems (MEMS) not only control the sensors in microelectronics but also allows their computational capabilities.

MEMS are now widely regarded as a game-changing technology in personalized healthcare. Microelectromechanical systems (MEMS) have been essential in the shift from large, centrally located hospital gadgets to smaller, more portable ones. MEMS-based medical devices are well-structured and can detect a wide range of illnesses, including abnormalities in respiration, blood pressure, temperature, motor function, and more.

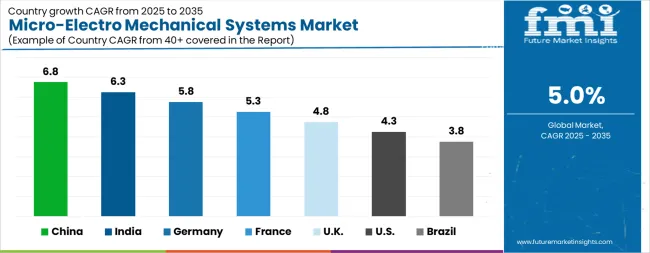

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Micro-Electro Mechanical Systems Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Micro-Electro Mechanical Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%. The USA Micro-Electro Mechanical Systems Market is estimated to be valued at USD 5.8 billion in 2025 and is anticipated to reach a valuation of USD 8.8 billion by 2035. Sales are projected to rise at a CAGR of 4.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 816.5 million and USD 488.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.2 Billion |

| Type | Sensor, Actuators, Audio Devices, and Switches |

| Industry Vertical | Automotive, Consumer Electronics, Medical, Aerospace & Defense, Telecom, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

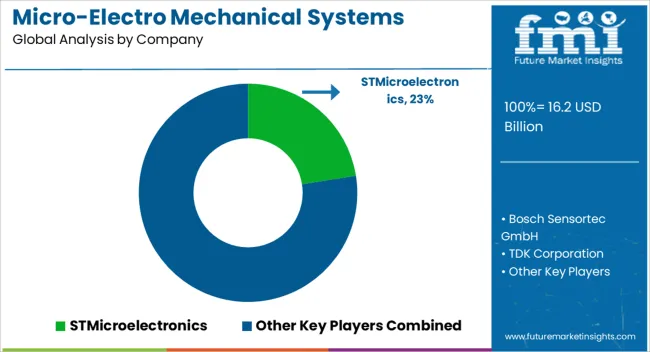

| Key Companies Profiled | STMicroelectronics, Bosch Sensortec GmbH, TDK Corporation, TE Connectivity, Murata Manufacturing Co., Ltd., and Honeywell International Inc. |

The global micro-electro mechanical systems market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the micro-electro mechanical systems market is projected to reach USD 26.4 billion by 2035.

The micro-electro mechanical systems market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in micro-electro mechanical systems market are sensor, _pressure sensor, _accelerometers, _gyroscope (motion sensor), _temperature sensor, _humidity sensor, _gas sensors, _others, actuators, _rf actuators, _optical devices, audio devices, _microphones, _speakers and switches.

In terms of industry vertical, automotive segment to command 41.2% share in the micro-electro mechanical systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Shaft Seal Market Size and Share Forecast Outlook 2025 to 2035

Mechanical And Electronic Fuzes Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Locks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mechanical Coil Tester Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Mechanical Performance Tuning Components Market Growth - Trends & Forecast 2025 to 2035

Mechanical Ventilator Market - Demand & Growth Outlook 2025 to 2035

Mechanical Seals Market Growth - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in the Mechanical Locks Industry

Mechanical Keyboard Market

Electromechanical Timers Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Mechanical Analyzer Market

Chemical Mechanical Planarization Market Growth – Size & Forecast 2025 to 2035

5G Electromechanical RF Switch Market Size and Share Forecast Outlook 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Floating Microelectrode Array (FMA) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA