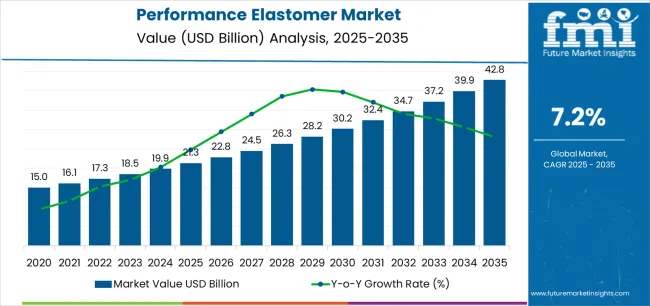

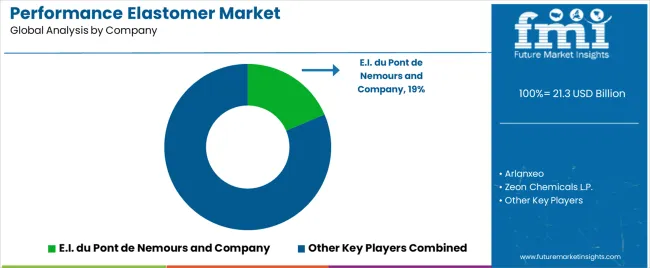

The Performance Elastomer Market is estimated to be valued at USD 21.3 billion in 2025 and is projected to reach USD 42.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The performance elastomer market is expanding steadily due to rising demand for high-performance materials across industrial and automotive sectors. Growth is being supported by advancements in polymer technology, increasing emphasis on durability and flexibility, and growing applications in extreme temperature and pressure environments. The market is witnessing strong adoption in automotive, aerospace, and electronics manufacturing due to superior mechanical strength and chemical resistance offered by performance elastomers.

Regulatory focus on lightweight materials and sustainable production is further driving innovation in formulation and processing. The future outlook remains optimistic as manufacturers continue investing in product development and process optimization to meet evolving industrial standards.

The combination of technological advancements, expanding end-use applications, and increasing awareness regarding material efficiency is expected to reinforce market stability These factors collectively underpin sustained growth and ensure that performance elastomers remain integral to next-generation engineering and design solutions.

| Metric | Value |

|---|---|

| Performance Elastomer Market Estimated Value in (2025 E) | USD 21.3 billion |

| Performance Elastomer Market Forecast Value in (2035 F) | USD 42.8 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

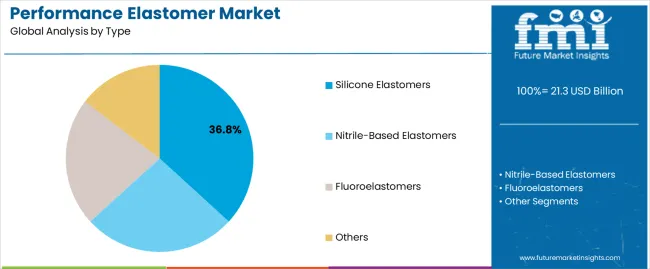

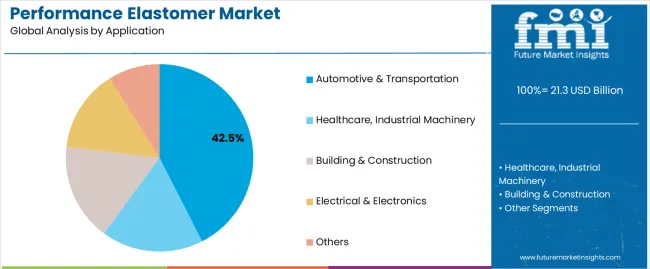

The market is segmented by Type and Application and region. By Type, the market is divided into Silicone Elastomers, Nitrile-Based Elastomers, Fluoroelastomers, and Others. In terms of Application, the market is classified into Automotive & Transportation, Healthcare, Industrial Machinery, Building & Construction, Electrical & Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The silicone elastomers segment, accounting for 36.80% of the type category, has emerged as the dominant segment due to its superior thermal stability, flexibility, and chemical resistance. These properties have made silicone elastomers highly suitable for demanding industrial and automotive applications.

Market leadership has been reinforced by their extensive use in sealing, insulation, and vibration control systems, where performance reliability under extreme conditions is critical. The segment’s growth is being further supported by advancements in formulation technologies and improvements in curing efficiency.

Ongoing R&D efforts are enhancing product versatility, enabling broader adoption across healthcare and electronics sectors The combination of durability, ease of processing, and compliance with stringent regulatory standards is expected to sustain the segment’s strong position and drive continued expansion within the overall performance elastomer market.

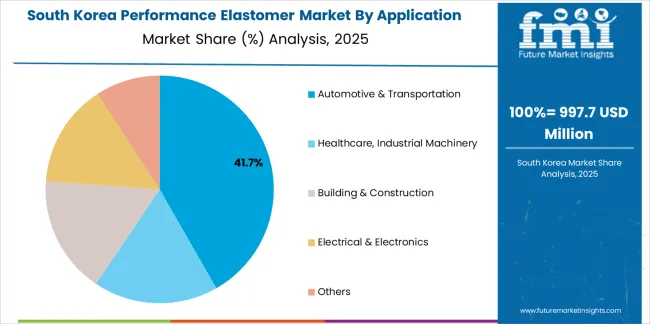

The automotive and transportation segment, holding 42.50% of the application category, has been the primary growth driver due to the widespread use of performance elastomers in vehicle components requiring heat resistance, elasticity, and long-term reliability. Applications in gaskets, seals, hoses, and vibration dampers have maintained consistent demand from both OEM and aftermarket sectors.

The transition toward electric vehicles and lightweight materials is further strengthening the use of advanced elastomers to improve energy efficiency and component performance. Increased investments in mobility infrastructure and emission reduction initiatives are also expanding adoption.

Continuous product innovation, integration of elastomers in new vehicle platforms, and global expansion of automotive manufacturing capacities are expected to sustain the segment’s dominance and contribute significantly to the market’s long-term growth trajectory.

From 2020 to 2025, the performance elastomer market experienced a CAGR of 8.7%. The automotive industry is a significant contributor to the performance elastomer market due to the rising demand for fuel-efficient vehicles and stringent emission regulations. Performance elastomers are used in automotive seals, gaskets, hoses, and engine components to enhance durability and reliability, thereby driving market growth.

In the aerospace sector, performance elastomers play a crucial role in applications requiring resistance to extreme temperatures, pressure differentials, and aerospace fluids. They are used in aircraft engines, fuel systems, seals, and O-rings, contributing to improved safety and performance of aerospace systems.

Overall, the performance elastomer market is poised for steady growth driven by increasing industrial applications, technological advancements, and the pursuit of high-performance materials across various sectors. Projections indicate that the global performance elastomer market is expected to experience a CAGR of 7.6% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 8.7% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 7.6% |

The provided table highlights the top five countries in terms of revenue, with the United Kingdom and South Korea leading the list. In the United Kingdom, one significant growth factor driving the performance elastomer market is the country's strong focus on sustainability and environmental regulations.

As the healthcare sector expands, driven by demographic shifts and advancements in medical technology, the demand for high-performance elastomers in South Korea is expected to continue growing steadily.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 7.8% |

| The United Kingdom | 8.9% |

| China | 7.9% |

| Japan | 8.2% |

| South Korea | 8.6% |

The performance elastomer market in the United States is forecast to expand with a CAGR of 7.8% from 2025 to 2035. The United States is a major market for automotive manufacturing and consumption.

Performance elastomers are extensively used in various automotive components such as seals, gaskets, hoses, and engine mounts. The growing demand for fuel-efficient vehicles, stringent emission regulations, and the increasing adoption of electric vehicles contribute to the demand for high-performance elastomers in the automotive sector.

Performance elastomers find widespread applications in industrial sectors such as oil and gas, aerospace, machinery, and construction in the United States. These elastomers are used in seals, O-rings, gaskets, and other critical components where resistance to extreme temperatures, chemicals, and mechanical stress is required. The robust industrial activity in the country drives the demand for high-performance elastomers.

The performance elastomer market in the United Kingdom is expected to progress at a CAGR of 8.9% from 2025 to 2035. There is a growing focus on sustainability and environmental regulations in the United Kingdom.

Performance elastomer manufacturers are investing in the development of eco-friendly elastomers made from renewable sources or recycled materials to meet environmental standards and address customer preferences.

Ongoing advancements in material science and manufacturing technologies have LED to the development of innovative performance elastomers with enhanced properties. These advancements cater to the evolving needs of industries in the United Kingdom, such as improved temperature resistance, chemical compatibility, and durability.

The performance elastomer market in China is expected to rise at a CAGR of 7.9% from 2025 to 2035. China is the world's largest automotive market, with a rapidly growing demand for vehicles.

Performance elastomers are extensively used in automotive applications. The expansion of the automotive industry in China, driven by increasing consumer demand, government policies promoting electric vehicles, and investments in automotive manufacturing, contributes to the demand for high-performance elastomers.

China's industrial sector is undergoing rapid growth and modernization, leading to increased demand for performance elastomers in industries such as oil and gas, aerospace, machinery, and construction. Performance elastomers are essential for critical components that require resistance to extreme temperatures, chemicals, and mechanical stress.

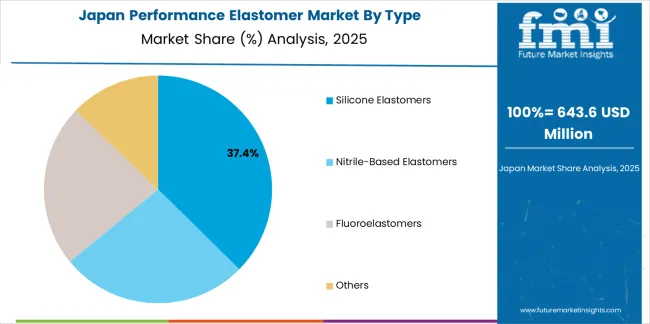

The performance elastomer market in Japan is expected to advance with a CAGR of 8.2% from 2025 to 2035. Performance elastomers find extensive use in various industrial sectors in Japan, including electronics, machinery, aerospace, and healthcare.

These elastomers are essential for critical components requiring resistance to extreme temperatures, chemicals, and mechanical stress. The growth of these industries contributes to the demand for high-performance elastomers.

Japan has a rapidly aging population, driving demand for healthcare services and medical devices. Performance elastomers are used in medical applications such as medical tubing, seals, and implants. The growth of the healthcare sector in Japan contributes to the demand for high-performance elastomers.

Performance elastomers find applications in electronic devices, including seals, gaskets, and insulating materials. The growth of the electronics industry in South Korea contributes to the demand for performance elastomers.

The demand for performance elastomers in industrial applications drives market growth in South Korea. The performance elastomer market in South Korea is expected to advance with a CAGR of 8.6% from 2025 to 2035

Performance elastomers are used in medical devices, pharmaceutical packaging, and healthcare equipment. The growth of the healthcare sector contributes to the demand for high-performance elastomers in South Korea.

The below section shows the leading segment. The nitrile-based elastomers segment is to grow at a CAGR of 7.4% from 2025 to 2035. Based on application, the automotive & transportation segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 7.3% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Nitrile-Based Elastomers | 7.4% |

| Automotive & Transportation | 7.3% |

Based on type, the nitrile-based elastomers segment is anticipated to grow at a CAGR of 7.4% from 2025 to 2035. Nitrile-based elastomers exhibit excellent resistance to oils, fuels, hydraulic fluids, and other chemicals. This property makes them ideal for use in seals, gaskets, hoses, and other components exposed to harsh chemical environments, particularly in automotive, oil and gas, and industrial applications.

Nitrile-based elastomers offer good mechanical properties, including high tensile strength, tear resistance, and abrasion resistance. These properties contribute to their durability and reliability in demanding applications, such as automotive seals and industrial machinery components.

Compared to some other high-performance elastomers like fluorocarbon elastomers (FKM), nitrile-based elastomers are generally more cost-effective. This affordability makes them an attractive option for applications where high performance is required but cost considerations are also important.

Based on application, the automotive and transportation segment is anticipated to advance at a CAGR of 7.3% from 2025 to 2035. Performance elastomers are essential for creating reliable seals in automotive systems such as engines, transmissions, brakes, and fuel systems. These elastomers offer excellent sealing properties, including resistance to high temperatures, fuels, oils, and chemicals, ensuring optimal performance and preventing leaks or failures.

Automotive manufacturers are continuously striving to improve fuel efficiency and reduce vehicle weight to meet regulatory requirements and consumer demands for more eco-friendly and cost-effective vehicles. Performance elastomers contribute to light-weighting efforts by replacing heavier materials in various automotive components without compromising performance or safety.

Performance elastomers are used in automotive suspension systems, engine mounts, and vibration isolation mounts to dampen vibrations, reduce noise, and improve ride comfort. These elastomers absorb and dissipate energy generated by engine vibrations and road shocks, enhancing vehicle comfort and handling.

Market players expanding their product portfolios to offer a comprehensive range of performance elastomers tailored to different industry requirements and applications. This strategy allows companies to cater to diverse customer needs and penetrate new market segments.

Companies invest in research and development to innovate and introduce new performance elastomer formulations with enhanced properties such as higher temperature resistance, improved chemical compatibility, better durability, and reduced environmental impact. Continuous innovation helps companies differentiate their products and stay ahead of competitors.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 19.8 billion |

| Projected Market Valuation in 2035 | USD 41 billion |

| Value-based CAGR 2025 to 2035 | 7.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Type, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | E.I. du Pont de Nemours and Company; Arlanxeo; Zeon Chemicals L.P.; Solvay S.A.; Mitsui & Co. Ltd.; Dow Corning Corporation; Wacker Chemie AG; JSR Corporation; Momentive Performance Materials Inc.; Showa Denko K.K. |

The global performance elastomer market is estimated to be valued at USD 21.3 billion in 2025.

The market size for the performance elastomer market is projected to reach USD 42.8 billion by 2035.

The performance elastomer market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in performance elastomer market are silicone elastomers, nitrile-based elastomers, fluoroelastomers and others.

In terms of application, automotive & transportation segment to command 42.5% share in the performance elastomer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Performance tires Market

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

High-performance Electric Sports Cars Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Computing Market Size and Share Forecast Outlook 2025 to 2035

High Performance Polyamides Market Size and Share Forecast Outlook 2025 to 2035

High Performance Data Analytics (HPDA) Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Trucks Market Size and Share Forecast Outlook 2025 to 2035

High Performance Barrier Films Market Size, Growth, and Forecast 2025 to 2035

High Performance Message Infrastructure Market Size, Growth, and Forecast 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

BRIC Performance Coatings Market Growth - Trends & Forecast 2025 to 2035

High Performance Refinery Additives Market Trend Analysis Based on Product, Application, and Region 2025-2035

High-Performance Catalyst Market Trend Analysis Based on Product, End-Use, and Region 2025-2035

High-Performance Insulation Materials Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA