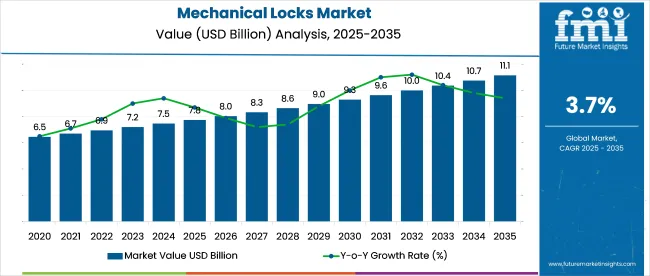

Global mechanical lock market is forecast to increase from USD 7.75 billion in 2025 to USD 11.15 billion by 2035, at a 3.7% CAGR. North America is expected to retain the largest revenue share, but higher growth momentum is being recorded in Southeast Asia, Eastern Europe, and parts of Latin America.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.75 billion |

| Industry Value (2035F) | USD 11.15 billion |

| CAGR (2025 to 2035) | 3.7% |

Over 210 million new residential units across BRICS and ASEAN are projected to adopt mechanical or hybrid locking systems by 2030, driven by policy-backed housing and lower per-unit installation costs. Production capacity in India, Vietnam, and Poland is being raised by 12% by 2027 to meet expanding regional demand. 38% of new lock SKUs introduced in 2024 offer compatibility with digital upgrades.

On June 3, 2025, Allegion plc announced the acquisition of Nova Hardware Pty Ltd (Novas), a premium architectural door hardware manufacturer based in Victoria, Australia. Novas specializes in mechanical and electronic locks, closers, hinges, and master keying systems for multifamily and commercial sectors.

The acquisition strengthens Allegion’s footprint in the Australian market and aligns with its international growth strategy. Novas will operate under Allegion International, with its founder, Todd Foster, joining in an advisory role. The deal excludes Novas’ kitchen and bathroom business, which will be retained as a separate entity. Terms of the acquisition were not disclosed.

The mechanical locks market occupies different levels of importance across its parent segments. It holds approximately 41% of the door hardware market due to its core role in latch and lock assemblies. In physical security equipment, its share stands near 17%, reduced by the presence of surveillance and biometric systems.

Within access control, it captures about 11%, primarily from hybrid lock applications. Its contribution to the building products and materials segment is around 6%, and just 4% in the residential and commercial construction market, where locks form a smaller fraction of structural investments relative to roofing, flooring, or insulation.

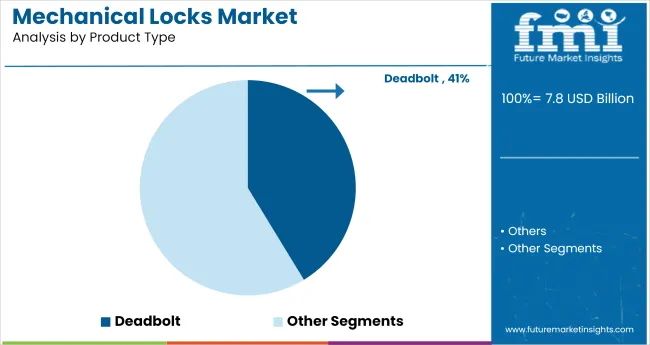

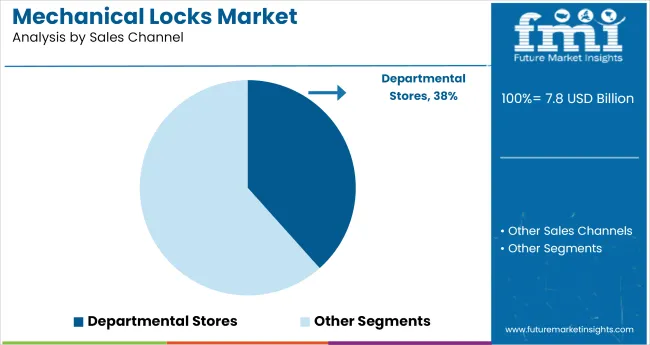

The market is segmented by product type, sales channel, and region. Deadbolts are projected to dominate the product type segment, capturing 41.3% share in 2025. Departmental stores are expected to lead the sales channel segment, holding a 38.6% share.

Strong growth is expected in regions like North America, Western Europe, and East Asia, driven by security concerns and rising construction activities. Other regions such as Latin America, South Asia & Pacific, and the Middle East & Africa are also anticipated to witness steady growth.

The deadbolt product segment is expected to capture 41.3% share in 2025. Deadbolts are widely used for both residential and commercial security due to their robust ability to prevent forced entry. Their popularity is driven by their simplicity, effectiveness, and relatively low cost compared to electronic alternatives.

Companies like ASSA ABLOY, Schlage, and Kwikset are key players, offering various models designed to meet the needs of different applications, from high-security areas to standard residential use. The deadbolt’s effectiveness and durability in high-security environments continue to drive its demand, particularly in regions with increasing security concerns.

Departmental stores are expected to account for 38.6% of the industry in 2025. These stores are preferred by consumers for their ability to offer a wide variety of mechanical locks, allowing for side-by-side product comparisons. Retailers like Home Depot, Lowe's, and Walmart dominate this segment, offering in-store inspections, expert assistance, and a wide range of security solutions.

The convenience of physical retail locations, combined with knowledgeable staff, enhances consumer confidence and purchasing decisions. Departmental stores offer consumers the opportunity to evaluate product quality firsthand, which is crucial in the decision-making process.

The market is projected to grow steadily, driven by increasing demand for security solutions across residential, commercial, and industrial sectors. Despite the growth of smart and electronic locking systems, mechanical locks remain popular due to their simplicity, affordability, and reliability. The market faces challenges, including competition from advanced lock technologies and the need for constant innovation to meet evolving consumer preferences.

Rising Security Demands and Affordability Drive Growth

The market is benefiting from growing security concerns, particularly in residential and commercial sectors. According to a recent report, the global burglary rate has increased by 12% over the past decade, pushing demand for reliable locking systems.

The construction industry's rapid expansion, particularly in emerging economies, is contributing to an uptick in demand. It is estimated that emerging industries such as Asia-Pacific and Latin America will witness a 6% rise in construction activities annually, further driving mechanical lock demand. These locks are often 20-30% more affordable than their electronic counterparts, making them more appealing in price-sensitive sectors.

Competition from Advanced Locking Technologies

Mechanical locks are encountering significant competition from electronic and smart locks. These advanced systems are gaining traction, particularly in developed industries like North America and Western Europe. Their appeal lies in features such as remote access and compatibility with smart home systems. These locks require more frequent maintenance, with 45% of users reporting higher repair rates compared to electronic systems. Only 38% of homeowners are aware of the benefits of mechanical locks over digital alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.3% |

| UK | 3.1% |

| Germany | 2.9% |

| Japan | 4.4% |

| GCC | 5.1% |

The mechanical locks industry is projected to grow at a global CAGR of 3.7% from 2025 to 2035. Among the profiled regions, GCC markets lead at 5.1%, outperforming the global average by 1.4 percentage points, supported by a construction pipeline concentrated in mid-rise residential, hospitality, and retail developments.

Japan follows at 4.4%, driven by a mix of retrofitting in aging multifamily units and security upgrades in schools and public infrastructure. Both regions are increasing imports of Grade 1 and Grade 2 certified cylinders and mortise locks from OEM hubs in Taiwan and Korea.

Germany and the United Kingdom, both within the OECD, grow at 2.9% and 3.1% respectively, tracking below the baseline. These markets rely heavily on standard-compliant, insurance-approved hardware and face slower volume expansion due to stable housing turnover.

The United States lags with a 2.3% CAGR, reflecting saturation in primary housing segments and limited institutional renovations. Domestic players are focusing on contract wins tied to federal facility maintenance and university housing retrofits to offset replacement cycle stagnation.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for mechanical locks in the United States is projected to grow at a CAGR of 2.3% from 2025 to 2035. Rising security concerns in residential and commercial sectors continue to drive the demand for these locks, which are favored for their cost-effectiveness, simplicity, and reliability.

Homeowners prefer these locks for their affordability, while businesses and commercial properties rely on them to secure premises effectively. These locks offer ease of installation and low maintenance compared to newer smart lock systems. With the ongoing construction and renovation boom, the demand for these traditional, reliable security solutions is set to increase.

The UK market, growing at a CAGR of 3.1% from 2025 to 2035. This growth is driven by the need for secure, affordable solutions in residential, commercial, and high-risk sectors such as healthcare and financial institutions. These locks are widely preferred for their proven reliability, durability, and ease of installation.

Despite the increasing popularity of smart locks, traditional locks continue to be favored due to their cost-effectiveness. Ongoing urban construction and stringent security regulations in the UK further support the demand for these locks, ensuring their long-term dominance in the security market.

Sales for mechanical locks in Germany are expanding at a CAGR of 2.9% from 2025 to 2035. The continued demand for locks in both residential and commercial sectors is driven by their affordability, reliability, and long lifespan. In high-security environments, such as government buildings and industrial sites, mechanical locks remain a trusted security solution due to their ease of use and low maintenance.

The industry is supported by strict security standards and ongoing infrastructure development. Despite the increasing adoption of electronic locks, mechanical solutions remain essential for both new constructions and renovations.

Demand for mechanical locks in Japan is forecasted to rise at a CAGR of 4.4% from 2025 to 2035. The demand for these locks remains strong due to their durability, affordability, and reliability in securing both residential and commercial properties. Japan’s focus on high-security standards, especially in government institutions and financial sectors, ensures continued demand for these locks.

While smart locks are increasingly popular, mechanical locks continue to dominate in various sectors due to their effectiveness, ease of maintenance, and lower cost. With ongoing construction growth, particularly in commercial real estate and urban development, mechanical locks are set to remain a trusted security solution.

The mechanical locks market in the GCC region is projected to grow at a CAGR of 5.1% from 2025 to 2035. This growth is largely driven by the rapid urbanization and expansion of the construction and real estate sectors in countries such as the UAE, Saudi Arabia, and Qatar.

Mechanical locks continue to be the preferred security solution due to their reliability, affordability, and ease of installation. In high-rise buildings, residential complexes, and commercial properties, these locks provide effective and cost-efficient security measures. As the region modernizes and builds new infrastructure, mechanical locks will remain integral to ensuring the safety of buildings.

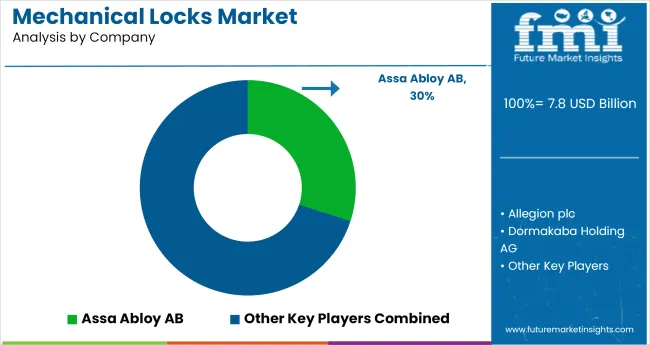

In the mechanical locks market, leading companies are pursuing growth through strategic acquisitions, high-volume project bids, and expanded OEM integration across commercial and residential sectors. Assa Abloy AB, the leading player, is scaling through product consolidation, digital-mechanical convergence, and geographic expansion into Eastern Europe and Southeast Asia. Allegion, Dormakaba, and Stanley Black & Decker are reinforcing their positions through infrastructure contracts, school security upgrades, and institutional lock system deployments.

Spectrum Brands, with its Kwikset and Baldwin brands, remains active in the mid-range residential segment via USA retail and builder channels. Regional manufacturers like Godrej & Boyce, ABUS, and Mul-T-Lock are strengthening their foothold through country-specific product lines and price-tiered distribution networks.

Competitive intensity in this space is increasing as digital retrofitting challenges legacy lock formats and project-based procurement compresses margins. Defending industry share requires backward integration into component sourcing, IP protection across lock families, and multi-year builder or government contracts.

Most players are focused on three strategies: accelerating hybrid lock development using analog shells with digital upgrades, forming co-manufacturing pacts to stabilize input costs, and aligning certifications with evolving OECD and BRICS building standards to retain compliance-led supply advantages.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 7.75 billion |

| Projected Industry Size (2035) | USD 11.15 billion |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Deadbolt, Others |

| Sales Channels Analyzed (Segment 2) | Departmental Stores, Other Sales Channels |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Assa Abloy AB, Allegion plc, Dormakaba Holding AG, Spectrum Brands Holdings, Inc., Stanley Black & Decker, Inc., CISA S.p.A., Godrej & Boyce Manufacturing Company Limited, ABUS August Bremicker Söhne KG, Mul-T-Lock Ltd., Kaba Group, Other Players (As Requested) |

| Additional Attributes | Dollar sales, share by product type and sales channel, continued demand across residential and commercial segments, price advantages over smart locks, regional channel preferences |

The segment includes Deadbolt and Others.

The industry is segmented into Departmental Stores and Other Sales Channels.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is projected to reach USD 7.75 billion in 2025.

The industry is expected to grow at a CAGR of 3.7% from 2025 to 2035.

Deadbolt locks are expected to capture 41.3% in 2025.

The GCC region is projected to register a CAGR of 5.1% from 2025 to 2035.

The industry is projected to reach USD 11.15 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Understanding Market Share Trends in the Mechanical Locks Industry

Mechanical Shaft Seal Market Size and Share Forecast Outlook 2025 to 2035

Mechanical And Electronic Fuzes Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Coil Tester Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Mechanical Performance Tuning Components Market Growth - Trends & Forecast 2025 to 2035

Mechanical Ventilator Market - Demand & Growth Outlook 2025 to 2035

Mechanical Seals Market Growth - Trends & Forecast 2025 to 2035

Mechanical Keyboard Market

Electromechanical Timers Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Mechanical Analyzer Market

Chemical Mechanical Planarization Market Growth – Size & Forecast 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Micro-Electro Mechanical Systems Market Size and Share Forecast Outlook 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Locks Market Size and Share Forecast Outlook 2025 to 2035

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA