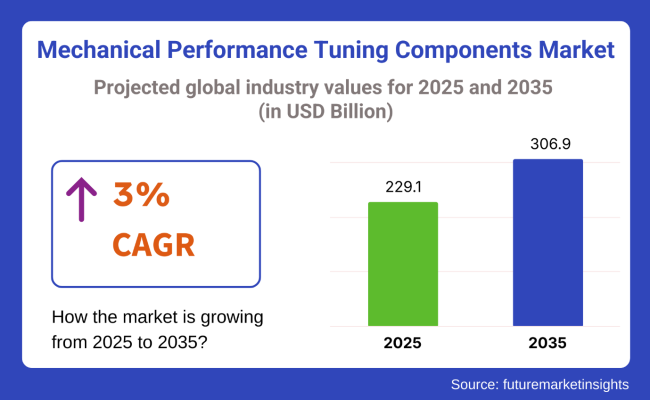

The mechanical performance tuning components market was valued at USD 202.8 billion in 2020 and is projected to reach USD 229.1 billion by 2025. From 2025 to 2035, the market is expected to expand at a CAGR of 3.0%, surpassing USD 306.9 billion by the end of the forecast period.

The market continues to grow as aftermarket modifications gain popularity, especially in regions with maturing vehicle ownership cycles. Consumers are increasingly integrating performance components such as exhaust systems, air intakes, suspension kits, and ECU tuning modules into compact and mid-size vehicles. The preference for bolt-on parts-which require minimal changes to factory engine systems-has contributed to wider adoption across enthusiast and daily-use segments.

Demand for engine management remapping has surged, allowing users to unlock additional horsepower and torque without engaging in invasive mechanical modifications. According to UpFix’s 2024 Aftermarket Guide, ECU and TCU refurbishments have become a cost-effective alternative to complete replacements, reinforcing the rise of OEM+ tuning philosophies. This has reshaped consumer expectations, placing greater emphasis on drivability, compliance, and warranty retention.

Advancements in testing tools have also accelerated professionalization in the tuning segment. Engine Builder Magazine reported in 2025 that hub dyno systems have proliferated across performance centers and motorsport shops, enabling tuners to conduct real-time adjustments with minimal drivetrain stress. These systems eliminate wheel contact, improving accuracy and repeatability during tuning sessions-benefits that are increasingly critical for component validation workflows.

Industry leaders such as Gentech Performance, HKS, and EcuTek have launched digital configurators and modular upgrade kits that simplify the customer journey. Gentech’s 2024 tuning overview emphasized this shift, stating, “Performance is no longer exclusive to experts-accessibility is driving the next wave of modification culture.” As a result, a broader customer base now engages with performance upgrades, from street-legal enhancements to track-focused builds.

At the same time, tightening emissions and noise regulations have influenced the design of performance mufflers, turbochargers, and air intakes. Manufacturers have engineered new geometries and material compositions to ensure road legality while still optimizing combustion, airflow, and thermodynamic efficiency. These developments have sustained market demand in highly regulated regions such as Europe and North America.

Performance workshops are also integrating OBD-II diagnostics into their tuning workflows. These tools enable fault prediction, compatibility mapping, and warranty-safe installations, increasing consumer trust in authorized service centers. Additionally, the integration of telemetry systems and data-logging platforms allows users to monitor performance metrics post-upgrade, making the value proposition more quantifiable and transparent.

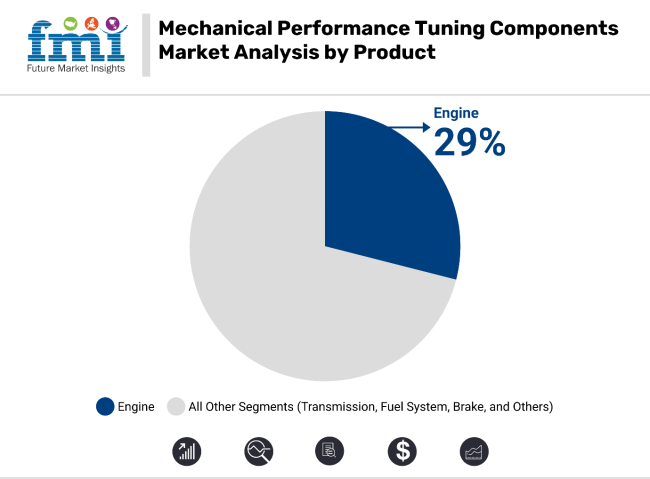

Engine components are expected to dominate the global automotive parts aftermarket by 2025, contributing approximately 29% of the total market revenue. The segment is projected to grow at a CAGR of 3.2% from 2025 to 2035, slightly above the global market growth rate of 3%. Engines remain the most serviced and replaced system in aging vehicle populations, particularly in regions with extended vehicle lifespans such as Latin America, Eastern Europe, and South Asia.

The demand is driven by routine engine part replacements including gaskets, cylinder heads, belts, oil pumps, filters, and timing components. With increasing adoption of turbochargers and electronic engine control modules, the complexity of engine maintenance has risen, further fueling demand for high-quality aftermarket parts.

Additionally, remanufacturing and refurbishment trends are extending the usability of engine components, while emission regulation compliance is pushing owners to upgrade parts to meet new standards. The penetration of hybrid powertrains is also generating demand for specialized engine-related components in plug-in hybrid and range-extender vehicle formats.

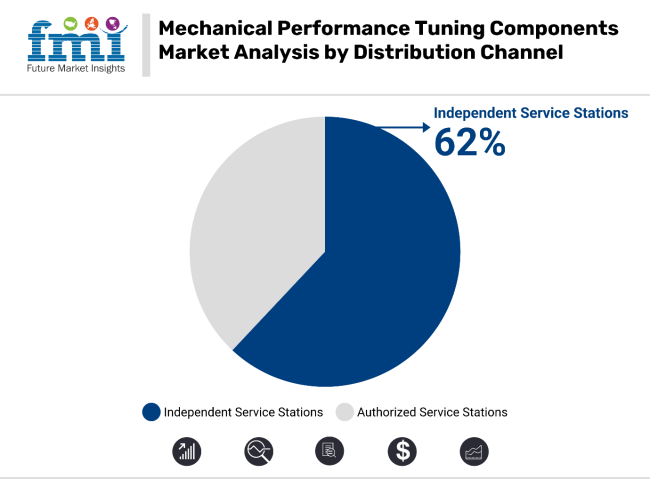

Independent service stations are projected to hold the largest share of the distribution channel, contributing around 62% of global revenue in 2025, with a projected CAGR of 3.1% through 2035. These service providers are widely preferred for their cost-effectiveness, convenience, and wide network access-especially in regions where authorized dealership networks have limited presence.

Independent garages typically offer flexible pricing, a broad selection of aftermarket brands, and faster turnaround for repair services. As vehicles exit warranty periods, owners increasingly turn to independent stations for non-critical services involving the fuel system, body and suspension, and exhaust mufflers.

Additionally, technological advancements in diagnostic tools and online spare parts sourcing are enhancing the competitiveness of independent stations. In emerging markets, where used car ownership is high, independent service providers play a crucial role in maintaining older vehicles, reinforcing their importance in the aftermarket value chain.

Challenges High Costs, Regulatory Restrictions, and Compatibility Issues

Mechanical performance tuning components market and engage organic and synthetic stakeholders. Specialized engineering and materials are needed for performance-enhancing components like turbochargers, exhaust systems, suspension kits, and engine tuning modules, making them costly for the average consumer.

And then you've got emissions and safety regulations from places like the EPA, EU regulations, as well as local transport authorities that help minimize what you can do to high-performance vehicles especially when it comes to street-legal capabilities.

While many vehicles will contain similar parts, this segment of the tuning and modifications market produces a different type of product altogether, as parts must be engineered down to the vehicle model level, creating compatibility issues and leaving each piece unique with a higher cost due to extensive customization..

Opportunities Growth in Electric Vehicle (EV) Performance Tuning, AI-Driven Optimization, and Lightweight Materials

Despite these challenges, the mechanical performance tuning components market does encounter hurdles such as high development costs and rigid regulatory frameworks, it holds significant growth potential in areas like EV tuning, AI-influenced performance tuning, and advanced lightweight material integration.

With the rising popularity of electric vehicles comes a growing need for things like battery performance tuning, high-performance aerodynamic improvements, and all of that has to be supplemented with EV-specific suspension enhancements.

And AI-based tuning software is changing the way we do both in performance vehicles, allowing real-time engine mapping, suspension adjustments, and predictive maintenance to ensure optimal performance. Performance parts companies are also adding carbon fiber, titanium and nanomaterials to improve fuel efficiency, durability, speed, while still meeting sustainability rules.

The USA to the mechanical performance tuning components market would continue to witness healthy growth backed by increasing demand for the automotive aftermarket, racing applications and other performance tuning applications.

Market growth is being driven by the increasing trend of car customization as well as by an increasing number of automobile enthusiasts investing in high-performance components. Furthermore, among the factors that are further aiding the growth of the industry are the development of lightweight materials and precision engineering.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

Market growth in the United Kingdom is driven by a robust motorsports and racing industry presence, notably in Formula 1, rally racing, and street performance vehicles. The demand for turbochargers, exhaust systems, and high-performance brakes is increasing to meet the needs of growing customers investing in performance-enhancing upgrades. Further, government incentives for greener performance tuning solutions will boost several market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

Mechanical performance tuning components segment is expected to capture the markets of several European Union countries. Modifying EVs such as the Tesla Model S was almost unheard of ten years ago. Moreover, the industry is progressively moving in Germany to the presence of various top leading automotive manufacturers and performance tuning brands, which in turn is aiding in Europe industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.3% |

The Japan mechanical performance tuning components market will witness a moderate growth, aided by the rich automotive tuning culture and presence of top-tier performance brands in the country. Growing popularity of JDM (Japanese Domestic Market) tuning components such as aftermarket exhaust parts, suspension kits, and ECU tuning solutions are driving the growth of the market. Also, hybrid and EV tuning technologies are set to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

In South Korea, the mechanical performance tuning components market is growing, as the country has a well-established automotive aftermarket industry and a rising interest in modifying high-performance and luxury vehicles.

Market growth is driven by the strong presence of automotive manufacturing giants like Hyundai and Kia, as well as an increase in demand for aesthetic and performance upgrades. Both the government initiatives encouraging the use of eco-friendly performance tuning solutions and innovations in hybrid and EV tuning parts are driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

The demand for high-performance automotive tuning components is driving the mechanical performance tuning components market. As consumers become increasingly interested in mods like engine tuning, suspension upgrades, and body kits, the stage is being set for breakthroughs in ideas like AI-picked tuning optimizations, lightweight performance components, and electronically controlled performance upgrades.

This is what the market encapsulates automotive component manufacturer’s aftermarket tuning specialists and motorsport engineering firms that bring these innovations in performance tuning cityscape AI diagnostics fuel efficiency optimization, etc.

The overall market size for the mechanical performance tuning components market was USD 229.1 billion in 2025.

The mechanical performance tuning components market is expected to reach USD 306.9 billion in 2035.

Growth is driven by the rising demand for high-performance vehicles, increasing customization trends, advancements in engine optimization technologies, and expanding motorsports and automotive aftermarket sectors.

The top 5 countries driving the development of the mechanical performance tuning components market are the USA, Germany, China, Japan, and the UK.

Authorized Service Stations and Passenger Cars are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Tuning and Engine Remapping Services Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Industry Analysis in Japan Forecast & Analysis: 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Performance Elastomer Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Shaft Seal Market Size and Share Forecast Outlook 2025 to 2035

Mechanical And Electronic Fuzes Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Tuning Box Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Locks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mechanical Coil Tester Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Mechanical Ventilator Market - Demand & Growth Outlook 2025 to 2035

Mechanical Seals Market Growth - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in the Mechanical Locks Industry

Mechanical Keyboard Market

Performance tires Market

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA